Professional Documents

Culture Documents

Where To Park Your Money?: Customized Research

Uploaded by

Muhammad Aqeel AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Where To Park Your Money?: Customized Research

Uploaded by

Muhammad Aqeel AhmedCopyright:

Available Formats

Customized Research

July 31, 2013

WHERE TO PARK YOUR MONEY?

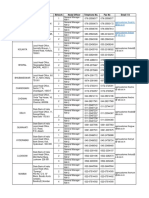

Key Rates Rates on the rise: Why?

MONEY MARKET RATES Did you notice the mix trend cut offs have shown in the last few auctions?

Gove rnm e nt Se curitie s Wonder which maturity would be the safest bet at the moment?

Te nors Avg Yie lds

Overnight 8.51% All questions are answered here, but for that first lets have a look at the cut

1 w eek 8.56% off trend with an analytical eye. It is a preconceived notion that market

2 w eeks 8.59%

1 month 8.71%

expectations about the policy rate drive the cut off yields. True to some

2-months 8.79% extent! But the picture has another side to it as well. For example, the

3-months 8.84%

5-months

recent hike in the cut-off yield of three-month papers in auction held on 10th

8.90%

6-months 8.90% July 2013 was more to do with the fact that the settlement date delayed due

9-months 9.00%

to first of Ramadan was a holiday, consequently reducing tenure of paper

1 year 9.01%

from 84 to 83 days.

Source: JS Treasury

T Bill Rate s

On the other hand, government securities of relatively longer tenure

Cut offs 3-m onths 6-m onths 12-m onths including PIBs and T Bills (12 months) are showing upward trajectory too.

Current 8.96% 8.99% 8.98%

These rising yields indicate rising expectations in the bond market of a

Previous 8.97% 8.97% 8.98%

near-term increase in the policy rate, possibly of 50-100bp.

9.00% Current Previous

8.99% Discount rate to hike 50-100bps in…

8.98%

8.97%

The news that is making rounds is the expected hike in policy rate. But the

8.96% million dollar question is when is the reversal in rate expected?

8.95%

8.94% We base our expectation of rise in policy rate on the following factors:

3-mo nths 6-mo nths 12-months

Rising inflation due to sharp looming hike in power and gas tariffs,

Source: SBP

PIB Rate s Higher currency devaluation followed by continuous depleting foreign

Cut offs 3 Ye ar 5 Ye ar 10 Ye ar reserves,

Current 10.44% 10.90% 11.65%

Previous 9.69% 10.15% 11.05%

And most importantly, possible monetary tightening under the IMF

14.00%

program

Current Previous

12.00%

Apart from this, with monthly figures yet to be updated by SBP of Balance

10.00%

8.00% of Payment for 1MFY14, we cannot say if the conditions on the external

6.00% front are favorable or still deteriorating. In months to come, imported

4.00%

2.00%

inflation is also to keep a watch at. If international oil prices start rising,

0.00% which remained stable throughout FY13 around USD 108-109/bbl, we can

3 Year 5 Year 10 Year

expect serious threats to our import bills.

Source: SBP

Taking all above points into consideration, we believe that a rate hike may

JS BANK LIMITED NOT be a call for upcoming monetary policy. Likelihood of reversal in

Tre as ury Analys t: Sana Taw fik

October’s policy too seems bleak. Thus, investing in short tenures; in 3

Em ail: s ana.taw fik @js bl.com

UAN: +92-21-111-JSBank (572 265) Ext: 213 months T Bill to be precise, would be a prudent decision for now and a safe

bet.

Disclaimer: This report has been prepared for information purposes by the Treasury Department of JS Bank Ltd. The information and data on which this report is based are obtained from sources which we believe to be reliable

but we do not guarantee that it is accurate or complete. In particular, the report takes no account of the investment objectives, financial situation and particular needs of investors who should seek further professional advice

or rely upon their own judgment and acumen before making any investment/decision. This report should also not be considered as a reflection on the concerned company’s management and its performances or ability, or

appreciation or criticism, as to the affairs or operations of such company or institution. Warning: This report may not be reproduced, distributed or published by any person for any purpose whatsoever. Action will be taken for

unauthorized reproduction, distribution or publication.

You might also like

- Businesses and Prime Rate Decisions in Ghana: by Sampson AkligohDocument3 pagesBusinesses and Prime Rate Decisions in Ghana: by Sampson AkligohKwadwo KonaduNo ratings yet

- Financial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesFrom EverandFinancial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesNo ratings yet

- Fixed Income Weekly 03082007Document3 pagesFixed Income Weekly 03082007FarahZBNo ratings yet

- Market Haven Monthly 2011 JanuaryDocument10 pagesMarket Haven Monthly 2011 JanuaryMarketHavenNo ratings yet

- CMO BofA 08-21-2023 AdaDocument8 pagesCMO BofA 08-21-2023 AdaAlejandroNo ratings yet

- Weekly Economic & Financial Commentary 14octDocument13 pagesWeekly Economic & Financial Commentary 14octErick Abraham MarlissaNo ratings yet

- CFA Chapter 15 Problems SolutionsDocument5 pagesCFA Chapter 15 Problems SolutionsFagbola Oluwatobi OmolajaNo ratings yet

- 40 Bangladesh CiplaDocument9 pages40 Bangladesh CiplaPartho MukherjeeNo ratings yet

- Macro Economic Impact Apr08Document16 pagesMacro Economic Impact Apr08shekhar somaNo ratings yet

- Ch6 Interest Rates For CLASSDocument18 pagesCh6 Interest Rates For CLASSken cruzNo ratings yet

- EFM2e, CH 06, Interest RatesDocument21 pagesEFM2e, CH 06, Interest RatesAerhia KimNo ratings yet

- Práctica Dirigida 3 2021Document5 pagesPráctica Dirigida 3 2021Winny Vento HerreraNo ratings yet

- 2022 Global Outlook The Success and Excesses Resulting From Mp3 PoliciesDocument10 pages2022 Global Outlook The Success and Excesses Resulting From Mp3 PoliciesDEV FreelancerNo ratings yet

- Answer For T3 FMRDocument4 pagesAnswer For T3 FMRYehHunTeeNo ratings yet

- Monetary: TrendsDocument20 pagesMonetary: Trendsapi-25887578No ratings yet

- ANZ-Roy Morgan Consumer Confidence - October 2009Document5 pagesANZ-Roy Morgan Consumer Confidence - October 2009bernardchickeyNo ratings yet

- EOC08 UpdatedDocument25 pagesEOC08 Updatedtaha elbakkushNo ratings yet

- Práctica Dirigida 3 2016-IIDocument2 pagesPráctica Dirigida 3 2016-IILeonardo CastilloNo ratings yet

- Exercícios Fundamento de FinançasDocument8 pagesExercícios Fundamento de FinançasTayná TeixeiraNo ratings yet

- Leading Index May 2010Document7 pagesLeading Index May 2010Peter MartinNo ratings yet

- Description: Tags: SAPmemo72001Document14 pagesDescription: Tags: SAPmemo72001anon-223436No ratings yet

- Er 20120815 Bull Consumer SentimentDocument2 pagesEr 20120815 Bull Consumer SentimentChrisBeckerNo ratings yet

- Topics:: 16 Jun 2010, 0144 Hrs IST, Shaji Vikraman and Gayatri Nayak, ET BureauDocument10 pagesTopics:: 16 Jun 2010, 0144 Hrs IST, Shaji Vikraman and Gayatri Nayak, ET BureauHerat TrivediNo ratings yet

- Capital Markets - 4/18/2008Document1 pageCapital Markets - 4/18/2008Russell KlusasNo ratings yet

- Onthly Utlook: U.S. Overview International OverviewDocument6 pagesOnthly Utlook: U.S. Overview International OverviewInternational Business TimesNo ratings yet

- Modern Principles Macroeconomics 3rd Edition Cowen Solutions ManualDocument6 pagesModern Principles Macroeconomics 3rd Edition Cowen Solutions Manualkibitkarowdyismqph9100% (21)

- Westpack AUG 09 Weekly CommentaryDocument8 pagesWestpack AUG 09 Weekly CommentaryMiir ViirNo ratings yet

- 2019macro Outlook PDFDocument71 pages2019macro Outlook PDFAdiKangdraNo ratings yet

- RV Capital Letter 2019-06Document10 pagesRV Capital Letter 2019-06Rocco HuangNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 5/1/2011Document1 pageGreenpath's Weekly Mortgage Newsletter - 5/1/2011CENTURY 21 AwardNo ratings yet

- AssignmentDocument22 pagesAssignmenttanyaNo ratings yet

- Fortnightly Banking Update: Deposit Growth Moderated But Bank Credit Growth Moderates Even MoreDocument3 pagesFortnightly Banking Update: Deposit Growth Moderated But Bank Credit Growth Moderates Even Morekumar ganeshNo ratings yet

- Capital Alert - 6/20/2008Document1 pageCapital Alert - 6/20/2008Russell KlusasNo ratings yet

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasNo ratings yet

- Week 03 - CH 6 Solutions To Selected End of Chapter ProblemsDocument5 pagesWeek 03 - CH 6 Solutions To Selected End of Chapter Problemsbobhamilton3489No ratings yet

- TTP 0611 Can You Time LongDurationDocument3 pagesTTP 0611 Can You Time LongDurationEun Woo HaNo ratings yet

- JULY 2009: Monthly UpdateDocument33 pagesJULY 2009: Monthly UpdatepuneetggNo ratings yet

- Breakfast With Dave - 060909Document8 pagesBreakfast With Dave - 060909variantperceptionNo ratings yet

- Onthly Utlook: U.S. Overview International OverviewDocument6 pagesOnthly Utlook: U.S. Overview International OverviewInternational Business TimesNo ratings yet

- Financial Management Activity 1 AnswersDocument3 pagesFinancial Management Activity 1 AnswersPeng GuinNo ratings yet

- PR201007Document1 pagePR201007qtipxNo ratings yet

- The Stable Growth RateDocument2 pagesThe Stable Growth RateSuuhail RajaniNo ratings yet

- Mortgage Market Perspectives - LendingTree - July 31, 2009Document8 pagesMortgage Market Perspectives - LendingTree - July 31, 2009Lending TreeNo ratings yet

- Greenpath's Weekly Mortgage Newsletter - 10/31/2010Document1 pageGreenpath's Weekly Mortgage Newsletter - 10/31/2010CENTURY 21 AwardNo ratings yet

- Healthcare Reform March 2010Document3 pagesHealthcare Reform March 2010elise_stefanikNo ratings yet

- Morning Review - 091410Document10 pagesMorning Review - 091410pdoorNo ratings yet

- San Mateo County Market Update - November 2011Document4 pagesSan Mateo County Market Update - November 2011Gwen WangNo ratings yet

- The Yield Curve As A Leading Indicator Some Practical Issues (Estrella 2006)Document8 pagesThe Yield Curve As A Leading Indicator Some Practical Issues (Estrella 2006)butunboevsNo ratings yet

- Chapter 7 ProblemsDocument6 pagesChapter 7 ProblemsOkabe RinNo ratings yet

- GGP Ackman Presentation Ira Sohn Conf 5-26-10Document89 pagesGGP Ackman Presentation Ira Sohn Conf 5-26-10fstreet100% (2)

- Capital Alert - 8/29/2008Document1 pageCapital Alert - 8/29/2008Russell KlusasNo ratings yet

- Solman PortoDocument26 pagesSolman PortoYusuf Raharja0% (1)

- Capital Markets - 8/15/2008Document2 pagesCapital Markets - 8/15/2008Russell KlusasNo ratings yet

- It Starts With InflationDocument3 pagesIt Starts With InflationVelayNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter EightDocument25 pagesSolutions For End-of-Chapter Questions and Problems: Chapter EightSam MNo ratings yet

- May 2022 Strategy Call How To Make Money in A Recession Final.01Document40 pagesMay 2022 Strategy Call How To Make Money in A Recession Final.01xtremewhizNo ratings yet

- AlchemyDocument8 pagesAlchemyAshwin HasyagarNo ratings yet

- U.K. Inflation Forecasting Using Quantity Theory of MoneyDocument9 pagesU.K. Inflation Forecasting Using Quantity Theory of MoneyDan IslNo ratings yet

- GX Fsi Dcfs 2019 Banking Cap Markets Outlook PDFDocument40 pagesGX Fsi Dcfs 2019 Banking Cap Markets Outlook PDFJyoti KumawatNo ratings yet

- License TotalDocument1 pageLicense TotalBimo Puthut BienpNo ratings yet

- When The Holy ProphetDocument1 pageWhen The Holy ProphetMuhammad Aqeel AhmedNo ratings yet

- License TotalDocument1 pageLicense TotalBimo Puthut BienpNo ratings yet

- Summery To CM (Time Scale Promotion) PDFDocument4 pagesSummery To CM (Time Scale Promotion) PDFMuhammad Aqeel AhmedNo ratings yet

- Summery To CM (Time Scale Promotion) PDFDocument4 pagesSummery To CM (Time Scale Promotion) PDFMuhammad Aqeel AhmedNo ratings yet

- Summery To CM (Time Scale Promotion)Document4 pagesSummery To CM (Time Scale Promotion)Muhammad Aqeel AhmedNo ratings yet

- Government Initiatives on Philippine Agrarian ReformDocument9 pagesGovernment Initiatives on Philippine Agrarian ReformyoyiyyiiyiyNo ratings yet

- Alamat Kantor Airlines Di Jakarta IndonesiaDocument2 pagesAlamat Kantor Airlines Di Jakarta IndonesiaSeptia Riani100% (1)

- International BusinessDocument9 pagesInternational Business191-006 PC-Riasad Nur SafinNo ratings yet

- Econometrics Lecture Notes Ii Functional Forms of Regression ModelsDocument5 pagesEconometrics Lecture Notes Ii Functional Forms of Regression ModelsUsama RajaNo ratings yet

- Unilever, Leader in Social Responsibility: E-135: Corporate Sustainability StrategyDocument4 pagesUnilever, Leader in Social Responsibility: E-135: Corporate Sustainability StrategyVictor TorresNo ratings yet

- Exploring The Effectiveness of LCR in IndiaDocument50 pagesExploring The Effectiveness of LCR in IndiaLee SmithNo ratings yet

- Class DiagramDocument4 pagesClass Diagramapi-235769548No ratings yet

- Case 05 Lincoln ElectricDocument13 pagesCase 05 Lincoln ElectricMarc Jason Cruz DelomenNo ratings yet

- Mba Project Report On HDFC BankDocument13 pagesMba Project Report On HDFC BanknehaNo ratings yet

- Public Distribution SystemDocument9 pagesPublic Distribution SystemTanushree_Razd_215No ratings yet

- Ronan Livingston: 4752 Red Coat RD Virginia Beach, VA 23456 Phone: (757) 793-1016 E-Mail: Ronanlivingston327@gmai - Co MDocument2 pagesRonan Livingston: 4752 Red Coat RD Virginia Beach, VA 23456 Phone: (757) 793-1016 E-Mail: Ronanlivingston327@gmai - Co Mapi-400357926No ratings yet

- Agriculture in Nepal Group 1 FinalDocument21 pagesAgriculture in Nepal Group 1 FinalsurajNo ratings yet

- MicroeconomicsDocument66 pagesMicroeconomicsAnanya GuptaNo ratings yet

- 2023 Economics GR 10 Exam GuidelinesDocument31 pages2023 Economics GR 10 Exam GuidelinesLinda DladlaNo ratings yet

- Wire Nail PmegpDocument4 pagesWire Nail PmegpTarun ChakrabortyNo ratings yet

- 4.2 Elemental Analysis File No. 1198 - Mr. Abdullah Flah Jaber Al AhbabiDocument5 pages4.2 Elemental Analysis File No. 1198 - Mr. Abdullah Flah Jaber Al AhbabiEdmond SantosNo ratings yet

- Range Trading GuideDocument21 pagesRange Trading GuideFox Fox0% (1)

- Analysis of Impact of GST With Reference To Perspective of Small Business StakeholdersDocument12 pagesAnalysis of Impact of GST With Reference To Perspective of Small Business StakeholdersnaseeemNo ratings yet

- Jurnal Manstra 1Document19 pagesJurnal Manstra 1Syarifahku SNo ratings yet

- SBI local head office contact detailsDocument2 pagesSBI local head office contact detailsWeb SitesNo ratings yet

- MACROECONOMICSDocument4 pagesMACROECONOMICSHarshit BelwalNo ratings yet

- What Is A Cheque Truncation System?Document7 pagesWhat Is A Cheque Truncation System?PrramakrishnanRamaKrishnanNo ratings yet

- SEAC Agenda for 156th Meeting on State Level Expert Appraisal Committee ProjectsDocument10 pagesSEAC Agenda for 156th Meeting on State Level Expert Appraisal Committee ProjectsEthinrajNo ratings yet

- Zia and The EconomyDocument5 pagesZia and The EconomyHamza ChaudhryNo ratings yet

- Tourism in AustraliaDocument4 pagesTourism in AustraliaAnnisaNo ratings yet

- Muneeb Ur Rehman CVDocument2 pagesMuneeb Ur Rehman CVMuneebUrRehmanNo ratings yet

- Brazilian Auto Industry Performance Report 2010Document391 pagesBrazilian Auto Industry Performance Report 2010Flavio AlvesNo ratings yet

- Commodity AgreementsDocument8 pagesCommodity AgreementsshamshamanthNo ratings yet

- Econ 155 Syllabus Fall 2013Document2 pagesEcon 155 Syllabus Fall 2013da.hvedNo ratings yet

- MoratelindoDocument1 pageMoratelindorikko dwiwijanarkoNo ratings yet