Professional Documents

Culture Documents

Choice To Move Cash Back To Equities Pays Off: Invest

Uploaded by

kailim90Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Choice To Move Cash Back To Equities Pays Off: Invest

Uploaded by

kailim90Copyright:

Available Formats

B14 | The Sunday Times | Sunday, November 12, 2017

Invest

Save&Invest

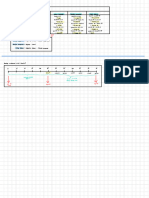

Portfolio performance (as at Oct 31, 2017)

Choice to move Portfolio

Ms Shona Chee

Investment as at Current portfolio

Jan 31, 2017* ($)

63,732

value ($)

70,673.01

Net total

return (%)

10.89

Benchmark

return (%)

9.56

Dividends and

coupons ($)

1,146.02

Realised

P/L ($)

Unrealised

P/L ($)

2,833.95 5,756.38

cash back to

Mr Getty Goh 222,193 255,848.03 15.15 12.08 3,355.62 18,881.37 25,234.03

Mr Wang Moo Kee 437,248 476,702.98 9.02 7.98 9,818.79 20,241.66 22,081.24

*New fiscal year begins from Jan 31, 2017.

What is in the simulated portfolios?

equities pays off Initial investment

amount

Portfolio value

Asset class

$60,000

$70,673.01

Ms Shona Chee

Security (Weightage)

$200,000

$255,848.03

Mr Getty Goh

Security (Weightage)

Mr Wang Moo Kee

$400,000

$476,702.98

Security (Weightage)

Cash 0.6% 0.2% 6.8%

benchmark that best reflects its Domestic 33.8% 36.7% 27.9%

Positive returns for all simulated portfolios mix. equities -Netlink NBN Trust

-OCBC

-Netlink NBN Trust -Netlink NBN Trust

-OCBC

Mr Goh’s portfolio is heavier on -OCBC

as global markets rally in the last month blue-chip shares, while bonds fit -Singapore Exchange -Singapore Exchange -Singapore Exchange

-Singtel -Singtel -Thai Bev

Mr Wang’s more conservative

-ThaiBev -ThaiBev -Singtel

stance. The portfolios are con-

-Wing Tai -Wing Tai -Wing Tai

The Save & Invest Portfolio Series structed by the CFA Society Singa-

features communications manager pore (CFAS) for an ideal invest- Global ETFs 25% 39.3% 12.4%

Shona Chee, 26, entrepreneur ment horizon of five to 10 years. -DBX AC ASIA ex-Japan 1C -DBX AC Asia ex-Japan 1C -DBX AC Asia ex-Japan 1C

Getty Goh, 39, who is married with -DBX EURO STOXX 50 -DBX EURO STOXX 50 -DBX EURO STOXX 50

two children, and retiree Wang PORTFOLIO PERFORMANCE -DBX FTSE China 50 1C -DBX FTSE China 50 1C -DBX FTSE China 50 1C

Moo Kee, 63. Ms Chee’s portfolio was up 3.2 per -ISHARES MSCI India Index ETF -DBX MSCI Japan 1C -SPDR Gold shares

Introduced by The Sunday Times cent the month ended Oct 31, beat- -SPDR Gold shares -ISHARES MSCI India Index ETF

in January last year, the series does ing the benchmark by 0.57 percent- -SPDR Gold shares

Lorna Tan not involve actual money as it is in- age point. Mr Goh’s was up 4.48 per Reits 10.1% 12.9% 10%

tended for the purposes of illustra- cent, beating the benchmark by -A-Reit -Keppel DC Reit -A-Reit -Keppel DC Reit -A-Reit -Keppel DC Reit

Invest Editor tion and education only. 1.23 percentage points, while Mr

Bonds 30.6% 11% 43%

All three portfolios are limited to Wang’s portfolio advanced 2.30 per -ABF Singapore Bond Index Fund

instruments listed on the Singa- cent, 0.17 percentage point ahead -CMT 3.08% Feb 21 -CMT 3.08% Feb 21

-FCL 3.65% May 22 -FCL 3.65% May 22 -CMT 3.08% Feb 21

All three simulated portfolios pore Exchange and the Singapore of the benchmark. -DBS 4.7% Perp (call Nov 20)

-ISHARES JPM USD Asia Bond -ISHARES JPM USD Asia Bond

achieved positive returns last Savings Bonds. There are similari- “The decision to deploy the 20 -FCL 3.65% May 22

-Singapore Savings Bond -Singapore Savings Bond

month, with performance boosted ties between the holdings, but the per cent cash and move back to eq- -ISHARES JPM USD Asia Bond

by the decision to move cash back allocations differ depending on in- uities last month paid off, allowing -OCBC 5.1% Perp (call Sep 18)

to equities before the global mar- dividual risk-return objectives and the portfolios to benefit from the -Singapore Savings Bond

kets rally. preferences. Each portfolio has a rally in global markets in October,”

said the CFAS expert panel. NOTES: • Portfolio start date was Jan 18, 2016.

It reversed the decision in August • Portfolio performance as at Oct 31, 2017.

to lock in some profits and raise • As the Portfolio Series is intended for illustrative and educational purposes only, it will not involve actual money, investments or

solicitation of funds for actual fund management by CFAS or the advisory panel.

The series cash levels to 20 per cent to reduce • You are advised to seek independent financial or other professional advice for your own investments.

risk exposure in all the simulated • CFAS and the advisory panel may provide information and recommendations on investments which they have an interest in.

The Save & Invest Portfolio Se- The CFAS panellists tracking portfolios. That proved to be the • All views or recommendations made by the advisory panel are to be attributed to CFAS.

ries features the simulated port- the simulated portfolios are: Mr right move then. • Figures may not add up to 100% due to rounding off.

folios of a young working adult, a Phoon Chiong Tuck, senior fixed Security selection across all cate- • To access past articles and portfolio reports, click on the Save & Invest Portfolio Series banner at www.sgx.com/academy

Source: CFAS SUNDAY TIMES GRAPHICS

married couple with two young income manager at Lion Global gories, apart from the global ex-

children and a retiree over a two- Investors; Mr Jack Wang, partner change-traded funds (ETFs) alloca-

year period. It guides retail in- at Lexico Capital; Mr Praveen Jag- tion in Mr Wang’s portfolio (both

vestors in basic investment tech- wani, chief executive of UTI Inter- gold and Europe underperformed Asian equities – Asia ex-Japan Furthermore, it trimmed the independence from Spain.

niques and shows how to build a national, Singapore; and Mr Si- MSCI World), helped to contribute (5.5 per cent), India (7.2 per cent), gold ETF in Mr Wang’s portfolio to Developed market equities

portfolio in line with their finan- mon Ng, CEO of CCB Interna- to the outperformance. China (5.4 per cent) and Japan (5.9 allow the addition of other equity (MSCI World) gained 2.5 per cent

cial goals and risk tolerance. tional (Singapore). The panel noted that the Singa- per cent) – all helped the global ETFs. The sales proceeds were (all returns stated are in SGD

This initiative involves the Sin- You can access past articles in pore equities allocation was driven ETF selection beat MSCI World (2.5 channelled to various equity securi- terms) last month and 12.7 per cent

gapore Exchange collaborating the series, as well as monthly by strong performance in Wing Tai per cent). ties to maintain the overall equity year to date. Emerging market equi-

with CFA Society Singapore portfolio reports, by clicking on (11.1 per cent) and Thai Beverage The bond selection outper- allocation. ties gained 4 per cent in the same

(CFAS) and MoneySense, the na- the Save & Invest Portfolio Series (8.9 per cent). Both Keppel DC Reit formed due to gains by retail corpo- For Ms Chee, a China ETF was month with year-to-date returns of

tional financial education pro- banner at www.sgx.com/a- (3.8 per cent) and A-Reit (3 per rate bonds and bank perpetuals, added to her portfolio while for Mr 24.6 per cent.

gramme. cademy. cent) outpaced the broader S-Reit compared with the bond index Goh, the Netlink Trust, A-Reit and During the same period, the STI

index (2.4 per cent). which was up 0.1 per cent. Keppel DCReit positions were performed well, gaining 4.8 per

boosted. An Asia ex-Japan ETF and cent. Strong results from the manu-

ADJUSTMENTS China ETF were added for Mr Wang. facturing sector helped Singapore’s

The panel decided to sell off First economy grow 4.6 per cent in the

Resources in all three portfolios, MARKET DEVELOPMENTS third quarter from a year ago, beat-

and to trim the Wing Tai position in Global markets finished October ing the median forecast of 3.8 per

Mr Goh’s portfolio as the position strongly, brushing off unnerving cent.

size had grown to over 10 per cent events such as the North Korean

of the portfolio. missile crisis and Catalonia’s bid for lornatan@sph.com.sg

Source: Sunday Times © Singapore Press Holdings Limited. Permission required for reproduction

You might also like

- B HereDocument1 pageB Herekailim90No ratings yet

- Behance 65491db977c96Document25 pagesBehance 65491db977c96Significant AntNo ratings yet

- 5.1 Cost Spreadsheet of Idea in Two StagesDocument10 pages5.1 Cost Spreadsheet of Idea in Two StagesHector Luis Chilo ChaccaNo ratings yet

- AOL Personal Money Manager v1.2.1 (For Public)Document70 pagesAOL Personal Money Manager v1.2.1 (For Public)michelleminoza15No ratings yet

- Dixon 1QFY22 Result Update - OthersDocument14 pagesDixon 1QFY22 Result Update - OthersjoycoolNo ratings yet

- Compound Interest CalculatorDocument6 pagesCompound Interest Calculatorbajramo1No ratings yet

- DMCC DashboardDocument1 pageDMCC DashboardAmjad Wael Yahia FayedNo ratings yet

- Truck Refrigration Import Duty CostDocument1 pageTruck Refrigration Import Duty Costsrk1066997No ratings yet

- AccountDocument32 pagesAccountelias dawudNo ratings yet

- Dell-U2715h - Reference Guide - En-UsDocument1 pageDell-U2715h - Reference Guide - En-UsRazvan Razvi NedelcuNo ratings yet

- At Least 30% Are Women Involved in The M & EDocument10 pagesAt Least 30% Are Women Involved in The M & EleahtabsNo ratings yet

- 21-Feb-2019 To, The Managing Director, AP Technology Services LTD., 3rd Floor, R&B Building, Opp Indira Gandhi Municipal Stadium, M G Road, Vijayawada - 520 010 Respected SirDocument1 page21-Feb-2019 To, The Managing Director, AP Technology Services LTD., 3rd Floor, R&B Building, Opp Indira Gandhi Municipal Stadium, M G Road, Vijayawada - 520 010 Respected SirsagarNo ratings yet

- Budget 2024 ProfileDocument1 pageBudget 2024 ProfilemadhurmehrotraNo ratings yet

- Busines Summary - Sjms Coal: Un. Variable & Data ValueDocument1 pageBusines Summary - Sjms Coal: Un. Variable & Data ValueRino ErmawanNo ratings yet

- Warehouse Stationery 2degreesDocument8 pagesWarehouse Stationery 2degrees13777100% (2)

- Quarterly SnapshotDocument5 pagesQuarterly SnapshotDr. Mukesh JindalNo ratings yet

- MCExample SalesForecastDocument103 pagesMCExample SalesForecastpawankumarsahu42No ratings yet

- DownloadDocument1 pageDownloadsoniaNo ratings yet

- Power Finance Corporation 18 08 2021 EmkayDocument10 pagesPower Finance Corporation 18 08 2021 EmkayPavanNo ratings yet

- Jinja District ProfileDocument2 pagesJinja District ProfileJohn KimutaiNo ratings yet

- Monte Carlo Simulation Example: Input ValuesDocument103 pagesMonte Carlo Simulation Example: Input ValuesHarsya FitrioNo ratings yet

- IFIC Bank LimitedDocument2 pagesIFIC Bank LimitedMrittika SahaNo ratings yet

- PRUEBADocument7 pagesPRUEBAIngrid BritoNo ratings yet

- Form - X: Plot No 116-117 & 65-66, Part-A, Mie, Bahadurgarh, Distt - Jhajjar (Haryana)Document11 pagesForm - X: Plot No 116-117 & 65-66, Part-A, Mie, Bahadurgarh, Distt - Jhajjar (Haryana)Varun MalhotraNo ratings yet

- Other Financial Assets at Fair ValueDocument1 pageOther Financial Assets at Fair Valuencq6dmzmp4No ratings yet

- Exercise 1Document3 pagesExercise 1dhiyaasmaNo ratings yet

- Cost Estimate Report AppendicesDocument203 pagesCost Estimate Report AppendicesDavid Hurchanik100% (1)

- Pune-I CompaniesDocument9 pagesPune-I CompaniesTPO RCOEMNo ratings yet

- Semiconductor Sector Update: Kick Starting The NKEA-15/10/2010Document2 pagesSemiconductor Sector Update: Kick Starting The NKEA-15/10/2010Rhb InvestNo ratings yet

- Offer Compensation Breakup: Estimate Based On Current Conversion RateDocument1 pageOffer Compensation Breakup: Estimate Based On Current Conversion RateAyush Gupta 4-Year B.Tech. Electrical EngineeringNo ratings yet

- Mohan MandirDocument2 pagesMohan MandirRoopesh ChaudharyNo ratings yet

- Adventure Cycles DashboardDocument2 pagesAdventure Cycles DashboardUpadrasta HarishNo ratings yet

- Curva S y Dashboard ProyectoDocument2 pagesCurva S y Dashboard ProyectoCristianNo ratings yet

- Real Estate Asset Sale To Accelerate Retailization: L&T Finance HoldingsDocument4 pagesReal Estate Asset Sale To Accelerate Retailization: L&T Finance HoldingsAshwet JadhavNo ratings yet

- Tables For PrintDocument1 pageTables For PrintSophiaNo ratings yet

- Chugging Along: Reliance IndustriesDocument12 pagesChugging Along: Reliance IndustriesAshokNo ratings yet

- Pain Not Coming To An End Cut To Reduce: Bharti AirtelDocument17 pagesPain Not Coming To An End Cut To Reduce: Bharti AirtelAshokNo ratings yet

- Maths NotesDocument43 pagesMaths NotesBurnt llamaNo ratings yet

- 12-Month Business Budget: Budget Analysis (Profit & Loss Category) Budget Analysis (Balance Sheet Category)Document2 pages12-Month Business Budget: Budget Analysis (Profit & Loss Category) Budget Analysis (Balance Sheet Category)Mohamed SururrNo ratings yet

- Standard Bank Limited: Symbol: Standbankl Sector: Bank Board: MainDocument2 pagesStandard Bank Limited: Symbol: Standbankl Sector: Bank Board: MainMrittika SahaNo ratings yet

- Tabel Biaya Reguler Cycle3 2022Document1 pageTabel Biaya Reguler Cycle3 2022Bydin 46No ratings yet

- U2713HM Outline Dimension: Unit: MM (Inch) Dimension: Nominal Drawing: Not To ScaleDocument1 pageU2713HM Outline Dimension: Unit: MM (Inch) Dimension: Nominal Drawing: Not To ScalemarcosNo ratings yet

- NtungamoDocument2 pagesNtungamoJulius MuhimboNo ratings yet

- United Breweries Q4FY21 Result Update - OthersDocument10 pagesUnited Breweries Q4FY21 Result Update - OthersYash MehtaNo ratings yet

- Blue Chip Equity Fund: Portfolio AllocationDocument1 pageBlue Chip Equity Fund: Portfolio Allocationshahar2010No ratings yet

- Blank Performa Convence Bill Neveen 3Document15 pagesBlank Performa Convence Bill Neveen 3ACSFZRNo ratings yet

- Mind Map - Disclosure - Capital StructureDocument1 pageMind Map - Disclosure - Capital StructureAhmad SyubailiNo ratings yet

- Preferred: AssignmentDocument2 pagesPreferred: AssignmentTaetae ElyenNo ratings yet

- 1713 Beaumontmsa PDFDocument1 page1713 Beaumontmsa PDFBrandon ScottNo ratings yet

- Pdip 2023-2028Document7 pagesPdip 2023-2028elaiamapalo395No ratings yet

- Dokumen - Tips - For Analysis of Rate of Part A Work Sector 1 Civil For Analysis of Rate of Part ADocument10 pagesDokumen - Tips - For Analysis of Rate of Part A Work Sector 1 Civil For Analysis of Rate of Part Ashivacivil2124No ratings yet

- 3 Calculation of Daily Exchange PositionDocument10 pages3 Calculation of Daily Exchange PositionTalha AdilNo ratings yet

- BSDE Annual Report 2017 RevisiDocument266 pagesBSDE Annual Report 2017 RevisiRenggana Dimas Prayogi WiranataNo ratings yet

- Annual EV ReportCard 2023 JMK Research 4Document10 pagesAnnual EV ReportCard 2023 JMK Research 4SHIVI TRIPATHINo ratings yet

- Sssar2010low 120222214841 Phpapp02 PDFDocument31 pagesSssar2010low 120222214841 Phpapp02 PDFKhaela MercaderNo ratings yet

- Cost Volume Profit AnalysisDocument17 pagesCost Volume Profit AnalysisNoel CarpioNo ratings yet

- V-C Pay Survey 2018 Full Results 2Document4 pagesV-C Pay Survey 2018 Full Results 2indyradioNo ratings yet

- Wel 28 January 2022Document9 pagesWel 28 January 2022Kaneez FatimaNo ratings yet

- A HereDocument1 pageA Herekailim90No ratings yet

- Paula Begoun Original Beauty Bible PDFDocument485 pagesPaula Begoun Original Beauty Bible PDFAnnaliza Bendal100% (3)

- DK Eyewitness Books World War I by Simon AdamsDocument74 pagesDK Eyewitness Books World War I by Simon AdamsGurgu Ciprian92% (24)

- Rise in Bonds, Equities Offsets Weaker Etfs, Reits in June: InvestDocument1 pageRise in Bonds, Equities Offsets Weaker Etfs, Reits in June: Investkailim90No ratings yet

- Simulated Portfolios All Outperform Benchmarks: InvestDocument1 pageSimulated Portfolios All Outperform Benchmarks: Investkailim90No ratings yet

- Portfolio Tweaks To Cope With High Geopolitical Risk: InvestDocument1 pagePortfolio Tweaks To Cope With High Geopolitical Risk: Investkailim90No ratings yet

- Global Equity Markets' Rally Boosts Portfolios: InvestDocument1 pageGlobal Equity Markets' Rally Boosts Portfolios: Investkailim90No ratings yet

- Rise in Bonds, Equities Offsets Weaker Etfs, Reits in June: InvestDocument1 pageRise in Bonds, Equities Offsets Weaker Etfs, Reits in June: Investkailim90No ratings yet

- Portfolio Tweaks To Cope With High Geopolitical Risk: InvestDocument1 pagePortfolio Tweaks To Cope With High Geopolitical Risk: Investkailim90No ratings yet

- Portfolios Achieve Double-Digit Gains in 2017: InvestDocument1 pagePortfolios Achieve Double-Digit Gains in 2017: Investkailim90No ratings yet

- New TechnologyDocument2 pagesNew Technologykailim90No ratings yet

- Right To Lock in Profits, Up Cash Levels: InvestDocument1 pageRight To Lock in Profits, Up Cash Levels: Investkailim90No ratings yet

- Snap FitDocument21 pagesSnap Fitguru_axiom100% (4)

- New TechnologyDocument2 pagesNew Technologykailim90No ratings yet

- Chinese-English Business Email SampDocument104 pagesChinese-English Business Email Sampkailim90No ratings yet

- Shasta County Project: Privatization of Public ServicesDocument33 pagesShasta County Project: Privatization of Public Servicesreltih18No ratings yet

- Name: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CDocument5 pagesName: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CKirti RawatNo ratings yet

- ENT - 1-Nature & Importance of EntrepreneursDocument25 pagesENT - 1-Nature & Importance of EntrepreneursMajhar Ul Haque100% (4)

- Basics-For-Traders Idbi STK MKT V V V Imp Gooood 220622Document20 pagesBasics-For-Traders Idbi STK MKT V V V Imp Gooood 220622jig3309No ratings yet

- FINC521-Most Important QuestionsDocument24 pagesFINC521-Most Important QuestionsAll rounder NitinNo ratings yet

- Lyceum of The Philippines University Preliminary Examination ECON01A-Principles of Economics With Land Reform and Taxation Prof. Nestor C. VelascoDocument3 pagesLyceum of The Philippines University Preliminary Examination ECON01A-Principles of Economics With Land Reform and Taxation Prof. Nestor C. VelascoJM Hernandez VillanuevaNo ratings yet

- Fiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order ToDocument2 pagesFiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order TominhaxxNo ratings yet

- Phase Test 2017 - 18Document15 pagesPhase Test 2017 - 18AKSHIT SHUKLANo ratings yet

- Master in Management: Fundamentals of Finance - Session 1Document446 pagesMaster in Management: Fundamentals of Finance - Session 1Leonardo MercuriNo ratings yet

- Descon Chemicals Limited Swot Analysis BacDocument6 pagesDescon Chemicals Limited Swot Analysis BacAamir HadiNo ratings yet

- Goodwill and Its Amortization The Rules and The RealitiesDocument4 pagesGoodwill and Its Amortization The Rules and The RealitiesArun SinghalNo ratings yet

- Introduction To Corporate FinanceDocument19 pagesIntroduction To Corporate FinanceMadhu dollyNo ratings yet

- MFI in IndonesiaDocument38 pagesMFI in IndonesiaAgus GunawanNo ratings yet

- Convertible Note Term SheetDocument2 pagesConvertible Note Term SheetVictorNo ratings yet

- GCC Oman PDFDocument113 pagesGCC Oman PDFkinzahNo ratings yet

- SS9 FMDocument2 pagesSS9 FMNguyễn Hồng HạnhNo ratings yet

- Natural ResourcesDocument59 pagesNatural ResourcesSohel BangiNo ratings yet

- Database DefinitionsDocument632 pagesDatabase DefinitionskumardesaiNo ratings yet

- Renewable Energy: in RomaniaDocument56 pagesRenewable Energy: in RomaniaIonut AndreiNo ratings yet

- Kumar Mangalam Birla Committee - Docxkumar Mangalam Birla CommitteeDocument3 pagesKumar Mangalam Birla Committee - Docxkumar Mangalam Birla CommitteeVanessa HernandezNo ratings yet

- Ebook PDF Contemporary Financial Management 13th Edition PDFDocument41 pagesEbook PDF Contemporary Financial Management 13th Edition PDFlori.parker237100% (34)

- Jurnal Inter SintyaDocument7 pagesJurnal Inter SintyaAbhimana NegaraNo ratings yet

- Math Problem SolvingDocument41 pagesMath Problem Solvingthomascrown68No ratings yet

- 2 Types of SecuritiesDocument2 pages2 Types of SecuritiesMark MatyasNo ratings yet

- Marathon Batch Final With Cover and Index PDFDocument106 pagesMarathon Batch Final With Cover and Index PDFChandreshNo ratings yet

- Legal Aspects of Doing Business in The NetherlandsDocument130 pagesLegal Aspects of Doing Business in The NetherlandsDesNo ratings yet

- Securitization: Financial Engineering UBS ChandigarhDocument21 pagesSecuritization: Financial Engineering UBS Chandigarhtony_njNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentFarhan TyeballyNo ratings yet

- FI Data ExtractionDocument19 pagesFI Data ExtractionEmanuelPredescu100% (1)

- Advanced Financial Management - Finals-11Document2 pagesAdvanced Financial Management - Finals-11graalNo ratings yet