Professional Documents

Culture Documents

Activity 1.2.1

Uploaded by

De Nev OelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity 1.2.1

Uploaded by

De Nev OelCopyright:

Available Formats

Activity 1.2.

Direction: Provide what is asked.

Test I. Long Problem

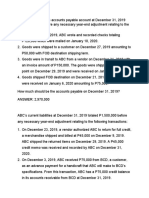

The capital accounts of Castro and Diaz show the following facts for the fiscal year ended December 31, 2016:

Castro Diaz

Jan. 1 Balance P 26,000 Jan. 1 Balance P 16,500

Mar. 30 Investment 3,000 May 18 Investment 5,000

May 10 Investment 7,000 Aug. 24 Withdrawal 2,000

July 25 Withdrawal 4,000 Dec. 21 Balance 19,500

Dec. 31 Balance 32,000

The profit and loss account shows a credit balance of P 23,800 on December 31.

Required: Prepare a schedule of profit distribution under the following independent agreements on the division of profits:

1. In the ratio of investments at the beginning or the fiscal period.

2. In the ratio of average capitals, investments and withdrawals are to be considered as made at the beginning of the month if

made before the middle of the month, and are to be considered as made at the beginning of the following month if made after

the middle of the month.

3. Interest of 24% on average capitals, salaries to Castro and Diaz of P 36,000 and P 24,000, respectively, and any balance

equally. Investments and withdrawals are to be considered as in (2).

4. Allowance to Castro of a bonus of 25% of the net profit after bonus; interest of 10% to be allowed on the excess of the

average investment (simple average) of one partner over that of the other, and any balance in the ratio of 3:2 to Castro and

Diaz, respectively.

Test II. Short Problems

1. Peter and Paul formed a partnership on January 2, 2016, and agreed to share net income and losses 90 percent and 10

percent, respectively. Peter invested cash of P 250,000. Paul invested no assets but had a specialized expertise and

managed the firm full time. The partnership contract provided the following:

Partners’ capital accounts are to be credited annually with interest at 5 percent of beginning capital account

balances.

Paul is to be paid a salary of P 10,000 a month.

Paul is to receive a bonus of 20 percent of income before deduction of salary bonus and interest on partners’ capital

account balances.

Bonus, interest, and Paul salary are considered expenses.

The statement of comprehensive income for the year ended 2016 for the partnership includes the following:

Revenue P 964,500

Expenses (including salary, interest, and bonus to Paul) 497,000

Net income P 467,500

What is Paul’s bonus for 2016? ___________________

2. LL, MM and PP are partners with capitals of P 40,000, P 25,000 and P 15,000 respectively. The partnership agreement

provides that each partner shall be allowed 5 percent interest on his capital, that LL shall be allowed an annual salary of P

8,500, and that MM shall be entitled to a minimum of P 14,000 per annum including amounts allowed as interest on capital

and as share of profit. Profit after interest and salary allowances is to be divided between LL, MM and PP 5:3:2 respectively.

What amount must be earned by the partnership during 2016 before charged for interest or salary if LL is to receive an

aggregate of P 20,000 to include interest, salary and share of profit? ________________

3. Mel and Jay are partners with capitals of P 200,000 and P 120,000, respectively. The partnership agreement provided the

following:

10 percent interest on their capital investments

Annual salary of P 36,000 to Mel

Remainder in 60:40 ratio to Mel and Jay.

What is the profit to be earned by the partnership before charges for interest, salary and the balance, so that Jay will received

P 40,000 in the remainder of the profit after salary and interest? _______________

You might also like

- If The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnDocument2 pagesIf The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnJoana TrinidadNo ratings yet

- AFAR - Partnership OperationDocument21 pagesAFAR - Partnership OperationReginald ValenciaNo ratings yet

- CH 005Document2 pagesCH 005Joana TrinidadNo ratings yet

- 3.3 Exercise - Improperly Accumulated Earnings TaxDocument2 pages3.3 Exercise - Improperly Accumulated Earnings TaxRenzo KarununganNo ratings yet

- AFAR-01 PartnershipDocument6 pagesAFAR-01 PartnershipRamainne Ronquillo0% (1)

- Problem 44Document2 pagesProblem 44Arian AmuraoNo ratings yet

- Partnership Q4Document2 pagesPartnership Q4Lorraine Mae Robrido100% (1)

- Partnership - Operation, LiquidationDocument4 pagesPartnership - Operation, LiquidationKenneth Bryan Tegerero TegioNo ratings yet

- ACTIVITY 2 - Cost Behavior, Cost FunctionDocument2 pagesACTIVITY 2 - Cost Behavior, Cost FunctionAizen IchigoNo ratings yet

- SMA Chapter Four - Variance AnalysisDocument86 pagesSMA Chapter Four - Variance Analysisngandu100% (1)

- Partnership Mock ExamDocument15 pagesPartnership Mock ExamPerbielyn BasinilloNo ratings yet

- There Is Revaluation of Assets Equal To P50,000Document2 pagesThere Is Revaluation of Assets Equal To P50,000Joana TrinidadNo ratings yet

- CORPORATIONDocument14 pagesCORPORATIONcpacpacpaNo ratings yet

- Partnership Dissolution 4Document6 pagesPartnership Dissolution 4Karl Wilson GonzalesNo ratings yet

- Practical Accounting 2 - ExaminationDocument10 pagesPractical Accounting 2 - ExaminationPrincess Claris ArauctoNo ratings yet

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument46 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionKeith Anthony AmorNo ratings yet

- Quiz - PartnershipDocument2 pagesQuiz - PartnershipLeisleiRagoNo ratings yet

- 4partnership DissolutionEDITED OnlineDocument15 pages4partnership DissolutionEDITED OnlinePaul BandolaNo ratings yet

- Qa PartnershipDocument9 pagesQa PartnershipFaker MejiaNo ratings yet

- Quiz - M1 M2Document12 pagesQuiz - M1 M2Jenz Crisha PazNo ratings yet

- Introduction To Partnership Accounting Partnership DefinedDocument33 pagesIntroduction To Partnership Accounting Partnership DefinedMarcus MonocayNo ratings yet

- I. Concept Notes Joint CostsDocument9 pagesI. Concept Notes Joint CostsDanica Christele AlfaroNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Partnership Dissolution - PART 1Document17 pagesPartnership Dissolution - PART 1Aby ReedNo ratings yet

- Abm QuizDocument5 pagesAbm QuizCastleclash CastleclashNo ratings yet

- Wala LangDocument8 pagesWala LangMax Dela TorreNo ratings yet

- Accounting 2 PrelimsDocument3 pagesAccounting 2 PrelimsJohn Alfred Castino100% (1)

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- Multiple Choice Partnership and CorporationDocument14 pagesMultiple Choice Partnership and CorporationTrina Joy HomerezNo ratings yet

- Partnership AcctgDocument3 pagesPartnership AcctgcessbrightNo ratings yet

- Consolidating Balance SheetsDocument4 pagesConsolidating Balance Sheetsangel2199No ratings yet

- Chapter 09Document16 pagesChapter 09FireBNo ratings yet

- Partnership - I: "Your Online Partner To Get Your Title"Document10 pagesPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Question Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsDocument32 pagesQuestion Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsYou're WelcomeNo ratings yet

- CH 009Document2 pagesCH 009Joana TrinidadNo ratings yet

- Partnership Admission Problems and Journal EntriesDocument2 pagesPartnership Admission Problems and Journal EntriesKaren Joy Jacinto ElloNo ratings yet

- Financial Accounting ExamDocument12 pagesFinancial Accounting Examjano_art21No ratings yet

- ParCor Corpo EQ Set ADocument3 pagesParCor Corpo EQ Set AMara LacsamanaNo ratings yet

- True or False. Partnership FormationDocument1 pageTrue or False. Partnership Formation촏교새벼No ratings yet

- Costacc Final ExamDocument20 pagesCostacc Final ExamGemNo ratings yet

- Chapter 2Document12 pagesChapter 2Cassandra KarolinaNo ratings yet

- Student Scorecard for Partnership Accounting ExamDocument6 pagesStudent Scorecard for Partnership Accounting ExamShaira Nicole Vasquez50% (2)

- AA Chap1 Basic ConsiderationsDocument60 pagesAA Chap1 Basic ConsiderationsArly Kurt TorresNo ratings yet

- Accounting 12Document4 pagesAccounting 12Breathe ArielleNo ratings yet

- Partneship Handout Without Answer KeyDocument10 pagesPartneship Handout Without Answer KeyAirah Manalastas0% (1)

- Accounting For Partnership DissolutionDocument19 pagesAccounting For Partnership DissolutionMelanie kaye ApostolNo ratings yet

- Problem 1: Rizal Review CenterDocument6 pagesProblem 1: Rizal Review CenterrenoNo ratings yet

- Quizzer Acctg2Document1 pageQuizzer Acctg2elminvaldez0% (1)

- X 3Document8 pagesX 3Max Dela Torre0% (1)

- Partnership Accounting QuestionsDocument15 pagesPartnership Accounting QuestionsNhel AlvaroNo ratings yet

- AdvaccDocument3 pagesAdvaccMontessa GuelasNo ratings yet

- Partnership Liquidation and Capital Account DistributionsDocument7 pagesPartnership Liquidation and Capital Account DistributionsMaria Beatriz Munda0% (1)

- Cost Accounting Quiz 5 Joint Products & By-Products CostingDocument7 pagesCost Accounting Quiz 5 Joint Products & By-Products CostingshengNo ratings yet

- Calculating Transaction Price for New ProductDocument3 pagesCalculating Transaction Price for New Productjefferson sarmientoNo ratings yet

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- Handouts PartnershipDocument9 pagesHandouts PartnershipCPANo ratings yet

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaNo ratings yet

- Partnership Formation and Capital AccountsDocument4 pagesPartnership Formation and Capital Accountslinkin soyNo ratings yet

- Partnership Profit Sharing CalculationsDocument4 pagesPartnership Profit Sharing CalculationsAngelo VilladoresNo ratings yet

- SET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyDocument19 pagesSET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyJomar RabiaNo ratings yet

- Silicon 1.2Document3 pagesSilicon 1.2De Nev OelNo ratings yet

- Silicon 1.3Document3 pagesSilicon 1.3De Nev OelNo ratings yet

- Silicon 1.5Document4 pagesSilicon 1.5De Nev OelNo ratings yet

- Silicon 1.0Document2 pagesSilicon 1.0De Nev OelNo ratings yet

- Silicon 1.0Document5 pagesSilicon 1.0De Nev OelNo ratings yet

- Silicon 1.0Document3 pagesSilicon 1.0De Nev OelNo ratings yet

- Silicon 1.3Document2 pagesSilicon 1.3De Nev OelNo ratings yet

- Silicon 1.4Document3 pagesSilicon 1.4De Nev OelNo ratings yet

- Silicon 1.3Document3 pagesSilicon 1.3De Nev OelNo ratings yet

- GEEL 3 Module 1.1Document7 pagesGEEL 3 Module 1.1De Nev OelNo ratings yet

- Silicon 1.5Document4 pagesSilicon 1.5De Nev OelNo ratings yet

- Silicon 1.2Document2 pagesSilicon 1.2De Nev OelNo ratings yet

- Silicon 1.3Document2 pagesSilicon 1.3De Nev OelNo ratings yet

- Silicon 1.4Document2 pagesSilicon 1.4De Nev OelNo ratings yet

- GEEL 3 Module 2.1Document7 pagesGEEL 3 Module 2.1De Nev OelNo ratings yet

- Silicon 1.5Document2 pagesSilicon 1.5De Nev OelNo ratings yet

- Indigenous Craft Materials and ToolsDocument8 pagesIndigenous Craft Materials and ToolsDe Nev OelNo ratings yet

- Dela Pena, C. Sci2 ElectronegativityDocument2 pagesDela Pena, C. Sci2 ElectronegativityDe Nev OelNo ratings yet

- MU Learning Module Importance of VMO & Core ValuesDocument3 pagesMU Learning Module Importance of VMO & Core ValuesDe Nev OelNo ratings yet

- KinshipDocument44 pagesKinshipDe Nev OelNo ratings yet

- Dela Pena, C. Marygold Bank Recon AnswerDocument6 pagesDela Pena, C. Marygold Bank Recon AnswerDe Nev OelNo ratings yet

- Jose Rizal Has Become A Symbol of The Philippine Struggle For Independence. HisDocument2 pagesJose Rizal Has Become A Symbol of The Philippine Struggle For Independence. HisDe Nev OelNo ratings yet

- Document (2) 1Document1 pageDocument (2) 1De Nev OelNo ratings yet

- Investing in Stocks, Bonds, Funds and Real EstateDocument48 pagesInvesting in Stocks, Bonds, Funds and Real EstateDe Nev OelNo ratings yet

- Identifying Money Management Philosophy: LearningDocument2 pagesIdentifying Money Management Philosophy: LearningDe Nev OelNo ratings yet

- Add: Deposits in Transit (DIT) Subtotal Less: Outstanding Check (OC)Document6 pagesAdd: Deposits in Transit (DIT) Subtotal Less: Outstanding Check (OC)De Nev OelNo ratings yet

- Identifying Investment TypesDocument3 pagesIdentifying Investment TypesDe Nev OelNo ratings yet

- Dela Pena, C. Marygold Bank Recon AnswerDocument6 pagesDela Pena, C. Marygold Bank Recon AnswerDe Nev OelNo ratings yet

- FMarkets - Key Learnings 1.10Document4 pagesFMarkets - Key Learnings 1.10De Nev OelNo ratings yet

- FMarkets - Key Learnings 1.11Document1 pageFMarkets - Key Learnings 1.11De Nev OelNo ratings yet

- 2nd Semester Income Taxation Module 9 CPAR Fringe Benefits TaxDocument13 pages2nd Semester Income Taxation Module 9 CPAR Fringe Benefits Taxnicole tolaybaNo ratings yet

- Construction Methods and Project Management GuideDocument30 pagesConstruction Methods and Project Management GuideJay LoyaoNo ratings yet

- LABOR LawDocument7 pagesLABOR LawKylie DanielleNo ratings yet

- Contractor Agreement REF 3jg4zp4Document23 pagesContractor Agreement REF 3jg4zp4Admin TradersNo ratings yet

- Construction Contract TemplateDocument5 pagesConstruction Contract TemplatebryNo ratings yet

- Labor Relation Chapter 1 6Document14 pagesLabor Relation Chapter 1 6Phoebe WalastikNo ratings yet

- Constitutional Validity of Minimum Wages ActDocument23 pagesConstitutional Validity of Minimum Wages ActNitish Kumar NaveenNo ratings yet

- Offer Letter ExperiencedDocument11 pagesOffer Letter ExperiencedANUHYA CHINTHALANo ratings yet

- Labor Law Syllabus 2021Document3 pagesLabor Law Syllabus 2021Francisco BanguisNo ratings yet

- By: Nyalusi B.P: Labour Law Lecture Notes DefinitionsDocument85 pagesBy: Nyalusi B.P: Labour Law Lecture Notes DefinitionsMarco kusyamaNo ratings yet

- Development of Labour Laws in IndiaDocument5 pagesDevelopment of Labour Laws in IndiamanjushreeNo ratings yet

- WDR 1995 - EnglishDocument265 pagesWDR 1995 - EnglishorkhanNo ratings yet

- Quantity Survey and Cost EstimatesDocument4 pagesQuantity Survey and Cost Estimatesfelix mapilesNo ratings yet

- Professional Service Agreement of Modirumid Oü and J.A.Rgon I.T. SolutionsDocument11 pagesProfessional Service Agreement of Modirumid Oü and J.A.Rgon I.T. SolutionsBuck FourtyNo ratings yet

- EE Relationship Basis for Labor OrganizingDocument36 pagesEE Relationship Basis for Labor OrganizingJamiah Obillo HulipasNo ratings yet

- SAAR Integrated Services PVT LTD:, A Group Company of SA AssociatesDocument11 pagesSAAR Integrated Services PVT LTD:, A Group Company of SA Associatesதமிழக மாற்று திறனாளிகள்No ratings yet

- Components of StaffingDocument11 pagesComponents of StaffingRamanjotNo ratings yet

- CONTRACT OF AGENCY (EDITED) Summarised DocumentDocument10 pagesCONTRACT OF AGENCY (EDITED) Summarised DocumentShubham PhophaliaNo ratings yet

- CDC vs. Association of CDC Supervisory Personnel Union - GR No. 207853 - LISINGDocument2 pagesCDC vs. Association of CDC Supervisory Personnel Union - GR No. 207853 - LISINGAnawin FamadicoNo ratings yet

- Transmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack DueDocument24 pagesTransmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack DueTender 247No ratings yet

- Case Analysis: Submitted To-Dr. Liji SamuelDocument14 pagesCase Analysis: Submitted To-Dr. Liji SamuelSebin JamesNo ratings yet

- Stella J Ackon SHRMDocument13 pagesStella J Ackon SHRMImtiazNo ratings yet

- Constructive dismissal-Info-Sheet-2023Document1 pageConstructive dismissal-Info-Sheet-2023ThabooNo ratings yet

- Temporary Teaching Job InsightsDocument10 pagesTemporary Teaching Job InsightsMr StefyNo ratings yet

- Offer LetterDocument7 pagesOffer LetterDarshan RNo ratings yet

- Employment Contracting BasicsDocument7 pagesEmployment Contracting Basicsalexis liscumNo ratings yet

- Dealership Cooperation Agreement: InternalDocument20 pagesDealership Cooperation Agreement: InternalEmmanuel DimasacatNo ratings yet

- Labor Standards Outline (2020)Document19 pagesLabor Standards Outline (2020)Kyle Dionisio100% (1)

- Working in Sweden GuideDocument24 pagesWorking in Sweden GuideMatthew ReachNo ratings yet

- New in The Netherlands: For European Labour MigrantsDocument24 pagesNew in The Netherlands: For European Labour MigrantsDrilon ShkourtiNo ratings yet