Professional Documents

Culture Documents

Muhammad Alfarizi - 142200278 - Ea-J - Tugas 2 Ap2

Uploaded by

Muhammad AlfariziOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Muhammad Alfarizi - 142200278 - Ea-J - Tugas 2 Ap2

Uploaded by

Muhammad AlfariziCopyright:

Available Formats

Nama :

Kelas :

NIM :

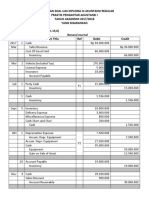

P8-1A

1. Account receivable 3 315. 000

Sales Revenue 3.315.000

Sales Returne and allowance 50.000

Account receivable 50.000

Cash 2.810, 000

Account Receivable 2.810.000

Allowance for Debtfull Accouunt 90.000

Account Receivable 90.000

2. ACCOUNT Receivable

Dec 3 Bal. 960.000 Jan 1 595

Jan 1 Bal. 365.000

Allowance for Debtfull AccouNT

Jan 1 595.000 dec 31. 960.000

Jan 1 Bal. 365.000

3. & 4

Bad Debt Expense

Des 31 125.000

Allowance for Debtfull AccouNT

Jan 1 90.000

Des 31 125.000

Des 31 Bal. 225..000

P8-2A

(a) £66,000

(b) 2,500,000 x 3% = £75,000

(c) 970,000 x 7% - 3,000 = £64,900

(d) 970,000 x 7% + 3,000 = £70,900

(e) Kelemahan dari metode Penghapusan Langsung adalah tidak bisa memenuhi prinsip penandingan. Selain itu,

piutang tidak dinyatakan pada jumlah yang diharapkan akkan diterima serta tidak dapat digunakan untuk laporan

keuangan.

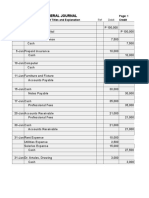

P8-3A

a)

Dec. 31 Bad Debt Expense ................................................................... 31,630

Allowance for Doubtful Accounts ($40,830-$9,200).......... 31,630

b)

Mar.31 Allowance for Doubtful Accounts 1.000

Accounts Receivable 1.000

May 31 Accounts Receivable 1.000

Allowance for Doubtful Accounts 1.000

31 Cash 1.000

Accounts Receivable 1.000

c)

Dec. 31 Bad Debt Expense .................................................................... 32,700

Allowance for Doubtful Accounts ($31,600 + $1,100) .......

32,700

(a) dan (b)

Bad Debts Expense

Date Explanation Ref. Dr. Cr. Balance

Dec.31 2017 Adjusting Entry $31,630 $31,630

Allowance for Doubtful Accounts

Date Explanation Ref. Dr. Cr. Balance

Dec.31 2017 Balance $9,200

Dec.31 2017 Adjusting Entry $31,630 $40,830

Mar.31 2018 $1,000 $39,830

May.31 2018 $1,000 $40,830

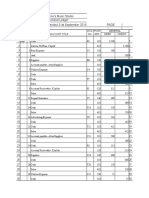

P8-6A

a) Jurnal Transaksi pada bulan oktober

Tanggal Akun Debit Kredit

7 Accounts Receivable 6,300

Sales Revenua 6,300

12 Cash 1,164

Service Charge Expense 36

Sales Revenue 1,200

15 Accounts Receivable 460

Revenue 460

15 Cash 8,107

Notes Receivable 8,000

Interest Receivable 80

Interest Revenue 27

24 Accounts Receivable 9,150

Notes Receivable 9,000

Interest Receivable 90

Interest Revenue 60

30 Interest Receivable 105

Interest revenue 105

b)

Notes Receivabale

Date Account Ref Debit Credit Balance

Oct. 1 Balance 31.000

15 8,000 23,000

24 9,000 14,000

Accounts Receivable

Date Account Ref Debit Credit Balance

Oct. 7 Balance 6,300 6,300

15 460 6,760

24 9,150 15,910

Interest Receivable

Date Account Ref Debit Credit Balance

Oct 1 Balance 170

15 80 90

24 90 0

31 105 105

c) All of the Recieveable accounts:

Notes Recieveable $14,000

Accounts Recievable $15,910

Interest Receivable $105

Total receivable $30,015

You might also like

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Solution: P7-3 (L03) Bad-Debt Reporting-Aging: InstructionsDocument8 pagesSolution: P7-3 (L03) Bad-Debt Reporting-Aging: InstructionsHerry SugiantoNo ratings yet

- TUGAS SEBELUM UTS PENGANTAR AKUNTANSI IIDocument12 pagesTUGAS SEBELUM UTS PENGANTAR AKUNTANSI IIMuhammad QolbiNo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- General Journal Entries for April 2017Document7 pagesGeneral Journal Entries for April 2017kdjasldkajNo ratings yet

- 4 Solution Exam Auditing 2Document5 pages4 Solution Exam Auditing 2Kristina KittyNo ratings yet

- Quateur Ltd Financial StatementsDocument8 pagesQuateur Ltd Financial StatementsTASH TASHNANo ratings yet

- Tugas AkkeuDocument21 pagesTugas AkkeuAulia RahmawatiNo ratings yet

- P9-3A Journalize Entries To Record Transactions Related To Bad DebtsDocument1 pageP9-3A Journalize Entries To Record Transactions Related To Bad DebtsDrenyar ScoutNo ratings yet

- Kieso Chapter 10Document6 pagesKieso Chapter 10Dian Permata SariNo ratings yet

- Akun Pengantar Jurnal Ledger Neraca SaldoDocument13 pagesAkun Pengantar Jurnal Ledger Neraca SaldoAdi Al HadiNo ratings yet

- Quiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionDocument4 pagesQuiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionJennifer Reloso100% (1)

- Closing and Post Closing Entries - 102823Document10 pagesClosing and Post Closing Entries - 102823Jerickho JNo ratings yet

- Accounts Receivable: QuizDocument4 pagesAccounts Receivable: QuizRisa Castillo MiguelNo ratings yet

- Accounts Receivable Chapter 4 Study GuideDocument4 pagesAccounts Receivable Chapter 4 Study GuideSano ManjiroNo ratings yet

- Solution Problem 8-3aDocument2 pagesSolution Problem 8-3aPlok TingNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- Principles of AccountingDocument6 pagesPrinciples of AccountingDanish MuradNo ratings yet

- Acctg 115 - CH 7 SolutionsDocument9 pagesAcctg 115 - CH 7 SolutionsShehryaar MunirNo ratings yet

- MULTIPLE CHOICES-answer KeyDocument7 pagesMULTIPLE CHOICES-answer KeyLiaNo ratings yet

- Auditing Problems - 001Document2 pagesAuditing Problems - 001Geoff MacarateNo ratings yet

- Accounting For Trade Receivables (Accounts Receivable) - Continuation 11Document5 pagesAccounting For Trade Receivables (Accounts Receivable) - Continuation 11rufamaegarcia07No ratings yet

- BUS 142 - Exercises CH 8Document22 pagesBUS 142 - Exercises CH 8Jess IcaNo ratings yet

- Final Exam QuestionDocument4 pagesFinal Exam QuestionHồng XuânNo ratings yet

- Ricardo Pangan Company General Journal For The Month of January 2021 Date Accounts Receivable Debit CreditDocument14 pagesRicardo Pangan Company General Journal For The Month of January 2021 Date Accounts Receivable Debit CreditTiamzon Ella Mae M.No ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- Akuntansi Account ReceivableDocument8 pagesAkuntansi Account Receivablem habiburrahman55No ratings yet

- Bank reconciliation and allowance for doubtful accountsDocument3 pagesBank reconciliation and allowance for doubtful accountsMutiara ameliaNo ratings yet

- Kunjaw UasDocument11 pagesKunjaw UasIvan Katibul FaiziNo ratings yet

- V1620034 - Dzaky FarhansyahDocument11 pagesV1620034 - Dzaky FarhansyahDzaky FarhansyahNo ratings yet

- 2016 Vol 2 CH 1 AnswersDocument11 pages2016 Vol 2 CH 1 AnswersHohohoNo ratings yet

- Bank Reconciliation AnalysisDocument6 pagesBank Reconciliation AnalysisRinconada Benori ReynalynNo ratings yet

- Chapter 1 - Guide to Current Liabilities, Provisions and ContingenciesDocument86 pagesChapter 1 - Guide to Current Liabilities, Provisions and ContingenciesSutnek Isly94% (17)

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentTAWHID ARMANNo ratings yet

- Name: Lecturer: Course Name: Course CodeDocument6 pagesName: Lecturer: Course Name: Course CodeJaredNo ratings yet

- Espanola Far 201 QuizDocument7 pagesEspanola Far 201 QuizCINDY MAE SARAH ESPANOLANo ratings yet

- Worksheet ProblemDocument4 pagesWorksheet Problemusernames358No ratings yet

- On January 1Document6 pagesOn January 1Warren Nahial ValerioNo ratings yet

- Adjust Accounts Receivable, Allowances and Notes ReceivableDocument6 pagesAdjust Accounts Receivable, Allowances and Notes ReceivablekrizzmaaaayNo ratings yet

- Ans: A) Journal Entry On Date of Issue Date Account DR CRDocument4 pagesAns: A) Journal Entry On Date of Issue Date Account DR CRHumera AkbarNo ratings yet

- Problem 8-3Document1 pageProblem 8-3Gilbert MoralesNo ratings yet

- General Journal: Date Account Titles and Explanation CreditDocument4 pagesGeneral Journal: Date Account Titles and Explanation CreditHarriane Mae GonzalesNo ratings yet

- Question P8-1A: Cafu SADocument29 pagesQuestion P8-1A: Cafu SAMashari Saputra100% (1)

- Let'S Check: PROBLEM 1 Garliet CompanyDocument5 pagesLet'S Check: PROBLEM 1 Garliet Companymaica G.No ratings yet

- Module 2 ProblemsDocument15 pagesModule 2 ProblemsCristina TayagNo ratings yet

- Depreciation Expense, Rp. 25.000.000Document12 pagesDepreciation Expense, Rp. 25.000.000Roni SinagaNo ratings yet

- C. Allowance For Doubtful Accounts 20,000 Accounts Receivable 20,000Document2 pagesC. Allowance For Doubtful Accounts 20,000 Accounts Receivable 20,000yes yesnoNo ratings yet

- Exercises - Trial Balance and Final Accounts - PracticeDocument23 pagesExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- Auditing Problems Assignment AnswersDocument4 pagesAuditing Problems Assignment AnswersSophia Anne Margarette NicolasNo ratings yet

- Closing and Worksheet UnsolvedDocument6 pagesClosing and Worksheet UnsolvedNilda Sahibul BaclayanNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Requirement No. 1: PROBLEM NO. 1 - Peso CorporationDocument13 pagesRequirement No. 1: PROBLEM NO. 1 - Peso CorporationDreiu EsmeleNo ratings yet

- AP 5907 CashDocument8 pagesAP 5907 CashClariceLacanlaleDarasinNo ratings yet

- Assignment, ANdallo, Ransey Ace DDocument3 pagesAssignment, ANdallo, Ransey Ace DRansey Ace AndalloNo ratings yet

- Trial Balance and Journal Entries for Rialubin CompanyDocument3 pagesTrial Balance and Journal Entries for Rialubin CompanyNo NotreallyNo ratings yet

- Ae 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Document4 pagesAe 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Mae Ann RaquinNo ratings yet

- Ae 15 Bs Acc 1 Home Based ActivityDocument4 pagesAe 15 Bs Acc 1 Home Based ActivityMae Ann RaquinNo ratings yet

- Tevis Company Inventory Costing MethodsDocument6 pagesTevis Company Inventory Costing MethodsMinh HiềnNo ratings yet

- Quiz 2B - Bank Reconciliation and Proof of CashDocument5 pagesQuiz 2B - Bank Reconciliation and Proof of CashLorence Ibañez100% (2)

- Output 3Document6 pagesOutput 3Muhammad AlfariziNo ratings yet

- Kertas Kerja Dari Buku Karya Selvy Monalisa ISBN 978-979-061-736-0 © 2017, 2013, 2011, 2008, 2006Document1 pageKertas Kerja Dari Buku Karya Selvy Monalisa ISBN 978-979-061-736-0 © 2017, 2013, 2011, 2008, 2006Muhammad AlfariziNo ratings yet

- HR Integration: A Review of M&A HR Integration Literature: Chang-Howe (2019)Document3 pagesHR Integration: A Review of M&A HR Integration Literature: Chang-Howe (2019)Muhammad AlfariziNo ratings yet

- Environmental Regulation and The Competitiveness of U.S. Manufacturing: What Does The Evidence Tell Us?Document34 pagesEnvironmental Regulation and The Competitiveness of U.S. Manufacturing: What Does The Evidence Tell Us?Muhammad AlfariziNo ratings yet

- Corporate Environmentalism and Public Policy Book ReviewDocument4 pagesCorporate Environmentalism and Public Policy Book ReviewMuhammad AlfariziNo ratings yet

- Economic Geography & Public Policy Book Review Explains Key ModelsDocument9 pagesEconomic Geography & Public Policy Book Review Explains Key ModelsMuhammad AlfariziNo ratings yet

- Accounting CycleDocument24 pagesAccounting CycleVanessa Dozon0% (1)

- MARJ Accounting Act 2.1 2.3Document12 pagesMARJ Accounting Act 2.1 2.3Ace Hulsey TevesNo ratings yet

- Ose Pa1Document17 pagesOse Pa1gladys manaliliNo ratings yet

- Claimed and Unclaimed Spes ChecksDocument808 pagesClaimed and Unclaimed Spes ChecksgurnaNo ratings yet

- Dayag Chapter 14 Home Office and Branch Accounting Special ProceduresDocument26 pagesDayag Chapter 14 Home Office and Branch Accounting Special ProceduresLosel CebedaNo ratings yet

- Reinforcement Activity 1 Financial Statement Amp WorksheetsDocument29 pagesReinforcement Activity 1 Financial Statement Amp Worksheetsapi-33564620681% (16)

- College Accounting 12th Edition Slater Test BankDocument38 pagesCollege Accounting 12th Edition Slater Test Bankrobertnelsonxrofbtjpmi100% (13)

- Module 7 - Merchandising Business Special TransactionsDocument40 pagesModule 7 - Merchandising Business Special TransactionsMaria Nicole OroNo ratings yet

- K SSG 9 Ob HZGN 9 o YxbDocument14 pagesK SSG 9 Ob HZGN 9 o Yxbdhivya sNo ratings yet

- Bookkeeping MaterialDocument16 pagesBookkeeping MaterialPrincess Alyssa BarawidNo ratings yet

- TB - Ch14-Process Costing and Cost Accounting CyclesDocument20 pagesTB - Ch14-Process Costing and Cost Accounting CyclesCloudKielGuiangNo ratings yet

- Accounting Funeral Service CompendDocument25 pagesAccounting Funeral Service Compendasafoabe4065No ratings yet

- Chapter Eight Bank Reconciliation-2Document67 pagesChapter Eight Bank Reconciliation-2Kingsley MweembaNo ratings yet

- Answers Unit 1-7Document7 pagesAnswers Unit 1-7lizzaNo ratings yet

- Frongkyting 4-sdDocument28 pagesFrongkyting 4-sdapi-276985927100% (1)

- MBA Operations and Supply Chain Management Lecture Notes 5Document3 pagesMBA Operations and Supply Chain Management Lecture Notes 5Michael Finley100% (1)

- Variable Costing and Absorption Costing Income StatementsDocument6 pagesVariable Costing and Absorption Costing Income StatementsSid Chaudhary100% (1)

- BA1 ch03 QDocument2 pagesBA1 ch03 Qnimmi_jahanNo ratings yet

- Recapitulation PDFDocument2 pagesRecapitulation PDFMargaretha Maria YunitaNo ratings yet

- FABM1 Q4 Module 18Document12 pagesFABM1 Q4 Module 18Earl Christian BonaobraNo ratings yet

- Advanced Finance Chapter ExercisesDocument34 pagesAdvanced Finance Chapter ExercisesVan caothaiNo ratings yet

- Illustration Bank ReconciliationDocument2 pagesIllustration Bank ReconciliationRiyhu DelamercedNo ratings yet

- Journal 20general 20ledger 20mix 20ap1Document25 pagesJournal 20general 20ledger 20mix 20ap1api-276905645No ratings yet

- How to set up a rebate agreement for a specific customer in SAPDocument163 pagesHow to set up a rebate agreement for a specific customer in SAPSourav KumarNo ratings yet

- Ateneo de Zamboanga University Advanced Accounting FINAL EXAMINATION solutionsDocument7 pagesAteneo de Zamboanga University Advanced Accounting FINAL EXAMINATION solutionsRIZLE SOGRADIELNo ratings yet

- SSS Operational Analysis and Improvement PlanDocument23 pagesSSS Operational Analysis and Improvement PlanRahul SuriNo ratings yet

- Far Reviewer CompleteDocument87 pagesFar Reviewer CompleteAngelica NimerNo ratings yet

- Quiz 4,5,6Document15 pagesQuiz 4,5,6Sundaramani Saran100% (2)

- Journal EntryDocument5 pagesJournal EntryABM-AKRISTINE DELA CRUZNo ratings yet

- Materi Sebelum UTS Praktikum Akuntansi RemedDocument51 pagesMateri Sebelum UTS Praktikum Akuntansi Remedannisa rochmahNo ratings yet