Professional Documents

Culture Documents

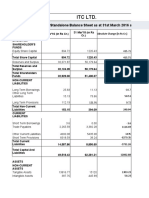

Balance Sheet: As at 31st March, 2015

Uploaded by

Yatin BhardwajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet: As at 31st March, 2015

Uploaded by

Yatin BhardwajCopyright:

Available Formats

Balance Sheet as at 31st March, 2015

As at As at

Note 31st March, 2015 31st March, 2014

(` in Crores) (` in Crores)

EQUITY AND LIABILITIES

Shareholders’ funds

Share capital 1 801.55 795.32

Reserves and surplus 2 29934.14 30735.69 25466.70 26262.02

Non-current liabilities

Long-term borrowings 3 38.69 51.00

Deferred tax liabilities (Net) 4 1631.60 1296.96

Other Long term liabilities 5 7.05 5.09

Long-term provisions 6 100.72 1778.06 110.00 1463.05

Current liabilities

Short-term borrowings 7 0.02 0.14

Trade payables 1904.62 1987.59

Other current liabilities 8 3671.18 3631.88

Short-term provisions 9 6106.09 11681.91 5884.71 11504.32

TOTAL 44195.66 39229.39

ASSETS

Non-current assets

Fixed assets 10

Tangible assets 13777.14 11948.69

Intangible assets 401.35 64.05

Capital work-in-progress - Tangible assets 2085.49 2272.94

Intangible assets under development 28.65 22.79

16292.63 14308.47

Non-current investments 11 2441.64 2512.17

Long-term loans and advances 12 1506.36 20240.63 1480.02 18300.66

Current assets

Current investments 13 5963.82 6311.26

Inventories 14 7836.76 7359.54

Trade receivables 15 1722.40 2165.36

Cash and bank balances 16 7588.61 3289.37

Short-term loans and advances 17 549.89 783.51

Other current assets 18 293.55 23955.03 1019.69 20928.73

TOTAL 44195.66 39229.39

The accompanying notes 1 to 34 are an integral part of the Financial Statements.

In terms of our report attached On behalf of the Board

For Deloitte Haskins & Sells

Chartered Accountants K. N. GRANT Director Y. C. DEVESHWAR Chairman

SHYAMAK R TATA R. TANDON Chief Financial Officer B. B. CHATTERJEE Company Secretary

Partner

Kolkata, 22nd May, 2015

110 ITC Limited REPORT AND ACCOUNTS 2015

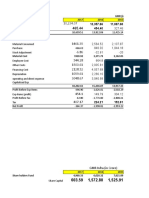

Statement of Profit and Loss for the year ended 31st March, 2015

Note For the year ended For the year ended

31st March, 2015 31st March, 2014

(` in Crores) (` in Crores)

Gross Income 19 51932.14 48175.80

Gross Revenue from sale of products and services 20 49964.82 46712.62

Less: Excise Duty 13881.61 13830.06

Net Revenue from sale of products and services 36083.21 32882.56

Other operating revenue 424.19 356.04

Revenue from operations 21 36507.40 33238.60

Other income 22 1543.13 1107.14

Total Revenue 38050.53 34345.74

Expenses

Cost of materials consumed 23 10987.83 10263.28

Purchases of Stock-in-Trade 24 3898.66 3021.47

Changes in inventories of finished goods,

Work-in-progress, Stock-in-Trade and Intermediates 25 (214.53) (128.41)

Employee benefits expense 26 1780.04 1608.37

Finance costs 27 57.42 2.95

Depreciation and amortisation expense 961.74 899.92

Other expenses 28 6581.85 6019.05

Total Expenses 24053.01 21686.63

Profit before tax 13997.52 12659.11

Tax expense:

Current tax 29 4020.99 3791.13

Deferred tax 30 368.80 82.77

Profit for the year 9607.73 8785.21

Earnings per share (Face Value ` 1.00 each) 31 (i)

Basic ` 12.05 ` 11.09

Diluted ` 11.93 ` 10.96

The accompanying notes 1 to 34 are an integral part of the Financial Statements.

In terms of our report attached On behalf of the Board

For Deloitte Haskins & Sells

Chartered Accountants K. N. GRANT Director Y. C. DEVESHWAR Chairman

SHYAMAK R TATA R. TANDON Chief Financial Officer B. B. CHATTERJEE Company Secretary

Partner

Kolkata, 22nd May, 2015

ITC Limited REPORT AND ACCOUNTS 2015 111

You might also like

- Exhibit+1Document28 pagesExhibit+1pre.meh21No ratings yet

- Cipla Limited Balance Sheet and Financial AnalysisDocument6 pagesCipla Limited Balance Sheet and Financial Analysisscribd sogawNo ratings yet

- Adani Power Ltd. - Balance Sheet - Consolidated: INR CroresDocument46 pagesAdani Power Ltd. - Balance Sheet - Consolidated: INR CroresIshan ShahNo ratings yet

- Balance Sheet As at March 31, 2019: Einancial AssetsDocument7 pagesBalance Sheet As at March 31, 2019: Einancial Assetsishwaryaishu0708No ratings yet

- Balance Sheet As at March 31, 2020: Property, Plant and EquipmentDocument8 pagesBalance Sheet As at March 31, 2020: Property, Plant and Equipmentishwaryaishu0708No ratings yet

- BALANCE SHEET HIGHLIGHTSDocument9 pagesBALANCE SHEET HIGHLIGHTSMadhur Gulati0% (1)

- 19-7-2022 Class Work HeroMoto DataDocument16 pages19-7-2022 Class Work HeroMoto DataMridav GoelNo ratings yet

- MS India P&LDocument15 pagesMS India P&LParth MalikNo ratings yet

- JunasBalance SheetDocument4 pagesJunasBalance Sheetleo EmmaNo ratings yet

- Names of Team Members Roll No Criteria For Selection of Main CompanyDocument31 pagesNames of Team Members Roll No Criteria For Selection of Main CompanyGaurav SharmaNo ratings yet

- Balance Sheet - Britannia IndustriesDocument2 pagesBalance Sheet - Britannia IndustriesAnuj SachdevNo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- Consolidated Balance Sheet: As at 31 March, 2016 As at 31 March, 2015 Equity and LiabilitiesDocument3 pagesConsolidated Balance Sheet: As at 31 March, 2016 As at 31 March, 2015 Equity and LiabilitiesShubhendu Tiwari100% (1)

- Property. Plant and Equipment: Capital Work-In-Progress Investment Property Intangible Assets Under DevelopmentDocument8 pagesProperty. Plant and Equipment: Capital Work-In-Progress Investment Property Intangible Assets Under Developmentishwaryaishu0708No ratings yet

- Swot Analysis I. Strenghts: WeaknessesDocument5 pagesSwot Analysis I. Strenghts: WeaknessesNiveditha MNo ratings yet

- ITC Limited: Presented by - Manasi Behere P02 Shweta Manwadkar P30Document16 pagesITC Limited: Presented by - Manasi Behere P02 Shweta Manwadkar P30Shweta ManwadkarNo ratings yet

- Hero MotoCorp LTDDocument10 pagesHero MotoCorp LTDpranav sarawagiNo ratings yet

- Equities and Liabilities Shareholder'S FundsDocument21 pagesEquities and Liabilities Shareholder'S Fundsakarshika raiNo ratings yet

- Data To Use - Detail InformationDocument44 pagesData To Use - Detail InformationAninda DuttaNo ratings yet

- CFRA - Balance SheetDocument29 pagesCFRA - Balance SheetSYKAM KRISHNA PRASADNo ratings yet

- Cipla Balance SheetDocument2 pagesCipla Balance SheetNEHA LAL100% (1)

- Zerone BS M23 Final For SignDocument24 pagesZerone BS M23 Final For SignauditNo ratings yet

- Tatasteel Inclass DiscusionDocument6 pagesTatasteel Inclass DiscusionADAMYA VARSHNEYNo ratings yet

- AxisBank financial performance 2015-2016Document9 pagesAxisBank financial performance 2015-2016Debanjan MukherjeeNo ratings yet

- Analysis of Asian Paints Financial StatementsDocument12 pagesAnalysis of Asian Paints Financial StatementsSahil SondhiNo ratings yet

- Graphite P&L and Balance Sheet AnalysisDocument22 pagesGraphite P&L and Balance Sheet AnalysisAbhishek SoniNo ratings yet

- Three Statement Model (Beauty of Our FM - ADF) - CompletedDocument9 pagesThree Statement Model (Beauty of Our FM - ADF) - CompletedAnkit SharmaNo ratings yet

- D-Mart Pranjali Agarwal - NMIMS BDocument440 pagesD-Mart Pranjali Agarwal - NMIMS BDewashish RaiNo ratings yet

- BirlasoftDocument3 pagesBirlasoftlubna ghazalNo ratings yet

- Financial Management AssignmentDocument5 pagesFinancial Management AssignmentSREEJITH RNo ratings yet

- AnnualReportFY2022 23Document1 pageAnnualReportFY2022 23anjaliNo ratings yet

- Itc LTD.: Comparative Standalone Balance Sheet As at 31st March 2016 and 2018Document32 pagesItc LTD.: Comparative Standalone Balance Sheet As at 31st March 2016 and 2018krishna shuklaNo ratings yet

- Kwality Balance Sheet Analysis Shows Declining Liquidity and ProfitabilityDocument56 pagesKwality Balance Sheet Analysis Shows Declining Liquidity and ProfitabilityStoryteller VZNo ratings yet

- Balance Sheet: Amts in Rs.'000Document12 pagesBalance Sheet: Amts in Rs.'000Aaryaman JainNo ratings yet

- Balance Sheet and P&L Analysis for Mar-19, Mar-18, Mar-17Document5 pagesBalance Sheet and P&L Analysis for Mar-19, Mar-18, Mar-17Dishant PatelNo ratings yet

- Hero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17Document25 pagesHero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17pranav sarawagiNo ratings yet

- Analysis of Adani PortsDocument63 pagesAnalysis of Adani PortsHarsh JaswalNo ratings yet

- Balance Sheet of Tata Communications: - in Rs. Cr.Document24 pagesBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaNo ratings yet

- Financial Statements: Consolidated Balance SheetDocument8 pagesFinancial Statements: Consolidated Balance Sheet既夹No ratings yet

- Financial AccountingDocument21 pagesFinancial AccountingMariam KupravaNo ratings yet

- 4808 Rishab Bansal Excel 39919 1194528774Document27 pages4808 Rishab Bansal Excel 39919 1194528774Rishab BansalNo ratings yet

- Leverage RatioDocument3 pagesLeverage RatioRahul PrasadNo ratings yet

- Onida Electronics Balance Sheet AnalysisDocument60 pagesOnida Electronics Balance Sheet Analysislal kapdaNo ratings yet

- ClairantDocument2 pagesClairantABHAY KUMAR SINGHNo ratings yet

- Annex B Feb 23 FinancialsDocument8 pagesAnnex B Feb 23 FinancialsMeeting Sarala DevelopmentNo ratings yet

- Hindalco Industries Balance Sheet AnalysisDocument3 pagesHindalco Industries Balance Sheet AnalysisSharon T100% (1)

- March 2021 Nine Month Orion PharmaDocument26 pagesMarch 2021 Nine Month Orion PharmaAfia Begum ChowdhuryNo ratings yet

- Bal SheetDocument6 pagesBal SheetSabyasachi PandaNo ratings yet

- Balance Sheet: Particulars 2018 2019Document9 pagesBalance Sheet: Particulars 2018 2019Manjusha JuluriNo ratings yet

- Rs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37Document6 pagesRs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37priyanshu14No ratings yet

- Common Size StatementDocument2 pagesCommon Size StatementKumar PranayNo ratings yet

- Orion Pharma Q3 2022 Condensed Financial StatementsDocument26 pagesOrion Pharma Q3 2022 Condensed Financial StatementsAfia Begum ChowdhuryNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print Financialsmohan raj100% (1)

- L & T Balance Sheet - Standalone - Common Size Statement - Analysis1Document11 pagesL & T Balance Sheet - Standalone - Common Size Statement - Analysis1Jatin CoolNo ratings yet

- Hexaware Technologies Financial Statements and ProjectionsDocument50 pagesHexaware Technologies Financial Statements and ProjectionsRahulTiwariNo ratings yet

- Britannia X Ls XDocument15 pagesBritannia X Ls Xshubham9308No ratings yet

- Business Valuation: Cia 1 Component 1Document7 pagesBusiness Valuation: Cia 1 Component 1Shubh SavaliaNo ratings yet

- FIn Data of Texmaco and MEPDocument10 pagesFIn Data of Texmaco and MEPWasp_007_007No ratings yet

- GMR and Larsen & Turbo financial data comparisonDocument20 pagesGMR and Larsen & Turbo financial data comparisonShashank PatelNo ratings yet

- 5 Common Sampling Errors - QualtricsDocument3 pages5 Common Sampling Errors - QualtricsYatin BhardwajNo ratings yet

- How To Minimize A Sampling Error - SynonymDocument3 pagesHow To Minimize A Sampling Error - SynonymYatin BhardwajNo ratings yet

- Non-Sampling Error - NzmathsDocument1 pageNon-Sampling Error - NzmathsYatin BhardwajNo ratings yet

- Presentation Outline on Sampling MethodsDocument25 pagesPresentation Outline on Sampling MethodsYatin BhardwajNo ratings yet

- 6.controlling Sampling Non-Sampling ErrorsDocument3 pages6.controlling Sampling Non-Sampling ErrorsAndy SibandaNo ratings yet

- A Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofDocument58 pagesA Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofYatin BhardwajNo ratings yet

- Consolidated Balance Sheet: As at 31St March, 2017Document7 pagesConsolidated Balance Sheet: As at 31St March, 2017Yatin BhardwajNo ratings yet

- Aaditya Final Report 6.10.17Document48 pagesAaditya Final Report 6.10.17Yatin BhardwajNo ratings yet

- Difference Between Sampling and Non-Sampling Error (With Comparison Chart) - Key DifferencesDocument7 pagesDifference Between Sampling and Non-Sampling Error (With Comparison Chart) - Key DifferencesYatin BhardwajNo ratings yet

- A Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofDocument7 pagesA Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofYatin BhardwajNo ratings yet

- A Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofDocument7 pagesA Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofYatin BhardwajNo ratings yet

- A Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofDocument7 pagesA Summer Training Report ON: Submitted in Partial Fulfillment For The Award of Degree ofYatin BhardwajNo ratings yet

- ITC Report and Accounts 2017 PDFDocument344 pagesITC Report and Accounts 2017 PDFcvikasguptaNo ratings yet

- Balance Sheet: As at 31st March, 2015Document20 pagesBalance Sheet: As at 31st March, 2015Yatin BhardwajNo ratings yet

- Report Accounts 2015Document272 pagesReport Accounts 2015Yatin BhardwajNo ratings yet

- HUL Annual ReportDocument208 pagesHUL Annual ReportYatin BhardwajNo ratings yet

- Meaning of Alternative InvestmentDocument1 pageMeaning of Alternative InvestmentYatin BhardwajNo ratings yet

- Aaditya Final Report 6.10.17Document48 pagesAaditya Final Report 6.10.17Yatin BhardwajNo ratings yet

- Consolidated Balance Sheet: As at 31St March, 2017Document7 pagesConsolidated Balance Sheet: As at 31St March, 2017Yatin BhardwajNo ratings yet

- Annual Report 2016 17 - tcm1255 507593 - enDocument220 pagesAnnual Report 2016 17 - tcm1255 507593 - enPRAVIN PALIWALNo ratings yet

- ITC Report and Accounts 2016 PDFDocument276 pagesITC Report and Accounts 2016 PDFrandomNo ratings yet

- Techniques of Environmental Scanning SAKSHIDocument17 pagesTechniques of Environmental Scanning SAKSHIDhairyaa BhardwajNo ratings yet

- Executive SummaryDocument10 pagesExecutive SummaryDhairyaa BhardwajNo ratings yet

- Techniques of Environmental Scanning SAKSHIDocument17 pagesTechniques of Environmental Scanning SAKSHIDhairyaa BhardwajNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- AmazonDocument19 pagesAmazonDhairyaa BhardwajNo ratings yet

- Primary Education SchoolDocument7 pagesPrimary Education SchoolDhairyaa BhardwajNo ratings yet

- Investor Behavior SurveyDocument36 pagesInvestor Behavior SurveyYatin BhardwajNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Raising Capital for Pacapol's Venture ExpansionDocument4 pagesRaising Capital for Pacapol's Venture ExpansionAnnu RiyadhNo ratings yet

- September 2015Document64 pagesSeptember 2015Eric SantiagoNo ratings yet

- Chapter-3 1Document5 pagesChapter-3 1Gabrielle Joshebed AbaricoNo ratings yet

- Brian Brackeen's Open Letter To ShareholdersDocument12 pagesBrian Brackeen's Open Letter To ShareholdersMegan Dickey0% (1)

- DEVELOPMENT of Material ResourcesDocument21 pagesDEVELOPMENT of Material ResourcesJennifer ManaogNo ratings yet

- Management Accounting ConsolidatedDocument330 pagesManagement Accounting ConsolidatedPraveen NairNo ratings yet

- Criteria for discontinued operations under 40 charactersDocument3 pagesCriteria for discontinued operations under 40 charactersJohn Philip L Concepcion100% (1)

- Crude Oil Mktwire July 2011Document13 pagesCrude Oil Mktwire July 2011Al QadiryNo ratings yet

- Insurance Capsule For UIIC Assistant Mains and OICL AO MainsDocument17 pagesInsurance Capsule For UIIC Assistant Mains and OICL AO MainsArjunNo ratings yet

- 07 Third Party Products Business & Risk ManagementDocument13 pages07 Third Party Products Business & Risk ManagementBAKN BAA100% (1)

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Carillion Sr2014 FullDocument136 pagesCarillion Sr2014 Fullnelly8No ratings yet

- Evaluation of Capital Budgeting TechniquesDocument36 pagesEvaluation of Capital Budgeting TechniquesAshish GoelNo ratings yet

- BR20161021 EnergyStorageDocument11 pagesBR20161021 EnergyStoragezacharioudakisNo ratings yet

- Unethical Issues of SHELLDocument6 pagesUnethical Issues of SHELLIshan GuptaNo ratings yet

- Business Strategy Moves for Boeing and AirbusDocument16 pagesBusiness Strategy Moves for Boeing and AirbusShravan WadhwaNo ratings yet

- Corporations True or FalseDocument1 pageCorporations True or FalseAngelo Andro Suan100% (5)

- Raadaa - Garri Production and ProcessingdocxDocument21 pagesRaadaa - Garri Production and ProcessingdocxMercyclara Igwe100% (2)

- Graham's Simplest Approach To Selecting StocksDocument9 pagesGraham's Simplest Approach To Selecting StockspiyushNo ratings yet

- City of Rayne 2015 Budget Final Amend and Approved 2015 2016Document39 pagesCity of Rayne 2015 Budget Final Amend and Approved 2015 2016Theresa RichardNo ratings yet

- 04 Analysis of The Yield CurveDocument19 pages04 Analysis of The Yield CurveSusanNo ratings yet

- Research Paper Rupesh Amol 11Document9 pagesResearch Paper Rupesh Amol 11gurjit20No ratings yet

- NseDocument7 pagesNseDebolina KunduNo ratings yet

- Advance Portfolio ManagementDocument7 pagesAdvance Portfolio ManagementKinza ZaheerNo ratings yet

- Investing in Music PDFDocument32 pagesInvesting in Music PDFEliel OlivereNo ratings yet

- CaseDocument23 pagesCaseNguyễnVũHoàngTấnNo ratings yet

- Price ActionDocument100 pagesPrice Actionchelle100% (2)

- RBI's Central Banking Functions (38Document52 pagesRBI's Central Banking Functions (38Anonymous im9mMa5100% (1)

- Narra Nickel vs. RedmontDocument4 pagesNarra Nickel vs. Redmontmarinette agliamNo ratings yet

- Charlie MungerDocument19 pagesCharlie MungerTeddy RusliNo ratings yet