Professional Documents

Culture Documents

Estate Tax Concepts Explained

Uploaded by

belinda dagohoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estate Tax Concepts Explained

Uploaded by

belinda dagohoyCopyright:

Available Formats

CHAPTER 13-B

CHAPTER 13-A

CHAPTER 13

ESTATE ESTATE

TAX:

THE CONCEPT GROSSTAX: GROSS

ESTATE

OF SUCCESSION ESTATE

OF ESTATE

AND MARRIEDTAXDECEDENT

Exempt Transfer

Gross estate consist of all properties of the

The gross estate of a decedent is reported

Gross as follows in the estate tax return:

Estate Formula The gross estate of married decedent is composed of: Property for exclusive personal use, except jewelry

decedent, tangible or intangible, real or personal

Conjugal/ 1. The decedent exclusive properties Under ACP, properties for the exclusive personal use of either of the

and wherever situated at the point of death.

Inventory of property at the point Exclusive

of death Communal PTotal

xxx,xxx 2. The common properties of the spouse spouses, except jewelry, are always exclusive property whether they are

GrossExempt

Less: estate Transfers P xxx,xxx P xxx,xxx P xxx,xxx acquired during the

1. Transfer marriage.

of the properties Note notthatowned

this ruleby

does

the not exist with

decedent

Less: Properties

deductions SUCCESSION

not owned

Types of Succession

ESTATE TAXATION

CPGProperties

. not owned by the decedent are not part of his/her donation

Properties owned but exclude by law Procedure in Establishing Gross mortis casua. These property must be excluded in gross estate even if they

Inventory of Taxable Present Properties Estate transfer to other person at the point of death.

Basic rules in the determination of property interest

Add:ATaxable

model ofTransfer

acquisition by virtue by which the property, 2. Transfer legally excluded

GROSS rights and obligations to the extent of the value of the

ESTATE Testate of Testamentary succession Pertains to the taxation

These properties naturallyof theform

gratuitous

part of his/her donation mortis casua to the

Property

inheritance, of Relations

a person are Between Spouses

transmitted through his * which result from the designationat heir, transfer

heirs of

but properties

are of

exempted the decedent

by the law to theestate taxation.Hence these are

from

Inventory count of existing Separate Properties Acquired During Marriage

death to another or others either by his will or made in a will executed in the form of properties at the point of death heirs upon

excluded fromthegrossdecedent

income. death.

Similar to conjugal partnership of gains, properties received by way way

operation of law. prescribe by law. of gratuitous title such as donation or inheritance during marriage is a

Adjustment

Common for exempt

Property transfersofRule

Presumption

Classification Decedents for

Under the family code, theProceeds of Life between

property relation Insurancethe and taxable transfers Taxation Purposes separate property unless designated by the donor or decedent to be for

spouses must be agreed upon by the spouses before their both spouses.

Transfer of the property not owned by the decedent

marriage and is set in their “prenuptial Designation

agreement”.of Beneficiary Legal or Intestate Succession 1. NatureMergerof of Estate Tax in the owner of the naked title

the usufruct

Beneficiary Elements of Succession Revocable Irrevocable

* when a decedent die w/o a will,In the

theinventory taking the property of the estate, the 2. The commission or delivery of the inheritance or legacy by the

Estate, administrator or include distribution of the estate shall properties

Include be in of the spouses is presumed common

Taxable Transfer fiduciary heir or legatee to the fedeicommissary

properties Resident or Citizen Decedents

Property Relation of the Spouses

executor accordance with the default provision of unless proven to be exclusive properties of 3. The transmission

Excise Fruit Taxfrom the first heir legatee or donee in favor of

Taxable on properties located within or

Other parties include the Civil Code on succession. either the spouses. This presumption does not apply

exclude * Estate another

tax is beneficiary, Income

a tax on theinproperty

notindustry

or Gains

accordance with the desire of the

under absolute separation outside the Philippines.

of property. Fruits of labor and

Decedent but on thepredecessor

privilege to transfer property

The property interest Mortis casua transfers of properties in the Fruits4.arising from theoflabor

Proceeds or industry

irrevocable of either orpolicy

life insurance both payable

spousesto arebeneficiary

* general term of the spouses

applied shall be determined

to the person throughproperties

common death. ofthe

theestate,executor

spouses.

base on their agreed property

whose property transmitted through regime. Mixed succession guise and form of inter-vivos transfer. other than or administrator

succession, whether Composition

or not he left ofaGross

will. estate * transmission of the decedent properties 5. Properties held in trust by the decedent

Non-resident Rule

Consistent Classification Alien decedents Fruits6.of Properties

1. Properties movable or immovable, tangible or intangible shall be partly by virtue of a written will Separate properties of the surviving spouse of the decedent.

Taxable only on properties located in the The fruit ofRevenue

separate or General

property is aTax

separate property. It follows therefore

2. Decedents interest on properties and partly by operation of law. TypesPhilippines,

of Taxable except

Transferintangible personal 7.

* Estate

that

Transfer

the fruittax ofiscommon

by theas

intended way

property

of bonaorfide sales

revenue

is a common property. In short, Fruits

3. Proceeds of life insurance

Common Types of Property Regime property when the reciprocity rule applies. fiscalprincipal

measure.

follow

a) Designated as revocable

Estate to any heir The sale or exchange of properties do not alter their

b) * The

Designated

property,torights

estate,

and administrator

obligation ofortheexecutor as beneficiary classification. Properties acquired using separate

4. Taxable decedent will extinguished by his death.

transfer properties are separate

Transfer properties. Likewise,

in contemplation of death properties

1. Absolute separation of property- all properties of acquired using common properties are common Valuation of The Gross Estate

These are donation made by the decedent during Ad Valorem Tax

the spouses are separate properties, except properties properties.

his lifetime which are motivated by the though of * Estate tax is dependent upon the value

which they may acquire jointly. his death. of the estate. Properties subject to estate tax shall be appraised at

2. Conjugal partnership of gain-

Heirs all properties that Properties acquired their Before marriage

fair value at the point During

of death.marriage

Presentation of Gross Estate in The Estate Tax Return The Estate Tax Model

accrue as * fruit

a of their

person individual

called to the or joint laboreither

succession during the

Inmarriage

reporting gross estate under BIR Form 1801, the composition of the gross estate From gratuitous

byshall

the become

provision common

of will orproperties

by operationof the

of Accruals

Revocable in Value or Gains

transfer, on Sale

including of Properties

conditional

shall be classified as follows: acquisitions communal exclusive

spouses. law. transfer National Tax

1.3.Real Properties- all immovable properties of the decedent, excluding family home. From fruit of industry communal Valuation communal

Rules

Absolute community of property- all present Involve transfer of possession over property * Estate taxofis imposed by the national

2.properties

Family Home From the fruit

owned by the spouses at the date of during the lifetime of the decedent, but not government.

3.celebration

Personal Properties-

shall becomeallcommon

movableproperties.

properties of the decedent, except right of The increase in valueGross Estate

or gains P xxx,xxx property

interest of any business transfer of ownership over saidon the sale of properties

property. -separate property Communal exclusive

Less: Deduction from

are fruits subject to the rules of the property regime

4. Business Interests agreed upon by the spouses.Gross estate P xxx,xxx -community

property

1. The fair value of theProportional

property Communal

as the communal

Net Taxable Estate P xxx,xxx Taxtime of death shall be the value to include in

In the absence of an agreement or when the regime Property passing under general power of grossFor exclusive

estate use of

* Estate tax is imposed as 6% on the net

agreed by the spouses is void, marriages celebrated appointment 2. Faireither

value spouses

rules set by the law or revenue regulation must be followed.

estate.

before August 3, 1988 shall be governed by the conjugal The presence of the general power enables the 3. In default

-jewelryof such fair value Communal

rules, reference may be communal made to fair value rules under

partnership of gains. Marriage celebrating starting holder of such power to do with the property generally accepted accountingExclusive

-non-jewelry principles. exclusive

august 3, 1988 shall be govern by the absolute anything which he could do as if the property 4. Encumbrances on the property or decrease in value thereof after death shall be

community of property. were his own. ignored. One-Time Tax

* Estate tax applies to a person only on in

a life time.

You might also like

- Philippine Accountancy Review For Excellence: A. Format of Computation (Bir Form 1801)Document17 pagesPhilippine Accountancy Review For Excellence: A. Format of Computation (Bir Form 1801)beayaoNo ratings yet

- The Tale of Sweet-Friend and Ali-NurDocument2 pagesThe Tale of Sweet-Friend and Ali-NurJomarie Siason Sumagpao100% (1)

- TAXATION ESTATEDocument15 pagesTAXATION ESTATEyna kyleneNo ratings yet

- Audit Program For InventoriesDocument2 pagesAudit Program For InventoriesRex Munda Duhaylungsod71% (7)

- Audit Program For InventoriesDocument2 pagesAudit Program For InventoriesRex Munda Duhaylungsod71% (7)

- Teresita Dio Versus STDocument2 pagesTeresita Dio Versus STmwaike100% (1)

- Introduction To Manufacturing ProcessesDocument64 pagesIntroduction To Manufacturing Processesnauman khanNo ratings yet

- Make Money OnlineDocument9 pagesMake Money OnlineTimiNo ratings yet

- Row and Cluster Housing Building Codes and Bye LawsDocument1 pageRow and Cluster Housing Building Codes and Bye Lawssadhana illaNo ratings yet

- Scan 18 Apr 2023Document5 pagesScan 18 Apr 2023Jayshree YadavNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- Fit 5Document13 pagesFit 5Renalyn Ps MewagNo ratings yet

- Deductions Matrix - Group 6Document9 pagesDeductions Matrix - Group 6moneybymachinesNo ratings yet

- ESTATE TAXATIONDocument15 pagesESTATE TAXATIONHannahbea LindoNo ratings yet

- From 16Document1 pageFrom 16biswajitnandi611No ratings yet

- Lease - Accessory Cs - CreditsDocument21 pagesLease - Accessory Cs - CreditsMikeeNo ratings yet

- C05-Ye41-Q-7859 - 1 - PS1, Emg-Ff Building, Below - Above Ground Earthing and Location of Lugs Layout, Section Details, SHT 4of4Document1 pageC05-Ye41-Q-7859 - 1 - PS1, Emg-Ff Building, Below - Above Ground Earthing and Location of Lugs Layout, Section Details, SHT 4of4sartajNo ratings yet

- Panel Boards Single Line DiagramDocument12 pagesPanel Boards Single Line DiagramBelle Santos SamanNo ratings yet

- Law On Succession PDFDocument3 pagesLaw On Succession PDFsakuraNo ratings yet

- Capital Gains - 26012024Document11 pagesCapital Gains - 2601202442 Rahul RawatNo ratings yet

- Credit TransactionsDocument5 pagesCredit TransactionsDanica ZamoraNo ratings yet

- Sa3-Ps2, Main Pump House Scale Below Ground Earthing - Location of Lugs Layout, Sections and DetailsDocument1 pageSa3-Ps2, Main Pump House Scale Below Ground Earthing - Location of Lugs Layout, Sections and DetailssartajNo ratings yet

- Cheat Sheet For Final Summary PDFDocument2 pagesCheat Sheet For Final Summary PDFQuy TranNo ratings yet

- Transfer: &business TaxationDocument13 pagesTransfer: &business TaxationSophia LadrilloNo ratings yet

- Legitimes in Intestate Succession - Law - On - SuccessionDocument3 pagesLegitimes in Intestate Succession - Law - On - SuccessionVictor FernandezNo ratings yet

- Securities Regulation CodeDocument3 pagesSecurities Regulation CodeDanica ZamoraNo ratings yet

- Gibbons v. Ogden: New Conservative ERA Rational Basis ERA Lochner Era Early EraDocument1 pageGibbons v. Ogden: New Conservative ERA Rational Basis ERA Lochner Era Early EraL RNo ratings yet

- UNIT III Notes To RememberDocument18 pagesUNIT III Notes To Remember100No ratings yet

- 1598ititchiwaa Wak WakDocument46 pages1598ititchiwaa Wak WakRon AgamataNo ratings yet

- Silliman Notes Political Law Suggested Answers 1987 2006Document46 pagesSilliman Notes Political Law Suggested Answers 1987 2006Dux Alair L0% (1)

- A1 Iter DivertorDocument1 pageA1 Iter DivertorVirak BaglioneNo ratings yet

- LAW ON PUBLIC CORPORATIONSDocument1 pageLAW ON PUBLIC CORPORATIONSMarlo Caluya ManuelNo ratings yet

- Tax Reviewer 1Document18 pagesTax Reviewer 1Mary Jean C. BorjaNo ratings yet

- Saln 2022 Format 3Document2 pagesSaln 2022 Format 3Fahd A. BallahoNo ratings yet

- 5 Property Regime and Estate Tax ModelDocument2 pages5 Property Regime and Estate Tax Modelyatot carbonelNo ratings yet

- Estate TaxDocument1 pageEstate TaxJenny SantiagoNo ratings yet

- Leases Study MaterialDocument37 pagesLeases Study MaterialHammadNo ratings yet

- Lift Thine EyesDocument3 pagesLift Thine EyesKatie HarperNo ratings yet

- SEZ Act 2005Document8 pagesSEZ Act 2005naina saxenaNo ratings yet

- O.Lqn 3080 2113) A-2: Pdor Farmersare) PLTDocument1 pageO.Lqn 3080 2113) A-2: Pdor Farmersare) PLTprashant_dc_inNo ratings yet

- Free ConsentDocument1 pageFree ConsentizzahNo ratings yet

- Sapienza 1Document1 pageSapienza 1tuniaipartnerzyNo ratings yet

- Tax3211 Estate Tax 220318 130404Document17 pagesTax3211 Estate Tax 220318 130404MOTC INTERNAL AUDIT SECTIONNo ratings yet

- Fundamental Principles of InsuranceDocument10 pagesFundamental Principles of InsuranceShruti sharmaNo ratings yet

- Copy of Units 8-10jsjjsjsDocument19 pagesCopy of Units 8-10jsjjsjsjidapabaitoeyNo ratings yet

- SALN2018 RevisedDocument4 pagesSALN2018 RevisedButz LuceroNo ratings yet

- 2 Can ManishaDocument6 pages2 Can ManishaApurv DixitNo ratings yet

- Comprehensive Agrarian Reform Law ReviewerDocument13 pagesComprehensive Agrarian Reform Law ReviewerE.F.FNo ratings yet

- Id 99Document2 pagesId 99Spb KumarNo ratings yet

- Click Here For Imperia-I VideoDocument11 pagesClick Here For Imperia-I VideoSanjeev SharmaNo ratings yet

- Risk Assesment FOR CONCRETEDocument12 pagesRisk Assesment FOR CONCRETEAnwar MohiuddinNo ratings yet

- 10 - Restriction On Testamentary FreedomDocument1 page10 - Restriction On Testamentary FreedomAnonymous Azxx3Kp9No ratings yet

- Figure 9Document1 pageFigure 9suryansh guptaNo ratings yet

- Tax Invoice, Credit and Debit Notes, E-Way Bill 02 - Class Notes - Udesh Regular - Group 1Document15 pagesTax Invoice, Credit and Debit Notes, E-Way Bill 02 - Class Notes - Udesh Regular - Group 1Uday TomarNo ratings yet

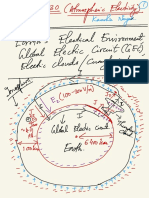

- Earth's Electrical EnvironmentDocument9 pagesEarth's Electrical EnvironmentVivek VkNo ratings yet

- SALN2022 Lastname Firstname MIDocument6 pagesSALN2022 Lastname Firstname MIMavelle Janyne MabayoNo ratings yet

- 11 GravitationDocument60 pages11 Gravitationmanikandhanp69No ratings yet

- BL para ModificarDocument1 pageBL para Modificardany ElNo ratings yet

- ACOSTADocument2 pagesACOSTAsahabudin ukangNo ratings yet

- 2023-03 The ConnexionDocument64 pages2023-03 The ConnexionleporeNo ratings yet

- Item Description Unit Qty Rate Amount Proposed Piggery Project in Busuju Bill No 1. Element: Preliminaries Tools and PlantsDocument8 pagesItem Description Unit Qty Rate Amount Proposed Piggery Project in Busuju Bill No 1. Element: Preliminaries Tools and PlantsRucho ConstructioncompanyNo ratings yet

- Saln VelayoDocument2 pagesSaln VelayocristinesilvaNo ratings yet

- FELS Energy V BatangasDocument1 pageFELS Energy V BatangasDjango TesterNo ratings yet

- Nischay MDocument13 pagesNischay MvaibhavNo ratings yet

- 3) Republic v. CaguioaDocument4 pages3) Republic v. CaguioaE SantosNo ratings yet

- Passport to Exotic Real Estate: Buying U.S. And Foreign Property In Breath-Taking, Beautiful, Faraway LandsFrom EverandPassport to Exotic Real Estate: Buying U.S. And Foreign Property In Breath-Taking, Beautiful, Faraway LandsNo ratings yet

- Dagohoy Q1Document4 pagesDagohoy Q1belinda dagohoyNo ratings yet

- Batucan-SOP - SQDocument5 pagesBatucan-SOP - SQbelinda dagohoyNo ratings yet

- Reaction Paper InstructionDocument2 pagesReaction Paper Instructionbelinda dagohoyNo ratings yet

- Audit EvidencesDocument1 pageAudit Evidencesbelinda dagohoyNo ratings yet

- Chapter 1 OpaudDocument5 pagesChapter 1 OpaudMelissa Kayla Maniulit0% (1)

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net Worthbelinda dagohoyNo ratings yet

- Lecture 2 Statement of Changes in Equity Multiple ChoiceDocument5 pagesLecture 2 Statement of Changes in Equity Multiple ChoiceJeane Mae Boo100% (1)

- Sworn Statement of Assets, Liabilities and Net WorthDocument6 pagesSworn Statement of Assets, Liabilities and Net Worthbelinda dagohoyNo ratings yet

- Tia Ch1 Rutojocie-Jean 258722027Document1 pageTia Ch1 Rutojocie-Jean 258722027belinda dagohoyNo ratings yet

- Journal Critique SeloterioDocument3 pagesJournal Critique Seloteriobelinda dagohoyNo ratings yet

- Midterm Output Output I - Concept Map Per TopicDocument1 pageMidterm Output Output I - Concept Map Per Topicbelinda dagohoyNo ratings yet

- How Tech Shapes World & LivesDocument2 pagesHow Tech Shapes World & Livesbelinda dagohoyNo ratings yet

- Acctg 46: Sustainability and Strategic AuditDocument31 pagesAcctg 46: Sustainability and Strategic Auditbelinda dagohoyNo ratings yet

- Audit Quality Differences Amongst Audit Firms in A Developing EconomyDocument1 pageAudit Quality Differences Amongst Audit Firms in A Developing Economybelinda dagohoyNo ratings yet

- Congratulation and Best Wishes Happy Wedding Day. From: Ninang BingDocument1 pageCongratulation and Best Wishes Happy Wedding Day. From: Ninang Bingbelinda dagohoyNo ratings yet

- Macaya Man Econ Final Documentation1Document2 pagesMacaya Man Econ Final Documentation1belinda dagohoyNo ratings yet

- Quarter 3 Health - 9 Week 3-LAS: Things To Remember in Doing Secondary SurveyDocument4 pagesQuarter 3 Health - 9 Week 3-LAS: Things To Remember in Doing Secondary Surveybelinda dagohoyNo ratings yet

- Mgt.14 - Strategic Management Course OutlineDocument2 pagesMgt.14 - Strategic Management Course Outlinebelinda dagohoyNo ratings yet

- Audit Quality Differences Amongst Audit Firms in A Developing EconomyDocument1 pageAudit Quality Differences Amongst Audit Firms in A Developing Economybelinda dagohoyNo ratings yet

- Congratulation and Best Wishes Happy Wedding Day. From: Ninang BingDocument1 pageCongratulation and Best Wishes Happy Wedding Day. From: Ninang Bingbelinda dagohoyNo ratings yet

- B DayDocument1 pageB Daybelinda dagohoyNo ratings yet

- TapScanner 08-07-2021-19.49Document1 pageTapScanner 08-07-2021-19.49belinda dagohoyNo ratings yet

- KWENEEEEEEDocument1 pageKWENEEEEEEbelinda dagohoyNo ratings yet

- TapScanner 08-07-2021-19.49Document1 pageTapScanner 08-07-2021-19.49belinda dagohoyNo ratings yet

- Las g9 Icf q3 w2 Francisco-1Document5 pagesLas g9 Icf q3 w2 Francisco-1belinda dagohoyNo ratings yet

- Yusayrr Fs Output FinalDocument116 pagesYusayrr Fs Output Finalbelinda dagohoyNo ratings yet

- Kyla Business PlanDocument27 pagesKyla Business Planbelinda dagohoyNo ratings yet

- TOGA4Document1 pageTOGA4belinda dagohoyNo ratings yet

- BATCH Bat Matrix OriginalDocument5 pagesBATCH Bat Matrix OriginalBarangay NandacanNo ratings yet

- Emerson Field Tools Quick Start GuideDocument48 pagesEmerson Field Tools Quick Start Guidepks_2410No ratings yet

- Section 5 - Triangles - Part 1 Answer KeyDocument48 pagesSection 5 - Triangles - Part 1 Answer KeyErryn Lowe100% (2)

- Impacts of Gmos On Golden RiceDocument3 pagesImpacts of Gmos On Golden RiceDianna Rose Villar LaxamanaNo ratings yet

- Elitox PPT ENG CompressedDocument18 pagesElitox PPT ENG CompressedTom ArdiNo ratings yet

- Charles Henry Brendt (1862-1929)Document2 pagesCharles Henry Brendt (1862-1929)Everything newNo ratings yet

- Og FMTDocument5 pagesOg FMTbgkinzaNo ratings yet

- Prompt 2022Document12 pagesPrompt 2022cecilferrosNo ratings yet

- OsteoporosisDocument57 pagesOsteoporosisViviViviNo ratings yet

- Food and Beverages Service: Learning MaterialsDocument24 pagesFood and Beverages Service: Learning MaterialsJoshua CondeNo ratings yet

- First Communion Liturgy: Bread Broken and SharedDocument11 pagesFirst Communion Liturgy: Bread Broken and SharedRomayne Brillantes100% (1)

- Emotion-WPS OfficeDocument2 pagesEmotion-WPS OfficemikaNo ratings yet

- Sec 4 RA 6713 & Sec 3 RA 3019 OutlineDocument4 pagesSec 4 RA 6713 & Sec 3 RA 3019 OutlineAivan Charles TorresNo ratings yet

- NCP GeriaDocument6 pagesNCP GeriaKeanu ArcillaNo ratings yet

- Ap Finance Go PDFDocument3 pagesAp Finance Go PDFSuresh Babu ChinthalaNo ratings yet

- Fishblade RPGDocument1 pageFishblade RPGthe_doom_dudeNo ratings yet

- Dasakam 31-40Document16 pagesDasakam 31-40Puducode Rama Iyer RamachanderNo ratings yet

- School RulesDocument2 pagesSchool RulesAI HUEYNo ratings yet

- Surveying 2 Practical 3Document15 pagesSurveying 2 Practical 3Huzefa AliNo ratings yet

- Maintenance Manual: Ul-Aircraft Ltf-Ul 2003 Manufacturer No.: FRXXX Registration No: D-MXXXDocument27 pagesMaintenance Manual: Ul-Aircraft Ltf-Ul 2003 Manufacturer No.: FRXXX Registration No: D-MXXXAlbaz DarwishNo ratings yet

- Sponsor A Child With E-Tuition 2022Document19 pagesSponsor A Child With E-Tuition 2022nuur xiemaNo ratings yet

- Module IV StaffingDocument3 pagesModule IV Staffingyang_19250% (1)

- Researching Indian culture and spirituality at Auroville's Centre for Research in Indian CultureDocument1 pageResearching Indian culture and spirituality at Auroville's Centre for Research in Indian CultureJithin gtNo ratings yet

- 41 Programmer Isp RT809F PDFDocument3 pages41 Programmer Isp RT809F PDFArunasalam ShanmugamNo ratings yet

- Student (Mechanical Engineering), JECRC FOUNDATION, Jaipur (2) Assistant Professor, Department of Mechanical Engineering, JECRC FOUNDATION, JaipurDocument7 pagesStudent (Mechanical Engineering), JECRC FOUNDATION, Jaipur (2) Assistant Professor, Department of Mechanical Engineering, JECRC FOUNDATION, JaipurAkash yadavNo ratings yet