Professional Documents

Culture Documents

FAR Resa First PB B39 Solutions

FAR Resa First PB B39 Solutions

Uploaded by

King Mercado0 ratings0% found this document useful (0 votes)

2K views11 pagesOriginal Title

FAR Resa First PB B39 Solutions (3)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views11 pagesFAR Resa First PB B39 Solutions

FAR Resa First PB B39 Solutions

Uploaded by

King MercadoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

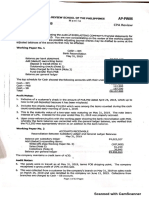

ReSA

The Review School of Accountancy

BTel. No. 735-9807 & 734-3989

FINANCIAL ACCOUNTING AND REPORTING

First Pre-board Examination ___Selution

Items 01 and 02 are based on the following information:

Helten Company’ has reported an account receivable of P905,000 and

merchandise inventory of P1,500,000 in its accounting books as of Decenper

t1, 2019; The reported inventory amount does not included goods costing

220,000" sent. to. a consignee, however, Molten Company charged the

consignee for the selling price of the goods transferred. The anount

Sharer against the. consignee was included in the their = account

Feceivable. The gooda are mark to sell at 25% on cost. The “account

(report from the consignee) revealed that 60% of the goods were

sdy sold. Charges of the consignee are as follows: 8% commission om

Sales value of merchandise gold and a 20,000 delivery cost for

indise received on consignment. and a P6,000 delivery cost for goods

Ot. At what amount should the inventory of Nolten Company be reported in its

er 31, 2019 statement of financial position?

a. B1,500, 000 c. PL, 588,000

b. P1, 580,000 4. 1,700,000

what amount should the account receivable of Molten Company be reduced

respect to the consigned goods?

3. P655, 000 ce P_ 793,000

bL P767,000 d. 2,017,000

ventory PL, 500,000

on consignment (P220,000 * 408) 88,000

Total 1,588, 000

Account receivable PB 905,000

Mase. sent on consignment:

(200,000 » 125%) (250, 000)

pue from consignee:

(2120, 000 1258 * 928 - P26,000) 112, 000

correct account receivable F167, 000

Items 03 and 04 are based on the following information

Feenstiowing limited infornation were made available from the cash record

or clarence Company and its bank statement for the month of December 31,

2019:

Book receipts 4, 462,500

Bank receipts 4,830, 000

November 30 deposit in transit 650,000

Erroneous bank credit for December 25,000

coeeus book credit for November, corrected in Deceaber 50/000

Erroneous book debit 20,000

Erroneous bank debit in November, corrected in December 17,500

Credit meno for December not yet recorded by Clarence 300,000

Credit memo for November, recorded by Clarence in December 375,000

Customer's check received and deposited but posted

‘as disbursement by Clarence

150, 000

03, What is the total anount of deposit in transit as of Decenber 31, 20197

a. 245,000 c. P325,000

b. P275,000 a. P375,000

04. What ig the correct receipt for December?

a. Pa, 237,500 e. Pa, 467,500

b. P4,287,500 ds P4, 407,500

Scanned with CamScanner

SA: The Review School of Accountancy Page 2_of 11

PA, 162,500 P4,840, 000

1 = Row 640,090)

{ein transit — Dee, x

tt meno Nav. (375,000)

Ai. memo — Dec 300, 000

. { 7o,000) (97,5000

aso,000

Correct receipt a, 467, 50014, 467,500

Book Ye

ee 3,B47,500 3,142,500

epoait. in transit 325,000 650,000

Brror 70,000 37,

a 4,462,500 Pa, 830,000

Understaterent of receipt _ 150,000 __

Total PH, 612,500 P4, 830,000

PL, 9 980,000

be 20, 000

ordinary share capital P1000, 000

Holding loss on investment (" 30,000)

Share dividends payable~ ordinary 150,000

share premiun - ordinary 250,000

550,000

Accumulated profits

‘Total shareholders’ equity 1,920,000

.¢ following information +

Ttems 07 and 08 are base_on thi

Gn the bank recone

The following information was included

Roman Co. for July of 2020:

iLiation for

ee ee

ION (Batch 39)

PRACTICAL ACCOUNTING T ~ FIRST PRE-BOARD EXAMINATI ey)

Scanned with CamScanner

ReSA: The Review School of Accountancy

& charges rec

‘ ee Paes ofl

le by bank in duly, Incluiing a July a

hargr of P3,000, PHe0,a007 vcervice. chante, mate hy Bank tattae aed

rade by bank in June and

entry made tn hooks, 116,00!

ded by th pany in daly,

ly M1, 300,000 Outstanding checks’ for June

Insuied In duly for 120,000 recorded by the com

any ane

mas hank charge dn duly, 20,0002 Erroneous bank cendit in

in duly, P40, M00 ant Ere eoeee cies ates

rrected in duly, 75,000, Erroneous book disburserent for #1040

he unadjusted disbursement per book on July 31, 20202

a. 2935, 000 cc. P945,000

940,000 d, P963, 000

0 t is the adjusted ancy

a. P935,000

b. P9¢0,000

0 the following information

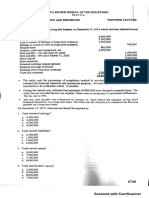

lar Company Feceived an PI,800,00 subsidy from the governnent. to purchase

anutacturing equipsent on January, 2, 2019. The equiprent has 2 cost of

009,000 a useful life a ten’ years, and no salvage valve. Solar

epreciates the equipment on a double declining method. Solar Company

hoses) to account for

fe grant as deferred revenue.

09. What is the combined impact of deferred grant revenue recognition and

lepreciation expense recorded for the year ended 2021 iss

a. a decrease in the net incone by P230,400

| decrease in the net incone by P409, 600

@ decrease in the net income by P640, 000

decrease in the net income by P870, 400

Depreciation 5,000,000 x .80 x .80 x .20 (2640, 000)

Realized income 1,800,00 x .80 x .80 x .20 230, 400

Decrease in the not incone 9,600)

on Jonvary 2, 2022, the government asked for the repayment of the

Ghe ‘co, che ‘noncompliance with attached condition of the grant.

Sanvary 3, 2022 Solar Company repaid the government in the amount

21eyGor000 ae full settlement. What anount of gain or loss should Solar

Company recognized as a result of the repayment?

a. pone e. P362,720

b. P178,400 d. P510,176

Anount paid P1,100, 000

Garrying value of deferred Income 1/1/22:

(2,800,000 x 80% x GOs x ADS) _921, 600

ose’ on repayment F178, 400

11, Assume that grant received on January 2, 2019 was treated as a reduction

ASHE gross carrying anount of the manufacturing equipment, what is the

adetying value of the equipaent after the repayment mas made on January

3, 20227

a. Pi, 638,400 e. P2,560,000

b. P2,500, 000 a. P3,645,000

5,000,000 x 80% x BOL x BOL = P2,560,000

decline in its Docenber 31, 2019

5 P1,850,000 and its

12, Simon Company has recognized a

Rerchandise inventory. The cost of the inventory wa fl

Ret realizable value was P1,425,000. The company has & Policy

Teciude ail declines in the other expense and reversals in the octet

renee a isos the allowance method. During 2020 market conditions Pare

incon cling and simon’a inventory decreases to an NRV of 1,200,000,

eee een oe che business year of 2020, Simon Company decided £0 shards

a ae ccaeaciagitor doclines andi roversaie. | 7herney POs!

PRACTICAL ACCOUNTING 1 ~ FIRST PREBOARD EXAMINATION (Batch 39) es)

Scanned with Camscanner

ReSA: The Review School of Accountancy

ai

——_______ Page 4 of 11

requires that all declines and rever should now be included in u,

roguises tat ie ineladed tote

nich of the following wit) Simon Company record in 20202

a. A debit to cont of alos and eradit mllomnen Cor daetina P125,000,

be Adeb§t to cont of salen and credit allowmnen for dello hen eee

c: Raebit to tons on Dectine Mes, 000,

4 A debét Lo Lon om beeline M880, 00D,

Bo + 3s 2018, Foster corporation sold for 1,500,000 an oid

Pekine davina an ortginat cost of 3,000,000 and a’ hook, value “we

9.000. The tern of the nate wore au fol lows

7300,000 down. payment

"00,000 payable on December 31 each of the next four years

agreement of sale made no mention of Interests however, 10% would be»

z_gete for this type of transaction. hot ia the amcunt, of

incone should be reportod in the statement Of comprehensive. incone

year onde Doceabor 3, 20207 vane bass

a. P27,273, ‘74,606 yo yo Me Fe

b. P82, 066 95,096 jana Boe ou,

Tafa fw 90d, —

tized cost as of December 31, 2019: rely mae S oP

Wi Factor of 101 annuity Talyfae #9009 |

for 3 periods s

Annual cash Qlews 300,000 x 2.406082 746,056

Prevailing rato at initial recogiitien ft

Interest income for year 2020

016 are based on the following informatics

jartian Fealized his lifelong dream of becoming 3 vin

able to purchase the Hillside Vineyard at an estate auction

2018 for ‘P2, 000,000.

is P800,000.

purchase was risky because the growing season was

Grapes must be harvested in the next several weeks,

experience in carrying off a grape harvest.

ieyard owner when he was

in October 1,

The fair value of the land being the contributory asset

Martian retained the Hillside name for his new busines

The

coning to an end, the

and Martian has Linited

©f operations, Martian is feelin:

A the end of the first quarter

first harvest was a success;

value

of P1,200,000,

19 Pretty good about his early results. The

300 bushels of grapes were harvested with a

harvest).

current commodity prices at

(based on the tine of

the net Fealizable value of Martian’

the end of the first quarter.

And given the strong yield from area vineyards during the season,

vineyard has increased to P2,500,000 at

200,000.

The contributory asset has

After storing the grapes for a short period of tine

increased by

Martian was

able to sell the entire harvest for P1,400,000 on Decenber 26, 2018.

estimated remaining life of

The

the grape vines on October 1, 2018 is 10 years

14, At what amount should the bearer plant be reported in the statement of

financial position of Martian at the end of the first quarter?

a. P1,170,000 ©. 1,500,000

b. P1, 200,000 dL P2,500,000

Bearer Plants Contributory Asset = Vineyard

FY, beg Pl, 200,000, 800,000, = P2,000,000

Increased by "300,000 200, 000 500, 000

Fv, end 1,500,000 P1, 000,000 = P2,500,000

Cost (bearer plants) 1,200,000 10 years

Depreciation 3 months (1,200,000/10 x 3/12) (""30/000)

Carrying value 12/31 1,170,000

1s.

to the vineyard and the harvests?

PRACTICAL ACCOUNTING I — FIRST PREBOARD EXAMINATION (Batch 39)

What is the net effect in the profit or logs statenent of Martian related

Scanned with CamScanner

CC OOSS'”-SC_o WO

SA:

ReSA: The Review School of Accountancy Page 5 of 11

a. P 200,000 increase ni 100 increase

BL 1,200,000 increase &Mfr00;000 Increase

Gain on initial recognition ~ harvest 1, 400,000

Depreciation — bearer plants «_"_30,099)

Net effect on the profit or 16 Pi, 310.000

18.

19.

What is the total not effect in the December 31,

Income of Martian Company in relation to the bearer plants,

2018 comprehensive

contesbutocy

Par ery es 1,370,000

ffoct on the Profit or loss (reduce and bearer plants) 1270000

Effect on the ‘contributory asset, i7s70-000

taloori lessee ibatary neoee) ts

Total effect on the Comprehensive income

as

oi

of 20,000 every December 31 of the year. The his

interest rate is 102. As of December 31,

difficulty and indicates it will be unable to make

fo the contractual terms. Bolow shows the

a note receivable from

gn annual interest

torical effective

‘in financial

©f December 31, 2020, Miracle Company has

‘ahan Company, with face amount of P200,000 that pays

Graham Company is

G11 payments according

‘ash flow schedule involving

the receivable from Grahan”

What amount of impairment

Decenber | Contractual cash Expected cash | boss cash

Flows lows lows

202 20,000, 16, 000, 4,000,

2022 20,000, 16, 000 4,000,

2023 720,000, Te6, 000, 34, 000

joss should Miracle Company recognized on the

bbove receivable as of December 31, 2020?

a. 246,830 ce. P66, 830

b. Pa7,513 @. 67,513

Assume that

e prevailing market rate of interest at the tine the

syed J should

Sedeived was 8%, what amount of impairment loss

receivable was

insacle Company recognized on Decenber 31, 2020?

a. P42, 867 ‘e. P46,830

b. P46,296 a. P50,000

Happy Company held

Limited Company.

a 32 holding of the shares of Polo Company, a public

the investaeat was classified as an investment in

nd at June 30, 2019 had a carrying amount of

equity. instruments

ye forward {rom the previous period). Happy Company

10,000,000 (broug}

had’ made an irrevo

Mable election to recognize all changes in fair value

income. The cumulative unrealized gain to dune

in other comprehensive

he investment was P800,000. On June 30, 2019, the

30, 2018 relating to t

whole of the share copst

ppeublie Limited company and,

Of Roxy Company

Galue of the shares ri

Of shares,

‘ol of Carry Company was acquired by Roxy Company,

‘as a result Hlappy Company received shares

in exchange for ite shares in Pole Company. The fair

ceive ig P11,000,000. As a result of the exchange

Cae umount of unrealized gain or loss should be transferred

fo retained earnings?

a. none e. P1,000, 000

b. 800,000 4. 1,800,000

. of the investment in Polo Company is P10, 000,000 needs

‘the carrying amoun

i ‘ir value in the amount of P11,000,000. A fair value gain of

ist

lappy Company °

soe ered shares of Polo and 50 the investment in Polo Company should

be derecognized a

should be recognized.

the

ee

PRACTICAL ACCOUNTING 1 — FIRST PRE-BOARD EXAMINATION (Batch 39)

updating to fai

990.000 to be reported in the other comprehensive income.

\o longer retains any risks and rewards of ownership in the

nd instead a financial asset for the investment in Roxy

No gain or loss on derecognition will arise. Both

Narealized gain at the date of derecognition and the cumulative gain

Scanned with CamScanner

ReSA: The Review School of Accountan Page 6_of U1

of ji ri

of 7800,000 previously recognized In the other Gompronensive i

ransferred to retained earnings as a reserves movenent «

20. Vivian Tne had not sales in 2020 of P700,000. AE DecenPer, ai, 20200

cee ee ead meeatclee, ‘the. balance in selecthd, 2 rT ccounts

Fee a ee Ga0 debit and atiowance £2F UOWPNT Orove te

San een ee pat DE of Tes net ane ee abl

be uncollectable. What the cash realizable value ‘of the receivables

What ia the cash realizapl®, “December 31, 20207

tof financial position at

reported on the statenon

109,800 . p12, 200

bl 111,000 a. 322,500

Account receivable 125,000

Required allowance:

Beginning balance p 1,200

Bad debts 700,000 x 2% 14,000 15,200

a B09, 800

Net realizable value

th without

ee 38. The finance

receivable for

ess) on the

ins accounts receivables Wi

for a finance charge

0 108 of the accounts

vrded as a gait

21. Sun Inc. factors P2,000,000 of

guarantee ( without recourse)

Company retains an amount equal ty

possible adjustments. What would be rece)

Eransfer of receivables?

a. PO fe. P60,000 gain

B. Lees of P60,000 6. 260,000 Loss

1s 72,000,000 of its accounts receivables 3° collateral

0 of fein, gun Inc. also pays a, finance 20

22. Sun Inc assigns

Sa be eecorded as a gain

for a PL million 8 lean w

EF i on the transaction upfront. What wou)

F receivables?

(less) on the transfer o!

a. PO ©. 260,000 loss

4. 180,000 1053

b. Loss of P160,000

fons 23 and 24

@ receivables with a carrying

‘soes a finance charge of

Relative to this

‘ale fo be reported

use the following information for questi

2020, Hlenaon Company factores

on eeer uP N500,000 to Agee Company. Ageo Conpany 295%:

anount of Pioteivables and retains 31 of the recesvalres

38 oF tian, you are to determine the amount Of toss on

transact Toone stacenent of Henson Company for February

on February 1

23, Assune that Henson factors the receivables on a without guarantee

722we eae) basis. The loss to be reported i=

fe. PYS,000

PO

4. P24, 000

fenson factors the oceivables on a with guarantee

24, Asoume that

‘The amount of cash received is

(recourse) basis

a. P265,000 ie. P291, 000

b. 276,000 d. 300, 000

a5, isera Tne. reported totsl assets of 1,600,000 and nat incose of

Risers "7S; tne current year. Risers determined that inventory was

sQ00 ae the beginning of the year and P10,000 at the

underatated by P2:

uaderatatet her iihat is the corrected anount for total assets and net

Gneone for the year?

'P1, 610,000 and P95, 000 e. P1,610,000 and P72,000

d. PI, 600,000 and P85, 000

D_ P1,590,000 and P98, 000

uae the following infornation for questions 26 and 27

the following information was available from the inventory records of Rich

Conpany for January:

PRACTICAL ACCOUNTING I — FIRST PREBOARD EXAMINATION (Batch 39) &

Scanned with CamScanner

SA: TI

ReSA: The Review School of Accountan Page 7 of 11

Balance at January 1 Units Unit Cost Total Cost

Purchase: 3,000 19. 29, 310

January 6

poner 2,000 10.30 204600

2,700 10.71 28,917

sates:

anwary 7

Januar enon

saiance ne 3a 000)

ee at January 31 Stb00

26 Assuming that Rich does ee

hat Rich does net maintain perpetual inventory ecorl,

Should ‘be "the inventory at damuary. aly, using the weighted average

inventory method, rounded to the nearest dotlaz?

a. P12, 606 ce P12,312

b. Pi2,26¢ ge Bla 322

+ 20,600 + 28/917) 78,827

310 + 20,600 9,827

Total goods available for sale (29,

7000 + 2000 + 2,700)

total unite available for aslo (3 70.237

Wwerage unit cost 2

* Units unsold 1

waza

Cost of inv

ory end -

27. Assuning that Rich maintains pexpetual inventory record, what Shes

Beene ucen: sega ciuaeuacry s)fcestagi cali aceOOaeeeees samara

method, rounded to the nearest dollar?

2. P12, 606 b. pt2,312

b. P12, 284 ) 12,432

Ae sale = TGAS 29,310 + 20,600 = p49, 910

‘Tuas 3,000 + 2,000 ~ ‘5,000

Unit cost, 9982

‘ae gale ~ Inventory beg. after the 1 sale 2,500 x 9.982 ~ 240295

Purchase 2200 28,917

Total goods available for sale 53,872

P Gnits available for sale 5,200

Unit cost 10-36

3,200

x unsold units

Cost of fnventory end

sell to local end national ice cream

oe eevey Rub Daisy Began operations on January ly 2015 by purcas.og

Producers we far 1,176,000. The company controller had the following

seeorsation available at year end relating to the cows:

26. Dub Dairy produces milk to

wilking cous

Eartying value, Jenuaryl, 2025 P1, 176, 000

rey ta fair value dve to grosth and price changes 365, 000

ceeegece in fair value duc to harvest (42,000)

it not yet sold P54, 000

ilk harvested during 2015 bu

‘on bub Daiy's incone statement for the year ending Decenber 31, 2025,

Oe ae GE unrealized gain on harvested milk will be reported?

a. No gain cP 54,000

a. P311,000

b. 212,000

yo, Braun pairy produces milk to sell t9 local and national ice croam

Bravmagra. Yseoum. Dairy begen operations on January iy 2015 by

Gao miik cons for 780,000. The company controller had the

purchasing

formation available at year end relating to the cows:

following ini

milking cous

Garzying value, January, 2015 700,000

erry ind gait value doe to growth and price changes 242, 000

Seerease in fair value duc to harvest 128,000)

Milk harvested during 2015 but not yet sold £56,200

on Braun Dairy's incone statement for the year ending December 31,

Sei Mhat amount of unrealized gain on biological assets will be

reported?

PRACTICAL ACCOUNTING I — FIRST PRE-BOARD EXAMINATION (Batch 39)

Scanned with CamScanner

5

ReSA: The Review Schoo! of Accountan Page 8 of 11

age Bo

1 ae

! ps6, 00 aa

_ :

March 15,9

From Jontary e (iventery on hand as of January 1 totaled Fl, 650,000

rea Jamtary 1 through the Ue ot the fiver the company mage purchase

PL,

10, 000. les returns of P100,000 and sales discount of 760,000

uming the rate of gross profit ice i ys, what is the

Resuming the rato Of gross profit to selling peice ts 30% *

inventory that was destroyed?

m maesc 5 Bates

18 1, 650,000

Pp 683, 000

Fc 78,000

Estimated cost of inventory end destroyed by fire 1,144,000

31. Dicer uses the FIFO retail method to determine its ending inventory of

Cost, Assune the beginning inventory at cost (retail) were PZ60, 000

(2396, 000), purchases during the eureent year at cost (retail) were

21,373,260" {2,200,000}, sales during the current year totaled

P2/100,000, and net markups {nackdowns) were P48,000 (P72, 000). What Le

the ending inventory value at cost?

a. P283, 200 c. P299,201

b. P292, 640 a. 300,832

co 260,000 1B 396,000 Sales — P2, 200,000

e 1,379,280 NP 2,276,000 SIE 472,000

yotal 1,638,280 fotal 2,572,000 Total 2,572,000

Ratio 1,379,280/2,176,000 = 63.39%

Inventory end at cost’ 472,000 x 63.398 = 299,201

32. bicer uses the conventionqal retail method to determine its ending

(nesntory at cost. Assume the beginning inventory at cost (retail) were

260,000. (#396, 000), purchases during the current year at cost (retail)

F260 on, 379,260. (22,200,000), sales during the current year totaled

1e'S00, 000, ‘and net markups (markdowns) were P48,000 (P72,000). What is

the ending inventory value at cost?

2. P203,200 fe. P299,202

b. 7292,640 2. P300, 832

1B 260,000 8 396,000 Sales — P2,100, 000

P 1,379,280 NP 2,176,000 ETE 472, 000

Total 1,639,280 Total 2,512/000 Total 2,572,000

Ratio 1,639,280/2, 644,000 = 62%

Taventory end at cost = 472,000 x 628 = 292,640

33. Boxer Inc. uses the average retail method to determine its ending

[nventory at cost. Assume the beginning inventory at cost (retail) were

600, 000. (P990, 000), purchases during the current year at cost (retail)

Were’ P6,025,000 (3,010,000), freight-in on these purchases totaled

265,000, sales during the current year totaled P8,110,000, and net

narkups were 600,000. What is the ending inventory value at cost?

3. P1,618,500 PL, 718,100

By. PL,715,610 a. 2,450,000

PRACTICAL ACCOUNTING 1 — FIRST PRE-BOARD EXAMINATION (Batch 39)

ze!

Scanned with CamScanner

ND

ReSA: The Review $1

hool of Ai

34. White count

faite Farm ‘Supply’ an Page 9 of 11

38.

36.

37.

39

38.

PRACTICAL ACCOUNTING 1 — FIRST PRE-BOARD EXAMINATION (Batch 39)

Purchases o: Fecords for

Seed OE the Tien) won or Tea anlatonce ADO"

September 5,500 280, 51

October ac000 116-000

Tota meaty to an0

18, 600

6,800

The invento:

OEY OF Commodity A at

aed the end of october using FIFO is valued at

Assuming ¢

suming that none .

What value wouten® OF commodity A was sold during August and Septenbers,

assuned? © shown at the end of October if average cost was

@) P351, 900

') 353, 300 ©) 9350, 662

&) 9365, 700

jentory end (F140)

October ac 363,900 6,900

SexgnRE teaetei tion 2,300 $.i00 votes

ember acquisition 93,600 @ 521,800 units

Ave

Ave unit cost 966, 800/19, 600 = P51.98

ventory end (Average) 6,900 x 51.98 = P658, 662

The following information pertains to the Inventory being produced PY

Stamp Company.

Cost of vaw materials put inte production, 900,000; Tabor | ang

overhead cost incurred during 2020, P300,000, Labor and overhead

costs incurred during the Lirst quarter of '2021 being the completion

date. 780,000. Selling price, Pl,210,000. Total costs to sell

P50, 000,

At what amount should the inventory be valued as of December 31, 2017?

a. P 900,000 ‘e. P1, 200, 000

b. 1,080,000 4. P1;280, 000

Material cost P 900,000

Labor and overhead 300,000

Total 004

NRV (2,220,000 ~ 80,000 ~ P50, 000) “77080, 000

Lower #1 089,.000

tens 36 to 38 are based on the following information:

Gn January 2, 2018, Jolo Company receives a government loan of P3,000,000

paying a coupon interest of 3% per year. The loan is repayable on

Beteber 31, 2022. Jolo Company's borrowing cost is 10% per annum. Thi

Pelowmarkes interest is provided by the government to enable Jolo Company

to bear cost of 3% per annum on the nominal value of the loan.

lihat amount of defersed incone should Jolo Company report in the statement

Of financial position as of Decenber 31, 20197

a. P64, 463 ‘c. P665, 672

b. 522,239 a. P7196, 065,

What is the anount of realized grant should the company report in its

December 31, 2018 statement of comprehensive income?

a. P130,393 fc. P1S1,776

bl p143,433 4. P173.554

lihat 15 the net effect in the profit or loss of 2018 in relation to the

government loan?

a. none fe. P130,393

b. (290,000) 4. (F220, 393)

Bailey, Tne. purchased 40,000 ordinary shares of Miller Manufacturing as

a trading investment for 2,640,000. During the year, Miller

Scanned with CamScanner

42.

43.

PRACTI

Re

vanar tt Schoo! of Accountan

"ler tanutactaring Sh divi 10 of 11

Treose MABEacKuring gyal HYldend ot R650 pee ahnro™_me_yonr-wde

ansane Qeatenont for aes, Me selt ing tor "Hea por sheer on eRe

= oat Lae git, OM etled. Decenbor ny Bhat “ha the total

Peo. a0 O88 and livident revenue faported by Balle

mast

‘000 ©. P260,000

ividens a pavosoo0

An

Unrealized sore 26:50 x 40,000 = p260,00

paueiboe

+ boite corpor:

Ps28 oon Rotation

at

Corp

Peutton purchased 16,000 ordinary shares of Comna Co. for

Yearontt i the Years Coma paid a cash dividend of O13 pee share:

ration pus’ Slates were selling for P38 por share. | Teire

Foetseeiee Berhasod: the” shares “to. moat. on-trading | FOgV1atotY

ratyeg aan Mat amount of total incomy will Loire Corporation report

a. P-a- me statement for the year?

b! P80, 000 08,000

of the outstanding

the equity method

reported net

on, Jonasey 2, 2020 tod company purchased, 254

fo account” for the investments "busing 2020 Jobe T00,

‘cone of 340,000" ant giseribated atvidens of £360,000, 7he, ending

Tance “inthe Equity, Sesccenonts acvoue, at peceaber 31» 2020 wad

P6t0/000 after’ aptiving the eayley method during 2020. Wat. was he

purchase price Pod Company paid for its investment in Jobs, ‘Inc?

a. F170, 000 c. P380,000

B! peeo,c00 & Becooo

sglex Corporation purchased 25,000

2019. Sherman Corporation

Corporation for P80 per share on January 2,

had. 100,000 ordinary. shares outstanding during 2020, peid cash

2020, and reported net income of

dividends of 600,000 during

52,000,000 for 2020. At Decenber 31, 2020 Sherman's shares are selling

at pee per share. By what net amount should the profit o loss of

Ziegler Company be affected by their investment in Sherman Company for

the year 20202

a. P150,000 fe. P500,000

b. P350,000 a. P550,000

Cost of investment 2,000,000

Ghcome from investment 2,000,000 x 25% ‘500,000

pividand 600,000 x 25% (150,000)

Carrying value 12/31/20 2,350,000

Foie value/recoverable amount 25,000 shares x P66 2,200,000

Impairment loss F 150,000

Incoue from investnent 500,000

$350,000

Not effect in the profit or loss

2020, Chronic Company is committed to a plan to sell a

auility and has initiated actions to locate a buyer.

‘oes not intend to transfer the facility to a buyer until

tions of the facility and eliminates the backlog

‘The facility was constructed for a total

period of 30

on January 2,

hanvfacturing. f

Chronic Company

Sifter it ceases all opera

Ge uncompleted customer orders.

oe enegrnG, 100,000. Tts estimated useful life was for a

$e8ks ind with an estimated salvage value of F300, 000.

the carrying value of the facility is P4, 300,000

of P4,500,000. As of December 31, 2020, Chronic

lete the customers’ orders and the facility has a

As of January 2, 2020,

anda recoverable value

Company has yet to comp!

Cecoverable amount of P4, 000,000:

on Decenber 31, 2020, Chronic Company should classify the facility as

oF Deoperty, plant & equipment valued at P4,000,000

CAL ACCOUNTING 1 — FIRST PRE-BOARD EXAMINATION (Batch 39) fio

ee

Scanned with CamScanner

Page 11 of 11

4, 100,000

assee Rel FOr 8910 and” valued at P4, 500,000

posal and valued at £4,000, 000

a

28 of Janu

atom th 3a, cee 4,300,000

38 Of Dace 200 = 300,000 + 20 years) 200,000

28 Of Becenber 31, 2020 4,100,000

P4/000,000

aa,

On Januar;

coy eee ces (408) of Polo

Company's ordinary ‘st

following in its

income and a 500,

Marco Company purchased 200,000 sha:

Statement, ot comprenensive income a P4,000/000, net

fair v. (000 unrealized loss from its investment in equity 2°

aa Value to other comprehensive income. Polo Company paid cash

dividends o£ 13,000,000 on Decenber 21, 2019- | on January 21,2020, teres

Company sold $0,000’ shares of Polo Company at the current BBEEES TONGS

‘olo’s shares at P32 per share. What amount of gain oF loss from the sale

should Harco Company recognise?

eelesseeos cc. P425,000

b. P375,000 &L pa7s,000

Cost of investment 4, 500, 000

Share in net income 4,000,000 x 408 1,600,000

Share in unrealized loss $00,000 x 408 «200, 000)

Share in the dividends 3,000,000 x 40% 43,200,000)

Carrying value a, 700, 000

Selling price $0,000 x P32 1, 600, 000

Carrying value of investment sold

(4,100,000 + 200,000 x 50/200 1,225, 000

Gain from sale 375,000

cavesstiseresseecessscsesvees ghd of axan shtsiensensantseagsecseneeeee®

PRACTICAL ACCOUNTING 1 — FIRST PREBOARD EXAMINATION (Batch 39)

Scanned with CamScanner

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AFAR Self Test - 9005Document6 pagesAFAR Self Test - 9005King MercadoNo ratings yet

- Practical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchDocument26 pagesPractical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchKing MercadoNo ratings yet

- AFAR Self Test - 9001Document5 pagesAFAR Self Test - 9001King MercadoNo ratings yet

- AFAR Self Test - 9003Document6 pagesAFAR Self Test - 9003King MercadoNo ratings yet

- AFAR Self Test - 9004Document4 pagesAFAR Self Test - 9004King MercadoNo ratings yet

- 1.TRUE 2.TRUE 3.TRUE 4.false 5.TRUE 6.TRUE 7.false 8.TRUE 9.TRUE 10. FalseDocument5 pages1.TRUE 2.TRUE 3.TRUE 4.false 5.TRUE 6.TRUE 7.false 8.TRUE 9.TRUE 10. FalseKing MercadoNo ratings yet

- AT.03-06 - Transaction CyclesDocument5 pagesAT.03-06 - Transaction CyclesKing MercadoNo ratings yet

- Cpar b86 Preweek - ApDocument12 pagesCpar b86 Preweek - ApKing MercadoNo ratings yet

- MAS-07 Standard Costing (Answers)Document1 pageMAS-07 Standard Costing (Answers)King MercadoNo ratings yet

- Practical Research 1: Quarter 3 - Module 1: Importance of Research in Daily LivesDocument20 pagesPractical Research 1: Quarter 3 - Module 1: Importance of Research in Daily LivesKing Mercado100% (5)

- AT.03-03 - The Accountancy ProfessionDocument4 pagesAT.03-03 - The Accountancy ProfessionKing MercadoNo ratings yet

- Code No. Region School Code Last Name: (001 - R10 - MSU-IIT - Delgado)Document4 pagesCode No. Region School Code Last Name: (001 - R10 - MSU-IIT - Delgado)King MercadoNo ratings yet

- Practical Research 1: Quarter 3 - Module 3: Quantitative and Qualitative ResearchDocument24 pagesPractical Research 1: Quarter 3 - Module 3: Quantitative and Qualitative ResearchKing Mercado100% (8)

- CPAR B86 Preweek - FAR Theories 1Document10 pagesCPAR B86 Preweek - FAR Theories 1King MercadoNo ratings yet

- 5 6338963844441833811Document22 pages5 6338963844441833811Phia CameroNo ratings yet

- Cpar b86 Preweek - at 2Document12 pagesCpar b86 Preweek - at 2King MercadoNo ratings yet

- Cpar b86 Preweek - AfarDocument14 pagesCpar b86 Preweek - AfarKing MercadoNo ratings yet

- Cpar b86 Preweek - FarDocument16 pagesCpar b86 Preweek - FarKing MercadoNo ratings yet

- Reasonable Reasonable Assurance AssuranceDocument26 pagesReasonable Reasonable Assurance AssuranceKing MercadoNo ratings yet

- NOLOLDocument11 pagesNOLOLPaula VillarubiaNo ratings yet

- CPAR B86 Preweek - AP Answer KeyDocument6 pagesCPAR B86 Preweek - AP Answer KeyKing MercadoNo ratings yet

- Aicpa Aud Moderate2015Document25 pagesAicpa Aud Moderate2015King MercadoNo ratings yet

- CPAR B86 Preweek - MAS Answer KeyDocument1 pageCPAR B86 Preweek - MAS Answer KeyKing MercadoNo ratings yet

- FAR 6704 (Bullet Review)Document8 pagesFAR 6704 (Bullet Review)King MercadoNo ratings yet

- 1019 PRTC Afar PWDocument7 pages1019 PRTC Afar PWKing MercadoNo ratings yet

- FAR Final PB SolutionDocument4 pagesFAR Final PB SolutionKing MercadoNo ratings yet