Professional Documents

Culture Documents

Preferred: Assignment

Uploaded by

Taetae ElyenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preferred: Assignment

Uploaded by

Taetae ElyenCopyright:

Available Formats

Abigail Neri

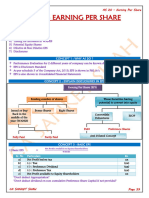

Module 7 Assignment

PT -

3 Preferred Dividends

case

A current

quarter Dividend $4

Add : Dividends in Arrears # ( $443)

total Dividends $16

=

B Dividend per share per period $110 42%

=

$2.2

=

dividends →

Preferred

per share must be paid ( only the latest

quarter )

C

$2 ←

preferred dividend per

.

share that must be paid

the

( onlyquarter

latest

)

D .

current

quarter Dividend $0.9 ($60 xt5% )

Add : Dividends in Arrears 3 -

6

( $0 -9×4 )

total Dividends $4.5

=

E .

current

quarter Dividend $2.1 ( $70 x 3% )

→ =

preferred dividends

per share must be paid ( only the latest

since there is no dividends in quarter )

Arrears

M -

9 Common stock valuation : constant Growth

Given :

D, $0.72 7%

g

= -

a .

rs

=

10%

Do =

Di

rs g

-

$0.72 $24 is the amount that I will

if

=

0.10 the

0.07

pay for stock the

-

is

0.72

required return logo .

=

O -

03

=

$24

T

b -

Rs

=

8%

Po =

Di

rs g

-

$0.72 I will willing to $72 for

.

be

pay

the stock if required

=

0-08-0.07 the return

0722 is 8% .

O -

01

=

$72

t

C .

One disadvantage of constant growth model is where

it assumes that dividends will grow at a constant

rate it disregards the changing economic conditions

-

that bear impact to the risks the dividend holders hold .

You might also like

- QuizzesDocument15 pagesQuizzesHai Au NguyenNo ratings yet

- IA 3 Chapter 20 River CoDocument1 pageIA 3 Chapter 20 River CoPrytj Elmo QuimboNo ratings yet

- R R β R R R: i Calculating Cost of Equity (A) Using CAPM MethodDocument3 pagesR R β R R R: i Calculating Cost of Equity (A) Using CAPM MethodHumphrey OsaigbeNo ratings yet

- Acct2121hw3 3-39Document1 pageAcct2121hw3 3-39Ckay LeeNo ratings yet

- Profitability Liquidity RatiosDocument10 pagesProfitability Liquidity RatiosPaola EsguerraNo ratings yet

- Case 2 RSPDocument26 pagesCase 2 RSPSabina DhakalNo ratings yet

- Math1 2019 PDFDocument12 pagesMath1 2019 PDFarmaanNo ratings yet

- Topic 10 Dividend Policy FinalDocument13 pagesTopic 10 Dividend Policy Finalshivani dholeNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozalNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFCarl SoriaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementCarl SoriaNo ratings yet

- CASHFLOW JuegoDocument1 pageCASHFLOW JuegoRebeca Valverde DelgadoNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKakz KarthikNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFArifNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementUtiyyalaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKNNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementGejehNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozal100% (1)

- Razones Financieras - Walmart SorianaDocument3 pagesRazones Financieras - Walmart SorianaBrenda RamosNo ratings yet

- Finance Formula SheetDocument2 pagesFinance Formula SheetBrandon RaoNo ratings yet

- Math Formulas Made EasyDocument3 pagesMath Formulas Made EasyJavaria KhanNo ratings yet

- Income Calculation WorksheetDocument1 pageIncome Calculation Worksheetrush2serveNo ratings yet

- 1) Asset S: Valuati OnDocument2 pages1) Asset S: Valuati OnSha MagondacanNo ratings yet

- Stock Valuation (Version 1)Document32 pagesStock Valuation (Version 1)محمد حمزه زاہدNo ratings yet

- Cfin 5th Edition Besley Solutions ManualDocument38 pagesCfin 5th Edition Besley Solutions Manualgarrywolfelsjftl100% (18)

- Ebook Cfin 5Th Edition Besley Solutions Manual Full Chapter PDFDocument32 pagesEbook Cfin 5Th Edition Besley Solutions Manual Full Chapter PDFseanmosstgdkf2100% (14)

- Cfin 5th Edition Besley Solutions ManualDocument11 pagesCfin 5th Edition Besley Solutions Manuallaeliavanfyyqz100% (26)

- Advanced Rental Income Model v6.4 LockedDocument116 pagesAdvanced Rental Income Model v6.4 LockedVictor IonescuNo ratings yet

- Worksheet For The Yukon 2020 Personal Tax Credits Return: When CompletedDocument1 pageWorksheet For The Yukon 2020 Personal Tax Credits Return: When CompletedBryan WilleyNo ratings yet

- Afar Quicknotes: GATO, Abdul Barri Indol MSU - Main Campus 09452146094Document19 pagesAfar Quicknotes: GATO, Abdul Barri Indol MSU - Main Campus 09452146094Zech PackNo ratings yet

- Activity #6Document3 pagesActivity #6ScribdTranslationsNo ratings yet

- B HereDocument1 pageB Herekailim90No ratings yet

- Chapter 7Document11 pagesChapter 7Niaz MorshedNo ratings yet

- FIM Question Practice 2Document15 pagesFIM Question Practice 2Bao Khanh HaNo ratings yet

- Merger ClassDocument9 pagesMerger Classnd4f4fn4hdNo ratings yet

- Choice To Move Cash Back To Equities Pays Off: InvestDocument1 pageChoice To Move Cash Back To Equities Pays Off: Investkailim90No ratings yet

- Bonds Payable Issued at A DiscountDocument10 pagesBonds Payable Issued at A DiscountCris Ann Marie ESPAnOLANo ratings yet

- Câu 5Document2 pagesCâu 5tsunami133100100020No ratings yet

- Fna Loss of Independance - 05041e06 (06-07)Document2 pagesFna Loss of Independance - 05041e06 (06-07)AndrewNo ratings yet

- ACCT503 Sample Project TemplateDocument6 pagesACCT503 Sample Project TemplateAriunaaBoldNo ratings yet

- As 20 - Earning Per Share CH-4Document5 pagesAs 20 - Earning Per Share CH-4lucifersdevil68No ratings yet

- 1 Lecturer GD Help Cap BudgetDocument13 pages1 Lecturer GD Help Cap BudgethenryNo ratings yet

- Financial Management - Chapter 18 Revision Exercises - SolutionsDocument18 pagesFinancial Management - Chapter 18 Revision Exercises - SolutionsMuhammad OsamaNo ratings yet

- FM Midterm LinhDocument7 pagesFM Midterm LinhLinh PhạmNo ratings yet

- Financial Ratios AcadDocument6 pagesFinancial Ratios AcadJohn Mark Estilles NudoNo ratings yet

- Giáo Trình CH NG KhoánDocument11 pagesGiáo Trình CH NG KhoánTung NguyenNo ratings yet

- Name: - Grade Level & Section: - ScoreDocument2 pagesName: - Grade Level & Section: - ScoreAngel Maclene BationNo ratings yet

- Simplified Cash Flow Projection Worksheet: Instructions: Instructions Cell / Column / RowDocument2 pagesSimplified Cash Flow Projection Worksheet: Instructions: Instructions Cell / Column / RowDuc TriNo ratings yet

- Homework 5Document4 pagesHomework 5Rohan SinghNo ratings yet

- Cost Volume Profit (CVP) AnalysisDocument12 pagesCost Volume Profit (CVP) AnalysisShan rNo ratings yet

- Zyanne BaringDocument7 pagesZyanne BaringKeziah ChristineNo ratings yet

- REAL 4000 Ch3 HW SolutionsDocument6 pagesREAL 4000 Ch3 HW SolutionsnunyabiznessNo ratings yet

- Salary Settlement ModelDocument1 pageSalary Settlement ModelScribdTranslationsNo ratings yet

- Problem Set 3Document7 pagesProblem Set 3Jade BilisNo ratings yet

- Dividends SampleDocument5 pagesDividends SampleJose Cardona0% (1)

- Finance - Spreadsheet Notes (Answers)Document51 pagesFinance - Spreadsheet Notes (Answers)Ashfaqullah KhanNo ratings yet

- Ust Spread Sheet v004 ConstDocument12 pagesUst Spread Sheet v004 ConstConstantin WedekindNo ratings yet

- Tutorial 8Document3 pagesTutorial 8NothingToKnowNo ratings yet

- Mod 13 AssignDocument7 pagesMod 13 AssignTaetae ElyenNo ratings yet

- Mod 12 AssignDocument6 pagesMod 12 AssignTaetae ElyenNo ratings yet

- Assignment: Long ProjectDocument8 pagesAssignment: Long ProjectTaetae ElyenNo ratings yet

- POL 1 A LAB Act 1Document6 pagesPOL 1 A LAB Act 1Taetae ElyenNo ratings yet

- Activity No. 7 Specific HeatDocument2 pagesActivity No. 7 Specific HeatTaetae ElyenNo ratings yet

- STATSDocument2 pagesSTATSTaetae ElyenNo ratings yet

- Lab Activity 12 Pol 1aDocument3 pagesLab Activity 12 Pol 1aTaetae ElyenNo ratings yet

- Seller/Firm Price Per KG: Prices of Related GoodsDocument3 pagesSeller/Firm Price Per KG: Prices of Related GoodsTaetae ElyenNo ratings yet

- Neri Mod6AssignDocument7 pagesNeri Mod6AssignTaetae ElyenNo ratings yet

- Official Guidelines For Magnates E-Games 2021: The PlayersDocument2 pagesOfficial Guidelines For Magnates E-Games 2021: The PlayersTaetae ElyenNo ratings yet

- Umut Uras & Usaid Siddiqui, 2021Document2 pagesUmut Uras & Usaid Siddiqui, 2021Taetae ElyenNo ratings yet

- Yes, I Think The Slogan "It's Time Every Juan FliesDocument2 pagesYes, I Think The Slogan "It's Time Every Juan FliesTaetae ElyenNo ratings yet

- Magnates Sponsorship Letter 2019 2020Document2 pagesMagnates Sponsorship Letter 2019 2020Taetae ElyenNo ratings yet

- Study Guide Week 11Document21 pagesStudy Guide Week 11Taetae ElyenNo ratings yet

- Study Guide Week 10 Module Vii: MotivationDocument4 pagesStudy Guide Week 10 Module Vii: MotivationTaetae ElyenNo ratings yet

- Learning Activity 6 TemplateDocument2 pagesLearning Activity 6 TemplateTaetae ElyenNo ratings yet

- Study Guide Week 7Document6 pagesStudy Guide Week 7Taetae ElyenNo ratings yet

- Determining The Discount For Lack of Marketability With Put Option Pricing Models in View of The Section 2704 Proposed RegulationsDocument20 pagesDetermining The Discount For Lack of Marketability With Put Option Pricing Models in View of The Section 2704 Proposed RegulationsAlexV100% (1)

- BMAN 21020: Financial Reporting and AccountabilityDocument24 pagesBMAN 21020: Financial Reporting and AccountabilityPat100% (2)

- Chapter 2 - Investment AlternativesDocument12 pagesChapter 2 - Investment AlternativesSinpaoNo ratings yet

- Global Securities OperationsDocument2 pagesGlobal Securities OperationsMd Zahid HussainNo ratings yet

- Master of Business Administration: Narsee Monjee Institute of Management StudiesDocument7 pagesMaster of Business Administration: Narsee Monjee Institute of Management StudiesDIVYANSHU SHEKHARNo ratings yet

- Equities ModuleDocument26 pagesEquities ModuleRahul M. DasNo ratings yet

- Week 2 - Lecture NoteDocument33 pagesWeek 2 - Lecture NoteChip choiNo ratings yet

- Module 4 Cost of Capital Sample ProblemsDocument2 pagesModule 4 Cost of Capital Sample ProblemsrhailNo ratings yet

- Question 1: Explain Black Whastcholes Model and Show That It Satisfies Put Call Parity ?Document8 pagesQuestion 1: Explain Black Whastcholes Model and Show That It Satisfies Put Call Parity ?arpitNo ratings yet

- Harshad Mehta Scam, 1992.Ppt11Document28 pagesHarshad Mehta Scam, 1992.Ppt11sangamch1230% (1)

- FINA3080 Assignment 1Document2 pagesFINA3080 Assignment 1Koon Sing ChanNo ratings yet

- Acc Ch-5 Lecture NoteDocument14 pagesAcc Ch-5 Lecture NoteBlen tesfayeNo ratings yet

- PUK Earnings DateDocument2 pagesPUK Earnings DateCarlos FrancoNo ratings yet

- Ican Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Document16 pagesIcan Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Sushant MaskeyNo ratings yet

- CM2ADocument4 pagesCM2AMike KanyataNo ratings yet

- Chapter 12 - Share CapitalDocument18 pagesChapter 12 - Share CapitalK59 Vo Doan Hoang AnhNo ratings yet

- Member Code Name of Broker Status Reg. # Address Phone # As at September 10, 2020Document2 pagesMember Code Name of Broker Status Reg. # Address Phone # As at September 10, 2020ms khanNo ratings yet

- RK ProjectDocument82 pagesRK ProjectRitika KhuranaNo ratings yet

- Hedge Accounting PresentationDocument29 pagesHedge Accounting PresentationAshwini Amit ShenoyNo ratings yet

- Online Trading at SharekhanDocument134 pagesOnline Trading at SharekhanAshok GuptaNo ratings yet

- What Shariah Experts SayDocument3 pagesWhat Shariah Experts SaymughalcmaNo ratings yet

- Market Risk Questions PDFDocument16 pagesMarket Risk Questions PDFbabubhagoud1983No ratings yet

- Coca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)Document7 pagesCoca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)sarthak mendiratta100% (1)

- R27.P1.T4.Hull Ch19 Greek Letters v5Document40 pagesR27.P1.T4.Hull Ch19 Greek Letters v5Imran MobinNo ratings yet

- Relative Value Single Stock VolatilityDocument12 pagesRelative Value Single Stock VolatilityTze Shao100% (2)

- AISM Rules BookDocument7 pagesAISM Rules Bookstyle doseNo ratings yet

- NSDL NotesDocument14 pagesNSDL NotesAnmol RahangdaleNo ratings yet

- A Project Report On: Mutual Funds Services System (MFSS) Conducted FOR Karvy Stock Broking LTDDocument37 pagesA Project Report On: Mutual Funds Services System (MFSS) Conducted FOR Karvy Stock Broking LTDJigar PipaliaNo ratings yet

- Technical Report Metal Energy Feb 07nirmalbangDocument5 pagesTechnical Report Metal Energy Feb 07nirmalbangGaurang GroverNo ratings yet

- PresentsDocument87 pagesPresentsdlfinlay100% (12)