Professional Documents

Culture Documents

Statement of Accounts For Partnership

Uploaded by

AsadUllah0 ratings0% found this document useful (0 votes)

17 views3 pagesCopyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views3 pagesStatement of Accounts For Partnership

Uploaded by

AsadUllahCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 3

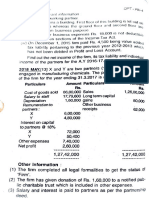

STATEMENT OF ACCOUNTS - For Partnership

NAME OF BUSINESS:

BUSINESS REGISTRATION NO. :

FOR PERIOD FROM TO

$ $

Revenue (Total Sales /Income) Box 1

Less: Cost of Goods Sold

Gross Profit (Revenue less Cost of Goods sold) 0.00 Box 2

Less: Allowable Business Expenses

(please refer to the section on "Claiming of deduction on non-deductible expenses" to ensure that

you do not claim any non-allowable expenese)

Rental paid for Business Premises

Utilities

Gross Employee Salary (DO NOT include partners' salaries)

Employer CPF Contributions (DO NOT include partners' CPF)

Transport Expenses (Public Transport)

Other Running Expenses of the business:

(please indicate the nature and breakdown below)

i)

ii)

iii)

iv)

v)

Total Allowable Business Expenses 0.00 Box 3

Adjusted Profit/(Loss) [Box 2 less Box 3] 0.00 Box 4

Identification Profit Partners' salary, Share of

Name of Partners: No. (NRIC/FIN): Allocation (%) bonus, CPF etc. Profits/(Loss) Total

1) 0 0

2) 0 0

3) 0 0

4) 0 0

Less: Partners' salaries, bonuses, CPF and allowances/benefits-in-kind 0.00 Box 5

Divisible Profit/(Loss) 0.00 Box 6

SUMMARY

Revenue (Total Sales/Income) (Box 1) 0.00

Please report these

Gross Profit (Box 2) 0.00 figures in your tax form

Allowable Business Expenses (Box 3) 0.00 (Form P)

Adjusted Profit/(Loss) (Box 4) 0.00

Partners' salaries, bonuses, CPF etc (Box 5) 0.00

Divisible Profit/(Loss) (Box 6) 0.00

I certify that the information given in this statement is true and correct.

Name of Precedent Partner: Signature :

Identification Number: Date:

Contact Number:

You might also like

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocument2 pagesQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNo ratings yet

- Form CST Errors Sno Error Box Description Error Line No Error Box NoDocument12 pagesForm CST Errors Sno Error Box Description Error Line No Error Box NoVivek PatilNo ratings yet

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocument2 pagesQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNo ratings yet

- Ch 1 Accounting of Partnership Basic ConceptDocument15 pagesCh 1 Accounting of Partnership Basic Concepthk6206131516No ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- Zaki Abdul Basit: Gain/Loss Statement AMOUNT (RS.) CGT Rate Tax Liability (RS.)Document1 pageZaki Abdul Basit: Gain/Loss Statement AMOUNT (RS.) CGT Rate Tax Liability (RS.)zaki Abadul BasitNo ratings yet

- Calculate Self-Employment IncomeDocument6 pagesCalculate Self-Employment IncomejoanaNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJohn Lesther PabiloniaNo ratings yet

- Finsas: Financial Statement Analysis SpreadsheetDocument25 pagesFinsas: Financial Statement Analysis SpreadsheetDharm Veer RathoreNo ratings yet

- 242-Mb Govt. Superior Services Housing Society, Opposite Bahria Town, Canal Bank ROAD, LAHORE., Lahore Iqbal Town Abdul Qadeer KhanDocument4 pages242-Mb Govt. Superior Services Housing Society, Opposite Bahria Town, Canal Bank ROAD, LAHORE., Lahore Iqbal Town Abdul Qadeer KhanAbbas WazeerNo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- Lapay Wali, Post Office Chawinda, Teshil PASRUR, Sialkot, Pasrur. Fiaz Ahmed BhattiDocument4 pagesLapay Wali, Post Office Chawinda, Teshil PASRUR, Sialkot, Pasrur. Fiaz Ahmed BhattiDAYYAN AHMED BHATTNo ratings yet

- GSTR1 33anypm1879j3z5 012024Document5 pagesGSTR1 33anypm1879j3z5 012024mmohamedharis3221No ratings yet

- 15/219, GALI THEKEDARAN, HAJI PURA, Sialkot Sialkot Khawaja Zain AmirDocument4 pages15/219, GALI THEKEDARAN, HAJI PURA, Sialkot Sialkot Khawaja Zain AmirALI JAFFERNo ratings yet

- (Marks 15) : DPT - Pbi-4Document22 pages(Marks 15) : DPT - Pbi-4chandrani4029No ratings yet

- UNIT-4 - Income-From-BusinessDocument114 pagesUNIT-4 - Income-From-BusinessGuinevereNo ratings yet

- Profitability: 2008 2010 Operating Profit Margin (%)Document4 pagesProfitability: 2008 2010 Operating Profit Margin (%)prarak7283No ratings yet

- Tax Report Form 05-158Document2 pagesTax Report Form 05-158eventura1100% (1)

- Chapter 6 - Income Tax For PartnershipDocument40 pagesChapter 6 - Income Tax For PartnershipNineteen AùgùstNo ratings yet

- fm_eco_answerDocument12 pagesfm_eco_answersriramakrishnajayamNo ratings yet

- PART I (See Instructions) : Name of Revenue Producing Activity (RPA)Document2 pagesPART I (See Instructions) : Name of Revenue Producing Activity (RPA)Gil SerranoNo ratings yet

- RandomDocument4 pagesRandomComplaint CellNo ratings yet

- Balance Sheet and Financial StatementsDocument6 pagesBalance Sheet and Financial StatementsKristenNo ratings yet

- 2584/2 Chotki Ghitti Hyd Rizwana: Acknowledgement Slip 114 (1) (Return of Income Filed Voluntarily For Complete Year)Document4 pages2584/2 Chotki Ghitti Hyd Rizwana: Acknowledgement Slip 114 (1) (Return of Income Filed Voluntarily For Complete Year)Mohsin Ali Shaikh vlogsNo ratings yet

- Write Your Business Name Here: Year 1 Year 2 Year 3Document1 pageWrite Your Business Name Here: Year 1 Year 2 Year 3haidee bernabeNo ratings yet

- GSTR1 27aaece1594j1ze 122023Document4 pagesGSTR1 27aaece1594j1ze 122023ca.priyanka025No ratings yet

- House No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidDocument4 pagesHouse No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidIkramNo ratings yet

- Robinhood Securities LLC: Tax Information Account 667446561Document6 pagesRobinhood Securities LLC: Tax Information Account 667446561Allen PrasadNo ratings yet

- Tax and investment documents for 2020Document14 pagesTax and investment documents for 2020Pete MulardNo ratings yet

- Business IncomeDocument15 pagesBusiness IncomeSarvar PathanNo ratings yet

- Acounting IDocument10 pagesAcounting Ikitty16.fonsecaNo ratings yet

- Tax Records SummaryDocument12 pagesTax Records SummaryChristopher ApadNo ratings yet

- Haji BilalDocument4 pagesHaji BilalComplaint CellNo ratings yet

- Form RR1: High-Income Individuals: Limitation On Use of Reliefs 2016Document8 pagesForm RR1: High-Income Individuals: Limitation On Use of Reliefs 2016Mil GustosNo ratings yet

- Document 0Document16 pagesDocument 0Ruby QienNo ratings yet

- Financial Analysis Final (Autosaved)Document159 pagesFinancial Analysis Final (Autosaved)sourav khandelwalNo ratings yet

- Test 9 SolutionDocument3 pagesTest 9 Solutionlalshahbaz57No ratings yet

- House No. 43, Ghous Ul Azam Colony, Gulberg 2, Lahore Humna ShabirDocument5 pagesHouse No. 43, Ghous Ul Azam Colony, Gulberg 2, Lahore Humna ShabirAngrry BurdNo ratings yet

- The Entrepreneurs Guide June SP2B EnglishDocument8 pagesThe Entrepreneurs Guide June SP2B EnglishDIOUF ASSANE MOMARNo ratings yet

- Apartment-201, 2nd Floor Plaza # 43, E-Commercial, Jinnah Boulevard, DHA Phase-II, Islamabad Islamabad Urban Ammar KhatirDocument3 pagesApartment-201, 2nd Floor Plaza # 43, E-Commercial, Jinnah Boulevard, DHA Phase-II, Islamabad Islamabad Urban Ammar KhatirAnonymous gKfTqXObkDNo ratings yet

- FIM-exel-1-1Document46 pagesFIM-exel-1-1Bao Khanh HaNo ratings yet

- Acknowledgement Slip Income Tax ReturnDocument3 pagesAcknowledgement Slip Income Tax ReturnIkramNo ratings yet

- Acca F6 Uk Taxation FA 2017: Course Notes For Exams From June 2018 To March 2019Document100 pagesAcca F6 Uk Taxation FA 2017: Course Notes For Exams From June 2018 To March 2019AliRazaSattarNo ratings yet

- Altman Z Score ModelDocument7 pagesAltman Z Score Modelsoumya_2688No ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Income Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Document134 pagesIncome Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Vipul SharmaNo ratings yet

- Pas 12Document27 pagesPas 12Princess Jullyn ClaudioNo ratings yet

- Trading Account FormatDocument4 pagesTrading Account FormatCommerce Adda ConsultancyNo ratings yet

- Management PrinciplesDocument2 pagesManagement Principlesamon zuluNo ratings yet

- 1701Document6 pages1701Dolly BringasNo ratings yet

- Week 9, CT Losses, 2022-23 - TutorDocument32 pagesWeek 9, CT Losses, 2022-23 - Tutorarpita aroraNo ratings yet

- IT Return - FAST Builder - 2022Document3 pagesIT Return - FAST Builder - 2022Shakir MuhammadNo ratings yet

- Draft ReportDocument8 pagesDraft Report0264192238No ratings yet

- Corporate Accounting AssignmentDocument5 pagesCorporate Accounting AssignmentMd.Mahmudul HasanNo ratings yet

- Creating an Income StatementDocument7 pagesCreating an Income StatementZa DoelNo ratings yet

- Commercial InvoiceDocument2 pagesCommercial InvoiceArdXkillerNo ratings yet

- Ie Profile 5Document10 pagesIe Profile 5AsadUllahNo ratings yet

- Ie Profile 2Document10 pagesIe Profile 2AsadUllahNo ratings yet

- Ie Profile 3Document10 pagesIe Profile 3AsadUllahNo ratings yet

- Ie Profile 4Document10 pagesIe Profile 4AsadUllahNo ratings yet

- Ie Profile 1Document10 pagesIe Profile 1AsadUllahNo ratings yet

- Mortgages Guide Dec 022010Document20 pagesMortgages Guide Dec 022010Malik DanishNo ratings yet

- Kibor 29 Mar 21Document1 pageKibor 29 Mar 21AsadUllahNo ratings yet

- Bank RegulationsDocument51 pagesBank RegulationspopatiaNo ratings yet

- Meezan Bank schedule of charges update Jan-Jun 2021Document1 pageMeezan Bank schedule of charges update Jan-Jun 2021Nawaz SharifNo ratings yet

- Partnership Accounting Chapter SummaryDocument31 pagesPartnership Accounting Chapter SummaryJason Cabrera0% (1)

- SBP PRsDocument28 pagesSBP PRsAdnan ManzoorNo ratings yet

- Kibor 18 Jan 21Document1 pageKibor 18 Jan 21AsadUllahNo ratings yet

- Sustainability 12 07703Document16 pagesSustainability 12 07703AsadUllahNo ratings yet

- Job Opportunities: Instructions & General ConditionsDocument1 pageJob Opportunities: Instructions & General ConditionsSaad MajeedNo ratings yet

- Kibor 29 Sep 21Document1 pageKibor 29 Sep 21AsadUllahNo ratings yet

- Partnership Accounting Chapter SummaryDocument31 pagesPartnership Accounting Chapter SummaryJason Cabrera0% (1)

- Kibor 29 Sep 21Document1 pageKibor 29 Sep 21AsadUllahNo ratings yet

- Depressed Demand To Overshadow The Lower RM Prices: Sector PerformanceDocument3 pagesDepressed Demand To Overshadow The Lower RM Prices: Sector PerformanceAsadUllahNo ratings yet

- Sustainability 12 07703Document16 pagesSustainability 12 07703AsadUllahNo ratings yet

- PEC Governing Body Members 2018-21Document2 pagesPEC Governing Body Members 2018-21AsadUllahNo ratings yet

- Employed Engineers - Consulting Firms-ListADocument4 pagesEmployed Engineers - Consulting Firms-ListAAsadUllahNo ratings yet

- Steel Sector Post Review Update - 1601130113Document31 pagesSteel Sector Post Review Update - 1601130113AsadUllahNo ratings yet

- PEC Governing Body Members 2018-21Document2 pagesPEC Governing Body Members 2018-21AsadUllahNo ratings yet

- AIOU Course 1429-2Document12 pagesAIOU Course 1429-2AsadUllahNo ratings yet

- Income Tax Ordinance, 2013 (Chapter 14)Document5 pagesIncome Tax Ordinance, 2013 (Chapter 14)Azeem ChaudharyNo ratings yet

- Nline Ncome AX Eturn Iling: O I T R FDocument1 pageNline Ncome AX Eturn Iling: O I T R FAsadUllahNo ratings yet

- Chapter 3 - Analysis and Interpretation of Financial StatementsDocument21 pagesChapter 3 - Analysis and Interpretation of Financial StatementsFahad Asghar100% (1)

- Income Tax Ordinance, 2013 (Chapter 14)Document5 pagesIncome Tax Ordinance, 2013 (Chapter 14)Azeem ChaudharyNo ratings yet

- AIOU Course 487-2Document16 pagesAIOU Course 487-2AsadUllahNo ratings yet

- Chapter 6-Exercise SetDocument23 pagesChapter 6-Exercise SetNatalie JimenezNo ratings yet

- Manila Doctors HospitalDocument45 pagesManila Doctors HospitalLordeen LagrimasNo ratings yet

- Chapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingDocument70 pagesChapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingEninta SebayangNo ratings yet

- Accounting For Income TaxesDocument16 pagesAccounting For Income TaxesMUNAWAR ALI100% (5)

- Feasibility Study of Paving Tile BusinessDocument31 pagesFeasibility Study of Paving Tile BusinessAngelica Jane AradoNo ratings yet

- Crocs: Revolutionizing An Industry's Supply Chain Model For Competitive AdvantageDocument24 pagesCrocs: Revolutionizing An Industry's Supply Chain Model For Competitive Advantagenehaarora9090% (1)

- Mid-Term Assignment: Company: Hoa Binh Construction (HBC) Item: Accounts ReceivableDocument9 pagesMid-Term Assignment: Company: Hoa Binh Construction (HBC) Item: Accounts ReceivableANo ratings yet

- Daily QuizDocument98 pagesDaily QuizpintosinghNo ratings yet

- Bing TestDocument6 pagesBing TestdfordhirajNo ratings yet

- Proforma Income StatementDocument13 pagesProforma Income StatementBeans FruitNo ratings yet

- Answers 5Document101 pagesAnswers 5api-308823932100% (1)

- Fundraising plan template guideDocument3 pagesFundraising plan template guideIbrahim ChambusoNo ratings yet

- Accounting Workbook Section 3 AnswersDocument30 pagesAccounting Workbook Section 3 AnswersAhmed Zeeshan83% (12)

- Doctrinal Digest:: Cir Vs Bpi G.R. No. 147375, June 26, 2006Document10 pagesDoctrinal Digest:: Cir Vs Bpi G.R. No. 147375, June 26, 2006JMANo ratings yet

- Ratio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosDocument4 pagesRatio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosCollen MahamboNo ratings yet

- ACC 213 SylabusDocument5 pagesACC 213 Sylabusfbicia218No ratings yet

- Ford Otosan 2015 Annual Report Highlights Record ResultsDocument92 pagesFord Otosan 2015 Annual Report Highlights Record ResultsErman CevikkalpNo ratings yet

- IF1 - Practice ProblemsDocument198 pagesIF1 - Practice ProblemssaikrishnavnNo ratings yet

- Financial Accounting Purpose External UsersDocument37 pagesFinancial Accounting Purpose External UsersChelsy Santos100% (1)

- TB CHDocument77 pagesTB CHg202301230No ratings yet

- Taxation Reviewerdocx PDF FreeDocument17 pagesTaxation Reviewerdocx PDF FreeAlexis Kaye DayagNo ratings yet

- Reporting Segment InformationDocument8 pagesReporting Segment InformationGlen JavellanaNo ratings yet

- IGCSE Business Studies - AccountsDocument53 pagesIGCSE Business Studies - Accountsdenny_sitorusNo ratings yet

- Introduction of Accounting and Terminology PDFDocument21 pagesIntroduction of Accounting and Terminology PDFGAURAV KUMARNo ratings yet

- PWC Global Annual Review 2021Document97 pagesPWC Global Annual Review 2021Sarah AndoNo ratings yet

- BASTDocument6 pagesBASTsyamsir nurNo ratings yet

- Revenues From Grants 1Document6 pagesRevenues From Grants 1محمد عرفاتNo ratings yet

- Financial Model - Real Estate DevelopmentDocument7 pagesFinancial Model - Real Estate DevelopmentAdnan Ali100% (1)

- Sri Lanka Ceramic Sector Ratio AnalysisDocument16 pagesSri Lanka Ceramic Sector Ratio Analysischinthaka gayan40% (5)

- Manufacturing Plant Cash FlowDocument9 pagesManufacturing Plant Cash FlowKuralay TilegenNo ratings yet