Professional Documents

Culture Documents

Small Business Tax Checklist: Sole Proprietorship or Partnership

Uploaded by

Nostalgia234Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Small Business Tax Checklist: Sole Proprietorship or Partnership

Uploaded by

Nostalgia234Copyright:

Available Formats

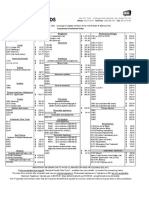

Small Business Tax Checklist

Sole Proprietorship or Partnership

T-slips Invoices, receipts, payroll information, and

Other income information GST/HST return

Business income and expenses

Corporation

T-slips Latest Notice of Assessment

GST/HST returns Accounts receivable

Financial statements and trial balance Accounts payable

Invoices, receipts, payroll, bank statements Employee deductions payable

Previous year’s tax returns Fixed asset continuity schedule

Incorporation papers (copy)

Business Income

Gross receipts for sales or services Business bank account interest

Sales records (checking/savings)

Returns and allowances Other income

Capital Assets

Business vehicles Buildings

Machinery and equipment Invoices for all capital assets purchased or

Tools sold in filing year

Cost of Goods Sold

Inventory Total dollar amount of ending inventory

Inventory purchases Items removed

Total dollar amount of beginning inventory Raw Materials and supplies

Expenses

Advertising Office Supplies

Phones Utilities

Computers Employee wages

Internet Federal and provincial payroll

Business insurance returns

Transportation and travel Employee benefits insurance and

Gas and fuel packages

Mileage log for business Statement of account

Travel expenses Accounts payable

Depreciation Rent / property expenses

Business use of assets Maintenance and repairs

Personal use of assets Meals and entertainment

Sales and disposition of assets Estimated tax payments made

Interest expenses In-home Office

Mortgage Square footage of office space and

Business loans home space

Investments Mortgage interest or rent paid

Professional service fees Insurance

Accounting, legal, consultations Utilities

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Sri Sai Divya Pooja EnglishDocument8 pagesSri Sai Divya Pooja Englishjadigeeta87% (15)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 40th Caterpillar Performance HandbookDocument372 pages40th Caterpillar Performance Handbookcarlos_córdova_8100% (11)

- Health and Wellness Frequently Used Dental CodesDocument1 pageHealth and Wellness Frequently Used Dental CodesNostalgia234No ratings yet

- A.P - A Plan For Sustained Wellbeing and Prosperity of All Farmers in The StateDocument48 pagesA.P - A Plan For Sustained Wellbeing and Prosperity of All Farmers in The StateGollapalli JRatnakar BabuNo ratings yet

- Instructions For Draping With Stretch Knits Stretch Fabric Patternmaking InstructionsDocument4 pagesInstructions For Draping With Stretch Knits Stretch Fabric Patternmaking InstructionsNostalgia234100% (1)

- Hardy Annuals Suggested For Winter SowingDocument3 pagesHardy Annuals Suggested For Winter SowingNostalgia234No ratings yet

- Usha S Pickle Digest The Perfect Pickle Recipe Book: Table of ContentDocument2 pagesUsha S Pickle Digest The Perfect Pickle Recipe Book: Table of ContentNostalgia234No ratings yet

- Ucalgary 2015 Balkaran RajDocument248 pagesUcalgary 2015 Balkaran RajNostalgia234No ratings yet

- Common Perennials For Winter SowingDocument3 pagesCommon Perennials For Winter SowingNostalgia234100% (1)

- RD Through ZBNFDocument30 pagesRD Through ZBNFJanki Chavda100% (1)

- AchyutashtakamDocument3 pagesAchyutashtakamdrmegharajNo ratings yet

- Jeremy Sherr Dynamic Provings Volume 1: Reading ExcerptDocument9 pagesJeremy Sherr Dynamic Provings Volume 1: Reading ExcerptNostalgia234No ratings yet

- Awesome Seed LinksDocument1 pageAwesome Seed LinksNostalgia234No ratings yet

- Tructuralism AND THE Lant Ingdom: Olume OnocotsDocument32 pagesTructuralism AND THE Lant Ingdom: Olume OnocotssillymindsNo ratings yet

- Sri Raja Rajesh Vari AshtakamDocument6 pagesSri Raja Rajesh Vari AshtakamNostalgia234No ratings yet

- Looking Beyond Stories - Durga SaptashatiDocument8 pagesLooking Beyond Stories - Durga SaptashatiNostalgia234No ratings yet

- Easy Wrap Dress Pattern PayhipDocument29 pagesEasy Wrap Dress Pattern PayhipNostalgia234No ratings yet

- Practice of WomenDocument17 pagesPractice of WomenChristina Howard100% (1)

- Sodasa NamaarchaniDocument1 pageSodasa NamaarchaniNostalgia234No ratings yet

- Elementary Hybrid Learning Model FAQDocument9 pagesElementary Hybrid Learning Model FAQNostalgia234No ratings yet

- Seed Planting ScheduleDocument1 pageSeed Planting ScheduleNostalgia234No ratings yet

- That Compassionate Touch of MA ANANDAMAYEE by Narayan Chaudhuri (147p)Document147 pagesThat Compassionate Touch of MA ANANDAMAYEE by Narayan Chaudhuri (147p)ray_molacha734No ratings yet

- OverDrive Q and A (Weeks 3 and 4)Document19 pagesOverDrive Q and A (Weeks 3 and 4)Nostalgia234No ratings yet

- Supply List Bra Pattern & ConstructionDocument1 pageSupply List Bra Pattern & ConstructionNostalgia234100% (1)

- Geetaji Shraddhanjali Better PDF VersionDocument51 pagesGeetaji Shraddhanjali Better PDF VersionCecilia RavagnanNo ratings yet

- Having Problems Downloading Ebooks Onto Your Ereader?Document3 pagesHaving Problems Downloading Ebooks Onto Your Ereader?Nostalgia234No ratings yet

- Small Business Tax Checklist: Sole Proprietorship or PartnershipDocument1 pageSmall Business Tax Checklist: Sole Proprietorship or PartnershipNostalgia234100% (1)

- Valmiki Ramayan TeekaTalks HindiDocument260 pagesValmiki Ramayan TeekaTalks HindicpbhatnagarNo ratings yet

- Sewing Instructions - Green DressDocument11 pagesSewing Instructions - Green DressNostalgia234100% (1)

- Learning Pathway Leisure LearnerDocument12 pagesLearning Pathway Leisure LearnerNostalgia234No ratings yet

- Learning Pathway Digital CreativityDocument10 pagesLearning Pathway Digital CreativityNostalgia234No ratings yet

- Psar Techspec Autologicsoftwaretechspecfor Psarvehicles en PF v2.0Document183 pagesPsar Techspec Autologicsoftwaretechspecfor Psarvehicles en PF v2.0PhatNo ratings yet

- RICS APC Candidate Guide-Aug 2015-WEB PDFDocument24 pagesRICS APC Candidate Guide-Aug 2015-WEB PDFLahiru WijethungaNo ratings yet

- Material Submission Form Register - STR (20210929)Document1 pageMaterial Submission Form Register - STR (20210929)HoWang LeeNo ratings yet

- Pathfinder House RulesDocument2 pagesPathfinder House RulesilililiilililliliI100% (1)

- Business PlanDocument20 pagesBusiness PlanRona BautistaNo ratings yet

- Report Managerial Finance@UniklDocument18 pagesReport Managerial Finance@UniklLee WongNo ratings yet

- Philippine Metal Foundries v. CADocument2 pagesPhilippine Metal Foundries v. CAMarcus AureliusNo ratings yet

- DocumentDocument2 pagesDocumentAddieNo ratings yet

- Incorporation of Industrial Wastes As Raw Materials in Brick's Formulation (Wiemes-Brasil-2016)Document9 pagesIncorporation of Industrial Wastes As Raw Materials in Brick's Formulation (Wiemes-Brasil-2016)juan diazNo ratings yet

- Appendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSDocument1 pageAppendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSPau PerezNo ratings yet

- ALLOY 7150-T7751 PLATE AND 7150-T77511 EXTRUSIONS: Alcoa Mill ProductsDocument4 pagesALLOY 7150-T7751 PLATE AND 7150-T77511 EXTRUSIONS: Alcoa Mill Productshitesh_tilalaNo ratings yet

- Intructional Tools With The Integration of TechnologyDocument44 pagesIntructional Tools With The Integration of TechnologyAlwyn SacandalNo ratings yet

- Crew Body Temp: Arrival ArrivalDocument1 pageCrew Body Temp: Arrival ArrivalАлександр ГриднёвNo ratings yet

- Lab Manual: Department of Computer EngineeringDocument65 pagesLab Manual: Department of Computer EngineeringRohitNo ratings yet

- DAR Vol1-2013Document744 pagesDAR Vol1-2013chitransh2002No ratings yet

- Andrew Beale - Essential Constitutional and Administrative LawDocument123 pagesAndrew Beale - Essential Constitutional and Administrative LawPop Rem100% (4)

- 2023-04-28 NMSU Executive SummaryDocument2 pages2023-04-28 NMSU Executive SummaryDamienWillisNo ratings yet

- Noor Hafifi Bin Jalal: Operating Code 1: Demand ForecastDocument47 pagesNoor Hafifi Bin Jalal: Operating Code 1: Demand ForecastGopalakrishnan SekharanNo ratings yet

- Roger Rabbit:, Forest Town, CA 90020Document3 pagesRoger Rabbit:, Forest Town, CA 90020Marc TNo ratings yet

- 2 - Water Requirements of CropsDocument43 pages2 - Water Requirements of CropsHussein Alkafaji100% (4)

- GTA TaxonomyDocument12 pagesGTA Taxonomyalvaropiogomez1No ratings yet

- Cover LetterDocument16 pagesCover LetterAjmal RafiqueNo ratings yet

- Reversible Motors: Additional InformationDocument36 pagesReversible Motors: Additional InformationAung Naing OoNo ratings yet

- Cir vs. de La SalleDocument20 pagesCir vs. de La SalleammeNo ratings yet

- Lesson 12: Parallel Transformers and Autotransformers: Learning ObjectivesDocument13 pagesLesson 12: Parallel Transformers and Autotransformers: Learning ObjectivesRookie Thursday OrquiaNo ratings yet

- Bizagi Podcast TranscriptDocument6 pagesBizagi Podcast TranscriptHortencia RodriguezNo ratings yet

- Dissertation Sample CommerceDocument4 pagesDissertation Sample CommerceBuyPapersOnlineForCollegeCanada100% (1)

- OOAD Documentation (Superstore)Document15 pagesOOAD Documentation (Superstore)Umâir KhanNo ratings yet

- CHAPTER ONE Structural GeologyDocument46 pagesCHAPTER ONE Structural GeologyAfolabi Eniola AbiolaNo ratings yet