Professional Documents

Culture Documents

Loans Receivable

Uploaded by

Xanny Bieber0 ratings0% found this document useful (0 votes)

7 views2 pagesThis document discusses loan impairment and how to determine if a loan is impaired. It provides the following steps:

1. Determine if the borrower will pay back the full principal, partial principal, or none at all. Also determine if interest will be paid in full, partially, or not at all.

2. If impaired, calculate the present value (PV) of future cash flows from the loan using PV factors and the original effective interest rate (EIR).

3. An impairment loss is recognized if the carrying amount of the loan exceeds the PV of future cash flows. There are two methods for recording the impairment loss.

Original Description:

Original Title

LOANS RECEIVABLE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses loan impairment and how to determine if a loan is impaired. It provides the following steps:

1. Determine if the borrower will pay back the full principal, partial principal, or none at all. Also determine if interest will be paid in full, partially, or not at all.

2. If impaired, calculate the present value (PV) of future cash flows from the loan using PV factors and the original effective interest rate (EIR).

3. An impairment loss is recognized if the carrying amount of the loan exceeds the PV of future cash flows. There are two methods for recording the impairment loss.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesLoans Receivable

Uploaded by

Xanny BieberThis document discusses loan impairment and how to determine if a loan is impaired. It provides the following steps:

1. Determine if the borrower will pay back the full principal, partial principal, or none at all. Also determine if interest will be paid in full, partially, or not at all.

2. If impaired, calculate the present value (PV) of future cash flows from the loan using PV factors and the original effective interest rate (EIR).

3. An impairment loss is recognized if the carrying amount of the loan exceeds the PV of future cash flows. There are two methods for recording the impairment loss.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

LOANS RECEIVABLE: LOAN IMPAIRMENT

Will the borrower pay?

If impaired:

full DETERMINE

a. date of cashflow

PRINCIPAL partial - lump sum multiply with

none - installment PV factor

% b. project amount

INTEREST

full

PV Factor of all cashflows:

Lump sum = projected amount x PV of 1 @ original EIR% for remaining period

Equal installment = projected amount x PV of ordinary annuity @ original EIR% for remaining

period

Unequal installment = projected amount x PV of 1 @ original EIR% for period 1

= projected amount x PV of 1 @ original EIR% for period 2

= projected amount x PV of 1 @ original EIR% for period 3

If impaired

= carrying amount of LR = Project future cashflow = PV of all future cashflows = calculate for impairment loss

Principal amt. xx Given: Carrying amt of LR xx

Add: accrued int. 1. P x PV factor xx Less: PV of all Future

income xx 2. P x PV factor xx cashflows xx

Carrying amt for xx PV of all future Impairment loss xx

LR cashflow xx

2 Methods in recording Impairment Loss:

1. Direct Method

2. Indirect Method

TIPS:

Difference is impairment loss = 284,520

Carrying amount Project Future Present Value of all

of LR Cashflow future cashflow

1,120,000 1,000,000 835,480

Principal + accrued receivable remaining amount multiplied by the

Not yet received to be paid given PV value

Difference of allow method

= 164,520

Recognized as INTEREST INCOME for the remaining life Carrying amount LR xx

X original EIR% xx

of the loan using original effective interest rate

Interest Income xx

NOTE: Values are given for presentation

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Math Formulas Made EasyDocument3 pagesMath Formulas Made EasyJavaria KhanNo ratings yet

- A 2 Quali ReviewerDocument4 pagesA 2 Quali ReviewerJASMIN RHYZEL C. PINEDANo ratings yet

- Depreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Document3 pagesDepreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Charles Kevin Mina100% (1)

- Handout Fin Man 2307Document6 pagesHandout Fin Man 2307Renz NgohoNo ratings yet

- Ia Notes-PayableDocument2 pagesIa Notes-PayableJhunnie LoriaNo ratings yet

- FL NotesDocument4 pagesFL NotesBarry AllenNo ratings yet

- Chapter 2Document3 pagesChapter 2Eyra MercadejasNo ratings yet

- MidtermsDocument108 pagesMidtermsdumpyforhimNo ratings yet

- Operating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingDocument5 pagesOperating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingzacchariahNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- RSM230Document2 pagesRSM230alankn2004No ratings yet

- (A+F) NYU Attack OutlineDocument8 pages(A+F) NYU Attack OutlineShawn BuskovichNo ratings yet

- Adjusting Entries and Merchandising BusinessDocument5 pagesAdjusting Entries and Merchandising BusinessLing lingNo ratings yet

- CA Inter FM Chalisa by CA Aaditya Jain For Dec.21 Exam OnlyDocument28 pagesCA Inter FM Chalisa by CA Aaditya Jain For Dec.21 Exam OnlyKrishna GuptaNo ratings yet

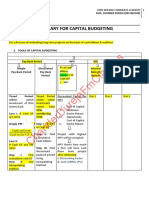

- Ca Final SFM Capital Budgeting Summary (Old Course)Document21 pagesCa Final SFM Capital Budgeting Summary (Old Course)swati mishraNo ratings yet

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocument9 pagesGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371No ratings yet

- Capital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalDocument2 pagesCapital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalMary Hazell Victori100% (1)

- 112.material For Receivable FinancingDocument8 pages112.material For Receivable FinancingJalanur MarohomNo ratings yet

- Capitalization: Capital Vs Operating LeaseDocument2 pagesCapitalization: Capital Vs Operating Leasejohnsmith12312312312No ratings yet

- SFM Formulas Sheet For Quick Revision Before ExamDocument28 pagesSFM Formulas Sheet For Quick Revision Before ExamKamakshi AdadadiNo ratings yet

- S6 Cost of Capital Online VersionDocument28 pagesS6 Cost of Capital Online Versionconstruction omanNo ratings yet

- Ia Valix Chap 8 2019Document2 pagesIa Valix Chap 8 2019M100% (1)

- Afar NotesDocument6 pagesAfar NotesJane EstradaNo ratings yet

- BEC CPA Formulas November 2015 Becker CPA Review PDFDocument20 pagesBEC CPA Formulas November 2015 Becker CPA Review PDFsasyedaNo ratings yet

- Leave A Message Then Pass It On!!Document43 pagesLeave A Message Then Pass It On!!May RamosNo ratings yet

- Bholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Document9 pagesBholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Chirag MalhotraNo ratings yet

- Rapid Review Selected Chapter TopicsDocument17 pagesRapid Review Selected Chapter Topicsy8twf89ggfNo ratings yet

- Capital Budgeting SummaryDocument8 pagesCapital Budgeting Summaryparvez ansariNo ratings yet

- Complete Strategic Financial Management FormulaeDocument39 pagesComplete Strategic Financial Management FormulaePrashanth Yadhav100% (2)

- Accounting Process 2Document2 pagesAccounting Process 2Glen JavellanaNo ratings yet

- Intacc 3 Leases FinalsDocument9 pagesIntacc 3 Leases FinalsDarryl AgustinNo ratings yet

- Corporate Finance - Lecture 3Document40 pagesCorporate Finance - Lecture 3Faraz BodaghiNo ratings yet

- AFAR Notes by Dr. Ferrer PDFDocument21 pagesAFAR Notes by Dr. Ferrer PDFjexNo ratings yet

- Notes ReceivableDocument16 pagesNotes Receivabledenice.dimantagaNo ratings yet

- Present Value and Future Value: Finance: Time Value of MoneyDocument11 pagesPresent Value and Future Value: Finance: Time Value of MoneyTes DudteNo ratings yet

- Mind MapsDocument18 pagesMind MapsSOFT-TRENDSNo ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceDocument4 pagesAccount Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceGurusamy KNo ratings yet

- Comm 308 FormulasDocument2 pagesComm 308 FormulasNidale ChehadeNo ratings yet

- Loan Receivable and Receivable Financing PDFDocument3 pagesLoan Receivable and Receivable Financing PDFgenesis serominesNo ratings yet

- 11 - Current Liabilities, Provisions and ContingenciesDocument5 pages11 - Current Liabilities, Provisions and ContingenciesSilent KillerNo ratings yet

- A. Liquidity Ratios - Short Term Solvency: Current Assets Current LiabilitiesDocument14 pagesA. Liquidity Ratios - Short Term Solvency: Current Assets Current LiabilitiesAshish kumar ThapaNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisNarayan DhunganaNo ratings yet

- SS6 Chapter 06 v0Document30 pagesSS6 Chapter 06 v0Thúy An NguyễnNo ratings yet

- Chanderdurejafmclasses: Summary For Capital BudgetingDocument5 pagesChanderdurejafmclasses: Summary For Capital BudgetingShiva AroraNo ratings yet

- Fam - 1Document20 pagesFam - 1shahidNo ratings yet

- Interacc Word JPDocument28 pagesInteracc Word JPJOCELYN NUEVONo ratings yet

- Topic 2. Discounting: Future ValueDocument13 pagesTopic 2. Discounting: Future ValueАндрей ДымовNo ratings yet

- Ratio Analysis BestDocument81 pagesRatio Analysis BestEyael ShimleasNo ratings yet

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MNo ratings yet

- Introduction To LiabilitiesDocument4 pagesIntroduction To LiabilitiesversNo ratings yet

- Accruals PrepaymentsDocument9 pagesAccruals PrepaymentsSeng Cheong KhorNo ratings yet

- Notes Receivable - Measurement and Determination of Interest ExpenseDocument6 pagesNotes Receivable - Measurement and Determination of Interest ExpenseMiles SantosNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Responsive Document - CREW: Department of The Treasury: Regarding Presidential Authority To Raise The Debt CeilingDocument433 pagesResponsive Document - CREW: Department of The Treasury: Regarding Presidential Authority To Raise The Debt CeilingCREWNo ratings yet

- Sample Answer & Affirmative Defenses Against Fannie MaeDocument6 pagesSample Answer & Affirmative Defenses Against Fannie MaeChristine HecklerNo ratings yet

- DFCU Bank LTD V Dotways Marketing Bureau LTD Anor (Originating Summons 6 of 2012) 2013 UGCommC 152 (3 September 2013)Document11 pagesDFCU Bank LTD V Dotways Marketing Bureau LTD Anor (Originating Summons 6 of 2012) 2013 UGCommC 152 (3 September 2013)Bright ElshadaiNo ratings yet

- Money Markets and Capital MarketsDocument4 pagesMoney Markets and Capital MarketsEmmanuelle RojasNo ratings yet

- CIBIL Google Credit Distributed 2021Document60 pagesCIBIL Google Credit Distributed 2021Abhishek MurarkaNo ratings yet

- Second Semester of Three Year LL.B./Sixth Semester of Five Year B.A. LL.B./B.B.A. LL.B. Examination, December 2013 Property Law (Course - Iii)Document4 pagesSecond Semester of Three Year LL.B./Sixth Semester of Five Year B.A. LL.B./B.B.A. LL.B. Examination, December 2013 Property Law (Course - Iii)saditha manjulahariNo ratings yet

- Unit 9 LeasingDocument21 pagesUnit 9 LeasingAnuska JayswalNo ratings yet

- PNB Compressed Bio GasDocument3 pagesPNB Compressed Bio Gasfreesites485No ratings yet

- Simple Property Agreement Format To SellDocument1 pageSimple Property Agreement Format To SellPratima KambleNo ratings yet

- Void or Inexistent ContractsDocument15 pagesVoid or Inexistent ContractsJv FerminNo ratings yet

- Housing FinanceDocument9 pagesHousing FinanceGeri NicoleNo ratings yet

- Module 3 - Events After The Reporting Period PDFDocument7 pagesModule 3 - Events After The Reporting Period PDFCaroline Bagsik100% (1)

- Consideration in The Indian Contract Act, 1872Document16 pagesConsideration in The Indian Contract Act, 1872ankit_chowdhri89% (35)

- SPA Ejectment CasesDocument5 pagesSPA Ejectment CasesAlpha ZuluNo ratings yet

- Plaintiff-Appellant Vs Vs Defendants-Appellees B. Francisco Matias P. PerezDocument10 pagesPlaintiff-Appellant Vs Vs Defendants-Appellees B. Francisco Matias P. PerezVMNo ratings yet

- Loan Amortization ScheduleDocument6 pagesLoan Amortization ScheduleflarrainmNo ratings yet

- Study of Consumer Durable Loan With Reference of HDFC BankDocument65 pagesStudy of Consumer Durable Loan With Reference of HDFC Bankprerana gandhi100% (3)

- Activities On Module 1 - Partnership AccountingDocument4 pagesActivities On Module 1 - Partnership AccountingANDI TE'A MARI SIMBALANo ratings yet

- Part Seven: THE Management of Financial InstitutionsDocument40 pagesPart Seven: THE Management of Financial InstitutionsIrakli SaliaNo ratings yet

- Lecture Notes On Law On Sales (Part 1)Document123 pagesLecture Notes On Law On Sales (Part 1)Ian Pol FiestaNo ratings yet

- U.S. Small Business Administration Fact Sheet - Disaster LoansDocument2 pagesU.S. Small Business Administration Fact Sheet - Disaster LoansNews 5 WCYBNo ratings yet

- Third DivisionDocument8 pagesThird DivisionBae IreneNo ratings yet

- Interest Rate Cap Structure Definition, Uses, and ExamplesDocument2 pagesInterest Rate Cap Structure Definition, Uses, and ExamplesACC200 MNo ratings yet

- Maja Radunovic Dissertation PDFDocument45 pagesMaja Radunovic Dissertation PDFBipin RethinNo ratings yet

- PSBank Auto Loan Application Form - IndividualDocument2 pagesPSBank Auto Loan Application Form - IndividualJp Dela CruzNo ratings yet

- Chapter 1: The Financial Environment Multiple Choice: Answer: B Level: Medium Section: What Is Finance? 3Document24 pagesChapter 1: The Financial Environment Multiple Choice: Answer: B Level: Medium Section: What Is Finance? 3Kaia LorenzoNo ratings yet

- Concept of NPADocument40 pagesConcept of NPAsonu_1986100% (2)

- Final Sip Mba Project PDFDocument87 pagesFinal Sip Mba Project PDFRinkesh Modi93% (14)

- 264871-2019-Land Bank of The Philippines v. Polillo20210425-12-1az28g0Document7 pages264871-2019-Land Bank of The Philippines v. Polillo20210425-12-1az28g0Form CruzNo ratings yet

- Gajendra Sharma RBI PetitionDocument33 pagesGajendra Sharma RBI PetitionlaxmiNo ratings yet