Professional Documents

Culture Documents

Review On Partnership Operation

Uploaded by

Philip Zamaico SerenioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Review On Partnership Operation

Uploaded by

Philip Zamaico SerenioCopyright:

Available Formats

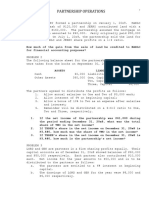

REVIEW ON PARTNERSHIP OPERATION

Problem 1

Shanks, Beckman, and Yassop are partners in Red Hair Partnership. Below shows their profit or

loss agreement and the changes in their capital accounts during the second year:

1. Distribute P50,000 fixed salary as capital credit to each of them.

2. Distribute 15% interest as capital credit based on capital balances.

3. Distribute 10% bonus as capital credit to Yassop as managing partner.

4. Distribute the remaining profit based on their agreed sharing ratio of 45:30:25.

Shanks Beckman Yassop

Beginning balance P350,000 P230,000 P200,000

March 31 70,000 ( 50,000) 55,000

July 1 ( 35,000) 75,000 ( 20,000)

September 30 ( 10,000) 40,000 15,000

Scenario 1: If the partnership earned net profit of P500,000, compute the share of each partner

on the net profit assuming:

1. The interest is based on beginning capital and the bonus is based on net profit

before salaries and interests.

2. The interest is based on ending capital before adjustment from distribution and

bonus is based on net profit after salaries and interests.

3. The interest is based on weighted average capital and bonus is based on net profit

after bonuses.

Scenario 2: The partnership earned net profit of P200,000, compute the share of each partner

on the net profit assuming:

1. The interest is based on beginning capital and the bonus is based on net profit

before salaries and interests, but after bonus.

2. The interest is based on ending capital before adjustment from distribution and

bonus is based on net profit after salaries, interests, and bonuses.

3. The interest is based on weighted average capital and bonus is based on net profit

before salaries, interests, and bonuses.

Scenario 3: The partnership incurred net loss of P150,000, compute the share of each partner on

the net loss assuming:

1. The interest is based on beginning capital.

2. The interest is based on ending capital before adjustment from distribution.

3. The interest is based on weighted average capital.

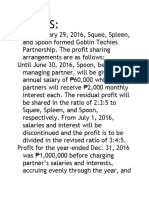

Problem 2

Rimuru is trying to decide whether to accept a salary of P80,000 or a salary of P50,000 plus a

bonus of 10% of net income after salary and bonus as a means of allocating profit among the

partners. Salaries traceable to other partners are estimated to be P100,000.

Requirement: What amount of income would be necessary so that Rimuru would

consider the choices to be equal?

Problem 3

The partnership of Godzilla and Kingkong has the agreement of distributing interest equal to 12%

per year as a credit to each partner on the basis of their capital balances. Below shows the

summary of accounts of Godzilla for the second year:

January 1 balance P210,000

June 30 additional investment 60,000

August 31 withdrawal 25,000

December 31 balance before share in profit or loss 245,000

Requirement: What amount of interest should be credited to Godzilla’s capital account

for the second year under the following assumptions?

1. Interest is based on beginning balance.

2. Interest is based on ending balance.

3. Interest is based on average balance.

Problem 4

Akainu, Kizaru, and Kuzan are partners with average capital balances during the second year of

P720,000, P360,000, and P240,000, respectively. Each of them is entitled to receive 7% interest

on their average capital balances. After considering salaries of P90,000 and P60,000 respectively

to Akainu and Kizaru, the remaining profit or loss is divided equally. During the second year, the

partnership earned profit of P150,000 before salaries and interests.

Requirement: What amount should each partner’s capital account increase or decrease?

Problem 5

Anos, Misha, and Sasha are partners in Misfit Partnership and have the following agreement for

the allocation of net profit in chronological order:

1. Anos is to receive 15% of net profit up to P300,000 and 25% over P300,000.

2. Misha and Sasha are to receive 10% of the remaining income over P200,000.

3. Any excess profit is to be allocated based on the ratio of 4:3:3.

The partnership net profit for the year amounted to P500,000 prior to distribution to partners.

Requirement: What amount each partner should receive as profit allocation?

Problem 6

Ayano, Kisara, and Sharon are partners in Engage Partnership with capital balances of P500,000,

P480,000, and P525,000, respectively. During the current year, the partnership earned a net

profit. They agreed to receive equal amount of salary, 5% interest based on capital balances,

bonus, if any, and the excess in the ratio of 3:5:2. Ayano’s capital increased to P693,683, only

Kisara received a bonus of P37,473 as managing partner which is 12% of net profit after salaries,

interests, and bonuses, while Sharon’s share in the excess profit is P62,455.

Requirement: How much is the net profit earned by the partnership in the current year?

You might also like

- A 2 OperationsDocument6 pagesA 2 OperationsAngela DucusinNo ratings yet

- Print SW PartnershipDocument5 pagesPrint SW PartnershipMike MikeNo ratings yet

- 2 OperationsDocument7 pages2 Operationsmartinfaith958No ratings yet

- Partnership Operations Lecture Problem and QuizzerPDFDocument6 pagesPartnership Operations Lecture Problem and QuizzerPDFjanefern49No ratings yet

- IM3 Partnership Operations ProblemsDocument4 pagesIM3 Partnership Operations ProblemsXivaughn Sebastian0% (1)

- Module 2 - Partnership OperationsDocument33 pagesModule 2 - Partnership OperationsMaluDyNo ratings yet

- Partnership OperationsDocument4 pagesPartnership Operationsdaniella tagikNo ratings yet

- Special Qualifying Examination Review 2019: Partnership OperationsDocument4 pagesSpecial Qualifying Examination Review 2019: Partnership OperationszoeNo ratings yet

- Partnership Operation 004Document2 pagesPartnership Operation 004John GacumoNo ratings yet

- 2nd Assign Topic2 AdvaccDocument2 pages2nd Assign Topic2 AdvaccStella SabaoanNo ratings yet

- Parcor 002Document17 pagesParcor 002Vincent Larrie MoldezNo ratings yet

- Prelim Exam ProblemsDocument4 pagesPrelim Exam Problemslinkin soyNo ratings yet

- Financial Accounting and ReportingDocument8 pagesFinancial Accounting and ReportingPauline Idra100% (1)

- Problems: Volume IDocument3 pagesProblems: Volume IRafael Capunpon VallejosNo ratings yet

- Special Qualifying Examination Review 2019: Partnership OperationsDocument4 pagesSpecial Qualifying Examination Review 2019: Partnership OperationsJonalyn AnchetaNo ratings yet

- CMPC 131 2-Partneship-OperationsDocument4 pagesCMPC 131 2-Partneship-OperationsGab IgnacioNo ratings yet

- AST Discussion 2 - PARTNERSHIP OPERATIONDocument3 pagesAST Discussion 2 - PARTNERSHIP OPERATIONYvone Claire Fernandez SalmorinNo ratings yet

- Partnership Operations Enabling AssessmentDocument6 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaNo ratings yet

- Ae100 Partnership Operations Notes and Sample ProblemsDocument3 pagesAe100 Partnership Operations Notes and Sample ProblemsJrm mendesNo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- Integ02 ADocument2 pagesInteg02 ARonald CorunoNo ratings yet

- Accounting For Special Transaction 2Document3 pagesAccounting For Special Transaction 2Nicole Gole CruzNo ratings yet

- Partnership ContinuationDocument3 pagesPartnership ContinuationRhoiz100% (2)

- SET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyDocument19 pagesSET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyJomar RabiaNo ratings yet

- BSA 23C-AFAR ReviewerDocument102 pagesBSA 23C-AFAR ReviewerKlint HandsellNo ratings yet

- Quiz 2 KeyDocument5 pagesQuiz 2 KeyRosie PosieNo ratings yet

- Partnership HCC CttoDocument7 pagesPartnership HCC CttoKenncy100% (1)

- 2018 03 10.accounting 3b.activityDocument2 pages2018 03 10.accounting 3b.activityPatOcampo100% (2)

- Partnership Operations Enabling AssessmentDocument2 pagesPartnership Operations Enabling AssessmentJoana TrinidadNo ratings yet

- ACC 1802 Partneship OperationsDocument3 pagesACC 1802 Partneship OperationsronnelNo ratings yet

- BONUSDocument16 pagesBONUSKristia AnagapNo ratings yet

- Activity 1.2.1Document1 pageActivity 1.2.1De Nev OelNo ratings yet

- Problem On AdmissionDocument2 pagesProblem On AdmissionSam Rae LimNo ratings yet

- ACCT201: Accounting For Special Transactions: Without Solutions Shall Not Merit PointsDocument2 pagesACCT201: Accounting For Special Transactions: Without Solutions Shall Not Merit PointsMiles SantosNo ratings yet

- Partnership Operations: Review of The Accounting CycleDocument8 pagesPartnership Operations: Review of The Accounting CycleAlloysius ParilNo ratings yet

- Partnership Operations Problems PDFDocument7 pagesPartnership Operations Problems PDFTherese Janine HetutuaNo ratings yet

- Quiz Partn OerationDocument6 pagesQuiz Partn OerationTommy OngNo ratings yet

- Prequalifying ExaminationDocument6 pagesPrequalifying ExaminationVincent Villalino LabrintoNo ratings yet

- Reviewer - ParCorDocument13 pagesReviewer - ParCoramiNo ratings yet

- ACCT601 - Prelim Examination PDFDocument10 pagesACCT601 - Prelim Examination PDFSweet EmmeNo ratings yet

- Actpaco ReviewerDocument49 pagesActpaco ReviewerMark Steven Pempengco100% (1)

- 2 ACCT 2A&B P. OperationDocument6 pages2 ACCT 2A&B P. OperationBrian Christian VillaluzNo ratings yet

- Quiz OperationsDocument4 pagesQuiz OperationsAngelo VilladoresNo ratings yet

- CMPC131Document15 pagesCMPC131Nhel AlvaroNo ratings yet

- 2 Partnership OperationDocument4 pages2 Partnership OperationDacanay, Sean Eigencris G.No ratings yet

- 1 Lecture Notes DissolutionDocument17 pages1 Lecture Notes DissolutionMaybelle Espenido0% (2)

- Partnership Operations P1Document7 pagesPartnership Operations P1Kyut KoNo ratings yet

- Part 5555Document2 pagesPart 5555Rhoiz80% (5)

- Part 5555Document2 pagesPart 5555RhoizNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- Partnership Operations ( (Exercise No. 1)Document1 pagePartnership Operations ( (Exercise No. 1)Shaira Nicole VasquezNo ratings yet

- Chapter 18 TestbankDocument8 pagesChapter 18 TestbankBea GarciaNo ratings yet

- You Can Do This!: TheoriesDocument3 pagesYou Can Do This!: Theoriesbae joohyunNo ratings yet

- Partnership Prelims ExercisesDocument4 pagesPartnership Prelims ExercisesAngelo VilladoresNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- Ra 7877Document16 pagesRa 7877Anonymous FExJPnCNo ratings yet

- User Manual For Inquisit's Attentional Network TaskDocument5 pagesUser Manual For Inquisit's Attentional Network TaskPiyush ParimooNo ratings yet

- Eradication, Control and Monitoring Programmes To Contain Animal DiseasesDocument52 pagesEradication, Control and Monitoring Programmes To Contain Animal DiseasesMegersaNo ratings yet

- UXBenchmarking 101Document42 pagesUXBenchmarking 101Rodrigo BucketbranchNo ratings yet

- AMUL'S Every Function Involves Huge Human ResourcesDocument3 pagesAMUL'S Every Function Involves Huge Human ResourcesRitu RajNo ratings yet

- SHS StatProb Q4 W1-8 68pgsDocument68 pagesSHS StatProb Q4 W1-8 68pgsKimberly LoterteNo ratings yet

- CebuanoDocument1 pageCebuanoanon_58478535150% (2)

- For FDPB Posting-RizalDocument12 pagesFor FDPB Posting-RizalMarieta AlejoNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummarySofia ArissaNo ratings yet

- Green Campus Concept - A Broader View of A Sustainable CampusDocument14 pagesGreen Campus Concept - A Broader View of A Sustainable CampusHari HaranNo ratings yet

- Delegated Legislation in India: Submitted ToDocument15 pagesDelegated Legislation in India: Submitted ToRuqaiyaNo ratings yet

- Landslide Hazard Manual: Trainer S HandbookDocument32 pagesLandslide Hazard Manual: Trainer S HandbookMouhammed AbdallahNo ratings yet

- GooseberriesDocument10 pagesGooseberriesmoobin.jolfaNo ratings yet

- You Are The Reason PDFDocument1 pageYou Are The Reason PDFLachlan CourtNo ratings yet

- Group 2 Lesson 2 DramaDocument38 pagesGroup 2 Lesson 2 DramaMar ClarkNo ratings yet

- Spitzer 1981Document13 pagesSpitzer 1981Chima2 SantosNo ratings yet

- ENTRAPRENEURSHIPDocument29 pagesENTRAPRENEURSHIPTanmay Mukherjee100% (1)

- Walt Whitman Video Worksheet. CompletedDocument1 pageWalt Whitman Video Worksheet. CompletedelizabethannelangehennigNo ratings yet

- Annals of The B Hand 014369 MBPDocument326 pagesAnnals of The B Hand 014369 MBPPmsakda HemthepNo ratings yet

- Literatures of The World: Readings For Week 4 in LIT 121Document11 pagesLiteratures of The World: Readings For Week 4 in LIT 121April AcompaniadoNo ratings yet

- 059 Night of The Werewolf PDFDocument172 pages059 Night of The Werewolf PDFomar omar100% (1)

- Allen F. y D. Gale. Comparative Financial SystemsDocument80 pagesAllen F. y D. Gale. Comparative Financial SystemsCliffordTorresNo ratings yet

- ANI Network - Quick Bill Pay PDFDocument2 pagesANI Network - Quick Bill Pay PDFSandeep DwivediNo ratings yet

- AITAS 8th Doctor SourcebookDocument192 pagesAITAS 8th Doctor SourcebookClaudio Caceres100% (13)

- 44) Year 4 Preposition of TimeDocument1 page44) Year 4 Preposition of TimeMUHAMMAD NAIM BIN RAMLI KPM-GuruNo ratings yet

- Amt 3103 - Prelim - Module 1Document17 pagesAmt 3103 - Prelim - Module 1kim shinNo ratings yet

- Review Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Document11 pagesReview Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Ulaş GüllenoğluNo ratings yet

- Astm D1895 17Document4 pagesAstm D1895 17Sonia Goncalves100% (1)

- Cover Letter For Lettings Negotiator JobDocument9 pagesCover Letter For Lettings Negotiator Jobsun1g0gujyp2100% (1)

- Karak Rules - EN - Print PDFDocument8 pagesKarak Rules - EN - Print PDFWesley TeixeiraNo ratings yet