Professional Documents

Culture Documents

Test of Liquidity

Uploaded by

00 ResilienceOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test of Liquidity

Uploaded by

00 ResilienceCopyright:

Available Formats

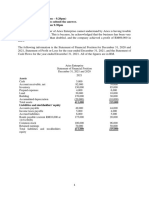

TEST OF LIQUIDITY

2090 2089

Current Assets 605,000 519,000

Current Ratio = = =

Current Liabilities 292,000 276,000

= 2.07 to 1 = 1.88 to 1

The result indicates an increase of current ratio in 2090 which means that the firm becomes

more liquid and its current assets are enough to pay its current liabilities twice.

2090 2089

Quick Asset 375,000 345,000

Acid Test Ratio = = =

Current Liabilities 292,000 276,000

= 1.28 to 1 = 1.25 to 1

The result indicates that You Corporation has enough liquid assets to pay its current

liabilities.

Receivable Net Credit Asset 3,280,000

= =

Turnover Average Receivable 180,000 + 210,000

2

3,280,000

=

195,000

= 16.82 turnovers

Average Age of No. of Working Days in a Year 360 days

= =

Receivables Receivable Turnover 16.82

= 21.40 days

The Company could evaluate the performance of the credit and collection of department if

it is satisfactory enough if the average age of receivable is less than the credit terms it

granted. The increase in turnover and a decrease of average age receivable is a good

indicator of the firm's efficiency of collecting it receivables.

Cost of Goods Sold 2,120,000

Inventory Turnover = =

Average Merchandise Inventory 150,000 + 112,000

2

2,120,000

=

131,000

Average Age of No. of Working Days in a Year 360 days

= =

Inventory Inventory Turnover 16.18

= 22.25 days

The Company can say that it is desirable for them if the turnover is high enough and the

average age of inventory is short.

Current Assets Cost of Sales + Operating Expense 2,120,000 + 770,000

= =

Turnover Average Current Assets 605,000 + 519,000

2

2,890,000

=

562,000

= 5.14

The satisfactory of this result must be related to other factors; if the turnover is too high as

compared with the others, it may indicate that the firm's current assets might be

inadequate to meet current operating requirements. On the other hand, a very low

turnover rate means that the firm might be keeping too much current assets for current

operations.

TEST OF SOLVENCY

2090

2090

2090 2089

2089

2089

Debt-equity

Time Income Total Liabilities

beforeTotal

tax + Liabilities

Interest Expense = 360,000 942,000

+ 30,000 = 428,000

742,000 876,000

+ 25,000

876,000

Debt Ratio= = =

Ratio

Interest TotalTotal

Owners' Equity

Assets == 858,000

1,800,000 == 774,000

1,650,000

Earned Interest Expense == 1.1 30,000 == 1.31 25,000

52.33% 53.09%

The test shows that amount of capital contributed=by the13

2090owners ofand

the creditors

The result indicates a a little bit of decrease in the percentage times = assets

total are provided

18.12 not

times

2089

equal

The

by the and the

testcreditor creditors'

indicates aTotal

from contribution

decrease

the Owners'of times

past year to the total

the interest

to 2090, assets

it is good seems

hasforbeen to be

the earned, greater,

lower the but

however it has

thesafer

debt, 774,000

the current

the

Equity 858,000

improved

Equity

resultRatio

company.is in

still 2090.

=

quite high which means that it can= still afford to pay all =

its expenses, including

Total Assets 1,800,000 1,650,000

its interest expense.

= 47.67% = 46.91%

The result shows an increase of the proportion of owners’ investment in total assets of the

company;if continually increase,a higher ratio is considered to be favourable for the

companies.

TEST OF PROFITABILITY

2090 2089

Income 234,000 278,200

Return on Sales = = =

Net Sales 3,280,000 2,950,000

= 7.13% = 9.43%

2090 2089

Gross Profit 1,160,000 1,033,000

Gross Profit Ratio = = =

Net Sales 3,280,000 2,950,000

= 35.37% = 35.02%

Return on Total Income before Interest and Taxes = 390,000

=

Assets Average Total Assets 1,650,000 + 1,800,000

2

390,000

=

1,725,000

= 23%

Return on Net Income 234,000

Shareholder = Average Shareholders' = 774,000 + 858,000

s' Equity Equity

2

234,000

=

816,000

= 29%

2090 2089

Earnings per Net Income - Preferred Dividends(if any) 234,000 278,200

= = =

Share Weighted Average Number of Common 100,000 100,000

Shares = 2.34 = 2.78

MARKET TESTS

Price-earning Ratio Price per Share P5

= =

(P/E) Earnings per Share P2.14

= 2.34

Dividend per Share P1

Dividend Yield = =

Price per Share P5

= 20%

Common Dividend Per Share P1

Dividend Payout = =

Earnings per Share P2.14

= 47%

You might also like

- 2 Ratio AnalysisDocument24 pages2 Ratio AnalysisLara Camille CelestialNo ratings yet

- Ratio AnalysisDocument24 pagesRatio AnalysisLara Camille CelestialNo ratings yet

- Quiz FMDocument3 pagesQuiz FMMarcos Jose AveNo ratings yet

- Tutorial 8Document6 pagesTutorial 8WEI QUAN LEENo ratings yet

- ACC 203 Ch05 SolutionDocument11 pagesACC 203 Ch05 Solutionomaritani2005No ratings yet

- MMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsDocument7 pagesMMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsSerena100% (1)

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisJoy ConsigeneNo ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- UBFI Resit Exam PaperDocument7 pagesUBFI Resit Exam PaperAdv Sailja Rohit DhootNo ratings yet

- Consolidation FP ExampleDocument4 pagesConsolidation FP ExampleYAUHANo ratings yet

- Consolidation FP ExampleDocument4 pagesConsolidation FP ExampleYoooNo ratings yet

- Consolidation/Group Accounts: Example 18: Disposal of SubsidiaryDocument4 pagesConsolidation/Group Accounts: Example 18: Disposal of SubsidiaryMuhammad Sarfraz AsmatNo ratings yet

- Current Assets Current Liabilities: I. Test of LiquidityDocument6 pagesCurrent Assets Current Liabilities: I. Test of LiquidityLuca PacioliNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Case F&B: Income StatementDocument3 pagesCase F&B: Income StatementDIPESH KUNWARNo ratings yet

- TP 2 Acct For BusinessDocument5 pagesTP 2 Acct For BusinessLuna AnggrainiNo ratings yet

- Jul22 Osa Supp Accounting and Financial Management Question PaperDocument9 pagesJul22 Osa Supp Accounting and Financial Management Question PaperMelokuhle MhlongoNo ratings yet

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- Ej 2 Cap 3 Mayers CanvasDocument2 pagesEj 2 Cap 3 Mayers CanvasAlvaro LopezNo ratings yet

- Gross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsDocument85 pagesGross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsMaria Dana BrillantesNo ratings yet

- Acc 2 Nov 2020 SolDocument3 pagesAcc 2 Nov 2020 SolKimberly GondoraNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- The Statement of Comprehensive Income: Profit For The YearDocument4 pagesThe Statement of Comprehensive Income: Profit For The YearPlawan GhimireNo ratings yet

- Total 23,500 23,500Document3 pagesTotal 23,500 23,500Vania DNo ratings yet

- 20 Preparation Question: Contract: Contract 1 Contract 2 Contract 3 Contract 4Document2 pages20 Preparation Question: Contract: Contract 1 Contract 2 Contract 3 Contract 4SerenaNo ratings yet

- MR BALIKDocument7 pagesMR BALIKGAMES EMPIRENo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- The Accounting Cycle: Reporting Financial ResultsDocument8 pagesThe Accounting Cycle: Reporting Financial ResultsOmar KhanNo ratings yet

- Coursebook Chapter 9 AnswersDocument5 pagesCoursebook Chapter 9 AnswersAhmed Zeeshan92% (12)

- Gmernacej W5C5 AssigmentOLDDocument6 pagesGmernacej W5C5 AssigmentOLDalmaNo ratings yet

- Consolidation FP ExampleDocument4 pagesConsolidation FP ExampleSuryaRaoNo ratings yet

- Construction ContractsDocument17 pagesConstruction ContractsCeline Marie AntonioNo ratings yet

- Tugas Tutorial Ke-2 Analisis Informasi Keuangan PDFDocument4 pagesTugas Tutorial Ke-2 Analisis Informasi Keuangan PDFputridewitawinantiNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (62)

- Short-Term ExamDocument6 pagesShort-Term Examymkuzangwe16No ratings yet

- Module 2 Statement of Comprehensive IncomeDocument8 pagesModule 2 Statement of Comprehensive IncomeStella MarieNo ratings yet

- Activity 9 (Q2 NSC Nov 2021) ENGDocument2 pagesActivity 9 (Q2 NSC Nov 2021) ENG8yscmvdjx9No ratings yet

- Financial RatioDocument3 pagesFinancial RatioDianna EsmerayNo ratings yet

- Acc117 Ass 3Document12 pagesAcc117 Ass 3izma hadirNo ratings yet

- ACCT 2208 - Final Review (Ch. 18, 22, 23)Document16 pagesACCT 2208 - Final Review (Ch. 18, 22, 23)MitchieNo ratings yet

- Practice Set 4 AssetsDocument9 pagesPractice Set 4 AssetsAashiNo ratings yet

- Nokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockDocument2 pagesNokia Corporation: ISIN: FI0009000681 WKN: Nokia Asset Class: StockMohtasim Bin HabibNo ratings yet

- Tôi Đang Chia Sẻ 'Financial Plan - Sample' Với BạnDocument12 pagesTôi Đang Chia Sẻ 'Financial Plan - Sample' Với BạnThùy Linh DươngNo ratings yet

- ACC117 Project 2Document7 pagesACC117 Project 2Aliamaisara ZahiraNo ratings yet

- Handouts 5-6 - Review - Exercises and SolutionsDocument6 pagesHandouts 5-6 - Review - Exercises and Solutions6kb4nm24vjNo ratings yet

- Ques 3:: Less: Management Cost Add: Capital ExpenditureDocument2 pagesQues 3:: Less: Management Cost Add: Capital ExpenditurearunNo ratings yet

- Assign #03 FNNDocument11 pagesAssign #03 FNNUsman GhaniNo ratings yet

- Practice QuestionsDocument19 pagesPractice QuestionsAbdul Qayyum Qayyum0% (2)

- Accounting Cycle Week 2 ReviewerDocument11 pagesAccounting Cycle Week 2 ReviewerVinz Danzel BialaNo ratings yet

- Tugas Personal Pertama AKDocument7 pagesTugas Personal Pertama AKerni75% (4)

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Installment Sales NotesDocument19 pagesInstallment Sales NotesTrixie HicaldeNo ratings yet

- IS - Notes (Part1)Document14 pagesIS - Notes (Part1)Andrea Marie CalmaNo ratings yet

- End Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument4 pagesEnd Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying Abilityawaischeema100% (1)

- Quiz AKL - ConsolidationDocument2 pagesQuiz AKL - Consolidationsuciati_liaNo ratings yet

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- 12 - Incomplete Record - With - AnswerDocument13 pages12 - Incomplete Record - With - AnswerAbid faisal AhmedNo ratings yet

- Project On Selling Methods of Life Insurance PoliciesDocument77 pagesProject On Selling Methods of Life Insurance Policiesravigumber1985No ratings yet

- Accounting Rate of ReturnDocument5 pagesAccounting Rate of ReturnTushar Mathur100% (4)

- Spreading Property KnowledgeDocument60 pagesSpreading Property KnowledgeTebogo MalepengNo ratings yet

- Jawaban Koger PropertiesDocument17 pagesJawaban Koger Propertiesakmal muzamarNo ratings yet

- Chapter 2 AbvDocument52 pagesChapter 2 AbvVienne MaceNo ratings yet

- Peng Cap 06 Investing Abroad Directly: Organizationally Embedded AssetsDocument3 pagesPeng Cap 06 Investing Abroad Directly: Organizationally Embedded AssetsPablo Peña TorresNo ratings yet

- AFM 101 Final Prof. Donna Psutka 2005Document22 pagesAFM 101 Final Prof. Donna Psutka 2005Kagaba Jean BoscoNo ratings yet

- Duties and Responsibilities of The Asset Management CompanyDocument19 pagesDuties and Responsibilities of The Asset Management Companysumairjawed8116100% (1)

- Life Cycle of A Trade: Training AcademyDocument98 pagesLife Cycle of A Trade: Training AcademyKishor KarankalNo ratings yet

- A Study On Mutual Funds With Due Reference To Sbi Mutual FundsDocument8 pagesA Study On Mutual Funds With Due Reference To Sbi Mutual FundskomalNo ratings yet

- Peter Schiff - Gold Scams ReportDocument15 pagesPeter Schiff - Gold Scams Reporttheinfrangibleiggybank100% (1)

- Department of Labor: 96 23926Document17 pagesDepartment of Labor: 96 23926USA_DepartmentOfLaborNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingSatish Kumar SonwaniNo ratings yet

- The Role of The Financial MarketsDocument6 pagesThe Role of The Financial Marketsrosalyn mauricioNo ratings yet

- Treasury Bills (T-Bills) Meaning:: Prepared by Mohuddin Memon 1Document7 pagesTreasury Bills (T-Bills) Meaning:: Prepared by Mohuddin Memon 1moinmemon1763No ratings yet

- Assignment 1Document3 pagesAssignment 1Syed Muhammad Abdullah ShahNo ratings yet

- Chapter 6 Efficient DiversificationDocument70 pagesChapter 6 Efficient DiversificationA_Students50% (2)

- The Holy Grail Strategy FinderDocument35 pagesThe Holy Grail Strategy FinderFrancesco Nano100% (1)

- Wealth Management Private BankingDocument36 pagesWealth Management Private BankingArunVellaiyappan100% (1)

- Mr. Yasir Ali: The Bright Future SchoolDocument47 pagesMr. Yasir Ali: The Bright Future SchoolWaqas AliNo ratings yet

- Ten Leading VCs Team Up On A $50 Million Fund To Back Underrepresented InvestorsDocument11 pagesTen Leading VCs Team Up On A $50 Million Fund To Back Underrepresented InvestorsJason MilesNo ratings yet

- 7 Stock ValuationDocument28 pages7 Stock ValuationShivanitarun100% (1)

- Herd BehaviorDocument14 pagesHerd BehaviorMarii KhanNo ratings yet

- FNC535 Midterms DraftDocument8 pagesFNC535 Midterms DraftRufino Gerard MorenoNo ratings yet

- V MartDocument2 pagesV Martsaarthak srivastavaNo ratings yet

- Random WalkDocument11 pagesRandom WalkmuntaquirNo ratings yet

- Modern Islamic Investment Management Mohd Ma'Sum BillahDocument255 pagesModern Islamic Investment Management Mohd Ma'Sum BillahMiladNo ratings yet

- Stryker Corporation PPT SlidesDocument13 pagesStryker Corporation PPT SlidesZahid UsmanNo ratings yet

- Cost of Capital RSB DR - PRRDocument44 pagesCost of Capital RSB DR - PRRPrramakrishnanRamaKrishnanNo ratings yet

- Comparetive Capital Structure On Return of Sunrise Bank Limited and Prime Commecrial BankDocument4 pagesComparetive Capital Structure On Return of Sunrise Bank Limited and Prime Commecrial BankAnees SthaNo ratings yet