Professional Documents

Culture Documents

Quiz Preparation Notes JT

Uploaded by

xhayyyzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz Preparation Notes JT

Uploaded by

xhayyyzCopyright:

Available Formats

Leases

Finance Lease vs Operating Lease

It is finance lease if:

1) Ownership is transferred to the lessee at the end of the lease

2) If there is a bargain purchase option

3) Lease term exceed 75% of the useful life

4) PV of the minimum lease payments exceed 90%

5) Asset is of a specialised nature

6) Lessor’s losses borne by lessee upon lessee’s cancellation

7) Gain/losses from fluctuation of residual value accrues to lessee

8) Bargain Renewal Option exists

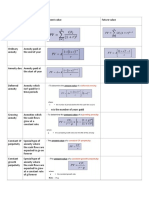

Journal Entries

Lessor Lessee

Dr Lease Receivable Dr Leased Asset

Cr Asset Cr Lease Payable

Cr Unearned Interest Income Cr Cash (If there are initial direct Costs)

Dr Cash Dr Lease Payable

Cr Lease Receivable Dr Interest Expense

Dr Unearned Interest Income Cr Cash

Cr Interest Income

Dr Depreciation

* Asset is equal to the present value of the Cr Accumulated Depreciation

lease payments, BPO, GRV & unGRV

* Leased Asset is equal to the present value of

the lease payments, BPO, GRV ONLY

* Depreciable amount will be equal to the

capitalised amount less the guaranteed

residual value

Sale and Leaseback Journal Entries

Operating Lease Finance Lease

Selling price – Fair Value: Deferred & If carrying amount is less than the fair value,

Amortised over asset usage period write down the asset to its recoverable

amount by recognising an impairment loss.

Fair Value – Carrying Amount: Go directly to

P/L Selling price – Carrying Amount: Deferred and

amortised on a straight line basis

Asset is leased back at its fair value

Dr Equipment $Fair Value

Cr Lease Payable $Fair Value

Financial Assets

When bond is sold before the end of financial period, do normal bond amortisation except adjust it

based on the number of months before disposing it.

Financial Liabilities

* If there is any transaction cost, reduce the bond value and calculate the new interest rate based on

the reduced bond value.

- When there is an derecognition of bond due to a change of terms, the gain/loss is obtained

compared by comparing the carrying amount with the fair value at that time

Loans to subsidiary, parent company & staff (Seminar 9 Outline)

Parent to subsidiary

Parent – Dr Investment in Subsidiary

Subsidiary – Cr Capital Reserve

Subsidiary to Parent

Subsidiary – Dr Capital Reserve

Parent – Cr Investment in Subsidiary

Subsidiary to Subsidiary

Parent/Subsidiary – Dr / Cr Capital Reserve

Interest free loan to employee

Parent – Dr Deferred Staff Cost (amortise over straight line)

You might also like

- Accounting For Bonds PayableDocument31 pagesAccounting For Bonds PayableJon Christian Miranda100% (2)

- Lease or Buy DecisionDocument25 pagesLease or Buy Decisionfadillah 256No ratings yet

- Us Er Accounting For Asc 842 LeasesDocument35 pagesUs Er Accounting For Asc 842 LeasesquyenhuynhhaNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Capitalization: Capital Vs Operating LeaseDocument2 pagesCapitalization: Capital Vs Operating Leasejohnsmith12312312312No ratings yet

- Ifm Formula Sheet - Quantitative FinanceDocument22 pagesIfm Formula Sheet - Quantitative FinanceschuylerNo ratings yet

- Ifm Formula SheetDocument22 pagesIfm Formula Sheet1106 815No ratings yet

- Hire Purchase PPT 1Document17 pagesHire Purchase PPT 1Sourabh ChatterjeeNo ratings yet

- LeasingDocument27 pagesLeasinglekshmi517100% (5)

- Chapter 10lessee AccountingDocument5 pagesChapter 10lessee AccountingANo ratings yet

- Hire Purchase PPT 1Document17 pagesHire Purchase PPT 1Virender Singh SahuNo ratings yet

- Audit of LeaseDocument17 pagesAudit of LeaseTrisha Mae RodillasNo ratings yet

- Accounting For Leases IFRS 16 Vs IAS 17Document20 pagesAccounting For Leases IFRS 16 Vs IAS 17Obisike Emezi100% (2)

- Accounting For Fixed Assets I. Property, Plant and EquipmentDocument45 pagesAccounting For Fixed Assets I. Property, Plant and EquipmentLayNo ratings yet

- Notes On Property, Plant and EquipmentDocument49 pagesNotes On Property, Plant and Equipmentcriszel4sobejanaNo ratings yet

- Community Tourism Training ModuleDocument19 pagesCommunity Tourism Training ModuleBabu GeorgeNo ratings yet

- Reviewer 5Document8 pagesReviewer 5Kindred Wolfe100% (1)

- Ia Vol 2 Chap 10-15Document31 pagesIa Vol 2 Chap 10-15Miko ArniñoNo ratings yet

- Pfrs 16 LeasesDocument4 pagesPfrs 16 LeasesR.A.No ratings yet

- Ifrs 16 LeasesDocument19 pagesIfrs 16 LeasesR SharmaNo ratings yet

- Indas-116: Name - Dipeeka Banka ROLL NO. - 859 Guide - Prof. Sonali SahaDocument15 pagesIndas-116: Name - Dipeeka Banka ROLL NO. - 859 Guide - Prof. Sonali SahaDipeeka BankaNo ratings yet

- Leasing: An OverviewDocument18 pagesLeasing: An OverviewNeha GoyalNo ratings yet

- Lessor AccountingDocument2 pagesLessor AccountingMaryam ZafarNo ratings yet

- 15) IFRS-16 IBCOM-FinalDocument20 pages15) IFRS-16 IBCOM-Finalmanvi jainNo ratings yet

- Valuations Basics (Aswath Damodaran)Document40 pagesValuations Basics (Aswath Damodaran)bipun.maharjan2002No ratings yet

- Module 3 - Cost of CapitalDocument59 pagesModule 3 - Cost of CapitalPrateek JainNo ratings yet

- Notes PayableDocument2 pagesNotes Payablereymonastrera07No ratings yet

- 3 A PPL 3 Akuntansi Sewa Pabrikan Dan Diler PSAK 73 020921Document7 pages3 A PPL 3 Akuntansi Sewa Pabrikan Dan Diler PSAK 73 020921Tri Dewi LestariNo ratings yet

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- Lease and HPDocument27 pagesLease and HPpreetimaurya100% (1)

- Lease Purchase LawDocument4 pagesLease Purchase LawViper VenomNo ratings yet

- 55 Comparison of Accounting AssumptionsDocument8 pages55 Comparison of Accounting Assumptionsmanoranjan838241No ratings yet

- 1-Ifrs16 Leases SBRDocument2 pages1-Ifrs16 Leases SBRahmedfouad0712No ratings yet

- Clase III - Information For Investment and ValuationDocument208 pagesClase III - Information For Investment and ValuationMiguel Vega OtinianoNo ratings yet

- Summary - Ppe - ImpairmentDocument15 pagesSummary - Ppe - ImpairmentLorelie OrtegaNo ratings yet

- 4222 CH 20 Slides From PDFDocument17 pages4222 CH 20 Slides From PDFAn NaNo ratings yet

- Hire Purchase Finance and Consumer CreditDocument18 pagesHire Purchase Finance and Consumer Creditchaudhary9240% (5)

- Intermediate: AccountingDocument46 pagesIntermediate: Accountingw3n123No ratings yet

- LeasesDocument9 pagesLeasesCris Joy BiabasNo ratings yet

- CFAS NotesDocument6 pagesCFAS NotesAngelNo ratings yet

- Chapter 5 - Asset Investment Decisions and Capital RationingDocument31 pagesChapter 5 - Asset Investment Decisions and Capital RationingInga ȚîgaiNo ratings yet

- Leases: Section 15Document9 pagesLeases: Section 15Chara etangNo ratings yet

- Hire PuchaseDocument21 pagesHire PuchasekarthinathanNo ratings yet

- Lease Accounting: Dr.T.P.Ghosh Professor, MDI, GurgaonDocument20 pagesLease Accounting: Dr.T.P.Ghosh Professor, MDI, Gurgaonkmillat100% (1)

- Asset Investment Decisions and Capital Rationing: Margarita KouloumbriDocument31 pagesAsset Investment Decisions and Capital Rationing: Margarita KouloumbriInga ȚîgaiNo ratings yet

- A 2 Quali ReviewerDocument4 pagesA 2 Quali ReviewerJASMIN RHYZEL C. PINEDANo ratings yet

- Property, Plant and Equipment (Pas 16)Document1 pageProperty, Plant and Equipment (Pas 16)Jhets CalumbayNo ratings yet

- Cfas - ReceivablesDocument9 pagesCfas - ReceivablesYna SarrondoNo ratings yet

- ReviewerDocument5 pagesReviewercholestudyNo ratings yet

- LESSORDocument6 pagesLESSORLoreine Cyrille LirioNo ratings yet

- CH 12 Operating Lease - LessorDocument2 pagesCH 12 Operating Lease - LessorGenebabe LoquiasNo ratings yet

- IFRS 16: Lessor & Lessee Accounting Treatment in The Finance LeaseDocument2 pagesIFRS 16: Lessor & Lessee Accounting Treatment in The Finance LeaseboygarfanNo ratings yet

- TaxTimeToolkit - Rental Borrowing ExpensesDocument2 pagesTaxTimeToolkit - Rental Borrowing ExpensesMintNo ratings yet

- W5. Production Factor-Labour, Capital, MachineryDocument9 pagesW5. Production Factor-Labour, Capital, MachineryNor AziraNo ratings yet

- Characteristics Characteristics: Cost of DebtDocument4 pagesCharacteristics Characteristics: Cost of DebtMegha Agarwal ParikhNo ratings yet

- Advances To Officers, Investment Property, Cash Surrender ValueDocument2 pagesAdvances To Officers, Investment Property, Cash Surrender ValueMary Joyce YuNo ratings yet

- LessorDocument3 pagesLessorZance JordaanNo ratings yet

- Ia FinalsDocument10 pagesIa FinalsdesblahNo ratings yet

- My SBR NOTEDocument21 pagesMy SBR NOTEMD.RIDWANUR RAHMANNo ratings yet

- Lessor Operating LeaseDocument2 pagesLessor Operating LeaseChristine AltamarinoNo ratings yet

- Introduction To Financial Reporting: Assets Liabilities + Owner's EquityDocument7 pagesIntroduction To Financial Reporting: Assets Liabilities + Owner's EquityKothari InvestmentsNo ratings yet

- FAR 006 Summary Notes - Property, Plant & EquipmentDocument9 pagesFAR 006 Summary Notes - Property, Plant & EquipmentMarynelle Labrador SevillaNo ratings yet

- AC 2101 - Finals Incomplete PDFDocument10 pagesAC 2101 - Finals Incomplete PDFsarahgywneth15No ratings yet

- Chapter 15 - Long Term Liabilities Journalizing Bond Transaction Issuing Bonds at Face ValueDocument11 pagesChapter 15 - Long Term Liabilities Journalizing Bond Transaction Issuing Bonds at Face Valueowais khanNo ratings yet

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocument9 pagesGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371No ratings yet

- Acc Tut 12 Final JTDocument21 pagesAcc Tut 12 Final JTxhayyyzNo ratings yet

- PopularDocument2 pagesPopularxhayyyzNo ratings yet

- Gatsby Discussion QuestionsDocument23 pagesGatsby Discussion QuestionsxhayyyzNo ratings yet

- Literary Analysis Data Sheet: AP English Lit/Mr. Kirby Name: Taylor BosargeDocument4 pagesLiterary Analysis Data Sheet: AP English Lit/Mr. Kirby Name: Taylor BosargexhayyyzNo ratings yet

- Kvantitatiivne Lõdvendamine Ja Selle Mõju USD/EUR ValuutakursileDocument82 pagesKvantitatiivne Lõdvendamine Ja Selle Mõju USD/EUR ValuutakursilexhayyyzNo ratings yet

- Weekly Study Schedule Grey With Times - MondayDocument1 pageWeekly Study Schedule Grey With Times - MondayxhayyyzNo ratings yet

- V2.15.NF - Sale and LeasebackDocument3 pagesV2.15.NF - Sale and LeasebackCzar RabayaNo ratings yet

- 2p Kap Kcom 5102-6102 PDFDocument32 pages2p Kap Kcom 5102-6102 PDFbilalNo ratings yet

- CorpoLaw Case GR No. 210316Document14 pagesCorpoLaw Case GR No. 210316H.A. P.No ratings yet

- Chapter 15 Business FinanceDocument55 pagesChapter 15 Business Financeapi-35899503767% (3)

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument538 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- WMRE - Market Trends and 2021 OutlookDocument77 pagesWMRE - Market Trends and 2021 OutlookVladimir NegalovNo ratings yet

- California Board of Equalization (BOE) Sales/Use Tax ExemptionsDocument50 pagesCalifornia Board of Equalization (BOE) Sales/Use Tax Exemptionswmartin46No ratings yet

- Structuring Aircraft Financing Transactions w0016292Document9 pagesStructuring Aircraft Financing Transactions w0016292forcetenNo ratings yet

- MBFS Question Bank & AnswersDocument17 pagesMBFS Question Bank & AnswersArunkumar JwNo ratings yet

- DOCXDocument18 pagesDOCXMequen Chille QuemadoNo ratings yet

- Lease Finance in BangladeshDocument10 pagesLease Finance in BangladeshtanmoyNo ratings yet

- Sales&leasebackDocument15 pagesSales&leasebackeulhiemae arong0% (1)

- Financial ServicesDocument3 pagesFinancial ServicesAnZeerNo ratings yet

- ACCOUNTINGDocument12 pagesACCOUNTINGRae MichaelNo ratings yet

- LEXINGTONREALTY10KDocument196 pagesLEXINGTONREALTY10Kmatthewphenry1951No ratings yet

- IFRS 16 Sale and Leaseback AccountingDocument3 pagesIFRS 16 Sale and Leaseback AccountingBeta ProfessionalsNo ratings yet

- By Otmar, B.A: Leasing PreparedDocument53 pagesBy Otmar, B.A: Leasing PreparedAnna Mwita100% (1)

- Evelopment S ACK: Brackett FlagshipDocument4 pagesEvelopment S ACK: Brackett FlagshipElicitsNo ratings yet

- RPS Akuntansi Menengah IIDocument18 pagesRPS Akuntansi Menengah IIAnyaaNo ratings yet

- AEP101 Accounting Enhancement Program Financial Accounting and ReportingDocument6 pagesAEP101 Accounting Enhancement Program Financial Accounting and ReportingMiles SantosNo ratings yet

- Question Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?Document25 pagesQuestion Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?J. KNo ratings yet

- 8 Sale and LeasebackDocument10 pages8 Sale and Leasebackkoketso rahabNo ratings yet

- Advanced Financial Accounting AQ054-3-2: IFRS 16 LeasesDocument18 pagesAdvanced Financial Accounting AQ054-3-2: IFRS 16 LeasesAbdul RehmanNo ratings yet