Professional Documents

Culture Documents

06 Task Performance

Uploaded by

Katherine BorjaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

06 Task Performance

Uploaded by

Katherine BorjaCopyright:

Available Formats

BM1804

NAME: DATE: SCORE:

Fringe Benefits Taxes (4 items x 10 points)

Compute for the fringe benefits tax due in the following scenarios.

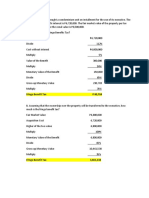

1. In 2018, Delta Corporation bought a condominium unit on installment for the use of its executive. The acquisition cost

inclusive of 12% interest is P6,720,000. The fair market value of the property per tax declaration is P6,800,000 while the

zonal value is P6,500,000.

a. How much is the fringe benefits tax?

Acquisition Cost P 6,720,000.00

Annual Value of benefit (6,720,000 x 5%) 336,000.00

Annual monetary benefit (336,000 x 50%) 168,000.00

GMV value of benefit (168,000 ÷ 65%) 258,461.54

Fringe Benefit Tax (258,461.54 x 35%) P 90,461.54

b. Assuming that the ownership over the property will be transferred to the executive, how much is the fringe

benefits tax?

Acquisition Cost P 6,720,000.00

Zonal value 6,500,000.00

Higher of two (2) values 6,720,000.00

Monetary Value of the benefit (6,720,000 x 100%) 6,720,000.00

GMV value of benefit (6,720,000÷ 65%) 10,338,461.54

Fringe Benefit Tax (10,338,461.54 x 35%) P 3,618,461.54

2. Delata Corporation bought a condominium unit for P6,000,0000. The fair market value of the property per tax

declaration is P6,800,000 while the zonal value is P6,500,000. It was transferred in the name of Pedro, one of its

executives, for a lower consideration amounting to P5,800,000. How much is the fringe benefits tax?

Real Property Tax Declaration P 6,720,000.00

Fair Market Value 6,800,000.00

Higher of two (2) values 6,800,000

Cost to Pedro 5,800,000

Monetary Value of the benefit 1,000,000

GMV value of benefit (1,000,000÷ 65%) 1,538,461.54

Fringe Benefit Tax (1,538,461.54 x 35%) P 538,461.54

3. Omega Corporation purchased a motor vehicle worth P1,400,000 for the use of its executive. It was registered under

the executive’s name despite the agreement that it should be used partly for the company’s benefit. How much is the

fringe benefits tax?

Acquisition Cost of motor vehicle P 1,400,000.00

GMV value of benefit (1,400,000 ÷ 65%) 2,153,846.15

Fringe Benefit Tax (258,461.54 x 35%) P 753,846.15

4. First Metro Pacific was able to persuade Francis to join the company as its Assistant Vice President for Finance which

included a car plan worth P3,000,000 in its compensation package. The company purchased the vehicle and registered

the same in favor of Francis. Assuming further that Francis is a non-resident alien not engaged in trade or business, how

much is the fringe benefits tax?

Acquisition Cost of car P 3,000,000

GMV value of benefit (3,000,000 ÷ 75%) 4,000,000

Fringe Benefit Tax (4,000,000 x 25%) P 1,000,000

Rubric for Grading:

CRITERIA POINTS

Complete solution with correct answer 10

Last two (2) major steps of the solution are incorrect 8

Half of the solution is correct 6

First two (2) major steps of the solution are correct 4

First major step of the solution is correct 2

06 Task Performance 1 *Property of STI

Page 1 of 1

You might also like

- Fringe Benefits, de Minimis Benefits, Filing of Income Tax ReturnDocument5 pagesFringe Benefits, de Minimis Benefits, Filing of Income Tax ReturndgdeguzmanNo ratings yet

- 07 eLMS Review 1 - ARGDocument2 pages07 eLMS Review 1 - ARGRico MarquezNo ratings yet

- Chapter 6 Activity Tax CalculationDocument3 pagesChapter 6 Activity Tax CalculationMa. Alexandria Palma0% (1)

- Calculate fringe benefit tax on condo, car, rental housing benefitsDocument6 pagesCalculate fringe benefit tax on condo, car, rental housing benefitsRonald SaludesNo ratings yet

- Deduction From Gross Income-Deduction Allowed Under Special LawDocument131 pagesDeduction From Gross Income-Deduction Allowed Under Special LawRance Harry Daza0% (2)

- Answer KeyDocument13 pagesAnswer KeyRoronoa Zoro100% (1)

- Identify The Quality Control Element To Which Each Policy Relates. Write The Letter of The Correct Answer On The Space Provided Before Each NumberDocument1 pageIdentify The Quality Control Element To Which Each Policy Relates. Write The Letter of The Correct Answer On The Space Provided Before Each Number?????No ratings yet

- Activities No. 2Document5 pagesActivities No. 2Joshua Cabinas60% (5)

- Quiz 3 - CabigonDocument4 pagesQuiz 3 - CabigonRie CabigonNo ratings yet

- FINAL ROUND EASYDocument15 pagesFINAL ROUND EASYmitakumo uwu50% (6)

- Week 10 CorporationssDocument9 pagesWeek 10 CorporationssAdrian MontemayorNo ratings yet

- Global Reciprocal College Inctax-1 Final Examination 1st Semester, SY 2020-2021 Problem 1Document4 pagesGlobal Reciprocal College Inctax-1 Final Examination 1st Semester, SY 2020-2021 Problem 1sharielles /No ratings yet

- Calculate Income Tax for Individual TaxpayersDocument4 pagesCalculate Income Tax for Individual TaxpayersKenneth Pimentel100% (1)

- Redeemer Corp Cost Analysis 2,000-5,000 HoursDocument2 pagesRedeemer Corp Cost Analysis 2,000-5,000 Hoursarisu100% (1)

- Drill Discussion on Gross Income Inclusions and ExclusionsDocument32 pagesDrill Discussion on Gross Income Inclusions and ExclusionsJao FloresNo ratings yet

- 8.2 Assignment - Regular Income Tax For IndividualsDocument8 pages8.2 Assignment - Regular Income Tax For Individualssam imperialNo ratings yet

- TAX 1.docx KeyDocument94 pagesTAX 1.docx Keymario1962No ratings yet

- Module 3 Tax On CorporationsDocument33 pagesModule 3 Tax On Corporationscha1150% (2)

- Corporation Part 2Document35 pagesCorporation Part 2annyeongchingu100% (2)

- TAX Quiz 1Document2 pagesTAX Quiz 1NaLyn SuLit44% (9)

- Golpo 10 Task Performance 1.taxationDocument13 pagesGolpo 10 Task Performance 1.taxationNin JahNo ratings yet

- Arturo Died Leaving The Following PropertiesDocument1 pageArturo Died Leaving The Following PropertiesCristine Salvacion PamatianNo ratings yet

- Bac03-Chapter 5Document25 pagesBac03-Chapter 5Rea Mariz JordanNo ratings yet

- Leonard 2Document8 pagesLeonard 2Leonard CañamoNo ratings yet

- Income Taxation Multiple Choice ProblemsDocument5 pagesIncome Taxation Multiple Choice Problemsfitz garlitosNo ratings yet

- Non-Individual Taxation: 1. Corporations 2. Co-Ownership 3. Estates and Trusts 4. PartnershipsDocument58 pagesNon-Individual Taxation: 1. Corporations 2. Co-Ownership 3. Estates and Trusts 4. PartnershipsShiela Marie Vics60% (5)

- Higher Education Department: Maryhill College, IncDocument4 pagesHigher Education Department: Maryhill College, Incpat patNo ratings yet

- Quiz 8 - BTX 113Document3 pagesQuiz 8 - BTX 113Rae Vincent Revilla100% (1)

- DocubDocument24 pagesDocubGayli Cortiguerra100% (1)

- Illegal Settler Can Rescind Forced Property SaleDocument1 pageIllegal Settler Can Rescind Forced Property SaleJanineD.Meranio100% (3)

- Lesson 5: Taxation of CorporationsDocument14 pagesLesson 5: Taxation of CorporationsGio yowyowNo ratings yet

- Tax Summative 2Document14 pagesTax Summative 2Von Andrei MedinaNo ratings yet

- Final Examination Income TaxDocument11 pagesFinal Examination Income TaxKristine Lumanaog100% (1)

- DM Corporation trial balance analysisDocument1 pageDM Corporation trial balance analysisBryan KenNo ratings yet

- Final Tax PDFDocument3 pagesFinal Tax PDFGianJoshuaDayrit0% (1)

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- 10 Activity 2Document1 page10 Activity 2Shai GomezNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- 10 TP 1 Income Tax San LuisDocument9 pages10 TP 1 Income Tax San Luislenlen100% (1)

- Quiz Week 2 No AnswerDocument10 pagesQuiz Week 2 No AnswerKatherine EderosasNo ratings yet

- Prelim Exam - Mac 421Document5 pagesPrelim Exam - Mac 421Ezzz VeriNo ratings yet

- Incotax Quiz 1Document7 pagesIncotax Quiz 1Claire RecioNo ratings yet

- The Use of OSD For Corporations Excludes Cost of Goods Sold From Gross Sales/Gross ReceiptsDocument8 pagesThe Use of OSD For Corporations Excludes Cost of Goods Sold From Gross Sales/Gross ReceiptsJohn Carlo Aquino100% (1)

- Elimination Round QuestionnairesDocument5 pagesElimination Round Questionnairesmitakumo uwuNo ratings yet

- False False True True True FalseDocument7 pagesFalse False True True True Falsegazer beam100% (1)

- Tax MergedDocument366 pagesTax MergedRengeline LucasNo ratings yet

- Tax LQ1 2Document21 pagesTax LQ1 2Maddy EscuderoNo ratings yet

- Sample Exercises ITDocument1 pageSample Exercises ITCris Joy BiabasNo ratings yet

- Dealings in PropertiesDocument12 pagesDealings in PropertiesJane Tuazon50% (2)

- MAS 5 - Module 1Document11 pagesMAS 5 - Module 1Razmen Ramirez PintoNo ratings yet

- Capital Gains Tax Quiz AnswersDocument2 pagesCapital Gains Tax Quiz AnswersJimbo Manalastas50% (2)

- Franco FM Taxation 7Document4 pagesFranco FM Taxation 7Kim FloresNo ratings yet

- Tax1 (T31920)Document82 pagesTax1 (T31920)Charles TuazonNo ratings yet

- Income TaxationDocument7 pagesIncome TaxationDummy GoogleNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- Income TaxationDocument2 pagesIncome TaxationEricah DumalaganNo ratings yet

- Answers, Solutions and Clarifications To Form 6Document5 pagesAnswers, Solutions and Clarifications To Form 6Annie LindNo ratings yet

- 06 Taskperformance 1 TaxationDocument2 pages06 Taskperformance 1 TaxationTrisha DomingoNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- Name 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Document3 pagesName 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Katherine Borja100% (2)

- Fiancial PositioonDocument2 pagesFiancial PositioonKatherine BorjaNo ratings yet

- Financial Statements CFASDocument2 pagesFinancial Statements CFASKatherine Borja100% (1)

- Financial PositionDocument2 pagesFinancial PositionKatherine BorjaNo ratings yet

- Cash Flow Indirect and DirectDocument2 pagesCash Flow Indirect and DirectKatherine Borja0% (1)

- Name 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Document3 pagesName 1: Date: Score: Name 2: Name 3: Name 4: Name 5: Name 6: Name 7: Name 8: Name 9: Name 10Katherine Borja100% (2)

- 07 Task Performance 1Document1 page07 Task Performance 1Katherine BorjaNo ratings yet

- 02 Seatwork 2Document1 page02 Seatwork 2Katherine BorjaNo ratings yet

- How Do You Think Your Community Influences Your Behavior?Document1 pageHow Do You Think Your Community Influences Your Behavior?Katherine Borja100% (1)

- SW2 Question 2 EthicsDocument1 pageSW2 Question 2 EthicsKatherine BorjaNo ratings yet

- How Do You Think Your Community Influences Your Behavior?Document1 pageHow Do You Think Your Community Influences Your Behavior?Katherine Borja100% (1)

- 02 Seatwork 2Document1 page02 Seatwork 2Katherine BorjaNo ratings yet

- Sal FebDocument2 pagesSal FebHimanshu Sekhar SahuNo ratings yet

- HI6028 Taxation Theory, Practice & Law: Student Name: Student NumberDocument12 pagesHI6028 Taxation Theory, Practice & Law: Student Name: Student NumberMah Noor FastNUNo ratings yet

- With GST 022Document1 pageWith GST 022mshNo ratings yet

- Estate-Tax ProblemsDocument3 pagesEstate-Tax ProblemsSharjaaahNo ratings yet

- Ing Bank N.V vs. CIRDocument2 pagesIng Bank N.V vs. CIRVel JuneNo ratings yet

- Income Tax Syllabus Rev. August 4 2022Document23 pagesIncome Tax Syllabus Rev. August 4 2022Nezer VergaraNo ratings yet

- Itr 2022-2023Document1 pageItr 2022-2023Deepak ThangamaniNo ratings yet

- TAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanDocument6 pagesTAXREV SYLLABUS - LOCAL TAXATION AND REAL PROPERTY TAXATION ATTY CabanPatrick GuetaNo ratings yet

- SalStmnt 2019julDocument1 pageSalStmnt 2019julNabendu KARMAKARNo ratings yet

- Local Government Taxation Short Cases ExplainedDocument1 pageLocal Government Taxation Short Cases ExplainedRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Nepali Talim Youtube Channel: Calculation of Taxable Income and Tax Liability Based On Income From EmploymentDocument20 pagesNepali Talim Youtube Channel: Calculation of Taxable Income and Tax Liability Based On Income From EmploymentsamNo ratings yet

- Shree Samarth Tax InvoiceDocument3 pagesShree Samarth Tax InvoicePAVAN YADAVNo ratings yet

- Commissioner of Internal Revenue vs. PERF Realty Corporation, 557 SCRA 165, July 04, 2008Document12 pagesCommissioner of Internal Revenue vs. PERF Realty Corporation, 557 SCRA 165, July 04, 2008j0d3No ratings yet

- Official Payslip: Department of EducationDocument1 pageOfficial Payslip: Department of EducationCamillo Kopa100% (1)

- Tally Payroll Tutorial: Setup & Process Payroll in Tally ERPDocument3 pagesTally Payroll Tutorial: Setup & Process Payroll in Tally ERPjyothiNo ratings yet

- What is Finance? Understanding the Key ConceptsDocument19 pagesWhat is Finance? Understanding the Key ConceptsArmilyn Jean CastonesNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearFMG PATELNo ratings yet

- U.S. Individual Income Tax Return: (See Instructions.)Document2 pagesU.S. Individual Income Tax Return: (See Instructions.)Daniel RamirezNo ratings yet

- DT-Revision Chart (Ec.263 - 264) by CA Vijay SardaDocument1 pageDT-Revision Chart (Ec.263 - 264) by CA Vijay Sardapooja4040100% (1)

- Payroll Deductions Group 2Document15 pagesPayroll Deductions Group 2Ronel A GaviolaNo ratings yet

- GST Invoice: Cdho Jilla Panchayat JunagadhDocument1 pageGST Invoice: Cdho Jilla Panchayat JunagadhOmkar DaveNo ratings yet

- 2021 22 SARS ELogbookDocument17 pages2021 22 SARS ELogbookBlack Snow ServicesNo ratings yet

- Assignment 7.1 Millania 25-10-21Document2 pagesAssignment 7.1 Millania 25-10-21Shifa MuslimahNo ratings yet

- Public Finance MCQDocument23 pagesPublic Finance MCQHarshit TripathiNo ratings yet

- Receipt CS-6686456Document1 pageReceipt CS-6686456Jean OrsayNo ratings yet

- Chapt-5 Exclude From Gross IncomeDocument4 pagesChapt-5 Exclude From Gross IncomehumnarviosNo ratings yet

- Digest RR 14-2001 PDFDocument1 pageDigest RR 14-2001 PDFCliff DaquioagNo ratings yet

- QB - Indirect Tax - Mcom Sem 4Document5 pagesQB - Indirect Tax - Mcom Sem 4Prathmesh KadamNo ratings yet

- Kratos - Quotation For - Website1Document1 pageKratos - Quotation For - Website1fapebiNo ratings yet

- Endowment Fund Scholarship FormDocument2 pagesEndowment Fund Scholarship FormPäťhäň ŘājāNo ratings yet