Professional Documents

Culture Documents

Investment Calculator - SmartAsset

Uploaded by

SulemanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Calculator - SmartAsset

Uploaded by

SulemanCopyright:

Available Formats

HOME BUYING TAXES RETIREMENT BANKING CREDIT CARDS INVESTING SMARTREADS MORE

Investment Calculator

SHARE

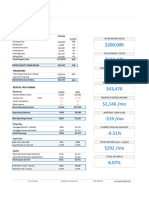

Starting Amount: Additional Contribution Rate of Return: Years to Grow: MORE FROM SMARTASSET

$ 50,000 $0 Annually 10.00 % 5

How much will your 401k be worth?

How much house can you a ord?

This investment will be worth: $80,526

Compare online brokerage accounts

Investment Growth Over Time Investment Balance at Year 2025 Align your asset allocation based on

your risk tolerance

$100k

$80k

$60k

MORE ABOUT THIS PAGE

$40k

About this answer

$20k Starting Amount $50,000

Total Contributions $0 How do we calculate this answer

$0 Total Interest Earned $30,526

2021 2022 2023 2024 2025 Learn more about investing

Infographic: Places with the most

incoming investments

Starting Annual Total Interest Total Interest End

Year

Amount Contribution Contributions Earned Earned Balance

2021 $50,000 $0 $0 $5,000 $5,000 $55,000

2022 $50,000 $0 $0 $5,500 $10,500 $60,500

2023 $50,000 $0 $0 $6,050 $16,550 $66,550

2024 $50,000 $0 $0 $6,655 $23,205 $73,205

2025 $50,000 $0 $0 $7,321 $30,526 $80,526

About This Answer

Our investment calculator tool shows how much the money you invest will grow over time. We use a xed rate of return. To

better personalize the results, you can make additional contributions beyond the initial balance. You choose how often you plan

to contribute (weekly, bi-weekly, monthly, semi-annually and annually) in order to see how those contributions impact how much

and how fast your money grows. When we make our calculations, we also factor in compounding interest, showing how the

interest you earn can then earn interest of its own.

Our Assumptions

Our Investing Expert

Save more with these rates that beat the National Average

SAVINGS & MMA CD'S

Unfortunately, we are currently unable to nd savings account that t your criteria. Please

change your search criteria and try again.

How likely is it that you would recommend this tool to 0 1 2 3 4 5 6 7 8 9 10

a friend or colleague?

Not at all likely Extremely likely

Investment Calculator

Whether you're considering getting started with investing or you're

already a seasoned investor, an investment calculator can help you gure

out how to meet your goals. It can show you how your initial investment,

frequency of contributions and risk tolerance can all a ect how your

money grows.

We'll walk you through the basics of investing, tell you about di erent risks

and considerations and then turn you loose. Ready to put your money to

Photo credit: © iStock/samxmeg work?

A nancial advisor can help you manage your investment portfolio. To nd a nancial advisor near you, try our free online

matching tool, or call 1-888-217-4199.

What Investing Does

Investing lets you take money you're not spending and put it to work for you. Money you invest in stocks and bonds can help

companies or governments grow, and in the meantime it will earn you compound interest. With time, compound interest takes

modest savings and turns them into serious nest eggs - so long as you avoid some investing mistakes.

You don't necessarily have to research individual companies and buy and sell stocks on your own to become an investor. In

fact, research shows this approach is unlikely to earn you consistent returns. The average investor who doesn't have a lot of

time to devote to nancial management can probably get away with a few low-fee index funds.

Risk and Returns

The closer you are to retirement, the more vulnerable you are to dips in

your investment portfolio. So what's an in investor to do? Conventional

wisdom says older investors who are getting closer to retirement should

reduce their exposure to risk by shifting some of their investments from

stocks to bonds.

In investing, there's generally a trade-o between risk and return. The

investments with higher potential for return also have higher potential for

Photo credit: © iStock/Linda Hides risk. The safe-and-sound investments sometimes barely beat in ation, if

they do at all. Finding the asset allocation balance that's right for you will

depend on your age and your risk tolerance.

Starting Balance

Say you have some money you've already saved up, you just got a bonus from work or you received money as a gift or

inheritance. That sum could become your investing principal. Your principal, or starting balance, is your jumping-o point for

the purposes of investing. Most brokerage rms that o er mutual funds and index funds require a starting balance of $1,000.

You can buy individual equities and bonds with less than that, though.

Contributions

Once you've invested that initial sum, you'll likely want to keep adding to it. Extreme savers may want to make drastic cutbacks

in their budgets so they can contribute as much as possible. Casual savers may decide on a lower amount to contribute. The

amount you regularly add to your investments is called your contribution.

You can also choose how frequently you want to contribute. This is where things get interesting. Some people have their

investments automatically deducted from their income. Depending on your pay schedule, that could mean monthly or biweekly

contributions (if you get paid every other week). A lot of us, though, only manage to contribute to our investments once a year.

Rate of Return

When you've decided on your starting balance, contribution amount and

contribution frequency, your putting your money in the hands of the

market. So how do you know what rate of return you'll earn? Well, the

SmartAsset investment calculator default is 4%. This may seem low to you

if you've read that the stock market averages much higher returns over

the course of decades.

Let us explain. When we gure rates of return for our calculators, we're

Photo credit: © iStock/kutaytanir assuming you'll have an asset allocation that includes some stocks, some

bonds and some cash. Those investments have varying rates of return,

and experience ups and downs over time. It's always better to use a conservative estimated rate of return so you don't under-

save.

Sure, you could count on a 10% rate of return if you want to feel great about your future nancial security, but you likely won't

be getting an accurate picture of your investing potential. That, my friend, would lead to undersaving. Undersaving often leads

to a future that's nancially insecure.

Years to Accumulate

The last factor to consider is your investment time frame. Consider the number of years you expect will elapse before you tap

into your investments. The longer you have to invest, the more time you have to take advantage of the power of compound

interest. That's why it's so important to start investing at the beginning of your career, rather than waiting until you're older. You

may think of investing as something only old, rich people do, but it's not. Remember that most mutual funds have a minimum

initial investment of just $1,000?

Bottom Line

It’s a good idea not to wait to start putting your money to work for you. And remember that your investment performance will

be better when you choose low-fee investments. You don't want to be giving up an unreasonable chunk of money to fund

managers when that money could be growing for you. Sure, investing has risks, but not investing is riskier for anyone who

wants to accrue retirement savings and beat in ation.

Places With the Most Incoming Investments Show 2019

SmartAsset’s interactive investing map highlights the places across the country that have the most incoming investments. Zoom

between states and the national map to see the places in the country with the highest investment activity. SHARE

MORE ABOUT THIS MAP

Incoming Investment Business Growth GDP Growth New Building Permits Federal Funding

View the data behind these rankings

How do we calculate these rankings

Interactive: Investment Calculator

MORE FROM SMARTASSET

How much will your 401k be worth?

How much house can you a ord?

Compare online brokerage accounts

Align your asset allocation based on

your risk tolerance

Map data ©2021 Google, INEGI Terms of Use

LEAST MOST

Rank County Business Growth GDP Growth ($ in New Building Federal Funding Incoming

millions) Permits (per (per capita) Investment Index

1,000 homes)

1 Comal, TX 12.4% $624 57.4 $422 100.00

2 Los Angeles, CA 6.4% $77,903 6.1 $1,254 99.25

3 Washington, UT 14.3% $885 47.0 $830 91.46

4 Rockwall, TX 11.6% $378 50.0 $485 91.44

5 Hays, TX 13.8% $724 44.5 $618 88.23

6 Collin, TX 13.6% $4,062 40.6 $1,152 86.68

7 Saint Johns, FL 14.2% $876 42.0 $295 86.13

8 Utah, UT 13.0% $2,371 41.6 $201 85.67

9 Wasatch, UT 13.9% $170 41.1 $188 84.40

10 Gadsden, FL 3.8% $96 50.0 $4 83.90

Nationwide 0.8% $380 5.8 $651

Methodology

There are several ways individuals, governments and businesses can invest money in a county or region. Our study aims to capture

the places across the country that are receiving the most incoming investments in business, real estate, government and the local

economy as a whole. To do this we looked at four factors: business establishment growth, GDP growth, new building permits and

federal funding.

We looked at the change in the number of businesses established in each location over a 3-year period. This shows whether or not

people are starting new business ventures in the county.

The second factor we looked at was the GDP growth. We used real growth (in ation adjusted) in the local economy.

We also looked at investment and development in the local residential real estate market. To measure this real estate growth, we

calculated the number of new building permits per 1,000 homes.

The nal factor we considered was federal funding received by each county. We found federal funding in the form of contracts

awarded to businesses in each county, which we divided by the population. This gave us a per capita look at the ow of investment

from the federal to the local level.

We scored every county in our study on these four factors. We then combined those scores to create a nal ranking of cities. With that

ranking, we created an index where the county with the most incoming investments was assigned a value of 100 and the county with

the least investment activity received a zero.

Sources: US Census Bureau 2017 American Community Survey, U.S. Bureau Economic Analysis, U.S. Census Bureau Building Permits Survey, USAspending.gov

GET IN TOUCH SMARTASSET GET SOCIAL LEGAL STUFF

Contact About Like on Facebook Terms of Service

Careers SmartReads Follow on Twitter Privacy Policy

Unsubscribe Captivate AdChoices

SmartAdvisor GLB Notice

Press Online Tracking Opt-Out Guide

SmartAdvisorMatch

Smartly made in NYC © 2021 SmartAsset, all rights reserved.

You might also like

- DCF Modeling Examplye Deal Gallagher MohanDocument16 pagesDCF Modeling Examplye Deal Gallagher Mohansuraj k33% (3)

- Group Week 7 Math108x Document W03groupassignment 2Document23 pagesGroup Week 7 Math108x Document W03groupassignment 2api-532525221100% (1)

- English HKSI LE Paper 9 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 9 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- Loan Agreement TemplateDocument3 pagesLoan Agreement TemplateWilma PereñaNo ratings yet

- 11 Examples of A Feasibility StudyDocument1 page11 Examples of A Feasibility StudySulemanNo ratings yet

- 2020 Financial ReportDocument12 pages2020 Financial ReportRodrigo GarretonNo ratings yet

- Project A: Question 1 AnswerDocument6 pagesProject A: Question 1 AnswerShafiqUr RehmanNo ratings yet

- Extra Payment CalculatorDocument12 pagesExtra Payment CalculatorZafar AhmedNo ratings yet

- Wholesale Banking PresentationDocument22 pagesWholesale Banking PresentationAlezNgNo ratings yet

- WPC Assignment - FM CaseDocument6 pagesWPC Assignment - FM CaseAhmed AliNo ratings yet

- NIKE Inc ReportDocument4 pagesNIKE Inc Reportdeepal patilNo ratings yet

- RMK Akl Hal 544-549Document5 pagesRMK Akl Hal 544-549Dizzy nindyaNo ratings yet

- Conny & Co II V6 - ShortDocument32 pagesConny & Co II V6 - ShortRandalNo ratings yet

- Buford Electronics - SolutionDocument5 pagesBuford Electronics - SolutionGracePameeNo ratings yet

- Act 6 Administracion FiancieraDocument6 pagesAct 6 Administracion FiancieraSantiago CardozoNo ratings yet

- Sample Financial PortfolioFIM06Document12 pagesSample Financial PortfolioFIM06Clarissa Ann Cruz RobertoNo ratings yet

- Rate Buydown FlyerDocument1 pageRate Buydown FlyerKen CaianiNo ratings yet

- Domain - 2 - Financial Metrics - Question - EVM - KPIsDocument11 pagesDomain - 2 - Financial Metrics - Question - EVM - KPIsducthanghnaNo ratings yet

- Mohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingDocument7 pagesMohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingMohsin HassanNo ratings yet

- 2021 22 PFS Fee Waiver GuidelinesDocument3 pages2021 22 PFS Fee Waiver GuidelinesOkNo ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- Financial Worksheet Master File 3Document13 pagesFinancial Worksheet Master File 3Alex Rafael Lleva AngelNo ratings yet

- 401k CalculatorDocument6 pages401k Calculatortrungtinh1506No ratings yet

- Medfield Pharma CaseDocument7 pagesMedfield Pharma CaseRahul KumarNo ratings yet

- Accounting Principles Assignment on Depreciation and Allowance for Doubtful AccountsDocument7 pagesAccounting Principles Assignment on Depreciation and Allowance for Doubtful AccountsMohsin HassanNo ratings yet

- SP Immigration Services Financial PlanDocument24 pagesSP Immigration Services Financial Planmalik_saleem_akbarNo ratings yet

- Tugas 3 - 27190096 - Liussetiawan AndyDocument5 pagesTugas 3 - 27190096 - Liussetiawan AndyLiussetiawan AndyNo ratings yet

- Case 2Document7 pagesCase 2Armin SibrianNo ratings yet

- M3. CAPEX Appraisal Answer 8.4.19Document24 pagesM3. CAPEX Appraisal Answer 8.4.19hanis nabilaNo ratings yet

- Financial DecisionDocument5 pagesFinancial DecisionJoshua MahNo ratings yet

- The Good StewardDocument14 pagesThe Good StewardRibhararnus PracutiarNo ratings yet

- FIRE EstimatorDocument10 pagesFIRE EstimatorJared PerezNo ratings yet

- Mp1936091e Understanding Your Personal Rate of ReturnDocument2 pagesMp1936091e Understanding Your Personal Rate of ReturnNiger RomeNo ratings yet

- Wise Portfolio IdeasDocument29 pagesWise Portfolio Ideasarpittripathi.bhilwaraNo ratings yet

- Best Inflation Calculator (2021) - Historical & Future ValueDocument1 pageBest Inflation Calculator (2021) - Historical & Future ValueSulemanNo ratings yet

- WBS T C S Description Budget StartDocument14 pagesWBS T C S Description Budget StartJohn NoriegaNo ratings yet

- Project Red: Problem 9-3: Daisy CompanyDocument2 pagesProject Red: Problem 9-3: Daisy CompanyJPNo ratings yet

- What Power Dividens HaveDocument12 pagesWhat Power Dividens HaveAlin UngureanuNo ratings yet

- M&a Trends Post-PandemicDocument29 pagesM&a Trends Post-PandemicNguyễn HuyNo ratings yet

- Jawaban UTS MK Capital BudgetingDocument2 pagesJawaban UTS MK Capital BudgetingAnugerah AgungNo ratings yet

- Retirement PlannerDocument4 pagesRetirement PlannerKushal DabhadkarNo ratings yet

- Chapter 4Document70 pagesChapter 4Laziness OverloadNo ratings yet

- Rental Investment ReportDocument5 pagesRental Investment ReportTuba TunaNo ratings yet

- Bangladesh Economy and DevelopmentDocument14 pagesBangladesh Economy and DevelopmentNafis Hasan khanNo ratings yet

- Good InformationDocument3 pagesGood InformationHoshen MollaNo ratings yet

- ICC Trade Now AsiaDocument4 pagesICC Trade Now AsiaducvaNo ratings yet

- Multinational Capital Budget Analysis: Spartan, IncDocument13 pagesMultinational Capital Budget Analysis: Spartan, IncAsif RahmanNo ratings yet

- Update on $7.6B Investment Driving Growth of Start-up Space Ventures in 2020Document26 pagesUpdate on $7.6B Investment Driving Growth of Start-up Space Ventures in 2020rebate182No ratings yet

- Only Enter Data Into The Green CellsDocument34 pagesOnly Enter Data Into The Green CellsEthan StoneNo ratings yet

- payscale salary reports - cincinnati - ohioDocument3 pagespayscale salary reports - cincinnati - ohioapi-736506490No ratings yet

- Barack Home Rental Income Statement and Balance SheetDocument3 pagesBarack Home Rental Income Statement and Balance SheetStephen FrancisNo ratings yet

- Why Choosing Spac Over IpoDocument6 pagesWhy Choosing Spac Over IpoNNo ratings yet

- Robotics Online Annual Report Sep 2019 - Jun 2021Document27 pagesRobotics Online Annual Report Sep 2019 - Jun 2021Антон ПервыйNo ratings yet

- Rep. Hakeem Jeffries - Campaign Finance Summary - OpenSecretsDocument2 pagesRep. Hakeem Jeffries - Campaign Finance Summary - OpenSecretsRobie KholilurrahmanNo ratings yet

- Retirement PlannerDocument6 pagesRetirement PlannerJosip KarakasicNo ratings yet

- Small Business Sales Lead TrackerDocument3 pagesSmall Business Sales Lead TrackerAaléé AairéNo ratings yet

- DL1_FinTech 14 Aug 2023Document68 pagesDL1_FinTech 14 Aug 2023misfitsldswNo ratings yet

- Donald 1Document11 pagesDonald 1adam burdNo ratings yet

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- What if Your House Paid Dividends?: Do You Understand Leverage and Investing?: MFI Series1, #41From EverandWhat if Your House Paid Dividends?: Do You Understand Leverage and Investing?: MFI Series1, #41Rating: 1 out of 5 stars1/5 (1)

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachFrom EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachNo ratings yet

- International Food Policy Research InstituteDocument44 pagesInternational Food Policy Research InstituteBerhanu AlemuNo ratings yet

- FAO Ethio-Live Animal and Meat Export-2005Document39 pagesFAO Ethio-Live Animal and Meat Export-2005SulemanNo ratings yet

- Ethiopia Spices Production and Marketing-2021Document1 pageEthiopia Spices Production and Marketing-2021Suleman100% (1)

- Business Feasibility Study OutlineDocument14 pagesBusiness Feasibility Study OutlineMohamed AbbasNo ratings yet

- Agribusiness Investment in Ethiopia 2015Document32 pagesAgribusiness Investment in Ethiopia 2015SulemanNo ratings yet

- Business Feasibility Study OutlineDocument14 pagesBusiness Feasibility Study OutlineMohamed AbbasNo ratings yet

- Business Feasibility Study OutlineDocument14 pagesBusiness Feasibility Study OutlineMohamed AbbasNo ratings yet

- Agriculture in Ethiopia - Wikipedia 2018Document1 pageAgriculture in Ethiopia - Wikipedia 2018Suleman0% (1)

- Business Feasibility Study OutlineDocument14 pagesBusiness Feasibility Study OutlineMohamed AbbasNo ratings yet

- Poultry Breeding, Meat Processing and Trade - Business Plan For A New CompanyDocument59 pagesPoultry Breeding, Meat Processing and Trade - Business Plan For A New Companymetro hydraNo ratings yet

- Business Feasibility Study OutlineDocument14 pagesBusiness Feasibility Study OutlineMohamed AbbasNo ratings yet

- 20 Types of Business Risk - SimplicableDocument1 page20 Types of Business Risk - SimplicableSulemanNo ratings yet

- Business Feasibility Study OutlineDocument14 pagesBusiness Feasibility Study OutlineMohamed AbbasNo ratings yet

- Business Feasibility Study OutlineDocument14 pagesBusiness Feasibility Study OutlineMohamed AbbasNo ratings yet

- New Car Prices in Ethiopia - 2021Document1 pageNew Car Prices in Ethiopia - 2021Suleman50% (2)

- Hyundai Santa Fe Hybrid Blue 2021 Price in EthiopiaDocument1 pageHyundai Santa Fe Hybrid Blue 2021 Price in EthiopiaSulemanNo ratings yet

- Hyundai Santa Fe Hybrid Blue 2021 Price in EthiopiaDocument1 pageHyundai Santa Fe Hybrid Blue 2021 Price in EthiopiaSulemanNo ratings yet

- 30+ Types of Project RiskDocument1 page30+ Types of Project RiskSulemanNo ratings yet

- 6 Examples of Liquidity Risk - SimplicableDocument1 page6 Examples of Liquidity Risk - SimplicableSulemanNo ratings yet

- New Car Prices in Ethiopia - 2021Document1 pageNew Car Prices in Ethiopia - 2021Suleman50% (2)

- Profile On Red Iron Oxide. IndiaDocument8 pagesProfile On Red Iron Oxide. IndiaSulemanNo ratings yet

- 4 Types of Inflation Risk - SimplicableDocument1 page4 Types of Inflation Risk - SimplicableSulemanNo ratings yet

- Hyundai Tucson Sport AWD 2021 Price in EthiopiaDocument1 pageHyundai Tucson Sport AWD 2021 Price in EthiopiaSulemanNo ratings yet

- Business Planning Guide - SimplicableDocument1 pageBusiness Planning Guide - SimplicableSulemanNo ratings yet

- Profile On Red Iron Oxide. IndiaDocument8 pagesProfile On Red Iron Oxide. IndiaSulemanNo ratings yet

- Ethiopian Textile ReviewDocument8 pagesEthiopian Textile ReviewSuleman100% (1)

- Feasibility Study For Sunflower Oil Production and Processing Project Proposal, Feasibility Study, Business Pan in EthiopiaDocument1 pageFeasibility Study For Sunflower Oil Production and Processing Project Proposal, Feasibility Study, Business Pan in EthiopiaSuleman100% (2)

- Profile On Activated Carbon PlantDocument5 pagesProfile On Activated Carbon PlantsolomonNo ratings yet

- Leather Opportunity in EthiopiaDocument9 pagesLeather Opportunity in EthiopiaSuleman100% (2)

- KT CPC Financial Sector Development Strategy 2016 2025 EnglishDocument133 pagesKT CPC Financial Sector Development Strategy 2016 2025 EnglishHo Sy VietNo ratings yet

- PayPal vs. SkrillDocument3 pagesPayPal vs. Skrillmyron kipropNo ratings yet

- Cryptocurrency Micro-Investing Platform Cred Partners With Komodo PlatformDocument3 pagesCryptocurrency Micro-Investing Platform Cred Partners With Komodo PlatformPR.comNo ratings yet

- Chapter 005 PMDocument5 pagesChapter 005 PMHayelom Tadesse GebreNo ratings yet

- SFE Maintenance Loan Request Form 2223 DDDocument2 pagesSFE Maintenance Loan Request Form 2223 DDFinton ArbuckleNo ratings yet

- Gold HistoryDocument4 pagesGold HistoryRakesh WalaNo ratings yet

- All Economics Notes by Dinesh Bakshi PDFDocument205 pagesAll Economics Notes by Dinesh Bakshi PDFAdithya ShettyNo ratings yet

- FSA Atlas Honda AnalysisDocument20 pagesFSA Atlas Honda AnalysisTaimoorNo ratings yet

- The Impact of Demonetisation of Currency in Thanjavur CityDocument3 pagesThe Impact of Demonetisation of Currency in Thanjavur CitysantoshNo ratings yet

- Module 8 - The Global Financial CrisisDocument5 pagesModule 8 - The Global Financial CrisisAmiteshNo ratings yet

- Foundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsDocument18 pagesFoundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsHamis Rabiam MagundaNo ratings yet

- Comparing Channel Finance FacilitiesDocument34 pagesComparing Channel Finance FacilitiesSAIMBAhelplineNo ratings yet

- Sia FlowchartDocument1 pageSia FlowchartDewi RenitasariNo ratings yet

- My Swipe, My Treat 3.0 Promo MechanicsDocument2 pagesMy Swipe, My Treat 3.0 Promo MechanicsMaraNo ratings yet

- Ep 2Document11 pagesEp 2ZulfikarMuhammad100% (1)

- Chapter 4 MultistreamDocument27 pagesChapter 4 MultistreamCLAIRE OCTNo ratings yet

- Finance Pre-Read 2023Document30 pagesFinance Pre-Read 2023Kshitij SinghalNo ratings yet

- Ethnography Number 9 Alan Klima Introduc PDFDocument53 pagesEthnography Number 9 Alan Klima Introduc PDFKTNo ratings yet

- Still Searching For Optimal Capital StructureDocument26 pagesStill Searching For Optimal Capital Structureserpent222No ratings yet

- Problematic Banks of Ukraine 29.10.19Document1 pageProblematic Banks of Ukraine 29.10.19Guillaume PtakNo ratings yet

- Bangladesh Bank National Payment Switch Project Discovery ReportDocument186 pagesBangladesh Bank National Payment Switch Project Discovery ReportParvez AlamNo ratings yet

- Economy Gets New Anti-Viral Shot: Big Spike Again, 44 New Cases in K'takaDocument16 pagesEconomy Gets New Anti-Viral Shot: Big Spike Again, 44 New Cases in K'takaShaik RuksanaNo ratings yet

- Daftar Riwayat Hidup Calon Anggota Dewan Komisaris PT Bank Jago TBKDocument5 pagesDaftar Riwayat Hidup Calon Anggota Dewan Komisaris PT Bank Jago TBKbimobimoprabowoNo ratings yet

- The Value Pitch The Importance of Team Management v3Document30 pagesThe Value Pitch The Importance of Team Management v3Caio Sadao TamezavaNo ratings yet

- Time Value of Money TVMDocument48 pagesTime Value of Money TVMNikita KumariNo ratings yet

- Algerian Banking Sector Deposits and Loans Gap 2000-2011Document1 pageAlgerian Banking Sector Deposits and Loans Gap 2000-2011omm berNo ratings yet

- Abev3 20-F 2014 EngDocument286 pagesAbev3 20-F 2014 EngTang WtchrprnNo ratings yet

- Breakfasting Mr. Ifan 31 Maret 2023Document2 pagesBreakfasting Mr. Ifan 31 Maret 2023Ifan FadilahNo ratings yet