Professional Documents

Culture Documents

Years 0 1 2 3 4 5 6 7 8 Cash Flows - $550,000 $89,000 $89,000 $89,000 $95,000 $95,000 $95,000 $105,000 $105,000

Uploaded by

Allen GasparOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Years 0 1 2 3 4 5 6 7 8 Cash Flows - $550,000 $89,000 $89,000 $89,000 $95,000 $95,000 $95,000 $105,000 $105,000

Uploaded by

Allen GasparCopyright:

Available Formats

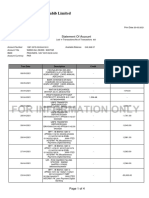

Problem 1

Timeline

Years 0 1 2 3 4 5 6 7 8

Cash Flows -$550,000 $89,000 $89,000 $89,000 $95,000 $95,000 $95,000 $105,000 $105,000

Calculation

(a)(b)(c)(d) IRR: 7.61%

Year 3% 4% 8% 9%

(1) NPV @ 3%: $115,924.10 0 1.000 ### ### ###

(2) NPV @ 4%: $87,866.30 1 0.971 0.96 0.93 0.92

(3) NPV @ 8%: -$8,294.29 2 0.943 0.93 0.86 0.84

(4) NPV @ 9%: -$28,890.95 3 0.915 0.89 0.79 0.77

4 0.888 0.86 0.74 0.71

(1) Required Return = 3%; Accept the project since IRR > 3% and NPV > 0 5 0.863 0.82 0.68 ###

(2) Required Return = 4%; Accept the project since IRR > 4% and NPV > 0 6 0.837 0.79 0.63 0.6

(3) Required Return = 8%; Reject the project since IRR < 8% and NPV < 0 7 0.813 0.76 0.58 0.55

(4) Required Return = 9%; Reject the project since IRR < 9% and NPV < 0 8 0.789 0.73 0.54 0.5

NPV Table

Rate of Return NPV

3% $115,924.10

4% $87,866.30

8% -$8,294.29

9% -$28,890.95

NPV

140000

120000 115924.097333075

100000

Net Present Values ($)

87866.2971029654

80000

60000

40000

20000

0 -8294.28947194281

0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.1

-20000 -28890.9468498016

-40000

Required Rates of return (%)

You might also like

- PC Ch. 11 Techniques of Capital BudgetingDocument22 pagesPC Ch. 11 Techniques of Capital BudgetingVinod Mathews100% (2)

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- GBA5204 Homework 4Document4 pagesGBA5204 Homework 4Allen GasparNo ratings yet

- Book1 (AutoRecovered)Document5 pagesBook1 (AutoRecovered)Tayba AwanNo ratings yet

- Engg. Economics ProjectDocument13 pagesEngg. Economics ProjectkawtharNo ratings yet

- Which Project Should You Accept and Why?: Chart TitleDocument7 pagesWhich Project Should You Accept and Why?: Chart Titlesohinidas91No ratings yet

- Cumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowDocument173 pagesCumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowAditi OholNo ratings yet

- Discount Rate 10% Year Cash Flow 1 $100.00 2 $200.00 3 $300.00 4 $400.00 5 $500.00Document13 pagesDiscount Rate 10% Year Cash Flow 1 $100.00 2 $200.00 3 $300.00 4 $400.00 5 $500.00Futuresow support zone BangladeshNo ratings yet

- Chapter 6 Invetsment ExercisesDocument14 pagesChapter 6 Invetsment ExercisesAntonio Jose DuarteNo ratings yet

- Assignment 10 SolutionsDocument8 pagesAssignment 10 SolutionsZohaib MalikNo ratings yet

- 660 Final Assignment M-1Document16 pages660 Final Assignment M-1Maruf ChowdhuryNo ratings yet

- First Name Last Name ABC Analysis EOQ Reorder Point & Safety StockDocument9 pagesFirst Name Last Name ABC Analysis EOQ Reorder Point & Safety StockNATHAN SAMMYNo ratings yet

- PV 16214.920522 - Shiela (Check Niyo Na Lang Din)Document2 pagesPV 16214.920522 - Shiela (Check Niyo Na Lang Din)Isaiah John Domenic M. CantaneroNo ratings yet

- Slides - Capital Budgeting - 2Document8 pagesSlides - Capital Budgeting - 2Anish AdhikariNo ratings yet

- Present & Future Value CalculationDocument9 pagesPresent & Future Value CalculationHoney SrivastavaNo ratings yet

- Exam 2 ReviewDocument53 pagesExam 2 ReviewNkeih FidelisNo ratings yet

- Cell Name Original Value Final ValueDocument13 pagesCell Name Original Value Final ValueAyman AlamNo ratings yet

- BCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMEDocument5 pagesBCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMERukshani RefaiNo ratings yet

- Computing The Value of A Growing Finite AnnuityDocument10 pagesComputing The Value of A Growing Finite AnnuityMahmood AhmadNo ratings yet

- FM Assaignment Second SemisterDocument9 pagesFM Assaignment Second SemisterMotuma Abebe100% (1)

- Apple - Free Cash Flow Valuation - MemoDocument3 pagesApple - Free Cash Flow Valuation - Memocollen.osidonNo ratings yet

- Cliffs and Associates-A2G08 Cliffs and AssociatesDocument42 pagesCliffs and Associates-A2G08 Cliffs and AssociatesmisalNo ratings yet

- 12 40Document10 pages12 40Gonçalo AlmeidaNo ratings yet

- Year Cash Flows: 1. Calculate The Present Value Annuity Discounted at 10%Document6 pagesYear Cash Flows: 1. Calculate The Present Value Annuity Discounted at 10%Dr. VinothNo ratings yet

- Name: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureDocument8 pagesName: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureErick KinotiNo ratings yet

- Capital Budgeting Sep 04 2021Document51 pagesCapital Budgeting Sep 04 2021Mohammad RekabderNo ratings yet

- Finance ProblemSets11Document323 pagesFinance ProblemSets11Stefan CN100% (2)

- NPV & IrrDocument58 pagesNPV & IrrAira DacilloNo ratings yet

- Practice ProblemDocument8 pagesPractice ProblemDivyam GargNo ratings yet

- Case StudyDocument5 pagesCase Studyphượng nguyễn thị minhNo ratings yet

- Byjus Base ModelDocument8 pagesByjus Base Modelsharma.kunal70No ratings yet

- Write Your Name and Roll Number BelowDocument8 pagesWrite Your Name and Roll Number BelowPrince Waqas AliNo ratings yet

- Copia de Caso Healthy Bear 2022Document4 pagesCopia de Caso Healthy Bear 2022rataNo ratings yet

- Present-Worth Analysis Example 5.1: Conventional-Payback Period: PP 195 - 196Document11 pagesPresent-Worth Analysis Example 5.1: Conventional-Payback Period: PP 195 - 196tan lee huiNo ratings yet

- Chattel Private Property 11-07-18Document1 pageChattel Private Property 11-07-18janisnagobadsNo ratings yet

- Math English 2Document13 pagesMath English 2lraNo ratings yet

- Real Options 2Document7 pagesReal Options 2Paula AntonioNo ratings yet

- Excel BasicsDocument8 pagesExcel BasicsAkash RajputNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- C4 Class Problems-Excel (Answers)Document81 pagesC4 Class Problems-Excel (Answers)ArjhiePalaganasDioquinoNo ratings yet

- Total Current Asset Total Current Liabilities Total Assets Stockholder's EquityDocument9 pagesTotal Current Asset Total Current Liabilities Total Assets Stockholder's EquityEric StinsonNo ratings yet

- Bond Valuation 22Document8 pagesBond Valuation 22phượng nguyễn thị minhNo ratings yet

- Banking - Prof. Rafael Schiozer - Exercícios de Aula - Aulas 5 A 9 - SoluçõesDocument5 pagesBanking - Prof. Rafael Schiozer - Exercícios de Aula - Aulas 5 A 9 - SoluçõesCaioGamaNo ratings yet

- Apartment Excel AnalysisDocument234 pagesApartment Excel AnalysisCeline TeeNo ratings yet

- Chapter 11Document43 pagesChapter 11Rishu GargNo ratings yet

- Internal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420Document14 pagesInternal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420ONASHI DEVNANI BBANo ratings yet

- Aminul Islam 2016209690 EMB-660-Assignment-2Document35 pagesAminul Islam 2016209690 EMB-660-Assignment-2Aminul Islam 2016209690No ratings yet

- Year (T) Project S Project L Differential 0 ($1,000) ($1,000) 0 1 500 100 400 2 400 300 100 3 300 400 (100) 4 100 600Document11 pagesYear (T) Project S Project L Differential 0 ($1,000) ($1,000) 0 1 500 100 400 2 400 300 100 3 300 400 (100) 4 100 600Phuntru PhiNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- F9 JUNE 17 Mock AnswersDocument15 pagesF9 JUNE 17 Mock AnswersottieNo ratings yet

- Stargrove AnalysisDocument3 pagesStargrove AnalysisTenebrae LuxNo ratings yet

- Net Present Value and Other Investment RulesDocument38 pagesNet Present Value and Other Investment RulesBussines LearnNo ratings yet

- Cost of Debt, KD - Using IntepolationDocument7 pagesCost of Debt, KD - Using IntepolationiskandardzulkarnienNo ratings yet

- Year 0 - 8000 - 8800 1 7600 6800 2 7800 7600 3 8400 7800 4 9600 7950 5 9800 8300 6 8450 7 8900 8 9300 Project Rose Project LilyDocument2 pagesYear 0 - 8000 - 8800 1 7600 6800 2 7800 7600 3 8400 7800 4 9600 7950 5 9800 8300 6 8450 7 8900 8 9300 Project Rose Project LilySourav SinghNo ratings yet

- LeasingDocument14 pagesLeasingSana SarfarazNo ratings yet

- Capital Investment AnalysisDocument7 pagesCapital Investment AnalysisAIDYNo ratings yet

- Laura Leticia López Aguilar Activiti 1 Capital BudgetingDocument2 pagesLaura Leticia López Aguilar Activiti 1 Capital BudgetingLets A LopezNo ratings yet

- Sinopec - Individual AssignmentDocument6 pagesSinopec - Individual AssignmentShaarang BeganiNo ratings yet

- Quantitative Finance: Its Development, Mathematical Foundations, and Current ScopeFrom EverandQuantitative Finance: Its Development, Mathematical Foundations, and Current ScopeNo ratings yet

- 02 - Tutorial 2 - Week 4 SolutionsDocument8 pages02 - Tutorial 2 - Week 4 SolutionsJason ChowNo ratings yet

- BankingDocument5 pagesBankingkorkor hammondNo ratings yet

- Cross Currency Basis - RBS PDFDocument7 pagesCross Currency Basis - RBS PDFJaz MNo ratings yet

- Introduction of Online BankingDocument18 pagesIntroduction of Online BankingRavi Kashyap506No ratings yet

- Vietnam FSADocument28 pagesVietnam FSAHungreo411No ratings yet

- Desertation Project KaranDocument66 pagesDesertation Project KaranFaheem QaziNo ratings yet

- Net Present Value: Mcgraw-Hill/Irwin Corporate Finance, 7/EDocument48 pagesNet Present Value: Mcgraw-Hill/Irwin Corporate Finance, 7/Esyed HassanNo ratings yet

- The Best Independent Financial Advisors ListDocument4 pagesThe Best Independent Financial Advisors ListMichelle JeanneNo ratings yet

- Idbi Bank ProjectDocument109 pagesIdbi Bank Projectvishvak100% (7)

- #2 Flip & Gap First Position Funding, Instructions, C&P, Referral 06-03-19Document8 pages#2 Flip & Gap First Position Funding, Instructions, C&P, Referral 06-03-19Darnell Woodard100% (1)

- 1slider For APPDocument1 page1slider For APPYong BenedictNo ratings yet

- To Shape A World Where People and Communities Thrive": About The RoleDocument2 pagesTo Shape A World Where People and Communities Thrive": About The RoleNITIN SINGHNo ratings yet

- Foriegn Exchange of Social Islami Bank LimitedDocument20 pagesForiegn Exchange of Social Islami Bank LimitedRipa AkterNo ratings yet

- Investment Banking: Industry AnalysisDocument12 pagesInvestment Banking: Industry Analysiskeshav kumarNo ratings yet

- U NeedDocument2 pagesU NeedAshok RajulaNo ratings yet

- The 8 Branches of Accounting: Their Uses and How They WorkDocument11 pagesThe 8 Branches of Accounting: Their Uses and How They WorkMoratuoa MaitseNo ratings yet

- Commercial Bank ManagementDocument8 pagesCommercial Bank ManagementShilpika ShettyNo ratings yet

- Habibmetro BankDocument18 pagesHabibmetro Bankfoqia nishatNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalASMARA HABIBNo ratings yet

- Advisory No. 9 of 2023 Dated October 23 2023Document2 pagesAdvisory No. 9 of 2023 Dated October 23 2023Rohan ChoudhariNo ratings yet

- Putnam Absolute Return Funds BrochureDocument5 pagesPutnam Absolute Return Funds BrochurePutnam InvestmentsNo ratings yet

- LCCI Level 2 Certificate in Bookkeeping and Accounting ASE20093 RB Nov 2018Document8 pagesLCCI Level 2 Certificate in Bookkeeping and Accounting ASE20093 RB Nov 2018Ei Ei TheintNo ratings yet

- Senae LuanzDocument19 pagesSenae LuanzDanpatz GarciaNo ratings yet

- History of Canara BankDocument8 pagesHistory of Canara BankVikas Tirmale100% (1)

- Framework For Business Analysis and Valuation Using Financial StatementsDocument17 pagesFramework For Business Analysis and Valuation Using Financial Statementsnovita sariNo ratings yet

- Tally Question PaperDocument2 pagesTally Question PaperRAAGHAV GUPTANo ratings yet

- BS50919008030495Document2 pagesBS50919008030495Renz Christopher TangcaNo ratings yet

- Super 30 Questions For CA Inter MAY - 24 ExamsDocument63 pagesSuper 30 Questions For CA Inter MAY - 24 Examsmmukund1632No ratings yet

- Slide One Afs BbaDocument12 pagesSlide One Afs BbaMaqbool AhmedNo ratings yet

- SRReport 1621473715093Document4 pagesSRReport 1621473715093wasiqa242No ratings yet