Professional Documents

Culture Documents

017 - IAS 40 - Investment Property

Uploaded by

Noman AnserCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

017 - IAS 40 - Investment Property

Uploaded by

Noman AnserCopyright:

Available Formats

FACR – ICMAP ML2 (S-21) IAS 40

IAS 40 - INVESTMENT PROPERTY

INVESTMENT PROPERTY:

Investment property is property (land or a building – or part of a building – or both) held to earn rentals or

for capital appreciation or both. The word “held” includes both (a) legal owner and (b) finance lease.

Examples for IP:

This standard provides the following examples land and buildings that should be classified as investment

property:

Land held for long term capital appreciation.

Land held for currently undetermined future use.

Building leased out under an operating lease arrangement.

Vacant buildings held to be leased out under operating lease.

Property being constructed for future use as investment property.

Examples for NON-IP:

Owner occupied property used for Production or supply of goods and services or administration.

(Covered in IAS-16)

Property occupied by employees irrespective of whether they pay rent or otherwise.

Owner occupied property awaiting disposal. (Covered in IFRS-05)

Held for sale in ordinary course of business or in the process of construction or development for such

sale. (Covered in IAS-02)

Property leased out under finance lease arrangement. (Covered in IFRS-16)

Property being constructed or developed on behalf of third parties. (Covered in IFRS-15)

PROPERTY WITH DUAL USES:

There could be a situation where a building can be accounted for in two different ways. If an entity

occupies a premises but rents out certain floors to other companies, then the part occupied will be

classed as PP&E as per IAS 16, with the floors rented out classed as investment property per IAS 40.

If a building is rented by a subsidiary of the entity, then the building will be classed as an investment

property in the individual accounts, but will be classed as property, plant and equipment per IAS 16 in the

consolidated financial statements.

MEASUREMENT:

Initial Subsequent:

Fair value model: Cost model:

Investment properties should • The investment properties are • Continue to carry on costs

initially be measured at cost revalued to fair value at each same as per IAS-16.

i.e. purchase price plus directly reporting date. • The properties are

attributable costs. • Gains or losses on revaluation depreciated like any other

are recognised directly asset.

through P&L. • When fair value model is

• The properties are NOT impractical to apply.

depreciated.

IAS-40 encourages consistent application of adopted method to overall IP portfolio (not to specific

class). However, discourages change of method from fair value to cost model as it is highly unlikely that it

would result in fair presentation. As per IAS-08, voluntary change in accounting policy should be made

only when it being more reliable financial information and presentation.

Prepared by: M. Umar Munir (Gold Medalist), FCMA, MS Finance

FACR – ICMAP ML2 (S-21) IAS 40

Definition of Fair Value:

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date.

TRANSFERS / MIGRATION:

Transfers into and out of investment property should only be made when supported by a change of use of

the property.

FROM IAS 16 TO IAS 40 FROM IAS 40 TO IAS 16

Fair Value Model Cost Model: Fair Value Model Cost Model:

The asset must first The asset is transferred Revalue the property first The asset is

be revalued per IAS into investment properties per IAS 40 (taking the transferred into

16 (creating a at the current carrying gain or loss to the property, plant and

revaluation surplus in amount and continues to statement of profit or equipment at the

equity) and then be depreciated. loss) and then transfer to current carrying

transferred into property, plant and amount and continues

investment property at equipment at fair value. to be depreciated.

fair value.

Prepared by: M. Umar Munir (Gold Medalist), FCMA, MS Finance

You might also like

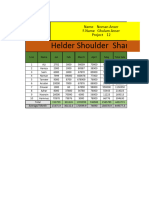

- Noman Project 17Document2 pagesNoman Project 17Noman AnserNo ratings yet

- Noman Project 16.Document2 pagesNoman Project 16.Noman AnserNo ratings yet

- Noman Project 12Document2 pagesNoman Project 12Noman AnserNo ratings yet

- Noman Project 15Document2 pagesNoman Project 15Noman AnserNo ratings yet

- Engagement Letter (ISA 210) 2020Document2 pagesEngagement Letter (ISA 210) 2020Noman AnserNo ratings yet

- Preconditions (ISA 210) 2020Document2 pagesPreconditions (ISA 210) 2020Noman AnserNo ratings yet

- Practice Questions - ISA 210 - Pre-Conditions of An AuditDocument6 pagesPractice Questions - ISA 210 - Pre-Conditions of An AuditNoman AnserNo ratings yet

- Library - BrochureDocument13 pagesLibrary - BrochureNoman AnserNo ratings yet

- MA TheoryDocument18 pagesMA TheoryNoman AnserNo ratings yet

- Ias 16Document6 pagesIas 16Noman AnserNo ratings yet

- FA TheoryDocument22 pagesFA TheoryNoman AnserNo ratings yet

- 041 - IFRS 16 - Lessor AccountingDocument2 pages041 - IFRS 16 - Lessor AccountingNoman AnserNo ratings yet

- ISA 210 Past Papers - Engagement LetterDocument8 pagesISA 210 Past Papers - Engagement LetterNoman AnserNo ratings yet

- Cgbl&E MCQS: Modaraba CompaniesDocument5 pagesCgbl&E MCQS: Modaraba CompaniesNoman AnserNo ratings yet

- Mcqs 700-800Document10 pagesMcqs 700-800Noman AnserNo ratings yet

- Index Number: The Formula Pnqn/poqn x100 Is Used To Calculate?Document7 pagesIndex Number: The Formula Pnqn/poqn x100 Is Used To Calculate?Noman AnserNo ratings yet

- Sale of Goods Act 1930Document5 pagesSale of Goods Act 1930Noman AnserNo ratings yet

- Mcqs 400-500Document17 pagesMcqs 400-500Noman AnserNo ratings yet

- Mcqs 700-800Document10 pagesMcqs 700-800Noman AnserNo ratings yet

- Mcq's 500-600Document8 pagesMcq's 500-600Noman AnserNo ratings yet

- Mcqs 800-900Document10 pagesMcqs 800-900Noman AnserNo ratings yet

- Mcqs 900-1000Document10 pagesMcqs 900-1000Noman AnserNo ratings yet

- Mcqs 200-400Document19 pagesMcqs 200-400Noman AnserNo ratings yet

- Mcq's 105-180Document8 pagesMcq's 105-180Noman AnserNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Samrah Qamar Khan: Roll No. 71Document7 pagesSamrah Qamar Khan: Roll No. 71Samrah QamarNo ratings yet

- Go To Market Strategies That WorkDocument25 pagesGo To Market Strategies That WorkFounder Institute100% (1)

- BMP ProcessDocument11 pagesBMP Processcpat2201No ratings yet

- Asset Management: Management of Physical AssetsDocument40 pagesAsset Management: Management of Physical AssetsJulio CesarNo ratings yet

- Formations Et CoutsDocument129 pagesFormations Et CoutsMOUBAMBA Stevi DorelNo ratings yet

- Registration: The Cost of Business and Licensing in Ethiopia and Options For ReformDocument156 pagesRegistration: The Cost of Business and Licensing in Ethiopia and Options For ReformAshenafi GirmaNo ratings yet

- Business English Placement TestDocument3 pagesBusiness English Placement TestIrenaNikolovskaNo ratings yet

- Certificate of Deposit Account Agreement 2023may31Document12 pagesCertificate of Deposit Account Agreement 2023may31acescamerNo ratings yet

- Chapter One An Over View of BankingDocument10 pagesChapter One An Over View of BankingTajudin Abba RagooNo ratings yet

- DocxDocument65 pagesDocxAllana MierNo ratings yet

- "Pioneer or Imitate? An Analysis of Business Imitations": AuthorsDocument8 pages"Pioneer or Imitate? An Analysis of Business Imitations": AuthorsThuong Vy MinhNo ratings yet

- Liston Mechanic CorporationDocument14 pagesListon Mechanic CorporationKunal MehtaNo ratings yet

- Application For A Medicare Entitlement Statement: Applying Online Is Faster and EasierDocument5 pagesApplication For A Medicare Entitlement Statement: Applying Online Is Faster and EasierRalph AnchetaNo ratings yet

- Variable ReviewerDocument14 pagesVariable ReviewerMaria Teresa ArceNo ratings yet

- Atrium Management Corp vs. CAvvvvvvvvDocument2 pagesAtrium Management Corp vs. CAvvvvvvvvMonikkaNo ratings yet

- Kalyani ResumeDocument1 pageKalyani ResumeSooraj JadhavNo ratings yet

- Taxation Ch3Document27 pagesTaxation Ch3sabit hussenNo ratings yet

- Chapter 7Document16 pagesChapter 7arfankafNo ratings yet

- Business Analytics 705 v1 468Document468 pagesBusiness Analytics 705 v1 468Harty Robert100% (1)

- Datasheet LIVEO Q7-2243Document2 pagesDatasheet LIVEO Q7-2243felipe geymerNo ratings yet

- Eli Lilly Employee Contract AgreementDocument3 pagesEli Lilly Employee Contract AgreementMeerab KhanNo ratings yet

- Mamta MeenaDocument58 pagesMamta MeenaTarun Bhati0% (1)

- Cobit SoalDocument36 pagesCobit SoalYANI ANJANI 1No ratings yet

- Label Process Flow DiagramDocument1 pageLabel Process Flow DiagramMunem ShahriarNo ratings yet

- SPC HIRADC - ... - Pile Cutting & Hacking (Sub-Structure Work)Document10 pagesSPC HIRADC - ... - Pile Cutting & Hacking (Sub-Structure Work)Kalai ArasanNo ratings yet

- Module 3 - Business Transaction and Their Analysis Part 3Document16 pagesModule 3 - Business Transaction and Their Analysis Part 31BSA5-ABM Espiritu, Charles100% (1)

- Unit 7 Student Book Outcome LOADocument33 pagesUnit 7 Student Book Outcome LOAFilip AntonijevicNo ratings yet

- Raport de Activitate ENGIE 2019Document72 pagesRaport de Activitate ENGIE 2019Dana CiupeNo ratings yet

- Srawan Kumar NaiduDocument2 pagesSrawan Kumar NaiduSavanNo ratings yet

- Shuchana Development Human Resource PlanningDocument4 pagesShuchana Development Human Resource PlanningNaveed AdnanNo ratings yet