Professional Documents

Culture Documents

Costs Employees Compensation Payroll Taxes Accounting System

Uploaded by

maha khanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costs Employees Compensation Payroll Taxes Accounting System

Uploaded by

maha khanCopyright:

Available Formats

Q) How does accounting relates to human resources?

ANS) Human resource accounting involves the tracking of all costs related to employees in a

separate report. These costs include employee compensation, payroll taxes, benefits, training,

and recruiting. Such an accounting system can be used to determine where human resources

costs are especially heavy or light in an organization. This information can be used to redirect

employees toward those activities to which they can bring the most value. Conversely, the

report can be used to identify those areas in which employee costs are too high, which may lead

to a reduction in force or a reallocation of staff away from those areas.

A more comprehensive human resource accounting system goes beyond the simple tracking of

employee-related costs, and addresses the following two additional areas:

Budgeting. An organization's annual budget includes a human resources component, in

which is concentrated all employee costs being incurred from across the organization. By

concentrating cost information by its nature, management can more clearly see the total impact

of human resource costs on the entity.

Employee valuation. Rather than looking at employees as costs, the system is redirected

toward viewing them as assets. This can involve the assignment of values to employees based

on their experience, education, innovativeness, leadership, and so forth. This can be a difficult

area in which to achieve a verifiable level of quantification, and so may have limited value from

a management perspective.

From an accounting perspective, the expense-based view of human resources is quite easy -

employee costs from the various departments are simply aggregated into a report. The employee

valuation approach is not a tenable concept for the accountant, since this is an internally-

generated intangible asset, and so cannot be recorded in the accounting system.

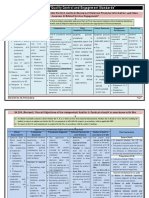

Q) Difference between cost accounting and management accounting?

The key difference between Cost Accounting vs Management accounting

is that Cost accounting is gathering and analyzing the information

related to cost which provides only the quantitative information to the

users of the reports whereas Management Accounting is the preparation

of the financial as well as non-financial information i.e., it involves both

quantitative and qualitative information.

Management accounting includes a lot of aspects of business such as decision

making, strategizing, planning, performance management, risk management,

etc. Cost accounting, on the other hand, only revolves around cost

computation, cost control, and overall cost reduction of business.

In simple terms, cost accounting is one of the sub-sets of management

accounting. As a result, the scope and reach of management accounting are

much broader and pervasive than cost accounting. So, we can say that

management accounting can provide a helicopter view of the business by

looking at each aspect qualitatively and quantitatively. Cost accounting only

gives a pixel view of the cost of each product, service, or process.

Q) what is income statement ? describe the components of income statement?

The Income Statement is one of a company’s core financial statements that

shows their profit and loss over a period of time. The profit or loss is

determined by taking all revenues and subtracting all expenses from both

operating and non-operating activities.

Income Statement Components

Revenue

Revenue is the money an entity receives from the sale of goods or services. Other terms

frequently used for revenue are sales, net sales, or sale revenue. It is also referred to as

the “top line” because revenues are reported at the top of the income statement.

Cost of Goods Sold

Cost of goods sold are the direct costs of producing the goods being offered by the entity.

This would include the materials, labor, and other resources required for production.

Gross Profit

Gross profit is the difference between the revenue received for the product less the cost

of goods sold.

Operating Expenses

Operating expenses are the amount an entity expends to maintain and operate the

general business. Operating expenses include research and development, marketing,

general and administrative, amortization of intangible assets (i.e. patents, good will,

etc.), etc.

In addition, when an entity purchases a capital asset, such as a building or equipment,

they expense a portion of the asset over a number of years; this is called depreciation.

Depreciation expense is an accounting expense that is deducted from net income.

Operating Income

Operating income is equal to revenues minus cost of goods sold and operating expenses.

In other words, it measures the profits or losses of the day to day operations of the

business. Another name for Operating Income is Earnings Before Interest and Taxes

(EBIT).

Other Income/Expenses

To obtain net income, further adjustments must be made to account for interest income

and expense, income tax expenses, and other extraordinary and miscellaneous items.

Profits

Revenues minus all expenses equals net income (profits or losses). Profits are also

referred to as net income or the “bottom line” because profits are reported at the bottom

of the income statement. Some analysts call these “accounting profits” because they

include non-cash accounting entries such as depreciation and amortization.

Q) Write formulas of the following.

ANS) Gross Profit : Revenue – Cost of Goods Sold.

2) Operating profit= Revenues – Direct Costs – Indirect Costs

3) Net Profit = Total Revenue - Total Expenses

You might also like

- Japanese Apparel DistributionDocument4 pagesJapanese Apparel Distributionsaumil parikh100% (1)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Cost AccountingDocument31 pagesCost AccountingRayala SaisrinivasNo ratings yet

- Full Project KomulDocument106 pagesFull Project Komulmohan ks80% (10)

- Module 1 Introduction To Cost AccountingDocument21 pagesModule 1 Introduction To Cost AccountingLeslieNo ratings yet

- Notes Management AccountingDocument23 pagesNotes Management AccountingAbidNo ratings yet

- Cost Accounting NotesDocument56 pagesCost Accounting NotesPiyu Jain100% (2)

- Consumers' Perception Regarding Branded and Unbranded Grocery ItemsDocument74 pagesConsumers' Perception Regarding Branded and Unbranded Grocery Items01copy100% (5)

- CNN 9/11 Memorial Victims SSA Death Index Cross ReferenceDocument133 pagesCNN 9/11 Memorial Victims SSA Death Index Cross ReferenceErsun Warncke100% (1)

- Cost I Ch. 1Document29 pagesCost I Ch. 1Magarsaa AmaanNo ratings yet

- Financial ControllershipDocument4 pagesFinancial ControllershipjheL garciaNo ratings yet

- Chapter - 8Document26 pagesChapter - 8Rathnakar SarmaNo ratings yet

- Basic of CostingDocument15 pagesBasic of CostingAmit JaiswatNo ratings yet

- Arbaminch University: Colege of Business and EconomicsDocument13 pagesArbaminch University: Colege of Business and EconomicsHope KnockNo ratings yet

- What Is Cost Accounting and DiferencesDocument6 pagesWhat Is Cost Accounting and Diferenceskasuntop99838No ratings yet

- Managerial Accounting - Class 1Document19 pagesManagerial Accounting - Class 1AshiqNo ratings yet

- Cost AccountingDocument77 pagesCost Accountinghayenje rebeccaNo ratings yet

- Text1-Introduction To Cost Accounting-Student ResourceDocument22 pagesText1-Introduction To Cost Accounting-Student Resourcekinai williamNo ratings yet

- Accountancy Bbs 1st Year - Oweisme PDFDocument21 pagesAccountancy Bbs 1st Year - Oweisme PDFPratima Upreti100% (1)

- Chapter IIIDocument37 pagesChapter IIISyed Aziz HussainNo ratings yet

- Responsibility AccountingDocument15 pagesResponsibility AccountingSudipto RoyNo ratings yet

- Assignment 1Document9 pagesAssignment 1Yashveer SinghNo ratings yet

- Ques - Distinguish Between Operating Activities, Investing Activities and Financing Activities?Document12 pagesQues - Distinguish Between Operating Activities, Investing Activities and Financing Activities?Aniket SinghNo ratings yet

- Management Accounting - SBA1501: Unit - IDocument9 pagesManagement Accounting - SBA1501: Unit - ISubhasri RajaNo ratings yet

- Finiii MaDocument311 pagesFiniii MamanishaNo ratings yet

- Basic Concepts in Cost FYBBA-IBDocument14 pagesBasic Concepts in Cost FYBBA-IBSakuraNo ratings yet

- Module 1 PDFDocument13 pagesModule 1 PDFWaridi GroupNo ratings yet

- What Is Cost AccountingDocument3 pagesWhat Is Cost AccountingJappy QuilasNo ratings yet

- Defination of Cost AccountingDocument5 pagesDefination of Cost AccountingYaseen Saleem100% (1)

- 09435BBA305 - Notes (Module 1)Document11 pages09435BBA305 - Notes (Module 1)Divakar Pratap SinghNo ratings yet

- Management Control System: Responsibility Centers: Revenue and Expense CenterDocument12 pagesManagement Control System: Responsibility Centers: Revenue and Expense CenterIchaNo ratings yet

- Chapter 1Document28 pagesChapter 1Rahila RafiqNo ratings yet

- Accounting: Management Accounting or Managerial Accounting Is Concerned With The Provisions and UseDocument6 pagesAccounting: Management Accounting or Managerial Accounting Is Concerned With The Provisions and Useomair133No ratings yet

- Cost Accounting: Divestment of Peripheral Activities, Mass Layoffs, or Outsourcing, CostDocument11 pagesCost Accounting: Divestment of Peripheral Activities, Mass Layoffs, or Outsourcing, Costhiren79111No ratings yet

- Management AcctngDocument20 pagesManagement AcctngJamby RamosNo ratings yet

- Notes PDFDocument80 pagesNotes PDFRahila Rafiq100% (5)

- Responsibility Accounting in McsDocument5 pagesResponsibility Accounting in McsRajesh WariseNo ratings yet

- Zero-Based Budgeting: Zero-Based Budgeting Is A Budgeting Method That Involves Starting With $0 and Adding OnlyDocument10 pagesZero-Based Budgeting: Zero-Based Budgeting Is A Budgeting Method That Involves Starting With $0 and Adding OnlysalmanNo ratings yet

- Cost Accounting AssignmentDocument5 pagesCost Accounting AssignmentMargie Therese SanchezNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingAnunobi JaneNo ratings yet

- Fundamental of CostingDocument24 pagesFundamental of CostingCharith LiyanageNo ratings yet

- General Task of ManagementDocument2 pagesGeneral Task of ManagementEshita Batta SinhaNo ratings yet

- SM 26Document16 pagesSM 26ishaisha1940No ratings yet

- Responsibility AccountingDocument6 pagesResponsibility AccountingAnuradha MauryaNo ratings yet

- Lesson 1: Introduction To Management Accounting: Learning ObjectivesDocument5 pagesLesson 1: Introduction To Management Accounting: Learning ObjectivesShivani GuptaNo ratings yet

- Cost AccountingDocument70 pagesCost Accountingsriharsha5877454No ratings yet

- Cost Management P1Document3 pagesCost Management P1Muzamil LoneNo ratings yet

- Chapter One Introdutoin: 1.1. What Is Cost Accounting?Document156 pagesChapter One Introdutoin: 1.1. What Is Cost Accounting?NatnaelNo ratings yet

- Cost AccountingDocument11 pagesCost AccountingPriyansh KhatriNo ratings yet

- Management Accounting (Unit 01)Document12 pagesManagement Accounting (Unit 01)md tabishNo ratings yet

- Week 1-Module 1: Overview of Cost Accounting I. Introduction To Cost AccountingDocument72 pagesWeek 1-Module 1: Overview of Cost Accounting I. Introduction To Cost Accountingtricia quilangNo ratings yet

- Nature, Scope and Objective of Management AccountingDocument2 pagesNature, Scope and Objective of Management Accountingjosh lunarNo ratings yet

- Basics of Managerial AccountingDocument6 pagesBasics of Managerial AccountingUwuNo ratings yet

- Accounting FundamentalsDocument60 pagesAccounting FundamentalsErin YoungNo ratings yet

- Shafiulhaq Kaoon's Assignment of Cost Accounting PDFDocument9 pagesShafiulhaq Kaoon's Assignment of Cost Accounting PDFShafiulhaq Kaoon QuraishiNo ratings yet

- Mcs Safira Annisa RCDocument9 pagesMcs Safira Annisa RCDasril ChaniagoNo ratings yet

- Managerial AccountingDocument5 pagesManagerial AccountingBestboyshoyoNo ratings yet

- Cost and Management Accountint CWDocument6 pagesCost and Management Accountint CWOketayot Bosco KatzNo ratings yet

- Fa 1Document18 pagesFa 1Rahul KotagiriNo ratings yet

- "Responsibility Accounting": Assignment ONDocument11 pages"Responsibility Accounting": Assignment ONsaueabhbhandari100% (1)

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- Business Strategy QuestionsDocument92 pagesBusiness Strategy QuestionsRahul PatelNo ratings yet

- SA 'S ChartsDocument46 pagesSA 'S ChartsBharath Kumar100% (1)

- Telus 41532478 2023 12 31Document8 pagesTelus 41532478 2023 12 31redd.xox93No ratings yet

- UntitledDocument26 pagesUntitledsunil_panchal34100% (1)

- Product Life Cycle: Parle - G: Group 10Document6 pagesProduct Life Cycle: Parle - G: Group 10Raj DeepNo ratings yet

- Chapter 17 - Ppe - AssignmentDocument16 pagesChapter 17 - Ppe - Assignmentsabina del monteNo ratings yet

- Module 1 - Introduction To Project PlanningDocument20 pagesModule 1 - Introduction To Project PlanningVishnu RajendranNo ratings yet

- Link 2019Document387 pagesLink 2019Finka AmeliaNo ratings yet

- Relationship Management/Business Development ProfessionalDocument3 pagesRelationship Management/Business Development ProfessionalAhamed IbrahimNo ratings yet

- Materi 1: Introduction To The Computer-Based Information SystemDocument33 pagesMateri 1: Introduction To The Computer-Based Information SystemElma Apryliany SiraitNo ratings yet

- Statement of Financial Position Lecture 2Document3 pagesStatement of Financial Position Lecture 2AG VenturesNo ratings yet

- MKT Brand AuditDocument35 pagesMKT Brand Auditapi-312659543No ratings yet

- Backgroud of Malaysia Airlines 1Document38 pagesBackgroud of Malaysia Airlines 1Amirul SyafiqNo ratings yet

- EDP Pr-12 (CM6I - 92 Ankita Adam)Document3 pagesEDP Pr-12 (CM6I - 92 Ankita Adam)02 - CM Ankita AdamNo ratings yet

- Cara Menghitung Biaya K3Document53 pagesCara Menghitung Biaya K3H. Muhammad Temter GandaNo ratings yet

- f2 Acca Lesson6 (Labour)Document10 pagesf2 Acca Lesson6 (Labour)Mikhail Banhan100% (1)

- Human Resource Management (An Overview) : by Ambuj Tiwari MBA Ist SemDocument36 pagesHuman Resource Management (An Overview) : by Ambuj Tiwari MBA Ist SemAmbuj Kumar TiwariNo ratings yet

- International Marketing NotesDocument11 pagesInternational Marketing Notesnetpirate.dev4381No ratings yet

- Vcap-Dcd Study NotesDocument11 pagesVcap-Dcd Study Notesjonesie946No ratings yet

- The International University of Management: Surname: NendongoDocument3 pagesThe International University of Management: Surname: NendongoNatalia NendongoNo ratings yet

- SAP MM Unit Test CasesDocument8 pagesSAP MM Unit Test Caseshemantkinoni100% (1)

- Zanzibar Public-Private Partnership Policy (PPP) PolicyDocument42 pagesZanzibar Public-Private Partnership Policy (PPP) PolicyYaula SiminyuNo ratings yet

- BBP Ducab PP 1v1Document197 pagesBBP Ducab PP 1v1hussam ghanemNo ratings yet

- Free Cash Flow To Equity (Fcfe)Document3 pagesFree Cash Flow To Equity (Fcfe)Rahul lodhaNo ratings yet

- EMC Case StudyDocument1 pageEMC Case Studyomar gamalNo ratings yet

- Strategy Implementation at Functional LevelDocument14 pagesStrategy Implementation at Functional Levelpopat vishal100% (1)

- F004 Bills of Exchange, Sale or Return and ADD Teachers Test 4Document11 pagesF004 Bills of Exchange, Sale or Return and ADD Teachers Test 4bhumikaaNo ratings yet