Professional Documents

Culture Documents

Sale and leaseback arrangements

Uploaded by

Czar Rabaya0 ratings0% found this document useful (0 votes)

53 views3 pagesThis document discusses accounting for sale and leaseback transactions under IFRS 16. Key points:

1) A sale and leaseback transaction involves an entity selling an asset then immediately leasing it back.

2) The selling entity must account for the leaseback as a finance lease if the lease term is for a major part of the asset's economic life.

3) Gains or losses are separated between the portion pertaining to the right retained by the seller and the portion pertaining to the right transferred to the buyer. Only the latter portion is recognized.

4) Illustrations are provided for situations where the sale price is equal to, above, or below fair value. Adjustments are made as needed

Original Description:

Lease Accounting

Original Title

V2.15.NF.Sale and Leaseback

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses accounting for sale and leaseback transactions under IFRS 16. Key points:

1) A sale and leaseback transaction involves an entity selling an asset then immediately leasing it back.

2) The selling entity must account for the leaseback as a finance lease if the lease term is for a major part of the asset's economic life.

3) Gains or losses are separated between the portion pertaining to the right retained by the seller and the portion pertaining to the right transferred to the buyer. Only the latter portion is recognized.

4) Illustrations are provided for situations where the sale price is equal to, above, or below fair value. Adjustments are made as needed

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views3 pagesSale and leaseback arrangements

Uploaded by

Czar RabayaThis document discusses accounting for sale and leaseback transactions under IFRS 16. Key points:

1) A sale and leaseback transaction involves an entity selling an asset then immediately leasing it back.

2) The selling entity must account for the leaseback as a finance lease if the lease term is for a major part of the asset's economic life.

3) Gains or losses are separated between the portion pertaining to the right retained by the seller and the portion pertaining to the right transferred to the buyer. Only the latter portion is recognized.

4) Illustrations are provided for situations where the sale price is equal to, above, or below fair value. Adjustments are made as needed

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

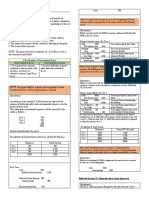

Chapter 15 – SALE AND LEASE BACK Dep’n.

200T *To record depreciation of

AccDep’n. 200T the Machinery

=an arrangement whereby one party sells an asset

to another party and then immediately leases the Illustration: Sale Price at Fair Value With Gain

asset back from the owner. Lessor sold equipment on Jan 1 with remaining UL of 10yrs and

Seller: Seller-Lessee immediately leased it back for 4yrs at the prevailing market

rental. Sale Price at FV = 6M; Equipt-CA = 4.5M; Annual rent

Buyer: Buyer-Lessor

every 12/31 = 800T; Implicit Int Rate = 10%

= this occurs when the seller-lessee is experiencing *The Seller-Lessee shall account for the leaseback as a

cash flow or financing problem or because there Finance Lease.

are tax advantages in such an arrangement in the 1. PV of LL = PV of Lease Payments = RR by SL

PV of LL (800T X 3.17) = 2,536,000

lessee’s jurisdiction. *Proceed with the Table of Amortization*

= Or that, the seller-lessee would like to avoid the *IFRS 16, P.100, provides that the Seller-Lessee shall

burden of paying the executory costs attendant to measure the Right of Use Asset at the proportional amount of

Right of Use retained by Seller-Lessee (PV of LL) over FV

the asset e.g. repairs, insurance and taxes.

multiplied to the Previous CA of Asset.

IFRS 16,P.100: The transfer of an asset must

2. Compute for the cost of RUA

satisfy the requirements for the recognition of RR by SL 2536T 1902T RUA

sale in order to be accounted for as sale and FV 6000T 4500T CA of UA

leaseback.

IFRS 16, P. 100: GAIN or LOSS that pertains to the:

*NOTE that there is NO physical transfer of Right Retained (RR) by Seller-Lessee, and

Right Transferred (RT) to Buyer-Lessor

asset. Only that there should be:

3. Compute for the Total Gain.

1. A Sale; & = the total gain contains both the Gains pertaining

2. A Lease Agreement for the same asset to RR and RT.

in which the seller is the lessee and the Sale Price at FV 6M

Carrying Amount 4.5M

buyer is the lessor. Total Gain. 1.5M

*The lease rent and sale price are usually 4. Compute for the RR by SL and RT to BL

Interdependent as they are negotiated as a Fair Value. 6M

RR by SL (Lease Liab) 2536T

package.

RT to BL 3464T

*Common Accounting issues is S&L: *GAIN OR LOSS that pertains to the Right Retained by

1. Sale Price at Fair Value seller-lessee is NOT RECOGNIZED

2. Sale Price at Fair Value With Gain *GAIN OR LOSS that pertains to the Right Transferred to

the Buyer-Lessor is RECOGNIZED

3. Sale Price at Fair Value With Loss

5. Get the proportional Amount of the Gains that

4. Sale Price above Fair Value pertain to the RR by SL and RT to BL from the

5. Sale Price below Fair Value total gain.

6. Transfer of Asset is Not a Sale

RR by SL. 2536T 634T (Not Recognized)

*Illustration – Sale Price at Fair Value RT to BL. 3464T 866T (Recognized)

Lessor sold a machinery on Jan 2020 for 2M, which is also the Total 6000T 1500T Total Gain

Fair Value of the Machinery. Books of Seller - Lessee

The Lessee immediately leased the machinery back for 1 year Cash 6M *To record the Sale And

at the prevailing annual rental of 300T; RUA. 1902T Leaseback.

Machinery-CA = 1.8M, net of AccDep’n of 1.2M Equipt 4.5M *The seller-lessee shall apply

Books of Seller - Lessee Lease Liab 2536T the Finance Lease model

Cash 2M *To record the Sale Gains on RT. 866T

AccDep’n 1.2M Selling Price 2M Int Exp 253600 *To record the Annual Rental

Machinery 3M Mach-CA (3M-1.2M). (1.8M) Lease Liab. 546400 for the first year

Gain on rights Gain on rights Cash 800T IE = (2536T X .10)

Transferred 200T Transferred 200T Dep’n exp. 475500 *To record annual Dep’n

Rent Exp 300T *To record Annual Rental AccDep'n. 475500 (1902T/4yrs) based on RUA

Cash 300T Books of Buyer - Lessor

Books of Buyer - Lessor =shall apply the Operating Lease model if Lease term is below

Machinery. 2M *To record the Purchase 75% of the Useful Life of the Underlying Asset

Cash. 2M Equipt *To record purchase of the

Cash. 100T *To record the Annual Rental Cash asset

Rent income 100T Cash. 800T *To record the Annual Rental

Rent Income 800T Seller-Lessee shall make ADJUSTMENTS to the PV of Lease

Dep'n 600T *To record dep’n of Asset Liability to recognize the excess of the Sale Price over FV.

AccDep'n 600T based on the Purchase price *The goal is to make it seem like SP = FV

(6,000T/10yrs) *In concept then (for computation), the Sale Price is Equal to

Fair Value so it would seem like SP = FV = 18M and so what

happens now to the Excess 2M?

Illustration – Sale Price at Fair Value With Loss *The Excess Sale Price over FV shall be accounted for as

Lessor sold a bldg with remaining UL of 25yrs and immediately Additional financing provided by the BL to SL.

leased it back for 3yrs; Sale Price at FV = 10M; Bldg-CA = 12M *In effect and to recognize the additional financing, this will

Annual Rent every 12/31 = 500T; Implicit Int Rate = 8% reduce the amount of PV of Lease Liability or “RR by SL”

1. Get the PV of LL or the RR by SL *But this adjustment is only for the computation of other

PV of Lease Liability = (500T X 2.58) = 1290T accounts stated below. The Lease Liab will still be at orig. PV

*Proceed with Table of Amortization 7. Get the Excess Sale Price

2. Compute for the cost of RUA Sale Price 20M

RR by SL 1290T 1548T RUA FV of Bldg 18M

FV 10M 12M CA of UA Excess Sale Price over FV. 2M

8. Adjust the PV of Lease Liability

PV of LL 5.4M

IFRS 16, P. 100: GAIN or LOSS that pertains to the: Additional financing (2M) (FA to BL)

Right Retained (RR) by Seller-Lessee, and PV of LL related to rentals 3.4M (RR by SL)

Right Transferred (RT) to Buyer-Lessor 9. Compute for the RUA

3. Compute for the Total Loss.

= the total Loss contains both the Loss pertaining

to RR and RT. RR by SL 3400T 2040T RUA

Sale Price at FV 10M FV 18000T 10800T CA of UA

Carrying Amount 12M 10. Compute for the Total Gain.

Total Loss. (2M) = in case SP ≠ FV, then whichever is higher between

4. Compute for the RR by SL and RT to BL Sale price and FV is the basis in getting the total

Fair Value. 10M gain, because the concept provides for Sale price

RR by SL (Lease Liab) 1290T to measure at the Amount of FV.

RT to BL 8710T =in this case, Sale Price is the basis.

5. Get the proportional Amount of the Loss that

pertain to the RR by SL and RT to BL from the Sale Price 20M

total Loss. Carrying Amount 10.8M

Total Gain. 7.2M

RR by SL. 1290T 258T (Not Recognized) 11. Compute for the RR by SL and RT to BL

RT to BL. 8710T 1742T (Recognized) Fair Value. 18M

Total 10M 2000T Total Loss RR by SL (Lease Liab) 3.4M

Books of Seller - Lessee RT to BL 14.6M

Cash 10M 12. Get the proportional Amount of the Gains that

RUA. 1548T pertain to the RR by SL and RT to BL from the

*To record the Sale And total gain.

Loss on RT 1742T

Leaseback.

Bldg 12M

Lease Liab 1290T RR by SL. 3.4M 1360T (Not Recognized)

Int Exp 103200 *To record the Annual Rental RT to BL. 14.6M 5840T (Recognized)

Lease Liab. 396800 for the first year Total 18M 7.2M Total Gain

Cash 500T IE = (1290T X .08) Books of Seller - Lessee

Dep'n 516T *To record Annual Dep’n of Cash 20M *To record the Sale and

AccDep'n 516T RUA (1548T/3yrs) RUA 2040T Leaseback

Books of Buyer – Lessor Bldg 10.8M Sale = Cash and Bldg

Building 10M *To record purchase of Bldg LL 5.4M Leaseback = RUA, LL and

Cash. 10M Gain on Right Gain on RT

Cash 500T *To record the Annual Transferred 5840T

Rental Inc 500T Collection for the lease Int Exp 648T *To record the payment for

Dep'n 400T *To record Dep’n of Bldg LL. 852T the Annual Rental for 2020

AccDep'n 400T over UL (10M/25yrs) Cash. 1500T IE = (5.4M X .12)

Dep'n 408T *To record the Annual Dep’n

*Illustration – Sale Price above Fair Value AccDep'n. 408T of RUA over LT (2040T/5yrs)

Lessor sold a building with Remaining UL of 20yrs and leased Books of Buyer – Lessor

it back for 5 years. Sale Price = 20M; FV of bldg = 18M; =only 5 yrs or 25% of the 20 year life of the asset of the

Bldg-CA = 10.8M; Annual rent every 12/31 = 1.5M; IIR = 12% asset was leased, therefore the BL shall apply the Operating

6. Get the PV of LL or the RR by SL Lease model.

PV of Lease Liability = (1.5M X 3.60) = 5.4M = also, the PV of LL related to rentals is less than 90% of FV

IFRS 16, P.101: if Sale Price is NOT EQUAL to Fair Value, the Bldg. 18M *To record the purchase of

FinAsset 2M the bldg

Cash 20M *FA = Financial Asset = RR by SL. 4591T 918,200 (Not Recognized)

Excess of Sale price over FV RT to BL. 1409T 281,800 (Recognized)

*The Seller-Lessor’s annual payment will be apportioned to: Total 6000T 1200T Total Gain

1. The Leased Asset – Building & Books of Seller - Lessee

2. The Financial Asset Cash 5000T *To record the Sale and

RUA 3672800 Leaseback

Bldg 4.8M Sale = Cash and Bldg

Rental Income 3.4M 944,444

LL 3591T Leaseback = RUA, LL and

Financial Asset 2M 555,556

Gain on Right Gain on RT

Lease Liability 5.4M 1,500,000

Transferred 281800

Int Exp 287280 *To record the payment for

*The FA will be amortized over the Lease Term LL. 612720 the Annual Rental for 2020

Cash 944,444 *To record the portion for Cash. 900T IE = (3591T X .08) *orig LL

Rent Income 944,444 the Leased Asset from the Dep'n 408T *To record the Annual Dep’n

Annual Collection AccDep'n. 408T of RUA over LT (3672800/5yrs)

*You can proceed with the Amortization table for Fin Asset. Books of Buyer – Lessor

You can also Journalize directly, just update the PV carefully =shall apply the Operating Lease model because lease term is

Cash 555,556 *To record the portion for only 62.5% of the UL of the asset, which is less than 75%

Fin Asset 315,556 FA from the collection =moreover, PV of LL of 4591T is less than 90% of FV of 6M

Int Income 240,000 Int Income = (2M X .12) *To record the purchase of

Dep’n 900T *To record the Annual Dep’n the Equipment

Equip't. 5M

AccDep’n 900T of Asset (18M/20yrs) *The Excess of FV only

Cash 5M

concerns the SL

*Illustration – Sale Price below Fair Value Cash 900T *To record the Annual Rental

Lessor sold an Equipment with remaining UL of 8 yrs and Rent Income 900T

leased it back for 5 yrs. Sale Price = 5M; FV of Equip't = 6M Dep'n 625T *To record the Annual Dep’n

Equip't-CA = 4.8M; Annual Rent every 12/31 = 900T; IIR = 8% AccDep'n. 625T of Equipt over its UL (5M/8yrs)

based on Sale Price

1. Get the PV of LL or the RR by SL

PV of Lease Liability = (900T X 3.99) = 3591T

*Note, always try to think of the Sale Price to equal the FV. Transfer of Asset is Not a Sale

So in this case, there is Excess Fair Value. IFRS 16, P. 103, provides that if the transfer of an asset by

*if the Sale price is Below Fair Value, the difference is the Seller-Lesser does not Satisfy the requirements for the

Accounted for As Prepayment of Rental. recognition of a Sale:

*So, in contrast with additional financing, the excess is added a.

to the Lease Liability. So, to put into amount the concept that

SP = FV = 6M, then the Excess FV would serves as an

additional liability by the SL to the BL.

2. Get the Excess Fair Value

FV of Equipt 6M

Sale Price 5M

Excess FV over Sale Price. 2M

3. Adjust the PV of Lease Liability

PV of LL 3591T

Prepayment of Rental 1000T (FA to BL)

Total Lease Liability 4591T (RR by SL)

4. Compute for the RUA

RR by SL 4591T 3672800 RUA

FV 6000T 4800T CA of UA

5. Compute for the Total Gain.

= in this case, the basis is the Fair Value

Fair Value 6M

Carrying Amount 4.8M

Total Gain. 1.2M

6. Compute for the RR by SL and RT to BL

Fair Value. 6M

RR by SL (Lease Liab) 4591T

RT to BL 1409T

7. Get the proportional Amount of the Gains that

pertain to the RR by SL and RT to BL from the

total gain.

You might also like

- Accounting Lesson 17 - Royalty AccountsDocument38 pagesAccounting Lesson 17 - Royalty AccountsRameshKumarMurali79% (19)

- Royalty AccountsDocument19 pagesRoyalty Accountsjashveer rekhi100% (2)

- Sale Leaseback Transactions (Leases)Document4 pagesSale Leaseback Transactions (Leases)Paulo Emmanuel SantosNo ratings yet

- Royalty Accounting SolutionsDocument5 pagesRoyalty Accounting SolutionsRehan RaufNo ratings yet

- SALE AND LEASEBACK TRANSACTIONDocument6 pagesSALE AND LEASEBACK TRANSACTIONJoan BartolomeNo ratings yet

- Insolvency Account 222Document22 pagesInsolvency Account 222Sajjadur RahmanNo ratings yet

- 1644473600SLFRS 16 - Part 6Document5 pages1644473600SLFRS 16 - Part 6mg21138No ratings yet

- Financial Accounting RoyaltyDocument483 pagesFinancial Accounting RoyaltyGoogle Plays50% (2)

- 15) IFRS-16 IBCOM-FinalDocument20 pages15) IFRS-16 IBCOM-Finalmanvi jainNo ratings yet

- Royalty AccountDocument21 pagesRoyalty AccountLokesh Sharma100% (2)

- Lecture 6 Investment MethodDocument65 pagesLecture 6 Investment Methodhani nazirahNo ratings yet

- Royalty and Hire PurchaseDocument4 pagesRoyalty and Hire PurchaseJaved Khan100% (1)

- Lecture Note BA212 L2 - Lease: (Katen / Lease Accounting/ DBS PNGUOTDocument3 pagesLecture Note BA212 L2 - Lease: (Katen / Lease Accounting/ DBS PNGUOTBee jayNo ratings yet

- Lease 12 AprilDocument32 pagesLease 12 Aprilr4vemaster100% (1)

- FRS 117 Leases: © 2008 Nelson Lam and Peter Lau Intermediate Financial Reporting: An IFRS Perspective (Chapter 4) - 1Document36 pagesFRS 117 Leases: © 2008 Nelson Lam and Peter Lau Intermediate Financial Reporting: An IFRS Perspective (Chapter 4) - 1jericleecfNo ratings yet

- 4222 CH 20 Slides From PDFDocument17 pages4222 CH 20 Slides From PDFAn NaNo ratings yet

- Royalty AccountsDocument30 pagesRoyalty AccountsKavinraj R S0% (1)

- Royalty Account: Royalty Meaning in AccountingDocument8 pagesRoyalty Account: Royalty Meaning in AccountingMahfooz AlamNo ratings yet

- Module 11-SALE AND LEASEBACKDocument9 pagesModule 11-SALE AND LEASEBACKJeanivyle CarmonaNo ratings yet

- Books of Intermediate Lessor Operating LeaseDocument2 pagesBooks of Intermediate Lessor Operating LeaseCzar Ysmael RabayaNo ratings yet

- Accounting Standard 19Document12 pagesAccounting Standard 19Kamal HassanNo ratings yet

- Chapter 15 Ia2Document21 pagesChapter 15 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- Net Present Value and Net Advantage of LeasingDocument5 pagesNet Present Value and Net Advantage of Leasingketanikul143100% (1)

- Lesson 2 LeaseDocument26 pagesLesson 2 Leaselil telNo ratings yet

- Income Approach To ValuationDocument35 pagesIncome Approach To Valuation054 Modi TanviNo ratings yet

- Accounting For Leases IFRS 16 Vs IAS 17Document20 pagesAccounting For Leases IFRS 16 Vs IAS 17Obisike Emezi100% (2)

- Lo 17-6, 17-7, 17-8Document25 pagesLo 17-6, 17-7, 17-8gl0879 p4No ratings yet

- ACC226 Lease AccountingDocument18 pagesACC226 Lease AccountingJaneth Barrete100% (2)

- Operating Lease Accounting for LessorsDocument4 pagesOperating Lease Accounting for LessorsikiNo ratings yet

- Investments in Property, Plant, and Equipment and in Intangible AssetsDocument53 pagesInvestments in Property, Plant, and Equipment and in Intangible AssetsGaluh Boga KuswaraNo ratings yet

- Financial accounting and reporting lease sale and leasebackDocument2 pagesFinancial accounting and reporting lease sale and leasebackAireyNo ratings yet

- Royalty AccountingDocument10 pagesRoyalty AccountingsmlingwaNo ratings yet

- FAR 3 Lease AccountingDocument10 pagesFAR 3 Lease AccountingMhyke Vincent Panis100% (1)

- Running Head: DEAL OF DOZER 1Document5 pagesRunning Head: DEAL OF DOZER 1Ayesha TanvirNo ratings yet

- Module 3 Real Estate Worksheet 5Yj89ZvoPADocument12 pagesModule 3 Real Estate Worksheet 5Yj89ZvoPANAMAN JAINNo ratings yet

- Deloitte Guide IASsDocument944 pagesDeloitte Guide IASsshakeel_cmaNo ratings yet

- Sale Leaseback & MortgageDocument30 pagesSale Leaseback & MortgageshivpreetsandhuNo ratings yet

- Final Fa8 by RiddhiDocument31 pagesFinal Fa8 by RiddhichinkuliNo ratings yet

- Browne Tax Aspects of Acquisitions and Dispositions of Oil and GasDocument29 pagesBrowne Tax Aspects of Acquisitions and Dispositions of Oil and Gastsar_philip2010No ratings yet

- Nas 17 - Ifrs 16 V9Document65 pagesNas 17 - Ifrs 16 V9binuNo ratings yet

- Arpia Lovely Quiz Chapter 8 Leases Part 2Document5 pagesArpia Lovely Quiz Chapter 8 Leases Part 2Lovely ArpiaNo ratings yet

- Sesi 11 - ch21 - Lease Part 2 - Rev 221121Document69 pagesSesi 11 - ch21 - Lease Part 2 - Rev 221121haikal.abiyu.w41No ratings yet

- Example 1: Classification of Leases: 1. Calculating Present Value of Minimum Lease PaymentsDocument9 pagesExample 1: Classification of Leases: 1. Calculating Present Value of Minimum Lease PaymentsJessa BasadreNo ratings yet

- CHAPTER FOUR LeaseDocument27 pagesCHAPTER FOUR LeaseDawit AmahaNo ratings yet

- Lease AccountingDocument12 pagesLease AccountingJayachandran MalayidappadathNo ratings yet

- Accounting for Liabilities and Leases (IFRS 16Document24 pagesAccounting for Liabilities and Leases (IFRS 16Vanshika TilakNo ratings yet

- 2016 05 31 Realtor University Speaker Series Ling Petrova Impact of Tax Incentives On Investment 02-06-2017Document46 pages2016 05 31 Realtor University Speaker Series Ling Petrova Impact of Tax Incentives On Investment 02-06-2017National Association of REALTORS®No ratings yet

- Royalty Accounts AnalysisDocument15 pagesRoyalty Accounts AnalysisVignesh C100% (1)

- Accounting for Leases Under PFRS 16Document16 pagesAccounting for Leases Under PFRS 16Isaiah ValenciaNo ratings yet

- Supplemental Reading - Sale and LeasebackDocument6 pagesSupplemental Reading - Sale and LeasebackangelapearlrNo ratings yet

- Part 3 - Sale and LeasebackDocument11 pagesPart 3 - Sale and LeasebackPoru SenpiiNo ratings yet

- 041 - IFRS 16 - Lessor AccountingDocument2 pages041 - IFRS 16 - Lessor AccountingNoman AnserNo ratings yet

- EA EA2 SU3 OutlineDocument9 pagesEA EA2 SU3 OutlineAdil AliNo ratings yet

- Topic 3-Investment MethodDocument29 pagesTopic 3-Investment MethodSyafiq SaidinNo ratings yet

- M-FAC 4861 - 3 - IFRS 16 Leases Lecture Notes-1Document47 pagesM-FAC 4861 - 3 - IFRS 16 Leases Lecture Notes-1AceNo ratings yet

- SBRRDocument60 pagesSBRRruysdf86No ratings yet

- Leases Can Seriously Damage Your Wealth: Leases of Flats in England and WalesFrom EverandLeases Can Seriously Damage Your Wealth: Leases of Flats in England and WalesNo ratings yet

- Educated REIT Investing: The Ultimate Guide to Understanding and Investing in Real Estate Investment TrustsFrom EverandEducated REIT Investing: The Ultimate Guide to Understanding and Investing in Real Estate Investment TrustsNo ratings yet

- Auditing TheoryDocument1 pageAuditing TheoryCzar RabayaNo ratings yet

- Fair Value (Pfrs 13) :: PAS 41: AgricultureDocument2 pagesFair Value (Pfrs 13) :: PAS 41: AgricultureCzar RabayaNo ratings yet

- Accounts Receivable: 1. Trade ReceivablesDocument3 pagesAccounts Receivable: 1. Trade ReceivablesCzar RabayaNo ratings yet

- Equipment: Chapter 25: PROPERTY, PLANT &Document4 pagesEquipment: Chapter 25: PROPERTY, PLANT &Czar RabayaNo ratings yet

- Receivables Financing OptionsDocument5 pagesReceivables Financing OptionsCzar RabayaNo ratings yet

- Intermediate Accounting PAS 23 Borrowing CostsDocument1 pageIntermediate Accounting PAS 23 Borrowing CostsCzar RabayaNo ratings yet

- V1.22.Investment PropertyDocument5 pagesV1.22.Investment PropertyCzar RabayaNo ratings yet

- V1.09.Receivable Financing - Discounting of NRDocument3 pagesV1.09.Receivable Financing - Discounting of NRCzar RabayaNo ratings yet

- Intacc SolmanDocument104 pagesIntacc Solmanpam92% (36)

- V1.26 PAS 20 - Government Grants - NFDocument2 pagesV1.26 PAS 20 - Government Grants - NFCzar RabayaNo ratings yet

- OWNER OF GOODS IN TRANSITDocument3 pagesOWNER OF GOODS IN TRANSITCzar RabayaNo ratings yet

- Chapter 10: Lessee Accounting: IFRS 16: New Lease Standard P Resent ValueDocument5 pagesChapter 10: Lessee Accounting: IFRS 16: New Lease Standard P Resent ValueCzar RabayaNo ratings yet

- Claims Supported by Formal Promises To Pay Usually in The Form of NotesDocument3 pagesClaims Supported by Formal Promises To Pay Usually in The Form of NotesCzar RabayaNo ratings yet

- Total Annual de P N Total Cost: InadequacyDocument5 pagesTotal Annual de P N Total Cost: InadequacyCzar RabayaNo ratings yet

- Estimation of Doubtful AccountsDocument2 pagesEstimation of Doubtful AccountsCzar RabayaNo ratings yet

- Accounts ReceivableDocument2 pagesAccounts ReceivableCzar RabayaNo ratings yet

- PAS 7 - SOCF - Cash and Cash EquivalentsDocument3 pagesPAS 7 - SOCF - Cash and Cash EquivalentsCzar RabayaNo ratings yet

- Fair Value (Pfrs 13) :: PAS 41: AgricultureDocument2 pagesFair Value (Pfrs 13) :: PAS 41: AgricultureCzar RabayaNo ratings yet

- Warranty Liability Actually Incurred: Total Available Warranty Cost For Products SoldDocument2 pagesWarranty Liability Actually Incurred: Total Available Warranty Cost For Products SoldCzar RabayaNo ratings yet

- Philippine Financial Reporting StandardsDocument5 pagesPhilippine Financial Reporting StandardsCzar RabayaNo ratings yet

- PDM YumbeDocument18 pagesPDM YumbeAkimu sijaliNo ratings yet

- PM Surya Ghar Muft Bijli YojanaDocument5 pagesPM Surya Ghar Muft Bijli Yojanaminhaj.xploreNo ratings yet

- Winning From Within - SummaryDocument4 pagesWinning From Within - SummaryShraddha Surendra100% (3)

- National Income Accounting: Unit HighlightsDocument37 pagesNational Income Accounting: Unit HighlightskalehiwotkoneNo ratings yet

- QSRPDocument3 pagesQSRPEugene GuillermoNo ratings yet

- Gibbons Stamp Monthly Mess With LinkgsDocument4 pagesGibbons Stamp Monthly Mess With LinkgsbNo ratings yet

- Pob study notes sections 3-4 and 7-10Document21 pagesPob study notes sections 3-4 and 7-10ShaeNo ratings yet

- SAIL Expansion Plan and Review Q3-FY-22Document52 pagesSAIL Expansion Plan and Review Q3-FY-22kanwarkahlonNo ratings yet

- SFM Theory With SolutionsDocument64 pagesSFM Theory With SolutionsNisen ShresthaNo ratings yet

- Promesa Has Failed: How A Colonial Board Is Enriching Wall Street and Hurting Puerto RicansDocument77 pagesPromesa Has Failed: How A Colonial Board Is Enriching Wall Street and Hurting Puerto RicansACRE CampaignsNo ratings yet

- GDP, inflation and trade data for South Asian countriesDocument7 pagesGDP, inflation and trade data for South Asian countriesHamza KhanNo ratings yet

- Technical AnalysisDocument97 pagesTechnical AnalysisMasoom Tekwani100% (1)

- Crypto Signal Date Target To Buy 1st Target 2nd Target Price Done (Date) Price Trading Flat FormDocument10 pagesCrypto Signal Date Target To Buy 1st Target 2nd Target Price Done (Date) Price Trading Flat FormDinuka ChathurangaNo ratings yet

- Chapter 1 Running Your Own MNCDocument4 pagesChapter 1 Running Your Own MNCMotasem adnan0% (1)

- Global Market Analysis 2023 - FinalDocument16 pagesGlobal Market Analysis 2023 - FinalAleksandraFetisovaNo ratings yet

- Standard Settlement Instructions: ABG Sundal Collier ASADocument4 pagesStandard Settlement Instructions: ABG Sundal Collier ASAmqchocolateNo ratings yet

- CommerceDocument934 pagesCommerceCBSE UGC NET EXAMNo ratings yet

- Primary Logistics ActivitiesDocument6 pagesPrimary Logistics ActivitiesyakmaeNo ratings yet

- Bajaj Auto OCRDocument29 pagesBajaj Auto OCRMurtaza ChoolawalaNo ratings yet

- Airtel Postpaid BillDocument4 pagesAirtel Postpaid BillShubhajeet DeyNo ratings yet

- Foundations of Engineering EconomyDocument45 pagesFoundations of Engineering EconomySaid SaayfanNo ratings yet

- Chapter 13 Section 1: The Growth of Industrial ProsperityDocument9 pagesChapter 13 Section 1: The Growth of Industrial ProsperityJacori LandrumNo ratings yet

- Economic Systems, Features & Goals of Us EconomyDocument15 pagesEconomic Systems, Features & Goals of Us Economyanon-583057100% (2)

- Overview of The Money Supply Process: Changes in The Required Reserve Ratio, RRDocument10 pagesOverview of The Money Supply Process: Changes in The Required Reserve Ratio, RRmaria ritaNo ratings yet

- FerraroDocument38 pagesFerrarodaniela soto gNo ratings yet

- Vellikallu Culvert Revised Working EstimateDocument33 pagesVellikallu Culvert Revised Working EstimateRA1511001010329 229510No ratings yet

- Warren Buffet Powerpoint PresentationDocument7 pagesWarren Buffet Powerpoint PresentationMihaela MihaiNo ratings yet

- Urban Form Determinant PDFDocument2 pagesUrban Form Determinant PDFSobia AhsanNo ratings yet

- Allen Onyema Criminal IndictmentDocument36 pagesAllen Onyema Criminal IndictmentDavid HundeyinNo ratings yet

- ECON1220A Introductory Macroeconomics: Chi-Wa Yuen University of Hong KongDocument32 pagesECON1220A Introductory Macroeconomics: Chi-Wa Yuen University of Hong KongHo Chi SinNo ratings yet