Professional Documents

Culture Documents

A 2 Quali Reviewer

Uploaded by

JASMIN RHYZEL C. PINEDAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A 2 Quali Reviewer

Uploaded by

JASMIN RHYZEL C. PINEDACopyright:

Available Formats

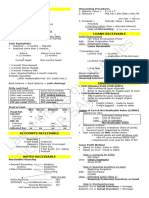

Current Liabilities and Contingencies Contingent asset

Possible asset

B. Premiums and Warranties Disclosed IF probable, not recognized

No disclosure If possible or remote

Premiums to be redeemed (% redeemed x sold)

Less: Premiums redeemed Bonds and Long Term Liabilities

Outstanding (still to be redeemed)

A. Bonds payable

Unit Cost

Delivery & Handling Not designated at FV thru P/L = FV – transaction costs

Less: Cash to be remitted Designated at FV thru P/L = expensed immediately

Net premium cost

No Amortization:

Premium expense = (to be redeemed / in exchange) x

net premium cost Face amount of bonds

Estimated liability = (outstanding / in exchange) x net Add: Premium / Less: Discount

premium cost Less: Bond Issue Costs

Carrying Amount

Estimated Warranty Liability Issue price

Accrued Interest

Actual War. Costs Less: Bond Issue Costs

(Claims/payments) Beg. Balance

War. Expense Premium = issue price > face amount

Effective rate < nominal rate

*add previous year’s estimated liability balance if next Discount = issue price < face amount

yr inaask Effective rate > nominal rate

Interest Paid = face amount x nominal rate

C. Contingents Interest Expense = CA x semiannual or annual effective

rate

Provision

uncertain *amortization increases at either premium/discount

both probable & measurable * add discount amort, less premium amort to reach 0 at

equivalent to accrued loss maturity date

contingency/estimated liab

B. Notes payable

Probable – more than 50%

Possible – 11% - 50% Not designated at FV thru P/L = FV – transaction

Remote – 10% or less, very slight costs (transaction costs are included in

measurement of NP)

Measurement:

Single obli – individual most likely outcome Irrevocably designated = expensed immediately

adjusted for effect of other possible outcomes

Continuous range – midpoint Issued for:

Large population – weighting cash = cash proceeds

interest bearing property/NCA = purchase price

Contingent liability noninterest bearing = cash price

Possible obligation

Disclosed, NOT recognized NP at FV

Either probable or measurable but NOT both Less: Discount

If remote, no disclosure CA

C. Debt restructuring Interest (new Principal x int. rate x pv of ordinary at old

- Creditor grants debtor concession para hindi rate)

mahirapan magbayad si debtor Pv of new

1. Asset Swap Old liab

Less: pv of new

Note Payable Gain on modification

Accrued Interest Payable

Total liability (gain/old liab) = if more than 10%, substantial

Less: Carrying amount of asset

Gain on extinguishment of debt (MARKET RATE)

USA GAAP on asset swap ( 2 transactions ) Principal (new principal x pv of 1 at market rate)

Interest (new Principal x int. rate x pv of ordinary at

FV of land market rate)

Less: CA of land PV of New Note Payable

Gain on exchange

Old liab

Total Liability Less: PV of new note payable

Less: FV of land Gain on extinguishment

Gain on debt restructuring

PV of new note payable

2. Dacion en Pago Multiply by: market rate

- Mortgaged property is offered in payment Int. expense

3. Equity Swap D. Lease

- Issuance of share capital in payment

1. Operating

In order of priority: ( separate line item) - Does NOT transfer substantially all risks

- Lessor records depreciation and lease

revenue, monthly rental as income

- Lease payments are straight line basis over

a. FV of equity instruments issued lease term

b. FV of liability extinguished Initial direct costs – added to CA and recognized

c. CA of liability extinguished (no gain or loss as expense over lease term (LESS AND DIVIDED

on extinguishment if this is used) OVER LEASE TERM)

Security deposit – noncurrent liab (IGNORED)

Fair value of shares Lease bonus – unearned rent income, amortized

Less: Par value of shares over lease term

Share Premium

Total Months (# of years x 12 months)

Bonds Payable Less: free

Accrued Interest Payable Remaining Months

CA of bonds

Less: FV of shares/bonds Total Rental over Lease Term = Total Months x monthly

Gain on extinguishment rent

Modification on terms:

10% test (OLD RATE): Total Rental Over Lease Term

Principal (new principal x pv of 1 at old rate) Divide by: No. of years

Average Annual

Multiply by: x/12 months

Rent Income for the year 3. Sales and Leaseback

1st yr Initial Lease Liability = Annual Rental Payable x PV of

2nd yr ordinary

3rd yr

Total Rental Revenue Cost of Right of Use Asset = (Initial Lease Liability/FV or

Average annual rental revenue (Total / yrs) sale price of asset) x CA of asset

Rent revenue from date of contract to date of report

(average annual x number of years)

Less: Rentals received (1st yr + 2nd yr)

Rent receivable

2. Direct Financing

- Recognize only interest income

Gross Rentals

RV (guaranteed or not)

Gross Investment

Cost of Asset

Initial Direct costs

Net Investment

Gross Investment

Less: Net Investment

Unearned Interest Income

No transfer of title/No purchase option/Revert to the

lessor:

Cost of machinery

Less: PV of RV (RV x PV of 1)

Net investment to be recovered from rental

Divide by: PV of ordinary

Annual Rental

Gross Rentals (annual rental x yrs)

RV (whether guaranteed or not)

Gross Investment

Less: Cost (net investment)

Unearned Interest Income

With transfer of title/will NOT revert to lessor:

Cost of Machinery

Divide by: PV of ordinary

Annual Rental

*RV is ignored if revert to lessor

Interest income = Cost x Interest Rate

Gain/Loss on right transferred = (right transferred to Reissuance at LESS than cost in order:

buyer-lessor/FV or sale price of asset) x total gain or loss a. Share premium from treasury shares

on sale b. RE

FV or sale price Cash

Less: CA Share Premium – TS

Total gain RE

Treasury Shares

FV or sale price

Less: initial lease liability Retirement of TS:

Right transferred to buyer-lessor

Par or stated value > cost of TS = gain on retirement

Annual rental income Par or stated value < cost of TS = loss on retirement

Less: depreciation of equipment purchased (sale price at a. Share premium from original issuance

FV/UL) b. Share premium from TS

Net rental income c. RE

Retained Earnings

Beg Retained Earnings

Net income for current year

Less: Net loss for current year

Retirement of Treasury shares

Preference Dividend (amount x %)

Less:

Dividend Distributions

Cash dividend

Property Div @ fair value

Share Dividend (% x shares x FV or Par)*

Add/Less: Prior Period Errors

Total Retained Earnings

Less: Appropriated for Treasury Shares (reacquired

treasury – sold treasury) x cost

Unappropriated Retained Earnings

*if share div is less than 20% (small share div) = amount

charged to RE is FV on date of declaration

if share div is 20% or more (large share div) = amount

charged to RE is par or stated value

(FV must NOT be lower than par, otherwise, amount

debited is equal to par/stated)

Treasury Shares

Reissuance of TS:

Reissuance at MORE than cost:

Cash

Treasury Shares

Share Premium - TS

You might also like

- Ia Notes-PayableDocument2 pagesIa Notes-PayableJhunnie LoriaNo ratings yet

- Chapter 1 Current LiabilitiesDocument7 pagesChapter 1 Current LiabilitiesTroisNo ratings yet

- 11 - Current Liabilities, Provisions and ContingenciesDocument5 pages11 - Current Liabilities, Provisions and ContingenciesSilent KillerNo ratings yet

- Fair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair ValueDocument6 pagesFair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair Valuedump acctNo ratings yet

- Intacc 3 Leases FinalsDocument9 pagesIntacc 3 Leases FinalsDarryl AgustinNo ratings yet

- FL NotesDocument4 pagesFL NotesBarry AllenNo ratings yet

- Prelim Reviewer - NotesDocument3 pagesPrelim Reviewer - NotesNorhanifah R. TampiNo ratings yet

- FMF T7 DoneDocument24 pagesFMF T7 DoneThongkit ThoNo ratings yet

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- Chapter 2Document3 pagesChapter 2Eyra MercadejasNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- Topic 2. Discounting: Future ValueDocument13 pagesTopic 2. Discounting: Future ValueАндрей ДымовNo ratings yet

- Notes Receivable: PresentationDocument2 pagesNotes Receivable: PresentationJonathan NavalloNo ratings yet

- Summary - Ppe - ImpairmentDocument15 pagesSummary - Ppe - ImpairmentLorelie OrtegaNo ratings yet

- CA Inter FM Chalisa by CA Aaditya Jain For Dec.21 Exam OnlyDocument28 pagesCA Inter FM Chalisa by CA Aaditya Jain For Dec.21 Exam OnlyKrishna GuptaNo ratings yet

- Capitalization: Capital Vs Operating LeaseDocument2 pagesCapitalization: Capital Vs Operating Leasejohnsmith12312312312No ratings yet

- Notes 02 Provisions and ContingenciesDocument3 pagesNotes 02 Provisions and Contingencieskrisha milloNo ratings yet

- Notes Ayable: Non-Interest Bearing NoteDocument1 pageNotes Ayable: Non-Interest Bearing NoteChris Tian FlorendoNo ratings yet

- SDFDDocument3 pagesSDFDVel JuneNo ratings yet

- Leave A Message Then Pass It On!!Document43 pagesLeave A Message Then Pass It On!!May RamosNo ratings yet

- TOPIC 2 NOTES and LOANS PAYABLEDocument4 pagesTOPIC 2 NOTES and LOANS PAYABLEDustinEarth Buyo MontebonNo ratings yet

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- FAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)Document12 pagesFAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)charlesNo ratings yet

- Receivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableDocument2 pagesReceivable Financing: 3. Factoring of Accounts Receivable 4. Discounting of Notes ReceivableJonathan NavalloNo ratings yet

- Notes Receivable: Valix, C. T. Et Al. Intermediate Accounting Volume 1. (2019) - Manila: GIC Enterprises & Co. IncDocument9 pagesNotes Receivable: Valix, C. T. Et Al. Intermediate Accounting Volume 1. (2019) - Manila: GIC Enterprises & Co. IncShergie GozumNo ratings yet

- IFRS 9 Part 2Document24 pagesIFRS 9 Part 2ErslanNo ratings yet

- TCF SummaryDocument11 pagesTCF SummarySylvan EversNo ratings yet

- Adjusting Entries and Merchandising BusinessDocument5 pagesAdjusting Entries and Merchandising BusinessLing lingNo ratings yet

- Ia Valix Chap 8 2019Document2 pagesIa Valix Chap 8 2019M100% (1)

- RSM230Document2 pagesRSM230alankn2004No ratings yet

- Aud Prob 2 Reviewer BDFDocument5 pagesAud Prob 2 Reviewer BDFMiles CasidoNo ratings yet

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocument9 pagesGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371No ratings yet

- ACYFMG2 Formula Sheet (Unit II)Document4 pagesACYFMG2 Formula Sheet (Unit II)Maha Bianca Charisma CastroNo ratings yet

- Laguna State Polytechnic Univeristy: Handout 08: Bonds PayableDocument11 pagesLaguna State Polytechnic Univeristy: Handout 08: Bonds PayableKaye Ann Abejuela RamosNo ratings yet

- Quiz Preparation Notes JTDocument2 pagesQuiz Preparation Notes JTxhayyyzNo ratings yet

- Table-Initial MeasurementDocument2 pagesTable-Initial MeasurementEla Gloria MolarNo ratings yet

- Loans ReceivableDocument2 pagesLoans ReceivableXanny BieberNo ratings yet

- Notes PayableDocument2 pagesNotes Payablereymonastrera07No ratings yet

- Current Liabilities: School of Business and AccountancyDocument4 pagesCurrent Liabilities: School of Business and AccountancyRochelle FactoresNo ratings yet

- CFAS NotesDocument6 pagesCFAS NotesAngelNo ratings yet

- Bonds PayableDocument10 pagesBonds Payablenot funny didn't laughNo ratings yet

- Math Formulas Made EasyDocument3 pagesMath Formulas Made EasyJavaria KhanNo ratings yet

- AC330 Exam Notes SampleDocument3 pagesAC330 Exam Notes SampleRicardo KlnNo ratings yet

- Ca Final SFM Capital Budgeting Summary (Old Course)Document21 pagesCa Final SFM Capital Budgeting Summary (Old Course)swati mishraNo ratings yet

- Chapter 7 Bonds PayableDocument9 pagesChapter 7 Bonds PayableCarlos arnaldo lavadoNo ratings yet

- Financial Liabilities SummaryDocument4 pagesFinancial Liabilities SummaryNancy Litera MusicoNo ratings yet

- Cheat Sheet Corporate - FinanceDocument2 pagesCheat Sheet Corporate - FinanceAnna BudaevaNo ratings yet

- FAR Last Minute by HerculesDocument10 pagesFAR Last Minute by Herculesjanjan3256No ratings yet

- 113 Module 1 - INTODUCTORY NOTES AND TRADE PAYABLES AND ACCRUED LIABILITIESDocument4 pages113 Module 1 - INTODUCTORY NOTES AND TRADE PAYABLES AND ACCRUED LIABILITIESRay SanzeninNo ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementBebark AkramNo ratings yet

- Liabilities: Includes Fees and Commission Paid Not Included Debt Premiums or DiscountsDocument2 pagesLiabilities: Includes Fees and Commission Paid Not Included Debt Premiums or DiscountsCatherine Joy MoralesNo ratings yet

- P7 - Investment in Debt Securities & Other Non-Current Financial AssetsDocument46 pagesP7 - Investment in Debt Securities & Other Non-Current Financial AssetsNashiel AnneNo ratings yet

- Credit Risk: Individual Loan Risk: Default Risk ModelsDocument6 pagesCredit Risk: Individual Loan Risk: Default Risk ModelsPranav ChandraNo ratings yet

- Unit 10 Master Budget - Financial StatementsDocument16 pagesUnit 10 Master Budget - Financial StatementsAshish Sharma PokhrelNo ratings yet

- ACCA FR Concept CapsuleDocument8 pagesACCA FR Concept CapsulehasharawanNo ratings yet

- Notes in ReceivablesDocument9 pagesNotes in ReceivablesAnj HwanNo ratings yet

- Notes ReceivableDocument16 pagesNotes Receivabledenice.dimantagaNo ratings yet

- Operating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingDocument5 pagesOperating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingzacchariahNo ratings yet

- IFRS 16 LeasesDocument3 pagesIFRS 16 Leasesrifa14142008No ratings yet

- MODULE 4 Topic 1Document26 pagesMODULE 4 Topic 1Lowie Aldani SantosNo ratings yet

- Summer Internship Project Company: Edelweiss Stock Broking Ltd. Proect Title: An Analysis of Investment Avenues Prevailing in IndiaDocument11 pagesSummer Internship Project Company: Edelweiss Stock Broking Ltd. Proect Title: An Analysis of Investment Avenues Prevailing in IndiaDEBALINA SENNo ratings yet

- Fundamentals Feasibility StudyDocument78 pagesFundamentals Feasibility StudyMohamed Mubarak100% (4)

- Uniqlo: A Supply Chain Going Global Case Analysis: Dr. Diane Badame Fall 2019Document14 pagesUniqlo: A Supply Chain Going Global Case Analysis: Dr. Diane Badame Fall 2019Pandu Zea ArdiansyahNo ratings yet

- BPS 3203 Transport Planning and Policy CourseoutlineDocument2 pagesBPS 3203 Transport Planning and Policy CourseoutlineArnold MainaNo ratings yet

- Case Study QuestionsDocument2 pagesCase Study QuestionsAnkit Goyal0% (1)

- Cost and Management AccountingDocument4 pagesCost and Management AccountingMsKhan0078No ratings yet

- IFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Document55 pagesIFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Andualem ZenebeNo ratings yet

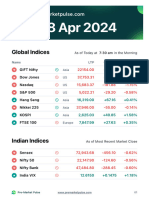

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Activity Statement For Hamilton Smith LTD 01Jul2020-31Jul2020Document1 pageActivity Statement For Hamilton Smith LTD 01Jul2020-31Jul2020BJ ManchusNo ratings yet

- Akanksha Bharti ReportDocument41 pagesAkanksha Bharti ReportPrashant MishraNo ratings yet

- US Internal Revenue Service: I1040 - 2000Document118 pagesUS Internal Revenue Service: I1040 - 2000IRS100% (4)

- Tax Invoice/Bill of Supply/Cash Memo: (Triplicate For Supplier)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Triplicate For Supplier)Subhashree PriyadarsiniNo ratings yet

- Corporation Law CasesDocument8 pagesCorporation Law CasesnojaywalkngNo ratings yet

- HSBC Credit Card Cashback PDFDocument1 pageHSBC Credit Card Cashback PDFSampath ReddyNo ratings yet

- DissertatioC BDocument16 pagesDissertatioC BKumar SwamyNo ratings yet

- API IDN DS2 en Excel v2Document447 pagesAPI IDN DS2 en Excel v2Indra ZulhijayantoNo ratings yet

- Auditor Office ProjectDocument34 pagesAuditor Office ProjectlooserNo ratings yet

- Accounting Research EssayDocument4 pagesAccounting Research EssayInsatiable LifeNo ratings yet

- ProfileDocument4 pagesProfileJose FilippiniNo ratings yet

- Impact of Covid 19 On Indian EconomyDocument4 pagesImpact of Covid 19 On Indian EconomyHaripriya VNo ratings yet

- Bizniz Plan Pt. Hilal Angkasa Indonesia 090922Document100 pagesBizniz Plan Pt. Hilal Angkasa Indonesia 090922indra lukmanNo ratings yet

- Annexure - III Process Flow ChartDocument1 pageAnnexure - III Process Flow ChartIbrahim AhmedNo ratings yet

- Roura ProjMgtExer1Document1 pageRoura ProjMgtExer1Irish Nicole RouraNo ratings yet

- European Central BankDocument2 pagesEuropean Central BanknairpranavNo ratings yet

- Mattel Product RecallDocument19 pagesMattel Product RecallRandy Cavalera100% (1)

- Chapter Three: General Fund & Special Revenue Funds 3.1 General Fund IsDocument41 pagesChapter Three: General Fund & Special Revenue Funds 3.1 General Fund IsTamirat BashaaNo ratings yet

- Ge 3 Module This Covers The Full Lecture of Contemporary WorldDocument112 pagesGe 3 Module This Covers The Full Lecture of Contemporary WorldJerle ParondoNo ratings yet

- Starbucks BankoneDocument7 pagesStarbucks BankoneDharun BlazerNo ratings yet

- Syed Waji Ul Hassan Bokhari (FIND)Document3 pagesSyed Waji Ul Hassan Bokhari (FIND)HshhsbsNo ratings yet