Professional Documents

Culture Documents

Accounting Quiz Sol

Uploaded by

MkaeDizon0 ratings0% found this document useful (0 votes)

6 views3 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesAccounting Quiz Sol

Uploaded by

MkaeDizonCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

Dizon, Marianne-Kae L.

BSA31KB2

Quiz-Solutions

3.) Tax depreciation 50,000,000.00

Tax rate 40%

20,000,000.00

4.) Depreciable asset 750,000.00

Tax rate 40%

Deferred tax liability 300,000.00

5.) Deferred tax asset 140,000.00 (350,000.00*40%)

Deferred tax liability 45,000.00

Deferred tax benefit 185,000.00

6-9.) Accounting income per book 3,500,000.00

Permanent differences expense 200,000.00

Permanent differences revenue (300,000.00)

Accounting income subject to tax 3,400,000.00

Deductible temporary differences:

Bad debts expense 100,000.00

Warranty expense 5,000.00

Taxable temporary differences:

Excess tax depreciation (50,000.00)

Deferred income tax on installment sales (450,000.00)

Taxable income 3,005,000.00

8.)Income tax expense 901,500.00

Income tax payable 901,500.00

Deferred tax asset 31,500.00

Income tax benefit 31,500.00

Income tax expense 150,000.00

Deferred tax liability 150,000.00

Tax benefit from inc in defrred tax asset (150,000.00)

Tax benefit from inc in defrred tax liability 31,500.00

6.) Net deferred tax benefit (118,500.00)

,000.00*40%)

Bad debts expense 100,000.00

Warranty expense 5,000.00

Total deductible temporary differences 105,000.00

Tax rate 30%

7.)Deferred tax asset 31,500.00

Excess tax depreciation 50,000.00

Deferred income tax on installment sales 450,000.00

Total taxable temporary differences 500,000.00

Tax rate 30%

9.)Deferred tax liability 150,000.00

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

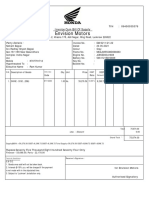

- Envision Motors: Invoice Cum Bill of SupplyDocument1 pageEnvision Motors: Invoice Cum Bill of SupplyEnvision MotorsNo ratings yet

- Core Competencies: Competitive AdvantageDocument12 pagesCore Competencies: Competitive AdvantageYamaanNo ratings yet

- Case No. 1 Zapanta vs. Posadas G.R. Nos. L-29204-09, December 29, 1928 FactsDocument29 pagesCase No. 1 Zapanta vs. Posadas G.R. Nos. L-29204-09, December 29, 1928 FactsChan ChanNo ratings yet

- Cost Accounting Assignment 1Document5 pagesCost Accounting Assignment 1MkaeDizonNo ratings yet

- Assignment 3.1 Aging of ReceivablesDocument2 pagesAssignment 3.1 Aging of ReceivablesMkaeDizonNo ratings yet

- Fin Acc 2 Chap 14Document9 pagesFin Acc 2 Chap 14MkaeDizonNo ratings yet

- Fin Acc 2 Chap 7Document10 pagesFin Acc 2 Chap 7MkaeDizonNo ratings yet

- Liqui by InstallmentDocument4 pagesLiqui by InstallmentMkaeDizonNo ratings yet

- AsnwerDocument4 pagesAsnwerMkaeDizonNo ratings yet

- This Study Resource Was: Appendix 3: Balanced Scorecard TemplateDocument3 pagesThis Study Resource Was: Appendix 3: Balanced Scorecard TemplateJaydeep KushwahaNo ratings yet

- Payslip 893625 CIN Jan 2024Document1 pagePayslip 893625 CIN Jan 2024yashkrish722No ratings yet

- Integrated Logistics Is A Unique Business Management Process That Governs The Flow ofDocument13 pagesIntegrated Logistics Is A Unique Business Management Process That Governs The Flow ofMukesh SinghNo ratings yet

- The Dairy Industry (Dairy Produce Safety) Regulations, 2020Document32 pagesThe Dairy Industry (Dairy Produce Safety) Regulations, 2020elinzola100% (1)

- Production Planning and Scheduling Production Planning Means To Fix The Production Goals Objectives of Production PlanningDocument3 pagesProduction Planning and Scheduling Production Planning Means To Fix The Production Goals Objectives of Production PlanningAurcus JumskieNo ratings yet

- Chapter 02 The Marketing AuditDocument30 pagesChapter 02 The Marketing AuditMadhushi SandupamaNo ratings yet

- Annual Report 2014 2015Document182 pagesAnnual Report 2014 2015Take One100% (1)

- Problems and Cases: Chapter 9 Accounting QualityDocument4 pagesProblems and Cases: Chapter 9 Accounting QualityHong NguyenNo ratings yet

- ContractsDocument169 pagesContractsStacy MustangNo ratings yet

- BÀI TẬP NGỮ PHÁP CÔ TỊNH đã chèn link video giảiDocument19 pagesBÀI TẬP NGỮ PHÁP CÔ TỊNH đã chèn link video giảiĐức ToànNo ratings yet

- 6.2. Western Style, Chinese Pop Jay Chou's Rap and Hip-Hop in ChinaDocument13 pages6.2. Western Style, Chinese Pop Jay Chou's Rap and Hip-Hop in ChinaCati HarigaNo ratings yet

- Gunnebo LiftingDocument129 pagesGunnebo Liftingjhon rodriguezNo ratings yet

- Community Relation Plan: Orbital & Oranges Nigeria LimitedDocument12 pagesCommunity Relation Plan: Orbital & Oranges Nigeria LimitedJustice AkuboNo ratings yet

- Nancy Vyhmeister Paripurna Sambeka: SkillsDocument2 pagesNancy Vyhmeister Paripurna Sambeka: SkillsHilal MNo ratings yet

- Consolidated Balance Sheet As at March 31, 2021Document4 pagesConsolidated Balance Sheet As at March 31, 2021shreyansh naharNo ratings yet

- Worksheet For StepSmart CaseDocument27 pagesWorksheet For StepSmart CaseMADHUR BAGRINo ratings yet

- FINANCE Establishment ListDocument15 pagesFINANCE Establishment ListRanjith PNo ratings yet

- Redifining Product Management: Suresh Sukheja Is A Pune Based WriterDocument37 pagesRedifining Product Management: Suresh Sukheja Is A Pune Based WriterrahulNo ratings yet

- Law of Tort Knec NotesDocument55 pagesLaw of Tort Knec NotesBoss CKNo ratings yet

- 3.2.1 The Role of Market Research and Methods UsedDocument42 pages3.2.1 The Role of Market Research and Methods Usedsana jaleelNo ratings yet

- IBUS 5716 Case Preparation: Silvio Napoli at Schindler IndiaDocument4 pagesIBUS 5716 Case Preparation: Silvio Napoli at Schindler IndiaRohan RoyNo ratings yet

- Acr 203 - Module 4Document8 pagesAcr 203 - Module 4Day DreamNo ratings yet

- Journal of Administrative Management, Education and Training (JAMET)Document15 pagesJournal of Administrative Management, Education and Training (JAMET)ThuraMinSweNo ratings yet

- Model Economic Township Limited: Meet Your Future Business at Reliance METDocument27 pagesModel Economic Township Limited: Meet Your Future Business at Reliance METtanyasingh711No ratings yet

- BS - CorpPlanning Per - The Charter ppt-1Document56 pagesBS - CorpPlanning Per - The Charter ppt-1SM IrfanNo ratings yet

- Brochure Ruko Elevee PromenadeDocument12 pagesBrochure Ruko Elevee PromenadeRiasto PropertyNo ratings yet

- IN Contemporary World: Student's NameDocument9 pagesIN Contemporary World: Student's NameJessan Ybañez JoreNo ratings yet