Professional Documents

Culture Documents

1stPB Masol

1stPB Masol

Uploaded by

Emey Calbay0 ratings0% found this document useful (0 votes)

15 views1 pageOriginal Title

1stPB_masol

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 page1stPB Masol

1stPB Masol

Uploaded by

Emey CalbayCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

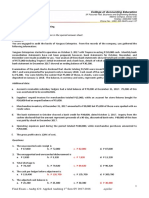

MAS First Pre-Board Examinations (Batch 37 * May 2019 batch)

<= _ ANSWERS and SOLUTIONS/CLARIFICATIONS to selected items

at) Tee] ec yar

pa 27 sa ase

a a

4 [A [2915

S{ A [301

Het 8 [31 [eB Ts6

2 A 32 B 57

3 |p Tas {8 _ [se

[9 {es [34{—a—Ts0

10[ > [35D [60

a1 papas | Bo fen

12 A [37 ¢ 62

a3] A_| 38] Aes

14 | c[39| A Toa

15/87 [40] B l6s|_

16 |B [a1 {0 [65|

az {a faz [cfr

18 B 43 Db 68 |

19 —c [4s] 8 [69]

20 A 45 D 70

21 Cc 46 Ca

220 B \47) aD

23 c fas}

24] A [49| A

25/6 [501A

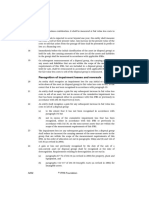

2, 10,000 (SP - 65) - 80,000 = 20% (300,000)

4. Standard quantity: 12,000 x 2 = 24,000

Standard price: 60,000 + 24,000°= P 2.50

Actual price: 105,000 + 35,000 = P 3,00

Materials quantity variance

(Actual quantity - 24,000) 2.5 = 2,500 U

.

Materials p

25,000 (3 - 2.5) = P 12,500 U

7. Given excess capacity, minimum price =

variable costs incurred for internal transfer,

excluding any costs on external sales.

9. First equation: 420 = 3a + 60b

Second equation: 8,800 = 60.a + 1,400 b

= variable cost = P 2 per unit

@ 10 units: 2x 10 = P20

12. Cost of make: 15 + 10 + 2 + 25% (4) = 28

Loss (buy); 5,000 (30 - 28)

14, CMR: 100% - (2% - 259% - 10%) = 639%

Sales: 104,720 + (63% - 20%) = P 243,535.

Unit sales: 243,535 = 45

16. 30,000 + 4 (7,000)

17. Prod (10,000) > Sales (7,000), Ay > vy

‘Ay = A Inventory x unit FFOH,

‘4y = (10,000 = 7,000) 7 = P 23,000

48, 10,000 (8 + 9 + 3) « 70,000

20.As there is only one available

company has no other recourse but

the standard to reflect the higher

materials.

22, Production: 19,000 + 3,000 ~ 4,000 =

Purchases: (18,000 x 8) + 53,000

124. Meturn on investment:

(4M ~ 2.144 M) + (560,000 ‘+ 720,000)

25. Required Income: 12%

*

24

28. Allocation. based on Product Mi (priority):

31,000 + (6,500 x 2) + (6,000 x 3)

tt = (6,500 x 5) + (6,000 x 5.7)

‘AFOH (Fixed): 540,000

BAAH (Fixed): 100,000 (5)

32, Monopolistic competition usually involves many

Sellers of heterogeneous products,

33. Weighted Average Unit CM

0% (20 ~ 12) + 40% (35 - 24.5)

24, Over-ail BEP: 45,000 + 9 =5,000

BEP (product Fighter): 40% (5,000)

36. May purchases:

100,000 + 35,000 ~ 20,000 = 115,000

May cash payments:

{60% (115,000) + 40% (90,000)

39. Department B's segment margin:

‘50,000 - 42,000 ~ 6,400 (70%)

41, Since the performance of Household Appliance:

division is based on Rol, it would have no

incentive of undertaking the project with Rol of

414% that is lower than its present RoI of 16%

== albeit acceptable.

42.A mixed cost neither has a constant total

Dept. A: 72,000 + 64,000 = 1.125 per peso

Dept. B: 75,000 + 10,000 = 7.50 per hour

Job Bie..105

partment A: 30 + 36 + 36 (1.125) = 106.50

Department 8: 45 + 25 +15 (7.5) = 182.50

Unit cost of Job No. 105: 289 + 30 units

Department A: 74,000 (1.125) = 83,

Department B: 9,000 (7.50) = 67,500

Applied FOH: 150,750 AFOH: 149,000

46. Unit VC: (2,150 - 1,450) + (75 - 40) = 20

Fixed costs: 1,450 - 20 (40)

49. CM ~ FC = pre-tax profit

22,000 units (25 - 13.75) - (135,000 + x) =

(60,000 = 0.6)

LRV: (22,000 + 10) x (10 - 12)

53. EPS is used for company-wide (not divisional)

performance measure, :

‘54, Gain: 30,000 (30 ~ 20) ~ 10% (2.7 M)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FAR Final Preboard-10Document1 pageFAR Final Preboard-10Emey CalbayNo ratings yet

- FAR Final Preboard-5Document1 pageFAR Final Preboard-5Emey CalbayNo ratings yet

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- FAR Final Preboard-9Document1 pageFAR Final Preboard-9Emey CalbayNo ratings yet

- Ifrs 5: Presentation and DisclosureDocument1 pageIfrs 5: Presentation and DisclosureEmey CalbayNo ratings yet

- FAR Final Preboard-11Document1 pageFAR Final Preboard-11Emey CalbayNo ratings yet

- Appendix A Defined Terms: Ifrs 5Document1 pageAppendix A Defined Terms: Ifrs 5Emey CalbayNo ratings yet

- Ifrs5 12Document1 pageIfrs5 12Emey CalbayNo ratings yet

- CH 19Document29 pagesCH 19Emey CalbayNo ratings yet

- Recognition of Impairment Losses and Reversals: Ifrs 5Document1 pageRecognition of Impairment Losses and Reversals: Ifrs 5Emey CalbayNo ratings yet

- Gains or Losses Relating To Continuing Operations: Ifrs 5Document1 pageGains or Losses Relating To Continuing Operations: Ifrs 5Emey CalbayNo ratings yet

- Appendix B Application Supplement: Extension of The Period Required To Complete A SaleDocument1 pageAppendix B Application Supplement: Extension of The Period Required To Complete A SaleEmey CalbayNo ratings yet

- Transitional Provisions: Ifrs 5Document1 pageTransitional Provisions: Ifrs 5Emey CalbayNo ratings yet

- Ifrs5 20Document1 pageIfrs5 20Emey CalbayNo ratings yet

- Chapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashDocument35 pagesChapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashEmey CalbayNo ratings yet

- Account Title Dr. CRDocument6 pagesAccount Title Dr. CREmey CalbayNo ratings yet

- Changes To A Plan of Sale or To A Plan of Distribution To OwnersDocument1 pageChanges To A Plan of Sale or To A Plan of Distribution To OwnersEmey CalbayNo ratings yet

- Ifrs5 6Document1 pageIfrs5 6Emey CalbayNo ratings yet

- International Financial Reporting Standard 5: Non Current Assets Held For Sale and Discontinued OperationsDocument1 pageInternational Financial Reporting Standard 5: Non Current Assets Held For Sale and Discontinued OperationsEmey CalbayNo ratings yet

- Ifrs5 1Document1 pageIfrs5 1Emey CalbayNo ratings yet

- Ifrs 5: Classification of Non Current Assets (Or Disposal Groups) As Held For Sale or As Held For Distribution To OwnersDocument1 pageIfrs 5: Classification of Non Current Assets (Or Disposal Groups) As Held For Sale or As Held For Distribution To OwnersEmey CalbayNo ratings yet

- Chapter 15 Inventories and Construction Contracts: 1. ObjectivesDocument20 pagesChapter 15 Inventories and Construction Contracts: 1. ObjectivesEmey CalbayNo ratings yet

- Fav2chp4 9Document122 pagesFav2chp4 9Emey CalbayNo ratings yet

- This Study Resource WasDocument6 pagesThis Study Resource WasEmey CalbayNo ratings yet

- This Study Resource Was: None of TheseDocument1 pageThis Study Resource Was: None of TheseEmey CalbayNo ratings yet