Professional Documents

Culture Documents

Madura: International Financial Management Chapter 2

Uploaded by

Optimistic RiditOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Madura: International Financial Management Chapter 2

Uploaded by

Optimistic RiditCopyright:

Available Formats

Madura: International Financial Management Chapter 2

Balance of Payments

Chapter

2 • The balance of payments is a

International Flow of Funds measurement of all transactions between

domestic and foreign residents over a

specified period of time.

• Each transaction is recorded as both a

credit and a debit, i.e. double-entry

bookkeeping.

• The transactions are presented in three

groups – a current account, a capital

account, and a financial account.

South-Western/Thomson Learning © 2003 B2 - 2

Components of Current

Balance of Payments

Account

• The current account summarizes the flow of

funds between one specified country and all • Merchandise exports and imports (Balance

other countries due to the purchases of of trade).

goods or services, the provision of income • Service exports and imports.

on financial assets, or unilateral current • Factor income (interest and dividend).

transfers (e.g. government grants and

pensions, private remittances).

• A current account deficit suggests a greater

outflow of funds from the specified country

for its current transactions.

B2 - 3 B2 - 4

Summary of U.S. International Transactions

(For the Year of 2000 in Millions of Dollars)

Balance of Payments

Current Account

Exports of goods and services and income receipts 1418568 • The new capital account is defined in the

Goods 772210

1993 System of National Accounts and the

Services 293492

fifth edition of IMF’s Balance of Payments

Income receipts 352866

Manual.

Imports of goods and services and income receipts -1809099

Goods -1224417 • It includes unilateral current transfers that

Services -217024 are really shifts in assets, not current

Income payments -367658 income. E.g. debt forgiveness, transfers

Balance on current account -390531 by immigrants, the sale or purchase of

rights to natural resources or patents.

Source: U.S. Bureau of Economic Analysis B2 - 5 B2 - 6

South-Western/Thomson Learning © 2003 Page 2 - 1

Madura: International Financial Management Chapter 2

Components of Financial

Balance of Payments

Account

• The financial account (which was called • Direct foreign investment resulting into

the capital account previously) change in control of business.

summarizes the flow of funds resulting • Portfolio investment (long term financial

from the sale of assets between one assets) without affecting control.

specified country and all other countries.

• Other capital investment (short term

financial assets).

B2 - 7 B2 - 8

Summary of U.S. International Transactions

(For the Year of 2000 in Millions of Dollars)

International Trade Flows

Financial Account

U.S.-owned assets abroad, net (increase/financial outflow) -580952 • Different countries rely on trade to

U.S. official reserve assets, net -290

different extents.

Other U.S. Gov’t assets, net -944

U.S. private assets, net -579718 • The trade volume of European countries is

Foreign-owned assets in the U.S., net (increase/financial inflow) typically between 30 – 40% of their

1024218 respective GDP, while the trade volume of

Foreign official assets in the U.S., net 37619 U.S. and Japan is typically between 10 –

Other foreign assets in the U.S., net 986599

20% of their respective GDP.

Net financial flows 443266

• Nevertheless, the volume of trade has

Statistical discrepancy (sum of items in all accounts with sign reversed)

696 grown over time for most countries.

Source: U.S. Bureau of Economic Analysis B2 - 9 B2 - 10

Factors Affecting Factors Affecting

International Trade Flows International Trade Flows

• Inflation • Government Restrictions

¤ A relative increase in a country’s inflation ¤ A government may reduce its country’s

rate will decrease its current account, as imports by imposing tariffs on imported

imports increase and exports decrease. goods, or by enforcing a quota. Note that

• National Income other countries may retaliate by imposing

¤ A relative increase in a country’s income their own trade restrictions.

level will decrease its current account, as ¤ Sometimes though, trade restrictions may

imports increase. be imposed on certain products for health

and safety reasons.

B2 - 11 B2 - 12

South-Western/Thomson Learning © 2003 Page 2 - 2

Madura: International Financial Management Chapter 2

Factors Affecting Correcting

International Trade Flows A Balance of Trade Deficit

• Exchange Rates • By reconsidering the factors that affect

¤ If a country’s currency begins to rise in the balance of trade, some common

value, its current account balance will correction methods can be developed.

decrease as imports increase and exports • For example, a floating exchange rate

decrease. system may correct a trade imbalance

• Note that the factors are interactive, such automatically since the trade imbalance

that their simultaneous influence on the will affect the demand and supply of the

balance of trade is a complex one. currencies involved.

B2 - 13 B2 - 14

Correcting

A Balance of Trade Deficit J-Curve Effect

• However, a weak home currency may not

U.S. Trade Balance

necessarily improve a trade deficit.

¤ Foreign companies may lower their prices

to maintain their competitiveness. 0 Time

¤ Some other currencies may weaken too.

¤ Many trade transactions are prearranged

and cannot be adjusted immediately. This J Curve

is known as the J-curve effect.

¤ The impact of exchange rate movements

on intracompany trade is limited.

B2 - 15 B2 - 16

Factors Affecting DFI Factors Affecting DFI

• Changes in Restrictions • Tax Rates

¤ New opportunities may arise from the ¤ Countries that impose relatively low tax

removal of government barriers. rates on corporate earnings are more likely

• Privatization to attract DFI.

¤ DFI has also been stimulated by the selling • Exchange Rates

of government operations. ¤ Firms will typically prefer to invest their

• Potential Economic Growth funds in a country when that country’s

¤ Countries with higher potential economic currency is expected to strengthen.

growth are more likely to attract DFI.

B2 - 17 B2 - 18

South-Western/Thomson Learning © 2003 Page 2 - 3

Madura: International Financial Management Chapter 2

Factors Affecting Agencies that Facilitate

International Portfolio Investment International Flows

• Tax Rates on Interest or Dividends International Monetary Fund (IMF)

¤ Investors will normally prefer countries • The IM F is an organization of 183 member

where the tax rates are relatively low. countries. Established in 1946, it aims

• Interest Rates ¤ to promote international monetary

¤ Money tends to flow to countries with high cooperation and exchange stability;

interest rates. ¤ to foster economic growth and high levels

• Exchange Rates of employment; and

¤ Foreign investors may be attracted if the ¤ to provide temporary financial assistance

local currency is expected to strengthen. to help ease imbalances of payments.

B2 - 19 B2 - 20

Agencies that Facilitate Agencies that Facilitate

International Flows International Flows

International Monetary Fund (IMF) International Monetary Fund (IMF)

• Its operations involve surveillance, and • The weights assigned to the currencies in

financial and technical assistance. the SDR basket are as follows:

• In particular, its compensatory financing Currency 2001 Revision 1996 Revision

facility attempts to reduce the impact of U.S. dollar 45 39

export instability on country economies. Euro 29

Deutsche mark 21

• The IM F uses a quota system, and its unit French franc 11

of account is the SDR (special drawing Japanese yen 15 18

right). Pound sterling 11 11

B2 - 21 B2 - 22

Agencies that Facilitate Agencies that Facilitate

International Flows International Flows

World Bank Group IBRD: International Bank for Reconstruction

• Established in 1944, the Group assists and Development

development with the primary focus of • Better known as the World Bank, the IBRD

helping the poorest people and the provides loans and development

poorest countries. assistance to middle-income countries

• It has 183 member countries, and is and creditworthy poorer countries.

composed of five organizations - IBRD, • In particular, its structural adjustment

IDA, IFC, MIGA and ICSID. loans are intended to enhance a country’s

long-term economic growth.

B2 - 23 B2 - 24

South-Western/Thomson Learning © 2003 Page 2 - 4

Madura: International Financial Management Chapter 2

Agencies that Facilitate Agencies that Facilitate

International Flows International Flows

IBRD: International Bank for Reconstruction IDA: International Development Association

and Development • IDA was set up in 1960 as an agency that

• The IBRD is not a profit-maximizing lends to the very poor developing nations

organization. Nevertheless, it has earned a on highly concessional terms.

net income every year since 1948. • IDA lends only to those countries that lack

• It may spread its funds by entering into the financial ability to borrow from IBRD.

cofinancing agreements with official aid • IBRD and IDA are run on the same lines,

agencies, export credit agencies, as well sharing the same staff, headquarters and

as commercial banks. project evaluation standards.

B2 - 25 B2 - 26

Agencies that Facilitate Agencies that Facilitate

International Flows International Flows

IFC: International Finance Corporation M IGA: Multilateral Investment Guarantee

• The IFC was set up in 1956 to promote Agency

sustainable private sector investment in • The MIGA was created in 1988 to promote

developing countries, by FDI in emerging economies, by

¤ financing private sector projects; ¤ offering political risk insurance to investors

¤ helping to mobilize financing in the and lenders; and

international financial markets; and ¤ helping developing countries attract and

¤ providing advice and technical assistance retain private investment.

to businesses and governments.

B2 - 27 B2 - 28

Agencies that Facilitate Agencies that Facilitate

International Flows International Flows

ICSID: International Centre for Settlement of World Trade Organization (WTO)

Investment Disputes • Created in 1995, the WTO is the successor

• The ICSID was created in 1966 to facilitate to the General Agreement on Tariffs and

the settlement of investment disputes Trade (GATT).

between governments and foreign • It deals with the global rules of trade

investors, thereby helping to promote between nations to ensure that trade flows

increased flows of international smoothly, predictably and freely.

investment.

• At the heart of the WTO's multilateral

trading system are its trade agreements.

B2 - 29 B2 - 30

South-Western/Thomson Learning © 2003 Page 2 - 5

Madura: International Financial Management Chapter 2

Agencies that Facilitate Agencies that Facilitate

International Flows International Flows

World Trade Organization (WTO) Bank for International Settlements (BIS)

• Its functions include: • Set up in 1930, the BIS is an international

¤ administering WTO trade agreements; organization that fosters cooperation

¤ serving as a forum for trade negotiations; among central banks and other agencies

¤ handling trade disputes; in pursuit of monetary and financial

¤ monitoring national trading policies; stability.

¤ providing technical assistance and training • It is the “central banks’ central bank” and

for developing countries; and “lender of last resort.”

¤ cooperating with other international groups.

B2 - 31 B2 - 32

Agencies that Facilitate Agencies that Facilitate

International Flows International Flows

Bank for International Settlements (BIS) Regional Development Agencies

• The BIS functions as: • Agencies with more regional objectives

¤ a forum for international monetary and relating to economic development include

financial cooperation; ¤ the Inter-American Development Bank;

¤ a bank for central banks; ¤ the Asian Development Bank;

¤ a center for monetary and economic ¤ the African Development Bank; and

research; and ¤ the European Bank for Reconstruction and

¤ an agent or trustee in connection with Development.

international financial operations.

B2 - 33 B2 - 34

South-Western/Thomson Learning © 2003 Page 2 - 6

You might also like

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- 2020 6 StatementDocument7 pages2020 6 StatementChad Schell100% (1)

- Fibre Optic Cable SplicingDocument33 pagesFibre Optic Cable SplicingAmax TeckNo ratings yet

- Review of The Accounting ProcessDocument10 pagesReview of The Accounting ProcessFranz TagubaNo ratings yet

- Strategic Business Management November 2022 Mark PlanDocument34 pagesStrategic Business Management November 2022 Mark PlanWongani Kaunda0% (1)

- Project Report On Working-CapitalDocument74 pagesProject Report On Working-Capitalravikant2105100% (1)

- MILLER Testable ConceptsDocument109 pagesMILLER Testable ConceptsMohammedGooda100% (1)

- Api-650 Storage Tank Design Calculations - DamasGate WikiDocument3 pagesApi-650 Storage Tank Design Calculations - DamasGate Wikipowder18No ratings yet

- International Flow of FundsDocument6 pagesInternational Flow of FundsSazedul EkabNo ratings yet

- Cot On Theoretical and Experimental ProbabilityDocument8 pagesCot On Theoretical and Experimental ProbabilityNoemie BautistaNo ratings yet

- Architectural Thesis PDFDocument7 pagesArchitectural Thesis PDFSuresh Balaji0% (1)

- Week 1-Growth of Accounting Practice of AccountingDocument9 pagesWeek 1-Growth of Accounting Practice of AccountingMark Anthony Llovit BabaoNo ratings yet

- Balance of PaymentsDocument6 pagesBalance of Paymentssakshikarn0207No ratings yet

- Macro 9 Balance of PaymentDocument7 pagesMacro 9 Balance of PaymentRashinaNo ratings yet

- Balance of PaymentsDocument6 pagesBalance of PaymentsEdNo ratings yet

- The Balance of PaymentsDocument8 pagesThe Balance of PaymentsAnny ChangNo ratings yet

- International Flow of Funds International Flow of Funds: South-Western/Thomson Learning © 2003Document12 pagesInternational Flow of Funds International Flow of Funds: South-Western/Thomson Learning © 2003SHAMRAIZKHANNo ratings yet

- BE Balance of PaymentDocument16 pagesBE Balance of Paymentkevinnp149No ratings yet

- 3.3 Balance of PaymentsDocument24 pages3.3 Balance of Paymentsrajai farwagiNo ratings yet

- 30-31. Open Economy Framework - Balance of Payments & GlobalizationDocument34 pages30-31. Open Economy Framework - Balance of Payments & GlobalizationLakshmi NairNo ratings yet

- Chapter 8 Bop-Fe 2021Document20 pagesChapter 8 Bop-Fe 2021Sireen IqbalNo ratings yet

- Prepared By: Group Members No. MatricDocument14 pagesPrepared By: Group Members No. MatrickirttanaNo ratings yet

- 9 Lecture PDFDocument47 pages9 Lecture PDFПоля КаменчукNo ratings yet

- BOP Lecture-14Document3 pagesBOP Lecture-14api-19641717No ratings yet

- Chapter 13 The Global Financial EnvironmentDocument23 pagesChapter 13 The Global Financial EnvironmentLuis SilvaNo ratings yet

- NZDB 225 International Trade and Finance: The Balance of PaymentsDocument4 pagesNZDB 225 International Trade and Finance: The Balance of Paymentsapi-3728516No ratings yet

- Balance of PaymentDocument19 pagesBalance of PaymentqiankeyangNo ratings yet

- Madura 2 EditedDocument36 pagesMadura 2 EditedAdnan KhondokarNo ratings yet

- Balance of PaymentDocument4 pagesBalance of PaymentTabish MirzaNo ratings yet

- Analisis Biaya: Semester Gasal TA 2017 - 2018 Lec 2 - Laporan KeuanganDocument48 pagesAnalisis Biaya: Semester Gasal TA 2017 - 2018 Lec 2 - Laporan KeuanganMaulida RahmaNo ratings yet

- Balance of PaymentsDocument44 pagesBalance of PaymentsHusain IraniNo ratings yet

- CH 2 3Document18 pagesCH 2 3Eyuel SintayehuNo ratings yet

- Chapter 4 - The Balance of Payments - BlackboardDocument28 pagesChapter 4 - The Balance of Payments - BlackboardCarlosNo ratings yet

- Ch02 Recording Business Transactions SVDocument28 pagesCh02 Recording Business Transactions SVBảo DươngNo ratings yet

- Chapter 2Document58 pagesChapter 2Aminul Islam AmuNo ratings yet

- CH 02 International Flow of Funds (MTM)Document67 pagesCH 02 International Flow of Funds (MTM)Faria RahimNo ratings yet

- Chapter 2 - International Flow of FundsDocument70 pagesChapter 2 - International Flow of FundsDung VươngNo ratings yet

- A Review of The Accounting CycleDocument17 pagesA Review of The Accounting Cycleanon_789756669No ratings yet

- Balance of PaymentDocument9 pagesBalance of PaymentMuskanNo ratings yet

- Balance of PaymentsDocument2 pagesBalance of Paymentsmahnoor ehsanNo ratings yet

- Difference Between The Balance of Payments CA and FADocument2 pagesDifference Between The Balance of Payments CA and FAIrfan AhmedNo ratings yet

- Lecture 8 BopDocument27 pagesLecture 8 BopGina WaelNo ratings yet

- Managerial Economics Topic 7Document103 pagesManagerial Economics Topic 7Renuka Badhoria (HRM 21-23)No ratings yet

- Ias 7Document3 pagesIas 7Anushkaa DattaNo ratings yet

- Bop BasicsDocument3 pagesBop Basicsdakshrwt06No ratings yet

- BWFF2033 Notes Topic 2Document28 pagesBWFF2033 Notes Topic 2Vharshaa ChandraNo ratings yet

- C04 PDFDocument35 pagesC04 PDFYiha FenteNo ratings yet

- Topic 2: Balance of Payments (Bop) Balance of Payments (BOP)Document2 pagesTopic 2: Balance of Payments (Bop) Balance of Payments (BOP)KayeNo ratings yet

- A Balance of PaymentsDocument27 pagesA Balance of PaymentsThaneesh KumarNo ratings yet

- CHapter 2 PDFDocument54 pagesCHapter 2 PDFTania ParvinNo ratings yet

- T Accounts: Basic Representations of The AccountsDocument21 pagesT Accounts: Basic Representations of The Accountscnsuu_No ratings yet

- Learning Activity Sheet No. 1: Don Carlos, Bukidnon Senior High School Department First Quarter School Year 2020-2021Document7 pagesLearning Activity Sheet No. 1: Don Carlos, Bukidnon Senior High School Department First Quarter School Year 2020-2021Mylene HeragaNo ratings yet

- ACTG 21B (CH5) - Lecture NotesDocument2 pagesACTG 21B (CH5) - Lecture Notesraimefaye seduconNo ratings yet

- Accounting CycleDocument9 pagesAccounting CycleSirfMujjuNo ratings yet

- Tarun Das Lecture BOP-1Document29 pagesTarun Das Lecture BOP-1Professor Tarun DasNo ratings yet

- Chapter 2-Flow of FundsDocument78 pagesChapter 2-Flow of Fundsธชพร พรหมสีดาNo ratings yet

- Balance of Payments and Organizations Control and Evaluation of International Business PDFDocument5 pagesBalance of Payments and Organizations Control and Evaluation of International Business PDFAndrean AquinoNo ratings yet

- Balance of Payments: Chapter ThreeDocument16 pagesBalance of Payments: Chapter ThreeiMQSxNo ratings yet

- Chapter 2 NewDocument20 pagesChapter 2 NewSmey MNo ratings yet

- 3 Chap3 IBFDocument27 pages3 Chap3 IBFLe Hong Phuc (K17 HCM)No ratings yet

- Unit IvDocument6 pagesUnit IvnamianNo ratings yet

- Bai 2 - Chu Chuyen Von Quo CteDocument13 pagesBai 2 - Chu Chuyen Von Quo CteThanh Dat PhanNo ratings yet

- International Flow of Funds & Engines of GrowthDocument82 pagesInternational Flow of Funds & Engines of GrowthPanashe MachekepfuNo ratings yet

- FAR1 - Lecture 03 Accounting Cycle - Steps 1-4Document4 pagesFAR1 - Lecture 03 Accounting Cycle - Steps 1-4Patricia Camille AustriaNo ratings yet

- IB NotesDocument55 pagesIB NotesKrithigaNo ratings yet

- Balance of Payments-Final For KreaDocument25 pagesBalance of Payments-Final For KreaDhananjay SinghalNo ratings yet

- Sparrso RulesDocument5 pagesSparrso RulesOptimistic RiditNo ratings yet

- Bakla 2Document105 pagesBakla 2Optimistic RiditNo ratings yet

- Penalty For Unfair Labor PracticesDocument12 pagesPenalty For Unfair Labor PracticesOptimistic RiditNo ratings yet

- Direct Investment and Collaborative StrategiesDocument19 pagesDirect Investment and Collaborative StrategiesOptimistic RiditNo ratings yet

- Part Six Managing International Operations: Chapter Seventeen Global Manufacturing and Supply Chain ManagementDocument32 pagesPart Six Managing International Operations: Chapter Seventeen Global Manufacturing and Supply Chain ManagementOptimistic RiditNo ratings yet

- 2849 1Document29 pages2849 1Optimistic RiditNo ratings yet

- Human Resource PlanningDocument10 pagesHuman Resource PlanningOptimistic RiditNo ratings yet

- OligopolyDocument2 pagesOligopolyOptimistic RiditNo ratings yet

- Introduction DbmsDocument20 pagesIntroduction DbmsOptimistic RiditNo ratings yet

- Class 9 NetworkDocument119 pagesClass 9 NetworkOptimistic RiditNo ratings yet

- Company Act - 1956Document17 pagesCompany Act - 1956Optimistic RiditNo ratings yet

- 07.capacity of PartiesDocument6 pages07.capacity of PartiesOptimistic RiditNo ratings yet

- Munication of Offer and AcceptanceDocument10 pagesMunication of Offer and AcceptanceOptimistic RiditNo ratings yet

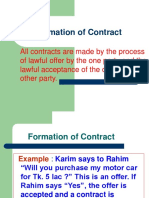

- Formation of Contract-1Document15 pagesFormation of Contract-1Optimistic RiditNo ratings yet

- Vertical Immersion Pump VTP-BBFDocument23 pagesVertical Immersion Pump VTP-BBFmourinho2No ratings yet

- Led ZepDocument82 pagesLed Zeprfahad22926No ratings yet

- Generators Portable Supersilent DCA60SSI2 Rev 3 STD Manual DataId 19056 Version 1Document164 pagesGenerators Portable Supersilent DCA60SSI2 Rev 3 STD Manual DataId 19056 Version 1andrealunalogoNo ratings yet

- Fermentación BatchDocument8 pagesFermentación BatchJennifer A. PatiñoNo ratings yet

- Customized ListDocument6,024 pagesCustomized ListItiNo ratings yet

- EPON OLT Operation Manual V1.2 20211102Document484 pagesEPON OLT Operation Manual V1.2 20211102MfahmifauzanNo ratings yet

- 1 Illinois Criminal Defense Motions - 9.14 2022-12-26 21 - 34 - 10 2Document4 pages1 Illinois Criminal Defense Motions - 9.14 2022-12-26 21 - 34 - 10 2Brandon SchrammNo ratings yet

- Front PageDocument5 pagesFront PageAnas AloyodanNo ratings yet

- BhavishyaTraining 07062016Document99 pagesBhavishyaTraining 07062016SRINIVASARAO JONNALANo ratings yet

- Fundamentals of Inviscid, Incompressible FlowDocument57 pagesFundamentals of Inviscid, Incompressible FlowpaariNo ratings yet

- Ronald Allan Talisay CV 2017 - 1Document6 pagesRonald Allan Talisay CV 2017 - 1Ronald AllanNo ratings yet

- Definition, Classification and Diagnosis of Diabetes, Prediabetes and Metabolic SyndromeDocument6 pagesDefinition, Classification and Diagnosis of Diabetes, Prediabetes and Metabolic SyndromemandaNo ratings yet

- ColsonCatalogR27!11!11 15Document124 pagesColsonCatalogR27!11!11 15Roberto SolorzanoNo ratings yet

- MIS 310 - Syllabus 1.0Document12 pagesMIS 310 - Syllabus 1.0jackNo ratings yet

- Basics of RainforestsDocument14 pagesBasics of RainforestspsrelianceNo ratings yet

- Notes - Market Failure-Ch 13Document3 pagesNotes - Market Failure-Ch 13Rodney MonroeNo ratings yet

- Your Paragraph TextDocument11 pagesYour Paragraph TextTalha AamirNo ratings yet

- Thesis Statement, Topic Sentence, and Supporting Details: Paul Christian Reforsado AbadDocument29 pagesThesis Statement, Topic Sentence, and Supporting Details: Paul Christian Reforsado AbadMicole BrodethNo ratings yet

- Nike Strategy AnalysisDocument24 pagesNike Strategy AnalysisasthapriyamvadaNo ratings yet

- 119 - Circular - 2021 - 211124 - 165700 (1) - 1Document3 pages119 - Circular - 2021 - 211124 - 165700 (1) - 1manoj jainNo ratings yet

- Manual Expert 7.1 - OXODocument1,324 pagesManual Expert 7.1 - OXOEduardo SilvaNo ratings yet

- Best Python TutorialDocument32 pagesBest Python Tutorialnord vpn1No ratings yet