Professional Documents

Culture Documents

FAR Final Preboard-9

FAR Final Preboard-9

Uploaded by

Emey Calbay0 ratings0% found this document useful (0 votes)

21 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views1 pageFAR Final Preboard-9

FAR Final Preboard-9

Uploaded by

Emey CalbayCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

a

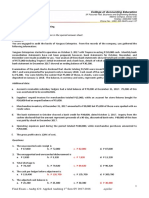

, Page 9

y Numbers 39 and 40

Situation 1 - An entty provided the following inventory information forthe curent year

Cost Retail

Beginning inventory 350,000 1,000,000

‘Net purchases 350,000 1,100,000

Net markups 150,000

‘Net markdowns 250,000

1,489,000

[Net sales (including sales discount of P50,000)

Situation 2 - An entity purchased several machines for use in operations:

«The maching was purchased on account for PS00,000. Credit terms were 2/10, 1/30. The entity paid

the account within the discount period.

4 Theenty issued to the seller a noninterest bearing note to purchase a machine, The note required &

payment ofP,000,000 and has a term of 2 years. The far value of the machine cannot be determined

pee te effective interest rte for similar notes was 10%. The present value ofl at 10% is 83 fortwo

periods.

«The emity traded in an old equipment with a cos of P280,000 and accumulated depreciation of

Piaig00 for a new equipment. The entity paid cash of PP440,000 and the fr value ofthe old

‘equipment was P50,000. The exchange has commercial substance, ;

«The ent issued 26,000, P100 par value ordinary shares in exchange for equipment, The equipment

‘could have been purchased for P250,000 cash.

139. What isthe cost of goods sold under the conventional retail method?

700,000

b. 680,000

675,000

4d. 652,500

40, What is the total cost of the equipment?

2,070,000

. 2,060,000

2,230,000

a. 2,010,000

‘Numbers 41 and 42

‘On January 1, 2019, an entity purchased equipment for Pé,800,000. The equipment is expected to have

fa useful life of six years with no residual value. On December 31, 2019, the entity elected to use the

revaluation model, The fir value of the equipment on this date was P4, 400,000,

41. What amount of revaluation surplus should be recognized on December 31,2019?

a. 400,000

'. 200,000,

«600,000

‘4. 800,000

42 What is the balance of revaluation surplus on'December 31, 20207

a. 400,000

'b. 160,000,

640,000

4. 320,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CH 19Document29 pagesCH 19Emey CalbayNo ratings yet

- FAR Final Preboard-5Document1 pageFAR Final Preboard-5Emey CalbayNo ratings yet

- FAR Final Preboard-10Document1 pageFAR Final Preboard-10Emey CalbayNo ratings yet

- 1stPB MasolDocument1 page1stPB MasolEmey CalbayNo ratings yet

- Final Exam 12 PDF FreeDocument17 pagesFinal Exam 12 PDF FreeEmey CalbayNo ratings yet

- Transitional Provisions: Ifrs 5Document1 pageTransitional Provisions: Ifrs 5Emey CalbayNo ratings yet

- Appendix A Defined Terms: Ifrs 5Document1 pageAppendix A Defined Terms: Ifrs 5Emey CalbayNo ratings yet

- FAR Final Preboard-11Document1 pageFAR Final Preboard-11Emey CalbayNo ratings yet

- Ifrs 5: Presentation and DisclosureDocument1 pageIfrs 5: Presentation and DisclosureEmey CalbayNo ratings yet

- International Financial Reporting Standard 5: Non Current Assets Held For Sale and Discontinued OperationsDocument1 pageInternational Financial Reporting Standard 5: Non Current Assets Held For Sale and Discontinued OperationsEmey CalbayNo ratings yet

- Recognition of Impairment Losses and Reversals: Ifrs 5Document1 pageRecognition of Impairment Losses and Reversals: Ifrs 5Emey CalbayNo ratings yet

- Ifrs5 20Document1 pageIfrs5 20Emey CalbayNo ratings yet

- Appendix B Application Supplement: Extension of The Period Required To Complete A SaleDocument1 pageAppendix B Application Supplement: Extension of The Period Required To Complete A SaleEmey CalbayNo ratings yet

- Ifrs5 12Document1 pageIfrs5 12Emey CalbayNo ratings yet

- Gains or Losses Relating To Continuing Operations: Ifrs 5Document1 pageGains or Losses Relating To Continuing Operations: Ifrs 5Emey CalbayNo ratings yet

- Ifrs 5: Classification of Non Current Assets (Or Disposal Groups) As Held For Sale or As Held For Distribution To OwnersDocument1 pageIfrs 5: Classification of Non Current Assets (Or Disposal Groups) As Held For Sale or As Held For Distribution To OwnersEmey CalbayNo ratings yet

- Changes To A Plan of Sale or To A Plan of Distribution To OwnersDocument1 pageChanges To A Plan of Sale or To A Plan of Distribution To OwnersEmey CalbayNo ratings yet

- Fav2chp4 9Document122 pagesFav2chp4 9Emey CalbayNo ratings yet

- Ifrs5 1Document1 pageIfrs5 1Emey CalbayNo ratings yet

- Ifrs5 6Document1 pageIfrs5 6Emey CalbayNo ratings yet

- Account Title Dr. CRDocument6 pagesAccount Title Dr. CREmey CalbayNo ratings yet

- Chapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashDocument35 pagesChapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashEmey CalbayNo ratings yet

- Chapter 15 Inventories and Construction Contracts: 1. ObjectivesDocument20 pagesChapter 15 Inventories and Construction Contracts: 1. ObjectivesEmey CalbayNo ratings yet

- This Study Resource Was: None of TheseDocument1 pageThis Study Resource Was: None of TheseEmey CalbayNo ratings yet

- This Study Resource WasDocument6 pagesThis Study Resource WasEmey CalbayNo ratings yet