Professional Documents

Culture Documents

041 - IFRS 16 - Lessor Accounting

Uploaded by

Noman AnserCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

041 - IFRS 16 - Lessor Accounting

Uploaded by

Noman AnserCopyright:

Available Formats

FACR – ICMAP ML2 (S-21) Lessor

LESSOR ACCOUNTING UNDER IFRS 16

IFRS 16 tells about to classify lease w.r.t. lessor into finance and operating lease. Therefore, the very first

issue into lessor accounting is to classify it into operating and finance lease.

Finance Lease: Significant risks and rewards transferred to lessee.

Operating Lease: Other than Finance Lease.

CONDITIONS FOR FINANCE LEASE: (ANY)

a) Ownership is transferred to lessee at end of the lease term

b) Option to purchase asset at below fair value at end of lease and reasonably certain option will be

exercised. (bargain purchase option)

c) Lease term represents the major part of assets economic life (usually >75% in practice).

d) PV of minimum lease payments represents substantially all of the asset’s fair value (usually 90% in

practice)

e) Leased asset is specialized / customized in nature.

OPERATING LEASE:

Under operating lease, income receipts are recognised as income through profit or loss on a straight-line

basis. The asset is continued to be recognized in the books of lessor. Depreciation on the asset continues

over its useful life.

FINANCE LEASE:

This is a long-term leasing arrangement. For example, bank leases a plane to an airline for 40 years. The

control of the asset passes to the lessee during the term of the lease. Therefore, this is a form of lending

arrangement.

Accounting:

a) Derecognize asset and record a receivable (@ net investment in the lease).

b) Record finance lease receipts as a reduction in the receivable.

c) Record interest income on the receivable.

• Gross investment in the lease = MLP receivable plus any unguaranteed residual value.

• Net investment in the lease = Gross investment in the lease discounted at the implicit rate of interest.

Note: The unguaranteed portion of residual value comes from third party.

Opening Balance + Interest Income – Lease Rentals Collected = Closing Balance

Prepared by: M. Umar Munir (Gold Medalist), FCMA, MS Finance

FACR – ICMAP ML2 (S-21) Lessor

NOTE:

• At the time of payment, lease receivable is split between finance income and recovery.

• Lease receivable is to be allocated between current and non-current into SFP.

At inception of lease (initial measurement)

Debit Lease receivable at NIL

Credit Asset at book value

Balance Gain / loss on disposal.

Subsequent measurement entries:

Debit Cash

Credit Lease Receivable (with the number of periodic rentals)

Debit Lease receivable

Credit Finance income (P/L)

LESSOR ACCOUNTING

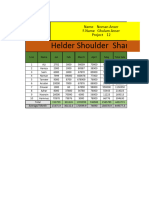

Cherry leases out an item of property, plant and equipment under a 5-year finance lease. The lease

commenced on 1 January 2015 and the rate implicit in the lease is 4%. The annual lease rentals of 5,000

are paid at the start of the lease period. Cherry estimates that the unguaranteed residual value of the

PPE is Rs.400. The asset has a carrying value of 24,000.

Required:

1. Calculate Cherry’s net investment in the lease. [Answer: NIL Rs.23,478]

2. Record the lease transaction at initial recognition. [Answer: Loss on disposal Rs.522]

3. Prepare lease amortization schedule.

Prepared by: M. Umar Munir (Gold Medalist), FCMA, MS Finance

You might also like

- Accounting Standard 19Document12 pagesAccounting Standard 19Kamal HassanNo ratings yet

- IAS 17/IFRS16 Accounting For Leases: MCA - FIA212Document30 pagesIAS 17/IFRS16 Accounting For Leases: MCA - FIA212Gift Malulu100% (1)

- Corporate Reporting - SPRING 2021 ACC-344 Assignment # 03 Submitted ToDocument5 pagesCorporate Reporting - SPRING 2021 ACC-344 Assignment # 03 Submitted ToAliyya TaimurNo ratings yet

- Lease 12 AprilDocument32 pagesLease 12 Aprilr4vemaster100% (1)

- As 19Document23 pagesAs 19soumya_2688No ratings yet

- Accounting For Leases Fra 2012Document8 pagesAccounting For Leases Fra 2012Srishti ShawNo ratings yet

- LESSOR 2021 Updated For Screen (1) - 1-13Document13 pagesLESSOR 2021 Updated For Screen (1) - 1-13TendaniNo ratings yet

- Session 04 AlkDocument28 pagesSession 04 AlkAriyanto Bakti PNo ratings yet

- Intermediate Financial AccountingDocument197 pagesIntermediate Financial AccountingZena AbidNo ratings yet

- Lease 2nd SessionDocument18 pagesLease 2nd SessionMohammad AnikNo ratings yet

- SLFRS 16 - Leasing: Please Note: LKAS 17: LEASING (Will Not Be Questioned) - For Additional Information OnlyDocument7 pagesSLFRS 16 - Leasing: Please Note: LKAS 17: LEASING (Will Not Be Questioned) - For Additional Information Onlyganraj100% (1)

- Accounting For Lease Ias 17: by Soundarya ADocument22 pagesAccounting For Lease Ias 17: by Soundarya ASoundarya .ANo ratings yet

- Leases Slides - FinalDocument34 pagesLeases Slides - FinalAnonymous n3n1Ae100% (1)

- AS19 LeaseDocument3 pagesAS19 LeasehariomnarayanNo ratings yet

- Chapter 13 LeasesDocument4 pagesChapter 13 LeasesAngelica Joy ManaoisNo ratings yet

- Leasing: An OverviewDocument18 pagesLeasing: An OverviewNeha GoyalNo ratings yet

- RMK Akm 2-CH 21Document14 pagesRMK Akm 2-CH 21Rio Capitano0% (1)

- CH 21Document108 pagesCH 21Aizhan AnarkulovaNo ratings yet

- Chapter21 Fininanalcial AccountingDocument103 pagesChapter21 Fininanalcial AccountingMan Kin100% (2)

- L9 - MFRS117Document98 pagesL9 - MFRS117andy100% (1)

- CH.5 LeaseDocument63 pagesCH.5 LeaseLidia SamuelNo ratings yet

- ACCT201 Handout (Topic 6) - LiabilitiesDocument36 pagesACCT201 Handout (Topic 6) - LiabilitiesElvin TanNo ratings yet

- Ifrs 16 LeasesDocument70 pagesIfrs 16 Leasessikute kamongwaNo ratings yet

- AS-19 LeasesDocument6 pagesAS-19 LeasesAparna Anand100% (1)

- Accounting For LeasesDocument9 pagesAccounting For LeasesNelson Musili100% (3)

- Module 1 LeasesDocument12 pagesModule 1 LeasesMon RamNo ratings yet

- 4222 CH 20 Slides From PDFDocument17 pages4222 CH 20 Slides From PDFAn NaNo ratings yet

- IFRS 16 - Lease by Ubong UdofiaDocument7 pagesIFRS 16 - Lease by Ubong Udofiaubongudofia98No ratings yet

- Financial Accounting IIDocument24 pagesFinancial Accounting IIsalman siddiqui100% (1)

- M-FAC 4861 - 3 - IFRS 16 Leases Lecture Notes-1Document47 pagesM-FAC 4861 - 3 - IFRS 16 Leases Lecture Notes-1AceNo ratings yet

- CH 21Document11 pagesCH 21Hanif MusyaffaNo ratings yet

- Leasing1 AspectsDocument19 pagesLeasing1 AspectssakshiNo ratings yet

- Chapter 2 - Additional Accounting Analysis - SVDocument9 pagesChapter 2 - Additional Accounting Analysis - SVK59 Le Nhat ThanhNo ratings yet

- Ch04 Accounting Treatment 2Document162 pagesCh04 Accounting Treatment 2Gere TassewNo ratings yet

- Chapter 8 Leases Part 2Document14 pagesChapter 8 Leases Part 2maria isabellaNo ratings yet

- Ifrs 16 LeasesDocument33 pagesIfrs 16 Leasesesulawyer2001100% (1)

- Accounting For LeasesDocument25 pagesAccounting For LeasesAnna Lin100% (1)

- IFRS16 LeaseDocument31 pagesIFRS16 Leaseahmad Radaideh100% (1)

- Chapter 16 - LeasingDocument31 pagesChapter 16 - LeasingSakthi VelNo ratings yet

- Far 46 60Document27 pagesFar 46 60GuadzNo ratings yet

- IfRS 16 Leases SummaryDocument7 pagesIfRS 16 Leases SummaryKent TacsagonNo ratings yet

- Ind - As 17Document22 pagesInd - As 17ambarishNo ratings yet

- Chapter 12. LeasesDocument24 pagesChapter 12. LeasesАйбар КарабековNo ratings yet

- Chapter 13 LeasesDocument13 pagesChapter 13 Leaseslou-924No ratings yet

- IFRS 16 - by Zubair SaleemDocument34 pagesIFRS 16 - by Zubair SaleemAli OptimisticNo ratings yet

- Govt. Acctg CHP 13Document13 pagesGovt. Acctg CHP 13Shane KimNo ratings yet

- Practical Guide Ias 17 LeasesDocument15 pagesPractical Guide Ias 17 Leasesgeorge antwiNo ratings yet

- Lease Accounting Lecture in Power PointDocument22 pagesLease Accounting Lecture in Power PointEjaz AhmadNo ratings yet

- Topic 1 Accounting For LeasesDocument59 pagesTopic 1 Accounting For LeasesAtira Shamsul Bahari100% (1)

- Lease Financing PDFDocument31 pagesLease Financing PDFreshma100% (5)

- Lease Financing: Learning OutcomesDocument31 pagesLease Financing: Learning Outcomesravi sharma100% (1)

- Leasing CH 22Document35 pagesLeasing CH 22Keisha ThompsonNo ratings yet

- Lesson 2 LeaseDocument26 pagesLesson 2 Leaselil telNo ratings yet

- Intermediate Accounting: Eleventh Canadian EditionDocument55 pagesIntermediate Accounting: Eleventh Canadian EditionAlexander Monroe100% (2)

- Lect Note Topic 4 PK - Leases Maksi UiDocument42 pagesLect Note Topic 4 PK - Leases Maksi UiAlbertusRicoPermanaKusumaNo ratings yet

- Accounting For LeasesDocument59 pagesAccounting For LeasesMei Chien Yap100% (2)

- Winning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertFrom EverandWinning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertNo ratings yet

- Noman Project 17Document2 pagesNoman Project 17Noman AnserNo ratings yet

- Noman Project 12Document2 pagesNoman Project 12Noman AnserNo ratings yet

- Listed Companies COCG 2019Document57 pagesListed Companies COCG 2019Muzammil LiaquatNo ratings yet

- Noman Project 16.Document2 pagesNoman Project 16.Noman AnserNo ratings yet

- Noman Project 15Document2 pagesNoman Project 15Noman AnserNo ratings yet

- Ias 16Document6 pagesIas 16Noman AnserNo ratings yet

- Library - BrochureDocument13 pagesLibrary - BrochureNoman AnserNo ratings yet

- Preconditions (ISA 210) 2020Document2 pagesPreconditions (ISA 210) 2020Noman AnserNo ratings yet

- FA TheoryDocument22 pagesFA TheoryNoman AnserNo ratings yet

- MA TheoryDocument18 pagesMA TheoryNoman AnserNo ratings yet

- Preconditions DiagramDocument1 pagePreconditions DiagramNoman AnserNo ratings yet

- Practice Questions - ISA 210 - Pre-Conditions of An AuditDocument6 pagesPractice Questions - ISA 210 - Pre-Conditions of An AuditNoman AnserNo ratings yet

- Summary Diagram (ISA 210) 2020Document1 pageSummary Diagram (ISA 210) 2020Noman AnserNo ratings yet

- ISA 210 Past Papers - Engagement LetterDocument8 pagesISA 210 Past Papers - Engagement LetterNoman AnserNo ratings yet

- Engagement Letter (ISA 210) 2020Document2 pagesEngagement Letter (ISA 210) 2020Noman AnserNo ratings yet

- Cgbl&E MCQS: Modaraba CompaniesDocument5 pagesCgbl&E MCQS: Modaraba CompaniesNoman AnserNo ratings yet

- 002 - Answers - Accounting Fundamentals QuizDocument9 pages002 - Answers - Accounting Fundamentals QuizNoman AnserNo ratings yet

- 5 - DEBENTURES MCQsDocument8 pages5 - DEBENTURES MCQsNoman AnserNo ratings yet

- 017 - IAS 40 - Investment PropertyDocument2 pages017 - IAS 40 - Investment PropertyNoman AnserNo ratings yet

- 006 - Additional Basic MCQsDocument10 pages006 - Additional Basic MCQsNoman AnserNo ratings yet

- 003 - Chapter 01 - Scratching The BasicsDocument11 pages003 - Chapter 01 - Scratching The BasicsHaris ButtNo ratings yet

- WINDING-UP MCQsDocument4 pagesWINDING-UP MCQsNoman AnserNo ratings yet

- Index Number: The Formula Pnqn/poqn x100 Is Used To Calculate?Document7 pagesIndex Number: The Formula Pnqn/poqn x100 Is Used To Calculate?Noman AnserNo ratings yet

- Cgble MCQS: Question No: 1Document5 pagesCgble MCQS: Question No: 1Noman AnserNo ratings yet

- Cgbl&E MCQS: Anti Money LaunderingDocument7 pagesCgbl&E MCQS: Anti Money LaunderingNoman AnserNo ratings yet

- Mcqs LLLDocument2 pagesMcqs LLLNoman AnserNo ratings yet

- Sale of Goods Act 1930Document5 pagesSale of Goods Act 1930Noman AnserNo ratings yet

- 1872 Contract ActDocument12 pages1872 Contract ActNoman AnserNo ratings yet

- Net Present Value and InvestmentsDocument50 pagesNet Present Value and InvestmentsNoman AnserNo ratings yet

- British Airways Vs CADocument17 pagesBritish Airways Vs CAGia DimayugaNo ratings yet

- Anderson v. Eighth Judicial District Court - OpinionDocument8 pagesAnderson v. Eighth Judicial District Court - OpinioniX i0No ratings yet

- Stalin Guided NotesDocument2 pagesStalin Guided Notesapi-536892868No ratings yet

- Document 2 - Wet LeasesDocument14 pagesDocument 2 - Wet LeasesDimakatsoNo ratings yet

- Pol Parties PDFDocument67 pagesPol Parties PDFlearnmorNo ratings yet

- AR 700-84 (Issue and Sale of Personal Clothing)Document96 pagesAR 700-84 (Issue and Sale of Personal Clothing)ncfranklinNo ratings yet

- 2 Secuya V de SelmaDocument3 pages2 Secuya V de SelmaAndrew GallardoNo ratings yet

- Ground Floor Plan Second Floor Plan: Bedroom 1 T & B Service Area Closet T & BDocument1 pageGround Floor Plan Second Floor Plan: Bedroom 1 T & B Service Area Closet T & BAbegail Dela CruzNo ratings yet

- The Reformation MovementDocument5 pagesThe Reformation MovementJulie Anne TasicNo ratings yet

- SUDAN A Country StudyDocument483 pagesSUDAN A Country StudyAlicia Torija López Carmona Verea100% (1)

- Module 7: Storm Over El Filibusterismo: ObjectivesDocument7 pagesModule 7: Storm Over El Filibusterismo: ObjectivesJanelle PedreroNo ratings yet

- Ada AtlantisDocument10 pagesAda AtlantisAda MacallopNo ratings yet

- ACCOUNT OF STEWARDSHIP AS Vice Chancellor University of IbadanDocument269 pagesACCOUNT OF STEWARDSHIP AS Vice Chancellor University of IbadanOlanrewaju AhmedNo ratings yet

- Ia Prompt 12 Theme: Knowledge and Knower "Is Bias Inevitable in The Production of Knowledge?"Document2 pagesIa Prompt 12 Theme: Knowledge and Knower "Is Bias Inevitable in The Production of Knowledge?"Arham ShahNo ratings yet

- Bible Trivia Questions - Bible Challenges For KidsDocument4 pagesBible Trivia Questions - Bible Challenges For KidsVinessa Johnson100% (1)

- Role of The Govt in HealthDocument7 pagesRole of The Govt in HealthSharad MusaleNo ratings yet

- Problem Set 9Document2 pagesProblem Set 9Siham BuuleNo ratings yet

- TA Holdings Annual Report 2013Document100 pagesTA Holdings Annual Report 2013Kristi DuranNo ratings yet

- Ecology Block Wall CollapseDocument14 pagesEcology Block Wall CollapseMahbub KhanNo ratings yet

- IGNOU Vs MCI High Court JudgementDocument46 pagesIGNOU Vs MCI High Court Judgementom vermaNo ratings yet

- Philippine Phoenix Surety vs. WoodworksDocument1 pagePhilippine Phoenix Surety vs. WoodworksSimon James SemillaNo ratings yet

- Man of Spain - Francis Suarez. (Millar, M. F. X.) PDFDocument3 pagesMan of Spain - Francis Suarez. (Millar, M. F. X.) PDFAdriel AkárioNo ratings yet

- Viking Solid Cone Spray NozzleDocument13 pagesViking Solid Cone Spray NozzlebalaNo ratings yet

- Three VignettesDocument3 pagesThree VignettesIsham IbrahimNo ratings yet

- Parent Leaflet Child Death Review v2Document24 pagesParent Leaflet Child Death Review v2InJailOutSoonNo ratings yet

- CIT Exercises - June 2020 - ACEDocument16 pagesCIT Exercises - June 2020 - ACEKHUÊ TRẦN ÁINo ratings yet

- E.I Dupont de Nemours & Co. vs. Francisco, Et - Al.Document3 pagesE.I Dupont de Nemours & Co. vs. Francisco, Et - Al.Carmille Marge MercadoNo ratings yet

- SHDP TizonDocument29 pagesSHDP TizonRonnel Alegria RamadaNo ratings yet

- Department of Planning and Community Development: Organizational ChartDocument5 pagesDepartment of Planning and Community Development: Organizational ChartkeithmontpvtNo ratings yet

- First Online Counselling CutoffDocument2 pagesFirst Online Counselling CutoffJaskaranNo ratings yet