Professional Documents

Culture Documents

AKD Index Tracker Fund: Fund Manager's Comments

Uploaded by

Ali RazaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AKD Index Tracker Fund: Fund Manager's Comments

Uploaded by

Ali RazaCopyright:

Available Formats

Fund Manager’s Report

May 2020

AKD Index Tracker Fund

Fund Manager’s Comments

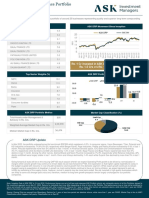

For the month of May’20, the NAV of the AKD Index Tracker Fund (AKDITF) decreased by 0.66% versus the benchmark KSE-100 Index that decreased

by 0.53%. The fiscal year to date return of the AKD Index Tracker Fund (AKDITF) stood at -1.50% versus the benchmark KSE-100 Index returns of 0.09%.

Fund Information Fund Performance: May 2020

Investment Objective: To track the return of the KSE- 2.00%

100 index with up to 85% accuracy, providing investors

with a high quality, in-depth diversification instrument. 1.00%

Fund Type Open-End 0.00%

24-May-…

10-May-…

11-May-…

12-May-…

13-May-…

14-May-…

15-May-…

16-May-…

17-May-…

18-May-…

19-May-…

20-May-…

21-May-…

22-May-…

23-May-…

25-May-…

26-May-…

27-May-…

28-May-…

29-May-…

Category Index Tracker

6-May-20

4-May-20

5-May-20

7-May-20

8-May-20

9-May-20

Risk Profile High -1.00%

Risk of Principal Erosion Principal at high risk -2.00%

Net Assets (PKR) 382,277,302

Change in KSE-100 Index Change in AKDITF NAV/UNIT

NAV (PKR) 10.9587

Benchmark KSE-100 Index

Dealing Days Monday to Friday 365 Since

FYTD MTD 3 Years* 5 Years*

Cut-off Timings 9:00 am to 5:00 pm Days Inception**

Pricing Mechanism Forward Pricing KSE 100 0.09% (0.53%) (5.68%) (32.93%) 2.65 9.09%

Management Fee 0.75% (exceptionally low AKDITF (1.50%) (0.66%) (7.17%) (35.58%) (8.59%) 6.30%

fees for passive FY19 FY18 FY17 FY16 FY15

management) KSE 100 (19.11)% (9.99)% 23.24% 9.84% 16.01%

Sales Load (Front End) 1% AKDITF (20.01)% (11.85)% 20.77% 4.73% 13.20%

Sales Load (Back End) Nil Asset Allocation

Total Expense Ratio 1.39% (% of Total Assets) 31-May-20 30April-20

(Absolute) ++ Equities 96.18% 94.74%

Date of Fund Launch October, 2005 TFCs Nil Nil

Trustee Central Depository Cash 2.77% 4.26%

Company (CDC) Other Assets 1.05% 1.00%

Auditor Deloitte Yousuf Adil Top Ten Equity Holdings (% of Total Assets)

Asset Manager Rating AM3++ by PACRA(8 Feb 20) Engro Corporation Limited 5.91% Pakistan Petroleum Limited 4.00%

Leverage Nil

Fauji Fertilizer Company

4.90% MCB Bank Limited 3.89%

Limited

Fund Manager Hub Power Company

4.86% Lucky Cement Limited 3.80%

Limited

Mr. Ajay Kumar, CFA Oil and Gas Development

4.73% United Bank Limited 3.01%

Investment Committee Members Company Limited

Pakistan Oilfields Limited

Mr. Imran Motiwala Ms. Anum Dhedhi Habib Bank Limited 4.52% 2.63%

Mr. Muhammad Yaqoob, CFA Mr. Ajay Kumar, CFA

Sector Allocation

Mr. Danish Aslam Mr. Muhammad Taha (% of Total Assets) 31-May-2020 30-April-20

Mr. Bilal Shuja Zaidi Commercial Banks 20.39% 21.37%

Fertilizer 14.00% 13.95%

* Cumulative Returns –Since 2006 Oil and Gas Exploration Companies 13.47% 12.49%

** Annualized

++Total Expense Ratio (TER) includes 0.14% representing government levy Cement 8.13% 8.14%

and SECP fee. Power Generation and Distribution Comp 6.26% 6.40%

The Funds Return are computed on NAV to NAV with dividends reinvested – (Excluding Sales Load) Others 37.75% 37.67%

Disclosure of Sindh Workers’ Welfare Fund (SWWF)

"The Scheme has maintained provisions against Sindh Workers' Welfare Fund liability to the tune of Rs. 2.18 million if the same were not made the NAV per unit/return of the Scheme would be higher

by Re. 0.06 or 0.57%. ''

DISCLAIMER: This publication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any fund. All investments in mutual funds are subject to

market risks. Past performance is not necessarily indicative of future results. Please read the Offering Document to understand the investment policies and risks involved.

Performance data does not include the cost incurred directly by an investor in the form of sales loads etc.

MUFAP’s Recommended Format

You might also like

- PageGroup Salary Guide 2023 Switzerland enDocument40 pagesPageGroup Salary Guide 2023 Switzerland enMr StrangerNo ratings yet

- Sample Investment ContractDocument2 pagesSample Investment ContractPrincess Hipolito100% (3)

- Course Outline - Investment Analysis and Portfolio ManagementDocument4 pagesCourse Outline - Investment Analysis and Portfolio ManagementMadihaBhatti100% (1)

- AKD Index Tracker Fund: Fund Manager's CommentsDocument1 pageAKD Index Tracker Fund: Fund Manager's CommentsAli RazaNo ratings yet

- IAC 2-Year Audit ProgrammeDocument1 pageIAC 2-Year Audit ProgrammeSADHEDNo ratings yet

- Poker League 10 JANDocument1 pagePoker League 10 JANmr_hiboyNo ratings yet

- Laporan Kegiatan Ramadhan Siswa SMKN 25 Jakarta Selatan TAHUN AJARAN 2019/2020Document1 pageLaporan Kegiatan Ramadhan Siswa SMKN 25 Jakarta Selatan TAHUN AJARAN 2019/2020Adrian KusumaNo ratings yet

- ICAEW-Part Time v1.3-AG & FARDocument1 pageICAEW-Part Time v1.3-AG & FARgene houNo ratings yet

- Kartu Stock Festive BJM 2024Document1 pageKartu Stock Festive BJM 2024Fadrian NoorNo ratings yet

- Mechanical Engineering Design Ii MEC 532 Final Report: MembersDocument40 pagesMechanical Engineering Design Ii MEC 532 Final Report: Members000No ratings yet

- KASB 2021 Equity StrategyDocument98 pagesKASB 2021 Equity StrategymirzaNo ratings yet

- Periodisation TemplateDocument4 pagesPeriodisation TemplateRishika KirtishaNo ratings yet

- MMSF FS 202304Document2 pagesMMSF FS 202304beddybair98No ratings yet

- Draft Project Schedule (Dates Are Met Up To End of Aug 2020) As On 19 May 2020Document1 pageDraft Project Schedule (Dates Are Met Up To End of Aug 2020) As On 19 May 2020Mary Ann VictoriaNo ratings yet

- Sitrep 12th July 2020 (ML Final)Document3 pagesSitrep 12th July 2020 (ML Final)Nauman ZafarNo ratings yet

- FREE Printable Ramadan ChecklistDocument1 pageFREE Printable Ramadan ChecklistAbubakr MaljeeNo ratings yet

- KMMP Collaboration - Base Timeline WB0.8Document1 pageKMMP Collaboration - Base Timeline WB0.8Luiggi RubiniNo ratings yet

- Fund Information: Fund Manager's CommentsDocument1 pageFund Information: Fund Manager's CommentsAhmed Abbas ZaidiNo ratings yet

- ISO 45001 2018 Internal Audit Programme SampleDocument1 pageISO 45001 2018 Internal Audit Programme SampleAmr EssamNo ratings yet

- Air Transport Outlook Q23Document18 pagesAir Transport Outlook Q23Greg VenanceNo ratings yet

- Sitrep 10th July 2020 (ML)Document3 pagesSitrep 10th July 2020 (ML)Nauman ZafarNo ratings yet

- CronogramaDocument1 pageCronogramafrancisco lopezNo ratings yet

- Evaluating Markets by Motilal OswalDocument54 pagesEvaluating Markets by Motilal OswalSaurabh NyatiNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- Stats Page - 29 June 2023Document1 pageStats Page - 29 June 2023VASANTNo ratings yet

- Failure Mode Department/Area Equipment: Top Contributors ParetoDocument1 pageFailure Mode Department/Area Equipment: Top Contributors ParetoNaresh_GajjarNo ratings yet

- CITP Weekly Report Feb 15'21Document3 pagesCITP Weekly Report Feb 15'21rcpepitobauerNo ratings yet

- India Oil Prices - Research Note - FINALDocument10 pagesIndia Oil Prices - Research Note - FINALBharat NarrativesNo ratings yet

- Simple Time Schedule v0 Rocketsheets - Com - Eyjl7mDocument4 pagesSimple Time Schedule v0 Rocketsheets - Com - Eyjl7mAVNo ratings yet

- GCSE Gantt Chart FoodDocument1 pageGCSE Gantt Chart FoodnatalleNo ratings yet

- Market Openingbell IciciDocument8 pagesMarket Openingbell IciciPrince ANo ratings yet

- Delivery Planner Cpo To Pacific Inter Link Cpo Export: Aicia To PilDocument3 pagesDelivery Planner Cpo To Pacific Inter Link Cpo Export: Aicia To PilKarim BakriNo ratings yet

- Attendance Sheet1Document42 pagesAttendance Sheet1Mohammed Abdul MoiedNo ratings yet

- Coanc 8Document75 pagesCoanc 8Devilrinaldo associatesNo ratings yet

- Daily Lab Test Report (Knitting Lab) - 2022Document2 pagesDaily Lab Test Report (Knitting Lab) - 2022Md. Mamunur RashidNo ratings yet

- NIT Jan'20Document11 pagesNIT Jan'20afnaniqbalNo ratings yet

- Iesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5Document24 pagesIesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5MARLON ROBLES CHAMORRONo ratings yet

- 02 - CTRL UsinasDocument22 pages02 - CTRL UsinasbrendonamorimalvesNo ratings yet

- Iesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5Document24 pagesIesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5MARLON ROBLES CHAMORRONo ratings yet

- Iesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5Document24 pagesIesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5MARLON ROBLES CHAMORRONo ratings yet

- Iesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5Document24 pagesIesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5MARLON ROBLES CHAMORRONo ratings yet

- Iesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5Document24 pagesIesa - Planes de Acción: Compromiso 1 Compromiso 2 Compromiso 3 Compromiso 4 Compromiso 5MARLON ROBLES CHAMORRONo ratings yet

- TAKAFUL IKHLAS March - 2020 - EngDocument6 pagesTAKAFUL IKHLAS March - 2020 - EngEncik ArifNo ratings yet

- 03FMR - March 2021Document1 page03FMR - March 2021Ali RazaNo ratings yet

- Project Schedule: 24-Apr-23 16-May-23Document2 pagesProject Schedule: 24-Apr-23 16-May-23HeyoNo ratings yet

- 20 PT SystemDocument1 page20 PT SystemRaymond OndesimoNo ratings yet

- Timesheet Roto # 16 Feb - 15 Mar 2022Document2 pagesTimesheet Roto # 16 Feb - 15 Mar 2022setianidarwatiNo ratings yet

- Excel Project ManagerDocument30 pagesExcel Project ManagerMohamed LabbeneNo ratings yet

- 2021-02 Monthly Housing Market OutlookDocument29 pages2021-02 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2024 Cpa 510Document5 pages2024 Cpa 510Flores Incapoma Bryan EdgarNo ratings yet

- Micro-Schedule For Khatau Bungalow Repair WorksDocument8 pagesMicro-Schedule For Khatau Bungalow Repair WorksOmkar AdurkarNo ratings yet

- The Coming Collapse of Inflation and How To Benefit From It July 2022Document29 pagesThe Coming Collapse of Inflation and How To Benefit From It July 2022Dinesh RupaniNo ratings yet

- Jadwal Perkuliahan Semester Genap Ta. 2018/2019: Program Studi Kesehatan Hewan Semester 2Document1 pageJadwal Perkuliahan Semester Genap Ta. 2018/2019: Program Studi Kesehatan Hewan Semester 2keswan polbangtan bogorNo ratings yet

- SD New Time Frame - R1Document17 pagesSD New Time Frame - R1hkhxrcts44No ratings yet

- Work Execution Schedule (L4) For DM Water Storage Tank A & BDocument2 pagesWork Execution Schedule (L4) For DM Water Storage Tank A & BMostafizur RahmanNo ratings yet

- Et - Mar 23Document2 pagesEt - Mar 23coureNo ratings yet

- Rajkot Airport - Master Outline ScheduleR0 - 21 Oct 19Document2 pagesRajkot Airport - Master Outline ScheduleR0 - 21 Oct 19Creative GroupNo ratings yet

- Cromwell and Bottom FishesDocument32 pagesCromwell and Bottom FishesCanicani KimNo ratings yet

- Scheme of Studies For Class VIII (Plain Station)Document30 pagesScheme of Studies For Class VIII (Plain Station)Sappurd Ali SaqibNo ratings yet

- Blood Pressure RecordDocument1 pageBlood Pressure RecordatiqNo ratings yet

- Blood Pressure RecordDocument1 pageBlood Pressure RecordatiqNo ratings yet

- Vale Ioweek RN - FinalDocument21 pagesVale Ioweek RN - FinalKe Lun ChuaNo ratings yet

- Read MeDocument2 pagesRead MeAli RazaNo ratings yet

- RAZAALISYEDMRx2 - The Travel ItineraryDocument2 pagesRAZAALISYEDMRx2 - The Travel ItineraryAli Raza100% (1)

- FMR Faaf SepDocument1 pageFMR Faaf SepAli RazaNo ratings yet

- NBP Stock Fund (NSF) : MONTHLY REPORT (MUFAP's Recommended Format) February 2021 Unit Price (28/02/2021) : Rs.16.1513Document1 pageNBP Stock Fund (NSF) : MONTHLY REPORT (MUFAP's Recommended Format) February 2021 Unit Price (28/02/2021) : Rs.16.1513Ali RazaNo ratings yet

- NBP Government Securities Savings Fund (NGSSF)Document1 pageNBP Government Securities Savings Fund (NGSSF)Ali RazaNo ratings yet

- Dear Customer!Document1 pageDear Customer!Ali RazaNo ratings yet

- NAFA Islamic Opportunity Fund January 2008Document1 pageNAFA Islamic Opportunity Fund January 2008Ali RazaNo ratings yet

- ReadMe AE DocumentationDocument5 pagesReadMe AE DocumentationAli RazaNo ratings yet

- ReadMe PR DocumentationDocument6 pagesReadMe PR DocumentationAli RazaNo ratings yet

- ReadMe PR DocumentationDocument6 pagesReadMe PR DocumentationAli RazaNo ratings yet

- Benchmark 022021Document1 pageBenchmark 022021Ali RazaNo ratings yet

- K-Electric - ICP-11: Rating ReportDocument6 pagesK-Electric - ICP-11: Rating ReportAli RazaNo ratings yet

- FMR February 2021 ShariahDocument9 pagesFMR February 2021 ShariahAli RazaNo ratings yet

- SFMRDocument6 pagesSFMRAli RazaNo ratings yet

- Dynamic: Youtube Subscribe ButtonDocument10 pagesDynamic: Youtube Subscribe ButtonAli RazaNo ratings yet

- 3.instructions For Installing A MOGRT Template in Premiere ProDocument1 page3.instructions For Installing A MOGRT Template in Premiere ProAli RazaNo ratings yet

- Lakson Group: We Manage Your Money, As We Manage Our OwnDocument16 pagesLakson Group: We Manage Your Money, As We Manage Our OwnAli RazaNo ratings yet

- ReadMe AE DocumentationDocument5 pagesReadMe AE DocumentationAli RazaNo ratings yet

- List of Branch Office For IT Division-22!4!2021Document51 pagesList of Branch Office For IT Division-22!4!2021Ali RazaNo ratings yet

- BHR v2 1-Muller Edit2Document7 pagesBHR v2 1-Muller Edit2Ali RazaNo ratings yet

- AfB1 Tutorial Questions For Week 5Document4 pagesAfB1 Tutorial Questions For Week 5zhaok0610No ratings yet

- 09-Module 9Document22 pages09-Module 9lemon esquitieNo ratings yet

- Axis Smallcap FundDocument1 pageAxis Smallcap FundManoj JainNo ratings yet

- CFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)Document39 pagesCFA Investment Foundations - Module 1 (CFA Institute) (Z-Library)gmofneweraNo ratings yet

- Hedge Funds: Investcorp Bank BSCDocument22 pagesHedge Funds: Investcorp Bank BSCMatthias_Link_8937No ratings yet

- Nav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument9 pagesNav Details - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsHariSharanPanjwaniNo ratings yet

- BiasesDocument3 pagesBiasesHEYNo ratings yet

- J.P. Morgan Asset Management Global Liquidity Investment Survey 2011Document40 pagesJ.P. Morgan Asset Management Global Liquidity Investment Survey 2011alphathesisNo ratings yet

- M.ComDocument22 pagesM.ComMd JunedNo ratings yet

- Mutual FundDocument27 pagesMutual FundAmar ChavanNo ratings yet

- Equalisation On Investment FundsDocument10 pagesEqualisation On Investment FundsWilling ZvirevoNo ratings yet

- Chap 004Document24 pagesChap 004Hiep LuuNo ratings yet

- Brochure - Columbia - Private - Equity - 25 - August - 2020 - V10 2Document11 pagesBrochure - Columbia - Private - Equity - 25 - August - 2020 - V10 2sam_schwartz_7No ratings yet

- Andrea Unger OTS2018 Presentation SlidesDocument58 pagesAndrea Unger OTS2018 Presentation Slidesshree bNo ratings yet

- Mutual Funds: A Beginner's ModuleDocument2 pagesMutual Funds: A Beginner's Moduledavidd121No ratings yet

- Syllabus McomDocument16 pagesSyllabus McomRadhey JangidNo ratings yet

- 1Document68 pages1Ujwal JaiswalNo ratings yet

- Philequity Dividend Yield FundDocument1 pagePhilequity Dividend Yield Fundjovz castillonesNo ratings yet

- Nism 5 A - Mutual Fund Exam - Practice Test 1Document24 pagesNism 5 A - Mutual Fund Exam - Practice Test 1Aditi Sawant100% (5)

- Fundamental and Technical Analysis of Portfolio Management.Document17 pagesFundamental and Technical Analysis of Portfolio Management.Deven RathodNo ratings yet

- Board of Studies The Institute of Chartered Accountants of IndiaDocument16 pagesBoard of Studies The Institute of Chartered Accountants of IndiaRakeshNo ratings yet

- Ethics in FinanceDocument5 pagesEthics in FinanceArpit KumarNo ratings yet

- Alternative InvestmentsDocument62 pagesAlternative Investmentsdimplle parmaniNo ratings yet

- 4real Estate Investor ListDocument8 pages4real Estate Investor ListelmoustaphaelNo ratings yet

- Security Analysis and Portfolio Management (SAPM) E-Lecture Notes (For MBA) IMS, MGKVP, Session 2020Document17 pagesSecurity Analysis and Portfolio Management (SAPM) E-Lecture Notes (For MBA) IMS, MGKVP, Session 2020Sukanya ShridharNo ratings yet

- Wealth Management: Faculty: Mr. Aneesh DayDocument29 pagesWealth Management: Faculty: Mr. Aneesh DayHIMANSHU DUTTANo ratings yet