Professional Documents

Culture Documents

Reference: I. Introduction To The National Flood Insurance Program

Uploaded by

Cindy WijayaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reference: I. Introduction To The National Flood Insurance Program

Uploaded by

Cindy WijayaCopyright:

Available Formats

TOC NEXT SECTION

REFERENCE

I. INTRODUCTION TO THE NATIONAL • Encourage state and local governments to

FLOOD INSURANCE PROGRAM use wisely the lands under their jurisdictions

by considering the hazard of flood when

The National Flood Insurance Program (NFIP) rendering decisions on the future use of

was established by the National Flood Insurance such land, thus minimizing damage caused

Act of 1968. The Act was in response to by flooding.

Congress finding that:

In 1979, the Federal Emergency Management

• Flooding disasters required unforeseen Agency (FEMA) was established as a single point

disaster relief and placed an increased of contact within the federal government for

burden on the nation's resources. emergency management activities. The Federal

Insurance Administration (FIA), which directly

• The installation of flood preventive and administered the NFIP, became a part of FEMA,

protective measures and other public having been originally a part of the Department of

programs designed to reduce losses caused Housing and Urban Development from 1968 to

by flood damage had not been sufficient to 1979. In 2000, FIA and FEMA’s Mitigation

adequately protect against the growing Directorate were consolidated into the Federal

exposure to flood losses as a matter of Insurance and Mitigation Administration (FIMA).

national policy. A reasonable method of

slowing the risk of flood losses would be The NFIP is a program in which communities

through a program of flood insurance which formally agree, as evidenced by their adoption of

could complement and encourage codes and ordinances, to regulate the use of their

preventive and protective measures. flood-prone lands. In return, FIMA makes flood

insurance coverage available on buildings and

• Many factors made it uneconomical for the their contents throughout the community. FIMA

private insurance industry carriers to make has traditionally identified these flood hazard

flood insurance available to those in need of areas on maps, which are provided to

such protection on reasonable terms and communities for carrying out their responsibilities.

conditions. The maps are also used by insurance producers

to determine rates and by lenders to determine

• A program of flood insurance with large purchase requirements.

scale participation of the federal government

and the maximum extent practicable by the II. THE WRITE YOUR OWN PROGRAM

private industry was feasible and could be

initiated. The Write Your Own (WYO) Program, begun in

1983, is a cooperative undertaking of the

Congress stated that the purpose in passing the insurance industry and the Federal Insurance and

Act was to: Mitigation Administration. The WYO Program

operates within the context of the NFIP and is

• Authorize a flood insurance program which, subject to its rules and regulations. WYO allows

over a period of time, could be made participating property and casualty insurance

available on a nationwide basis through the companies to write and service federal flood

cooperative effort of the federal government insurance in their own names. The companies

and the private insurance industry. receive an expense allowance for policies written

and claims processed while the federal

• Provide flexibility in the program so that such government retains responsibility for

flood insurance would be based on workable underwriting losses. Individual WYO Companies

methods of pooling risks, minimizing costs, may, to the extent possible, and consistent with

and distributing burdens equitably among Program rules and regulations, conform their flood

the general public and those who would be business to their normal business practices for

protected by flood insurance. other lines of insurance. Many producers have

elected to move or place their flood policies with

one or more of the WYO Companies they

represent.

REF 1 May 1, 2003

In brief, the producer has the following options: (WYO) companies should direct questions and

requests for technical assistance to the WYO

• Place all business with one or more WYO Company itself. If the WYO Company needs

Companies; technical assistance, then it will contact its

Program Coordinator at the NFIP’s Bureau and

• Place business with both the NFIP directly Statistical Agent. If the Program Coordinator, with

and with one or more WYO Companies; or the assistance of technical experts at the Bureau,

cannot provide the needed assistance, the Bureau

• Continue to place all flood insurance directly will direct the inquiry to the Federal Insurance and

with the NFIP (referred to as "NFIP direct Mitigation Administration for an answer.

business").

B. NFIP Servicing Agent (NFIP Direct)

The goals of the Program are to increase the

policy base, improve services, and involve the Agents and adjusters servicing flood insurance

insurance companies. business through the NFIP Servicing Agent

should contact the NFIP Servicing Agent for the

III. TECHNICAL ASSISTANCE answer to technical questions or the resolution of

technical problems connected with the NFIP. If

In order to provide the most efficient service to the NFIP Servicing Agent cannot provide the

policyholders, follow these procedures when needed assistance, it will contact the Federal

requesting technical assistance in connection with Insurance and Mitigation Administration for an

the sale and servicing of Standard Flood answer.

Insurance Policies. It is essential that all parties—

WYO companies, the National Flood Insurance C. Special Direct Facility

Program’s Bureau and Statistical Agent, the NFIP

Servicing Agent, insurance agents and Agents and adjusters serving flood insurance

adjusters—comply. policies identified as targeted repetitive loss

properties should contact the Special Direct

A. WYO Companies Facility established by the NFIP Servicing Agent

for technical assistance. See the Repetitive Loss

Agents and adjusters servicing flood insurance section of this manual for more information.

business through one of the Write Your Own

REF 2 May 1, 2003

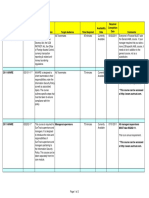

DIRECT PROGRAM REFERENCE AND RESOURCE GUIDE

Agents/producers writing with the Direct Program should send all correspondence to the addresses listed

below. Write Your Own company agents should call their company’s flood service desk first for information.

CORRESPONDENCE TYPE MAILING ADDRESS TELEPHONE

NUMBER

Applications (not submit for rate) NFIP Servicing Agent

1-800-638-6620

Endorsements P.O. Box 6464

Cancellations Rockville, MD 20849-6464

Underpayment Letters

Scheduled Building Applications NFIP Servicing Agent

1-800-638-6620

Submit-for-Rate Applications P.O. Box 6466

(See pages RATE 23-24) Rockville, MD 20849-6466

Underwriting Inquiries and Issues

Renewal Premiums (with premium NFIP Servicing Agent

1-800-638-6620

payments) P.O. Box 105656

Expiration Notice (with premium Atlanta, GA 30348

payments)

Notices of Loss* NFIP Servicing Agent

1-800-767-4341

Written Claims Inquiries P.O. Box 6465

Rockville, MD 20849-6465

*(Fax 1-800-767-5574)

Targeted Repetitive Loss Properties Special Direct Facility

1-800-638-6620

Special Direct Facility P.O. Box 6465

Rockville, MD 20849-6465

All other inquiries (without premium NFIP Servicing Agent

1-800-638-6620

payments) P.O. Box 6468

Rockville, MD 20849-6468

REF 3 May 1, 2003

ADDITIONAL REFERENCES AND RESOURCES

MAILING/W EBSITE TELEPHONE AND FAX

TOPIC

ADDRESSES NUMBERS

CBRS Areas - Map Panel Listing www.fema.gov/nfip N/A

Community Status Book FEMA Map Service Center 1-800-358-9616

P.O. Box 1038 Fax: 1-800-358-9620

Jessup, MD 20794-1038

www.fema.gov/nfip

NFIP Marketing & Advertising www.fema.gov/nfip N/A

Update (monthly)

Flood Insurance Manual & FEMA Map Service Center 1-800-358-9616

Producer’s Edition P.O. Box 1038 Fax: 1-800-358-9620

Jessup, MD 20794-1038

www.fema.gov/nfip

Flood Zone Determination Companies www.fema.gov/nfip N/A

(list)

Lead Referral Program www.fema.gov/nfip 1-800-720-1093

Sign-up Form

Maps and Q3 Data FEMA Map Service Center 1-800-358-9616

P.O. Box 1038 Fax: 1-800-358-9620

Jessup, MD 20794-1038

http://msc.fema.gov

Rating Software Information (list) www.fema.gov/nfip N/A

Supply Order Forms FEMA Distribution Center 1-800-480-2520

Claims & Underwriting P.O. Box 2012 Fax: 1-301-362-5335

Public Awareness Materials Jessup, MD 20794-2012

Training on Flood Insurance www.fema.gov/nfip Your NFIP Regional Office

(see list on following

pages)

Write Your Own (WYO) Companies www.fema.gov/nfip 1-800-480-2520

(list) Item #073 Choice Is Yours

Telecommunication Device for the Deaf (TDD) 1-800-447-9487

REF 4 May 1, 2003

NATIONAL FLOOD INSURANCE PROGRAM

BUREAU AND STATISTICAL AGENT

REGIONAL OFFICES

The National Flood Insurance Program's Bureau and Statistical Agent operates 10 regional offices within the

continental United States.

The primary function of the regional office is lender and producer training through workshops and individual

visits. Other services provided by the regional office are similar to those provided by an insurance company

field office.

The regional offices do not handle processing nor do they have policy files at their locations;

however, the regional staff may be able to assist with problems and answer questions of a general nature.

NFIP BUREAU AND NFIP BUREAU AND TERRITORY

STATISTICAL AGENT STATISTICAL AGENT

REGIONAL OFFICES REGIONAL STAFF

Region I Thomas Gann Connecticut, Maine, Massachusetts,

Suite 200

Manager New Hampshire, Rhode Island,

140 Wood Road

Vermont

Braintree, MA 02184

(781) 848-1908

(781) 356-4142 (fax)

Region II Melanie Graham New Jersey, New York

Suite 600 Manager

33 Wood Avenue, South

Iselin, NJ 08830

(732) 603-3875

(732) 321-6562 (fax)

Region III Richard Sobota, CPCU Delaware, District of Columbia,

Building T, Suite 13 Manager Maryland, Pennsylvania, Virginia,

1930 East Marlton Pike West Virginia

Cherry Hill, NJ 08003-4219

(856) 489-4003

(856) 751-2817 (fax)

Region IV Roger Widdifield Alabama, Georgia, Kentucky,

Suite 200

Manager Mississippi, North Carolina, South

1532 Dunwoody Village Parkway

Carolina, Tennessee

Dunwoody, GA 30338

(770) 396-9117

(770) 396-7730 (fax)

Region IV – Tampa Office Lynne Magel Florida

Suite 300

Program Specialist

8875 Hidden River Parkway

Tampa, FL 33637

(813) 975-7451

(813) 975-7471 (fax)

REF 5 May 1, 2003

NFIP BUREAU AND NFIP BUREAU AND TERRITORY

STATISTICAL AGENT STATISTICAL AGENT

REGIONAL OFFICES REGIONAL STAFF

Region V

Richard Slevin Illinois, Indiana, Michigan, Minnesota,

Suite 209

Manager Ohio, Wisconsin

1111 E. Warrenville Road

Naperville, IL 60563

(630) 577-1407

(630) 577-1437 (fax)

Region VI

Diana Herrera Arkansas, Louisiana, New Mexico,

Suite 108

Manager Oklahoma, Texas. Interim basis:

15835 Park Ten Place

Puerto Rico, Virgin Islands

Houston, TX 77084

(281) 829-6880

(281) 829-6879 (fax)

Region VII

Dean Ownby, CPCU Iowa, Kansas, Missouri, Nebraska

The Courtyard

Manager

Suite 13-B

601 North Mur-Len Road

Olathe, KS 66062-5445

(913) 780-4238 or -4247

(913) 780-4368 (fax)

Region VIII

Norman Ashford, CPCU Colorado, Montana, North Dakota,

Suite 300

Manager South Dakota, Utah, Wyoming

2801 Youngfield Street

Golden, CO 80401

(303) 275-3475

(303) 275-3471 (fax)

Region IX

Edie Lohmann Arizona, California, Guam, Hawaii,

Suite 103

Manager Nevada

1532 Eureka Road

Roseville, CA 95661

(916) 780-7889

(916) 780-7905 (fax)

Region X

Leslie Melville Alaska, Idaho, Oregon, Washington

Suite 108

Manager

19125 Northcreek Parkway

Bothell, WA 98011

(425) 488-5820

(425) 488-5011 (fax)

REF 6 May 1, 2003

PAPERWORK BURDEN DISCLOSURE NOTICE

GENERAL--This information is provided pursuant to Public Law 96-511 (Paperwork Reduction Act of 1980,

as amended), dated December 11, 1980, to allow the public to participate more fully and meaningfully in the

Federal paperwork review process.

AUTHORITY--Public Law 96-511, amended; 44 U.S.C. 3507; and 5 CFR 1320

DISCLOSURE OF BURDEN--Public reporting burden for the collection of information entitled "National Flood

Insurance Program Policy Forms," is estimated to average 10 minutes per response, excluding the V-Zone

Risk Factor Rating Form. The estimated burden includes the time for reviewing instructions, searching

existing data sources, gathering and maintaining the data needed, and completing and reviewing the forms.

Reporting burden for these forms, as part of this collection, is listed below. Send comments regarding the

burden estimate or any aspect of the collection, including suggestions for reducing the burden, to: Information

Collections Management, Federal Emergency Management Agency, 500 C Street, S.W., Washington, D.C.

20472; and to the Office of Management and Budget, Paperwork Reduction Project (3067-0022),

Washington, D.C. 20503.

PRIVACY ACT--The information requested is necessary to process these forms for flood insurance. The

authority to collect the information is Title 42, U.S. Code, Section 4001 to 4028. Furnishing the information is

voluntary. It will not be disclosed outside the Federal Emergency Management Agency except to the

servicing office acting as the government's fiscal agent, to routine users, to agents, and mortgagees named

on policies.

FEMA FORM NUMBER TITLE BURDEN HOURS

81-16 Application for Flood Insurance (New)

15.00 Minutes

81-16 Application for Flood Insurance (Renewal)

7.50 Minutes

81-17 Cancellation/Nullification Request

7.50 Minutes

81-18 General Change Endorsement (w/Premium)

9.00 Minutes

81-18 General Change Endorsement (w/o Premium)

9.00 Minutes

81-25 V-Zone Risk Factor Rating

6.00 Hours

81-67 Preferred Risk Application

12.00 Minutes

REF 7 May 1, 2003

TOC NEXT SECTION

You might also like

- Taxation of InsuranceDocument351 pagesTaxation of InsuranceJerwin DaveNo ratings yet

- TSC Wealth DeclarationDocument4 pagesTSC Wealth DeclarationMutai Kiprotich100% (2)

- Dry Cleaning Home Delivery Business PlanDocument39 pagesDry Cleaning Home Delivery Business PlanDivya AggarwalNo ratings yet

- BS FormatDocument12 pagesBS Formatsudershan90% (1)

- Introduction To The NFIP: 1. What Is The National Flood Insurance Program (NFIP) ?Document64 pagesIntroduction To The NFIP: 1. What Is The National Flood Insurance Program (NFIP) ?Ivan BodnaryukNo ratings yet

- V. Lending - Flood Disaster Protection Flood Disaster Protection ActDocument36 pagesV. Lending - Flood Disaster Protection Flood Disaster Protection ActSom Dutt VyasNo ratings yet

- Oxford University Press Agricultural & Applied Economics AssociationDocument11 pagesOxford University Press Agricultural & Applied Economics Associationmichael17ph2003No ratings yet

- Key Principles For Climate-Related Risk InsuranceDocument24 pagesKey Principles For Climate-Related Risk InsuranceCenter for American ProgressNo ratings yet

- Haiti Micro InsuranceDocument2 pagesHaiti Micro InsurancedoubleoddNo ratings yet

- East West Insurance Company2Document16 pagesEast West Insurance Company2Faraz RiazNo ratings yet

- Summary Report On NFIP Holly DavisDocument11 pagesSummary Report On NFIP Holly Davishadavis1979No ratings yet

- Ghana: National Progress Report On The Implementation of The Hyogo Framework For ActionDocument17 pagesGhana: National Progress Report On The Implementation of The Hyogo Framework For ActionCele Adu-wusuNo ratings yet

- Risk Transfer Mechanisms - Towards Policy Innovations FinDocument18 pagesRisk Transfer Mechanisms - Towards Policy Innovations FinDennis Dela TorreNo ratings yet

- Statement Fugate FemaDocument8 pagesStatement Fugate FemaPeter J. MahonNo ratings yet

- Environmental and Coronavirus Coverage Considerations COVIDDocument2 pagesEnvironmental and Coronavirus Coverage Considerations COVIDKomkep MHJSNo ratings yet

- Ucsp Reporting InstutionsDocument4 pagesUcsp Reporting InstutionsALAINE MARIE MENDOZANo ratings yet

- HyogoDocument3 pagesHyogoHaidelyn CapistranoNo ratings yet

- The Role of International, Regional & Local Reinsurers in The MarketDocument3 pagesThe Role of International, Regional & Local Reinsurers in The Marketashok karkiNo ratings yet

- Lazear20070411Document6 pagesLazear20070411losangelesNo ratings yet

- Chapter 7 - Hazard MitigationDocument28 pagesChapter 7 - Hazard MitigationCristine EchaveNo ratings yet

- Olicy: Financing Postdisaster Reconstruction in The PhilippinesDocument6 pagesOlicy: Financing Postdisaster Reconstruction in The PhilippinesJohn Rameses BaroniaNo ratings yet

- Consumer ProtectionDocument8 pagesConsumer ProtectiondonNo ratings yet

- Risk and Resilience: Derin Ural College of Engineering University of MiamiDocument42 pagesRisk and Resilience: Derin Ural College of Engineering University of MiamiLuiz Felipe Disconzi LopesNo ratings yet

- 17-12-2021 79.varsha Bima - Scheme - Doc Gen132Document11 pages17-12-2021 79.varsha Bima - Scheme - Doc Gen132tusharNo ratings yet

- Ministry of Agric Farmers AND Ulture Welfare: 1.1. PM Fasal Bima YojanaDocument13 pagesMinistry of Agric Farmers AND Ulture Welfare: 1.1. PM Fasal Bima Yojanamadhuja mukhopadhyayNo ratings yet

- The Nigeria Deposit Insurance Corporation: The Journey So Far BYDocument26 pagesThe Nigeria Deposit Insurance Corporation: The Journey So Far BYrapidshonuffNo ratings yet

- InsuredDocument2 pagesInsuredmonica zapataNo ratings yet

- IIB3Document1 pageIIB3Ivan BodnaryukNo ratings yet

- Crop Insurance in The PhilippinesDocument15 pagesCrop Insurance in The PhilippinesSherylDinglasanFenolNo ratings yet

- Parametric Insurance For DisastersDocument6 pagesParametric Insurance For DisastersMohammed Touhami GOUASMINo ratings yet

- Activities of Insurance Companies in Libya DuringDocument3 pagesActivities of Insurance Companies in Libya Duringعادل الحاتميNo ratings yet

- Climatewise Principles Report 2014: Introduction - Background of Aviva'S BusinessDocument12 pagesClimatewise Principles Report 2014: Introduction - Background of Aviva'S BusinesssaxobobNo ratings yet

- BCCM - Session 6 - Power PointDocument12 pagesBCCM - Session 6 - Power PointPauloNo ratings yet

- Covid19 Evolving Insurance and RM Implications AsiaDocument18 pagesCovid19 Evolving Insurance and RM Implications AsiaLê HiếuNo ratings yet

- 5.spotlight OnDocument4 pages5.spotlight Onihsan nawawiNo ratings yet

- National Flood Legislation For GhanaDocument5 pagesNational Flood Legislation For GhanaCephas EgbefomeNo ratings yet

- FloodInsurance CDocument12 pagesFloodInsurance CEdlyn Jade TagulaoNo ratings yet

- United Nations: Plan of Action OnDocument16 pagesUnited Nations: Plan of Action Oneshu1112No ratings yet

- 2020 Hurricane Pandemic PlanDocument59 pages2020 Hurricane Pandemic Planepraetorian100% (2)

- FEMA ReportDocument8 pagesFEMA ReportMatthew PapaycikNo ratings yet

- Business Interruption Insurance Notes-Final 2023Document12 pagesBusiness Interruption Insurance Notes-Final 2023tshililo mbengeniNo ratings yet

- Prospects of Marine Insurance Industry in NigeriaDocument7 pagesProspects of Marine Insurance Industry in NigeriaDubem EnarunaNo ratings yet

- Yomi BrainDocument63 pagesYomi BrainYomi BrainNo ratings yet

- Agricultural Credit & Crop InsuranceDocument20 pagesAgricultural Credit & Crop InsuranceRupesh KandurwarNo ratings yet

- Joint Memorandum Circular No. 2017-1 Dated June 30, 2017 LDRRMFDocument7 pagesJoint Memorandum Circular No. 2017-1 Dated June 30, 2017 LDRRMFLala LanibaNo ratings yet

- The Roles & Responsibilities of & Guidlines For Govt. DeptsDocument69 pagesThe Roles & Responsibilities of & Guidlines For Govt. DeptsManoj RamanNo ratings yet

- Impacts of Claim Settlements On Profitability in The Nigerian Insurance IndustryDocument63 pagesImpacts of Claim Settlements On Profitability in The Nigerian Insurance IndustrySinmiloluwa S.No ratings yet

- Task Force On Use of Technology For Agriculture Insurance Sub Group - 5 - Livestock and AquacultureDocument15 pagesTask Force On Use of Technology For Agriculture Insurance Sub Group - 5 - Livestock and AquacultureSahil Affriya YadavNo ratings yet

- UNDRR Resilience of SMEs ReportDocument68 pagesUNDRR Resilience of SMEs ReportCristian RamírezNo ratings yet

- The Role of INSURANCEDocument22 pagesThe Role of INSURANCEJosephine CepedaNo ratings yet

- REWG Flood RiskDocument72 pagesREWG Flood RiskShubham MehtaNo ratings yet

- Policy Brief Natural Disasters - ENDocument6 pagesPolicy Brief Natural Disasters - ENthinh_41No ratings yet

- PRRRR OoooDocument13 pagesPRRRR OoooFranoli MathewNo ratings yet

- Pradhan Mantri Fasal Bima Yojana (Pmfby)Document17 pagesPradhan Mantri Fasal Bima Yojana (Pmfby)Deep Narayan MukhopadhyayNo ratings yet

- Pradhan Mantri Fasal Bima Yojana (Pmfby) : 1. ObjectivesDocument40 pagesPradhan Mantri Fasal Bima Yojana (Pmfby) : 1. ObjectivesAnimesh TiwariNo ratings yet

- Chapter One: 1.1 Background of StudyDocument63 pagesChapter One: 1.1 Background of StudyYomi BrainNo ratings yet

- 02A Lesson Proper For Week 19Document4 pages02A Lesson Proper For Week 19Mohammad Aanzahri MasongNo ratings yet

- Disaster-Specific MOUDocument12 pagesDisaster-Specific MOUPhil MirandoNo ratings yet

- Catastrophe EconomicsDocument22 pagesCatastrophe EconomicsGuillermo Martinez JNo ratings yet

- Protocol For EWS On Thunderstorm and LightingDocument12 pagesProtocol For EWS On Thunderstorm and Lightingdakshraj jadejaNo ratings yet

- 16 A National Injury Insurance Scheme: Key PointsDocument43 pages16 A National Injury Insurance Scheme: Key PointsNuan LinNo ratings yet

- Assessing the Enabling Environment for Disaster Risk Financing: A Country Diagnostics Tool KitFrom EverandAssessing the Enabling Environment for Disaster Risk Financing: A Country Diagnostics Tool KitNo ratings yet

- Application: I. Use of The FormDocument10 pagesApplication: I. Use of The FormCindy WijayaNo ratings yet

- 03 General RulesDocument12 pages03 General RulesCindy WijayaNo ratings yet

- 01 Table of ContentsDocument16 pages01 Table of ContentsCindy WijayaNo ratings yet

- Federal Emergency Management Agency: Memorandum ToDocument2 pagesFederal Emergency Management Agency: Memorandum ToCindy WijayaNo ratings yet

- Take Home Activity 3Document6 pagesTake Home Activity 3Justine CruzNo ratings yet

- Uco BankDocument9 pagesUco BankPuja Sahay0% (1)

- Report On Private BankDocument72 pagesReport On Private BankNajmul TuhinNo ratings yet

- Kamal Sarkar: Academic QualificationsDocument1 pageKamal Sarkar: Academic QualificationsKing SarkarNo ratings yet

- Logistical Challenges of Warehousing and TransportingDocument5 pagesLogistical Challenges of Warehousing and Transportingiamcheryl2098No ratings yet

- Ghana Investment Promotion Centre (Gipc) Act 865Document19 pagesGhana Investment Promotion Centre (Gipc) Act 865JeffreyNo ratings yet

- Aptitude Part ThreeDocument3 pagesAptitude Part ThreeAddisu Zeleke100% (1)

- Sourin Mukherjee (PG-10-084)Document17 pagesSourin Mukherjee (PG-10-084)ppoooopopopooopopNo ratings yet

- Advanced Audit and Assurance: Acca AaaDocument4 pagesAdvanced Audit and Assurance: Acca AaaZainabNo ratings yet

- Module 1 Capital and Cost EstimationDocument39 pagesModule 1 Capital and Cost EstimationYozora夜空No ratings yet

- Service & Rate GUIDE 2020: DHL ExpressDocument23 pagesService & Rate GUIDE 2020: DHL ExpressSuiro TeasNo ratings yet

- CMA Inter GR I (Cost Accounting) TheoryDocument25 pagesCMA Inter GR I (Cost Accounting) TheoryManav JainNo ratings yet

- The Kingsmen IIM B VFDocument19 pagesThe Kingsmen IIM B VFSupriya MurdiaNo ratings yet

- Portfolio Theory and The Capital Asset Pricing Model: Answers To Problem SetsDocument18 pagesPortfolio Theory and The Capital Asset Pricing Model: Answers To Problem SetsShyamal VermaNo ratings yet

- MRP and SchedulingDocument128 pagesMRP and SchedulingHinata UzumakiNo ratings yet

- Finance Compliance Training Calendar - Current v1Document2 pagesFinance Compliance Training Calendar - Current v1shilpan9166No ratings yet

- Ethiopia Customs Guide v3Document160 pagesEthiopia Customs Guide v3Sarah سارةNo ratings yet

- Chapter 7 Solved Booklet Page 72 and 83Document3 pagesChapter 7 Solved Booklet Page 72 and 83Rumana AliNo ratings yet

- Tax3703 2Document61 pagesTax3703 2mariechen13koopmanNo ratings yet

- IDCloudHost - Invoice #158341 PDFDocument2 pagesIDCloudHost - Invoice #158341 PDFQorthonyNo ratings yet

- Quiz 1Document8 pagesQuiz 1Kurt dela TorreNo ratings yet

- Adjusting Entries FR UTB Fill in The Blanks N Effects of OmissionsDocument31 pagesAdjusting Entries FR UTB Fill in The Blanks N Effects of Omissionsjadetablan30No ratings yet

- Treston. Industrial Furniture and Workstations (En)Document204 pagesTreston. Industrial Furniture and Workstations (En)gigel1980No ratings yet

- Filipino EngineersDocument5 pagesFilipino EngineersClarence PascualNo ratings yet

- Can Fin Homes LTD., Branch Address CIN No. L85110KA1987PLC008699Document2 pagesCan Fin Homes LTD., Branch Address CIN No. L85110KA1987PLC008699swaroop24x7No ratings yet

- Limni CoDocument3 pagesLimni CoDavid Jung ThapaNo ratings yet

- A Study On Profitability Analysis ProjectDocument72 pagesA Study On Profitability Analysis Projectharshith rajuNo ratings yet