FRANCO,Arven A.

BSBA-II FM B

True or False. If the statement is TRUE, write T on the space provided. Write F if the statement

is FALSE.

F 1. Items of gross income subject to final tax and capital gains tax are

excluded in gross income subject to regular income tax.

T 2. The taxable compensation income is computed as gross compensation

less than non-taxable compensation income.

F 3. The gross income from business is measured as sales or gross receipts

less cost of sales or cost of services.

F 4. The tax due of individuals is determined by means of schedules of tax

rates.

F 5. The deadline of annual income tax return of corporations using the

calendar year is similar to the deadline fixed for individual taxpayers.

T 6. The deadline of filing the corporate quarterly income tax return is the

m

same with the deadline of the quarterly income tax return of individuals.

er as

F 7. Only corporations may incur deductions against taxable income.

co

T 8. The P250,000 income tax exemption for individuals is designed to be in

eH w

lieu of their personal and business expenses.

o.

F 9. Business expenses can be deducted against all types of gross income

rs e

subject to regular tax.

ou urc

T 10. The tax due of corporations is determined by multiplying their gross

income by 30%

o

Compute the following problems. Write the letter of your answer on the table provided.

aC s

vi y re

1. B 6. A 11. A

2. D 7. D 12. B

3. D 8. B 13. C

4. D 9. C 14. B

ed d

5. A 10. A 15. C

ar stu

1. Progressive income tax is applicable to

a. Corporate taxpayers

is

b. Individual taxpayers

c. Compensation earners only

Th

d. Individuals in business only

2. Proportional regular income tax is applicable to

a. Corporations only

sh

b. Compensation earners only

c. Individuals engaged in business

d. Both individuals and corporations

This study source was downloaded by 100000822764997 from [Link] on 04-05-2021 [Link] GMT -05:00

[Link]

� 3. Who cannot claim deductions?

a. Employed taxpayers

b. Self-employed taxpayers in business

c. Self-employed professional taxpayers

d. B and C

4. Who are required to file quarterly declaration of income?

a. Individuals engaged in business

b. Corporations and individuals engaged in business

c. Corporations

d. All individuals and corporations

5. Mr. Jones wishes to file his 2019 income tax return. To avoid penalty, he must file his

return on or before

a. April 15, 2019

b. April 15, 2020

c. August 15, 2020

m

d. November 15, 2020

er as

co

6. An individual taxpayer must file his income tax return on the third quarter of 2019 on or

eH w

before

a. April 15, 2019

o.

b. August 15, 2019

rs e

ou urc

c. November 15, 2020

d. November 15, 2019

7. A purely engaged in business individual taxpayer shall use

o

a. BIR Form 1701A

aC s

b. BIR Form 1701

vi y re

c. BIR Form 1700

d. BIR Form 1702

ed d

8. A corporation subject to different rates shall use

a. Form 1702-RT

ar stu

b. Form 1702-EX

c. Form 1702-MX

d. Form 1701A

is

9. A school which is subject to a preferential or special tax rate shall use

Th

a. Form 1702-RT

b. Form 1702-EX

c. Form 1702-MX

sh

d. Form 1701A

This study source was downloaded by 100000822764997 from [Link] on 04-05-2021 [Link] GMT -05:00

[Link]

� 10. A corporation that is subject only to a 30% income tax rate shall use

a. Form 1702-RT

b. Form 1702-EX

c. Form 1702-MX

d. Form 1701A

11. Mrs. Sanchez Mira had a gross taxable compensation income of P400,000. She also

earned an additional P2,000 by investing her money in time deposits plus P3,000 interest

income from lending money to a friend. Compute her taxable income.

a. P405,000

b. P402,000

c. P400,000

d. P403,000

Solution: P 400,000

2,000

+ 3,000

m

P 405,000

er as

co

12. Ms. Claveria had a business net income of P300,000. She also earned P5,000 commission

eH w

from selling cellular cards and P12,000 dividends from a domestic corporation. Compute

her taxable income.

o.

a. P300,000

rs e

ou urc

b. P312,000

c. P305,000

d. P317,000

o

Solution: P 300,000

aC s

12,000

vi y re

P 312,000

13. Mr. Pamplona earned total gross receipts of P800,000 and paid P300,000 in expenses in

ed d

his accounting practice. During the same year, he also earned a total of P60,000 net gain

from the sale of domestic stocks directly to a buyer. He also disposed a vacant lot at a net

ar stu

gain of P140,000. What is the taxable income of Mr. Pamplona?

a. P400,000

b. P460,000

is

c. P500,000

d. P600,000

Th

Solution: P 800,000

- 300,000

sh

P 500,000

This study source was downloaded by 100000822764997 from [Link] on 04-05-2021 [Link] GMT -05:00

[Link]

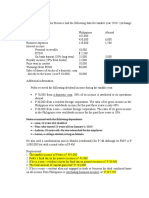

� 14. Mr. Gudani had the following data in 2019:

Philippines Abroad

Gross Income from Sales P 4,000,000 P 6,000,000

Interest Income from Deposits 40,000 80,000

Less: Deductions 2,000,000 3,600,000

Total P 2,040,000 P 2,480,000

Compute the taxable income if Mr. Gudani is a resident citizen.

a. P4,480,000

b. P4,520,000

m

c. P2,040,000

er as

d. P2,000,000

co

eH w

Solution: Local :P 2,040.000

o.

International : + 2,480.000

rs e P 4,520.000

ou urc

15. In the preceding problem, compute the taxable income if Mr. Gudani is a non-resident

o

citizen.

aC s

a. P4,480,000

vi y re

b. P4,520,000

c. P2,040,000

d. P2,000,000

ed d

Solution: P4,000.000 + 40,000 = P4,040.000

ar stu

P4,040.000 – 2,000.000 = P2,040.000

is

Th

sh

This study source was downloaded by 100000822764997 from [Link] on 04-05-2021 [Link] GMT -05:00

[Link]

Powered by TCPDF ([Link])