Professional Documents

Culture Documents

Supermax Corp (SUCB MK) : Regional Morning Notes

Uploaded by

Iqbal YusufOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Supermax Corp (SUCB MK) : Regional Morning Notes

Uploaded by

Iqbal YusufCopyright:

Available Formats

R e g i o n a l M o r n i n g N o t e s Thursday, 06 May 2021

COMPANY RESULTS HOLD

Supermax Corp (SUCB MK) (Downgraded)

3QFY21: Within Expectations As Temporary Closure Weighs On Output Share Price RM5.57

3QFY21 results came in within expectations as revenue remained flat despite higher Target Price RM5.00

ASPs as a result of the temporary closure of production due to COVID-19. Supermax is Upside -10.2%

due for an explosive influx of capacity over the next two years. However, this is against

the backdrop of realising its peak quarterly earnings and potentially moderating

sentiment. This balanced reward-to-risk payoff prompts us to downgrade Supermax to COMPANY DESCRIPTION

a HOLD from BUY with an unchanged target price of RM5.00. Among the largest nitrile glove manufacturers

in the world, Supermax differentiates itself

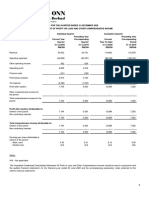

3QFY21 RESULTS with its OBM range and independent

Year to 30 Jun (RMm) 3QFY21 qoq % chg yoy % chg 9MFY20 9MFY21 yoy % chg distribution network. Also produces latex,

surgical gloves and contact lens.

Revenue 1,937.5 (3.1) 333.2 1,202.7 5,288.7 339.7

Operating exp. (591.1) 0.8 73.9 (987.4) (1,477.0) 49.6 STOCK DATA

EBITDA 1,346.4 (4.7) 1,154.6 215.3 3,811.7 1,670.8 GICS sector Health Care

EBIT 1,326.7 (5.0) 1,307.9 176.8 3,762.4 2,028.2

Bloomberg ticker: SUCB MK

Finance costs (1.8) (10.9) (50.2) (12.3) (6.1) (50.2)

PBT 1,342.3 (3.9) 1,308.8 169.5 3,788.8 2,134.6 Shares issued (m): 2,617.6

Taxation (320.0) 0.8 1,295.5 (42.2) (874.3) 1,970.8 Market cap (RMm): 15,103.8

Core net profit 1,080.2 2.0 1,420.2 126.0 2,929.2 2,225.3 Market cap (US$m): 3,673.5

qoq ppt chg yoy ppt chg yoy ppt chg 3-mth avg daily t'over (US$m): 35.1

EBITDA margin (%) 69.5 (1.2) 45.5 17.9 72.1 54.2

Price Performance (%)

Eff. tax rate (%) (23.8) (1.1) 0.2 (24.9) (23.1) 1.8

Core Net Margin (%) 55.8 2.7 39.9 10.5 55.4 44.9 52-week high/low RM11.63/RM1.13

Source: Supermax, UOB Kay Hian 1mth 3mth 6mth 1yr YTD

35.8 (11.6) (37.7) 451.2 (4.0)

RESULTS

Major Shareholders %

• Within expectations. Supermax Corp (Supermax) saw another solid quarter with a core net

Stanley Thai 37.2

profit of RM1,080m (+2.0% qoq, +1,420% yoy) for 3QFY21, bringing 9MFY21 core profit to

Vanguard 2.4

RM2,929m (+2,225% yoy). This is within our and consensus’ expectations, accounting for

Norges Bank 2.4

74% and 72% of our and consensus’ full-year estimates respectively. Core net profit has

been adjusted for a RM75m contribution to the government in its efforts to combat COVID- FY21 NAV/Share (RM) 1.58

19. The company declared a special DPS of 13 sen.

FY21 Net Cash/Share (RM) 0.74

• Temporary closure mutes top-line growth. Revenue declined 3.1% qoq (+332% yoy) in

3QFY21. This was largely due to the temporary closure at its Meru plants following the PRICE CHART

detection of several COVID-19 cases among its foreign workforce. This more than offset the

(lcy) SU PER MA X COR P BH D SU PERMA X COR P BHD/FBM KL CI IND EX (%)

higher ASPs. During the quarter, Supermax realised a full quarter’s contribution from its new 12 840

Plant 12 (Block B: 2.2b pieces p.a.). This lifted production capacity to 26.2 pieces p.a. or 10 720

9.2% enlarged capacity. This was amid the US dollar weakening against the ringgit by 1.1% 600

8

qoq. 480

6

KEY FINANCIALS 4

360

240

Year to 30 Jun (RMm) 2019 2020 2021F 2022F 2023F

2 120

Net turnover 1,538 2,132 7,471 5,979 4,783

0 0

EBITDA 179 693 5,424 3,164 1,602 200

Volume (m)

Operating profit 134 631 5,364 3,095 1,524 150

100

Net profit (rep./act.) 123 525 3,947 2,295 1,148 50

0

Net profit (adj.) 123 525 3,947 2,295 1,148 May 20 Jul 20 Sep 20 Nov 20 Jan 21 Mar 21 May 21

EPS (sen) 4.5 19.3 145.1 84.3 42.2

PE (x) 127.5 29.9 4.0 6.8 13.7 Source: Bloomberg

P/B (x) 14.0 10.3 3.7 2.7 2.3

EV/EBITDA (x) 73.4 18.9 2.4 4.1 8.2 ANALYST(S)

Dividend yield (%) 0.3 0.3 7.6 4.4 2.2 Philip Wong

Net margin (%) 8.0 24.6 52.8 38.4 24.0 +603 2147 1996

Net debt/(cash) to equity (%) 19.4 (56.4) (46.8) (60.7) (64.2) philipwong@uobkayhian.com

Interest cover (x) 9.1 40.6 571.9 895.7 453.6

ROE (%) 11.5 39.6 135.7 45.1 18.2

Consensus net profit - - 4,083 2,388 1,501

UOBKH/Consensus (x) - - 0.97 0.96 0.76

Source: Supermax, Bloomberg, UOB Kay Hian

Refer to last page for important disclosures. 10

1

R e g i o n a l M o r n i n g N o t e s Thursday, 06 May 2021

• Operating margins softened by lower economies of scale. EBITDA margins declined SUPERMAX: ASSUMPTIONS

marginally to 69.5% (or 1.2 ppt qoq) despite the higher ASPs. We believe this can be FY21F FY22F FY23F

attributed to a combination of issues: a) lower economies of scale; b) market pricing for nitrile Revenue (RMm) 7471 5979 4783

butadiene rubber (NBR) was 15% higher qoq; and c) weakening of the US dollar against the - yoy % chg 250 -20 -20

ringgit. Going forward, Supermax’s NBR prices could ease alongside that seen by its peers. Utilisation rate (%) 95 95 95

Despite the marginally higher effective tax rate, 3QFY21 PAT margins improved to 55.8% or Output (b pcs/year) 24.8 33.1 37.1

2.7ppt due to the adjustment of RM75m contribution to the government’s COVID-19 fund. - yoy % chg 34.1 33.4 12.0

ASP - yoy % chg 161.2 -40.0 -28.6

• Sustained earnings for 4QFY21. Following the completion of Plant 12 (Block B) and Source: UOB Kay Hian

Supermax addressing the COVID-19 outbreak among its foreign workforce, Supermax’s

SUPERMAX: CAPACITY EXPANSION PLAN

output should pick up in the subsequent quarter. Apart from that, Supermax expects ASPs to

Capacity Capacity at YE

soften by 15-25%. That said, we expect margins to be sustained off the back of moderating Plant (b pieces p.a.) (b pieces p.a.) % (yoy)

NBR prices and higher economies of scale. 2019 24.0 10.3

12 2.2

STOCK IMPACT

2020 26.2 9.1

• Huge capacity influx up ahead. Off the back of the fully commissioned Block B of Plant 12 13 2.8

amounting to 2.2b pieces p.a., Supermax is in the midst of constructing Plants 13, 14, 15, 16 14 1.0

and 17. Capacity arising from these new plants will amount to 22.2b pieces p.a., and would 15 3.8

boost existing capacity to 48.4b pieces p.a. or 85%. These plants are slated to be completed 16 1.4

by end-22. Over 2021-22, capacity is slated to grow by 39.2% and 32.9% respectively. 17 1.4

2021 36.4 39.2

• Widening production footprint. We gather that Supermax is in the midst of incorporating a 13 1.0

US-based subsidiary with a paid-up capital of US$100m. In the long run, it intends to have a 14 2.8

15b-piece annual production capacity in the US, or 10% of the country’s glove consumption. 16 4.1

We gather that the US government agencies have offered lucrative incentives and tax breaks 17 4.1

to attract Supermax. This is amid the government’s intention to lower its dependence on 2022 48.4 32.9

imported gloves. Supermax is also looking to build a plant in the UK, with similar strategic Source: Supermax

intentions. 5-YEAR FORWARD PE BAND

• Possibility of dropping out of the FBMKLCI Index. Supermax has declined by close to 35

40% over the past four months, with that, its market capitalisation has eroded to RM14.5b. It 30

is currently the last among the 30 constituents (slightly behind Sime Darby by RM15.0b) and

25 +1SD = 18.0x

is at risk of being replaced by the possible entry of Mr. DIY. Mr. DIY is now positioned 20th in

20 AVG = 14.0x

terms of its market capitalisation and will replace the lowest of the 30 constituents when it

15

rebalances.

10

EARNINGS REVISION/RISK 5 -1SD = 10.0x

• Unchanged earnings. 0

• Key risks are: a) vaccine newsflow. The gradual ramp-up in global manufacturing of vaccines

would mean that glove ASPs are unlikely to fall sharply immediately; b) the strengthening of Source: Bloomberg, UOB Kay Hian

the ringgit against the US dollar; and c) heightened competition.

VALUATION/RECOMMENDATION

• Downgrade to HOLD from BUY with an unchanged target price of RM5.00. Our target

price is derived from the present value of: a) expected dividends over 2021-23, and b) 2023

earnings pegged to Supermax’s mean of its five-year PE (18x) as a reflection of normalised

earnings. Our target price implies a PE of 5.9x to FY22. While we continue to like Supermax

for its aggressive expansion ambitions and its OBM model for creating downstream value,

the reward-to-risk payoff appears balanced at this juncture with our expectations of sentiment

moderating going forward.

• The execution of its aggressive expansion could be a catalyst to its valuations being rerated

from 18x (in our derivation of its target price) closer to its peers (30x) that includes Hartalega

(42x), Top Glove (25x) and Kossan (23x).

Refer to last page for important disclosures. 11

2

R e g i o n a l M o r n i n g N o t e s Thursday, 06 May 2021

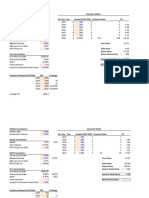

PROFIT & LOSS BALANCE SHEET

Year to 30 Jun (RMm) 2020 2021F 2022F 2023F Year to 30 Jun (RMm) 2020 2021F 2022F 2023F

Net turnover 2,132 7,471 5,979 4,783 Fixed assets 1,082 1,414 1,624 1,841

EBITDA 693 5,424 3,164 1,602 Other LT assets 209 209 209 209

Deprec. & amort. 62 60 69 78 Cash/ST investment 1,186 2,080 3,650 4,371

EBIT 631 5,364 3,095 1,524 Other current assets 728 1,296 1,229 1,140

Total other non-operating income 48 48 48 48 Total assets 3,204 4,999 6,711 7,561

Associate contributions 18 18 18 18 ST debt 224 24 24 24

Net interest income/(expense) (17) (9) (4) (4) Other current liabilities 1,283 575 693 750

Pre-tax profit 680 5,420 3,157 1,586 LT debt 100 50 50 50

Tax (145) (1,464) (852) (428) Other LT liabilities 47 47 47 47

Minorities (10) (10) (10) (10) Shareholders' equity 1,529 4,289 5,892 6,693

Net profit 525 3,947 2,295 1,148 Minority interest 21 13 5 (3)

Net profit (adj.) 525 3,947 2,295 1,148 Total liabilities & equity 3,204 4,999 6,711 7,561

CASH FLOW KEY METRICS

Year to 30 Jun (RMm) 2020 2021F 2022F 2023F Year to 30 Jun (%) 2020 2021F 2022F 2023F

Operating 1,304 2,621 2,544 1,367 Profitability

Pre-tax profit 680 5,420 3,157 1,586 EBITDA margin 32.5 72.6 52.9 33.5

Tax (62) (1,464) (852) (428) Pre-tax margin 31.9 72.5 52.8 33.2

Deprec. & amort. 62 60 69 78 Net margin 24.6 52.8 38.4 24.0

Associates (18) (18) (18) (18) ROA 20.8 96.2 39.2 16.1

Working capital changes 658 (1,388) 185 145 ROE 39.6 135.7 45.1 18.2

Non-cash items (31) 0 0 0

Other operating cashflows 16 9 4 4 Growth

Investing (191) (280) (280) (295) Turnover 38.6 250.5 (20.0) (20.0)

Capex (growth) (191) (280) (280) (295) EBITDA 287.9 682.6 (41.7) (49.4)

Proceeds from sale of assets 0 0 0 0 Pre-tax profit 294.5 696.9 (41.8) (49.8)

Others 0 0 0 0 Net profit 326.3 652.1 (41.9) (50.0)

Financing (150) (1,447) (695) (351) Net profit (adj.) 326.3 652.1 (41.9) (50.0)

Dividend payments 0 (1,187) (691) (347) EPS 326.3 652.1 (41.9) (50.0)

Proceeds from borrowings (91) (250) 0 0

Loan repayment 25 0 0 0 Leverage

Others/interest paid (84) (9) (4) (4) Debt to total capital 17.3 1.7 1.2 1.1

Net cash inflow (outflow) 963 894 1,570 721 Debt to equity 21.2 1.7 1.3 1.1

Beginning cash & cash equivalent 174 1,186 2,080 3,650 Net debt/(cash) to equity (56.4) (46.8) (60.7) (64.2)

Changes due to forex impact 50 0 0 0 Interest cover (x) 40.6 571.9 895.7 453.6

Ending cash & cash equivalent 1,186 2,080 3,650 4,371

Refer to last page for important disclosures. 12

3

R e g i o n a l M o r n i n g N o t e s Thursday, 06 May 2021

Disclosures/Disclaimers

This report is prepared by UOB Kay Hian Private Limited (“UOBKH”), which is a holder of a capital markets services licence and an

exempt financial adviser in Singapore.

This report is provided for information only and is not an offer or a solicitation to deal in securities or to enter into any legal relations, nor an

advice or a recommendation with respect to such securities.

This report is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation and the

particular needs of any recipient hereof. Advice should be sought from a financial adviser regarding the suitability of the investment

product, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the

recommendation, before the person makes a commitment to purchase the investment product.

This report is confidential. This report may not be published, circulated, reproduced or distributed in whole or in part by any recipient of this

report to any other person without the prior written consent of UOBKH. This report is not directed to or intended for distribution to or use by

any person or any entity who is a citizen or resident of or located in any locality, state, country or any other jurisdiction as UOBKH may

determine in its absolute discretion, where the distribution, publication, availability or use of this report would be contrary to applicable law

or would subject UOBKH and its connected persons (as defined in the Financial Advisers Act, Chapter 110 of Singapore) to any

registration, licensing or other requirements within such jurisdiction.

The information or views in the report (“Information”) has been obtained or derived from sources believed by UOBKH to be reliable.

However, UOBKH makes no representation as to the accuracy or completeness of such sources or the Information and UOBKH accepts

no liability whatsoever for any loss or damage arising from the use of or reliance on the Information. UOBKH and its connected persons

may have issued other reports expressing views different from the Information and all views expressed in all reports of UOBKH and its

connected persons are subject to change without notice. UOBKH reserves the right to act upon or use the Information at any time,

including before its publication herein.

Except as otherwise indicated below, (1) UOBKH, its connected persons and its officers, employees and representatives may, to the

extent permitted by law, transact with, perform or provide broking, underwriting, corporate finance-related or other services for or solicit

business from, the subject corporation(s) referred to in this report; (2) UOBKH, its connected persons and its officers, employees and

representatives may also, to the extent permitted by law, transact with, perform or provide broking or other services for or solicit business

from, other persons in respect of dealings in the securities referred to in this report or other investments related thereto; (3) the officers,

employees and representatives of UOBKH may also serve on the board of directors or in trustee positions with the subject corporation(s)

referred to in this report. (All of the foregoing is hereafter referred to as the “Subject Business”); and (4) UOBKH may otherwise have an

interest (including a proprietary interest) in the subject corporation(s) referred to in this report.

As of the date of this report, no analyst responsible for any of the content in this report has any proprietary position or material interest in

the securities of the corporation(s) which are referred to in the content they respectively author or are otherwise responsible for.

IMPORTANT DISCLOSURES FOR U.S. PERSONS

This research report was prepared by UOBKH, a company authorized, as noted above, to engage in securities activities in Singapore.

UOBKH is not a registered broker-dealer in the United States and, therefore, is not subject to U.S. rules regarding the preparation of

research reports and the independence of research analysts. This research report is provided for distribution by UOBKH (whether directly

or through its US registered broker dealer affiliate named below) to “major U.S. institutional investors” in reliance on the exemption from

registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). All US persons that

receive this document by way of distribution from or which they regard as being from UOBKH by their acceptance thereof represent and

agree that they are a major institutional investor and understand the risks involved in executing transactions in securities.

Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on

the information provided in this research report should do so only through UOB Kay Hian (U.S.) Inc (“UOBKHUS”), a registered broker-

dealer in the United States. Under no circumstances should any recipient of this research report effect any transaction to buy or sell

securities or related financial instruments through UOBKH.

UOBKHUS accepts responsibility for the contents of this research report, subject to the terms set out below, to the extent that it is

delivered to and intended to be received by a U.S. person other than a major U.S. institutional investor.

The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry

Regulatory Authority (“FINRA”) and may not be an associated person of UOBKHUS and, therefore, may not be subject to applicable

restrictions under FINRA Rules on communications with a subject company, public appearances and trading securities held by a research

analyst account.

Refer to last page for important disclosures. 36

4

R e g i o n a l M o r n i n g N o t e s Thursday, 06 May 2021

Analyst Certification/Regulation AC

Each research analyst of UOBKH who produced this report hereby certifies that (1) the views expressed in this report accurately reflect

his/her personal views about all of the subject corporation(s) and securities in this report; (2) the report was produced independently by

him/her; (3) he/she does not carry out, whether for himself/herself or on behalf of UOBKH or any other person, any of the Subject Business

involving any of the subject corporation(s) or securities referred to in this report; and (4) he/she has not received and will not receive any

compensation that is directly or indirectly related or linked to the recommendations or views expressed in this report or to any sales,

trading, dealing or corporate finance advisory services or transaction in respect of the securities in this report. However, the compensation

received by each such research analyst is based upon various factors, including UOBKH’s total revenues, a portion of which are

generated from UOBKH’s business of dealing in securities.

Reports are distributed in the respective countries by the respective entities and are subject to the additional restrictions listed in the

following table.

General This report is not intended for distribution, publication to or use by any person or entity who is a citizen or resident of or

located in any country or jurisdiction where the distribution, publication or use of this report would be contrary to

applicable law or regulation.

Hong Kong This report is distributed in Hong Kong by UOB Kay Hian (Hong Kong) Limited ("UOBKHHK"), which is regulated by the

Securities and Futures Commission of Hong Kong. Neither the analyst(s) preparing this report nor his associate, has

trading and financial interest and relevant relationship specified under Para. 16.4 of Code of Conduct in the listed

corporation covered in this report. UOBKHHK does not have financial interests and business relationship specified under

Para. 16.5 of Code of Conduct with the listed corporation covered in this report. Where the report is distributed in Hong

Kong and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKHHK (and not the relevant foreign research house) in Hong

Kong in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Hong Kong

who is not a professional investor, or institutional investor, UOBKHHK accepts legal responsibility for the contents of the

analyses or reports only to the extent required by law.

Indonesia This report is distributed in Indonesia by PT UOB Kay Hian Sekuritas, which is regulated by Financial Services Authority

of Indonesia (“OJK”). Where the report is distributed in Indonesia and contains research analyses or reports from a

foreign research house, please note recipients of the analyses or reports are to contact PT UOBKH (and not the relevant

foreign research house) in Indonesia in respect of any matters arising from, or in connection with, the analysis or report.

Malaysia Where the report is distributed in Malaysia and contains research analyses or reports from a foreign research house, the

recipients of the analyses or reports are to contact UOBKHM (and not the relevant foreign research house) in Malaysia,

at +603-21471988, in respect of any matters arising from, or in connection with, the analysis or report as UOBKHM is the

registered person under CMSA to distribute any research analyses in Malaysia.

Singapore This report is distributed in Singapore by UOB Kay Hian Private Limited ("UOBKH"), which is a holder of a capital

markets services licence and an exempt financial adviser regulated by the Monetary Authority of Singapore.Where the

report is distributed in Singapore and contains research analyses or reports from a foreign research house, please note:

(i) recipients of the analyses or reports are to contact UOBKH (and not the relevant foreign research house) in Singapore

in respect of any matters arising from, or in connection with, the analysis or report; and

(ii) to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore

who is not an accredited investor, expert investor or institutional investor, UOBKH accepts legal responsibility for the

contents of the analyses or reports only to the extent required by law.

Thailand This report is distributed in Thailand by UOB Kay Hian Securities (Thailand) Public Company Limited, which is regulated

by the Securities and Exchange Commission of Thailand.

United This report is being distributed in the UK by UOB Kay Hian (U.K.) Limited, which is an authorised person in the meaning

Kingdom of the Financial Services and Markets Act and is regulated by The Financial Conduct Authority. Research distributed in

the UK is intended only for institutional clients.

United This report cannot be distributed into the U.S. or to any U.S. person or entity except in compliance with applicable U.S.

States of laws and regulations. It is being distributed in the U.S. by UOB Kay Hian (US) Inc, which accepts responsibility for its

America contents. Any U.S. person or entity receiving this report and wishing to effect transactions in any securities referred to in

(‘U.S.’) the report should contact UOB Kay Hian (US) Inc. directly.

Copyright 2021, UOB Kay Hian Pte Ltd. All rights reserved.

http://research.uobkayhian.com

RCB Regn. No. 197000447W

Refer to last page for important disclosures. 37

5

You might also like

- Datasonic Trading Buy Maintained on Recovery HopesDocument4 pagesDatasonic Trading Buy Maintained on Recovery HopesGiddy YupNo ratings yet

- Solarvest - 1QFY24Document4 pagesSolarvest - 1QFY24gee.yeap3959No ratings yet

- Bhel-3qfy11 Ru-210111Document12 pagesBhel-3qfy11 Ru-210111kshintlNo ratings yet

- EARNINGS REPORTDocument5 pagesEARNINGS REPORTnishio fdNo ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- Yongnam Holdings LTD: Good Results As ExpectedDocument5 pagesYongnam Holdings LTD: Good Results As Expectedsagger09No ratings yet

- Kossan Rubber (KRI MK) : Regional Morning NotesDocument5 pagesKossan Rubber (KRI MK) : Regional Morning NotesFong Kah YanNo ratings yet

- FORTH230228RDocument7 pagesFORTH230228RsozodaaaNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- Sime Darby Takes Leave to Review Energy LossesDocument4 pagesSime Darby Takes Leave to Review Energy LossesmanjamaheraNo ratings yet

- MOIL 07feb20 Kotak PCG 00210 PDFDocument6 pagesMOIL 07feb20 Kotak PCG 00210 PDFdarshanmadeNo ratings yet

- Mizuho Securities 6961@JP Enplas (6961, NR) 3Q results standstill in 2Q continueDocument3 pagesMizuho Securities 6961@JP Enplas (6961, NR) 3Q results standstill in 2Q continuephatNo ratings yet

- Serba Dinamik hit by audit flagsDocument4 pagesSerba Dinamik hit by audit flagsRichbull TraderNo ratings yet

- AmInv 95622347Document5 pagesAmInv 95622347Lim Chau LongNo ratings yet

- BCTA-RR (2QFY19) - LTHB-FinalDocument4 pagesBCTA-RR (2QFY19) - LTHB-FinalZhi_Ming_Cheah_8136No ratings yet

- Titan Industries: Performance HighlightsDocument10 pagesTitan Industries: Performance Highlightscbz786skNo ratings yet

- Dixon Technologies Q4 Result Update Nirmal BangDocument8 pagesDixon Technologies Q4 Result Update Nirmal BangSwati 45No ratings yet

- Dsonic - 1QFY24Document4 pagesDsonic - 1QFY24gee.yeap3959No ratings yet

- ITC Analyst Meet Key TakeawaysDocument19 pagesITC Analyst Meet Key TakeawaysTatsam VipulNo ratings yet

- 7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Document4 pages7204 D&O KENANGA 2023-08-24 SELL 2.30 DOGreenTechnologiesSluggishNewOrders - 167722211Nicholas ChehNo ratings yet

- CJ Century Logistics Holdings Berhad: TP: RM0.95Document3 pagesCJ Century Logistics Holdings Berhad: TP: RM0.95SirPojiNo ratings yet

- Amara Raja Batteries: Performance HighlightsDocument10 pagesAmara Raja Batteries: Performance HighlightssuneshsNo ratings yet

- Clean Science ICDocument35 pagesClean Science ICErr DatabaseNo ratings yet

- TCS Q4FY22 Result Review: Healthy deal wins but cautious on Europe marginsDocument13 pagesTCS Q4FY22 Result Review: Healthy deal wins but cautious on Europe marginsuefqyaufdQNo ratings yet

- TCS Q2FY22 Result Update: Minor blip, well positioned to gain market shareDocument14 pagesTCS Q2FY22 Result Update: Minor blip, well positioned to gain market shareRajesh SharmaNo ratings yet

- Jubilant Pharmova-2QFY22 Result Update-24 October 2021Document8 pagesJubilant Pharmova-2QFY22 Result Update-24 October 2021officialdevjeetsinghNo ratings yet

- Larsen & Toubro: Performance HighlightsDocument14 pagesLarsen & Toubro: Performance HighlightsrajpersonalNo ratings yet

- Ock - 2qcy23Document5 pagesOck - 2qcy23gee.yeap3959No ratings yet

- MISC Berhad Outperform : Weaker Core Earnings in 1QFY21Document5 pagesMISC Berhad Outperform : Weaker Core Earnings in 1QFY21Iqbal YusufNo ratings yet

- LKP Moldtek 01feb08Document2 pagesLKP Moldtek 01feb08nillchopraNo ratings yet

- Top Glove Corporation Berhad - 3QFY21 Hit by Lower Volumes - 210610Document3 pagesTop Glove Corporation Berhad - 3QFY21 Hit by Lower Volumes - 210610Chin Yee LooNo ratings yet

- MM Forgings (Q1FY24 Result Update)_15-Aug-2023Document10 pagesMM Forgings (Q1FY24 Result Update)_15-Aug-2023instiresmilanNo ratings yet

- TCS - 1QFY20 - HDFC Sec-201907100816499656445Document15 pagesTCS - 1QFY20 - HDFC Sec-201907100816499656445Sandip HaseNo ratings yet

- Daily Story - Driver IC Sector - 2023 - 05 - 09 - C - TWDocument7 pagesDaily Story - Driver IC Sector - 2023 - 05 - 09 - C - TW風雲造天No ratings yet

- Cocoland 20100727 - CUDocument2 pagesCocoland 20100727 - CUlimml63No ratings yet

- GMDC - 2QFY18 - HDFC Sec-201711141533578171264Document11 pagesGMDC - 2QFY18 - HDFC Sec-201711141533578171264Anonymous y3hYf50mTNo ratings yet

- GCB - 2qcy23Document6 pagesGCB - 2qcy23gee.yeap3959No ratings yet

- Ambuja Cement (ACEM IN) : Q3CY20 Result UpdateDocument6 pagesAmbuja Cement (ACEM IN) : Q3CY20 Result Updatenani reddyNo ratings yet

- Kossan Rubber Industries Berhad: 1H Core Net Profit Up 15.8% YoY-27/08/2010Document3 pagesKossan Rubber Industries Berhad: 1H Core Net Profit Up 15.8% YoY-27/08/2010Rhb InvestNo ratings yet

- Indian Hotel - Q4FY22 Results - DAMDocument8 pagesIndian Hotel - Q4FY22 Results - DAMRajiv BharatiNo ratings yet

- Public Investment Bank: Hartalega Holdings Berhad NeutralDocument4 pagesPublic Investment Bank: Hartalega Holdings Berhad NeutralZhi_Ming_Cheah_8136No ratings yet

- Bca VistaDocument18 pagesBca VistaSaputra SaputraNo ratings yet

- ICICI - Piramal EnterprisesDocument16 pagesICICI - Piramal EnterprisessehgalgauravNo ratings yet

- URC: Results in Line, But Downside Risks RemainDocument5 pagesURC: Results in Line, But Downside Risks RemainJNo ratings yet

- CENTEL230228RDocument8 pagesCENTEL230228RsozodaaaNo ratings yet

- Telecommunication: OverweightDocument4 pagesTelecommunication: Overweightmuhamad fadzirNo ratings yet

- MOBILY MOVEDocument36 pagesMOBILY MOVEAliNo ratings yet

- PPPPPTDocument41 pagesPPPPPTbikash ranaNo ratings yet

- Sona BLW Precision Forgings: Order Book Leaps New Product Elongates Growth VisibilityDocument9 pagesSona BLW Precision Forgings: Order Book Leaps New Product Elongates Growth VisibilityVivek S MayinkarNo ratings yet

- ICICI Securities Tarsons Re Initiating CoverageDocument14 pagesICICI Securities Tarsons Re Initiating CoverageGaurav ChandnaNo ratings yet

- Accumulate: Growth Momentum Continues!Document7 pagesAccumulate: Growth Momentum Continues!sj singhNo ratings yet

- VA Tech Wabag-KotakDocument9 pagesVA Tech Wabag-KotakADNo ratings yet

- Yes Bank - IDFC SSKI - 22 01 09Document6 pagesYes Bank - IDFC SSKI - 22 01 09api-19728845No ratings yet

- Dam Capital Initiating Coverage Report On JK Tyre Rating BUY TargetDocument18 pagesDam Capital Initiating Coverage Report On JK Tyre Rating BUY TargetНикита МузафаровNo ratings yet

- IDBI Capital Century Plyboards Q1FY23 Result ReviewDocument10 pagesIDBI Capital Century Plyboards Q1FY23 Result ReviewTai TranNo ratings yet

- Deleum 2Q10Results UpdateDocument3 pagesDeleum 2Q10Results Updatelimml63No ratings yet

- British American Tobacco: TIV Remains Under Pressure-23/04/2010Document3 pagesBritish American Tobacco: TIV Remains Under Pressure-23/04/2010Rhb InvestNo ratings yet

- Stove Kraft-Company Update 25 September 2021 - Nirmal Bang (Inst.)Document14 pagesStove Kraft-Company Update 25 September 2021 - Nirmal Bang (Inst.)Raghu KuchiNo ratings yet

- Tata Motors: Performance HighlightsDocument10 pagesTata Motors: Performance HighlightsandrewpereiraNo ratings yet

- 0202 - RGTECH - QR - 2020-12-31 - Radiant Globaltech Berhad - Quarterly Results - 31.12.2020 - 670632592Document20 pages0202 - RGTECH - QR - 2020-12-31 - Radiant Globaltech Berhad - Quarterly Results - 31.12.2020 - 670632592Iqbal YusufNo ratings yet

- SiTime Presentation - Raymond James March 3 2020 - VFINAL (Web)Document27 pagesSiTime Presentation - Raymond James March 3 2020 - VFINAL (Web)Iqbal YusufNo ratings yet

- SiTime Third Quarter 2020 Financial Results-Transcript (Web)Document12 pagesSiTime Third Quarter 2020 Financial Results-Transcript (Web)Iqbal YusufNo ratings yet

- 5159 - YOCB - QR - 2020-12-31 - 31.12.20 Qtrly Report - 102750368Document13 pages5159 - YOCB - QR - 2020-12-31 - 31.12.20 Qtrly Report - 102750368Iqbal YusufNo ratings yet

- Cho Bee Metal Industries 1Q2021 Results SurgeDocument18 pagesCho Bee Metal Industries 1Q2021 Results SurgeIqbal YusufNo ratings yet

- Membership Categories and Fees: Individual CorporateDocument1 pageMembership Categories and Fees: Individual CorporateIqbal YusufNo ratings yet

- Yocb Ar2020Document120 pagesYocb Ar2020Gan ZhiHanNo ratings yet

- Yocb Ar2020Document120 pagesYocb Ar2020Gan ZhiHanNo ratings yet

- Kgu1 ImDocument48 pagesKgu1 Imphantom78No ratings yet

- Unaudited Condensed Consolidated Financial Statement For The Financial Year 2021 Fourth Quarter Ended 31 March 2021Document21 pagesUnaudited Condensed Consolidated Financial Statement For The Financial Year 2021 Fourth Quarter Ended 31 March 2021Iqbal YusufNo ratings yet

- JHM Consolidation: MalaysiaDocument6 pagesJHM Consolidation: MalaysiaIqbal YusufNo ratings yet

- AsdasdasdsadDocument2 pagesAsdasdasdsadIqbal YusufNo ratings yet

- Supermax Corp: MalaysiaDocument8 pagesSupermax Corp: MalaysiaIqbal YusufNo ratings yet

- Lotte Chemical: Cyclical Strength To ContinueDocument11 pagesLotte Chemical: Cyclical Strength To ContinueIqbal YusufNo ratings yet

- MISC Berhad Outperform : Weaker Core Earnings in 1QFY21Document5 pagesMISC Berhad Outperform : Weaker Core Earnings in 1QFY21Iqbal YusufNo ratings yet

- AmChina A-Shares Fund UpdatesDocument75 pagesAmChina A-Shares Fund UpdatesIqbal YusufNo ratings yet

- Public Investment Bank Research Daily Highlights Accommodative Policy Continues, IPI Manufacturing on a RollDocument9 pagesPublic Investment Bank Research Daily Highlights Accommodative Policy Continues, IPI Manufacturing on a RollIqbal YusufNo ratings yet

- Country GDP (In Billions) Moody's Rating Adj. Default Spread Malaysia 314.5 A3 1.35% United Kingdom 2622.43 Aa2 0.56% United States 19390.6 Aaa 0.00%Document2 pagesCountry GDP (In Billions) Moody's Rating Adj. Default Spread Malaysia 314.5 A3 1.35% United Kingdom 2622.43 Aa2 0.56% United States 19390.6 Aaa 0.00%Iqbal YusufNo ratings yet

- FCFE CalculationDocument23 pagesFCFE CalculationIqbal YusufNo ratings yet

- DCFDocument3 pagesDCFIqbal Yusuf100% (1)

- Hungarian Phrasebook - WikitravelDocument17 pagesHungarian Phrasebook - WikitravelIqbal YusufNo ratings yet

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Document14 pagesUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufNo ratings yet

- Johore Tin (Johotin-Ku) : Average ScoreDocument11 pagesJohore Tin (Johotin-Ku) : Average ScoreIqbal YusufNo ratings yet

- Configuration: Getting Started GuDocument24 pagesConfiguration: Getting Started GuIqbal YusufNo ratings yet

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Document14 pagesUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufNo ratings yet

- Lampiran ADocument10 pagesLampiran AHàNîf ImRàn IVNo ratings yet

- Debate: Abortion: Should Abortions of Any Kind Be Permitted? Background and ContextDocument39 pagesDebate: Abortion: Should Abortions of Any Kind Be Permitted? Background and ContextIqbal YusufNo ratings yet

- Coca-Cola Case StudyDocument8 pagesCoca-Cola Case StudyDiogo GomesNo ratings yet

- IB Revision Notes on Business TopicsDocument3 pagesIB Revision Notes on Business TopicsKANAK KOKARENo ratings yet

- S Alyssa 2021Document6 pagesS Alyssa 2021aamir hayatNo ratings yet

- IGCSE Economics Definition SheetDocument38 pagesIGCSE Economics Definition SheetneelNo ratings yet

- Special journals expedite transactionsDocument5 pagesSpecial journals expedite transactionsPaw VerdilloNo ratings yet

- Challenges in the Oil & Gas Industry: An OverviewDocument22 pagesChallenges in the Oil & Gas Industry: An OverviewWesam Salah AlooloNo ratings yet

- Result Paper - 11 (ITX) : 2: LogoutDocument11 pagesResult Paper - 11 (ITX) : 2: LogoutbavithraNo ratings yet

- Job satisfaction sample confidence intervalsDocument6 pagesJob satisfaction sample confidence intervalsHồng HàNo ratings yet

- Important Sap Fico QuestionsDocument33 pagesImportant Sap Fico Questionsswetha devarakondaNo ratings yet

- Draft Contract GLIIT-BMI GAR 5500-5300Document12 pagesDraft Contract GLIIT-BMI GAR 5500-5300Julian Nico100% (1)

- Unilever Independent Assurance ReportDocument5 pagesUnilever Independent Assurance ReportAbdeljalil OuiNo ratings yet

- MCQ Accounts For 10+2 TS Grewal SirDocument66 pagesMCQ Accounts For 10+2 TS Grewal SirYash ChhabraNo ratings yet

- Cluster JuryDocument45 pagesCluster JuryPayal ParidaNo ratings yet

- Occupational Health & Safety ReportDocument18 pagesOccupational Health & Safety Reportargya nareswaraNo ratings yet

- IFAS TableDocument6 pagesIFAS TableAgneesh DuttaNo ratings yet

- Bachelor of Science in Business Administration BSBA Major in Operations ManagementDocument4 pagesBachelor of Science in Business Administration BSBA Major in Operations ManagementJustine BridgertonNo ratings yet

- Chapter 2 - External Environment AnalysisDocument23 pagesChapter 2 - External Environment Analysismuhammad naufalNo ratings yet

- Business Office Manager Executive Assistant in Savannah GA Resume Sonia McClinticDocument3 pagesBusiness Office Manager Executive Assistant in Savannah GA Resume Sonia McClinticSoniaMcClinticNo ratings yet

- Direct Marketing and Personal Selling ToolsDocument41 pagesDirect Marketing and Personal Selling ToolsARPIT TIRKEYNo ratings yet

- 5 Nemo Dat Rule PDFDocument9 pages5 Nemo Dat Rule PDFrajragavanNo ratings yet

- IFRS S2sDocument46 pagesIFRS S2sComunicarSe-ArchivoNo ratings yet

- The business environment and start upDocument9 pagesThe business environment and start upPhấn LêNo ratings yet

- Equipment Cost EstimationDocument63 pagesEquipment Cost EstimationMustefa Mohammed Adem100% (1)

- Invoice 50698496Document1 pageInvoice 50698496monicahmuthee22No ratings yet

- Judith Morris ResumeDocument2 pagesJudith Morris Resumeashish ojhaNo ratings yet

- Market Structures - Price DeterminationDocument118 pagesMarket Structures - Price DeterminationJohanna Francis100% (1)

- Business Ethics Governance and Risk 1utHS66BXJalDocument9 pagesBusiness Ethics Governance and Risk 1utHS66BXJalAdityaSinghNo ratings yet

- At CubispaceDocument3 pagesAt CubispaceAratrika BoseNo ratings yet

- HunterDocument10 pagesHuntersuneetaNo ratings yet

- Do It Yourself PDFDocument88 pagesDo It Yourself PDFcoutoNo ratings yet