Professional Documents

Culture Documents

CBA Business Taxation Updated

CBA Business Taxation Updated

Uploaded by

I am JacobCopyright:

Available Formats

You might also like

- Visa Fee InvoiceReceipt PDFDocument1 pageVisa Fee InvoiceReceipt PDFVikram Singh50% (2)

- Metabank Ace Bank Statement TemplateDocument2 pagesMetabank Ace Bank Statement TemplateSteven Lee100% (2)

- SOREV Income Approach DiagnosticDocument4 pagesSOREV Income Approach DiagnosticReyn شكرا100% (1)

- Account 1 Final Requirement RemDocument9 pagesAccount 1 Final Requirement RemClarisse AlimotNo ratings yet

- Basic Principles LectureDocument7 pagesBasic Principles LectureevaNo ratings yet

- Ra 8424Document220 pagesRa 8424embiesNo ratings yet

- Chapter 1 To 4Document27 pagesChapter 1 To 4Karla Barbacena100% (1)

- REAL PROPERTY TAXATION - PresentationDocument71 pagesREAL PROPERTY TAXATION - PresentationMarcial Militante100% (1)

- Bus Law and TaxDocument15 pagesBus Law and Taxkay_kleirNo ratings yet

- Sample Problem For Gross EstateDocument5 pagesSample Problem For Gross EstateChristineNo ratings yet

- A. Condonation or Remission of A DebtDocument3 pagesA. Condonation or Remission of A DebtTk KimNo ratings yet

- Business and Transfer Reviewer CompressDocument11 pagesBusiness and Transfer Reviewer CompressMarko JerichoNo ratings yet

- Real Estate Taxation - 12.11.15 (Wo Answers)Document7 pagesReal Estate Taxation - 12.11.15 (Wo Answers)Juan FrivaldoNo ratings yet

- Donor S Tax QuizDocument5 pagesDonor S Tax QuizDerick John Palapag100% (1)

- Tax Lecture VATDocument4 pagesTax Lecture VATRozzane Ann RomaNo ratings yet

- Local Government Code of The PhilippinesDocument3 pagesLocal Government Code of The PhilippinesBon Jovi RosarioNo ratings yet

- Problems Income Tax On CorporationsDocument3 pagesProblems Income Tax On CorporationsJemimah Malicsi0% (1)

- Dealings in PropertyDocument30 pagesDealings in PropertyPrie DitucalanNo ratings yet

- Taxation of Employment IncomeDocument7 pagesTaxation of Employment IncomeJamvy Jose FernandezNo ratings yet

- Dof Do 37-09 Ivs AdoptionDocument2 pagesDof Do 37-09 Ivs Adoptionrubydelacruz100% (1)

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- Tax On Ind-QuizDocument34 pagesTax On Ind-QuizKathleen Jane Solmayor100% (2)

- Output Tax and Input TaxDocument12 pagesOutput Tax and Input TaxKiro ParafrostNo ratings yet

- 2.1. Property Plant and Equipment IAS 16Document7 pages2.1. Property Plant and Equipment IAS 16Priya Satheesh100% (1)

- Reviewer in Estate Tax PDFDocument43 pagesReviewer in Estate Tax PDFmikheal beyberNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document31 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo GironellaNo ratings yet

- Taxation PDFDocument15 pagesTaxation PDFJaneNo ratings yet

- Manual On Real Property Appraisal and Assessment Operations DOF-BLGF 2006 (Key Points)Document40 pagesManual On Real Property Appraisal and Assessment Operations DOF-BLGF 2006 (Key Points)ElsieRaquiño100% (1)

- Taxation 888 PowerpointDocument888 pagesTaxation 888 PowerpointMelanie OngNo ratings yet

- PD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Document2 pagesPD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Rocky MarcianoNo ratings yet

- Q7 Dealings in PropertiesDocument5 pagesQ7 Dealings in PropertiesNhajNo ratings yet

- 2316 JAKEDocument1 page2316 JAKEJM HernandezNo ratings yet

- University of St. Lasalle: Student HandoutsDocument13 pagesUniversity of St. Lasalle: Student HandoutsMae EscanillanNo ratings yet

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDocument6 pagesEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandeNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Yes, Because Goccs Are Essentially Commercial in NatureDocument19 pagesYes, Because Goccs Are Essentially Commercial in NatureAdah Micah PlarisanNo ratings yet

- TAX-1001 (Fringe Benefit Tax)Document6 pagesTAX-1001 (Fringe Benefit Tax)Ciarie SalgadoNo ratings yet

- CH 01Document64 pagesCH 01Kh H100% (1)

- Special Economic ZoneDocument27 pagesSpecial Economic ZoneMaangNo ratings yet

- Transfer & Business TaxDocument5 pagesTransfer & Business TaxAlif FabianNo ratings yet

- Chapter 4 Information Technology ItDocument63 pagesChapter 4 Information Technology It黄勇添No ratings yet

- TB 16Document70 pagesTB 16Saliha BajwaNo ratings yet

- Short Quiz 4 Set A With AnswerDocument3 pagesShort Quiz 4 Set A With AnswerJean Pierre IsipNo ratings yet

- Module 5. Preferential TaxationDocument6 pagesModule 5. Preferential TaxationYolly DiazNo ratings yet

- Income Tax, Tax RemDocument23 pagesIncome Tax, Tax RemAlyanna CabralNo ratings yet

- Broker Reviewer 2022Document8 pagesBroker Reviewer 2022Janzel SantillanNo ratings yet

- Professiona Review & Training Center, IncDocument14 pagesProfessiona Review & Training Center, IncBryan Christian MaragragNo ratings yet

- Business and Transfer TaxDocument8 pagesBusiness and Transfer TaxJust WOWNo ratings yet

- Amended Guidelines Abot-Kamay Pabahay Program'Document30 pagesAmended Guidelines Abot-Kamay Pabahay Program'Ge-An Moiseah Salud AlmueteNo ratings yet

- TAX 56 - Business and Transfer TaxesDocument8 pagesTAX 56 - Business and Transfer TaxesAl JovenNo ratings yet

- Prefinals Exam in Income TaxationDocument3 pagesPrefinals Exam in Income TaxationYen YenNo ratings yet

- Bir Regulations MonitoringDocument87 pagesBir Regulations MonitoringErica NicolasuraNo ratings yet

- A Look at The Phillipine EcomomyDocument38 pagesA Look at The Phillipine EcomomyJayvee FelipeNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Estate TaxDocument2 pagesEstate Taxucc second yearNo ratings yet

- List of Bir FormsDocument26 pagesList of Bir FormsAviaNo ratings yet

- Transfer and Business TaxationDocument4 pagesTransfer and Business TaxationKhai Supleo PabelicoNo ratings yet

- CBA - Fundamentals of Accounting - UpdatedDocument4 pagesCBA - Fundamentals of Accounting - UpdatedVher DucayNo ratings yet

- Bibliography: IRS's Comprehensive Approach To Compliance. Paper Presented at National Tax Association SpringDocument4 pagesBibliography: IRS's Comprehensive Approach To Compliance. Paper Presented at National Tax Association Springashura08No ratings yet

- CBA Financial Accounting UpdatedDocument4 pagesCBA Financial Accounting UpdatedHyo-Shin KimNo ratings yet

- Rift Valley Universty Chiro CampusDocument37 pagesRift Valley Universty Chiro CampusBobasa S AhmedNo ratings yet

- Daniel S. Goldberg - The Death of The Income Tax - A Progressive Consumption Tax and The Path To Fiscal Reform (2013)Document335 pagesDaniel S. Goldberg - The Death of The Income Tax - A Progressive Consumption Tax and The Path To Fiscal Reform (2013)Muhammad FaisalNo ratings yet

- Í!"! (RWQ!!!$S #Ay4Î: Hello DanielaDocument2 pagesÍ!"! (RWQ!!!$S #Ay4Î: Hello Danieladany.cantaragiuNo ratings yet

- 5 - 6307586346680583618 (1) (1) - 1Document4 pages5 - 6307586346680583618 (1) (1) - 1Rohit raagNo ratings yet

- Impact of The TRAIN Law by PICPA Taxation CPALEDocument46 pagesImpact of The TRAIN Law by PICPA Taxation CPALEJohn LuNo ratings yet

- Presumptive Taxation: - Under Income Tax Act, 1961Document21 pagesPresumptive Taxation: - Under Income Tax Act, 1961Saksham JoshiNo ratings yet

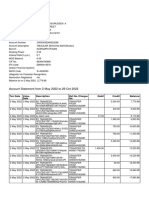

- Statement 42304092 USD 2023-03-07 2023-10-25Document6 pagesStatement 42304092 USD 2023-03-07 2023-10-25Fawad AkhtarNo ratings yet

- Complete BIR Taxation Guide For Self-Employed & FreelancersDocument35 pagesComplete BIR Taxation Guide For Self-Employed & FreelancersKuzan AokijiNo ratings yet

- Yes BankDocument9 pagesYes Bankरायटर लेखनवालाNo ratings yet

- The Following Selected Transactions Were Completed by Green Lawn SuppliesDocument1 pageThe Following Selected Transactions Were Completed by Green Lawn SuppliesAmit PandeyNo ratings yet

- Q.1 Who Is A Goods Transport Agency (GTA) ?Document3 pagesQ.1 Who Is A Goods Transport Agency (GTA) ?ANo ratings yet

- Other Percentage TaxesDocument5 pagesOther Percentage TaxesjamNo ratings yet

- Payroll Management SystemDocument14 pagesPayroll Management SystemShifat TalukdarNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument11 pagesMobile Services: Your Account Summary This Month'S ChargesgeniluniNo ratings yet

- Sindoor 2Document2 pagesSindoor 2sanju.wageeshaNo ratings yet

- Complete List of Banking TermsDocument33 pagesComplete List of Banking TermsTanya Hughes100% (1)

- JioMart Invoice 16501052870178594A 1Document1 pageJioMart Invoice 16501052870178594A 1SkAliHassanNo ratings yet

- Booking.com_ Confirmation NEWDocument1 pageBooking.com_ Confirmation NEWrohanmalhotra930No ratings yet

- Revised Cash Disbursement RegisterDocument8 pagesRevised Cash Disbursement RegisterPatrice GonzalesNo ratings yet

- SVX 3 E3 YS0 Xyj VP BCDocument14 pagesSVX 3 E3 YS0 Xyj VP BCmohamed arabathNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- CFI Accountingfactsheet-1499721167572 PDFDocument1 pageCFI Accountingfactsheet-1499721167572 PDFshaik imranNo ratings yet

- Alliance OnlineDocument1 pageAlliance Onlinestudy materialNo ratings yet

- SambaStatement PDFDocument1 pageSambaStatement PDFjoNo ratings yet

- Financial Accounting - Quiz 2Document3 pagesFinancial Accounting - Quiz 2AlfiyanNo ratings yet

- Aa4102 Group4 ExerciseDocument7 pagesAa4102 Group4 ExerciseShara Monique RolunaNo ratings yet

- MnA India TaxPerspectiveDocument36 pagesMnA India TaxPerspectiveGamer LastNo ratings yet

- Gross Income and DeductionsDocument6 pagesGross Income and DeductionsIvan Fausto OranteNo ratings yet

- Booking Confirmation On IRCTC, Train: 12628, 29-Jun-2019, 3A, NDLS - SBCDocument1 pageBooking Confirmation On IRCTC, Train: 12628, 29-Jun-2019, 3A, NDLS - SBCRajan GuptaNo ratings yet

- SNRR Rbi DocsDocument1 pageSNRR Rbi DocsAbin RajanNo ratings yet

CBA Business Taxation Updated

CBA Business Taxation Updated

Uploaded by

I am JacobCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBA Business Taxation Updated

CBA Business Taxation Updated

Uploaded by

I am JacobCopyright:

Available Formats

HOLY ANGEL UNIVERSITY LIBRARY

http://www.hau.edu.ph/university_library/

Library

Pathfinder

Business Taxation

DEFINITION

Business Taxation

Business taxation is defined as an enforced contribution, exacted pursuant to legislative

authority in the exercise of the taxing power, and imposed and collected for the purpose of raising

revenue to be used for public or governmental purposes. (Murphy, Kevin E. (2001). Concepts

in federal taxation. 2001 ed. Australia: South-Western College Publishing.)

Five major types of business taxes are: (1) corporate franchise tax, (2) employment (withholding)

tax, (3) excise tax, (4) gross-receipts tax, and (5) value added tax (VAT). Some types of firms

(such as insurance, mining, and petroleum extraction companies) pay additional taxes peculiar to

their industries. While firms too pay income, property, and sales taxes, such taxes are not specific

to businesses.(http://www.businessdictionary.com/definition/business-tax.html)

BOOKS

Circulation Section

3rd Floor

Alworth, Julian S., ed. (2012) Taxation and the financial crisis. GSL/Cir 339.525 T235

Cruz, Ana (2009) Fundamentals of taxation 2009. Cir 657.46 F981

Filipiniana Section

2nd Floor

(2013) Income taxation : a simplified presentation of the tax laws, concepts and principles. Fil

336.2409599In374

th

Aduana, Nick L. (2012) Simplified and procedural handbook on income taxation. 12 ed, Fil

343.599024 Ad244 2012

Aduana, Nick L. (2010) Simplified and procedural handbook on transfer and business taxation. 2nd

ed. Fil 343.599053 Ad244 2010

Aduana, Nick L. (2011) CPA reviewer in taxation. Fil 336.2 Ad244

th

Ampongan, Omar Erasmo G. (2014) Income taxation (With tax principles & remedies). 13 ed.

Fil 336.2409599 Am526 2014

Ampongan, Omar Erasmo G. (2011) CPA reviewer in taxation. 7th ed. Fil 336.2 Am526

th

Ballada, Win (2014) Income taxation made easy. 14 ed. Cir 336.24 B188 2014

th

Ballada, Win (2011) Income taxation made easy. 12 ed. Cir 336.24 B188 2011

th

Ballada, Win (2010) Income taxation made easy. 11 ed. Cir 336.24 B188 2010

Conti, Indalicio P. (2009) Fundamentals of Philippine income taxation. Fil 343.599052 C762

th

De Leon, Hector S. (2012) The Fundamentals of taxation. 16 ed. Fil 343.0402609599 D278 2012

De leon, Hector S. (2009). The law of transfer and business taxation with illustrations, problems

and solutions. 2009 ed. Fil 336.20709599 D346 2009

nd

Dimaampao, Japar B. (2005) Basic approach to income taxation. 2 ed. 343.052 D582 2005

th

Domondon, Abelardo T. (2013) Taxation. 10 ed. Fil 336.2 D673 2012

Manapat, Carlos L. (2014) Economics, taxation and agrarian reform. Rev ed. Fil 330 M266 2014

Reyes, Virgilo D. (2005). Philippine transfer and business taxes : principles, law and problems :

a new approach. Nov. 2005 ed. Fil 346.0436 R457

Reyes, Virgilo D. (2005). Philippine transfer and business taxes : principles, law and problems :

a new approach. Nov. 2005 ed. Fil 346.0436 R45

Valencia, Edwin G. (2013). Transfer and business taxation : principles and laws with accounting

th

applications. 2013-2014 6 ed. Fil 343.599053 V152 2013

Valencia, Edwin G. (2009). Transfer and business taxation : principles and laws with accounting

th

applications. 5 ed. Fil 343.59904 V152 2009

Valencia, Edwin G. (2007). Transfer and business taxation : principles and laws with accounting

th

applications. 4 ed. Cir 343.59904 V152 2007

Valencia, Edwin G. (2006). Transfer and business taxation : principles and laws with accounting

rd

applications. 3 ed. Fil 343.59904 V152

ELECTRONIC JOURNALS

Accessible thru HAU Library Webpage

ProQuest Central

Accounting & Taxation

Construction Accounting & Taxation

Corporate Taxation

Corporate Taxation

Journal of International Taxation

Journal of State Taxation

Journal of Taxation

The Journal of the American Taxation Association

National Tax Association - Tax Institute of America. Proceedings of the Annual Conference

on Taxation

NewsQuarterly. ABA Section of Taxation

OECD Taxation Working Papers

Real Estate Taxation

The Tax Lawyer

INTERNET RESOURCES

Multimedia/CD-Rom Station and Internet Workstation

nd rd

2 and 3 Floor

Business – Taxation from CSULB.edu.

Retrieved on March 2, 2015 from http://www.csulb.edu/library/subj/business/taxation.html

This site grants different related and authoritative links of taxation websites.

Business Taxation from FindLaw.com.

Retrieved on March 2, 2015 from http://smallbusiness.findlaw.com/small-business-taxes/

This site provides a business taxation section which has helpful articles, answers to frequently

asked questions, and resources on business income taxation, tax deductions for your business,

avoiding a tax audit, and more.

Tax, Accounting and Payroll Sites Directory from Taxsites.com.

Retrieved on March 2, 2015 from http://www.taxsites.com/topics.html

This site presents various essential topics pertaining to tax such as tax accounting, tax planning,

different forms of taxes, etc.

Tax Information for Businesses from Int’l Revenue Service, United Stated Dept. of Treasury.

Retrieved on March 2, 2015 from http://www.irs.gov/businesses/index.html

This site provides comprehensive and vital sets of information about business taxes and other

relevant forms of taxes in the United States of America.

Compiled by:

Reference and Information Section

nd

2 Floor, University Libra0072y

Tel. Nos. 888-8691 loc. 1458

March 2, 2015

You might also like

- Visa Fee InvoiceReceipt PDFDocument1 pageVisa Fee InvoiceReceipt PDFVikram Singh50% (2)

- Metabank Ace Bank Statement TemplateDocument2 pagesMetabank Ace Bank Statement TemplateSteven Lee100% (2)

- SOREV Income Approach DiagnosticDocument4 pagesSOREV Income Approach DiagnosticReyn شكرا100% (1)

- Account 1 Final Requirement RemDocument9 pagesAccount 1 Final Requirement RemClarisse AlimotNo ratings yet

- Basic Principles LectureDocument7 pagesBasic Principles LectureevaNo ratings yet

- Ra 8424Document220 pagesRa 8424embiesNo ratings yet

- Chapter 1 To 4Document27 pagesChapter 1 To 4Karla Barbacena100% (1)

- REAL PROPERTY TAXATION - PresentationDocument71 pagesREAL PROPERTY TAXATION - PresentationMarcial Militante100% (1)

- Bus Law and TaxDocument15 pagesBus Law and Taxkay_kleirNo ratings yet

- Sample Problem For Gross EstateDocument5 pagesSample Problem For Gross EstateChristineNo ratings yet

- A. Condonation or Remission of A DebtDocument3 pagesA. Condonation or Remission of A DebtTk KimNo ratings yet

- Business and Transfer Reviewer CompressDocument11 pagesBusiness and Transfer Reviewer CompressMarko JerichoNo ratings yet

- Real Estate Taxation - 12.11.15 (Wo Answers)Document7 pagesReal Estate Taxation - 12.11.15 (Wo Answers)Juan FrivaldoNo ratings yet

- Donor S Tax QuizDocument5 pagesDonor S Tax QuizDerick John Palapag100% (1)

- Tax Lecture VATDocument4 pagesTax Lecture VATRozzane Ann RomaNo ratings yet

- Local Government Code of The PhilippinesDocument3 pagesLocal Government Code of The PhilippinesBon Jovi RosarioNo ratings yet

- Problems Income Tax On CorporationsDocument3 pagesProblems Income Tax On CorporationsJemimah Malicsi0% (1)

- Dealings in PropertyDocument30 pagesDealings in PropertyPrie DitucalanNo ratings yet

- Taxation of Employment IncomeDocument7 pagesTaxation of Employment IncomeJamvy Jose FernandezNo ratings yet

- Dof Do 37-09 Ivs AdoptionDocument2 pagesDof Do 37-09 Ivs Adoptionrubydelacruz100% (1)

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- Tax On Ind-QuizDocument34 pagesTax On Ind-QuizKathleen Jane Solmayor100% (2)

- Output Tax and Input TaxDocument12 pagesOutput Tax and Input TaxKiro ParafrostNo ratings yet

- 2.1. Property Plant and Equipment IAS 16Document7 pages2.1. Property Plant and Equipment IAS 16Priya Satheesh100% (1)

- Reviewer in Estate Tax PDFDocument43 pagesReviewer in Estate Tax PDFmikheal beyberNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document31 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo GironellaNo ratings yet

- Taxation PDFDocument15 pagesTaxation PDFJaneNo ratings yet

- Manual On Real Property Appraisal and Assessment Operations DOF-BLGF 2006 (Key Points)Document40 pagesManual On Real Property Appraisal and Assessment Operations DOF-BLGF 2006 (Key Points)ElsieRaquiño100% (1)

- Taxation 888 PowerpointDocument888 pagesTaxation 888 PowerpointMelanie OngNo ratings yet

- PD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Document2 pagesPD 1812 - Amended Provision of PD 464 (Real Prop Tax Code)Rocky MarcianoNo ratings yet

- Q7 Dealings in PropertiesDocument5 pagesQ7 Dealings in PropertiesNhajNo ratings yet

- 2316 JAKEDocument1 page2316 JAKEJM HernandezNo ratings yet

- University of St. Lasalle: Student HandoutsDocument13 pagesUniversity of St. Lasalle: Student HandoutsMae EscanillanNo ratings yet

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDocument6 pagesEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandeNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Yes, Because Goccs Are Essentially Commercial in NatureDocument19 pagesYes, Because Goccs Are Essentially Commercial in NatureAdah Micah PlarisanNo ratings yet

- TAX-1001 (Fringe Benefit Tax)Document6 pagesTAX-1001 (Fringe Benefit Tax)Ciarie SalgadoNo ratings yet

- CH 01Document64 pagesCH 01Kh H100% (1)

- Special Economic ZoneDocument27 pagesSpecial Economic ZoneMaangNo ratings yet

- Transfer & Business TaxDocument5 pagesTransfer & Business TaxAlif FabianNo ratings yet

- Chapter 4 Information Technology ItDocument63 pagesChapter 4 Information Technology It黄勇添No ratings yet

- TB 16Document70 pagesTB 16Saliha BajwaNo ratings yet

- Short Quiz 4 Set A With AnswerDocument3 pagesShort Quiz 4 Set A With AnswerJean Pierre IsipNo ratings yet

- Module 5. Preferential TaxationDocument6 pagesModule 5. Preferential TaxationYolly DiazNo ratings yet

- Income Tax, Tax RemDocument23 pagesIncome Tax, Tax RemAlyanna CabralNo ratings yet

- Broker Reviewer 2022Document8 pagesBroker Reviewer 2022Janzel SantillanNo ratings yet

- Professiona Review & Training Center, IncDocument14 pagesProfessiona Review & Training Center, IncBryan Christian MaragragNo ratings yet

- Business and Transfer TaxDocument8 pagesBusiness and Transfer TaxJust WOWNo ratings yet

- Amended Guidelines Abot-Kamay Pabahay Program'Document30 pagesAmended Guidelines Abot-Kamay Pabahay Program'Ge-An Moiseah Salud AlmueteNo ratings yet

- TAX 56 - Business and Transfer TaxesDocument8 pagesTAX 56 - Business and Transfer TaxesAl JovenNo ratings yet

- Prefinals Exam in Income TaxationDocument3 pagesPrefinals Exam in Income TaxationYen YenNo ratings yet

- Bir Regulations MonitoringDocument87 pagesBir Regulations MonitoringErica NicolasuraNo ratings yet

- A Look at The Phillipine EcomomyDocument38 pagesA Look at The Phillipine EcomomyJayvee FelipeNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Estate TaxDocument2 pagesEstate Taxucc second yearNo ratings yet

- List of Bir FormsDocument26 pagesList of Bir FormsAviaNo ratings yet

- Transfer and Business TaxationDocument4 pagesTransfer and Business TaxationKhai Supleo PabelicoNo ratings yet

- CBA - Fundamentals of Accounting - UpdatedDocument4 pagesCBA - Fundamentals of Accounting - UpdatedVher DucayNo ratings yet

- Bibliography: IRS's Comprehensive Approach To Compliance. Paper Presented at National Tax Association SpringDocument4 pagesBibliography: IRS's Comprehensive Approach To Compliance. Paper Presented at National Tax Association Springashura08No ratings yet

- CBA Financial Accounting UpdatedDocument4 pagesCBA Financial Accounting UpdatedHyo-Shin KimNo ratings yet

- Rift Valley Universty Chiro CampusDocument37 pagesRift Valley Universty Chiro CampusBobasa S AhmedNo ratings yet

- Daniel S. Goldberg - The Death of The Income Tax - A Progressive Consumption Tax and The Path To Fiscal Reform (2013)Document335 pagesDaniel S. Goldberg - The Death of The Income Tax - A Progressive Consumption Tax and The Path To Fiscal Reform (2013)Muhammad FaisalNo ratings yet

- Í!"! (RWQ!!!$S #Ay4Î: Hello DanielaDocument2 pagesÍ!"! (RWQ!!!$S #Ay4Î: Hello Danieladany.cantaragiuNo ratings yet

- 5 - 6307586346680583618 (1) (1) - 1Document4 pages5 - 6307586346680583618 (1) (1) - 1Rohit raagNo ratings yet

- Impact of The TRAIN Law by PICPA Taxation CPALEDocument46 pagesImpact of The TRAIN Law by PICPA Taxation CPALEJohn LuNo ratings yet

- Presumptive Taxation: - Under Income Tax Act, 1961Document21 pagesPresumptive Taxation: - Under Income Tax Act, 1961Saksham JoshiNo ratings yet

- Statement 42304092 USD 2023-03-07 2023-10-25Document6 pagesStatement 42304092 USD 2023-03-07 2023-10-25Fawad AkhtarNo ratings yet

- Complete BIR Taxation Guide For Self-Employed & FreelancersDocument35 pagesComplete BIR Taxation Guide For Self-Employed & FreelancersKuzan AokijiNo ratings yet

- Yes BankDocument9 pagesYes Bankरायटर लेखनवालाNo ratings yet

- The Following Selected Transactions Were Completed by Green Lawn SuppliesDocument1 pageThe Following Selected Transactions Were Completed by Green Lawn SuppliesAmit PandeyNo ratings yet

- Q.1 Who Is A Goods Transport Agency (GTA) ?Document3 pagesQ.1 Who Is A Goods Transport Agency (GTA) ?ANo ratings yet

- Other Percentage TaxesDocument5 pagesOther Percentage TaxesjamNo ratings yet

- Payroll Management SystemDocument14 pagesPayroll Management SystemShifat TalukdarNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument11 pagesMobile Services: Your Account Summary This Month'S ChargesgeniluniNo ratings yet

- Sindoor 2Document2 pagesSindoor 2sanju.wageeshaNo ratings yet

- Complete List of Banking TermsDocument33 pagesComplete List of Banking TermsTanya Hughes100% (1)

- JioMart Invoice 16501052870178594A 1Document1 pageJioMart Invoice 16501052870178594A 1SkAliHassanNo ratings yet

- Booking.com_ Confirmation NEWDocument1 pageBooking.com_ Confirmation NEWrohanmalhotra930No ratings yet

- Revised Cash Disbursement RegisterDocument8 pagesRevised Cash Disbursement RegisterPatrice GonzalesNo ratings yet

- SVX 3 E3 YS0 Xyj VP BCDocument14 pagesSVX 3 E3 YS0 Xyj VP BCmohamed arabathNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- CFI Accountingfactsheet-1499721167572 PDFDocument1 pageCFI Accountingfactsheet-1499721167572 PDFshaik imranNo ratings yet

- Alliance OnlineDocument1 pageAlliance Onlinestudy materialNo ratings yet

- SambaStatement PDFDocument1 pageSambaStatement PDFjoNo ratings yet

- Financial Accounting - Quiz 2Document3 pagesFinancial Accounting - Quiz 2AlfiyanNo ratings yet

- Aa4102 Group4 ExerciseDocument7 pagesAa4102 Group4 ExerciseShara Monique RolunaNo ratings yet

- MnA India TaxPerspectiveDocument36 pagesMnA India TaxPerspectiveGamer LastNo ratings yet

- Gross Income and DeductionsDocument6 pagesGross Income and DeductionsIvan Fausto OranteNo ratings yet

- Booking Confirmation On IRCTC, Train: 12628, 29-Jun-2019, 3A, NDLS - SBCDocument1 pageBooking Confirmation On IRCTC, Train: 12628, 29-Jun-2019, 3A, NDLS - SBCRajan GuptaNo ratings yet

- SNRR Rbi DocsDocument1 pageSNRR Rbi DocsAbin RajanNo ratings yet