Professional Documents

Culture Documents

Partnership Operations (Prob. 1) - Solution

Uploaded by

Shaira Nicole Vasquez0 ratings0% found this document useful (0 votes)

24 views2 pagesOriginal Title

Partnership Operations (Prob. 1)- Solution (1)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views2 pagesPartnership Operations (Prob. 1) - Solution

Uploaded by

Shaira Nicole VasquezCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

Partnership Oprations

Problem 1 (Solutions)

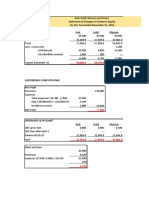

A. Luz Lim & Grace Espina

Luz Lim 150,000

Grace Espina 180,000

Total Capital 330,000

Profit: P110,000

1 Luz Lim 110,000 x 15/33 50,000

Grace Espina- 110,000 x 18/33 60,000

Total 110,000

2 Profit Distribution Schedule:

Lim Espina Total

Salaries 24,000 15,000 39,000

Balance: 3:2 42,600 28,400 71,000

Total 66,600 43,400 110,000

3 Lim Espina Total

Interest 10% 15,000 18,000 33,000

Balance: equally 38,500 38,500 77,000

Total 53,500 56,500 110,000

Problem B: Kent Dequito & Jude Sauler

1 Distribution of Profit Schedule: P450,000

Dequito Sauler Total

Salaries 40,000 30,000 70,000

8% interest on beg. Capital

8% of P752,000 60,160

8% of P680,000 54,400 114,560

Balance: equally 132,720 132,720 265,440

Total 232,880 217,120 450,000

2 Distribution of {rpfit Schedule: P450,000

Dequito Sauler Total

20% interest on end Capital

20% of P732,000 146,400

20% of P710,000 142,000 288,400

Salaries 50,000 20,000 70,000

Balance: 50%; 50% 45,800 45,800 91,600

Total 242,200 207,800 450,000

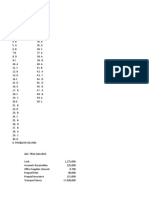

3 Distribution of Profit Schedule:

Dequitu Sauler Total

Salaries 120,000 100,000 220,000

25% of P450,000 112,500 112,500

Dequito:

P117,500 x 739/1481 58,631

Sauler:

P117,500 x 742/1481 58,869 117,500

Total 291,131 158,869 450,000

Computation of Average capital

Dequito:

752,000 x 9 mos. = 6,768,000

682.000 x 2 mos. 1,364,000

732,000 x 1 mo. 732,000

Total 8,864,000/12 mos. - P738,700

Sauler:

680,000 x 2 1,360,000

760,000 x 8 6,080,000

750,000 x 1 750,000

710,000 x 1 710,000

Total 8,900,000/12 mos. - P741,700

You might also like

- Cerberus LetterDocument5 pagesCerberus Letterakiva80100% (1)

- Real Estate and Stamp Duty (Final)Document11 pagesReal Estate and Stamp Duty (Final)Shashwat SinghNo ratings yet

- Trendline Trading Strategies GuideDocument12 pagesTrendline Trading Strategies GuideChan Ders100% (1)

- UntitledDocument13 pagesUntitledAnne GuamosNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- The California Fire Chronicles First EditionDocument109 pagesThe California Fire Chronicles First EditioneskawitzNo ratings yet

- Chapter 2 10Document2 pagesChapter 2 10graceNo ratings yet

- Jordan Pippen Total: Multiple Choice Answers and SolutionsDocument26 pagesJordan Pippen Total: Multiple Choice Answers and SolutionsJOEMAR LEGRESONo ratings yet

- Acctg Problem 7Document4 pagesAcctg Problem 7Salvie Perez Utana57% (14)

- Oracle Hyperion Planning Training ConceptsDocument99 pagesOracle Hyperion Planning Training ConceptsAsad HussainNo ratings yet

- AFAR Preweek Lecture (B42)Document34 pagesAFAR Preweek Lecture (B42)Ciarie Mae Salgado100% (2)

- PreweekSol (Advacc)Document91 pagesPreweekSol (Advacc)Rommel Cruz100% (2)

- Unclaimed Balances LawDocument17 pagesUnclaimed Balances LawFritchel Mae QuicosNo ratings yet

- Partnership and CorporationDocument6 pagesPartnership and CorporationShaira Nicole Vasquez50% (2)

- Chapter 2 #11Document2 pagesChapter 2 #11spp100% (3)

- Risk Management: Exchange RateDocument25 pagesRisk Management: Exchange RateAjay Kumar TakiarNo ratings yet

- Parcor Baysa Chapter 3 Parcor Baysa Chapter 3Document17 pagesParcor Baysa Chapter 3 Parcor Baysa Chapter 3FranciscoViloriaFrankNo ratings yet

- The Markets in Crypto-Assets Regulation (MICA)Document33 pagesThe Markets in Crypto-Assets Regulation (MICA)Eve AthanasekouNo ratings yet

- Mine Investment AnalysisDocument6 pagesMine Investment AnalysisTriAnggaBayuPutra50% (2)

- Qualifying Exam (Basic & ParCor)Document7 pagesQualifying Exam (Basic & ParCor)Rommel CruzNo ratings yet

- Chapter 2Document27 pagesChapter 2Mary MarieNo ratings yet

- Partnership OperationsDocument9 pagesPartnership OperationsJay Mark Marcial JosolNo ratings yet

- Calamba and Brillantes Problem-Obliga, Shaira MaeDocument3 pagesCalamba and Brillantes Problem-Obliga, Shaira MaeShaira Mae ObligaNo ratings yet

- AFAR Preboards SolutionsDocument27 pagesAFAR Preboards SolutionsIrra May GanotNo ratings yet

- Partnership Accounting - Paula GozunDocument8 pagesPartnership Accounting - Paula GozunPaupauNo ratings yet

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- Partnership Operation ExercisesDocument3 pagesPartnership Operation ExercisesArlene Diane OrozcoNo ratings yet

- Solutions - Formation-LumpSum LiquidationDocument14 pagesSolutions - Formation-LumpSum LiquidationLuna SanNo ratings yet

- Dissolution PDFDocument4 pagesDissolution PDFCyangenNo ratings yet

- Partnership Division of ProfitsDocument4 pagesPartnership Division of ProfitsRyou ShinodaNo ratings yet

- Partnership AssignmentsDocument11 pagesPartnership AssignmentsAldrin ZolinaNo ratings yet

- AFAR1 Operation SolutionDocument4 pagesAFAR1 Operation SolutionMiru YuNo ratings yet

- 2023 BudgetDocument1 page2023 Budgetmisyel deveraNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part C)Document2 pages(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part C)John Carlos DoringoNo ratings yet

- Partnership Formation Problem No. 1Document8 pagesPartnership Formation Problem No. 1tide podsNo ratings yet

- Solution Chapter 18Document3 pagesSolution Chapter 18starfireNo ratings yet

- Emnace, Activity 2Document6 pagesEmnace, Activity 2Cheveem Grace EmnaceNo ratings yet

- AssignmentDocument9 pagesAssignmentBaekhunnie ByunNo ratings yet

- 2601 PartnershipsDocument57 pages2601 PartnershipsMerdzNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- ANSWER KEY ON PARTNERSHIP MOCK TESTxDocument6 pagesANSWER KEY ON PARTNERSHIP MOCK TESTxzhyrus macasilNo ratings yet

- Final Preboard SolutionDocument74 pagesFinal Preboard SolutionJhedz CartasNo ratings yet

- AFAR Q1 Pre-Week SolMan - MAY 2019Document13 pagesAFAR Q1 Pre-Week SolMan - MAY 2019Aj PacaldoNo ratings yet

- Prac SolutionsDocument5 pagesPrac SolutionschrstncstlljNo ratings yet

- An0090 Xls EngDocument27 pagesAn0090 Xls Engdiana sofia galvisNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationDocument4 pagesNUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationKyla Artuz Dela CruzNo ratings yet

- AFAR Quiz Pt2Document3 pagesAFAR Quiz Pt2Cerise SNo ratings yet

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- Answers To LQ 4Document4 pagesAnswers To LQ 4Hahahhsnsma SahejkweNo ratings yet

- BFF2341 Tri A 2020 Mini Test 2 SolutionDocument3 pagesBFF2341 Tri A 2020 Mini Test 2 SolutionDuankai LinNo ratings yet

- APC Ch3sol 2Document16 pagesAPC Ch3sol 2Hans ManaliliNo ratings yet

- Red, Gold, Maroon and Green Statement of Changes in Partners' Equity For The Year Ended December 31, 2016Document7 pagesRed, Gold, Maroon and Green Statement of Changes in Partners' Equity For The Year Ended December 31, 2016Vivienne Rozenn LaytoNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Partnership Q6 SolutionDocument4 pagesPartnership Q6 SolutionLorraine Mae RobridoNo ratings yet

- Accounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 3Document18 pagesAccounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 3Eric BaquirNo ratings yet

- Fin Accts 2 AdditionalDocument5 pagesFin Accts 2 AdditionalChevonne OatesNo ratings yet

- Financial StatementDocument36 pagesFinancial StatementJigoku ShojuNo ratings yet

- Chapter 18 Answer KeyDocument9 pagesChapter 18 Answer KeyNCT100% (1)

- Afar 2701 PartnershipDocument57 pagesAfar 2701 PartnershipJoshmyrrh Richwel GammadNo ratings yet

- 10-14 InstallmentDocument4 pages10-14 InstallmentMary Ingrid Arellano RabulanNo ratings yet

- Baskoro Riyanto - 023001800063 - Latihan Soal AKL IIDocument4 pagesBaskoro Riyanto - 023001800063 - Latihan Soal AKL IIBaskoro RiyantoNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- 2021 CH 7 AnswersDocument8 pages2021 CH 7 AnswersMiquel VillamarinNo ratings yet

- AccountingDocument4 pagesAccountingAimie Licos EstradaNo ratings yet

- ACCTG11B8-58-6 Answer KeysDocument3 pagesACCTG11B8-58-6 Answer KeysEUBELLE DAVE SOLATARIONo ratings yet

- Quiz Liquidation SolutionDocument8 pagesQuiz Liquidation SolutionGrace RoqueNo ratings yet

- Midterm Examination AccountingDocument3 pagesMidterm Examination AccountingShaira Nicole VasquezNo ratings yet

- Fitt - Pe ReportDocument2 pagesFitt - Pe ReportShaira Nicole VasquezNo ratings yet

- Practice Exercises 3Document6 pagesPractice Exercises 3Shaira Nicole VasquezNo ratings yet

- Mathematics Midterm DoneDocument3 pagesMathematics Midterm DoneShaira Nicole VasquezNo ratings yet

- Mathematics Midterm DoneDocument3 pagesMathematics Midterm DoneShaira Nicole VasquezNo ratings yet

- Math Incomplete 2Document6 pagesMath Incomplete 2Shaira Nicole VasquezNo ratings yet

- Midterm FinacDocument4 pagesMidterm FinacShaira Nicole VasquezNo ratings yet

- HRM - ReportDocument5 pagesHRM - ReportShaira Nicole VasquezNo ratings yet

- Entrepreneurship-Report DoneDocument27 pagesEntrepreneurship-Report DoneShaira Nicole VasquezNo ratings yet

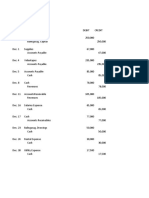

- Adjusting Entry Prob1Document1 pageAdjusting Entry Prob1Shaira Nicole VasquezNo ratings yet

- The Importance of TreesDocument2 pagesThe Importance of TreesShaira Nicole VasquezNo ratings yet

- Adjusting Entry Prob1Document1 pageAdjusting Entry Prob1Shaira Nicole VasquezNo ratings yet

- Trial Balance (Problem 4)Document1 pageTrial Balance (Problem 4)Shaira Nicole VasquezNo ratings yet

- Partnership Operation (Probelem Exercise 2)Document1 pagePartnership Operation (Probelem Exercise 2)Shaira Nicole VasquezNo ratings yet

- Problem 2 (Sir)Document1 pageProblem 2 (Sir)Shaira Nicole VasquezNo ratings yet

- T Account - Trial BalanceDocument2 pagesT Account - Trial BalanceShaira Nicole VasquezNo ratings yet

- Problem 3 (Sir)Document2 pagesProblem 3 (Sir)Shaira Nicole VasquezNo ratings yet

- T Account - Trial BalanceDocument2 pagesT Account - Trial BalanceShaira Nicole VasquezNo ratings yet

- Problem 1 (Sir)Document1 pageProblem 1 (Sir)Shaira Nicole VasquezNo ratings yet

- Basic Accounting (Adjusting-Problem No. 4)Document2 pagesBasic Accounting (Adjusting-Problem No. 4)Shaira Nicole VasquezNo ratings yet

- Basic Accounting (Adjusting-Problem No. 4)Document2 pagesBasic Accounting (Adjusting-Problem No. 4)Shaira Nicole VasquezNo ratings yet

- Basic Accounting (Adjusting-Problem No. 4)Document2 pagesBasic Accounting (Adjusting-Problem No. 4)Shaira Nicole VasquezNo ratings yet

- Iist History Reaction Paper - Vasquez ShairaDocument1 pageIist History Reaction Paper - Vasquez ShairaShaira Nicole VasquezNo ratings yet

- Basic Accounting (Adjusting-Problem No. 4)Document2 pagesBasic Accounting (Adjusting-Problem No. 4)Shaira Nicole VasquezNo ratings yet

- Iist History Reaction Paper - Vasquez ShairaDocument1 pageIist History Reaction Paper - Vasquez ShairaShaira Nicole VasquezNo ratings yet

- Categories of Physical FitnessDocument1 pageCategories of Physical FitnessShaira Nicole VasquezNo ratings yet

- Isae 3400Document9 pagesIsae 3400baabasaamNo ratings yet

- Business Finance Final Çalışma ÖrneğiDocument8 pagesBusiness Finance Final Çalışma ÖrneğiMustafa EyüboğluNo ratings yet

- Namma Kalvi 12th Commerce Chapter 1-15 One Mark 215111Document105 pagesNamma Kalvi 12th Commerce Chapter 1-15 One Mark 215111Aakaash C.K.No ratings yet

- Computational Methods For Compound SumsDocument29 pagesComputational Methods For Compound Sumsraghavo100% (1)

- Dunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Document2 pagesDunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Cath VeluzNo ratings yet

- Multinational CorporationsDocument26 pagesMultinational CorporationsHarshal ShindeNo ratings yet

- Dow Theory: Rail IndustrialDocument13 pagesDow Theory: Rail Industrialapi-281256227No ratings yet

- IC Accounts Payable Ledger Template Updated 8552Document2 pagesIC Accounts Payable Ledger Template Updated 8552M Monjur MobinNo ratings yet

- Ivo Welch Corporate Finance Chap14Document32 pagesIvo Welch Corporate Finance Chap14Laercio MusicaNo ratings yet

- Innocents Abroad Currencies and International Stock ReturnsDocument39 pagesInnocents Abroad Currencies and International Stock ReturnsShivaniNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument3 pagesHDFC ERGO General Insurance Company Limitedseshu 2010No ratings yet

- Busoni Company Is A Wholesaler During One Accounting Period ItDocument1 pageBusoni Company Is A Wholesaler During One Accounting Period ItTaimour HassanNo ratings yet

- Horizon Trial: Paul Smith Witness Statement 1/2Document8 pagesHorizon Trial: Paul Smith Witness Statement 1/2Nick WallisNo ratings yet

- IIK IDaySupplimentDocument59 pagesIIK IDaySupplimentincharamedia5516No ratings yet

- FM12 CH 02 ShowDocument88 pagesFM12 CH 02 ShowIbrahim AbdallahNo ratings yet

- Audit Check ListDocument8 pagesAudit Check ListpriyeshNo ratings yet

- This Study Resource Was: Lecture Handout For Chapter 12Document6 pagesThis Study Resource Was: Lecture Handout For Chapter 12rifa hanaNo ratings yet

- SRReport 1571660751494Document2 pagesSRReport 1571660751494Áĺí Áhméđ ŤhəbôNo ratings yet

- Testimony of Brian MoynihanDocument5 pagesTestimony of Brian MoynihanDealBookNo ratings yet

- 2020 Appraiser's Exam Mock Exam Set GDocument5 pages2020 Appraiser's Exam Mock Exam Set GMarkein Dael VirtudazoNo ratings yet

- Arbitrage Pricing TheoryDocument16 pagesArbitrage Pricing Theorya_karimNo ratings yet

- Secrecy in Bank DEPOSITS (R.A. 1405) : One of The Most StrictDocument48 pagesSecrecy in Bank DEPOSITS (R.A. 1405) : One of The Most StrictAleah Jehan AbuatNo ratings yet