Professional Documents

Culture Documents

FL Notes

Uploaded by

Barry AllenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FL Notes

Uploaded by

Barry AllenCopyright:

Available Formats

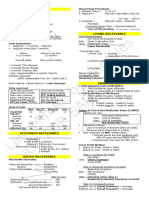

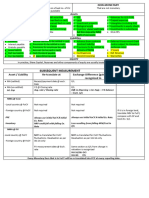

FVPL

Classification Initial Subsequent

Held for trading FV only UG/UL-P/L

Irrev. FVPL FV only UG/UL: OCI (no acctg mismatch)

P/L (with acctg mismatch) attributable to credit risk

Remaining balance: P/L

Transaction cost is expensed outright

Hedge Acctg Hedging instrument Hedged Item

(variable-fixed) Cash flow hedge Effective portion- FVOCI As usual accounting

Ineffective portion- FVPL

(fixed-variable) Fair value hedge FVPL FVPL

FLAC

Derecognition Kinds of FL@AC Recorded in books

G or L: P/L Bonds payable Face amount

Notes payable Face amount

G or L: Retained Earning Loans payable Face amount

Computation of G/L Initial Recognition:

Consideration paid xx Fair value xx

FV @ prev. reporting date (xx) * Transaction cost (xx)

G or L xx Initial Carrying amount xx

Subsequent Recognition

amortization table should be used

Scheme ER vs NR

at a premium ER < NR

at a discount ER > NR

at face amount ER = NR

Derecognition

Payment of Debt: on maturity

prior to maturity

Debt Restructuring Total Liability

CA/Fair value

G/L on extinguishment

DR: Modification of terms

Testing: If G/L (PV using old rate)

10% or more

less than 10%

FLAC

External Documentation

Bond contract/prospectus * Examples:

acknowledgement from creditor Cost of certificate

Loan agreement Legal & accounting services

Registration fee

Commissions to underwriters

EIR given, Cash price equivalent given, Face amount ** Except if serial bonds, notes, loans

Direct issuance cost or direct origination fees *** Premium on B/L/N - Premium amort

If problem is with transaction cost & CPE, **** Discount on B/L/N - Discount amort

use interpolation to find the new EIR ***** Order of priority of fair value in equity swap

(1) Fair value of equity instruments issued

(2) Fair value of liability extinguished

(3) CA of liability extinguished

**

Maturity Value Net Carrying Value

Face Amount Face Amt + Premium ***

Face Amount Face Amt - Discount ****

Face Amount Face amount

Settlement price = CA; no Gain or Loss

Settlement price: xx

CA on settlement date (xx)

Gain or Loss xx

xx (Notes/Bonds/Loans + accrued interest payable)

(xx) CA if asset swap; Fair value if equity swap *****

xx

ing old rate)

Extinguishment of old FL with G/L

Continue, new EIR no gain or loss

alue in equity swap

struments issued

xtinguished

You might also like

- Account ClassificationDocument3 pagesAccount ClassificationUsama MukhtarNo ratings yet

- CH 13 - Liabilities:: Value of Obligation - Proceeds Yet To Be DelieveredDocument2 pagesCH 13 - Liabilities:: Value of Obligation - Proceeds Yet To Be DelieveredlovelaugherlifeNo ratings yet

- Accounting For Bonds PayableDocument31 pagesAccounting For Bonds PayableJon Christian Miranda100% (2)

- Money and CouplesDocument20 pagesMoney and CouplesTom ChoNo ratings yet

- Summary For Account ReceivablesDocument6 pagesSummary For Account ReceivablesDevine Grace A. Maghinay100% (1)

- Lecture 1 - Fundamentals and Accounting CycleDocument3 pagesLecture 1 - Fundamentals and Accounting CyclecoyNo ratings yet

- Capitalization: Capital Vs Operating LeaseDocument2 pagesCapitalization: Capital Vs Operating Leasejohnsmith12312312312No ratings yet

- Cash Flow StatementDocument40 pagesCash Flow Statementtairakazida100% (3)

- GOPAL DAIRY PROJECT MBA Project Report Prince DudhatraDocument68 pagesGOPAL DAIRY PROJECT MBA Project Report Prince DudhatrapRiNcE DuDhAtRa86% (7)

- IFRS 9 Part 2Document24 pagesIFRS 9 Part 2ErslanNo ratings yet

- SMEDA Private HospitalDocument25 pagesSMEDA Private HospitalKhan Ab75% (4)

- Ic Exam Review: VariableDocument122 pagesIc Exam Review: VariableJL RangelNo ratings yet

- 50 Questions To Ask A FranchisorDocument3 pages50 Questions To Ask A FranchisorRegie Sacil EspiñaNo ratings yet

- Module-3 - (Answer) Financial-Analysis-and-ReportingDocument10 pagesModule-3 - (Answer) Financial-Analysis-and-ReportingJoanna Man LangNo ratings yet

- FAR Last Minute by HerculesDocument10 pagesFAR Last Minute by Herculesjanjan3256No ratings yet

- A 2 Quali ReviewerDocument4 pagesA 2 Quali ReviewerJASMIN RHYZEL C. PINEDANo ratings yet

- Accounts FormatsDocument14 pagesAccounts Formats727822TPMB005 ARAVINTHAN.SNo ratings yet

- Leave A Message Then Pass It On!!Document43 pagesLeave A Message Then Pass It On!!May RamosNo ratings yet

- Intacc 3 Leases FinalsDocument9 pagesIntacc 3 Leases FinalsDarryl AgustinNo ratings yet

- Adobe Scan 20-Apr-2023Document6 pagesAdobe Scan 20-Apr-2023Notes GlobeNo ratings yet

- AFAR Last Minute by HerculesDocument8 pagesAFAR Last Minute by Herculesjanjan3256No ratings yet

- Investments 1Document1 pageInvestments 1Lyanna MormontNo ratings yet

- Ia Notes-PayableDocument2 pagesIa Notes-PayableJhunnie LoriaNo ratings yet

- IFRS 16 LeasesDocument3 pagesIFRS 16 Leasesrifa14142008No ratings yet

- AC330 Exam Notes SampleDocument3 pagesAC330 Exam Notes SampleRicardo KlnNo ratings yet

- Trading Account of - For The Year EndedDocument3 pagesTrading Account of - For The Year EndedUsman MandalNo ratings yet

- Causes of DepreciationDocument6 pagesCauses of DepreciationSHEKHAR SHUKLANo ratings yet

- Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmDocument2 pagesAccounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmGurinder Pal SinghNo ratings yet

- Non Current LiabilitiesDocument3 pagesNon Current LiabilitiesBryan ReyesNo ratings yet

- Double Accounts - Electricity CompaniesDocument18 pagesDouble Accounts - Electricity CompaniesbijubodheswarNo ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementBebark AkramNo ratings yet

- FAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)Document12 pagesFAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)charlesNo ratings yet

- Unit 3Document29 pagesUnit 3Urja DhabardeNo ratings yet

- CAPITAL GAINS REVISION (Part 2)Document31 pagesCAPITAL GAINS REVISION (Part 2)Mana SharmaNo ratings yet

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocument9 pagesGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371No ratings yet

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDocument1 pageCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552No ratings yet

- !!!!guide To Cash FlowsDocument3 pages!!!!guide To Cash Flowsws. cloverNo ratings yet

- Finance NotesDocument23 pagesFinance NoteschamilasNo ratings yet

- P7 - Investment in Debt Securities & Other Non-Current Financial AssetsDocument46 pagesP7 - Investment in Debt Securities & Other Non-Current Financial AssetsNashiel AnneNo ratings yet

- Finance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full ChapterDocument67 pagesFinance For Executives Managing For Value Creation 6Th Edition Gabriel Hawawini Full Chapterjoyce.clewis414100% (16)

- INVESTMENTS W Matrix PFRS 9 PDFDocument7 pagesINVESTMENTS W Matrix PFRS 9 PDFAra DucusinNo ratings yet

- Ebook Finance For Executives Managing For Value Creation PDF Full Chapter PDFDocument67 pagesEbook Finance For Executives Managing For Value Creation PDF Full Chapter PDFjulie.morrill858100% (26)

- BCA Part 1 Tally ExercisesDocument28 pagesBCA Part 1 Tally ExercisesEswara kumar JNo ratings yet

- Fundamentos de La Contabilidad de Coberturas: (Hedge Accounting)Document78 pagesFundamentos de La Contabilidad de Coberturas: (Hedge Accounting)doiNo ratings yet

- Fair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair ValueDocument6 pagesFair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair Valuedump acctNo ratings yet

- Introduction To LiabilitiesDocument4 pagesIntroduction To LiabilitiesversNo ratings yet

- Quiz Preparation Notes JTDocument2 pagesQuiz Preparation Notes JTxhayyyzNo ratings yet

- Income Tax Notes-IAS 12Document11 pagesIncome Tax Notes-IAS 12mehdi.jjh313No ratings yet

- 10.cashflows AAFR NotesDocument10 pages10.cashflows AAFR Notesmehdi.jjh313No ratings yet

- FR 知识点串讲(二)Document25 pagesFR 知识点串讲(二)周于No ratings yet

- IAS-12 Lecture NotesDocument11 pagesIAS-12 Lecture NotesAli OptimisticNo ratings yet

- Borrowing Cost Class NotesDocument4 pagesBorrowing Cost Class Noteschad sampsonNo ratings yet

- 55 Comparison of Accounting AssumptionsDocument8 pages55 Comparison of Accounting Assumptionsmanoranjan838241No ratings yet

- IFA Lesson 3 Slides (Financial Liabilities & Equity)Document53 pagesIFA Lesson 3 Slides (Financial Liabilities & Equity)zengruiqi20000302No ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceDocument4 pagesAccount Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceGurusamy KNo ratings yet

- Trading, P&L, Balance SheetDocument3 pagesTrading, P&L, Balance SheetjulekhabegumNo ratings yet

- Ias 21Document1 pageIas 21Dawar Hussain (WT)No ratings yet

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552No ratings yet

- Notes For L3Document11 pagesNotes For L3yuyin.gohyyNo ratings yet

- Slump Sale 45 (4) 9B ULIP & QuestionsDocument11 pagesSlump Sale 45 (4) 9B ULIP & Questionshtassociates12No ratings yet

- Poa FormatDocument4 pagesPoa FormatSumithaNo ratings yet

- Finance 101 Cheat SheetDocument1 pageFinance 101 Cheat SheetMinyu LvNo ratings yet

- IAS 21 - Foreign Currency TransactionsDocument1 pageIAS 21 - Foreign Currency TransactionsDawar Hussain (WT)No ratings yet

- Lecture Notes On Finance LeaseDocument4 pagesLecture Notes On Finance LeasesageNo ratings yet

- Tally Ledger List in PDF Format TeachooDocument10 pagesTally Ledger List in PDF Format Teachoothakur731011No ratings yet

- Loans ReceivableDocument2 pagesLoans ReceivableXanny BieberNo ratings yet

- Blockchain Fundamentals NotesDocument15 pagesBlockchain Fundamentals NotesBarry AllenNo ratings yet

- Blockchain Webinar Day 2Document3 pagesBlockchain Webinar Day 2Barry AllenNo ratings yet

- Blockchain Webinar Day 3Document4 pagesBlockchain Webinar Day 3Barry AllenNo ratings yet

- LESSON 4 Subject and ContentDocument12 pagesLESSON 4 Subject and ContentBarry AllenNo ratings yet

- Blockchain Webinar Day 1Document4 pagesBlockchain Webinar Day 1Barry AllenNo ratings yet

- LESSON 2 Art Appreciation - Imagination, Creativity, ExpressionDocument10 pagesLESSON 2 Art Appreciation - Imagination, Creativity, ExpressionBarry AllenNo ratings yet

- What Is Art - Introduction and AssumptionsDocument44 pagesWhat Is Art - Introduction and AssumptionsBarry AllenNo ratings yet

- Name: Assignment: GE AA: The PainterDocument1 pageName: Assignment: GE AA: The PainterBarry AllenNo ratings yet

- Soal Try Out Akl 2Document5 pagesSoal Try Out Akl 2Ilham Dwi NoviantoNo ratings yet

- Introduction To Financial Law NotesDocument10 pagesIntroduction To Financial Law Notesaustinmaina560No ratings yet

- MFM Project Guidelines From Christ University FFFFFDocument6 pagesMFM Project Guidelines From Christ University FFFFFakash08agarwal_18589No ratings yet

- General Principles SEC. 23. General Principles of Income Taxation in The Philippines-Except When Otherwise Provided in ThisDocument22 pagesGeneral Principles SEC. 23. General Principles of Income Taxation in The Philippines-Except When Otherwise Provided in ThisAnonymous bdm1KYJttNo ratings yet

- FY20 PresBuilder GBP 130520 2200 Full-LrDocument134 pagesFY20 PresBuilder GBP 130520 2200 Full-LrDeepak KapoorNo ratings yet

- Morgan MotorsDocument17 pagesMorgan MotorsKashaanNazikBalochNo ratings yet

- 08 - Chapter 1Document29 pages08 - Chapter 1aswinecebeNo ratings yet

- MSCI World Index (USD) : Cumulative Index Performance - Net Returns (Usd) (AUG 2006 - AUG 2021) Annual Performance (%)Document3 pagesMSCI World Index (USD) : Cumulative Index Performance - Net Returns (Usd) (AUG 2006 - AUG 2021) Annual Performance (%)Krishna MoorthiNo ratings yet

- Discount Rate or Hurdle Rate Module 7 (Class 24)Document18 pagesDiscount Rate or Hurdle Rate Module 7 (Class 24)Vineet Agarwal100% (1)

- Fsa 2006-09Document637 pagesFsa 2006-09zainabNo ratings yet

- Lim Vs QueenslandDocument3 pagesLim Vs QueenslandheyoooNo ratings yet

- Indraprastha Gas Limited - SWOT AnalysisDocument27 pagesIndraprastha Gas Limited - SWOT Analysissujaysarkar850% (1)

- Value of Production Income StatementsDocument12 pagesValue of Production Income StatementsnootsheiNo ratings yet

- Investing in Women's EmploymentDocument108 pagesInvesting in Women's EmploymentIFC SustainabilityNo ratings yet

- Kinnow ProcessingDocument14 pagesKinnow ProcessingM. Rehman Gul KhanNo ratings yet

- Anlagenbau Moebel Englisch 72 CNC MachineDocument22 pagesAnlagenbau Moebel Englisch 72 CNC MachinemacNo ratings yet

- A Summer Training Project Report OnDocument85 pagesA Summer Training Project Report Onrajancomes33% (3)

- Stress Management Towards Employees in Reliance Life Insurance SureshDocument90 pagesStress Management Towards Employees in Reliance Life Insurance SureshSuresh Babu Reddy100% (3)

- THE PORT OF PORT ANGELES v. CERTAIN UNDERWRITERS AT LLOYD'S LONDON Et Al ComplaintDocument33 pagesTHE PORT OF PORT ANGELES v. CERTAIN UNDERWRITERS AT LLOYD'S LONDON Et Al ComplaintACELitigationWatchNo ratings yet

- GROUP1TPTM5001GROUPASSIGNMENTS22011Document23 pagesGROUP1TPTM5001GROUPASSIGNMENTS22011Rahul SuriNo ratings yet

- Role of Entrepreneurship in Economic DvelopmentDocument8 pagesRole of Entrepreneurship in Economic DvelopmentAnju Vijayan100% (1)

- The Role of Sustainability in Brand Equity Value in The Financial SectorDocument19 pagesThe Role of Sustainability in Brand Equity Value in The Financial SectorPrasiddha PradhanNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument75 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownAmrit KeyalNo ratings yet