Professional Documents

Culture Documents

Picarra, Sherilyn - PROBLEM 8-4

Uploaded by

Sherilyn PicarraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Picarra, Sherilyn - PROBLEM 8-4

Uploaded by

Sherilyn PicarraCopyright:

Available Formats

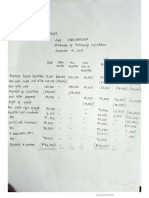

Name: Picarra, Sherilyn B.

CFAS/FAR

Yr. & Sec.: CBET 01-201P Prof. Felicitas C. Tuazon

Required: Prepare a statement of financial position, presented and classified

according to generally accepted accounting principles with appropriate notes.

PROBLEM 8-4 (IAA)

Summa Company

Statement of Financial Position

December 31, 2020

A SS E TS

Current assets: Note

Cash (1) 700,000

Bond sinking fund 2,000,000

Trade and other receivables (2) 830,000

Inventory 1,200,000

Prepaid expenses 100,000

Total current assets 4,830,000

Noncurrent assets:

Property, plant and equipment (3) 5,500,000

Investment property 700,000

Intangible asset (4) 370,000

Total noncurrent assets 6,570,000

Total assets 11,400,000

LIABILITIES AND EQUITY

Note

Current liabilities:

Trade and other payables (5) 2,050,000

Bonds payable due June 30, 2009 2,000,000

Total current liabilities 4,050,000

Noncurrent liability:

Deferred tax liability 650,000

Equity:

Share capital (6) 3,500,000

Reserves (7) 500,000

Retained earnings 2,700,000

Total equity 6,700,000

Total liabilities and equity 11,400,000

Note 1 - Cash

Cash on hand 50,000

Cash in bank 650,000

Total 700,000

Note 2 - Trade and other receivables

Accounts receivable 650,000

Allowance for doubtful accounts ( 50,000)

Notes receivable 200,000

Accrued interest receivable 30,000

Total 830,000

Note 3 - Property, plant and equipment

Accum. Book

Cost depr. value

Land 1,000,000 - 1,000,000

Building 5,500,000 2,500,000 3,000,000

Furniture and equipment 2,400,000 900,000 1,500,000

Total 8,900,000 3,400,000 5,500,000

Note 4 - Intangible asset

Patent 370,000

Note 5 - Trade and other payables

Accounts payable 1,000,000

Notes payable 850,000

Accrued taxes 50,000

Other accrued liabilities 150,000

Total 2,050,000

Note 6 – Share capital

Authorized share capital, 50,000 shares, P100 par 5,000,000

Unissued share capital (2,000,000)

Issued share capital 3,000,000

Subscribed share capital, 10,000 shares 1,000,000

Subscription receivable ( 500,000)

Paid in capital 3,500,000

Note 7 - Reserves

Share premium 300,000

Retained earnings appropriated for contingencies 200,000

Total 500,000

You might also like

- Problem 8-2: Exemplar Company Statement of Financial Position December 31, 2019 AssetsDocument3 pagesProblem 8-2: Exemplar Company Statement of Financial Position December 31, 2019 AssetsChincel G. ANI100% (1)

- PAS 33-Earnings Per Share PAS 33-Earnings Per ShareDocument27 pagesPAS 33-Earnings Per Share PAS 33-Earnings Per ShareHazel PachecoNo ratings yet

- Chapter 9Document7 pagesChapter 9Coursehero PremiumNo ratings yet

- CFAS - Chapter 7: Multiple ChoiceDocument1 pageCFAS - Chapter 7: Multiple Choiceagm25No ratings yet

- Depreciation Calculation for MachineryDocument1 pageDepreciation Calculation for MachineryKate Iannel VicenteNo ratings yet

- Chapter 18 20Document11 pagesChapter 18 20jessa mae zerdaNo ratings yet

- Cfas Problem 8 3 PDFDocument3 pagesCfas Problem 8 3 PDFAzuh ShiNo ratings yet

- WatatapsDocument29 pagesWatatapsjessa mae zerdaNo ratings yet

- Error Correction MethodsDocument2 pagesError Correction MethodsValentina Tan DuNo ratings yet

- CFASDocument61 pagesCFASPrinces Jamela G. AgraNo ratings yet

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- Revenue Cycle Trade DiscountsDocument50 pagesRevenue Cycle Trade DiscountsJean MaeNo ratings yet

- Chapter 5 Financial Management by CabreraDocument19 pagesChapter 5 Financial Management by CabreraLars FriasNo ratings yet

- Problem 7 - 22Document3 pagesProblem 7 - 22Jao FloresNo ratings yet

- Chapter 4Document8 pagesChapter 4Coursehero PremiumNo ratings yet

- MachineryDocument4 pagesMachineryDianna DayawonNo ratings yet

- InventoriesDocument19 pagesInventoriesNoella Marie BaronNo ratings yet

- Problem 3-1 Problem 3-2 Problem 3-3 Problem 3-4 Problem 3-5Document22 pagesProblem 3-1 Problem 3-2 Problem 3-3 Problem 3-4 Problem 3-5Yen YenNo ratings yet

- Land and building costs accounting problemsDocument2 pagesLand and building costs accounting problemsWeStan LegendsNo ratings yet

- Royalty Company Required1 Required5 2020 Required2Document2 pagesRoyalty Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Notes PayableDocument4 pagesNotes PayableShilla Mae BalanceNo ratings yet

- Management Accounting Practices of Philippine SMEsDocument21 pagesManagement Accounting Practices of Philippine SMEspamela dequillamorteNo ratings yet

- AFAR-First-Preboard-May-2023-BatchDocument14 pagesAFAR-First-Preboard-May-2023-BatchRhea Mae CarantoNo ratings yet

- Padernal BSA 1A SW Problem 3 11Document1 pagePadernal BSA 1A SW Problem 3 11Fly ThoughtsNo ratings yet

- Inventory Cost Formulas LCNRV Fs DisclosuresDocument15 pagesInventory Cost Formulas LCNRV Fs DisclosuresKawhileonard LeonardNo ratings yet

- Financial Planning: Projected Assets, Equity, and Funds NeededDocument3 pagesFinancial Planning: Projected Assets, Equity, and Funds NeededMasTer PanDaNo ratings yet

- MiyawwDocument9 pagesMiyawwjessa mae zerdaNo ratings yet

- Assets MCDocument19 pagesAssets MCpahuyobea cutiepatootieNo ratings yet

- Conceptual framework self-test questionsDocument3 pagesConceptual framework self-test questionsEndah DipoyantiNo ratings yet

- Chapter 33Document7 pagesChapter 33Shane Ivory ClaudioNo ratings yet

- Ai-1 RM8Document5 pagesAi-1 RM8Sheena0% (1)

- Receivable FinancingDocument15 pagesReceivable FinancingshaneNo ratings yet

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- Nature and Background of The Specialized IndustryDocument3 pagesNature and Background of The Specialized IndustryEly RiveraNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- 4-6 Dahlia CompanyDocument1 page4-6 Dahlia CompanyyayayaNo ratings yet

- QUESTION 5-10 Multiple Choice (ACP) : A. Asset, Liability and EquityDocument5 pagesQUESTION 5-10 Multiple Choice (ACP) : A. Asset, Liability and EquityJanine CamachoNo ratings yet

- Financial reporting of cash and cash equivalentsDocument8 pagesFinancial reporting of cash and cash equivalentsSamantha Suan CatambingNo ratings yet

- Silver Company Provided The Following Information at Year-EndDocument1 pageSilver Company Provided The Following Information at Year-EndKatrina Dela CruzNo ratings yet

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Intermediate Accounting Volume 1 Inventories by ValixDocument33 pagesIntermediate Accounting Volume 1 Inventories by ValixPeter PiperNo ratings yet

- Assignment #1 (Page 107)Document3 pagesAssignment #1 (Page 107)LauntNo ratings yet

- RequiredDocument11 pagesRequiredKean Brean GallosNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Planning and Budgeting Case StudyDocument3 pagesPlanning and Budgeting Case StudyRichie Donato100% (1)

- Sia 3.compound Financial InstrumentDocument11 pagesSia 3.compound Financial InstrumentleneNo ratings yet

- Statement of Financial PositionDocument36 pagesStatement of Financial PositionAbdulmajed Unda MimbantasNo ratings yet

- Accounting for Cash, Receivables and InventoriesDocument12 pagesAccounting for Cash, Receivables and InventoriesPaupau100% (1)

- Statement of Comprehensive Income Cost of Goods Sold and Operating Expenses Problem 4-1 (AICPA Adapted)Document11 pagesStatement of Comprehensive Income Cost of Goods Sold and Operating Expenses Problem 4-1 (AICPA Adapted)Clarisse PelayoNo ratings yet

- Dakak Company Provided The Following Statement of Financial Position On December 31 PDFDocument4 pagesDakak Company Provided The Following Statement of Financial Position On December 31 PDFAbe Mayores CañasNo ratings yet

- ACC 102.key Answer - Quiz 1.inventoriesDocument5 pagesACC 102.key Answer - Quiz 1.inventoriesMa. Lou Erika BALITENo ratings yet

- AFAR 2 Online Class - Ch. 13Document26 pagesAFAR 2 Online Class - Ch. 13Von Andrei MedinaNo ratings yet

- 01 The Accounting Environment and Accounting FrameworkDocument39 pages01 The Accounting Environment and Accounting Frameworkapostol ignacio100% (1)

- CHAPTER 3 - Notes To Financial StatementDocument32 pagesCHAPTER 3 - Notes To Financial StatementShane Aberie Villaroza AmidaNo ratings yet

- Frias Activity 1Document6 pagesFrias Activity 1Lars FriasNo ratings yet

- Forms of Statement of Financial PositionDocument7 pagesForms of Statement of Financial PositionRocel DomingoNo ratings yet

- INTACC Valix Chap3 QuestionsDocument10 pagesINTACC Valix Chap3 Questionsclary frayNo ratings yet

- Martinez, Althea E. Bsais 1-A (Far - Activity #4)Document4 pagesMartinez, Althea E. Bsais 1-A (Far - Activity #4)Althea Escarpe MartinezNo ratings yet

- Alvaran - Business Calling CardDocument1 pageAlvaran - Business Calling CardSherilyn PicarraNo ratings yet

- Alvaran - Business Calling CardDocument1 pageAlvaran - Business Calling CardSherilyn PicarraNo ratings yet

- Accounting FormulaDocument1 pageAccounting FormulaSherilyn PicarraNo ratings yet

- 20 Items Quiz-Art AppDocument4 pages20 Items Quiz-Art AppSherilyn PicarraNo ratings yet

- Accounting FormulaDocument1 pageAccounting FormulaSherilyn PicarraNo ratings yet

- .Job-Interview-Module - FinaaaaallllDocument22 pages.Job-Interview-Module - FinaaaaallllSherilyn PicarraNo ratings yet

- Feliciano, Princess Jonver - Problem 10-9Document1 pageFeliciano, Princess Jonver - Problem 10-9Sherilyn PicarraNo ratings yet

- Picarra, Sherilyn B - Problem 10-9Document2 pagesPicarra, Sherilyn B - Problem 10-9Sherilyn PicarraNo ratings yet

- Rizal Tech University explores musical structuresDocument61 pagesRizal Tech University explores musical structuresSherilyn PicarraNo ratings yet

- Practical Guidelines in Reducing and Managing Business RisksDocument6 pagesPractical Guidelines in Reducing and Managing Business RisksSherilyn PicarraNo ratings yet

- Work Plan For Peacekeeping Activities: Prepared By: Gobrin, Christine Joy BDocument6 pagesWork Plan For Peacekeeping Activities: Prepared By: Gobrin, Christine Joy BSherilyn PicarraNo ratings yet

- 20 Items Quiz-Art AppDocument4 pages20 Items Quiz-Art AppSherilyn PicarraNo ratings yet

- Picarra QUIZ #2Document4 pagesPicarra QUIZ #2Sherilyn PicarraNo ratings yet

- Philippine HistoryDocument1 pagePhilippine HistorySherilyn PicarraNo ratings yet

- Social classes among Tagalogs and their dutiesDocument3 pagesSocial classes among Tagalogs and their dutiesSherilyn PicarraNo ratings yet

- Peacekeeping Work PlanDocument5 pagesPeacekeeping Work PlanSherilyn PicarraNo ratings yet

- Week 1-2 Topic - Physical FitnessDocument41 pagesWeek 1-2 Topic - Physical FitnessSherilyn PicarraNo ratings yet

- The Contemporary Global GovernanceDocument12 pagesThe Contemporary Global GovernanceSherilyn Picarra100% (1)

- Understanding Human SexualityDocument13 pagesUnderstanding Human SexualitySherilyn Picarra100% (1)

- The Contemporary World: InstructionDocument2 pagesThe Contemporary World: InstructionSherilyn PicarraNo ratings yet

- Institute of Physical Education: GoalDocument2 pagesInstitute of Physical Education: GoalSherilyn PicarraNo ratings yet

- Investment: Van Expense Rent ExpenseDocument3 pagesInvestment: Van Expense Rent ExpenseSherilyn PicarraNo ratings yet

- Important Factors of LeadershipDocument5 pagesImportant Factors of LeadershipSherilyn PicarraNo ratings yet

- Important Factors of LeadershipDocument5 pagesImportant Factors of LeadershipSherilyn PicarraNo ratings yet

- Fasader I TraDocument56 pagesFasader I TraChristina HanssonNo ratings yet

- Architecture Floor Plan Abbreviations AnDocument11 pagesArchitecture Floor Plan Abbreviations AnGraphitti Koncepts and DesignsNo ratings yet

- Module IV StaffingDocument3 pagesModule IV Staffingyang_19250% (1)

- SALICYLATE POISONING SIGNS AND TREATMENTDocument23 pagesSALICYLATE POISONING SIGNS AND TREATMENTimmortalneoNo ratings yet

- ResMed Case Study AnalysisDocument12 pagesResMed Case Study Analysis徐芊芊No ratings yet

- MSDS Hygisoft Surface Disinfectant, Concentrate - PagesDocument5 pagesMSDS Hygisoft Surface Disinfectant, Concentrate - PagesDr. Omar Al-AbbasiNo ratings yet

- Form of SpesDocument2 pagesForm of SpesMark Dave SambranoNo ratings yet

- NASA: 181330main Jun29colorDocument8 pagesNASA: 181330main Jun29colorNASAdocumentsNo ratings yet

- Impacts of Gmos On Golden RiceDocument3 pagesImpacts of Gmos On Golden RiceDianna Rose Villar LaxamanaNo ratings yet

- NEW HOLLAND - Trucks, Tractor & Forklift Manual PDDocument14 pagesNEW HOLLAND - Trucks, Tractor & Forklift Manual PDAjjaakka0% (2)

- The Definition and Unit of Ionic StrengthDocument2 pagesThe Definition and Unit of Ionic StrengthDiego ZapataNo ratings yet

- Labor Law 1 Class NotesDocument20 pagesLabor Law 1 Class Notescmv mendozaNo ratings yet

- Researching Indian culture and spirituality at Auroville's Centre for Research in Indian CultureDocument1 pageResearching Indian culture and spirituality at Auroville's Centre for Research in Indian CultureJithin gtNo ratings yet

- Diagrama RSAG7.820.7977Document14 pagesDiagrama RSAG7.820.7977Manuel Medina100% (4)

- USA V Brandon Hunt - April 2021 Jury VerdictDocument3 pagesUSA V Brandon Hunt - April 2021 Jury VerdictFile 411No ratings yet

- l3 Immunization & Cold ChainDocument53 pagesl3 Immunization & Cold ChainNur AinaaNo ratings yet

- HamletDocument37 pagesHamlethyan teodoroNo ratings yet

- 09 Egyptian Architecture PDFDocument107 pages09 Egyptian Architecture PDFIra PecsonNo ratings yet

- Dasakam 31-40Document16 pagesDasakam 31-40Puducode Rama Iyer RamachanderNo ratings yet

- SCM Software Selection and EvaluationDocument3 pagesSCM Software Selection and EvaluationBhuwneshwar PandayNo ratings yet

- Development Plan-Part IV, 2022-2023Document3 pagesDevelopment Plan-Part IV, 2022-2023Divina bentayao100% (5)

- Samsung C&T AuditDocument104 pagesSamsung C&T AuditkevalNo ratings yet

- What Is MotivationDocument6 pagesWhat Is MotivationJohn Paul De GuzmanNo ratings yet

- Edited General English Question Paper Part 1Document12 pagesEdited General English Question Paper Part 1Utkarsh R MishraNo ratings yet

- Si Eft Mandate FormDocument1 pageSi Eft Mandate FormdSolarianNo ratings yet

- L.G.B.T. Fiction: Book ReviewDocument4 pagesL.G.B.T. Fiction: Book ReviewDejana KosticNo ratings yet

- Surrealismo TriplevDocument13 pagesSurrealismo TriplevVictor LunaNo ratings yet

- Contrastive Study of English and Romanian Legal TerminologyDocument39 pagesContrastive Study of English and Romanian Legal TerminologyVictorNo ratings yet

- Anne Frank Halloween Costume 2Document5 pagesAnne Frank Halloween Costume 2ive14_No ratings yet

- A Case of Haemochromatosis and Diabetes A Missed OpportunityDocument111 pagesA Case of Haemochromatosis and Diabetes A Missed Opportunitymimran1974No ratings yet