Professional Documents

Culture Documents

Interpretation

Uploaded by

TUAN NGUYỄNOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interpretation

Uploaded by

TUAN NGUYỄNCopyright:

Available Formats

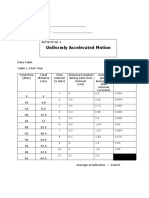

CoL1 Col. 2 Col. 3 Col. 4 Col. 5 Col.

6

Date Price EMA for Difference Exponent Col. 3 x Col. 2

Previous (Col. 1 Col. 4 ♦

Week ± Col. 2) ± Col. 5

EMA

Jan 2 121 120 +1.0 0.2 +.2 120.2

3 124 120.2 +3 8 0.2 +.8 121.0

4 123 121.0 +2.0 0.2 +.4 121.4

5 128 121.4 *e.e 0.2 +1.3 122.7

Table 5.5

Number of Weeks Exponent

5 0.4

10 0.2

15 0.13

20 0.1

40 0.05

80 0.025

the exponent 2 divided by 5 (0.4) will be twice as great, since 2 divided by 10

gives an exponent of 0.2.

Fortunately, most of us do not need to worry about making tedious

calculations because the computer now does it for us.

Interpretation

We discovered in chapter 3 that the magnitude of an ROC oscilla tion is, other

things being equal, a function of the time span under consideration. In other

words, the longer the span, the greater the swing and vice versa. A similar

principle applies to trend-deviation oscillators. The big difference here is that

the time span is a function of the length of the moving average. In this case, the

longer the average, the greater the fluctuation. Since the weighted and EMA

averages are more sensitive than a simple moving average, this also means that

the magnitude of the oscillations associated with them will be less than a

comparable time span. Moreover, their

You might also like

- Diseño de EscalerasDocument4 pagesDiseño de EscalerasMauricio MirandaNo ratings yet

- Rainrunoff MergedDocument3 pagesRainrunoff Mergedq0981423061No ratings yet

- Cec RangosDocument4 pagesCec RangosFernando MaltosNo ratings yet

- Vibration Lab 4-Mass Spring System B Lab 4Document19 pagesVibration Lab 4-Mass Spring System B Lab 4Fajobi AbeebNo ratings yet

- EN23534018 5C PendulumDocument11 pagesEN23534018 5C Pendulumdragonpplayz123No ratings yet

- EXEMPLAR PH 3.1 D Torsion PendulumDocument4 pagesEXEMPLAR PH 3.1 D Torsion PendulumDeclan PrenticeNo ratings yet

- Copy of Prak Geolistrik 18 Kel 1Document7 pagesCopy of Prak Geolistrik 18 Kel 1Andri Fatkhul AmriNo ratings yet

- This Study Resource WasDocument6 pagesThis Study Resource WasKimberly Claire AtienzaNo ratings yet

- NopeDocument14 pagesNopeSarah NeoSkyrerNo ratings yet

- GiangLe - SPC ProjectDocument8 pagesGiangLe - SPC ProjectGiang LêNo ratings yet

- Uniformly Accelerated Motion: Activity No. 3Document3 pagesUniformly Accelerated Motion: Activity No. 3Bharath CricketNo ratings yet

- PH302 - Electrical Communication & Instrument: Experiment No: 5 Title: Heterodyne CircuitDocument11 pagesPH302 - Electrical Communication & Instrument: Experiment No: 5 Title: Heterodyne CircuitTerence CheonNo ratings yet

- Particle Setting VelDocument3 pagesParticle Setting VelChengkc2014No ratings yet

- Af Cost Averaging WorksheetDocument150 pagesAf Cost Averaging WorksheetPanduNo ratings yet

- Periode Getar Vs Variasi LantaiDocument2 pagesPeriode Getar Vs Variasi LantaiSaefullah EfulNo ratings yet

- Module 8: Numerical Relaying I: Fundamentals: Fourier AlgorithmsDocument15 pagesModule 8: Numerical Relaying I: Fundamentals: Fourier Algorithmsjijo123408No ratings yet

- H.W of The Statistics: Republic of Yemen Sana'a University Faculty of Engineering Department of Mechanical EngineeringDocument7 pagesH.W of The Statistics: Republic of Yemen Sana'a University Faculty of Engineering Department of Mechanical Engineeringعبدالملك جمالNo ratings yet

- Lab 4-V I Characteristics of PN Diode and Zener Regulator PDFDocument9 pagesLab 4-V I Characteristics of PN Diode and Zener Regulator PDFpubg662299No ratings yet

- Pages From ASHRAE 62 - 1 2016Document4 pagesPages From ASHRAE 62 - 1 2016Manju NaikNo ratings yet

- Overcurrent Functions: IDMT Curves ExercisesDocument7 pagesOvercurrent Functions: IDMT Curves ExercisesYousefNo ratings yet

- Probset 2 Part 1Document4 pagesProbset 2 Part 1Kristian Elijah MarasiganNo ratings yet

- Analyte, % Analyte Ratio Unit 0.5 Cvhorwitz 0.67 Cvhorwitz 2 C (-0.1505)Document4 pagesAnalyte, % Analyte Ratio Unit 0.5 Cvhorwitz 0.67 Cvhorwitz 2 C (-0.1505)Abu WildanNo ratings yet

- Fundamentals of Digital Audio Processing: Federico Avanzini and Giovanni de PoliDocument46 pagesFundamentals of Digital Audio Processing: Federico Avanzini and Giovanni de PoliNafi NafiNo ratings yet

- General Data: Table 4. Modulating Valve Selections For Horizontal Concealed UnitsDocument1 pageGeneral Data: Table 4. Modulating Valve Selections For Horizontal Concealed UnitsSaul CerveraNo ratings yet

- Ashrae 62.1-2007Document2 pagesAshrae 62.1-2007Joel CuencoNo ratings yet

- Ashrea Standard 62.1-2007 Table 6-1 Minimum Ventilation Rates in Breathing ZonesDocument5 pagesAshrea Standard 62.1-2007 Table 6-1 Minimum Ventilation Rates in Breathing ZonesRohit SahNo ratings yet

- ASHRAE Table 6-1 Minimum Ventilation Rates in Breathing ZoneDocument2 pagesASHRAE Table 6-1 Minimum Ventilation Rates in Breathing ZoneCris EscoberNo ratings yet

- Iteração (K) x1 (K) x2 (K) x3 (K) x4 (K) m1k) m2 (K) m3 (K) m4 (K) : Evolução Do ErroDocument2 pagesIteração (K) x1 (K) x2 (K) x3 (K) x4 (K) m1k) m2 (K) m3 (K) m4 (K) : Evolução Do ErroCláudia FonsecaNo ratings yet

- Mass Moment of Inertia Lab ReportDocument9 pagesMass Moment of Inertia Lab ReportOmair Sadiq100% (1)

- Duration FRMDocument4 pagesDuration FRMnidhi pahujaNo ratings yet

- Capstone Design (Normalization) 112619Document4 pagesCapstone Design (Normalization) 112619JOHN KEAN NIEMONo ratings yet

- Zeszyt 1Document8 pagesZeszyt 1juzekNo ratings yet

- Gaya Dan Momen Gelombang Pada SLTT (A)Document22 pagesGaya Dan Momen Gelombang Pada SLTT (A)kometmayorNo ratings yet

- RTD of CSTR Observation and CalculatoinsDocument27 pagesRTD of CSTR Observation and CalculatoinsLucifer MorningstarNo ratings yet

- التكليفDocument8 pagesالتكليفعبدالملك جمالNo ratings yet

- ELE 3203 - LO1 - Part2Document26 pagesELE 3203 - LO1 - Part2ashwaq alkhooriNo ratings yet

- Oceanography and Marine Biology RepairedDocument542 pagesOceanography and Marine Biology Repairedajik indiantoNo ratings yet

- Book 1Document13 pagesBook 1Sabab MunifNo ratings yet

- Assignment 3Document6 pagesAssignment 3hatanoloveNo ratings yet

- Lecture 3 Profile Leveling Problem Solving PDFDocument1 pageLecture 3 Profile Leveling Problem Solving PDFJimbo PerezNo ratings yet

- اكرمDocument7 pagesاكرمعبدالملك جمالNo ratings yet

- Hidrograma Dep LimpiezaDocument37 pagesHidrograma Dep Limpiezaapi-3698757No ratings yet

- Copia de DESRIPIADOR - Y - LONG - TRANSICIONDocument6 pagesCopia de DESRIPIADOR - Y - LONG - TRANSICIONKatherine OñateNo ratings yet

- EEE 1218 Sessional On Analog ElectronicsDocument3 pagesEEE 1218 Sessional On Analog ElectronicsAfiat KhanNo ratings yet

- Chapter 13B CaseDocument5 pagesChapter 13B CaseAtaii Ckaa Ü Lolz100% (1)

- WRC 329 1987 Accuracy of Stress Intensification Factors For Branch Connections Part3 PDFDocument11 pagesWRC 329 1987 Accuracy of Stress Intensification Factors For Branch Connections Part3 PDFHarsh MatoliyaNo ratings yet

- Gaya Dan Momen Gelombang Pada SLTT (A)Document20 pagesGaya Dan Momen Gelombang Pada SLTT (A)kometmayorNo ratings yet

- Pengetesan ConsolidationDocument17 pagesPengetesan ConsolidationRandi SetiawanNo ratings yet

- Prajwal.P.Rahangdale (102) - QE Exp 7Document5 pagesPrajwal.P.Rahangdale (102) - QE Exp 7Prajwal RahangdaleNo ratings yet

- Pages From ASHRAE 62.1-2010Document3 pagesPages From ASHRAE 62.1-2010Anonymous CzMJt9100% (1)

- Seleccion 2 Modelos CAEXDocument3 pagesSeleccion 2 Modelos CAEXingenieromantencionNo ratings yet

- Valoare Maxima Numar Intervale Oi: (Frecventa Obs.)Document3 pagesValoare Maxima Numar Intervale Oi: (Frecventa Obs.)SebastianCosminAlecuNo ratings yet

- Stat T-Test CompDocument1 pageStat T-Test CompMackenzie Heart ObienNo ratings yet

- Figure 1.1. Histogram of Nonconforming Transducers Per BatchDocument4 pagesFigure 1.1. Histogram of Nonconforming Transducers Per BatchEduardo EvaristoNo ratings yet

- Daffa Amara Dzikri - 0101518004 - MonteCarloDocument6 pagesDaffa Amara Dzikri - 0101518004 - MonteCarloDaffa Amara DzikriNo ratings yet

- Ee 230 Lab 9Document4 pagesEe 230 Lab 9api-645212598No ratings yet

- 2 Intake-TrashrackDocument16 pages2 Intake-TrashrackMuchtar SufaatNo ratings yet

- Espectro 2016Document6 pagesEspectro 2016Francisco MartínNo ratings yet

- Inverter 1 Inverter 2 INVERTER Capacity 50kw INVERTER Capacity 50kw String Imp Voc String Imp VocDocument4 pagesInverter 1 Inverter 2 INVERTER Capacity 50kw INVERTER Capacity 50kw String Imp Voc String Imp VocRakesh HateyNo ratings yet

- Short-And Intermediate-Term Indicators: The KST SystemDocument1 pageShort-And Intermediate-Term Indicators: The KST SystemTUAN NGUYỄNNo ratings yet

- 148 Marlin Pring On Market MomentumDocument1 page148 Marlin Pring On Market MomentumTUAN NGUYỄNNo ratings yet

- 132 Martin Pring On Market Momentum: WarningDocument1 page132 Martin Pring On Market Momentum: WarningTUAN NGUYỄNNo ratings yet

- Martin Pring On Market Momentum Chart 6.5 Japanese Yen With Daily and Weekly Stochastics Reflecting Short-, Intermediate-, and Long-Term TrendsDocument1 pageMartin Pring On Market Momentum Chart 6.5 Japanese Yen With Daily and Weekly Stochastics Reflecting Short-, Intermediate-, and Long-Term TrendsTUAN NGUYỄNNo ratings yet

- ' Lane, George. "Lane's Stochastics." June 1984. Pp. 87-90Document1 page' Lane, George. "Lane's Stochastics." June 1984. Pp. 87-90TUAN NGUYỄNNo ratings yet

- Jim'Hr : I TRNTDocument1 pageJim'Hr : I TRNTTUAN NGUYỄNNo ratings yet

- The Best Trading Advice From 25 Top TradersDocument54 pagesThe Best Trading Advice From 25 Top TradersTUAN NGUYỄN100% (1)

- The MACD Indicator: 122 Martin Pring On Market MomentumDocument1 pageThe MACD Indicator: 122 Martin Pring On Market MomentumTUAN NGUYỄNNo ratings yet