Professional Documents

Culture Documents

Doremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)

Uploaded by

Guiana WacasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Doremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)

Uploaded by

Guiana WacasCopyright:

Available Formats

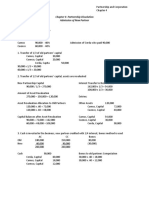

DOREMI PARTNERSHIP

DEBIT CREDIT

CASH P15,000

ACCOUNTS RECEIVABLE P20,000

INVENTORIES P65,000

LAND P50,000

BUILDING P100,000

FURNITURE P50,000

LOANS RECEIVABLE FROM Mi P10,000

ACCOUNTS PAYABLE P80,000

LOANS PAYABLE TO Do P10,000

Do, Capital (20%) P40,000

Re, Capital (30%) P60,000

Mi, Capital (50%) P50,000

ACCUM. DEPN. - BUILDING P40,000

ACCUM. DEPN. - FURNITURE P30,000

The following transactions and events occurred during the liquidation process:

June 10

Inventories and accounts receivable were realized at P20,000 and

P17,000 respectively.

June 20

P50,000 cash were used to pay outside creditors.

July 5 Land and building were sold for P100,000.

July 10 Liquidation expenses of P3,000 were paid.

July 15 Remaining outside creditors were paid from available cash.

July 20 Remaining available cash were distributed to partners.

August 10 Remaining noncash assets were sold for P5,000.

August 15 Paid to partners the remaining cash.

Required: Prepare the following:

A. Schedule of safe payments

DoReMi Partnership

Safe Payment Schedule

(Schedule 1)

PARTNERS

Do Re Mi

Profit and Loss agreement 20% 30% 50%

Combined claims of partners

Less: Loss on realization

Balance

Less Maximum Loss Possible:

Unsold non-cash assets

Estimated Liabilities

Expected Liquidation Expenses

TOTAL

Capital Balances

Deficiency Absorption

Capital Balances

1st Payment of Cash

DoReMi Partnership

Safe Payment Schedule

(Schedule 2)

PARTNERS

Do Re Mi

Profit and Loss agreement 20% 30% 50%

Combined claims of partners

Less: Loss on realization

Balance

Less Maximum Loss Possible:

Unsold non-cash assets

Estimated Liabilities

Expected Liquidation Expenses

TOTAL

Capital Balances

Deficiency Absorption

Capital Balances

1st Payment of Cash

DoReMi Partnership

Safe Payment Schedule

(Schedule 3)

PARTNERS

Do Re Mi

Profit and Loss agreement 20% 30% 50%

Combined claims of partners

Less: Loss on realization

Balance

Less Maximum Loss Possible:

Unsold non-cash assets

Estimated Liabilities

Expected Liquidation Expenses

TOTAL

Capital Balances

Deficiency Absorption

Capital Balances

1st Payment of Cash

B. Liquidation statement

C. Journal entries for the following:

1. Sale on June 10 and the distribution of gain or loss on realization. (Compound entry)

2. Payment to outside creditors on June 20.

3. Sale on July 5 and the distribution of gain or loss on realization. (Compound entry)

4. Actual liquidation expense paid on July 10.

5. Payment to outside creditor on July 15.

6. First cash distribution to the partners on July 20.

7. Sale on August 10 and the distribution of gain or loss on realization. (Compound entry)

8. Final payment to the partners on August 15.

You might also like

- Reviewer - ParCorDocument13 pagesReviewer - ParCoramiNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- PreweekSol (Advacc)Document91 pagesPreweekSol (Advacc)Rommel Cruz100% (2)

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Lumpsum LiquidationDocument28 pagesLumpsum LiquidationCAMILLE100% (1)

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Far 3 PDF FreeDocument6 pagesFar 3 PDF Freejunica casi�oNo ratings yet

- PARCORDocument5 pagesPARCORjelai anselmoNo ratings yet

- Partnership Formation ProblemsDocument3 pagesPartnership Formation Problemsai kawaiiNo ratings yet

- Partnership ReviewerDocument11 pagesPartnership Reviewerbae joohyun0% (1)

- Liquidation PDFDocument7 pagesLiquidation PDFGigo Kafare BinoNo ratings yet

- A Partnership With A Capital Less Than 3000 Is Void If It Is Unregistered With SECDocument4 pagesA Partnership With A Capital Less Than 3000 Is Void If It Is Unregistered With SECElla Mae TuratoNo ratings yet

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- ParCor Chapter 4 - Hernandez - BSA 1-1 PDFDocument7 pagesParCor Chapter 4 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Chapter 1 Partnership Basic Considerations and FormationDocument20 pagesChapter 1 Partnership Basic Considerations and FormationMIKASANo ratings yet

- Partnership Theories - OperationsDocument90 pagesPartnership Theories - OperationsBrIzzyJ100% (1)

- Problem 6 1Document2 pagesProblem 6 1SerdenRoseNo ratings yet

- Chapter 1 Problem SolvingDocument5 pagesChapter 1 Problem Solvingahmed arfanNo ratings yet

- Solution in Partnership Liquidation InstallmentDocument20 pagesSolution in Partnership Liquidation InstallmentNikki GarciaNo ratings yet

- Mock Aqe 1Document15 pagesMock Aqe 1AshNor RandyNo ratings yet

- Problem #9 Two Sole Proprietorship Form A PartnershipDocument3 pagesProblem #9 Two Sole Proprietorship Form A PartnershipNiño Rey LopezNo ratings yet

- Exercise 3: 1. Initial Capital Investments (Compound Entry) DR CRDocument4 pagesExercise 3: 1. Initial Capital Investments (Compound Entry) DR CRasdfNo ratings yet

- Jan David's Accounting Las 4Document9 pagesJan David's Accounting Las 4Cj ArquisolaNo ratings yet

- 202 Cases Partnership DissolutionDocument1 page202 Cases Partnership DissolutionAnonymous LusWvyNo ratings yet

- Partnership Dissolution From Prof. Cecilia MercadoDocument7 pagesPartnership Dissolution From Prof. Cecilia MercadoChitz Pobar0% (1)

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Suggested AnswersDocument18 pagesSuggested AnswersEl YangNo ratings yet

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- Answer Prob 1 and 2Document3 pagesAnswer Prob 1 and 2machelle franciscoNo ratings yet

- 1 Lecture Notes DissolutionDocument17 pages1 Lecture Notes DissolutionMaybelle Espenido0% (2)

- ActivityDocument9 pagesActivityKimberlie Jane GableNo ratings yet

- Partnership 2021 - Long ProblemsDocument5 pagesPartnership 2021 - Long ProblemsMichael MagdaogNo ratings yet

- MC 5 Dissolution P2Document3 pagesMC 5 Dissolution P2Jenny BernardinoNo ratings yet

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20ADocument4 pagesRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingNo ratings yet

- Assignment AnswerDocument2 pagesAssignment AnswerMims ChiiiNo ratings yet

- Partnership Dissolution Changes in OwnershipDocument30 pagesPartnership Dissolution Changes in OwnershipKeith Joshua GabiasonNo ratings yet

- CH 30 - First Time Adoption of PFRSDocument2 pagesCH 30 - First Time Adoption of PFRSJoyce Anne GarduqueNo ratings yet

- Chapter 2&3 Par - CorDocument31 pagesChapter 2&3 Par - CorJUARE MaxineNo ratings yet

- Activity Partnership DissolutionDocument2 pagesActivity Partnership DissolutionKaren Joy Jacinto ElloNo ratings yet

- AC - IntAcctg-A LSLiquidation.Document41 pagesAC - IntAcctg-A LSLiquidation.Janesene SolNo ratings yet

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocument19 pagesMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNo ratings yet

- Partnership Dissolution Withdrawal Retirement Death and IncapacityDocument25 pagesPartnership Dissolution Withdrawal Retirement Death and IncapacityGale KnowsNo ratings yet

- Partnership OperationDocument71 pagesPartnership Operationglenn langcuyanNo ratings yet

- ADVANCED ACCOUNTING Chapter 6Document90 pagesADVANCED ACCOUNTING Chapter 6Stork EscobidoNo ratings yet

- Partnership FormationDocument3 pagesPartnership FormationTon Martinez ArcenasNo ratings yet

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaNo ratings yet

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- Partnership Dissolution ProblemsDocument2 pagesPartnership Dissolution ProblemsMellanie SerranoNo ratings yet

- PARCOR - 2Nature-and-Formation-of-a-PartnershipDocument30 pagesPARCOR - 2Nature-and-Formation-of-a-PartnershipHarriane Mae GonzalesNo ratings yet

- Activity 1 Acc311Document3 pagesActivity 1 Acc311Aidreil LeeNo ratings yet

- FAR2 Classwork PDFDocument7 pagesFAR2 Classwork PDFBarley ManilaNo ratings yet

- Chapter 2 - Partnership Formation ObjectivesDocument10 pagesChapter 2 - Partnership Formation ObjectivesSapphire AliasNo ratings yet

- The Loss On Realization Are P45,000, (P20,000-P65,000) P3,000, (P17,000-P20,000)Document8 pagesThe Loss On Realization Are P45,000, (P20,000-P65,000) P3,000, (P17,000-P20,000)Vona Claire MahilumNo ratings yet

- 3 ACCT 2AB P. DissolutionDocument6 pages3 ACCT 2AB P. DissolutionMary Angeline LopezNo ratings yet

- Ast Discussion 4 - Partnership Liquidation For PrintDocument4 pagesAst Discussion 4 - Partnership Liquidation For PrintCHRISTINE TABULOGNo ratings yet

- AfarDocument6 pagesAfarRolando PasamonteNo ratings yet

- Module-Partnership-and-Corporation-Accounting - Lesson 1Document6 pagesModule-Partnership-and-Corporation-Accounting - Lesson 1Jay Lord GallardoNo ratings yet

- Forms of Business OrganizationDocument9 pagesForms of Business OrganizationKhim CortezNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- PAYROLLDocument10 pagesPAYROLLGuiana WacasNo ratings yet

- Employee Information: Record No. 1 2Document32 pagesEmployee Information: Record No. 1 2Guiana WacasNo ratings yet

- Chapter 6Document6 pagesChapter 6Guiana Wacas100% (2)

- Job OrderDocument9 pagesJob OrderMaybelleNo ratings yet

- 4 StatementOfComprehensiveIncomeDocument11 pages4 StatementOfComprehensiveIncomestudent75% (12)

- This Study Resource Was Shared Via: B. Working Capital ManagementDocument6 pagesThis Study Resource Was Shared Via: B. Working Capital ManagementGuiana WacasNo ratings yet

- English For Academic and Professional Purposes LAS Quarter 3Document270 pagesEnglish For Academic and Professional Purposes LAS Quarter 3Scira Sandejas91% (54)

- Chap 8, UnfinishedDocument11 pagesChap 8, UnfinishedGuiana WacasNo ratings yet

- Worksheet Reversing EntriesDocument20 pagesWorksheet Reversing EntriesGuiana Wacas100% (1)

- GNP ActivityDocument2 pagesGNP ActivityGuiana WacasNo ratings yet

- Assignment 1Document2 pagesAssignment 1Guiana WacasNo ratings yet

- Solution Guide Excercise 3 - Problem Solving-1Document4 pagesSolution Guide Excercise 3 - Problem Solving-1Guiana WacasNo ratings yet

- Activity 2 For FinalsDocument2 pagesActivity 2 For FinalsGuiana WacasNo ratings yet

- Research On Economic Development and Economic GrowthDocument1 pageResearch On Economic Development and Economic GrowthGuiana WacasNo ratings yet

- CoordinationDocument1 pageCoordinationGuiana WacasNo ratings yet

- TrainingDocument1 pageTrainingGuiana WacasNo ratings yet

- Activity 1 Intro To AcctgDocument1 pageActivity 1 Intro To AcctgGuiana WacasNo ratings yet

- Enumerate The Purpose of Sensory System Evaluation To The Integrity of The Integumentary SystemDocument2 pagesEnumerate The Purpose of Sensory System Evaluation To The Integrity of The Integumentary SystemGuiana WacasNo ratings yet

- Fol Haws Catering Service Exercise-1Document16 pagesFol Haws Catering Service Exercise-1Guiana WacasNo ratings yet

- HO1 Problems and ExercisesDocument2 pagesHO1 Problems and ExercisesGuiana WacasNo ratings yet

- HO1 Problems and ExercisesDocument2 pagesHO1 Problems and ExercisesGuiana WacasNo ratings yet

- HO1 Problems and ExercisesDocument2 pagesHO1 Problems and ExercisesGuiana WacasNo ratings yet

- Comparison Bookkeeping AccountingDocument3 pagesComparison Bookkeeping AccountingGuiana WacasNo ratings yet

- Joe Guaracino Government Memorandum On Eligibility of CJA CounselDocument11 pagesJoe Guaracino Government Memorandum On Eligibility of CJA CounselThe Straw BuyerNo ratings yet

- BATTON, Ivory Miles H. 2A - LLB: Herminia Cando V. Sps. Aurora Olazo and Claudio March 22, 2007 G.R. No. 160741 FactsDocument3 pagesBATTON, Ivory Miles H. 2A - LLB: Herminia Cando V. Sps. Aurora Olazo and Claudio March 22, 2007 G.R. No. 160741 FactsRollyn Dee De Marco PiocosNo ratings yet

- A Handbook On Private Equity FundingDocument109 pagesA Handbook On Private Equity FundingLakshmi811No ratings yet

- Uber Case StudyDocument6 pagesUber Case Studyapi-18227590No ratings yet

- FINAL MFI Directory 19 11 14Document389 pagesFINAL MFI Directory 19 11 14amandeepNo ratings yet

- Financial Accounting Part 3Document6 pagesFinancial Accounting Part 3Christopher Price67% (3)

- Law of Negotiable InstrumentsDocument16 pagesLaw of Negotiable InstrumentsSahrish Tahir100% (1)

- Eco by 2'sDocument2 pagesEco by 2'sBrian JavierNo ratings yet

- Cases Maceda and Recto LawDocument9 pagesCases Maceda and Recto LawAnonymous NqaBAyNo ratings yet

- Auddyo PDFDocument15 pagesAuddyo PDFmadhur chaurasiaNo ratings yet

- Credit Transactions - Car LoanDocument4 pagesCredit Transactions - Car LoanDonna CasequinNo ratings yet

- Kyc Update Form: Customer Details (Mandatory)Document2 pagesKyc Update Form: Customer Details (Mandatory)vikram122No ratings yet

- Taco Bout ItDocument14 pagesTaco Bout Itapi-248790355No ratings yet

- Habib Bank LimitedDocument51 pagesHabib Bank LimitedFarrukh BashirNo ratings yet

- FPC 03 Richard SharpDocument3 pagesFPC 03 Richard SharppoliticshomeukNo ratings yet

- The International Operations of National Firms - A Study of Direct Foreign Investment-MIT Press (MA) (Document288 pagesThe International Operations of National Firms - A Study of Direct Foreign Investment-MIT Press (MA) (Bhuwan100% (1)

- Jaminan Fidusia Yang Objek Jaminan DijualDocument24 pagesJaminan Fidusia Yang Objek Jaminan DijualSyafril SyaninNo ratings yet

- Welcome KitDocument20 pagesWelcome KitParthipan KumarNo ratings yet

- On Demand Bond - IChemE ContractDocument19 pagesOn Demand Bond - IChemE ContractMas Ayu MahmoodNo ratings yet

- SCL Reviewer. AquinioDocument12 pagesSCL Reviewer. AquiniotimothymarkmaderazoNo ratings yet

- The Ultimate ESL Teaching Book of Speaking ActivitiesDocument47 pagesThe Ultimate ESL Teaching Book of Speaking ActivitiesAntonio Albiero88% (8)

- Turkey GenDocument285 pagesTurkey GenMuhammad Talha TalhaNo ratings yet

- 2013 WBC Annual ReportDocument316 pages2013 WBC Annual ReportMaiNguyenNo ratings yet

- Finance Analysis of Capital BankDocument10 pagesFinance Analysis of Capital BankAnita GaoNo ratings yet

- Performance of Batangas I Electric Cooperative, Inc. (BATELEC I) in The Wholesale Electricity Spot Market (WESM)Document11 pagesPerformance of Batangas I Electric Cooperative, Inc. (BATELEC I) in The Wholesale Electricity Spot Market (WESM)Asia Pacific Journal of Multidisciplinary ResearchNo ratings yet

- ICAP Past 20 Attempts Questions - Topic WiseDocument38 pagesICAP Past 20 Attempts Questions - Topic Wisesohail merchant100% (1)

- SaaS Salesforce EconomicsDocument96 pagesSaaS Salesforce Economicsadityanagodra100% (1)

- China Bank 2010 Annual ReportDocument159 pagesChina Bank 2010 Annual ReportJerome DominguezNo ratings yet

- Productpdf 1578910938303Document72 pagesProductpdf 1578910938303Virat KohliNo ratings yet

- PNB v. PadaoDocument3 pagesPNB v. PadaoMaya Julieta Catacutan-EstabilloNo ratings yet