Professional Documents

Culture Documents

BFF2341 Tri A 2020 Mini Test 2 Solution

Uploaded by

Duankai LinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BFF2341 Tri A 2020 Mini Test 2 Solution

Uploaded by

Duankai LinCopyright:

Available Formats

MINI TEST 2 (TRI A 2020 SOLUTIONS)

Q. 1

Forward hedge

Given spot rate = $1 NZD = $0.64

Forward rate will be $1NZD = $0.64 x (1-4.5%) =$0.6112

Sell NZ$3,000,000 @ US$0.6112 = US$1,833,600

Money market hedge

All the interest rates are given as annual. We need to convert them to 180 days.

Borrow in NZD @ 7% for one year. So, rate for 180 days is: 7% x180/360 = 3.5%

Invest in USD @ 8% for one year. So, rate for 180 days is: 8% x180/360 = 4%

Borrow the PV of NZ$3,000,000 =NZ$3,000,000/1.035 = NZ$2,898,550

Convert NZ$2,898,550 to US$ (@spot rate)= NZ$2,898,550 x US$0.64 = US$1,855,072

Invest US$1,855,072@ 4% =US$2,981,651 x 1.04 = US$1,929,274

Put option hedge (exercise price = US$0.62; premium = US$0.03) = Net will be $0.59

Amount

Received per

Option Unit (also Total Amount

Possible Spot Premium per accounting for Received for

Rate Unit Exercise premium) NZD$3,000,000 Probability

$0.60 $0.03 Yes $0.59 $1,770,000 20%

$0.61 $0.03 Yes $0.59 $1,770,000 50%

$0.63 $0.03 No $0.60 $1,800,000 30%

The money market hedge is superior to the forward hedge and has a 100% chance of outperforming the

put option hedge. Therefore, the money market hedge is the optimal hedge.

Unhedged Strategy

Total Amount Received for

Possible Spot Rate NZ$3,000,000 Probability

$0.60 $1,800,000 20%

$0.61 $1,830,000 50%

$0.63 $1,890,000 30%

2. A

Exchange dollars for Euro = $2,000,000/$2.8 = Euro 714,286;

exchange Euros for yen = 714,286 x 280 = 200,000,000 yen.

Exchange yen for dollars = 200,000,000 yen / $.022 = $4,400,000.

Yield = {($4,400,000 - $2,000,000)/$2,000,000} =120%

2.B

$2,000,000/$0.60 = SF3,333,333.33 x (1.1) = SF3,666,666 X $.62 = $2,273,333.33

Yield = ($2,273,333.33- $2,000,000)/$2,000,000 = 13.67%

This yield exceeds what is possible domestically.

Opportunity cost in USA = $2,000,000 * 1.12 = $2,240,000

Alternative: Check the interest rate parity:

Interest difference = 2%; Spot and forward rate differentials = F-S/S = 0.62-0.60/0.60 = 3.33%

Therefore no parity

Q. 3

Calculate the exchange rates

Y0 $1 NZD= $0.50

Y1 $1 NZD= $0.50x0.95 = $0.475

Y2 $1 NZD= $0.475X0.95= $0.451250

Y3 $1 NZD= $0.451250X0.95= $0.4287

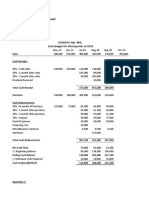

Yr.0 Yr.1 Yr.2 Yr.3

-

Initial Outlay/ Investment

30,000,000

Revenue 20,000,000 25,500,000 31,500,000

Less:

1,750,000 2,400,000 3,150,000

Total variable costs

Less:

6,000,000 6,000,000 6,000,000

Less: Other cash expenses

Less: Depreciation 3,000,000 3,000,000 3,000,000

Interest expense 1,000,000 1,000,000 1,000,000

EBIT 8,250,000 13,100,000 18,350,000

LESS:

2,475,000 3,930,000 5,505,000

30% Corporate Tax

EAT 5,775,000 9,170,000 12,845,000

Add back: Depreciation 3,000,000 3,000,000 3,000,000

Net cash flow ready for

8,775,000 12,170,000 15,845,000

remittance by subsidiary

Less: Remittance Tax 877,500 1,217,000 1,584,500

Cash flows after Remit. Tax 7,897,500 10,953,000 14,260,500

Plant sale proceeds 0 0 25,000,000

Total Cash Flow 7,897,500 10,953,000 39,260,500

Exchange Rate 0.5 0.475 0.45125 0.4286875

Total -

3,751,313 4,942,541 16,830,486

cash Flow to parent in USD 15,000,000

NPV $3,065,600

Q.4

NPV = $32,630

IRR = 17.9%

Payback = 3.9166 years

Payback = 3 years + $55,000/$60,000 =3.9166 years

Break Even Salvage Value= (initial investment – NPV) (1+i)^n = (145,000 – 32,630)X (1.10)5

= $180,973

You might also like

- Prac SolutionsDocument5 pagesPrac SolutionschrstncstlljNo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- Book 1Document8 pagesBook 1Alejandra LamasNo ratings yet

- Answer 1 - Blue Bill CorporationDocument2 pagesAnswer 1 - Blue Bill CorporationRheu ReyesNo ratings yet

- Years Operating Cost Benefit Depreciation Net Benefit Old NewDocument8 pagesYears Operating Cost Benefit Depreciation Net Benefit Old NewBilal AhmedNo ratings yet

- Sheetband & Halyard Inc The Correct AnswerDocument6 pagesSheetband & Halyard Inc The Correct Answermaran_navNo ratings yet

- Partnership OperationsDocument9 pagesPartnership OperationsJay Mark Marcial JosolNo ratings yet

- Final F09 SolutionDocument5 pagesFinal F09 SolutionWyatt Niblett-wilsonNo ratings yet

- FM Assaignment Second SemisterDocument9 pagesFM Assaignment Second SemisterMotuma Abebe100% (1)

- 3.0 Strategic Finance Projections & EvaluationDocument6 pages3.0 Strategic Finance Projections & EvaluationFatin Zafirah Binti Zurila A21A3251No ratings yet

- Practice Problems Ch12 PDFDocument57 pagesPractice Problems Ch12 PDFzoeyNo ratings yet

- Test 1 (2019672728) (NBF2D)Document5 pagesTest 1 (2019672728) (NBF2D)Masnur Aina Md RajehNo ratings yet

- Exercises Module 8 For UploadDocument16 pagesExercises Module 8 For UploadjpNo ratings yet

- 11 Profitability ParametersDocument23 pages11 Profitability ParametersDaris Putra Hadiman100% (2)

- Partnership Ops Solution ManualDocument3 pagesPartnership Ops Solution Manualcali cdNo ratings yet

- UntitledDocument13 pagesUntitledAnne GuamosNo ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- CH 12 SM AssigDocument6 pagesCH 12 SM AssigJefferson SarmientoNo ratings yet

- A) Determine The Weighted Average Number of Common SharesDocument7 pagesA) Determine The Weighted Average Number of Common SharesClyde Ian Brett PeñaNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- HyderabadDocument2 pagesHyderabadChisty MoinNo ratings yet

- HMW 2 - AnswersDocument2 pagesHMW 2 - Answersbrahim.safa2018No ratings yet

- FM FinalDocument7 pagesFM FinalStoryKingNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- Exam 6Document7 pagesExam 6Kalkidan ZerihunNo ratings yet

- Solutions To Chapter 15 Questions - Managing Current AssetsDocument5 pagesSolutions To Chapter 15 Questions - Managing Current AssetsSyeda MiznaNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- 1.1 - Whatif &PTDocument28 pages1.1 - Whatif &PTSalman AhmadNo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Answersto Question Bank - Leverages and Capital StructureDocument3 pagesAnswersto Question Bank - Leverages and Capital StructureSakshi SharmaNo ratings yet

- Franchising Consignment KeyDocument22 pagesFranchising Consignment KeyMichael Jay SantosNo ratings yet

- Problem 5-19Document5 pagesProblem 5-19Phuong ThaoNo ratings yet

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- CH SolutionsDocument6 pagesCH SolutionsPink MagentaNo ratings yet

- Investment Appraisal and Analysis Ide 2018Document4 pagesInvestment Appraisal and Analysis Ide 2018vincentNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Chapter 15Document8 pagesChapter 15Mychie Lynne MayugaNo ratings yet

- 3.6 Solutions To Classwork Questions On Working CapitalDocument42 pages3.6 Solutions To Classwork Questions On Working CapitalA001AADITYA MALIKNo ratings yet

- WP - Forex Practice SetDocument8 pagesWP - Forex Practice SetJester LimNo ratings yet

- Interest On SecuritiesDocument1 pageInterest On SecuritiesSayed PiashNo ratings yet

- Chapter 9 Making Capital Investment DecisionsDocument32 pagesChapter 9 Making Capital Investment Decisionsiyun KNNo ratings yet

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationDocument4 pagesNUDJPIA FAR AND AFAR SOLUTIONS - Partnership OperationKyla Artuz Dela CruzNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- Minimum Expected Rate of Return 12% Minimum Pay Back Period 4.5 YearsDocument4 pagesMinimum Expected Rate of Return 12% Minimum Pay Back Period 4.5 Yearsjagan pawanismNo ratings yet

- Corporate Finance II Section: 01 Homework No: 02Document5 pagesCorporate Finance II Section: 01 Homework No: 02Sumaiya TithiNo ratings yet

- Sesi 11 BDocument22 pagesSesi 11 BTata JanetaNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Capital Budgeting ExamplesDocument16 pagesCapital Budgeting ExamplesMuhammad azeemNo ratings yet

- Es - Group 8Document4 pagesEs - Group 8Papa NketsiahNo ratings yet

- Corporate FinanceDocument3 pagesCorporate FinanceRitesh BangNo ratings yet

- 01 Hire Purchase PQ SolDocument14 pages01 Hire Purchase PQ Solshubhamsingh143deepNo ratings yet

- FM II Assignment 3 SolutionDocument2 pagesFM II Assignment 3 SolutionSheryar NaeemNo ratings yet

- Solutions - Formation-LumpSum LiquidationDocument14 pagesSolutions - Formation-LumpSum LiquidationLuna SanNo ratings yet

- Mock Test SolutionsDocument11 pagesMock Test SolutionsMyraNo ratings yet

- Mine Investment AnalysisDocument6 pagesMine Investment AnalysisTriAnggaBayuPutra50% (2)

- CFIN 3rd Edition by Besley Brigham ISBN Solution ManualDocument6 pagesCFIN 3rd Edition by Besley Brigham ISBN Solution Manualrussell100% (22)

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter - 6 - 11th Edition - SD - 3 SlidesDocument29 pagesChapter - 6 - 11th Edition - SD - 3 SlidesDuankai LinNo ratings yet

- Diploma of Commerce: ACL2012 Applied Contract LawDocument11 pagesDiploma of Commerce: ACL2012 Applied Contract LawDuankai LinNo ratings yet

- BFF2341 Mini Test 2: PART A: Financial Problems. All Questions Are Compulsory Unless SpecifiedDocument3 pagesBFF2341 Mini Test 2: PART A: Financial Problems. All Questions Are Compulsory Unless SpecifiedDuankai LinNo ratings yet

- MAA250 Topic 10 - StudentDocument41 pagesMAA250 Topic 10 - StudentDuankai LinNo ratings yet

- MAA250 Topic 1 - StudentDocument45 pagesMAA250 Topic 1 - StudentDuankai LinNo ratings yet

- MAA250 Topic 8 - StudentDocument47 pagesMAA250 Topic 8 - StudentDuankai LinNo ratings yet

- MAA250 Topic 4 - StudentDocument39 pagesMAA250 Topic 4 - StudentDuankai LinNo ratings yet

- MAA250 Topic 5 - StudentDocument38 pagesMAA250 Topic 5 - StudentDuankai LinNo ratings yet

- MAA250 Topic 6 - StudentDocument47 pagesMAA250 Topic 6 - StudentDuankai LinNo ratings yet

- MAA250 Topic 7 - StudentDocument28 pagesMAA250 Topic 7 - StudentDuankai LinNo ratings yet

- ACCFIN5001 Group Assignment Briefing - Student VersionDocument6 pagesACCFIN5001 Group Assignment Briefing - Student VersionDuankai LinNo ratings yet

- Bill of LadingDocument1 pageBill of LadingboyNo ratings yet

- General Banking Law of 2000Document13 pagesGeneral Banking Law of 2000JyNo ratings yet

- 10 1108 - Ebr 03 2022 0051Document28 pages10 1108 - Ebr 03 2022 0051Solihin SolihinNo ratings yet

- Baroda BNP Paribas MF - RM - OffrollDocument2 pagesBaroda BNP Paribas MF - RM - OffrollNikitaNo ratings yet

- About Us: WWW - Gupshup.ioDocument2 pagesAbout Us: WWW - Gupshup.ioSwati ChaturvediNo ratings yet

- Export And/or Import: Evidence 8Document4 pagesExport And/or Import: Evidence 8Luis Enrique Hernandez RodriguezNo ratings yet

- Study Case Process Costing 4.17 & 4.18Document4 pagesStudy Case Process Costing 4.17 & 4.18bagustradi89No ratings yet

- Unbalanced Growth Theory (Unit 5.1)Document3 pagesUnbalanced Growth Theory (Unit 5.1)C. MittalNo ratings yet

- Prime Savings Form v1Document3 pagesPrime Savings Form v1Nitin BNo ratings yet

- S1 4 SampleQDocument3 pagesS1 4 SampleQAzail SumNo ratings yet

- Unit 2: Micro-Economics 2.4 Theory of Production Concept of ProductionDocument14 pagesUnit 2: Micro-Economics 2.4 Theory of Production Concept of ProductionAahana AahanaNo ratings yet

- Revision Questions 2020 Part VDocument18 pagesRevision Questions 2020 Part VJeffrey KamNo ratings yet

- MODULE 4 The Possible Products or Services That Will Meet The NeedDocument11 pagesMODULE 4 The Possible Products or Services That Will Meet The NeedJoan Layos Moncawe100% (10)

- Vat 220-223-224Document2 pagesVat 220-223-224timotheoigogo100% (1)

- Questionnaire On "Study On Consumer Perception of E-Commerce Shopping."Document3 pagesQuestionnaire On "Study On Consumer Perception of E-Commerce Shopping."anand shindeNo ratings yet

- Evonik Company Presentation (January 2018)Document94 pagesEvonik Company Presentation (January 2018)Yang Sunman100% (1)

- Front PagesDocument29 pagesFront Pagesksmd961No ratings yet

- Corporate Regulations - Bcom Bba - Juraz NotesDocument37 pagesCorporate Regulations - Bcom Bba - Juraz Notesjibinraj.n154No ratings yet

- Client: How Is Inventory Lead Time Calculated From An Inventory Amount (Pieces) in A Lean VSM?Document4 pagesClient: How Is Inventory Lead Time Calculated From An Inventory Amount (Pieces) in A Lean VSM?Rachidh UverkaneNo ratings yet

- Transportation and Economic Development Challenges - (4 Distance in The Existence of Political Pathologies Rationalized Tran... )Document13 pagesTransportation and Economic Development Challenges - (4 Distance in The Existence of Political Pathologies Rationalized Tran... )monazaNo ratings yet

- Partnership Liquidation Question#6Document2 pagesPartnership Liquidation Question#6Ivy BautistaNo ratings yet

- ISCDL - Problem Statements For State Level HackthonDocument6 pagesISCDL - Problem Statements For State Level HackthonSarvesh DubeyNo ratings yet

- BA 210 MANAGERIAL ECONOMICS - Module 5 - Balin, LDocument26 pagesBA 210 MANAGERIAL ECONOMICS - Module 5 - Balin, LMarianne PeritNo ratings yet

- Caso Tata SteelDocument7 pagesCaso Tata SteelGaby Mendieta100% (1)

- Project REFYHNE at The Shell Rhineland Refinery - Building The World Largest PEM ElectrolyserDocument16 pagesProject REFYHNE at The Shell Rhineland Refinery - Building The World Largest PEM Electrolysermsantosu000No ratings yet

- Presentation Title Goes HereDocument180 pagesPresentation Title Goes HereZouhair KalkhiNo ratings yet

- Problem 7.1 Amber Mcclain: A. B. C. Assumptions Values Values ValuesDocument25 pagesProblem 7.1 Amber Mcclain: A. B. C. Assumptions Values Values Valuesveronika100% (1)

- 1 s2.0 S0925527323001949 MainDocument17 pages1 s2.0 S0925527323001949 MainAli TNo ratings yet

- Earnings Statement Only Non NegotiableDocument1 pageEarnings Statement Only Non NegotiableLiz MatzNo ratings yet

- Acc 301 Corporate Finance - Lectures Two - ThreeDocument17 pagesAcc 301 Corporate Finance - Lectures Two - ThreeFolarin EmmanuelNo ratings yet