Professional Documents

Culture Documents

Digital Currency-Bit Coin and Its Legal Aspects in India and Globally

Uploaded by

Abhishek Kumar ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Digital Currency-Bit Coin and Its Legal Aspects in India and Globally

Uploaded by

Abhishek Kumar ShahCopyright:

Available Formats

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

Digital Currency- Bit Coin and its Legal Aspects in India and

Globally

Yoshita Chauhan1

Abstract

“With e-currency based on cryptographic proof, without the need to trust a third party middleman,

money can be secure and transactions effortless.”

The above are the words of Satoshi Nakamoto, bit coin developer shows that this new

technological development of digital currency will prove to be a revolutionary change and

will make the life lot easier. Many countries across the world have adopted bit coin and

considered them as legal tender and some countries are still pondering over giving it a legal

status. India should not miss on this vast and enormous opportunity. This paper will trace

the growth and evolution of digital currency and its legal paradigm globally and especially in

India. Bit coin, a major crypto currency is defined as the form or medium of payment that

uses cryptography for ensuring its security, transaction and management instead of relying

on any central authority. The bit coin uses block chain technology and is a decentralized

system based on peer to peer basis. Besides bit coin there are other crypto currency as well

like Ripple, Ethereum, Litecoin, Monero to name a few. This paper will examine and deal

with the legal aspects related to bit coin in particular and crypto currency in general with

special focus on Indian subcontinent. The statement of Arun Jaitley, Finance Minister of

India declaring bit coin as not a legal tender raised a new topic of discussion. This paper has

tried to throw light on status of bit coin in India with respect to various laws and regulations

prevailing in India and what can it be classified as by analyzing various definitions given in

all the germane Acts prevalent in India. The issues like taxation and money laundering

related to bit coin have also been touched upon in this paper. India before discarding bit coin

should analyze its potential and there is a need of appropriate regulatory method to exploit

this new technological development. Bit coin is a new and unique concept and is dynamic in

nature, in future Bit coin and other virtual currency may play an increasing role in payment

worldwide.

Keywords: Bit coin, Crypto currency, digital currency, India, legality, legal tender.

1

Student, B.A. LL.B. (Hons.), Hidayatullah National Law University, Naya, Raipur

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 436

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

Digitization of Currency: Bit coin and other Currency- An

Introduction

“Virtual currencies, perhaps most notably bit coin, have captured the imagination of some, struck

fear among others and confused the heck out of the rest of us,"2

Said by U.S. Senator Thomas R. Carper, chairman of the Senate Homeland Security and

Governmental Affairs Committee.

Digital currency also called as digital money, electronic money or electronic currency, crypto

currency can be defined as internet based money which is distinct from physical money like

banknotes and coins in a way as it does not have physical manifestation. Although it exhibits

some characteristics similar to physical currency, digital currency allows borderless transfer

of ownership as well as instantaneous transactions as it can be transferred easily between the

entities or users with the help of smart phones, computers and the internet.3 This electronic

money can be utilized, like traditional currency, to buy the goods and services as well as can

also be limited to certain online communities like social networking, online gaming. Virtual

currencies and crypto currencies like bit coin are the examples of digital money. Digital

currency helps in simple and transparent flow of money. As in case of electronic currency

there is direct payment between the payer and payee, no intermediary is required which

reduces the transaction cost, unlike traditional currency which cannot by- pass banks or

clearing houses. Digital currency has limited users at present and its tax treatment is still

evolving. The banks do not accept digital currency as a result no interest can be earned by

the individuals and organizations along with various security risks involved with the usage of

digital money make it acceptance limited in payment industry.4

As we all know money is accepted medium of exchange and a currency is accepted form of

money. Now, crypto currency is form of currency that uses cryptography to secure its

transaction or it can be defined as a currency whose generation is regulated by encryption

2

What you need to know about digital currencies, CNBC, (Dec 26, 2013, 1:17

AM),https://www.cnbc.com/2013/12/24/what-you-need-to-know-about-digital-currencies.html

3

Digital Currency News, COIN TELEGRAPH,(Oct 12, 2017, 10:00 AM),

https://cointelegraph.com/tags/digital-currency

4

Digital Currency, TECHOPEDIA,(13 October, 2017,

2:00PM),https://www.techopedia.com/definition/6702/digital-currency

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 437

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

technique.5 One of the most popular digital currencies is bit coin, it is so popular that

sometimes the term crypto currency, digital currency and bit coin are considered

synonymous. Besides bit coin there are other virtual currencies as well like Ripple, Lite coin,

Dash, Monero etc.6

History and Evolution of Digital Currency

“I think that the Internet is going to be one of the major forces for reducing the role of government.

The one thing that’s missing, but will soon be developed, is a reliable e-cash. A method whereby, on

the internet, you can transfer funds from A to B, without A Knowing B or B knowing A.”

- Milton Freedman, American Economist and Nobel Laureate, interview conducted by the

National Taxpayers Union Foundation.7

The research paper by David Chaum in 1983 introduced the idea of Digital Cash. The first

attempt was Digicash, an electronic cash company founded by David Chaum in 1990, in

Amsterdam to commercialize the ideas in his research. David Chaum’s system used the

concept of “Blind Signature” to ensure the anonymity of the user. But when DigiCash tried to

meet the National regulatory requirements it faced challenges as Regulatory did not allow

the anonymity to prevent money laundering. Impediments like this resulted in bankruptcy of

the company eventually in 1988.8 After this PayPal emerged which permitted the transfer of

money from person to person. Then came e-gold in 1996, which was backed by the physical

gold but soon it was infected by the hackers and criminals which lead to its downfall. Also

there was another digital currency called Liberty Reserve founded in 2006, which allowed the

users to make accounts without any verification and freely transfer money by converting

their Dollars and Euros into Liberty Reserve Dollars and Euros. It is also the centralized

system like e-gold and thus eventually shut down as it became the favorite place of

5

Crypto Currencies: A Brief Thematic Review Archived 2017-12-25 at the Wayback Machine.

Economics of Networks Journal. Social Science Research Network (SSRN)

6

Prableen Bajpai, The 6 Most Important Crypto Currencies Other Than Bit coin, (December 7, 2017,

1:55 PM EST), https://www.investopedia.com/tech/most-important-cryptocurrencies-other-than-bit

coin/

7

Barski, C & Wilmer C, Bit coin for the Befuddled, No Starch Press, San Francisco,

2015,https://www.linkedin.com/pulse/history-digital-currency-nathan-van-den-bosch

8

Griffith, Ken, "A Quick History of Crypto Currencies BBTC — Before Bit coin". Bit coin Magazine

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 438

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

cybercriminals.9 Now, recently the bit coin is introduced in 2008, which has become widely

popular, renewing the interest in digital currency.10

Law and Regulation

European Union has implemented E-Money Directives "on the taking up, pursuit and

prudential supervision of the business of electronic money institutions" since 2001 which

was last amended in 2009.11 Article 4A of the Uniform Commercial Code governs the

electronic money in U.S.A for wholesale transactions and for consumer transactions there is

Electronic Fund Transfer Act.12

There has been various regulatory guidance imposed on virtual currency as it has posed

challenges for central banks, financial regulators, departments or ministries of finance, as

well as fiscal authorities and statistical authorities. U.S Treasury Guidance- the Financial

Crimes Enforcement Network issued guidance on 20 March 2013 to clarify that persons

creating, exchanging and transmitting virtual currencies will be governed by US Bank

Secrecy Act.13 The U.S Security and Exchange Commission warned about the hazards of

virtual currencies and bit coin in May 2014.14 Then under New York state Regulation, New

York State Department of Financial Services proposed in July 2014 Bit License which is the

most comprehensive regulation of virtual currencies.15

Bit Coin- An Introduction

9

Ken Griffith, A Quick History of Crypto Currencies BBTC — Before Bit coin, Last Updated 04.16.14

5:10 PM, https://bit coinmagazine.com/articles/quick-history-cryptocurrencies-bbtc-bit coin-

1397682630/

10

Gautham, A Brief History of Digital Currency, Last updated (1:30 pm November 1, 2015)

http://www.newsbtc.com/2015/11/01/a-brief-history-of-digital-currency/

11

"Directive 2009/110/EC of the European Parliament and of the Council of 16 September 2009 on the

taking up, pursuit and prudential supervision of the business of electronic money institutions

amending Directives 2005/60/EC and 2006/48/EC and repealing Directive 2000/46/EC, Official Journal L

267, 10/10/2009 P. 0007 - 0017". (30 December 2013)

12

"ELECTRONIC FUND TRANSFER ACT (REGULATION E)" (PDF). Federal Deposit Insurance

Corporation

13

"FIN-2013-G001: Application of FinCEN's Regulations to Persons Administering, Exchanging, or

Using Virtual Currencies". Financial Crimes Enforcement Network. 18 March 2013. p. 6

14

Bobelian, Michael “SEC Warns Investors to Beware of Bit coin". Forbes

15

Bobelian, Michael “New York's Financial Regulator, Benjamin Lawsky, Maintains Lead On Bit coin

Regulation". Forbes. (3 October 2014)

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 439

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

Bit coin is the crypto currency and it is an electronic payment system, functioning through

peer to peer technology. The person or entity or group by the name of ‘Satoshi Nakamoto’

launched bit coin in the year 2009 and till date the real identity of Satoshi Nakamoto is

unknown. In 2008, in the aftermath of the subprime mortgage crisis, the faith and confidence

in the government issued currency and bank’s ability to manage the economy, the supply of

money had suffered a serious hit. Millions of dollars were used to bail out banks and

insurance companies after the “quantitative easing” measures adopted by the Federal

Reserve. This necessarily meant that money was being printed in order to stimulate the

economy. The glut of currency backed with little or no economic productivity led to a global

recession ultimately resulting in a sovereign debt crisis in several countries. The price of gold

was constantly inflating. At this point, for the very first time, the paper by Satoshi Nakamoto

was published online describing the bit coin.16

Bit coin uses complex and cryptographic codes in its design. One of the most fascinating

feature of bit coin is that no central authority or bank regulates, thus, making it not bound by

any geographical boundaries. Satoshis are the smaller units in which each bit coin is

subdivided down to eight decimal places, as a result of which 100,000,000 Satoshis are

formed. These bit coins are easily transferable through the computers and smart phones,

thereby eliminating the need of any intermediary. It is created through the system called

mining, a kind of system so designed that it allows maximum number of bit coin to be ever

created will not exceed 21 million.17 The servers called bit coin “miners’ secure and protect

the processing of bit coin transaction and communicate over an internet – based network.

These transactions get confirmed by adding them to a ledger which is updated and archived

periodically by using peer-to-peer file sharing technology which is also known as the “block

chain”. Block chain technology is used by bit coin in its operation to tackle the crippling and

one of the fundamental problems in designing the digital currency that is Double Spending.

Block chain technology is a shared public and incorruptible digital ledger which can be

programmed to incorporate or record the details of financial and non-financial transactions

or virtually anything. This ledger is completely transparent for each and every person in the

16

Taken from a five-hundred word essay written by Satoshi Nakamoto, where Bit coin were mentioned

for the first time. http://Bit coin.org/Bit coin.pdf

17

Samantha Sharf , $10: One Perspective On What Bit coin Will Be Worth In 2014 , (JAN 15, 2014,

02:17 PM ), https://www.forbes.com/sites/samanthasharf/2014/01/15/10-one-perspective-on-what-bit

coin-will-be-worth-in-2014/#3d124a944ba7

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 440

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

network.18 The authenticity, integrity and chronological order of block chain is maintained

and ensured by cryptography.19

A transfer or transaction of bit coins is nothing but simply a transfer of value between bit

coin addresses. Every person who is engaged in usage of bit coin gets a digital wallet and a

bit coin address which is the address from and to which bit coins can be transferred once this

address is given to another party for the transfer. Thus, the transfer of value between these

addresses gets included in the block chain or the system log, which takes care that each

transaction is valid or authenticated and that no person uses his or her bit coins more than

once i.e. it helps in avoiding and preventing the problem of double spending. A secret piece

of data called a “private key” for each bit coin address is kept by bit coin wallet. These

Private keys provide a mathematical proof that the bit coins have come from the owner of the

addresses and are further used to sign transaction. The “signature” refrain anybody from

altering the transaction once it has been issued.20

Legality of Digital Currency – Bit Coin

The question whether bit coin is legal or not depends on the way of using the digital

currency. Thus, who you are, where you live and what you are doing with the bit coin

determine the legality of your bit coin activities. Regulators and authorities of various

countries have been worried about the bit coin semi-anonymity and nature of

decentralization as it can be used for illicit purchase of goods which cannot be traced and

also money laundering. The reputation of bit coin has gone further down ever since now-

defunct Silk Road gained notoriety, and also its prevalence as the payment service for Silk

Road, a digital marketplace where illicit goods and services can be bought by the users. So,

for example we can see that using bit coin for purchase of well-natured goods and services is

not considered illegal according to the U.S. Treasury Department’s Financial Crimes

18

Karan Dhar, Don't know what's Blockchain technology? Let us explain, BUSINESSTODAY(March

1, 2017 ,20:00 IST), https://www.businesstoday.in/sectors/banks/what-is-blockchain-technology-let-us-

explain-bit coin-banks/story/238438.html

19

Block Chain, ‘My Wallet Be Your Own Bank’ BLOCKCHAIN (21st May, 2018, 12:15 AM),

https://blockchain.info/wallet/

20

VipulKharbanda,Bit coin: Legal Treatment under the Current Indian Legal and Regulatory Regime,

CISINDIA(May 21, 2018, 2:00 AM), https://cis-india.org/internet-governance/bit coin-legal-regulation-

india

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 441

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

Enforcement Network as of 2013.21 However, trading of bit coin for traditional currency or

operate exchanges on which bit coins are bought and sold by those who mine bit coins are

labeled as “money transmitters” and could be subject to special laws that govern that type of

activity. Hence, we can say that legality of bit coin is viewed differently in different countries.

Many countries have not given any official sanction to the use of bit coin by issuing

statement to this effect. This status given to bit coin put users under risk but would not have

them violating the law.22

Bit coin and crypto currencies being the latest technological development have not been

incorporated within the legal framework of many countries. There are variety of legal aspects

and issues related to this digital currency. Thus it is important to discuss the legality of bit

coin and other crypto currencies in different countries and issues like money laundering,

taxation and many other issues and legal status in different countries.23

Taxation

This is one of the major issues related to bit coin. If the person is cautious enough and taken

required precautions then, bit coin can easily be used for hiding assets, evading and reducing

taxation owing to its pseudo anonymity. Bit coin is often treated as the asset in most

countries for the purpose of taxation. Tax issues may raise on bringing large chunk of foreign

money in the country, however, storing and bringing in bit coin private key online makes it

easier to cross pass the border checkpoints. In this way one can effectively bypass the taxes

of levied on such type of transaction by cashing it out when in the country. In most places,

bit coin income at the current exchange rate has been declared for the purpose of payment of

taxation by legitimate taxpayer. On the other hand, taxation has not been considered at all at

places where bit coin is illegal and banned. Proper research of the tax laws must be

conducted by the tax payers of bit coin to ensure correct payment of tax on bit coin income.

Bit coin and crypto currency are treated as asset and not currency in many countries so tax

21

Is Bit coin Legal?,COINDESK(August 19, 2014), https://www.coindesk.com/information/is-bit coin-

legal/

22

Is Bit coin Legal?, BIT COINMAGZINE(Oct 29, 2017, 2:30 PM),https://bit

coinmagazine.com/guides/bit coin-legal/

23

Legality of Bit coin &cryptocurrency, BITCONNECT (November 7, 2017, 1:00

AM),https://bitconnect.co/bit coin-information/8/legality-of-bit coin-cryptocurrency

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 442

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

laws may differ accordingly which must be taken into consideration. It is illegal to avoid

taxation even though some countries have loopholes in laws.24

Money Laundering

This is another major issue associated with usage of bit coin. Money laundering as a concept

can be defined as introduction and integration of money and goods in legal economic system

coming from illegal means and source although The ease of movement and transfer of money

between countries at a blink of an eye makes money laundering key legal problem with bit

coin as it is the most used method to launder money online. Absence of the central server

doing peer to peer transaction and the anonymity, these two attributes of bit coin make

money laundering easier. In all jurisdiction across the world money laundering is illegal.25

Besides the above two major problems there are also other numerous legal issues related to

bit coin. The exchange Mt. Gox is the example of large thefts of bit coin which generated

pressure on regulators to regulate it.EU court in recent ruling answered the question

whether bit coin is VAT free in affirmation, permitting bit coins to be transacted like gold

VAT free. Another problem related to bit coin is that if the person holding large quantity of

bit coin loses its private key then, it is very hard to prove this and that person will still be

considered the owner of coins under tax jurisdiction as it is hard to prove otherwise. There

was online market place of drugs called Silk Road; it can run for long time due to the use of

bit coin until recently it was shut down after years of investigation and finally being able to

track down the real IP address of the server, resulting in arrest of those running it. However,

the bit coin provides little protection from scams. Lack of legal protection is the biggest

problem associated with crypto currencies and bit coin; they can be easily used to hide the

asset illegally or legally as in case of Divorce.

Legality of Bit Coin in Different Countries

Legality or legal status of bit coin and crypto currency varies from country to country

substantially and is undefined and keeps on changing in many. However, most countries do

not make the usage of bit coin illegal per say with the exception of Bangladesh, Bolivia,

Ecuador, Thailand & Kyrgyzstan. Some countries have allowed the explicit usage of bit coin

24

Supra note 15

25

SARA RUIZ CABRERA, How do you do money, laundering through bit coin?, REPOSTITORI

(November 4,2017, 10:30PM),

http://repositori.uji.es/xmlui/bitstream/handle/10234/161136/TFG_2015_ruizS.pdf?sequence=1.

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 443

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

and crypto currency while some countries have banned its usage or restricted it. Thus, some

countries class virtual currency and bit coin as asset and legal some consider it neither legal

nor illegal while some other consider it as illegal. In China, it is legal to hold bit coin by

private individuals for trade, mine, buy and sell but illegal for commercial use. Like many

other countries in United Kingdom, there is no legal framework in place and bit coin is

unregulated.

When we say bit coin is unregulated it means that there is no specific legal framework yet in

place or bit coin is deregulated, it can be used in any way or capacity with minimal or no

legal restrictions imposed. The countries where bit coin is unregulated are: United Kingdom,

Australia ,Belgium, Brazil, Columbia, Chile, Croatia, Cyprus, Czech Republic, Denmark,

Estonia, Greece , Hong Kong, India (however many Indian banks do not permit transactions

pertaining to bit coin, Indonesia, Ireland, Israel, Italy, Lithuania, Malaysia, Malta, New

Zealand, The Netherlands, Nicaragua, Pakistan, Philippines, Poland, Portugal, Romania,

Singapore, Slovakia, Slovenia, South Africa, Turkey, Vietnam, Nepal, North Korea, Papua

New Guinea, Antigua, Barbados, Iran, Iraq, Somalia, Afghanistan, Egypt, Saudi Arabia,

Oman, Qatar. There are countries where bit coin is legal but regulated for some specific

purposes like Finland, France, Germany, Japan, South Korea, Jordan, Lebanon, Luxembourg,

Spain, Sweden, Switzerland, Canada and Mexico. In China bit coin is restricted but can be

used by private individuals not banks and corporations, in Iceland mining is legal but buying

and selling is not and in Taiwan, ATMs for bit coin are illegal. Russia, Bangladesh, Thailand,

Kyrgyzstan, Ecuador banned the usage of bit coin out rightly and completely.26

India’s attempt to Cashless Society and Bit coin

India was the country with highly cash-centric economy until the campaign initiated by

demonetization which is more about turning India cashless rather than fighting corruption.

Indian economy was so cash centric that cash accounted for 90% of all the transactions, 85%

of the vendors do not have any means or ways to accept e-payment and nearly half of the

population in India does not possess a bank account. Also India is the only country where

even Uber accepts cash on delivery.27 Demonetization of 500 and 100 rupees notes on

26

Prableen Bajpai, Countries Where Bit coin Is Legal & Illegal, INVETOPEDIA (April 15, 2015, 1:51 ),

http://www.investopedia.com/articles/forex/041515/countries-where-bit coin-legal-illegal.asp

27

Wade Shepard A Cashless Future Is The Real Goal Of India's Demonetization Move, FORBES (DEC

14, 2016 01:37 PM), https://www.forbes.com/sites/wadeshepard/2016/12/14/inside-indias-cashless-

revolution/#52bce3594d12

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 444

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

November 8, 2016 by PM Narendra Modi’s government is the most important move towards

cashless society. Though this was said to be the attempt to curb black money but it contained

the hidden motive of cashless India. Lives of millions have been affected due to

demonetization. The people of the country have resorted to other ways of making payment

than the cash due to small volume of money and have also started supporting digitization of

currency and going cashless. The short term effect of demonetization has been the rapid

increase in use of e-wallet, debit and credit cards as the means of payment.28 Bit coin and

crypto currency are slowly and steadily gaining prominence in Indian construct. India is seen

as one of the nations with the ban and withdrawal of 500 and 1000 rupees notes from the

Indian economy, the volume of bit coins trading have almost become double in India. One of

the leading bit coin companies of India, ‘Unocoin’ reported a rise in daily average number of

visitors to the site from 4000 to 14000 after demonetization. Unocoin is the bit coin startup in

India and launched the full featured mobile bit coin app enabling instantaneous transaction

and provides 24/7 access to bit coin market place.29 The Finance Minister, Arun Jaitley in

their written reply to the Lok Sabha told that there are evidences of crypto currency/bit coin

being used in the country and there has been a notable growth in the use of bit coin in past

few years. Various concerns have been raised from time to time regarding the use of virtual

currency and the regulatory challenges faced. The users, traders, dealers and holders of

virtual currency like bit coin has been warned and cautioned from time to time by RBI

regarding the potential risks involved related to financial, legal, operational and customer

protection. The committee has been formed by the Department of Economic Affairs taking

cognizance of these risks and challenges. The representatives of Department of Economic

Affairs, Department of Financial Services, Revenue Department, Ministry of Home Affairs,

Ministry of Electronics and Information Technology, Reserve Bank of India, NITI Aayog and

State Bank of India constitute the panel. The committee will study and analyze the present

status of virtual currency in India and at global level. The committee will examine the legal

framework and structure across the world governing virtual currency and suggest the

regulatory framework for India catering to the issues related to customer protection, money

laundering and taxation. Though the proper regulation and jurisdiction related to bit coin is

28

INSIGHTS, Demonetization and digitization of the Indian economy, ASIAMARSH (Feb 03,

2017),http://asia.marsh.com/NewsInsights/ID/47198/Demonetization-and-digitization-of-the-Indian-

economy.aspx

29

PRAVEEN SHEKHAR, Will bit coins help Modi government realise its less-cash dream?, (Dec 19,

2016),http://www.dailyo.in/politics/bit coin-demonetisation-digital-currency-digitised-economy-rbi-

unocoin-digital-india/story/1/14634.html

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 445

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

obscure, the Income tax department is making all of the crypto currency transaction as

taxable and any gain accruing from such transaction irrespective of the fact that there is no

such mention in the Act.30

Bit Coin in India and its Legal Position

“Recommendations are being worked at. The government’s position is clear; we don’t recognize this

as legal currency as of now,”

Said Arun Jaitley, The Finance Minister on being asked what are the government plans to

regulate bit coin. Earlier in August Jaitley informed parliament about the absence of any

regulation governing bit coin in India and Reserve Bank of India has also not issued any

license to any institution/entity to deal with crypto currency. 31

In budget speech by Arun Jaitley for 2018-19, the Government announced that it would take

all measures to eliminate use of these crypto-assets in financing illegitimate activities or as

part of the payment system.32This announcement that crypto currency is not recognized as

legal tender in India raised a curiosity among the people of the nation about the fate of the

Bit coins in India. Paper has already thrown light on legal status of bit coin in different

countries which is not uniform as some countries have accepted it as legal tender while

others have restricted or banned its use and trade. Now let us discuss the legal position of bit

coin of Bit coin in present India by looking into the applicability of various Acts prevailing in

India which are germane to bit coin and stance of Supreme Court and RBI.

Applicability of the Coinage Act, 2011

The Coinage Act, 2011 governs coins in India. To understand whether bit coin can be called

coin under this Act, let us look into the section 2(a) which states that coin is anything made

of metal or any other material, stamped by the government of India or any other authority on

its behalf empowered or authorized for this purpose and which is a legal tender which

30

K.R. SRIVATS, Notable growth in bit coin market in India: Jaitley, (August 4, 2017),

http://www.thehindubusinessline.com/news/notable-growth-in-bitcoin-market-in-india-

jaitley/article9802341.ece

Government doesn’t recognise bit coin as legal: FM ArunJaitley, (Dec 01, 2017, 08.40

31

AM),https://economictimes.indiatimes.com/markets/stocks/news/government-doesnt-recognise-bit

coin-as-legal-fm-arun-jaitley/articleshow/61873558.cms

32

Budget 2018-2019 Speech of ArunJaitley Minister of Finance February 1, 2018, Para 112

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 446

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

includes commemorative coins and the one rupee note of government of India.33. This

definition of coin makes it clear that Bit coins are not legal tender as they lack sanction of

appropriate governmental authority in India and they do not come under the ambit of coins

as defined in The Coinage Act, 2011.

Application of FEMA (Foreign Exchange Management Act), 1999

Provisions of this Act are also germane to find out whether bit coin is a currency or not. The

section 2(m) which deals with foreign currency, section 2(h) which deals with currency and

section 2(q) which deals with Indian currency,34 must be studied to know the status of bit coin

or crypto currency. The definitions given in these sections of FEMA, 1999 do not cover

virtual or crypto currency. So, when it comes to regulation of bit coins, FEMA is not

applicable which further implies that RBI at present is unable to regulate or control the

operations of bit coin.35

Sale of Goods Act, 1930 and Its Applicability

Taking into consideration that bit coin can be treated as “goods” under Sale of Goods Act,

1930 as per section 2(7) which defines goods.36 However in the situations where bit coin is

used as a money consideration, the Sale of Goods Act cannot be applied as per section 2(10)

of this Act, consideration can only be in form of price and it cannot be in form of kind.37 If

transaction takes place in lieu of lawful consideration then, Indian Contract Act, 1872 and its

applicability can also be considered.38

KYC (Know Your Customer) and its Applicability

The meaning of KYC is ‘Know Your Customer ‘which can be defined as the process by

which the identity and address of the customers are obtained by Banks. This is undertaken

by the banks at the time when customers open their bank accounts. The Reserve Bank of

India formulates norms and rules for KYC as all the banks whether public or commercials

33

Section 2(a) of The Coinage Act,2011, No. 11, Acts of Parliament, 2011

34

Section 2(m), (h), (q) of Foreign Exchange Management Act,1999, No. 42, Acts of Parliament, 1999

35

Nishith Desai Associates, Bit coins –A Global Perspective, Pg 12, https://www.zebpay.com/wp-

content/uploads/2016/04/Bit coins.pdf

36

Section 2(7) of Sale of Goods Act,1930, No. 3, Acts of Parliament, 1930

37

Section2(10) of Sale of Goods Act, 1930, No. 3, Acts of Parliament, 1930

38

S.S Rana and Co., Bit coin in India and its legality, (May 29,2018, 3:30PM)

https://www.lexology.com/library/detail.aspx?g=7705641e-e5b1-4400-8fd2-b559254907ce

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 447

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

need to monitor the transactions done by their customers, keep a record of their identities

and need to take required steps if any customer deviates from his or her usual pattern of

behavior.

Zebpay, one of the most prominent and popular Bit coin wallet/app in India adheres to self-

regulation structure39currently while following KYC and Anti-Money Laundering (AML)

norms. In order to ensure that individuals or organizations do not use these as platforms for

their illicit and malafide motives, the provisions of Money Laundering Act,2002, should be

applied.40

Stance of Supreme Court of India and RBI

The Public Interest Litigation (civil writ petition no. 1076 of 2017)41 which was filed by

Advocate Dwaipayan Bhowmick under Article 32 of Constitution of India against the Union

of India seeking the government of India to establish a regulatory framework or structure for

virtual currency most importantly bit coins and demanded that virtual currency including bit

coins should be made accountable by the exchequer. After hearing this PIL, the honorable

Supreme Court of India has recently issued notice to Ministry of Law and Justice, Ministry of

Finance, Ministry of Information Technology and also to the market regulators including

RBI and Security Exchange Board of India (SEBI).42

The RBI in its press release 2016-17/205443 held on 1st February, 2017 made it very clear that it

has not given any sanction or authorization/license to any company/entity/institution or

individual to operate and trade in virtual currencies including bit coin and further in the

another press release by RBI 2017-2018/153044 dated 5th December, 2017 where RBI again

39

ZeBit coin is not illegal, (May 22, 2018), https://www.zebpay.com/legal

40

Supra Note 31 at page no. 17

41

DwaipayanBhowmick v. Union of India & Others, civil writ petition of

2017,https://barandbench.com/wp-content/uploads/2017/11/PIL_bit coin-watermark.pdf

42

http://supremecourtofindia.nic.in/supremecourt/2017/35252/35252_2017_Order_13-Nov-2017.pdf

43

Jose J. Kattoor, Chief General Manager,Press Release: 2016-17/2054, dated February 1, 2017, RBI

cautions users of Virtual Currencies (May 22, 2018, 4:00PM),

https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR205413F23C955D8C45C4A1F56349D1B8C457.PD

F

44

Jose J. Kattoor, Chief General Manager, Press Release: 2017-2018/1530 dated December 5,2017,

Reserve Bank cautions regarding risk of virtual currencies including Bit coins, (Last Visited: May 23.

2018, 5:00PM),

https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR15304814BE14A3414FD490B47B0B1BF79DDC.P

DF

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 448

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

reiterated its concerns regarding the flow and usage of crypto currency gave reference and

brought attention of the public to its earlier press release of February where it also stated

that anybody i.e. any trader, individual or any holder or investor etc. who are dealing with Bit

coins or virtual currency will be involved in its trading or business at their own risk.

The Burning Question- What can Bit Coin be classified as in India?

This is one of the controversial questions that under Indian Laws, what is the place of Bit

coin, in which category does it fall? This question can be addressed by analyzing various

definitions. Beginning with the Securities Contracts (Regulation ) Act, 1955, the definition of

‘securities’ given in section 2(h),merely the reading of the bare provision makes it clear that

bit coin cannot be treated as a securities.45 The only way through which the bit coin can be

called securities is when central government declares so and then the entire gamut of

regulations governing securities, in this situation, including rules laid down by SEBI will be

applicable.

The bit coin can be a derivative is another argument. However on reading the definition of

derivatives under SCRA the bit coin does not satisfy the first part of definition as it is not a

security and further, bit coin is also not a contract which is mentioned in second part of the

definition as it is only a voluntary currency between two parties deciding that there is some

value of code itself.46 The word derivatives is also defined in Reserve Bank of India Act, 1934,

the fact that bit coin is used as currency because bit coin users think that it has inherent

value and not that it has derived its value from any other object or thing, thus, bit coin

cannot come under the definition of derivatives as given in RBI Act, 193447.The bit coin

cannot be classified as negotiable instrument either under Negotiable Instruments Act, 1881

which defines negotiable instrument as “promissory note, bill of exchange or cheque payable

either to order or to bearer”48 These terms are easily understood in trading parlance, it is

suffice to say that the bit coin does not form part of definitions of any of these terms as given

in Negotiable Instruments Act, 1881.49

Conclusion

45

Section 2(h), Securities Contracts (Regulation) Act, 1955

46

Section 2(ac), Securities Contracts (Regulation) Act, 1955

47

Section 17(6A) of Reserve Bank of India Act, 1934

48

Section 13 of Negotiable Instruments Act, 1881

49

VipulKharbanda, Can Bit coin Be Banned by the Indian Government?, (May 26,2018 , 6:00PM),

https://cis-india.org/internet-governance/bit coin-legal-regulation-india

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 449

Published in Articles section of www.manupatra.com

Jus Dicere Review

A Publication of Jus Dicere & Co.

Volume 1 Issue 2 Publisher: Parag Agrawal

Bit coin is difficult to be classified under any definitions as already discussed, however it can

be said to be a computer program and currently it can be classified only as movable but this

position has not been testified under any court of law. Bit coin has not given a legal sanction

in India but there are countries where it enjoys a status as legal tender, thus, bit coin is

upcoming new form of medium of exchange which still needs some improvement as per the

economic, social, political conditions of India for its acceptance in India. The legality and

evolution of bit coin is quite interesting as discussed above. Bit coin is unique and dynamic

in nature and therefore government should try to develop self-regulatory framework for

management of bit coin instead of counter- productive measures. Bit coin can prove to be a

good opportunity for India to fulfill aspirations reflected in Constitution of India. Every

technology that comes has some issues and problems but it must be understood and analyzed

at appropriate time to get its benefit. In the words of Eric Schmidt, CEO of Google- “Bit coin

is a remarkable cryptographic achievement and creating something that is not duplicable in digital

world has enormous value.”

ISBN: 978-93-5300-108-7 | Copyrights with Jus Dicere & Co.

June, 2018 Page Number - 450

Published in Articles section of www.manupatra.com

You might also like

- Digital Currencies: Unlocking the Secrets of Crypto-CurrenciesFrom EverandDigital Currencies: Unlocking the Secrets of Crypto-CurrenciesRating: 1 out of 5 stars1/5 (1)

- The Digital Coin Revolution: Crypto Currency - How to Make Money OnlineFrom EverandThe Digital Coin Revolution: Crypto Currency - How to Make Money OnlineRating: 3.5 out of 5 stars3.5/5 (5)

- Impact of Cryptocurrency in India: ©2018 IJLMH - Volume 2, Issue 1 - ISSN: 2581-5369Document10 pagesImpact of Cryptocurrency in India: ©2018 IJLMH - Volume 2, Issue 1 - ISSN: 2581-5369Amar Nath sharmaNo ratings yet

- PCE Crypto ProjectDocument18 pagesPCE Crypto ProjectYash pawarNo ratings yet

- A Crypto Currency - Paper PresentationDocument8 pagesA Crypto Currency - Paper PresentationLijo SunnyNo ratings yet

- Accounting - 1800136Document18 pagesAccounting - 1800136Anonymous pPcOy7J8No ratings yet

- Bitcoin MilionairesDocument9 pagesBitcoin MilionairesFrancisco Rodeghiero PereiraNo ratings yet

- B Com2 W5P2T2 RPFinalDocument4 pagesB Com2 W5P2T2 RPFinalVinit VinitNo ratings yet

- A Survey On Crypto CurrenciesDocument7 pagesA Survey On Crypto CurrenciesidescitationNo ratings yet

- Finance Crypto AssignmentDocument8 pagesFinance Crypto AssignmentPromise GapareNo ratings yet

- An Analysis of Cryptocurrency and Their FunctioningDocument7 pagesAn Analysis of Cryptocurrency and Their Functioningأحمد حلميNo ratings yet

- Research PaperDocument4 pagesResearch Papersumit soniNo ratings yet

- 2 MareshDocument46 pages2 MareshUDayNo ratings yet

- Bit Coins Future CurrencyDocument8 pagesBit Coins Future Currencysourav_padhi5150No ratings yet

- A Strategists Guide To Blockchain - PWC PDFDocument17 pagesA Strategists Guide To Blockchain - PWC PDFJorge Ivan Zapata RiverosNo ratings yet

- Cryptocurrency A New Millennium Currency (Problem and Prospects in India)Document8 pagesCryptocurrency A New Millennium Currency (Problem and Prospects in India)IJRASETPublicationsNo ratings yet

- 1 - Valuing A Crypto-Currency - Do & Don'Ts - AaaaaaaDocument85 pages1 - Valuing A Crypto-Currency - Do & Don'Ts - AaaaaaaAB236No ratings yet

- Cashless India: Is Cryptocurrency The Future of Money?: I-AbstractDocument11 pagesCashless India: Is Cryptocurrency The Future of Money?: I-AbstractShreya ModiNo ratings yet

- A Study On Cryptocurrency-BitcoinDocument10 pagesA Study On Cryptocurrency-Bitcoinaditya jangdeNo ratings yet

- Cryptocurrency in India - Its Effect and Future On Economy With Special Reference To BitcoinDocument12 pagesCryptocurrency in India - Its Effect and Future On Economy With Special Reference To BitcoinnyenookeNo ratings yet

- By: Syed Jawad Ali KazmiDocument3 pagesBy: Syed Jawad Ali KazmiAli AwanNo ratings yet

- Blog - What Is CryptocurrencyDocument5 pagesBlog - What Is CryptocurrencyKarthik Guttha100% (1)

- A Study On Role of Bit Coin in Global Asset Class PortfolioDocument11 pagesA Study On Role of Bit Coin in Global Asset Class PortfolioIJAMTESNo ratings yet

- The Future of Crypto-Currency in The Absence of Regulation, Social and Legal ImpactDocument16 pagesThe Future of Crypto-Currency in The Absence of Regulation, Social and Legal ImpactGlobal Research and Development ServicesNo ratings yet

- Bitcoin and Cryptocurrency Trading for Beginners I Must Have Guide to Start Achieving Your Financial Freedom Today I Tools, Wallets, Analysis, Charts, Best Exchanges, Tips and Strategies, DisciplineFrom EverandBitcoin and Cryptocurrency Trading for Beginners I Must Have Guide to Start Achieving Your Financial Freedom Today I Tools, Wallets, Analysis, Charts, Best Exchanges, Tips and Strategies, DisciplineNo ratings yet

- CRYPTODocument62 pagesCRYPTOMubeenNo ratings yet

- Cryptocurrency Paper - OdtDocument8 pagesCryptocurrency Paper - Odtkarthik kpNo ratings yet

- Crypto CurrencyDocument3 pagesCrypto Currencyavaneeshy1310No ratings yet

- Cryptocurrency Legal IssuesDocument15 pagesCryptocurrency Legal IssuesVaishnavi CNo ratings yet

- Analysing The Investor Category of CryptocurrencyDocument11 pagesAnalysing The Investor Category of CryptocurrencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- USB CryptocurrencyDocument18 pagesUSB CryptocurrencytabNo ratings yet

- CryptocurrenciesDocument21 pagesCryptocurrencieskaka kynNo ratings yet

- Rbi Dy Gov Crypto 20220214Document12 pagesRbi Dy Gov Crypto 20220214bruhuhuNo ratings yet

- Cryptocurrency Beginners Bible: How You Can Make Money Trading and Investing in Cryptocurrency like Bitcoin, Ethereum and altcoinsFrom EverandCryptocurrency Beginners Bible: How You Can Make Money Trading and Investing in Cryptocurrency like Bitcoin, Ethereum and altcoinsRating: 5 out of 5 stars5/5 (2)

- The Rise of CryptocurrencyDocument13 pagesThe Rise of CryptocurrencyTanvir AhmedNo ratings yet

- How to Get Filthy Rich Investing in Bitcoin and Other Cryptocurrencies: Why It's Not Too Late to Become a Millionaire Investor With Digital MoneyFrom EverandHow to Get Filthy Rich Investing in Bitcoin and Other Cryptocurrencies: Why It's Not Too Late to Become a Millionaire Investor With Digital MoneyNo ratings yet

- Topic 2 - The Benfits and Limitations of Digital Currency in India - Corporate Tax PlanningDocument34 pagesTopic 2 - The Benfits and Limitations of Digital Currency in India - Corporate Tax PlanningRohit GhaiNo ratings yet

- Cryptocurrency: Beginners Bible - How You Can Make Money Trading and Investing in CryptocurrencyFrom EverandCryptocurrency: Beginners Bible - How You Can Make Money Trading and Investing in CryptocurrencyRating: 4 out of 5 stars4/5 (72)

- Gary Gensler - How Blockchain Can Solve The Payments RiddleDocument5 pagesGary Gensler - How Blockchain Can Solve The Payments RiddleJonathan CanteroNo ratings yet

- Cryptocurrencies: From The Trinidad and Tobago Securities and Exchange CommissionDocument3 pagesCryptocurrencies: From The Trinidad and Tobago Securities and Exchange CommissionTNo ratings yet

- Name: Harshal Vijay Magade. Roll No: 21-8902. Subject: Project Management. Topic: Future Scope of CryptocurrencyDocument8 pagesName: Harshal Vijay Magade. Roll No: 21-8902. Subject: Project Management. Topic: Future Scope of CryptocurrencyHarshal MagadeNo ratings yet

- CryptocurrencyDocument5 pagesCryptocurrencyAffan ChNo ratings yet

- A Study On Cryptocurrency in IndiaDocument12 pagesA Study On Cryptocurrency in IndiaReetika JainNo ratings yet

- Digital CurrencyDocument12 pagesDigital CurrencyMariel Ann RebancosNo ratings yet

- Digital CurrencyDocument17 pagesDigital CurrencyHanumanthNo ratings yet

- 3010 TYBBI Main File CRYPTOCURRENCYDocument64 pages3010 TYBBI Main File CRYPTOCURRENCYloknath100% (1)

- Cryptocurrency The Present and The Future ScenarioDocument16 pagesCryptocurrency The Present and The Future ScenarioIJRASETPublicationsNo ratings yet

- An Analysis of CryptocurrencyDocument5 pagesAn Analysis of CryptocurrencyJAVED PATELNo ratings yet

- He Legal Status of Online Currencies ARE Itcoins The Future: Rhys Bollen 2013 1Document38 pagesHe Legal Status of Online Currencies ARE Itcoins The Future: Rhys Bollen 2013 1prabin ghimireNo ratings yet

- Sakshee Sahay Proposed Ban On Cryptocurrency A Step in Right DirectionDocument10 pagesSakshee Sahay Proposed Ban On Cryptocurrency A Step in Right DirectionSakshee SahayNo ratings yet

- Cryptocurrencies in IndiaDocument14 pagesCryptocurrencies in IndiaEeshwaa CholadevanNo ratings yet

- An In-depth Overview of Cryptocurrency: WHY AND WHAT YOU NEED TO KNOW ABOUT BITCOIN, #2From EverandAn In-depth Overview of Cryptocurrency: WHY AND WHAT YOU NEED TO KNOW ABOUT BITCOIN, #2Rating: 1.5 out of 5 stars1.5/5 (3)

- 2017 AEP Risks and Vulnerabilities of Virtual CurrencyDocument40 pages2017 AEP Risks and Vulnerabilities of Virtual CurrencyLisaNo ratings yet

- Growth Analysis of CryptocurrencyDocument3 pagesGrowth Analysis of CryptocurrencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Risk Management ProjectDocument12 pagesRisk Management ProjectLakhan KodiyatarNo ratings yet

- The Economicsof Cryptocurrencies 2Document17 pagesThe Economicsof Cryptocurrencies 2chastomsNo ratings yet

- Cryptocurrency in India - Its Effect and Future On Economy With Special Reference To BitcoinDocument13 pagesCryptocurrency in India - Its Effect and Future On Economy With Special Reference To BitcoinArya YadavNo ratings yet

- The Murder of Jamal Khashoggi: Immunities, Inviolability and The Human Right To LifeDocument56 pagesThe Murder of Jamal Khashoggi: Immunities, Inviolability and The Human Right To LifeAbhishek Kumar ShahNo ratings yet

- Blockchain Technology: Is It Building A Brighter Future?: by Anurag Bana, Jane Ellis, Christian DecleDocument14 pagesBlockchain Technology: Is It Building A Brighter Future?: by Anurag Bana, Jane Ellis, Christian DecleAbhishek Kumar ShahNo ratings yet

- Dharmashastra National LAW University: P Indian Young Lawyers Association Vs The State of Kerala IIDocument11 pagesDharmashastra National LAW University: P Indian Young Lawyers Association Vs The State of Kerala IIAbhishek Kumar ShahNo ratings yet

- Reinventing Regulation: The Curious Case of Taxation of Cryptocurrencies in IndiaDocument26 pagesReinventing Regulation: The Curious Case of Taxation of Cryptocurrencies in IndiaAbhishek Kumar ShahNo ratings yet

- O M P B: AC S: The Indian Journal of Law and TechnologyDocument11 pagesO M P B: AC S: The Indian Journal of Law and TechnologyAbhishek Kumar ShahNo ratings yet

- Damodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaDocument13 pagesDamodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaAbhishek Kumar ShahNo ratings yet

- Abhishek Kumar Shah BAL/086/019 Semester - II ContractsDocument2 pagesAbhishek Kumar Shah BAL/086/019 Semester - II ContractsAbhishek Kumar ShahNo ratings yet

- Dharmashashtra National Law University, Jabalpur: Subject-History-2 Project - CAD - Freedom of ReligionDocument21 pagesDharmashashtra National Law University, Jabalpur: Subject-History-2 Project - CAD - Freedom of ReligionAbhishek Kumar ShahNo ratings yet

- Introduction To Law To Study The Filing Procedure of An FIR: Jabalpur (M.P.)Document16 pagesIntroduction To Law To Study The Filing Procedure of An FIR: Jabalpur (M.P.)Abhishek Kumar ShahNo ratings yet

- Dharmashastra National Law University, Jabalpur: Project Consultation RecordDocument10 pagesDharmashastra National Law University, Jabalpur: Project Consultation RecordAbhishek Kumar ShahNo ratings yet

- Abhishek Shah: Virtual InternshipDocument1 pageAbhishek Shah: Virtual InternshipAbhishek Kumar ShahNo ratings yet

- MT103: Single Customer Credit Transfer: Date: 01-Jul-2021 09:16Document1 pageMT103: Single Customer Credit Transfer: Date: 01-Jul-2021 09:16Victoire DjagbaNo ratings yet

- Competition - Good or Bad, Cetorrelli 2001Document11 pagesCompetition - Good or Bad, Cetorrelli 2001Ramm PknnNo ratings yet

- Solution Manual CHPT 6Document7 pagesSolution Manual CHPT 6xlovemadnessNo ratings yet

- REVISED Amendments To Residential Rent Adjustment Program Title Summary PDFDocument2 pagesREVISED Amendments To Residential Rent Adjustment Program Title Summary PDFRecordTrac - City of OaklandNo ratings yet

- ACX - IMS - HSE - F - 44 - Contractor Pre-QualificationDocument2 pagesACX - IMS - HSE - F - 44 - Contractor Pre-Qualificationsufiyan sskNo ratings yet

- The Cost of CorruptionDocument33 pagesThe Cost of CorruptionMiri ChNo ratings yet

- Conceptual and Regulatory FrameworkDocument10 pagesConceptual and Regulatory FrameworkMohamed Yada AlghaliNo ratings yet

- Act 145 Politeknik Ungku Omar Act 1974Document14 pagesAct 145 Politeknik Ungku Omar Act 1974Adam Haida & CoNo ratings yet

- Tesda Circular 013-2017 PDFDocument17 pagesTesda Circular 013-2017 PDFYaj Anilom100% (1)

- Cheetah Annual Report 2017Document98 pagesCheetah Annual Report 2017安 娜 胡No ratings yet

- Contract Safety Security Services Nov 2017Document2 pagesContract Safety Security Services Nov 2017MuhammadImranIrshadNo ratings yet

- BIFRDocument3 pagesBIFRkanchan_khadilkarNo ratings yet

- Compliance Gap AnalysisDocument1 pageCompliance Gap Analysismfulk3No ratings yet

- US & UK Whistleblowing ProgramsDocument13 pagesUS & UK Whistleblowing ProgramsNeelam A. ShujahUddinNo ratings yet

- Borges, Jorge Luis - Prólogos Con Un Prólogo de Prólogos PDFDocument126 pagesBorges, Jorge Luis - Prólogos Con Un Prólogo de Prólogos PDFTriciaGomez100% (1)

- Korean Soju DisputeDocument10 pagesKorean Soju DisputeAnuj KumarNo ratings yet

- Who Owns The FloatDocument4 pagesWho Owns The Floathasitha203252No ratings yet

- RAMS EvaluationDocument3 pagesRAMS EvaluationAnandu AshokanNo ratings yet

- Auditing Report (Prior Period Not Audited)Document2 pagesAuditing Report (Prior Period Not Audited)lloydNo ratings yet

- Reducing Irs PenaltiesDocument37 pagesReducing Irs PenaltiesMcKenzieLaw100% (1)

- RA 8172 - Asin Law - 2Document22 pagesRA 8172 - Asin Law - 2Maxine Alexandra JaimeNo ratings yet

- Tank CourseDocument2 pagesTank CoursebiskaalNo ratings yet

- Goa Waste ManagementDocument74 pagesGoa Waste ManagementPritish LaadNo ratings yet

- Week 6 Contract ConstructionDocument73 pagesWeek 6 Contract ConstructionLili ChenNo ratings yet

- Competent PersonDocument2 pagesCompetent PersonASCI AdminNo ratings yet

- G Sop 011005Document21 pagesG Sop 011005Rubén Reyes SalgadoNo ratings yet

- Non-Disclosure Agreement: by and Between M/s FINANCE BOX PRIVATE LIMITED, (CIN U74999TG2020PTC145408) A CompanyDocument9 pagesNon-Disclosure Agreement: by and Between M/s FINANCE BOX PRIVATE LIMITED, (CIN U74999TG2020PTC145408) A CompanyPrachi RajputNo ratings yet

- PROC-02 Training and Competency Procedure PDFDocument10 pagesPROC-02 Training and Competency Procedure PDFHaeqel FazarNo ratings yet

- 2020-10-07 Town Board - Full Agenda-1585-203-205Document3 pages2020-10-07 Town Board - Full Agenda-1585-203-205jc247977No ratings yet

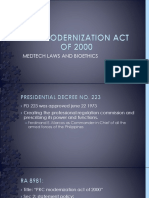

- PRC Modernization Act of 2000Document20 pagesPRC Modernization Act of 2000Dayledaniel Sorveto0% (1)