Professional Documents

Culture Documents

Chapter 2 #21

Chapter 2 #21

Uploaded by

spp0 ratings0% found this document useful (0 votes)

258 views4 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

258 views4 pagesChapter 2 #21

Chapter 2 #21

Uploaded by

sppCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Problem #21

Preparation of Financial Statements

The following are the adjusted accounts balances of Calamba and Santiago as at Dec 31, 2018:

Accounts Payable P677820

Accounts Receivable 545070

Accumulated Depreciation-Equipment 462870

Allowance for Uncollectible Accounts 18790

Cash 132310

Calamba, Capital 612000

Calamba, Drawing 326400

Equipment 753150

Transportation In 224880

General Expenses (control) 149390

Interest Expenses 35000

Merchandise Inventory, December 31 1320420

Notes Payable 299000

Prepaid Insurance 7350

Purchases 5407160

Purchases Discounts 43050

Purchases Return and Allowances 259600

Santiago Capital 499600

Santiago, Drawing 244800

Sales 7155000

Sales Return and Allowances 375750

Selling Expenses (control) 385880

There were no changes in the partners’ capital accounts during the year. The merchandise inventory at the beginning of

the year was P1440590. The partnership agreement provides for salary allowances of P330000 for Calamba and P290000

for Santiago. It also stipulates an interest allowance of 10% on invested capital at the beginning of the year, with the

remainder of the profit to be divided equally.

Required:

1. Prepare an income statement for the year. Show the division of profit.

2. Prepare a statement of changes in partners’ equity for the year.

3. Prepare a statement of financial position at the end of the year.

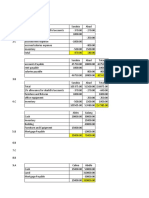

Calamba and Santiago

Income Statement

Dec 31, 2018

Net Sales

7155000.0

Sales 0

Sales Return and Allowances 375750.00

6779250.0

Net Sales 0

Cost of Sales

1440590.0

Merchandise Inventory, Jan 1 0

5407160.0

Purchases 0

Purchases Discounts 43050.00

Purchases Return and Allowances 259600.00 302650.00

5104510.0

Net Purchases 0

Transportation In 224880.00

5329390.0

Net Cost of Purchases 0

6769980.0

Goods Available for Sale 0

Merchandise Inventory, December 1320420.0

31 0

5449560.0

Cost of Sales 0

1329690.0

Gross Profit 0

Operating Expenses

General Expenses (control) 149390.00

Selling Expenses (control) 385880.00

Interest Expenses 35000.00

Total Operating Expenses 570270.00

Profit 759420.00

Calamba Santiago Total

salary 330000.00 290000.00 620000.00

interest 10% 61200.00 49960.00 111160.00

remainder 1:1 14130.00 14130.00 28260.00

profit 405330.00 354090.00 759420.00

Calamba and Santiago

Statement of Changes in Partners’ Equity

Dec 31, 2018

Calamba Santiago Total

1111600.0 1111600.0

Original Investments 612000.00 499600.00 0 0

Less: Temporary Withdrawals 326400.00 244800.00 571200.00 571200.00

Balances 285600.00 254800.00 540400.00 540400.00

Add: Profit 405330.00 354090.00 759420.00 759420.00

1299820.0 1299820.0

Partners' Equity, Dec 31 690930.00 608890.00 0 0

Calamba and Santiago

Statement of Financial Position

Dec 31, 2018

Assets

Cash 132310.00

Accounts Receivable 545070.00

Allowance for Uncollectible Accounts 18790.00 526280.00

1320420.0

Merchandise Inventory, December 31 0

Prepaid Insurance 7350.00

Equipment 753150.00

Accumulated Depreciation-Equipment 462870.00 290280.00

2276640.0

Total Assets 0

Liabilities & Partners' Equity

Accounts Payable 677820.00

Notes Payable 299000.00

Calamba, Capital 690930.00

Santiago Capital 608890.00

2276640.0

Total Liabilities and Partners' Equity 0

You might also like

- Problem #6 A Sole Proprietorship and An Individual With No Business Form A PartnershipDocument1 pageProblem #6 A Sole Proprietorship and An Individual With No Business Form A Partnershipstudentone93% (15)

- Solution Manual For Futures Options and Swaps 5th Edition by KolbDocument37 pagesSolution Manual For Futures Options and Swaps 5th Edition by Kolbsapiditysolvibleq3nl100% (12)

- Chapter 3 ParcorDocument6 pagesChapter 3 Parcornikki sy40% (5)

- Problem #7 A Sole Proprietorship and An Individual With No Business Form A PartnershipDocument2 pagesProblem #7 A Sole Proprietorship and An Individual With No Business Form A Partnershipspp78% (9)

- Problem #8 Two Sole Proprietors Form A PartnershipDocument2 pagesProblem #8 Two Sole Proprietors Form A Partnershipstudentone87% (15)

- Problem #9 Two Sole Proprietorship Form A PartnershipDocument3 pagesProblem #9 Two Sole Proprietorship Form A Partnershipstudentone60% (15)

- Problem #21 Preparation of Financial StatementsDocument4 pagesProblem #21 Preparation of Financial Statementsspp33% (3)

- Assignment Liquidation Lump SumDocument10 pagesAssignment Liquidation Lump SumCresenciano Malabuyoc100% (1)

- Problem #15 Distribution of Profits or Losses Based On Partners' AgreementDocument2 pagesProblem #15 Distribution of Profits or Losses Based On Partners' Agreementspp71% (7)

- Chapter 2 #13Document1 pageChapter 2 #13spp100% (3)

- Problem #16 Distribution of Profits or Losses Based On Partner's AgreementDocument2 pagesProblem #16 Distribution of Profits or Losses Based On Partner's Agreementspp50% (2)

- Chapter 2 #2Document2 pagesChapter 2 #2spp75% (4)

- Learning Task 2 - Shareholders Equity Transactions & Statements (Problem #7,11-13)Document8 pagesLearning Task 2 - Shareholders Equity Transactions & Statements (Problem #7,11-13)Feiya Liu50% (2)

- Problem #16 Distribution of Profits or Losses Based On Partner's AgreementDocument2 pagesProblem #16 Distribution of Profits or Losses Based On Partner's Agreementspp50% (2)

- Chapter 2 #13Document1 pageChapter 2 #13spp100% (3)

- Chapter 2 #2Document2 pagesChapter 2 #2spp75% (4)

- How To Obtain An Original Certificate of TitleDocument2 pagesHow To Obtain An Original Certificate of Titlessien100% (2)

- ParCor Chapter3 BuenaventuraDocument19 pagesParCor Chapter3 BuenaventuraAnonn100% (3)

- Chapter 2 #9Document2 pagesChapter 2 #9spp75% (4)

- Problem #1 Establishing Profit and Loss Sharing MethodDocument1 pageProblem #1 Establishing Profit and Loss Sharing Methodspp100% (1)

- Problem #5 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #5 Distribution of Profits or Losses Based On Partners' Agreementspp100% (2)

- Chapter 2 #11Document2 pagesChapter 2 #11spp100% (3)

- Chapter 2 ParcorDocument17 pagesChapter 2 Parcornikki sy100% (4)

- Chapter 2 #17Document1 pageChapter 2 #17sppNo ratings yet

- Multiple Choice PracticeDocument3 pagesMultiple Choice Practicespp100% (2)

- Problem #1 Establishing Profit and Loss Sharing MethodDocument1 pageProblem #1 Establishing Profit and Loss Sharing Methodspp100% (1)

- Chapter 2 #11Document2 pagesChapter 2 #11spp100% (3)

- Chapter 2 #17Document1 pageChapter 2 #17sppNo ratings yet

- Problem #5 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #5 Distribution of Profits or Losses Based On Partners' Agreementspp100% (2)

- 18 - Pak China RelationsDocument8 pages18 - Pak China RelationsTooba Xaidi100% (1)

- Oakwood Cemetery Richmond, VirginiaDocument20 pagesOakwood Cemetery Richmond, VirginiaTommy ClingerNo ratings yet

- Method Statement For Unloading MaterialDocument4 pagesMethod Statement For Unloading MaterialPaul LadjarNo ratings yet

- Problem #3 Rules For The Distribution of Profits or LossesDocument1 pageProblem #3 Rules For The Distribution of Profits or LossessppNo ratings yet

- Chapter 2 10Document2 pagesChapter 2 10graceNo ratings yet

- ParCor Chapter3 Part2 BuenaventuraDocument17 pagesParCor Chapter3 Part2 BuenaventuraAnonn100% (4)

- Problem #7 Rules For The Distribution of Profits or LossesDocument1 pageProblem #7 Rules For The Distribution of Profits or Lossesspp100% (3)

- Chapter 1 ParcorDocument11 pagesChapter 1 Parcornikki sy50% (2)

- DocxDocument1 pageDocxJannah FateNo ratings yet

- Problem #4 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #4 Distribution of Profits or Losses Based On Partners' Agreementspp100% (1)

- Problem #12 Distribution of Profits or Losses Based On Partners' AgreementDocument3 pagesProblem #12 Distribution of Profits or Losses Based On Partners' Agreementspp0% (1)

- Chapter 2 # 8 NsDocument1 pageChapter 2 # 8 Nsspp100% (2)

- Problem #6 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #6 Distribution of Profits or Losses Based On Partners' AgreementsppNo ratings yet

- Chapter 2 #20Document3 pagesChapter 2 #20spp50% (2)

- Assignment Bsma 1a April 6Document27 pagesAssignment Bsma 1a April 6Maeca Angela Serrano100% (1)

- Problem #19 Distribution of Profits or Losses Based On Partners' AgreementDocument2 pagesProblem #19 Distribution of Profits or Losses Based On Partners' Agreementspp75% (4)

- Problems On LiquidationDocument13 pagesProblems On LiquidationGrace Roque100% (2)

- PROBLEMDocument3 pagesPROBLEMSam VNo ratings yet

- Activity 3Document7 pagesActivity 3Rishaan Dominic100% (1)

- Chapter 2 (Prob.1-10) - Partnership and Corp.Document10 pagesChapter 2 (Prob.1-10) - Partnership and Corp.Andrea Joy ReyNo ratings yet

- Danica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Document4 pagesDanica Reign C. Figueroa Financial Accounting and Reporting Bsa 1C Problem 14Danica Reign FigueroaNo ratings yet

- Multiple Choice Practice 1Document3 pagesMultiple Choice Practice 1sppNo ratings yet

- Fish RUsDocument11 pagesFish RUseia aieNo ratings yet

- PatnershipDocument7 pagesPatnershipShevina MaghariNo ratings yet

- Sample Working Papers-1Document11 pagesSample Working Papers-1misonim.eNo ratings yet

- Lembar Jawaban Jurnal U.anakDocument38 pagesLembar Jawaban Jurnal U.anakjohannahtheresiaNo ratings yet

- Siklus CahayaDocument27 pagesSiklus CahayaBangYonnNo ratings yet

- CAlAMBA AND SANTIAGO - TUGOTDocument2 pagesCAlAMBA AND SANTIAGO - TUGOTAndrea Tugot100% (1)

- Preparation of Financial StatementDocument2 pagesPreparation of Financial Statementhatsumii 1927No ratings yet

- Irene LaguioDocument18 pagesIrene LaguioAlvinNoay100% (2)

- BLT FINAL Assignment (Feb - June 2020) FINALDocument16 pagesBLT FINAL Assignment (Feb - June 2020) FINALSalman SajidNo ratings yet

- Active Runner StoreDocument4 pagesActive Runner StoreAarshi AroraNo ratings yet

- PLBS 2023Document1 pagePLBS 2023mangeshreturnNo ratings yet

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- Finance StatementsDocument5 pagesFinance StatementsDanna Santos NuquiNo ratings yet

- FinanceDocument5 pagesFinanceDanna Santos NuquiNo ratings yet

- FinanceDocument5 pagesFinanceDanna Santos NuquiNo ratings yet

- Kunci JawabanDocument31 pagesKunci JawabanDeni HudayaNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- LembarDocument26 pagesLembarIbnu Kamajaya75% (4)

- Accountin Principals Task 2Document15 pagesAccountin Principals Task 2Thivya KrishnanNo ratings yet

- Example For Chapter 2 (FABM2)Document10 pagesExample For Chapter 2 (FABM2)Althea BañaciaNo ratings yet

- Summary of Operating Assumptions (For Example)Document5 pagesSummary of Operating Assumptions (For Example)Krishna SharmaNo ratings yet

- Irma4 104904Document2 pagesIrma4 104904Al QadriNo ratings yet

- Evi4 104957Document2 pagesEvi4 104957Al QadriNo ratings yet

- FIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisDocument3 pagesFIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisBetcy RaetoraNo ratings yet

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- Irma12 104932Document1 pageIrma12 104932Al QadriNo ratings yet

- Multiple Choice Practice 1Document3 pagesMultiple Choice Practice 1sppNo ratings yet

- Multiple ChoiceDocument2 pagesMultiple ChoicesppNo ratings yet

- DocxDocument1 pageDocxJannah FateNo ratings yet

- Chapter 2 #20Document3 pagesChapter 2 #20spp50% (2)

- Problem #19 Distribution of Profits or Losses Based On Partners' AgreementDocument2 pagesProblem #19 Distribution of Profits or Losses Based On Partners' Agreementspp75% (4)

- PracticeDocument2 pagesPracticesppNo ratings yet

- Problem #14 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #14 Distribution of Profits or Losses Based On Partners' AgreementsppNo ratings yet

- Problem #12 Distribution of Profits or Losses Based On Partners' AgreementDocument3 pagesProblem #12 Distribution of Profits or Losses Based On Partners' Agreementspp0% (1)

- Chapter 2 # 8 NsDocument1 pageChapter 2 # 8 Nsspp100% (2)

- Problem #6 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #6 Distribution of Profits or Losses Based On Partners' AgreementsppNo ratings yet

- Problem #10 Two Sole Proprietorship Form A PartnershipDocument2 pagesProblem #10 Two Sole Proprietorship Form A Partnershipstudentone83% (6)

- Problem #4 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #4 Distribution of Profits or Losses Based On Partners' Agreementspp100% (1)

- Problem #7 Rules For The Distribution of Profits or LossesDocument1 pageProblem #7 Rules For The Distribution of Profits or Lossesspp100% (3)

- IKI Guidelines For International Applicants - For IKI Selection Procedures Since 2018Document33 pagesIKI Guidelines For International Applicants - For IKI Selection Procedures Since 2018xylyx limitedNo ratings yet

- Engineers Scale of Fees - Draft - PDFDocument59 pagesEngineers Scale of Fees - Draft - PDFStephen Mauta KithongoNo ratings yet

- CLE Is ReviewerDocument6 pagesCLE Is ReviewerManoli MontinolaNo ratings yet

- Affidavit For Maids of Aya CentersDocument2 pagesAffidavit For Maids of Aya CentersAchyut BhattacharyaNo ratings yet

- Correspondents Guidelines - 2022Document13 pagesCorrespondents Guidelines - 2022MAHER MILADINo ratings yet

- CH 6 Time of Supply PDFDocument48 pagesCH 6 Time of Supply PDFManas Kumar SahooNo ratings yet

- Law 416Document2 pagesLaw 416Diyla RozainiNo ratings yet

- Edu303 Quiz 1Document3 pagesEdu303 Quiz 1Xia AlliaNo ratings yet

- Music For Alabama - DixielandDocument5 pagesMusic For Alabama - DixielandklkulzerNo ratings yet

- MCCLATCHEY v. ASSOCIATED PRESS - Document No. 60Document5 pagesMCCLATCHEY v. ASSOCIATED PRESS - Document No. 60Justia.comNo ratings yet

- 6351PHY3 Unit 3 Cheat SheetDocument2 pages6351PHY3 Unit 3 Cheat Sheetmonika durairajNo ratings yet

- Vote of Thanks - TampletsDocument1 pageVote of Thanks - TampletsarunloveNo ratings yet

- Sample Interview WriteupDocument2 pagesSample Interview WriteupSharan HansNo ratings yet

- James Brown Children V HynieDocument35 pagesJames Brown Children V HynieFindLaw100% (1)

- 2857 - Accounting For Governmental and Non-Profit Organizations-203203-Chapter 3Document70 pages2857 - Accounting For Governmental and Non-Profit Organizations-203203-Chapter 3shital_vyas1987No ratings yet

- Mei 1-30Document4 pagesMei 1-30Paxelco NgawiNo ratings yet

- of Tally PresentationDocument79 pagesof Tally PresentationSandip JadavNo ratings yet

- 2 IIIpiSeries-2BDocument67 pages2 IIIpiSeries-2BVbs ReddyNo ratings yet

- Severino v. SeverinoDocument1 pageSeverino v. SeverinokdescallarNo ratings yet

- Three Is A Lucky Number 4837t53Document1 pageThree Is A Lucky Number 4837t53Ángela RomeroNo ratings yet

- BS en 00734-1995 (1999)Document10 pagesBS en 00734-1995 (1999)Abshar ParamaNo ratings yet

- Upload 4 - Tan V RamirezDocument4 pagesUpload 4 - Tan V RamirezPatricia VillamilNo ratings yet

- Account StatementDocument7 pagesAccount StatementIjaz AshiqNo ratings yet

- Specific PerformanceDocument4 pagesSpecific PerformancePj TignimanNo ratings yet

- Social Studies 104Document4 pagesSocial Studies 104Basco Martin JrNo ratings yet