Professional Documents

Culture Documents

BT Vat Pe 2

Uploaded by

Therese Janine HetutuaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BT Vat Pe 2

Uploaded by

Therese Janine HetutuaCopyright:

Available Formats

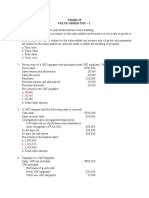

Business Tax: VAT

Practice Exercises_Part 2

1. A taxpayer, who is a VAT-registered processor of canned sardines, has the following data:

Selling price, invoice price net of VAT P300,000

Costs, exclusive of VAT if applicable

Fresh sardines purchased from fisherman 20,000

Tomatoes purchased from farmers 7,000

Olive oil 8,000

Tin can 15,000

Paper labels 7,000

Cardboard for boxes 9,000

2. Mcdonald Corp. sold P1,120,000, vat inclusive, worth of goods to the Commission of Audit for their

annual seminar. Mcdonald’s purchases on the related sale to the government total P625,000, vat

exclusive. Determine the following:

a. Final VAT withheld

b. Standard input vat

c. Actual input vat

3. VAT Business:

Domestic sales P2,000,000

Export sales 3,000,000

Non-VAT Business – domestic sales 1,000,000

Purchases of goods, for VAT business 1,500,000

Purchases of goods, for non-VAT business 200,000

Purchases of services, for VAT and non-VAT business 900,000

a. Determine the VAT payable (Input VAT on export sales is credited against output VAT)

b. Determine the VAT payable (Input VAT on export sales is refunded)

4. The following are the balances per books of accounts:

Deferred input taxes, December 2015 P 15,000

Sales, January 2016 800,000

Purchases, January 2016 500,000

Sales, February 2016 400,000

Purchases, February 2016 60,000

Sales, March 2016 500,000

Purchases, March 2016 200,000

Determine the VAT Payable for the quarter:

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- VatDocument16 pagesVatCPA100% (1)

- Vat OptDocument24 pagesVat OptCharity Venus100% (1)

- Quiz 405Document3 pagesQuiz 405Shaika HaceenaNo ratings yet

- Take Home Quiz 1Document9 pagesTake Home Quiz 1Akira Marantal Valdez100% (1)

- ApplicationTAX - LecturePROBLEMDocument2 pagesApplicationTAX - LecturePROBLEMAyessa ViajanteNo ratings yet

- BT Vat PeDocument2 pagesBT Vat PeTherese Janine HetutuaNo ratings yet

- VAT QuizzerDocument13 pagesVAT QuizzerGrace Managuelod GabuyoNo ratings yet

- Activity 2 Problems Vat On Sale of Goods or PropertiesDocument3 pagesActivity 2 Problems Vat On Sale of Goods or PropertiesNiña Mae NarcisoNo ratings yet

- Acctg Ass No. 10 Merchandising BusinessDocument5 pagesAcctg Ass No. 10 Merchandising BusinessDaisy Marie A. Rosel75% (4)

- Output and Input VAT: Business TaxDocument13 pagesOutput and Input VAT: Business TaxKathleen AgustinNo ratings yet

- VAT-problems-key by Andrew Gil AmbrayDocument10 pagesVAT-problems-key by Andrew Gil AmbrayMark Gelo WinchesterNo ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- VATDocument5 pagesVATCyril John RamosNo ratings yet

- Quiz 2 Part 2Document4 pagesQuiz 2 Part 2Renz CastroNo ratings yet

- Transfer and Business Taxation HOMEWORK 006 (HW006)Document3 pagesTransfer and Business Taxation HOMEWORK 006 (HW006)sora cabreraNo ratings yet

- DocxDocument14 pagesDocxtrisha100% (1)

- Tax SOLVINGDocument3 pagesTax SOLVINGjr centenoNo ratings yet

- Tax.M-1403 Value Added Tax Problem 1: AnswerDocument28 pagesTax.M-1403 Value Added Tax Problem 1: Answermichean mabao75% (8)

- Vat 2Document4 pagesVat 2Allen KateNo ratings yet

- 2.1 Assignment - VAT Exempt, Output Tax On Sale of GoodsDocument4 pages2.1 Assignment - VAT Exempt, Output Tax On Sale of GoodsKrisha TevesNo ratings yet

- Information For Items 21 & 22Document3 pagesInformation For Items 21 & 22Kurt Morin CantorNo ratings yet

- Review in Business Law and TaxationDocument4 pagesReview in Business Law and TaxationFery AnnNo ratings yet

- Local Media603729699590229664Document3 pagesLocal Media603729699590229664Mallari, Princess Diane D.No ratings yet

- Chapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFDocument14 pagesChapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFDani QureshiNo ratings yet

- Tax 2 PDFDocument16 pagesTax 2 PDFLeah MoscareNo ratings yet

- CASE 1 - 20 PtsDocument6 pagesCASE 1 - 20 PtsCendimee PosadasNo ratings yet

- Tax QuizzerDocument33 pagesTax QuizzerClarisse Peter86% (14)

- Methods of Estimating The Amount of Inventory:: Sales DiscountDocument4 pagesMethods of Estimating The Amount of Inventory:: Sales Discountellaine villafaniaNo ratings yet

- Tax ProbDocument3 pagesTax ProbJohn Paul Acebedo14% (7)

- Tax 2 - Midterm Quiz 1Document6 pagesTax 2 - Midterm Quiz 1Uy SamuelNo ratings yet

- Problems On TaxationDocument3 pagesProblems On TaxationRandy ManzanoNo ratings yet

- VAT ExercisesDocument2 pagesVAT ExercisesJunezel AshleyNo ratings yet

- Departmental Finals Answer KeyDocument6 pagesDepartmental Finals Answer KeyRichard de Leon50% (4)

- 2.2 Problems - VAT PayableDocument11 pages2.2 Problems - VAT PayableHafi DisoNo ratings yet

- Chapter 4 Part 2Document13 pagesChapter 4 Part 2rylNo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- ICMA Sales Tax (1) - 1Document13 pagesICMA Sales Tax (1) - 1Numan Rox100% (1)

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- Tax 2Document3 pagesTax 2Emmanuel DiyNo ratings yet

- CPA Review - VAT Quizzer - 2019Document11 pagesCPA Review - VAT Quizzer - 2019Kenneth Bryan Tegerero Tegio50% (2)

- 1.1 Problems On VAT (PRTC) PDFDocument17 pages1.1 Problems On VAT (PRTC) PDFmarco poloNo ratings yet

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- BSA 2105 Atty. F. R. Soriano Value-Added VAT Exercises - 3 (Transactions Deemed Sale, Presumptive Input Tax, Transitional Input Tax)Document2 pagesBSA 2105 Atty. F. R. Soriano Value-Added VAT Exercises - 3 (Transactions Deemed Sale, Presumptive Input Tax, Transitional Input Tax)ela kikayNo ratings yet

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDocument10 pagesJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Chapter 15 PDFDocument11 pagesChapter 15 PDFG & E ApparelNo ratings yet

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- Module VII Accounting Cycle of A Merchandising Business2Document3 pagesModule VII Accounting Cycle of A Merchandising Business2Marklein DumangengNo ratings yet

- Week 3 Learning ObjectivesDocument2 pagesWeek 3 Learning Objectiveshazel sergioNo ratings yet

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document10 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- Answer InventoryDocument7 pagesAnswer InventoryAllen Carl60% (5)

- Corresponding Supporting ScheduleDocument3 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- Shareholders Broad RoleDocument3 pagesShareholders Broad RoleTherese Janine HetutuaNo ratings yet

- Quiz 1 FinmarDocument1 pageQuiz 1 FinmarTherese Janine HetutuaNo ratings yet

- 3 Ways of Planting: Bernales, Tristan Arthur C. Bs Biology 1BDocument9 pages3 Ways of Planting: Bernales, Tristan Arthur C. Bs Biology 1BTherese Janine HetutuaNo ratings yet

- Bernales M3S3DiagnosticsDocument1 pageBernales M3S3DiagnosticsTherese Janine HetutuaNo ratings yet

- Great Books IntroDocument8 pagesGreat Books IntroTherese Janine HetutuaNo ratings yet

- BT - Sq1 VatDocument4 pagesBT - Sq1 VatTherese Janine HetutuaNo ratings yet

- BT Vat PeDocument2 pagesBT Vat PeTherese Janine HetutuaNo ratings yet

- Bernales M3S5 Assignment13Document2 pagesBernales M3S5 Assignment13Therese Janine Hetutua100% (1)

- Code of Corporate Governance For Publicly-Listed CompaniesDocument41 pagesCode of Corporate Governance For Publicly-Listed CompaniesTherese Janine HetutuaNo ratings yet

- Agree 2. Disagree 3. Agree 4. Disagree 5. Agree 6. Agree: M2S3 DiagnosticsDocument1 pageAgree 2. Disagree 3. Agree 4. Disagree 5. Agree 6. Agree: M2S3 DiagnosticsTherese Janine HetutuaNo ratings yet

- Assignment 4. Metacognitive Reading ReportDocument2 pagesAssignment 4. Metacognitive Reading ReportTherese Janine HetutuaNo ratings yet

- Hetutua, Therese Janine D. Great Books Bsac 2B 03/06/2021Document2 pagesHetutua, Therese Janine D. Great Books Bsac 2B 03/06/2021Therese Janine HetutuaNo ratings yet

- BT PT ExercisesDocument2 pagesBT PT ExercisesTherese Janine HetutuaNo ratings yet

- GB-Esssential Ingredient of LiteratureDocument5 pagesGB-Esssential Ingredient of LiteratureTherese Janine HetutuaNo ratings yet

- Therese Janine D. Hetutua: ExperienceDocument2 pagesTherese Janine D. Hetutua: ExperienceTherese Janine HetutuaNo ratings yet

- J.Kleider: Let Out Your Inner GoddessDocument8 pagesJ.Kleider: Let Out Your Inner GoddessTherese Janine HetutuaNo ratings yet

- Hetutua, Therese Janine D. Great Books Bsac 2B 02/22/2021: BeowulfDocument3 pagesHetutua, Therese Janine D. Great Books Bsac 2B 02/22/2021: BeowulfTherese Janine HetutuaNo ratings yet

- Hero of Alexandria: 1st Century ADDocument2 pagesHero of Alexandria: 1st Century ADTherese Janine HetutuaNo ratings yet

- Hetutua M2S5Document4 pagesHetutua M2S5Therese Janine HetutuaNo ratings yet

- Bernales M3S5 Assignment13Document2 pagesBernales M3S5 Assignment13Therese Janine Hetutua100% (1)

- Hetutua, Therese Janine D. Oct 8, 2020 Bsac 2B IT Application Tools in BusinessDocument4 pagesHetutua, Therese Janine D. Oct 8, 2020 Bsac 2B IT Application Tools in BusinessTherese Janine HetutuaNo ratings yet

- Hetutua M2S4Document3 pagesHetutua M2S4Therese Janine HetutuaNo ratings yet

- Assignment 3. Metacognitive Reading ReportDocument2 pagesAssignment 3. Metacognitive Reading ReportTherese Janine HetutuaNo ratings yet

- M2S1 Tasks Exercise1 Assignment5 HetutuaDocument6 pagesM2S1 Tasks Exercise1 Assignment5 HetutuaTherese Janine Hetutua100% (4)

- Assignment 4-HETUTUADocument2 pagesAssignment 4-HETUTUATherese Janine HetutuaNo ratings yet

- Hetutua-Assignment 7Document1 pageHetutua-Assignment 7Therese Janine HetutuaNo ratings yet

- STS M1S4 Flashcard HetutuaDocument2 pagesSTS M1S4 Flashcard HetutuaTherese Janine HetutuaNo ratings yet

- Computations MerchDocument5 pagesComputations MerchChayne Rodil100% (1)

- City of Manila vs. Coca-Cola Bottlers Philippines, IncDocument3 pagesCity of Manila vs. Coca-Cola Bottlers Philippines, IncAnonymous 5MiN6I78I0No ratings yet

- GST Annual - Report - 0Document80 pagesGST Annual - Report - 0Vbs ReddyNo ratings yet

- GST PPT TaxguruDocument30 pagesGST PPT Taxguru50raj506019No ratings yet

- Jayanita Exports PVT LTD GST InvoiceDocument3 pagesJayanita Exports PVT LTD GST InvoiceMITHUN BERANo ratings yet

- 15Document10 pages15mariyha PalangganaNo ratings yet

- Thailand Country AnalysisDocument11 pagesThailand Country AnalysisAbhi TejaNo ratings yet

- Excel New Assignment PDFDocument20 pagesExcel New Assignment PDFHimanshi VohraNo ratings yet

- IPCC Taxation Guideline Answer Nov 2015 ExamDocument16 pagesIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaNo ratings yet

- STO Configuration For GST - ERP SCM - SCN WikiDocument5 pagesSTO Configuration For GST - ERP SCM - SCN WikiMEENUNARANG100% (1)

- Chapter One 1.0 1.1 Background of StudyDocument42 pagesChapter One 1.0 1.1 Background of StudyOko IsaacNo ratings yet

- Going Through CustomsDocument1 pageGoing Through CustomsБогдан БоцянNo ratings yet

- Chapter 1 Audit Under TaxDocument15 pagesChapter 1 Audit Under TaxSaurabh GogawaleNo ratings yet

- Mba GST Project Tata MotorsDocument99 pagesMba GST Project Tata Motorsdeepak Gupta89% (9)

- Apple InvoiceDocument1 pageApple InvoicejustinsitohjsNo ratings yet

- Introduction and Basic Concept of Income Tax Final 5.12Document53 pagesIntroduction and Basic Concept of Income Tax Final 5.12Sai prasad100% (1)

- Hotel Check Validation ToolDocument3 pagesHotel Check Validation ToolRamesh MNo ratings yet

- Commissioner of Internal Revenue v. First Global Byo Corp., C.T.A. EB Case No. 2168 (C.T.A. Case Nos. 9172, 9212 & 9242), (July 1, 2021)Document16 pagesCommissioner of Internal Revenue v. First Global Byo Corp., C.T.A. EB Case No. 2168 (C.T.A. Case Nos. 9172, 9212 & 9242), (July 1, 2021)Kriszan ManiponNo ratings yet

- MVL0004BDocument1 pageMVL0004BnobuhleNo ratings yet

- Tally AssignmentDocument10 pagesTally AssignmentAnubhav Halwai100% (1)

- Rc4022-13e Brochure About HST-GST Collecting RulesDocument85 pagesRc4022-13e Brochure About HST-GST Collecting RulesSuzana NaskovaNo ratings yet

- JJJJJDocument1 pageJJJJJGiga GiggaNo ratings yet

- Site Perimeter Fence (Pay Items)Document13 pagesSite Perimeter Fence (Pay Items)Mark Christian FloresNo ratings yet

- Accounting Finals Project Paper: Ola-Vee Advertising CorporationDocument10 pagesAccounting Finals Project Paper: Ola-Vee Advertising CorporationGelo EspinuevaNo ratings yet

- TAX LossDocument38 pagesTAX LossBradNo ratings yet

- Paper 11 PDFDocument6 pagesPaper 11 PDFKaysline Oscar CollinesNo ratings yet

- Indian Insitute of Job-Oriented Training Tally Assignment: Company CreationDocument42 pagesIndian Insitute of Job-Oriented Training Tally Assignment: Company CreationTapas GhoshNo ratings yet

- 2550 Q BIR FORMS FOR Value Added TaxDocument2 pages2550 Q BIR FORMS FOR Value Added TaxEy EmNo ratings yet

- Consumer Perception Towards GSTDocument82 pagesConsumer Perception Towards GSTsakshi100% (3)

- Goods Transport Agency in GSTDocument3 pagesGoods Transport Agency in GSTRohan KulkarniNo ratings yet