Professional Documents

Culture Documents

Facts:: To Question The Action of Replevin, Petitioners May File Certiorari

Uploaded by

Dann MarrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Facts:: To Question The Action of Replevin, Petitioners May File Certiorari

Uploaded by

Dann MarrCopyright:

Available Formats

OCEJO, PEREZ & CO.

, plaintiffs-appellees,

vs. THE INTERNATIONAL BANKING CORPORATION, defendant-appellant.

FRANCISCO CHUA SECO, as assignee, intervener-appellant.

(c) Was the commencement of a replevin suit by the seller equivalent to the rescission of the sale?

FACTS: A few days after, the plaintiff firm took advantage of those provisions of the procedural law

which permit a plaintiff to replevin personal property. Subsequently, by agreement of the parties, the

sugar was sold and the proceeds of the sale deposited in the bank, subject to the order of the court

upon the final disposition of the case. After the answer of the defendant bank was filed, a complaint

in intervention was filed by Chua Seco, in which he asserts a preferential right to the sugar, or to the

proceeds of its sale, upon the ground that the delivery of the sugar by plaintiff, by virtue of which it

passed into the possession and control of Chua Teng Chong, had the effect of transmitting the title

of the pledge asserted by the bank was null and void. Upon these allegations the interveners

contends that the sugar is the property of the insolvent estate represented by him. The lower court

rendered judgment in favor of the plaintiff and from this decision appeals have been taken by the

bank and by the intervener.

In the brief filed on behalf of the bank it is argued that in no case may a revindicatory action be maintained when the plaintiff attempts to exercise the right to rescind the sale for nonpayment of

the purchase price and that therefore a replevin suit will not lie. But as it is held that the bank has no interest in this matter, as its alleged contract of pledge is utterly unavailing, it is evident that

the question of procedure does not affect it. It appears that by reason of the insolvency of the buyer Chua Teng Chong an insolvency proceeding was commenced in a court of competent

jurisdiction and in that proceeding Francisco Chua Seco was appointed assignee of the property of the insolvent. As such assignee Chua Seco filed a complaint in intervention in this suit, in

which he contends that by reason of its sale and delivery by plaintiff to the insolvent, title to the sugar passed to the latter and that the pledge set up by the bank is void as to third persons.

Standing in the place of the insolvent buyer, the assignee asks that he be recognized in his representative capacity as the owner of the sugar in question. The voluntary intervention of the

assignee of the insolvent buyer cures the defect of nonjoiner of the latter as a party defendant, and all parties in interest have been heard in this proceeding.

The judgment of the court below awards the plaintiff the product of the sale of the sugar, it having been so disposed of by agreement by the parties during the pendency of the suit. The

intervener excepted to the decision and joined in the bank's appeal. In his brief in this court the intervener raises a question as to the sufficiency of the complaint to support the decision of the

court below, adopting the argument of the bank upon this point. That is, assuming that by reason of the nonpayment of the purchase price, the seller is entitled to elect to rescind the sale, is the

rescission effected ipso facto by such election, or is it necessary for him to bring an action of rescission? The action of replevin, the intervener contends, is based (Code of Civil Procedure, sec.

263) upon the assumption that the plaintiff at the time of bringing the action is either the owner of the thing which is the subject matter of the suit or entitled to its possession. But the question

presented is whether, in cases in which title has passed by delivery and in which the buyer has failed to pay the purchased price on demand, title is revested in the seller by the mere fact that

he has mentally determined to elect to rescind? In its brief the plaintiff partnership contends for the affirmative, saying that the acts of the seller — the filing of its complaint — imply that it has

made the election. But the intervener, adopting the argument of the bank, contends that the party to whom article 1124 of the Civil Code grants the right to rescind "must apply to the court for

a decree for the rescission of the contract. . . ." (Scaevola, vol. 19, p. 673); and this conclusion is supported by the last paragraph of the article cited. Of course, if the action of the court is

necessary in order to effectuate the rescission of the sale, such rescission does not follow ipso jure by reason of nonpayment and the determination of the seller to elect to rescind.

Consequently, the action of replevin cannot be maintained. The right to rescind a sale, established by article 1506, in no wise differs from that which is established, in general terms, with

respect to reciprocal obligations, by article 1124 in "true event that one of the obligors fails to perform the obligation incumbent upon him." But the right so conferred is not an absolute one. The

same article provides that "the court shall decree the rescission demanded, unless there are causes which justify him in allowing a term."

Therefore, it is the judgment of the court and not the mere will of the plaintiff which produces the rescission of the sale. This being so, the action of replevin will no lie upon the theory that the

rescission has already taken place and that the seller has recovered title to the thing sold.

OSCAR C. FERNANDEZ and NENITA P. FERNANDEZ, petitioners,

vs. THE INTERNATIONAL CORPORATE BANK, now UNION BANK OF THE PHILIPPINES; and PREMIERE INSURANCE & SURETY CORP., respondents.

Why is jurisdiction based on the amount alleged in the claim

Assuming it was a foreclosure action, it would now be the amount of the fair market value would determine jurisdiction.

A petition for foreclosure of real estate mortgage is a real action and the assessed value of the property determines

jurisdiction while location of the property determines the venue.

Cause of action??? - subject matter: in a foreclosure action, cause of action is

What do you think of the real estate mortgage in relation to the loan? Replevin actions are typically initiated when a person serves papers showing why he or she has a claim

in the property -- in which case a sheriff seizes the property and delivers it to the person claiming rights to it until a hearing is held.

Pero delivery of money man ang gusto ni petitioner unta supposedly

When you file an action for foreclosure, it now becomes a real action so far as it is against the property, and seeks the judicial recognition of a property debt

To question the action of replevin, petitioners may file certiorari

Is it appropriate to assume Sir that the action for foreclosure is incapable of pecuniary

estimation

It is worthy to mention that the essence of a contract of mortgage indebtedness is that a property

has been identified or set apart from the mass of the property of the debtor-mortgagor as

security for the payment of money or the fulfillment of an obligation to answer the amount of

indebtedness, in case of default in payment.[4] Foreclosure is but a necessary

consequence of non-payment of the mortgage indebtedness.[5] In a real estate

mortgage when the principal obligation is not paid when due, the mortgagee has the right to

foreclose the mortgage and to have the property seized and sold with the view of applying the

proceeds to the payment of the obligation.[6] Therefore, the foreclosure suit is a real action so

far as it is against property, and seeks the judicial recognition of a property debt, and an order

for the sale of the res.[7]

A writ of replevin issued by the Metropolitan Trial Court of Pasay City may be served and enforced anywhere in the Philippines. Moreover, the jurisdiction of a court is determined by the amount

of the claim alleged in the complaint, not by the value of the chattel seized in ancillary proceedings.

Under the Resolution of the Supreme Court en banc dated January 11, 1983, providing for the interim rules and guidelines relative to the implementation of BP 129, a writ of replevin like the

one issued in the present case may be served anywhere in the Philippines. Specifically, the said Resolution states:

3. Writs and processes. —

(a) Writs of certiorari, prohibition, mandamus, quo, warranto, habeas corpus and injunction issued by a regional trial court may be enforced in any part of the

region.

(b) All other processes, whether issued by a regional trial court or a metropolitan trial court, municipal trial court or municipal circuit trial court may be served

anywhere in the Philippines, and, in the last three cases, without a certification by the judge of the regional trial court. 10

Thus, the Writ of Replevin issued by Judge Paas, which obviously does not fall under item "a" of the above-cited Rule, may be validly enforced anywhere in the Philippines. Petitioners confused

the jurisdiction of a court to hear and decide a case on the one hand with, on the other, its power to issue writs and processes pursuant to and in the exercise of said jurisdiction. Applying the

said Rule, Malaloan v. Court of Appeals reiterated the foregoing distinction between the jurisdiction of the trial court and the administrative area in which it could enforce its orders and

11

processes pursuant to the jurisdiction conferred on it:

We feel that the foregoing provision is too clear to be further belabored or enmeshed in unwarranted polemics. The rule enumerates the writs and processes

which, even if issued by a regional trial court, are enforceable only within its judicial region. In contrast, it unqualifiedly provides that all other writs and processes,

regardless of which court issued the same, shall be enforceable anywhere in the Philippines. No legal provision, statutory or reglementary, expressly or impliedly

provides a jurisdictional or territorial limit [to] its area of enforceability. On the contrary, the above-quoted provision of the interim Rules expressly authorizes its

enforcement anywhere in the country, since it is not among the processes specified in paragraph (a) and there is no distinction or exception made regarding the

processes contemplated in paragraph (b).

https://www.projectjurisprudence.com/2020/02/foreclosure-real-action-or-incapable-of-

pecuniary-estimation.html

You might also like

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- JOSEPHE v. JEBEILEDocument5 pagesJOSEPHE v. JEBEILEJunior AsamoahNo ratings yet

- 1st Assigned CasesDocument19 pages1st Assigned CasesRegine LangrioNo ratings yet

- Civil Procedure CasesDocument4 pagesCivil Procedure CasesLois DNo ratings yet

- 4 RCBC Vs Royal CargoDocument12 pages4 RCBC Vs Royal CargoDiana QuemeristaNo ratings yet

- Bpi vs. Yujuico (2015)Document3 pagesBpi vs. Yujuico (2015)XyraKrezelGajeteNo ratings yet

- Republic of The PhilippinesDocument30 pagesRepublic of The PhilippinesKathlene JaoNo ratings yet

- Leung Vs O'brienDocument13 pagesLeung Vs O'brienRachelle DomingoNo ratings yet

- Oblicon Cases 1Document148 pagesOblicon Cases 1Migz DimayacyacNo ratings yet

- Case DigestDocument21 pagesCase DigestAlan MakasiarNo ratings yet

- Cases Part 2Document8 pagesCases Part 2pa.sandiegoNo ratings yet

- Cash Bond Case 1Document8 pagesCash Bond Case 1Melody Sandagon CruzNo ratings yet

- Art. 1175-1230Document43 pagesArt. 1175-1230Nhordiza BayotNo ratings yet

- Cases ObliDocument18 pagesCases Oblimaria elisha intingNo ratings yet

- RCBC vs. MagwinDocument2 pagesRCBC vs. MagwinTheodore0176No ratings yet

- Leung Ben vs. Obrien - FULL TEXTDocument7 pagesLeung Ben vs. Obrien - FULL TEXTJan neNo ratings yet

- Sulit Vs CaDocument3 pagesSulit Vs CaSamantha BrownNo ratings yet

- A Money Claim Against An Estate Is More Akin To A Motion For CreditorsDocument10 pagesA Money Claim Against An Estate Is More Akin To A Motion For CreditorsNonoy D VolosoNo ratings yet

- Jose v. Javellana, G.R. No. 158239, January 25, 2012Document3 pagesJose v. Javellana, G.R. No. 158239, January 25, 2012Allyza RamirezNo ratings yet

- Lazo v. Republic Surety, GR No. L-27365 - Jan. 30, 1970Document3 pagesLazo v. Republic Surety, GR No. L-27365 - Jan. 30, 1970RENGIE GALONo ratings yet

- 57-61 Prov RemDocument3 pages57-61 Prov RemCeresjudicataNo ratings yet

- Home Bankers V CADocument3 pagesHome Bankers V CAKiana AbellaNo ratings yet

- Brillantes Vs CastroDocument4 pagesBrillantes Vs CastroChristian RiveraNo ratings yet

- Occena Law Office For Petitioners. Serrano, Diokno & Serrano For RespondentsDocument2 pagesOccena Law Office For Petitioners. Serrano, Diokno & Serrano For RespondentsJotmu SolisNo ratings yet

- Rule 57 AssignmentDocument4 pagesRule 57 AssignmentKathleen DilagNo ratings yet

- Philippine National Bank VsDocument70 pagesPhilippine National Bank VsJacques Andre Collantes BeaNo ratings yet

- Tijam v. Sibonghanoy G.R. No. L-21450 April 15, 1968 Estoppel by LachesDocument5 pagesTijam v. Sibonghanoy G.R. No. L-21450 April 15, 1968 Estoppel by LachesethNo ratings yet

- Mugoya Kyawa Guster V Global Trust Bank LTD Anor (Miscellaneous Application No 2262 of 2013) 2014 UGHCEBD 10 (8 July 2014)Document6 pagesMugoya Kyawa Guster V Global Trust Bank LTD Anor (Miscellaneous Application No 2262 of 2013) 2014 UGHCEBD 10 (8 July 2014)samurai.stewart.hamiltonNo ratings yet

- Civ Pro ReviewerDocument141 pagesCiv Pro ReviewerDr MailmanNo ratings yet

- Orca Share Media1515825631865Document142 pagesOrca Share Media1515825631865Alma PadrigoNo ratings yet

- Radiowealth Finance Company, Inc., vs. Pineda G.R. No. 227147, July 30, 2018 FactsDocument2 pagesRadiowealth Finance Company, Inc., vs. Pineda G.R. No. 227147, July 30, 2018 FactsChristine Rose Bonilla LikiganNo ratings yet

- G.R. No. 173979 February 12, 2007 AUCTION IN MALINTA, INC., Petitioner, WARREN EMBES LUYABEN, RespondentDocument4 pagesG.R. No. 173979 February 12, 2007 AUCTION IN MALINTA, INC., Petitioner, WARREN EMBES LUYABEN, RespondentAlfred DanezNo ratings yet

- US Vs Kilayko DigestDocument5 pagesUS Vs Kilayko DigestFelix Gabriel BalaniNo ratings yet

- DEVELOPMENT BANK OF THE PHILIPPINES-versus - GUARIÑA AGRICULTURAL AND REALTY DEVELOPMENT CORPORATIONDocument2 pagesDEVELOPMENT BANK OF THE PHILIPPINES-versus - GUARIÑA AGRICULTURAL AND REALTY DEVELOPMENT CORPORATIONRochelle GablinesNo ratings yet

- Leung Ben Vs O'BrienDocument11 pagesLeung Ben Vs O'BrienJennifer Corpuz- GinesNo ratings yet

- 3rd Handwritten AssignmentDocument3 pages3rd Handwritten AssignmentowenNo ratings yet

- Patente Vs OmegaDocument4 pagesPatente Vs Omegaalchupot0% (1)

- Chpter 4 Cases StatconDocument114 pagesChpter 4 Cases StatconMark Jason Crece AnteNo ratings yet

- 1 Granting Private Respondent's Motion For Execution PendingDocument8 pages1 Granting Private Respondent's Motion For Execution PendingAlyssa Clarizze MalaluanNo ratings yet

- Radiowealth Finance Company, Inc. vs. Pineda, JR PDFDocument7 pagesRadiowealth Finance Company, Inc. vs. Pineda, JR PDFEmir MendozaNo ratings yet

- Stat Con Full TextDocument56 pagesStat Con Full TextAnonymous fL9dwyfekNo ratings yet

- Co Tiamco Vs Diaz DigestDocument2 pagesCo Tiamco Vs Diaz DigestVienna Mantiza - Portillano100% (1)

- Jesus M. Aguas For Petitioner. The Solicitor General For RespondentsDocument50 pagesJesus M. Aguas For Petitioner. The Solicitor General For Respondentslou017No ratings yet

- GHGFHGFDocument4 pagesGHGFHGFAngelo Igharas InfanteNo ratings yet

- Fels Energy Vs Province of BatangasDocument4 pagesFels Energy Vs Province of BatangasRaymond RoqueNo ratings yet

- El Banco EspañolDocument14 pagesEl Banco EspañolVince FajardoNo ratings yet

- Abacus v. AmpilDocument11 pagesAbacus v. AmpilNylaNo ratings yet

- Civil Procedure DigestsDocument5 pagesCivil Procedure DigestsJozele DalupangNo ratings yet

- Conflict Case Digest - El Banco Espanol v. PalancaDocument2 pagesConflict Case Digest - El Banco Espanol v. PalancaJimboy Fernandez100% (5)

- 2008 Lecture Notes On Civil ProcedureDocument223 pages2008 Lecture Notes On Civil ProcedureJohanna ArnaezNo ratings yet

- Bpi v. Hon. HontanosasDocument21 pagesBpi v. Hon. HontanosasDanielle AngelaNo ratings yet

- G.R. No. L-8933 February 28, 1957 SILVERIO UMBAO, Plaintiff-Appellee, vs. SANTIAGO YAP, Defendant-Appellant. Bengzon, J.Document17 pagesG.R. No. L-8933 February 28, 1957 SILVERIO UMBAO, Plaintiff-Appellee, vs. SANTIAGO YAP, Defendant-Appellant. Bengzon, J.8600431No ratings yet

- BarrorosoDocument5 pagesBarrorosoDaphnne SantosNo ratings yet

- Boston Equity Resources, Inc. v. CA, G.R. No. 173946, June 19, 2013Document4 pagesBoston Equity Resources, Inc. v. CA, G.R. No. 173946, June 19, 2013PASAY cityjailmdNo ratings yet

- Mendoza, J.:: Appeals, We HeldDocument9 pagesMendoza, J.:: Appeals, We HeldSK Fairview Barangay BaguioNo ratings yet

- NVMDocument55 pagesNVMMarla OcampoNo ratings yet

- CD Phil British Assurance Corp vs. IACDocument1 pageCD Phil British Assurance Corp vs. IACAP CruzNo ratings yet

- Rule 88Document42 pagesRule 88Therese JavierNo ratings yet

- Case Digest ExecutionDocument11 pagesCase Digest ExecutionGlyza Kaye Zorilla PatiagNo ratings yet

- Yap Vs CADocument3 pagesYap Vs CAMichael JovankiiNo ratings yet

- Asturias Disiplina Muna 1q2021 Annex B 4.14.2021Document1 pageAsturias Disiplina Muna 1q2021 Annex B 4.14.2021Dann MarrNo ratings yet

- DFBHFDBDGDocument8 pagesDFBHFDBDGDann MarrNo ratings yet

- Finals: Avr-Case Tracker Assigned Cases in Labor (Avr)Document67 pagesFinals: Avr-Case Tracker Assigned Cases in Labor (Avr)Dann MarrNo ratings yet

- Implementation of The Supreme Court Decision in The Mandanas CaseDocument29 pagesImplementation of The Supreme Court Decision in The Mandanas CaseDann MarrNo ratings yet

- Peace and Order and Public Safety (Pops) Plan 2020 - 2022Document4 pagesPeace and Order and Public Safety (Pops) Plan 2020 - 2022Dann MarrNo ratings yet

- Department of The Interior and Local Government Agrarian Reform Beneficiaries' Organizations (Arbos) Monthly ReportDocument2 pagesDepartment of The Interior and Local Government Agrarian Reform Beneficiaries' Organizations (Arbos) Monthly ReportDann MarrNo ratings yet

- Special Proceedings Case Digests - AVRDocument87 pagesSpecial Proceedings Case Digests - AVRDann MarrNo ratings yet

- Badac Functionality Assessment Pointing System & Mode of Verifications (Movs)Document115 pagesBadac Functionality Assessment Pointing System & Mode of Verifications (Movs)Dann MarrNo ratings yet

- Peace and Order and Public Safety (Pops) Plan 2020 - 2022 Municipality of Asturias, Cebu POPS Plan SummaryDocument4 pagesPeace and Order and Public Safety (Pops) Plan 2020 - 2022 Municipality of Asturias, Cebu POPS Plan SummaryDann MarrNo ratings yet

- DGDFBDocument4 pagesDGDFBDann MarrNo ratings yet

- 10 Monthly Report On Road Clearing OperationsDocument1 page10 Monthly Report On Road Clearing OperationsDann Marr100% (2)

- Report Requirements Cluster Deadline RemarksDocument3 pagesReport Requirements Cluster Deadline RemarksDann MarrNo ratings yet

- Office Memorandum 2021-01 Annex D1Document2 pagesOffice Memorandum 2021-01 Annex D1Dann MarrNo ratings yet

- Integrated Planning Process With Local Special Bodies and Advisory CouncilsDocument3 pagesIntegrated Planning Process With Local Special Bodies and Advisory CouncilsDann Marr100% (1)

- Certificate of Participation: Rojhelou J. Patac Porferio Q. Goc-OngDocument1 pageCertificate of Participation: Rojhelou J. Patac Porferio Q. Goc-OngDann MarrNo ratings yet

- Asturias - SK Utilization Report 2021Document13 pagesAsturias - SK Utilization Report 2021Dann MarrNo ratings yet

- Monitoring of Lgus On The Management of Covid-19 Related Health Care WastesDocument3 pagesMonitoring of Lgus On The Management of Covid-19 Related Health Care WastesDann MarrNo ratings yet

- Leocadio T. Trovela, Ceso Iv: Cebu Extension OfficeDocument1 pageLeocadio T. Trovela, Ceso Iv: Cebu Extension OfficeDann MarrNo ratings yet

- GHFGNHGDocument374 pagesGHFGNHGDann MarrNo ratings yet

- MC 2019-114 Dated July 18, 2019.: Conduct of Ela Formulation WorkshopDocument13 pagesMC 2019-114 Dated July 18, 2019.: Conduct of Ela Formulation WorkshopDann MarrNo ratings yet

- Office Performance Commitment and Review (Opcr) : Use 5 Decimals (If Any) - Do Not Round OffDocument13 pagesOffice Performance Commitment and Review (Opcr) : Use 5 Decimals (If Any) - Do Not Round OffDann MarrNo ratings yet

- BADAC FORM - Activity ReportDocument2 pagesBADAC FORM - Activity ReportDann MarrNo ratings yet

- SGLG Act IrrDocument17 pagesSGLG Act IrrDann MarrNo ratings yet

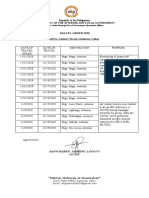

- Travel Order 2020: Republic of The Philippines Department of The Interior and Local GovernmentDocument1 pageTravel Order 2020: Republic of The Philippines Department of The Interior and Local GovernmentDann MarrNo ratings yet

- Civil Society Organization (Cso) Conference: August 7, 2019 SB Session HallDocument21 pagesCivil Society Organization (Cso) Conference: August 7, 2019 SB Session HallDann MarrNo ratings yet

- Flag Adinistration Contact ListDocument26 pagesFlag Adinistration Contact ListMuhammad Rizki AsharNo ratings yet

- Social Determinants of Health Concept Tool Kit 4Document31 pagesSocial Determinants of Health Concept Tool Kit 4bromberg.alexaNo ratings yet

- 208 S. Akard Street SUİTE 2954 Dallas Texas TX 75202 0800-288-2020Document1 page208 S. Akard Street SUİTE 2954 Dallas Texas TX 75202 0800-288-2020elise starkNo ratings yet

- Agent Causation and Agential ControlDocument309 pagesAgent Causation and Agential Controlorj78No ratings yet

- Rem2 Finals 6 23 21Document3 pagesRem2 Finals 6 23 21Austin Viel Lagman MedinaNo ratings yet

- A Glossary of Kumarajiva's Translation of The Lotus SutraDocument580 pagesA Glossary of Kumarajiva's Translation of The Lotus SutraSammacittaNo ratings yet

- US Vs Reyes Case DigestDocument2 pagesUS Vs Reyes Case DigestSarah BuendiaNo ratings yet

- LO - Franchise Cockpit Arena (Salcedo)Document2 pagesLO - Franchise Cockpit Arena (Salcedo)Riel Villalon100% (1)

- Mangonon vs. DelgadoDocument2 pagesMangonon vs. DelgadoBea Patricia Cutor100% (1)

- 4011-COR-ABE-GEE-XXX - FFS in Administration &non-Process BuildingsDocument2 pages4011-COR-ABE-GEE-XXX - FFS in Administration &non-Process BuildingsAnonymous J2B1utLYnNo ratings yet

- Theopoetics Is The RageDocument9 pagesTheopoetics Is The Rageblackpetal1No ratings yet

- Regalado - Civil Procedure CompendiumDocument922 pagesRegalado - Civil Procedure CompendiumJennylyn F. Magdadaro100% (4)

- Effect of Independence, Professionalism, Professional Skepticism and Time Budget Pressure On Audit Quality With Moral Reasoning As Moderation VariablesDocument13 pagesEffect of Independence, Professionalism, Professional Skepticism and Time Budget Pressure On Audit Quality With Moral Reasoning As Moderation VariablesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Finger of GodDocument6 pagesThe Finger of GodFapo TundeNo ratings yet

- We'll Begin With The 24 Most Common German Adverbs and Then List The Most Common and Useful Ones by TypeDocument9 pagesWe'll Begin With The 24 Most Common German Adverbs and Then List The Most Common and Useful Ones by TypeIsmaNo ratings yet

- Agency Program Coordinator GuideDocument42 pagesAgency Program Coordinator Guidenate mcgradyNo ratings yet

- Act 163 Extra Territorial Offences Act 1976Document8 pagesAct 163 Extra Territorial Offences Act 1976Adam Haida & CoNo ratings yet

- 2020 Republican Primary NeedhamDocument3 pages2020 Republican Primary NeedhamTrevor BallantyneNo ratings yet

- Gopher CEO Open Letter To Tampa Bay CommunityDocument2 pagesGopher CEO Open Letter To Tampa Bay CommunityPeter SchorschNo ratings yet

- Cha v. CA 277 SCRA 690Document4 pagesCha v. CA 277 SCRA 690Justine UyNo ratings yet

- G.P.F Proforma NewDocument2 pagesG.P.F Proforma NewSarah Harrison100% (1)

- 16 March 2015 Damac Real Estate Development Limited Annual Report 2014 English PDFDocument54 pages16 March 2015 Damac Real Estate Development Limited Annual Report 2014 English PDFAnonymous KnzY4UIO100% (1)

- Rules of Phonology 1Document21 pagesRules of Phonology 1aqilah atiqah100% (1)

- GovernpreneurshipDocument10 pagesGovernpreneurshipDr-Mohammed FaridNo ratings yet

- Brief Document - CYDEEDocument11 pagesBrief Document - CYDEEChandra KumarNo ratings yet

- Foreign Policy of Pakistan - Docx-627546669Document4 pagesForeign Policy of Pakistan - Docx-627546669AqibJaved50% (2)

- Construction Procurement HandbookDocument178 pagesConstruction Procurement HandbookClement OnwordiNo ratings yet

- MCN201 Sustainable Engineering, December 2021 PDFDocument2 pagesMCN201 Sustainable Engineering, December 2021 PDFhihihiNo ratings yet

- Risk Return Analysis of InvestmentDocument3 pagesRisk Return Analysis of InvestmentAnju PrakashNo ratings yet