Professional Documents

Culture Documents

AST Chapter 1

Uploaded by

ElleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AST Chapter 1

Uploaded by

ElleCopyright:

Available Formats

e

CHAPTER 1 (PARTNERSHIP FORMATION AND OPERATION) ▲ Partnership Formation

▲ Structure of Partnership • Two or more sole proprietors form a partnership

• Two or more persons form a partnership for the first time Tori and Mavy, decided to form a partnership on October 1 of the current

• A person already in business may invite an individual to form a year. Their statement of financial position on this date were:

partnership

• Two or more sole proprietors may form a partnership Tori Mavy

Cash 65,625 164,063

▲ Articles of Co-Partnership – a voluntary contract between/ among two Accounts receivable 1,487,500 896,875

or more persons to place their capital, labor, and skills into business with

the understanding that there will be a sharing of the profits and losses Merchandise inventory 875,000 885,937

between/ among partners Equipment 656,250 1,268,750

• Name of the partnership Total 3,084,375 3,215,625

• Name and address of the partners

• Rights and responsibilities of each partner

Accounts payable 459,375 1,159,375

• The purpose for which the partnership is formed

Tori, Capital 2,625,000

• The initial investment and additional investments to be made by each of

the partner Mavy, Capital 2,056,250

• The withdrawals that maybe made by partners and the limitations, if any Total 3,084,375 3,215,625

• The profit and loss ratio

• Procedures on dissolving the partnership They agreed to the following adjustments:

- Equipment of Tori is under depreciated by P87,500 and that Mavy is over

▲ Recording the Contributions of the Partners depreciated by P131,250

• Cash contributions - Allowance for doubtful accounts is to be set up amounting to P297,500

for Tori and P196,875 for Mavy

- Valued at its face value (fair value)

- Inventories of P21,875 and P15,320 are worthless in the books of Tori

- Foreign currency denominated cash contributions are valued based on

and Mavy, respectively

exchange rates on the date of contribution

- The profit and loss ratio for Tori and Mavy is 6:4

- Cash deposited in a bankrupt or closed bank is valued at its estimated

recoverable amount (net realizable value)

Required:

• Noncash contributions 1. Adjusted capital of Tori and Mavy using the net investment method

- Valued at its fair market value 2. Adjusted capital of Tori and Mavy using the bonus method, assuming

their capital ratio is the same as the profit and loss ratio

• Accounts receivables transferred to the partnership

1. Net Investment Method

- Recorded at gross amount accompanied by corresponding allowance for

bad debts Tori Mavy

Unadjusted capital 2,625,000 2,625,000

• Fixed assets transferred to the partnership Under/Over depreciated

(87,500) 131,250

- Recorded at fair market value equipment

Allowance for bad debts (297,500) (196,875)

▲ Accounting for Initial Investment Write down of

(21,875) (15,320)

inventories

• Net investment method (Transfer of Capital Method) – the

partnership credited for the amount of net assets invested (FV of assets Adjusted capital 2,218,125 1,975,305

minus FV of liabilities)

- This will happen if the contributions ratio is equal to capital ratio 2. Bonus Method

Tori, adjusted capital 2,218,125

• Bonus method – partner’s capital is credited based on their agreed ratio Mavy, adjusted capital 1,975,305

which may be different from their contribution

Total contributed capital 4,193,430

- The difference between the amount contributed and amount credited to

the capital is the bonus

Tori Mavy

Contributed capital 2,218,125 1,975,305

Capital credit per 2,516,058 1,677,372

agreement

Bonus 297,933 (297,933)

Pagatpat, Aischelle Mhae R.

e

• A sole proprietor and two individuals form a partnership 2. Layla as the base (595,000/35% = 1,700,000

On December 1 of the current year, Mikee, the sole proprietor of the Mikee Layla Roma

Victory Company, expands the company and establish a partnership with Contributed capital 905,200 595,000 687,000

Layla and Roma. The partners plan to share profits and losses as follows:

Agreed capital 680,000 595,000 425,000

Mikee, 40%; Layla, 35% and Roma, 25%. Mikee asked Layla to join the

partnership because his image and reputation are expected to be valuable Withdrawal (225,200) 0 (262,000)

during formation. Layla is also contributing P105,000 cash and the

building that was acquired for P1,010,000, with carrying amount of

P870,000 and fair value of P490,000. The building is subject to mortgage 3. Using net investment method

P198,000 that the partnership did not assume. Roma is contributing Mikee Layla Roma

P212,000 cash and marketable securities costing P336,000 to Roma but are Contributed capital 905,200 595,000 687,000

currently worth P475,000. Mikee's investment in the partnership is the

Agreed capital 874,8880 765,520 546,800

Victory Company.

Withdrawal (30,320) 170,520 (140,200)

Assets Liabilities and Capital

Cash Accounts

390,000 437,000 ▲ Partnership Operations

Payable

Accounts Notes Payable • Factors in Profit and Loss Sharing Agreement

456,000 592,000

Receivable ■ Single ratio

Merchandise

394,000

Capital

829,000

- If the partners agree on the manner of profit distribution but not loss

Inventory distribution, then loss will be distributed using the profit ratio

Equipment, net 618,000 829,000 - If the partners agree on the manner of loss distribution but not profit

Total 1,858,000 Total 1,858,000 distribution, then profit will be distributed using the capital ratio

- If there is no provision for the distribution of profit and losses, then it will

be divided on the basis of capital ratio

The partners agreed that 35% of inventory is considered worthless, the

equipment is 75% of its carrying amount, in 15% of accounts receivable is

uncollectible. Mikee plans to pay off the accounts payable with his ■ Provision for Salaries – part of profit distribution given to the partners

personal assets. The other partners have agreed a partnership will assume that devote time in the management of the partnership

the notes payable. The partners agreed that their capital balances upon

formation will be in conformity with their profit and loss ratio. ■ Provision for Interest – part of profit distribution which allowed

partners interest on capital to give recognition to the differences in the

Required: capital given to the partnership

1. Assuming the partners will either invest or withdraw cash, using Roma

as the base, Mikee and Layla will both invest cash with total amount of ■ Provision for Bonus – part of profit distribution give it to the partners

2. Show me the partners that either investor withdraw cash, using Layla as who contribute skills or expertise to the partnership

the base, Mikee and Roma will both withdraw cash with total amount of

3. If the net investment method is used, the capital account of Mikee and ◊ Computation of Bonus

Roma will change by Based on profit before deducting bonus income tax

Based on profit after deducting bonus but before deducting income tax

Mikee (40%) Layla (35%) Roma (25%) Total Based on profit before deducting bonus but after deducting income tax

Unadjusted capital 829,000 Based on profit after deducting bonus and income tax

Write-down of

(137,900)

inventory

ILLUSTRATION 1: Single Method of Allocation

Write-down or

(154,500)

PPE James and Howard are partners and have capital balance at the end of 2017

Provision for as follows: James – P 60,000; Howard – P 30,000. The results of its 2017

(68,400)

uncollectible operations is a net income after tax of P 120,000.

Payables not

437,000

assumed by firm

Required

Cash contribution 105,000 212,000

1. Profit is divided equally

Fair value of

490,000 2. Profit is divided in the ratio of 3:1

building

Marketable 3. No agreement on profit distribution

475,000

securities

Net asset

contribution

905,200 595,000 687,000 2,187,200 1. Equally

James Howard

1. Roma as the base (687,000/25% = 2,748,000) 120,000*50% 60,000

Mikee Layla Roma 120,000*50% 60,000

Contributed capital 905,200 595,000 687,000 Share in profit 60,000 60,000

Agreed capital 1,099,200 961,800 687,000

Additional

194,000 961,800 0

investment

Pagatpat, Aischelle Mhae R.

e

2. Ratio of 3:1 Joseph

James Howard Beginning capital 300,000 * 12/12 300,000

120,000*3/4 90,000

May 31 50,000 * 8/12 33,333

120,000*1/4 30,000

Aug 1 35,000 * 5/12 (14,583)

Share in profit 60,000 60,000

Dec 1 30,000 * 1/12 2,500

Average capital 321,250

3. No agreement

James Howard

2. Profit Distribution

120,000*6/9 80,000

Ezekiel Joseph Total

120,000*3/9 40,000

Salary 50,000 50,000

Share in profit 60,000 60,000

Interest 55,500 32,125 87,625

ILLUSTRATION 2: Multiple Bases of Allocation Bonus 10,000 10,000

On January 1, 2021, partners Ezekiel and Joseph formed Meow Balance 20,950 31,425 52,375

Partnership with Ezekiel contributing P500,000 and Joseph contributing

Total 136,450 63,550 200,000

P300,000. Partnership realized a profit of P200,000 for the year 2021.

Below is the summary of additional investments and withdrawals from

partners during the year ▲ Accounting for Errors

• Counterbalancing errors – this error if on detected or corrected will

Ezekiel Additional Investment Withdrawal offset or correct them after two reporting period

Feb 1 60,000 - A correcting journal entry is necessary for any counterbalancing error

that is detected before it has counterbalanced

Mar 31 30,000

- If the error is discovered after it has counterbalanced, no correcting

Jul 1 50,000 journal entry is necessary, that the financial statements should be restated

so that they are not misleading

Nov 1 15,000

■ Effects of Common Counterbalancing Errors

Joseph Additional Investment Withdrawal

Type of adjustment Income (current year) Income (next year)

May 31 50,000

Ending inventory

Over Under

Aug 1 35,000 overstated

Dec 1 30,000 Ending inventory

Under Over

understated

Failure to accrue

Profit is distributed to the partners according to the following provisions: Over Under

expenses at year end

- Annual salary to Ezekiel, managing partner in the amount of P50,000 Overstatement of

- Interest of 10% each based on average capital balances accrued expenses at year Under Over

end

- Bonus to Ezekiel off 5% of net income before bonus and income tax

Failure to accrue earned

- Balance 4:6 revenue at year end

Under Over

Overstatement of

Required accrued revenue at year Over Under

1. Compute the average capital end

2. Distribute the profit to partners Failure to expense

Over Under

prepayments at year end

Understatement of year-

1. Average Capital Under Over

end prepaid expense

Understatement of year

2. Profit distribution end liabilities for

Over Under

revenues received in

Ezekiel advance

Beginning capital 500,000 *12/12 500,000 Overstatement of near

and liability for revenue Under Over

Feb 1 60,000 * 11/12 55,000 received in advance

Mar 31 30,000 * 9/12 (22,500)

Jul 1 50,000 * 6/12 25,000 • Non-counterbalancing errors – are areas that will not be automatically

offset in the next accounting period

Nov 1 15,000 * 2/12 (2,500)

- A correcting journal entry is necessary for a non-counterbalancing error

Average capital 555,000 and any applicable financial statements must be restated

Pagatpat, Aischelle Mhae R.

e

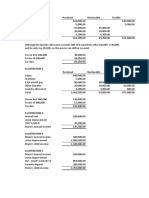

ILLUSTRATION 3: Correction of Errors

Teddy, Kyla and Poe are partners who share profits on a 5:3:2 ratio. For

the year 2019, the net income of the partnership was reported at P250,000.

However, it is discovered that the following items were omitted in the

partnership's books:

Unrecorded at year

2018 2019

end

Prepaid expense 16,000

Accrued expense 12,000

Unearned income 14,000

Accrued income 10,000

Required: Compute the correct net income for 2019

Reported net income, 2019 250,000

Prepaid expense (16,000)

Accrued expense (12,000)

Unearned income 14,000

Accrued income 10,000

Adjusted net income, 2019 246,000

Pagatpat, Aischelle Mhae R.

You might also like

- Law On Partnership and Corporation by Hector de LeonDocument113 pagesLaw On Partnership and Corporation by Hector de LeonShiela Marie Vics75% (12)

- Law On Sales - Villanueva 2009Document688 pagesLaw On Sales - Villanueva 2009Don Sumiog93% (27)

- Afar-01-Partnership Formation and OperationsDocument26 pagesAfar-01-Partnership Formation and OperationsRafael Renz DayaoNo ratings yet

- Atty. D RFBT Notes PDFDocument28 pagesAtty. D RFBT Notes PDFRowell Bunan arevalo67% (3)

- Bank of Nova Scotia Brand AnalysisDocument11 pagesBank of Nova Scotia Brand AnalysisAshik Paul0% (1)

- Case 1 AnswerDocument10 pagesCase 1 AnswerEdwin EspirituNo ratings yet

- AFAGroupConsolidation3 Lecture NotesDocument43 pagesAFAGroupConsolidation3 Lecture NotesRameen ShehzadNo ratings yet

- Adjusted Trial BalanceDocument4 pagesAdjusted Trial BalanceMonir HossainNo ratings yet

- Materi Lab 2 - Business CombinationDocument6 pagesMateri Lab 2 - Business Combination[Naz]wa BintangNo ratings yet

- Profit or Loss Pre and Post Incorporation: Learning ObjectivesDocument20 pagesProfit or Loss Pre and Post Incorporation: Learning Objectivesjsus22No ratings yet

- BF-2 Assignment 1Document8 pagesBF-2 Assignment 1sabya.rathoreNo ratings yet

- Understanding Financial StatementsDocument36 pagesUnderstanding Financial StatementsHarshita Rajput HarshuNo ratings yet

- Changes in A PartnershipDocument18 pagesChanges in A PartnershipHadi HarizNo ratings yet

- Cash Flow StatementDocument14 pagesCash Flow StatementMohd AtifNo ratings yet

- Idea Cash FlowDocument23 pagesIdea Cash FlowSurbhi GroverNo ratings yet

- Advacc NotesDocument11 pagesAdvacc Notesthirdyear83No ratings yet

- Intercorporate Investments 2019Document14 pagesIntercorporate Investments 2019Jähäñ ShërNo ratings yet

- Estimating Cash Flows PDFDocument34 pagesEstimating Cash Flows PDFAlisha SharmaNo ratings yet

- Damodaran - Estimating Cash FlowDocument36 pagesDamodaran - Estimating Cash FlowYến NhiNo ratings yet

- Finance For Non-FinanceDocument35 pagesFinance For Non-FinanceDr Sarbesh Mishra100% (5)

- MABALAZADocument4 pagesMABALAZAMahasa R HajiiNo ratings yet

- 03 Module ABM502Document9 pages03 Module ABM502Leodian Diadem MercurioNo ratings yet

- XFINMAN - Cash Flow AnalysisDocument17 pagesXFINMAN - Cash Flow AnalysisMae Justine Joy TajoneraNo ratings yet

- Payback AnalysisDocument14 pagesPayback Analysisrabbit_39No ratings yet

- Multiply PerformanceDocument7 pagesMultiply PerformanceAlanNo ratings yet

- Valutation by Damodaran Chapter 3Document36 pagesValutation by Damodaran Chapter 3akhil maheshwariNo ratings yet

- ConsolidationDocument2 pagesConsolidationssslll2No ratings yet

- ch3 Slides PostedDocument28 pagesch3 Slides Postedakshitnagpal9119No ratings yet

- Building Blocks To A General Journal Entry and T AccountDocument2 pagesBuilding Blocks To A General Journal Entry and T AccountChris AdoraNo ratings yet

- Accounting Tips and Practice Sheet SolutionsDocument2 pagesAccounting Tips and Practice Sheet SolutionsThe PsychoNo ratings yet

- Materi Lab 3 - Stock Investment PDFDocument4 pagesMateri Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Outline Taxation of PartnershipsDocument22 pagesOutline Taxation of PartnershipsHardeep ChauhanNo ratings yet

- ProblemDocument6 pagesProblemTina AntonyNo ratings yet

- Company ValuationDocument10 pagesCompany ValuationJia MakhijaNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildStory pizzieNo ratings yet

- Partnership AsDocument9 pagesPartnership AsSir YusufiNo ratings yet

- CH 05Document38 pagesCH 05Abdulelah AlhamayaniNo ratings yet

- Individual Assignment 2A - Aisyah Nuralam 29123362Document4 pagesIndividual Assignment 2A - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Partnership Formation and Capital AccountsDocument13 pagesPartnership Formation and Capital AccountsKristine BlancaNo ratings yet

- FM203Document11 pagesFM203Vinoth KumarNo ratings yet

- AFA (2021) - 02 - Consolidation Process and Intragroup TransactionsDocument68 pagesAFA (2021) - 02 - Consolidation Process and Intragroup Transactionsyu11111caoniNo ratings yet

- Topic 8 Wholly Owned SubsidiariesDocument20 pagesTopic 8 Wholly Owned SubsidiariesOlivia TheNo ratings yet

- Assg2 - Open UniversityDocument26 pagesAssg2 - Open UniversityAzrul MuhamedNo ratings yet

- Estimating Cash Flows with Aswath DamodaranDocument15 pagesEstimating Cash Flows with Aswath Damodaranthomas94josephNo ratings yet

- Session - Cash FlowsDocument42 pagesSession - Cash Flowsmohit rajputNo ratings yet

- RUE Hread TD: Ompany AckgroundDocument3 pagesRUE Hread TD: Ompany AckgroundAthulya SanthoshNo ratings yet

- Final Cia SubmissionDocument44 pagesFinal Cia SubmissionGarvit GuptaNo ratings yet

- Neon Associates, (Hrishikesh Bijoy Das) Limit-Rs.20.00 LacsDocument36 pagesNeon Associates, (Hrishikesh Bijoy Das) Limit-Rs.20.00 LacsAjoydeepNo ratings yet

- Edelweiss Q2FY20 Earnings UpdateDocument78 pagesEdelweiss Q2FY20 Earnings Updatebharath reddyNo ratings yet

- 7 - Adjusting EntriesDocument28 pages7 - Adjusting EntriesBianca RoswellNo ratings yet

- Company Accounts NotesDocument7 pagesCompany Accounts NotesAmonique DaveyNo ratings yet

- Key Terms and Chapter Summary-3Document3 pagesKey Terms and Chapter Summary-3AbhiNo ratings yet

- Statement of Cash Flows: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseDocument26 pagesStatement of Cash Flows: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseKGGGGNo ratings yet

- CDS Lec Entreprise CréationDocument33 pagesCDS Lec Entreprise CréationRazafitsialonina TsioryNo ratings yet

- Working Capital Management: Investment Decision Financing DecisionDocument41 pagesWorking Capital Management: Investment Decision Financing DecisionMazen SalahNo ratings yet

- Corporate Accounting I I FinalDocument82 pagesCorporate Accounting I I Finalthangarajbala123No ratings yet

- Tugas 1 Managementg Financial PT WIKADocument4 pagesTugas 1 Managementg Financial PT WIKAMohammad IrfanNo ratings yet

- Tugas 1 Managementg Financial PT WIKADocument4 pagesTugas 1 Managementg Financial PT WIKAMohammad IrfanNo ratings yet

- Manual of Accounting Policies (MAP) : Shareholders EquityDocument10 pagesManual of Accounting Policies (MAP) : Shareholders EquityMiruna RaduNo ratings yet

- Valuation: How Much Are Those Cash Flows Worth?Document47 pagesValuation: How Much Are Those Cash Flows Worth?DamTokyoNo ratings yet

- Assessing Dividend Policy: How Much Cash is Too MuchDocument37 pagesAssessing Dividend Policy: How Much Cash is Too MuchJinzhi FengNo ratings yet

- Valuation: How Much Are Those Cash Flows Worth?Document47 pagesValuation: How Much Are Those Cash Flows Worth?zezedascouvesNo ratings yet

- 2018 - Session11 - 12 FSA - PGP - SentDocument40 pages2018 - Session11 - 12 FSA - PGP - SentArty DrillNo ratings yet

- Dividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksFrom EverandDividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksNo ratings yet

- Bernie Madoff Dead at 82 Disgraced Investor Ran Biggest Ponzi Scheme in History - WSJDocument4 pagesBernie Madoff Dead at 82 Disgraced Investor Ran Biggest Ponzi Scheme in History - WSJElleNo ratings yet

- Bernie Madoff, Mastermind of Largest Ponzi Scheme in History, Dies at 82Document7 pagesBernie Madoff, Mastermind of Largest Ponzi Scheme in History, Dies at 82ElleNo ratings yet

- Bernie Madoff - Biography, Ponzi Scheme, & Facts - BritannicaDocument5 pagesBernie Madoff - Biography, Ponzi Scheme, & Facts - BritannicaElleNo ratings yet

- Bernie Madoff - Overview, History, and The Ponzi SchemeDocument7 pagesBernie Madoff - Overview, History, and The Ponzi SchemeElleNo ratings yet

- Bernie Madoff Dies - Mastermind of The Nation's Biggest Investment Fraud Was 82Document11 pagesBernie Madoff Dies - Mastermind of The Nation's Biggest Investment Fraud Was 82ElleNo ratings yet

- StratCost Quiz 2Document6 pagesStratCost Quiz 2ElleNo ratings yet

- Enron Scandal - The Fall of A Wall Street DarlingDocument11 pagesEnron Scandal - The Fall of A Wall Street DarlingElleNo ratings yet

- Enron Scandal - Summary, Explained, History, & Facts - BritannicaDocument4 pagesEnron Scandal - Summary, Explained, History, & Facts - BritannicaElleNo ratings yet

- SEC Was Charmed by Madoff and Failed To Act Quickly, Here's Why - FortuneDocument6 pagesSEC Was Charmed by Madoff and Failed To Act Quickly, Here's Why - FortuneElleNo ratings yet

- SCM Chapter 7Document2 pagesSCM Chapter 7ElleNo ratings yet

- StratCost Chapter 8Document13 pagesStratCost Chapter 8ElleNo ratings yet

- Chapter 8 (Differential Cost Analysis) : Pagatpat, Aischelle Mhae RDocument3 pagesChapter 8 (Differential Cost Analysis) : Pagatpat, Aischelle Mhae RElleNo ratings yet

- StratCost Chapter 5Document2 pagesStratCost Chapter 5ElleNo ratings yet

- StratCost Chapter 7Document1 pageStratCost Chapter 7ElleNo ratings yet

- InTax Quiz 3Document7 pagesInTax Quiz 3ElleNo ratings yet

- Unit Iii:: Income Tax ON CorporationsDocument35 pagesUnit Iii:: Income Tax ON CorporationsElleNo ratings yet

- InTax Quiz 1Document7 pagesInTax Quiz 1ElleNo ratings yet

- Special Tax Laws for Senior CitizensDocument33 pagesSpecial Tax Laws for Senior CitizensValerieNo ratings yet

- InTax Unit 2Document3 pagesInTax Unit 2ElleNo ratings yet

- InTax Unit 7Document1 pageInTax Unit 7ElleNo ratings yet

- Pagatpat, Aischelle Mhae RDocument4 pagesPagatpat, Aischelle Mhae RElleNo ratings yet

- InTax Unit 8 Fringe BenefitsDocument3 pagesInTax Unit 8 Fringe BenefitsElleNo ratings yet

- InTax Unit 2Document2 pagesInTax Unit 2ElleNo ratings yet

- InTax Unit 8Document3 pagesInTax Unit 8ElleNo ratings yet

- InTax Final Quiz (Unit 7-9)Document15 pagesInTax Final Quiz (Unit 7-9)ElleNo ratings yet

- Intellectual Property LawDocument11 pagesIntellectual Property LawaiswiftNo ratings yet

- Securities Regulations CodeDocument5 pagesSecurities Regulations Codeariane espirituNo ratings yet

- CMR ReportDocument2 pagesCMR ReportRajesh KUMAR JHANo ratings yet

- Soleto Vs SC (Sumitha S)Document2 pagesSoleto Vs SC (Sumitha S)MaChAnZzz OFFICIALNo ratings yet

- Dropship Suspend AppealDocument10 pagesDropship Suspend AppealenesahvalekinciNo ratings yet

- Bopp FilmsDocument4 pagesBopp FilmsHimanshuNo ratings yet

- Cutting and shaping equipment optimizationDocument9 pagesCutting and shaping equipment optimizationLuiz HenriqueNo ratings yet

- Larfarge-22 ArDocument302 pagesLarfarge-22 ArLou VreNo ratings yet

- The List of Adas and Their Respective Addresses, Telephone Numbers and Broker Codes Are As FollowsDocument22 pagesThe List of Adas and Their Respective Addresses, Telephone Numbers and Broker Codes Are As FollowsZakwan ZainalNo ratings yet

- Group - 2 - NBFC REPORTDocument13 pagesGroup - 2 - NBFC REPORTSheetalNo ratings yet

- Topic 11 - Open-Economy Macroeconomics - Basic Concepts.Document36 pagesTopic 11 - Open-Economy Macroeconomics - Basic Concepts.Trung Hai TrieuNo ratings yet

- Chapter 2 Exercises-TheMarketDocument7 pagesChapter 2 Exercises-TheMarketJan Maui VasquezNo ratings yet

- AFO+ +Mock+TestDocument12 pagesAFO+ +Mock+TestArrow NagNo ratings yet

- Sem II Transportation Economics N EvaluationDocument2 pagesSem II Transportation Economics N EvaluationDwijendra ChanumoluNo ratings yet

- The Impact of Stock Management On The Performance of Manufacturing Firms Case Study of Rwenzori Beverages (U) LTDDocument36 pagesThe Impact of Stock Management On The Performance of Manufacturing Firms Case Study of Rwenzori Beverages (U) LTDMAGOMU DAN DAVIDNo ratings yet

- Motilal Oswal Zomato IPO NoteDocument10 pagesMotilal Oswal Zomato IPO NoteKrishna GoyalNo ratings yet

- Ashok Leyland Balane SheetDocument2 pagesAshok Leyland Balane SheetNaresh Kumar NareshNo ratings yet

- Trading Questions AnsweredDocument22 pagesTrading Questions AnsweredShagudi Gutti100% (1)

- Humpuss Intermoda Transportasi TBK - Bilingual - 31 - Dec - 2018 - Released PDFDocument132 pagesHumpuss Intermoda Transportasi TBK - Bilingual - 31 - Dec - 2018 - Released PDFAyu Krisma YupitaNo ratings yet

- Final Accounts of Banking Company (Lecture 01Document8 pagesFinal Accounts of Banking Company (Lecture 01akash gautamNo ratings yet

- Mirjana Radović-Marković, Borislav Đukonović - Macroeconomics of Western Balkans in The Context of The Global Work and Business Environment-Information Age Publishing (2022)Document180 pagesMirjana Radović-Marković, Borislav Đukonović - Macroeconomics of Western Balkans in The Context of The Global Work and Business Environment-Information Age Publishing (2022)pakor79No ratings yet

- Jaya BlackBook Final1Document75 pagesJaya BlackBook Final1SauravNo ratings yet

- SE ContractDocument21 pagesSE Contractaugusta.mironNo ratings yet

- Best Performing Cities 2021Document75 pagesBest Performing Cities 2021Adam ForgieNo ratings yet

- Dwnload Full Essentials of Economics 10th Edition Schiller Solutions Manual PDFDocument20 pagesDwnload Full Essentials of Economics 10th Edition Schiller Solutions Manual PDFcryer.westing.44mwoe100% (10)

- Ridhi Gupta: Course Code: IBO-03Document13 pagesRidhi Gupta: Course Code: IBO-03ManuNo ratings yet

- Hocmai TOEIC 450 Word Formation PracticeDocument5 pagesHocmai TOEIC 450 Word Formation PracticeDụ ThụNo ratings yet

- JURNAL Anggrenita Aulia (1810412620008) - RevisiDocument11 pagesJURNAL Anggrenita Aulia (1810412620008) - Revisipengetikan normansyahNo ratings yet

- Liquidation of CompaniesDocument4 pagesLiquidation of CompanieshanumanthaiahgowdaNo ratings yet

- 2fa3 Group Project 1Document15 pages2fa3 Group Project 1api-588408469No ratings yet