Professional Documents

Culture Documents

RR No. 23-2018

RR No. 23-2018

Uploaded by

Scion RaguindinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RR No. 23-2018

RR No. 23-2018

Uploaded by

Scion RaguindinCopyright:

Available Formats

BUREAU OF rtrr rkr.tNAL trHvF_!

\ue

REPUBLIC OF THE PHILIPPINES

r{rj ( rri i OI FINANCE

ERNAL REVENUE

lL CvrrririU

City

RECORD-q MGT. DIViS IOt.i

NOV 2019

UiUIi

REVE|;; REGULATTSNS No. Js-hol!

SUBJECT Amending Certain Provisions of Revenue Regulations (RR) No. 17-

2011, as Amended, Implementing Republic Act (RA) No. 9505,

Otherwise Known as the "Personal Equity and Retirement Account

(PERA) Act of 2008".

TO All lnternal Revenue Officers and Others Concemed

SECTION 1. SCOPE. Pursuant to the provisions of Sections 244 and245 of the National

Internal Revenue Code of - 1997, as amended, in relation to Section 13 of Republic Act (RA)

No. 9505, otherwise known as the "Personal Equity and Retirement Accouni (pEne) abt oi

?00.8", certain provisions of Revenue Regulations (RR) No. 17-2011, as amended, is hereby

further amended as prescribed under the aforesaid law.

SECTION 2. Sections a (5) of RR No. 17-2011, as amended, is hereby'further amended to

read as follows:

"SECTION 4.Establishment of a PERA.

- A Contributor must comply with

following requirements in establishing a PERA;

the

(5) Submission of proof of source o.f-funds for the year or to be earned.for the

year when the PERA contribution wcts made. "

SECTION 3. Section 10 (B) of RR No. 17-2011, as amended, is hereby renumbered and

further amended to read as follows:

"SECTION 10. PERA Distributions and Early Withdrawals.

-

B. Early Withdrawal

The follov,ing shall nol be subject tct thc Early Withdrav,al Penalty;

(1) Transfer qf PERA assets to another Oualified/Elisible PERA Investment

Product and/or another Administrator within.fifteen (15) calendar davs

.from the withdrav,al thereot

2) For payment of accident or illness-reloted hospitalization in excess of

thirty (30) days, in which case o duly notarized doctor's certificate

attesting to the' said event shall be attached to the Notice qf

Termination/Withdrawal/Transfer to be submitted to the PERA Processing

Office;

(3) For payment to a Contributor y,ho has been subsequently rendered

permanently totally disabled as defined under the Employees

Compensation Law or Social Security System Lqw, in which case a

certification dtly issued by a pertinent government agency that the

Contributor had been permanently totally disabled shall be attached to the

Notice of Termination/ Withdrcrwal/Transfer to be submitted to the PERA

Processing Office,'

(4) Deduction qf fees o-f the administrator, custodian and product provider

(subsesuent to account openind from PERA assets, provided that such

deduction is made with the consent of the Contributor.

SECTION 4. REPEALING CLAUSE. Any rules and regulations, issuances or parts

- Regulations are hereby repealed, amended or

thereof inconsistent with the provisions of these

modified accordingly.

SECTION 5. SEPARABILITY CLAUSE.

- If anyofofthetheremaining provisions

provisions of these regulations is

subsequently declared unconstitutional, the validity hereof shall

remain in full force and effect.

SECTION 6. EFFECTIYITY. These Revenue Regulations shalltake effect immediately.

-

Recommending Approval:

@ CAESAR R. DULAY

Commissioner of Internal Revenue

+ 0 20 o 3 3

Approved:

47, ,

firt

Secretary of Finance tib';,

'€-,0*.r,

H-I-LMAT 0[T 2 3 2018

BtIREAIJ OF tfr t l:FTNAL Hl:vr: i\, !Jh

f:\

I t\\

1il1

Nol/ 212018

/|:aa ont

N)

RECORD$ MST, DIVIS!O N

PAGE 2 OF 2

You might also like

- College Accounting Chapters 1-27-23rd Edition Heintz Solutions ManualDocument35 pagesCollege Accounting Chapters 1-27-23rd Edition Heintz Solutions Manualengildhebraism.he3o100% (9)

- Undertaking To VacateDocument1 pageUndertaking To VacateAngieLlantoCurioso67% (3)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Moot Court Competition: D R P & O Vs U O BDocument26 pagesMoot Court Competition: D R P & O Vs U O Bchitra lounganiNo ratings yet

- RR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018Document2 pagesRR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018sdysangcoNo ratings yet

- RR No. 6-2018Document2 pagesRR No. 6-2018Andrew Benedict PardilloNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- RR 10-2018Document2 pagesRR 10-2018jomari ian simandoNo ratings yet

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- Rmo No.47-2019Document2 pagesRmo No.47-2019Sid CandelariaNo ratings yet

- RMC No 89-2017Document3 pagesRMC No 89-2017Mark Lord Morales BumagatNo ratings yet

- 4?' of For All: NO. AODocument1 page4?' of For All: NO. AOKythkatNo ratings yet

- RMC No 54-18 Interest and Penalty PDFDocument2 pagesRMC No 54-18 Interest and Penalty PDFGil PinoNo ratings yet

- RR No. 7-2017Document2 pagesRR No. 7-2017Lenin Rey PolonNo ratings yet

- Tw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Document1 pageTw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Lenin Rey PolonNo ratings yet

- RMC No. 27-2022Document1 pageRMC No. 27-2022Shiela Marie MaraonNo ratings yet

- RR 22-2020Document2 pagesRR 22-2020Christopher ArellanoNo ratings yet

- RMC No. 16-2021Document2 pagesRMC No. 16-2021Leichelle BautistaNo ratings yet

- RMC No 102-2016Document2 pagesRMC No 102-2016Duralex SedlexNo ratings yet

- RMC No. 28-2022Document1 pageRMC No. 28-2022Shiela Marie MaraonNo ratings yet

- RR No. 22-2020 PDFDocument2 pagesRR No. 22-2020 PDFSandyNo ratings yet

- BIR RMO No. 13-2021Document2 pagesBIR RMO No. 13-2021Earl PatrickNo ratings yet

- RMC No. 28-2019Document2 pagesRMC No. 28-2019AmberlyNo ratings yet

- Revenue MC 63-2018 - DTI DAO 16-01Document8 pagesRevenue MC 63-2018 - DTI DAO 16-01Angel BacaniNo ratings yet

- flg-20 ?RT: Republic Philippines Department of Finance InternalDocument1 pageflg-20 ?RT: Republic Philippines Department of Finance InternalJayvee OlayresNo ratings yet

- RR No 17-18 Estate and Donor's TaxDocument1 pageRR No 17-18 Estate and Donor's TaxGil PinoNo ratings yet

- RR 5-2016Document3 pagesRR 5-2016McrislbNo ratings yet

- gL.,!IO2I.: RE) UBL/CO) T//E) ///L//,) /NES InternalDocument2 pagesgL.,!IO2I.: RE) UBL/CO) T//E) ///L//,) /NES InternalKe VinNo ratings yet

- RR No. 1-2017Document3 pagesRR No. 1-2017Kayelyn LatNo ratings yet

- RR No. 10-2016Document2 pagesRR No. 10-2016Romer LesondatoNo ratings yet

- Internal Revenue: Republic of Pfiilippines DepartmentDocument1 pageInternal Revenue: Republic of Pfiilippines DepartmentJohn RoeNo ratings yet

- RR No. 6-2022Document3 pagesRR No. 6-2022chato law officeNo ratings yet

- RR 10-2019Document2 pagesRR 10-2019Jackie PadasasNo ratings yet

- RMC No. 105-2016 PDFDocument1 pageRMC No. 105-2016 PDFReymund BumanglagNo ratings yet

- RMC No. 62-2018 Estate TaxDocument2 pagesRMC No. 62-2018 Estate TaxJade MarkNo ratings yet

- RR No. 31-2020Document3 pagesRR No. 31-2020JejomarNo ratings yet

- RR No. 31-2020Document3 pagesRR No. 31-2020nathalie velasquezNo ratings yet

- March: Republic Philippines Department of Finance OI-RevenueDocument2 pagesMarch: Republic Philippines Department of Finance OI-Revenueantonio espirituNo ratings yet

- RMC No. 44-2021 RevisedDocument2 pagesRMC No. 44-2021 RevisedDessere Ann AnchetaNo ratings yet

- RMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFDocument2 pagesRMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFBien Bowie A. CortezNo ratings yet

- RR No. 10-2021Document2 pagesRR No. 10-2021eric yuulNo ratings yet

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- RMC No. 7-2021Document1 pageRMC No. 7-2021nathalie velasquezNo ratings yet

- RMO Nos. 30-31-2020Document8 pagesRMO Nos. 30-31-2020nathalie velasquezNo ratings yet

- RMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsDocument2 pagesRMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsMiming BudoyNo ratings yet

- RMC No. 124-2019Document1 pageRMC No. 124-2019Melody Lim DayagNo ratings yet

- Rmo No.45-2019Document2 pagesRmo No.45-2019Earl PatrickNo ratings yet

- RR No. 26 - 2020Document3 pagesRR No. 26 - 2020Bobby LockNo ratings yet

- RR No. 9-2016 PDFDocument1 pageRR No. 9-2016 PDFJames SusukiNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- RMC No. 70-2020Document1 pageRMC No. 70-2020lara.zestoNo ratings yet

- Jllois: in ToDocument2 pagesJllois: in ToA2 ZNo ratings yet

- RMC No 10-2018 - Wholding Tax On CreditorsDocument2 pagesRMC No 10-2018 - Wholding Tax On CreditorsMinnie JulianNo ratings yet

- RMO No. 64-2016 PDFDocument1 pageRMO No. 64-2016 PDFGabriel EdizaNo ratings yet

- RMC No. 46-2021Document1 pageRMC No. 46-2021Joel SyNo ratings yet

- RMC No. 125-2020Document1 pageRMC No. 125-2020Raine Buenaventura-EleazarNo ratings yet

- BSP MTPP (Circular Letter 2019-012) ReferenceDocument1 pageBSP MTPP (Circular Letter 2019-012) ReferenceKristine ArangNo ratings yet

- RR No 21-2018Document3 pagesRR No 21-2018Larry Tobias Jr.No ratings yet

- RR No. 33-2020Document2 pagesRR No. 33-2020JejomarNo ratings yet

- RMC No. 88-2021Document1 pageRMC No. 88-2021Jogenn Karla GagarinNo ratings yet

- RMO No.5-2019Document2 pagesRMO No.5-2019Jhenny Ann P. SalemNo ratings yet

- Wiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- RAO NO. 4-2019 DigestDocument1 pageRAO NO. 4-2019 Digestnathalie velasquezNo ratings yet

- RAO No. 2-2020Document2 pagesRAO No. 2-2020nathalie velasquezNo ratings yet

- Eureau Inter) Dai, City: ... I R,, I L,:ri Ri U - AuDocument5 pagesEureau Inter) Dai, City: ... I R,, I L,:ri Ri U - Aunathalie velasquezNo ratings yet

- RMC No. 15-2021Document1 pageRMC No. 15-2021nathalie velasquezNo ratings yet

- RMC No. 16-2021Document1 pageRMC No. 16-2021nathalie velasquezNo ratings yet

- The Revised One-Page Freedom of Information (FOI) ManualDocument1 pageThe Revised One-Page Freedom of Information (FOI) Manualnathalie velasquezNo ratings yet

- 20 Defendant Regents Opposition To The Ex Parte Application For Shortening Time 11/04/21Document4 pages20 Defendant Regents Opposition To The Ex Parte Application For Shortening Time 11/04/21José DuarteNo ratings yet

- 00001-00020 RedactedDocument54 pages00001-00020 RedactedRuss RacopNo ratings yet

- Name Address OR Sales Invoice CR Make Mitsubishi Mirage Motor Chassis Plate Year 2023 ID Phone 09294409062 Email Bank Security BankDocument8 pagesName Address OR Sales Invoice CR Make Mitsubishi Mirage Motor Chassis Plate Year 2023 ID Phone 09294409062 Email Bank Security Bankwilfredo sicioNo ratings yet

- Crim 105Document2 pagesCrim 105Glendel Fernandez LasamNo ratings yet

- Template - Final Demand LetterDocument1 pageTemplate - Final Demand LetterScott Ostaffy67% (6)

- 2a. EDITED - Pecho - v. - Sandiganbayan - 1994Document21 pages2a. EDITED - Pecho - v. - Sandiganbayan - 1994April ValenNo ratings yet

- Bail Counter Villayutham HCDocument26 pagesBail Counter Villayutham HCadvpreetipundirNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument2 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionManojNo ratings yet

- Create A Civilization Project 6th GradeDocument4 pagesCreate A Civilization Project 6th Gradepatrick macmullanNo ratings yet

- Manalili v. CA, G.R. No. 113447Document2 pagesManalili v. CA, G.R. No. 113447Pepper PottsNo ratings yet

- Incidences of Employment and Minimum ConditionsDocument44 pagesIncidences of Employment and Minimum Conditionsmundukuta chipunguNo ratings yet

- Indian Evidence ACT 1872: Relevancy & AdmissibilityDocument9 pagesIndian Evidence ACT 1872: Relevancy & Admissibilitychhaayaachitran akshu100% (1)

- Cee-Bee Produce, Inc. v. Stokes-Shaheen Produce, Inc., Et Al - Document No. 5Document3 pagesCee-Bee Produce, Inc. v. Stokes-Shaheen Produce, Inc., Et Al - Document No. 5Justia.com100% (4)

- Non Doctrinal ResearchDocument52 pagesNon Doctrinal Researchsanthiyakarnan16No ratings yet

- Spot Repport On Qualified Theft CaseDocument2 pagesSpot Repport On Qualified Theft CaseArt Guevs0% (1)

- Student Consent Form 2023Document1 pageStudent Consent Form 2023hayleyofarrell18No ratings yet

- Dwnload Full Management Information Systems 6th Edition Oz Test Bank PDFDocument35 pagesDwnload Full Management Information Systems 6th Edition Oz Test Bank PDFduntedmazdeismwa55y9100% (10)

- EN ISO 16852 (2016) (E) CodifiedDocument9 pagesEN ISO 16852 (2016) (E) CodifiedFabricio VitorinoNo ratings yet

- European Standard Norme Europeenne Europaische Norm: Metallic Products - Types of Inspection DocumentsDocument10 pagesEuropean Standard Norme Europeenne Europaische Norm: Metallic Products - Types of Inspection DocumentsGabriel RodriguezNo ratings yet

- Full Download Selling Today Partnering To Create Value Global 13th Edition Reece Test BankDocument36 pagesFull Download Selling Today Partnering To Create Value Global 13th Edition Reece Test Bankezrak2martin100% (36)

- HSC Textual DictionaryDocument217 pagesHSC Textual DictionaryArfin Hasan AdnanNo ratings yet

- Carriage of Goods by Sea ACT: Public Act No. 521 CA No. 65Document24 pagesCarriage of Goods by Sea ACT: Public Act No. 521 CA No. 65Juan Rafael SilvaNo ratings yet

- VOL. 763, JULY 22, 2015 487: BPI Family Savings Bank, Inc. vs. YujuicoDocument7 pagesVOL. 763, JULY 22, 2015 487: BPI Family Savings Bank, Inc. vs. YujuicoAngelie FloresNo ratings yet

- HVAC User GuideDocument514 pagesHVAC User GuideDmitriy RybakovNo ratings yet

- Before The LawDocument2 pagesBefore The Lawbalaj iqbalNo ratings yet

- Tax Invoice Sulemaan Sayyedshaikh: Pay BillDocument3 pagesTax Invoice Sulemaan Sayyedshaikh: Pay Billsia hairnbeautyNo ratings yet

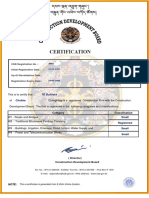

- CDB Registration No .: Initial Registration Date.:: Up-Gr/Revalidation Date.: Registration Expiry Date.Document2 pagesCDB Registration No .: Initial Registration Date.:: Up-Gr/Revalidation Date.: Registration Expiry Date.Ojhal RaiNo ratings yet