Professional Documents

Culture Documents

Partnership Operations ( (Exercise No. 1)

Uploaded by

Shaira Nicole VasquezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Operations ( (Exercise No. 1)

Uploaded by

Shaira Nicole VasquezCopyright:

Available Formats

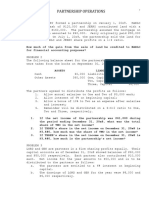

Partnership Operations

Problem Exercises

Problem A.

Luz Lm and Grace Espina formed a partnership by investing P150,000 and P180,000,

respectively. At the end of the year, the partnership has realized a profit of P110,000.

Required:

Prepare distribution of profit under each of the following independent assumption:

1. The partnership contract is silent about the profit and loss distribution.

2. Salaries of P24,000 and P15,000, respectively and remainder on a 3:2 basis.

3. Interest of 10% based on original investment and remainder equally.

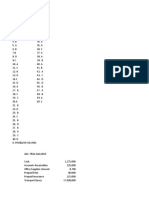

Problem B.

Kent Dequito and Jude Sauler are partners of Cebu Vintage. The income summary account

before final closing shows a credit balance of P450,000 at the end of the year.

The following were taken from ther respective capital account ledgers:

Kent Dequito

Jan. 1, Balance - P752,000

Oct. 1 Withdrawal 70,000

Dec. 1 Investment 50,000

Jude Sauler

Jan. 1 Balance P680,000

March 1 Investment 80,000

Nov. 1 Withdrawal 10,000

Dec. 1 Withdrawal 40,000

Required:

Show profit distribution to partners under the following assumption:

1. Annual salaries of P40,000 and P30,000, 8% interest based on beginning capital balance

and remainders equally.

2. 20% interest to partners based on the ending capital balance, annual salaries to each

partner, P50,000 and P20,000, respectively, and balance for distribution according to the

ratio of 50%-50%.

3. Annual salaries of P120,000 and P100,000, bonus to Dequito of 25% of profit before

salaries to both, remainder is divided based on average capital ratio.

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Prelim Exam ProblemsDocument4 pagesPrelim Exam Problemslinkin soyNo ratings yet

- Partnership MyDocument13 pagesPartnership MyHoneylyne PlazaNo ratings yet

- Partnership Operations Lecture Problem and QuizzerPDFDocument6 pagesPartnership Operations Lecture Problem and QuizzerPDFjanefern49No ratings yet

- CMPC 131 2-Partneship-OperationsDocument4 pagesCMPC 131 2-Partneship-OperationsGab IgnacioNo ratings yet

- Session 2 - Partnership Operations - Problems January 29, 2016Document10 pagesSession 2 - Partnership Operations - Problems January 29, 2016Johnny CervantesNo ratings yet

- You Can Do This!: TheoriesDocument3 pagesYou Can Do This!: Theoriesbae joohyunNo ratings yet

- Parcor 002Document17 pagesParcor 002Vincent Larrie MoldezNo ratings yet

- Print SW PartnershipDocument5 pagesPrint SW PartnershipMike MikeNo ratings yet

- Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASDocument2 pagesInstruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASKristine Lirose BordeosNo ratings yet

- IM3 Partnership Operations ProblemsDocument4 pagesIM3 Partnership Operations ProblemsXivaughn Sebastian0% (1)

- Partnership HCC CttoDocument7 pagesPartnership HCC CttoKenncy100% (1)

- Chapter 1 and 2 Additional ProblemsDocument3 pagesChapter 1 and 2 Additional ProblemsChristlyn Joy BaralNo ratings yet

- Financial Accounting and ReportingDocument8 pagesFinancial Accounting and ReportingPauline Idra100% (1)

- Partnership Operation Part 1 PDFDocument2 pagesPartnership Operation Part 1 PDFazzenethfaye.delacruz.mnlNo ratings yet

- Problems: Volume IDocument3 pagesProblems: Volume IRafael Capunpon VallejosNo ratings yet

- A 2 OperationsDocument6 pagesA 2 OperationsAngela DucusinNo ratings yet

- 2 OperationsDocument7 pages2 Operationsmartinfaith958No ratings yet

- 2122 1st AC - FAR Act. 05Document2 pages2122 1st AC - FAR Act. 05Airish GeronimoNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- P U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Document10 pagesP U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Shaina AragonNo ratings yet

- Problem On AdmissionDocument2 pagesProblem On AdmissionSam Rae LimNo ratings yet

- Integ02 ADocument2 pagesInteg02 ARonald CorunoNo ratings yet

- 2nd Assign Topic2 AdvaccDocument2 pages2nd Assign Topic2 AdvaccStella SabaoanNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- 1st Evals p2Document10 pages1st Evals p2Shiela MayNo ratings yet

- Review On Partnership OperationDocument2 pagesReview On Partnership OperationPhilip Zamaico SerenioNo ratings yet

- Partnership HandoutsDocument4 pagesPartnership Handoutsrose anne0% (1)

- Quiz - Chapter 2 - Partnership OperationsDocument5 pagesQuiz - Chapter 2 - Partnership OperationsChristian Arnel Jumpay LopezNo ratings yet

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Partnership HandoutsDocument9 pagesPartnership HandoutsEuniceChungNo ratings yet

- Partnership OperationsDocument4 pagesPartnership Operationsdaniella tagikNo ratings yet

- Partnership Prelims ExercisesDocument4 pagesPartnership Prelims ExercisesAngelo VilladoresNo ratings yet

- Partnership Formation and Operation.Document4 pagesPartnership Formation and Operation.May RamosNo ratings yet

- AfarDocument3 pagesAfarDanielle Nicole MarquezNo ratings yet

- Partnership Operations Enabling AssessmentDocument6 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaNo ratings yet

- Accounting For Special Transaction 2Document3 pagesAccounting For Special Transaction 2Nicole Gole CruzNo ratings yet

- ACC 1802 Partneship OperationsDocument3 pagesACC 1802 Partneship OperationsronnelNo ratings yet

- 15Qs-Partnership-Corporate Liquidation - 052406Document8 pages15Qs-Partnership-Corporate Liquidation - 052406Daniboy BalinawaNo ratings yet

- Partnership Operation SeatworkDocument2 pagesPartnership Operation Seatworkaleksiyaah lexleyNo ratings yet

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopNo ratings yet

- Acctng 7 Partnership Review ProblemsDocument5 pagesAcctng 7 Partnership Review ProblemssarahbeeNo ratings yet

- Ae100 Partnership Operations Notes and Sample ProblemsDocument3 pagesAe100 Partnership Operations Notes and Sample ProblemsJrm mendesNo ratings yet

- Partnership CE W Control Ans PDFDocument10 pagesPartnership CE W Control Ans PDFRedNo ratings yet

- Partnership Operations (Additional Sample Problems)Document5 pagesPartnership Operations (Additional Sample Problems)Pauline Anne LopezNo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- Partnership Operation 004Document2 pagesPartnership Operation 004John GacumoNo ratings yet

- Dokumen - Tips Partnership-HandoutsDocument4 pagesDokumen - Tips Partnership-HandoutsMarcus MonocayNo ratings yet

- AfarDocument14 pagesAfarPaulo MiguelNo ratings yet

- PartnershipDocument3 pagesPartnershipMark Edgar De Guzman0% (1)

- 2018 03 10.accounting 3b.activityDocument2 pages2018 03 10.accounting 3b.activityPatOcampo100% (2)

- Partnership Operations Problems PDFDocument7 pagesPartnership Operations Problems PDFTherese Janine HetutuaNo ratings yet

- Problem - Set - 1 - Partnership - Distribution - Mandatory Assessment (021922)Document9 pagesProblem - Set - 1 - Partnership - Distribution - Mandatory Assessment (021922)dimitriv7209No ratings yet

- SET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyDocument19 pagesSET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyJomar RabiaNo ratings yet

- Quiz AccountingDocument11 pagesQuiz Accountingsino ako100% (1)

- ADFINA 1 - Partnerhip - Luidation - Quizzer - 2016NDocument3 pagesADFINA 1 - Partnerhip - Luidation - Quizzer - 2016NKenneth Bryan Tegerero TegioNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- Midterm FinacDocument4 pagesMidterm FinacShaira Nicole VasquezNo ratings yet

- HRM - ReportDocument5 pagesHRM - ReportShaira Nicole VasquezNo ratings yet

- Partnership and CorporationDocument6 pagesPartnership and CorporationShaira Nicole Vasquez50% (2)

- The Importance of TreesDocument2 pagesThe Importance of TreesShaira Nicole VasquezNo ratings yet

- Entrepreneurship-Report DoneDocument27 pagesEntrepreneurship-Report DoneShaira Nicole VasquezNo ratings yet

- Trial Balance (Problem 4)Document1 pageTrial Balance (Problem 4)Shaira Nicole VasquezNo ratings yet

- Partnership Operation (Probelem Exercise 2)Document1 pagePartnership Operation (Probelem Exercise 2)Shaira Nicole VasquezNo ratings yet

- Fitt - Pe ReportDocument2 pagesFitt - Pe ReportShaira Nicole VasquezNo ratings yet

- Partnership Operations (Prob. 1) - SolutionDocument2 pagesPartnership Operations (Prob. 1) - SolutionShaira Nicole VasquezNo ratings yet

- Iist History Reaction Paper - Vasquez ShairaDocument1 pageIist History Reaction Paper - Vasquez ShairaShaira Nicole VasquezNo ratings yet

- Adjusting Entries (Solutions - Problem 1)Document2 pagesAdjusting Entries (Solutions - Problem 1)Shaira Nicole VasquezNo ratings yet

- The Profile of Entrepreneurs: Characteristis TraitsDocument2 pagesThe Profile of Entrepreneurs: Characteristis TraitsShaira Nicole VasquezNo ratings yet

- Entrepreneur DefinedDocument2 pagesEntrepreneur DefinedShaira Nicole VasquezNo ratings yet

- Trial Balance - Daria TolentinoDocument1 pageTrial Balance - Daria TolentinoShaira Nicole VasquezNo ratings yet

- Suggested Flexibility ExerciseDocument10 pagesSuggested Flexibility ExerciseShaira Nicole VasquezNo ratings yet

- Merchandising Accounting (Erlinda See Chua)Document1 pageMerchandising Accounting (Erlinda See Chua)Shaira Nicole VasquezNo ratings yet