Professional Documents

Culture Documents

New Pacific Timber v. Seneris

Uploaded by

Vener MargalloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Pacific Timber v. Seneris

Uploaded by

Vener MargalloCopyright:

Available Formats

New Pacific Timber & Supply Co., Inc vs.

Seneris

GR No. L-41764.

December 19, 1980

FACTS: Herein petitioner was the defendant in a complaint for collection of a sum of money filed by the private

respondent. On July 19, 1974, a compromise judgment was rendered by the respondent Judge in accordance

with an amicable settlement entered into by the parties. For failure of the petitioner to comply with his judgment

obligation, the respondent Judge, issued an order for the issuance of a writ of execution. Accordingly, writ of

execution was issued for the amount of P63,130.00 pursuant to which, the Ex Officio Sheriff levied upon the

following personal properties of the petitioner and set the auction sale thereof on January 15, 1975. Prior to

January 15, 1975, petitioner deposited with the Clerk of CFI the sum of P63,130.00 for the payment of the

judgment obligation, consisting of the following. (1) P50,000.00 in Cashier's Checks No. S314361 dated

January 3, 1975 of the Equitable Banking Corporation; and (2) P13,130.00 in cash. The private respondent

refused to accept the check as well as the cash deposit. The respondent judge upheld private respondent's

claim that he has the right to refuse payment by means of a check, the respondent Judge citing Section 63 of

the Central Bank Act, and Article 1249 of the New Civil Code.

ISSUE: Whether or not the private respondent can validly refuse acceptance of the payment of the judgment

obligation made by the petitioner consisting of P50,000.00 in Cashier's Check and P13,130.00 in cash which it

deposited with the Ex-Officio Sheriff before the date of the scheduled auction sale.

HELD: It is to be emphasized in this connection that the check deposited by the petitioner in the amount of

P50.000.00 is not an ordinary check but a Cashier's Check of the Equitable Banking Corporation, a bank of

good standing and reputation. Where a check is certified by the bank on which it is drawn, the certification is

equivalent to acceptance. The object of certifying a check, as regards both parties, is to enable the holder to

use it as money. When the holder procures the check to be certified, "the check operates as an assignment of

a part of the funds to the creditors". The exception to the rule enunciated under Section 63 of the Central Bank

Act to the effect "that a check which has been cleared and credited to the account of the creditor shall be

equivalent to a delivery to the creditor in cash in an amount equal to the amount credited to his account" shall

apply in this case. Petition was granted ordering the private respondent to accept the sum of P63,130.00 under

deposit as payment of the judgment obligation in his favor. “Considering that the whole amount deposited by

the petitioner consisting of Cashier's Check of P60;000.00 and P13,130.00 in cash covers the judgment

obligation of P63,000.00 as mentioned in the writ of execution, then. We see no valid reason for the private

respondent to have refused acceptance of the payment of the obligation in his favor”.

NOTES:

The effective ruling of the SC in New Pacific Timber vs. Seneris is that manager’s check, certified check and

cashier’s check are as good as cash. As such, the creditor does not have a right to refuse.

Today, the SC reverted back to earlier decisions that checks of whatever kind do not have legal tender power.

A creditor cannot be compelled to accept payment through checks.

You might also like

- New Pacific Timber vs. SefferisDocument2 pagesNew Pacific Timber vs. SefferisRichard AmorNo ratings yet

- Gempesaw V CaDocument2 pagesGempesaw V Caבנדר-עלי אימאם טינגאו בתולהNo ratings yet

- Casabuena vs. CA, 286 SCRA 594Document3 pagesCasabuena vs. CA, 286 SCRA 594Xuagramellebasi100% (1)

- ANG TEK LIAN vs. CADocument1 pageANG TEK LIAN vs. CAObin Tambasacan BaggayanNo ratings yet

- Case #10 Benjamin-Abubakar-V-Auditor-generalDocument1 pageCase #10 Benjamin-Abubakar-V-Auditor-generalpistekayawaNo ratings yet

- YHT Realty Corporation v. CADocument3 pagesYHT Realty Corporation v. CAtemporiari100% (2)

- BPI v. RoxasDocument2 pagesBPI v. RoxasYvette MoralesNo ratings yet

- Metropolitan Bank v. Rosales GR 183204 Jan 13/2014: Page 1 of 74Document74 pagesMetropolitan Bank v. Rosales GR 183204 Jan 13/2014: Page 1 of 74Michelle FelloneNo ratings yet

- BPI vs. Court of Appeals and NapizaDocument12 pagesBPI vs. Court of Appeals and NapizaMp CasNo ratings yet

- Bibiano Banas vs. CA, 325 SCRA 259, Feb. 10, 2000Document11 pagesBibiano Banas vs. CA, 325 SCRA 259, Feb. 10, 2000Allen Windel BernabeNo ratings yet

- CBCI NOT NEGOTIABLEDocument1 pageCBCI NOT NEGOTIABLEStefanRodriguezNo ratings yet

- Provisional Remedies Cases - Rule 59Document30 pagesProvisional Remedies Cases - Rule 59Ma Gloria Trinidad ArafolNo ratings yet

- Checks and Negotiable Instruments Case BriefsDocument3 pagesChecks and Negotiable Instruments Case BriefsMaria Anna M Legaspi50% (2)

- DBP Vs CADocument2 pagesDBP Vs CAPaolo BrillantesNo ratings yet

- Philippine Hawk Corporation v. Lee ruling on damages calculationDocument2 pagesPhilippine Hawk Corporation v. Lee ruling on damages calculationJanine IsmaelNo ratings yet

- Non-negotiable instrument assignmentDocument2 pagesNon-negotiable instrument assignmentAdrian HilarioNo ratings yet

- #38. Allan Vs PNBDocument37 pages#38. Allan Vs PNBeizNo ratings yet

- 135 PBTC v. Abasalo MargalloDocument2 pages135 PBTC v. Abasalo MargalloVener MargalloNo ratings yet

- People V ManiegoDocument2 pagesPeople V ManiegoBeeya EchauzNo ratings yet

- Malayan Insurance CoDocument2 pagesMalayan Insurance CoJeru SagaoinitNo ratings yet

- PNB V CA 256 SCRA 491Document2 pagesPNB V CA 256 SCRA 491Angeline RodriguezNo ratings yet

- Chan Wan V Tan Kim G.R. No. L-15380Document3 pagesChan Wan V Tan Kim G.R. No. L-15380John Basil ManuelNo ratings yet

- Creditdigeststeam DepositDocument8 pagesCreditdigeststeam DepositCheenee Nuestro SantiagoNo ratings yet

- Abubakar v. Auditor GeneralDocument1 pageAbubakar v. Auditor GeneralAvs SalugsuganNo ratings yet

- Prudential Bank v. MartinezDocument1 pagePrudential Bank v. MartinezKeren del RosarioNo ratings yet

- Consolidated Bank & Trust Co. Vs CADocument2 pagesConsolidated Bank & Trust Co. Vs CARish DiasantaNo ratings yet

- SEC Vs PICOP Digest With Full TextDocument10 pagesSEC Vs PICOP Digest With Full TextXhin CagatinNo ratings yet

- NIL DigestsDocument7 pagesNIL DigestsaugustofficialsNo ratings yet

- GMA Network Inc., V. NTC GR 192128 September 13, 2017 Case DigestDocument3 pagesGMA Network Inc., V. NTC GR 192128 September 13, 2017 Case Digestbeingme2No ratings yet

- PNB Vs RocamoraDocument2 pagesPNB Vs RocamoraMEREDITHNo ratings yet

- 299 Ilusorio vs. IlusorioDocument14 pages299 Ilusorio vs. IlusoriosnhlaoNo ratings yet

- DIGEST - Republic v. CFI ManilaDocument2 pagesDIGEST - Republic v. CFI ManilaAgatha ApolinarioNo ratings yet

- Simeon Del Rosario vs. Equitable Ins. & CasualtyDocument7 pagesSimeon Del Rosario vs. Equitable Ins. & CasualtyMa. Princess CongzonNo ratings yet

- Petitioner vs. vs. Respondents: First DivisionDocument8 pagesPetitioner vs. vs. Respondents: First DivisionJerald Oliver MacabayaNo ratings yet

- 49) The International Corporate Bank, Inc. vs. CA and PNBDocument2 pages49) The International Corporate Bank, Inc. vs. CA and PNBAlexandraSoledadNo ratings yet

- Philippine Bank of Commerce VsDocument1 pagePhilippine Bank of Commerce VsJan Aldrin AfosNo ratings yet

- Case Name Facts & Issue RulingDocument15 pagesCase Name Facts & Issue RulingApril ToledoNo ratings yet

- Associated Bank vs. CADocument2 pagesAssociated Bank vs. CAdm8mNo ratings yet

- Case Digest Ang Tiong Vs Ting, 1968Document2 pagesCase Digest Ang Tiong Vs Ting, 1968Jesa FormaranNo ratings yet

- PNB V PicornellDocument1 pagePNB V PicornellEinstein NewtonNo ratings yet

- 03-Sps. Yu v. Atty. Palaña A.C. No. 7747 July 14, 2008Document4 pages03-Sps. Yu v. Atty. Palaña A.C. No. 7747 July 14, 2008Jopan SJNo ratings yet

- 289494Document1 page289494Rhuejane Gay MaquilingNo ratings yet

- Sps. Silos vs. Philippine National Bank: Interest Rate of Escalation ClauseDocument2 pagesSps. Silos vs. Philippine National Bank: Interest Rate of Escalation ClauseJovz BumohyaNo ratings yet

- Preliminary Attachment - Mangila V CA DigestDocument4 pagesPreliminary Attachment - Mangila V CA Digestdeboglie100% (1)

- GR 146717Document2 pagesGR 146717Maryanne UnoNo ratings yet

- Credit - Loan DigestDocument12 pagesCredit - Loan DigestAlyssa Fabella ReyesNo ratings yet

- Prudencio Vs CADocument3 pagesPrudencio Vs CARZ ZamoraNo ratings yet

- Olizon vs. CA GR 107075 Sept. 1, 1994 Case DigestDocument2 pagesOlizon vs. CA GR 107075 Sept. 1, 1994 Case Digestbeingme2No ratings yet

- Development Bank of Rizal vs. Sima Wei, 219 SCRA 736, March 09, 1993Document6 pagesDevelopment Bank of Rizal vs. Sima Wei, 219 SCRA 736, March 09, 1993RACNo ratings yet

- International Hotel Corp Vs JoaquinDocument6 pagesInternational Hotel Corp Vs JoaquinmonjekatreenaNo ratings yet

- Metropolitan Bank vs. CA (194 SCRA 169, 18 February 1991)Document2 pagesMetropolitan Bank vs. CA (194 SCRA 169, 18 February 1991)Howard ClarkNo ratings yet

- Llorin vs. CA, G.R. No. 103592 February 4, 1993 (218 SCRA 436)Document6 pagesLlorin vs. CA, G.R. No. 103592 February 4, 1993 (218 SCRA 436)CLark Barcelon100% (1)

- Dalton Vs FGR RealtyDocument2 pagesDalton Vs FGR RealtyCarla VirtucioNo ratings yet

- BPI V CA (2000)Document2 pagesBPI V CA (2000)Diana GervacioNo ratings yet

- CASE 31 - Rizal Commercial Banking Corporation v. CA 2Document1 pageCASE 31 - Rizal Commercial Banking Corporation v. CA 2Aquiline ReedNo ratings yet

- Great Asian Sales v. CA, G.R. No. 105774, 2002Document2 pagesGreat Asian Sales v. CA, G.R. No. 105774, 2002Rizchelle Sampang-ManaogNo ratings yet

- 40 Biaco V CountrysideDocument15 pages40 Biaco V Countrysidepa0l0sNo ratings yet

- Contracts Cases PDFDocument130 pagesContracts Cases PDFEller-Jed Manalac MendozaNo ratings yet

- SC Rules Cashier's Checks Equivalent to Cash in Debt PaymentDocument1 pageSC Rules Cashier's Checks Equivalent to Cash in Debt PaymentVener MargalloNo ratings yet

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- 149 - Tong Brothers Cp. IACDocument1 page149 - Tong Brothers Cp. IACVener MargalloNo ratings yet

- 177 - Clarin v. RulonaDocument1 page177 - Clarin v. RulonaVener MargalloNo ratings yet

- 163 - Sps. Aguinaldo v. TorresDocument2 pages163 - Sps. Aguinaldo v. TorresVener MargalloNo ratings yet

- 247 - Barretto v. Sta MarinaDocument2 pages247 - Barretto v. Sta MarinaVener MargalloNo ratings yet

- Unionbank v. DBPdocxDocument3 pagesUnionbank v. DBPdocxVener MargalloNo ratings yet

- Odiamar v. Valencia G.R. No. 213582 June 28, 2016 FactsDocument1 pageOdiamar v. Valencia G.R. No. 213582 June 28, 2016 FactsVener MargalloNo ratings yet

- 135 PBTC v. Abasalo MargalloDocument2 pages135 PBTC v. Abasalo MargalloVener MargalloNo ratings yet

- 8 - People's Car v. Commando Security - MargalloDocument1 page8 - People's Car v. Commando Security - MargalloVener MargalloNo ratings yet

- Petitioner vs. vs. Respondents Purugganan & Bersamin Salvador N. BeltranDocument7 pagesPetitioner vs. vs. Respondents Purugganan & Bersamin Salvador N. BeltranVener MargalloNo ratings yet

- 143713-1967-Philippine Banking Corp. v. Lui SheDocument17 pages143713-1967-Philippine Banking Corp. v. Lui SheGloriette Marie AbundoNo ratings yet

- Spouses Yu V Ayala LandDocument23 pagesSpouses Yu V Ayala LandBBNo ratings yet

- 2 People's Car Inc. v. Commando Security PDFDocument4 pages2 People's Car Inc. v. Commando Security PDFChaoSisonNo ratings yet

- Dalton v. FGR RealtyDocument1 pageDalton v. FGR RealtyVener MargalloNo ratings yet

- Philbank v. Lui SheDocument2 pagesPhilbank v. Lui SheVener MargalloNo ratings yet

- Second Division: Decision DecisionDocument12 pagesSecond Division: Decision DecisionVener MargalloNo ratings yet

- 37 - Robes-Francisco v. CFIDocument1 page37 - Robes-Francisco v. CFIVener MargalloNo ratings yet

- Petitioner vs. vs. Respondent: Second DivisionDocument10 pagesPetitioner vs. vs. Respondent: Second DivisionArjay ElnasNo ratings yet

- CAIHTE - People v. Susan Sayo and Alfredo RoxasDocument14 pagesCAIHTE - People v. Susan Sayo and Alfredo Roxasiana_fajardoNo ratings yet

- Plaintiff-Appellee vs. vs. Accused-Appellant: Third DivisionDocument15 pagesPlaintiff-Appellee vs. vs. Accused-Appellant: Third DivisionEnri PrinzNo ratings yet

- Petitioner vs. vs. Respondents: Second DivisionDocument11 pagesPetitioner vs. vs. Respondents: Second DivisionAngelica de LeonNo ratings yet

- Petitioners vs. vs. Respondents: Second DivisionDocument9 pagesPetitioners vs. vs. Respondents: Second DivisionIan ButaslacNo ratings yet

- Petitioners vs. vs. Respondents: Third DivisionDocument13 pagesPetitioners vs. vs. Respondents: Third DivisionVener MargalloNo ratings yet

- Petitioner vs. vs. Respondents: Second DivisionDocument11 pagesPetitioner vs. vs. Respondents: Second DivisionAndrei Anne PalomarNo ratings yet

- Petitioners vs. vs. Respondent: Second DivisionDocument21 pagesPetitioners vs. vs. Respondent: Second DivisionmenggayubeNo ratings yet

- Petitioner vs. vs. Respondents: Third DivisionDocument13 pagesPetitioner vs. vs. Respondents: Third DivisionVener MargalloNo ratings yet

- CIVIL LIABILITY OF DISHONORED CHECKDocument17 pagesCIVIL LIABILITY OF DISHONORED CHECKjackyNo ratings yet

- Petitioners vs. vs. Respondents: Second DivisionDocument11 pagesPetitioners vs. vs. Respondents: Second DivisionVener MargalloNo ratings yet

- Petitioners vs. vs. Respondent: Second DivisionDocument11 pagesPetitioners vs. vs. Respondent: Second DivisionVener MargalloNo ratings yet

- Petitioner vs. vs. Respondent: Second DivisionDocument12 pagesPetitioner vs. vs. Respondent: Second DivisionmenggayubeNo ratings yet

- Canara Bank Mobile Number Change and UpdateDocument1 pageCanara Bank Mobile Number Change and UpdateAnonymous YFac6px77% (44)

- GS III Booster Mainstorming 2023 WWW - Iasparliament.com1Document117 pagesGS III Booster Mainstorming 2023 WWW - Iasparliament.com1sayednishattanaum99No ratings yet

- Financial disclosure rules and exceptionsDocument2 pagesFinancial disclosure rules and exceptionsHaikal AdninNo ratings yet

- PR DICGC AmendmentAct2021 Section18A PaymentToDepositorsOfInsuredBanksUnder AIDDocument3 pagesPR DICGC AmendmentAct2021 Section18A PaymentToDepositorsOfInsuredBanksUnder AIDMoneylife FoundationNo ratings yet

- ICICI Financial StatementsDocument9 pagesICICI Financial StatementsNandini JhaNo ratings yet

- Philippine Banking SystemDocument9 pagesPhilippine Banking SystemJungkookie Bae100% (3)

- 7 Key Finance Principles That Everyone Needs To MasterDocument11 pages7 Key Finance Principles That Everyone Needs To MasterYousri KarchoudNo ratings yet

- RBL Application Form1680992689896 - 9540523355Document5 pagesRBL Application Form1680992689896 - 9540523355Vikram SharmaNo ratings yet

- Business Finance: Introduction To Financial ManagementDocument13 pagesBusiness Finance: Introduction To Financial Managementalmira calaguioNo ratings yet

- BANKING LAW AND PRACTICE MCQsDocument38 pagesBANKING LAW AND PRACTICE MCQsChris Shean100% (1)

- Supreme Court rules PEACe Bonds not deposit substitutesDocument2 pagesSupreme Court rules PEACe Bonds not deposit substitutesCrisbon ApalisNo ratings yet

- Ref - No. 11532934-16309213-3: Pintukumar Rameshbhai PatelDocument4 pagesRef - No. 11532934-16309213-3: Pintukumar Rameshbhai Patelpintukumar rameshbhaiNo ratings yet

- UMB Mobile Banking: SMS/Text Message CommandsDocument3 pagesUMB Mobile Banking: SMS/Text Message CommandsMenk JnrNo ratings yet

- C5 Sa PIjm 8 W6 HH6 IrDocument7 pagesC5 Sa PIjm 8 W6 HH6 Irarun royNo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaIntu SekhNo ratings yet

- Banks CHDocument8 pagesBanks CHabeerNo ratings yet

- "Credit Appriasal System of Commercial Vehicles": "Shriram Transport Finance Co - LTD" PuneDocument81 pages"Credit Appriasal System of Commercial Vehicles": "Shriram Transport Finance Co - LTD" PuneHarish Da0% (1)

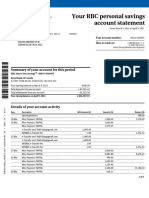

- Your RBC Personal Savings Account StatementDocument3 pagesYour RBC Personal Savings Account StatementRobert Friday100% (1)

- 26as 2021 22Document5 pages26as 2021 22Aarti ThdfcNo ratings yet

- L33 10 PDFDocument1 pageL33 10 PDF魏釨洋No ratings yet

- Suspense QuestionsDocument15 pagesSuspense QuestionsChaiz MineNo ratings yet

- The Cat Level 1 PDF FreeDocument1 pageThe Cat Level 1 PDF FreeJenbert SantiagoNo ratings yet

- Growth of Commercial Bank in IndiaDocument2 pagesGrowth of Commercial Bank in Indiavinayak_874580% (5)

- Bni PT Bangun Jun22Document3 pagesBni PT Bangun Jun22Yehezkiel AdhiNo ratings yet

- June CalendarDocument2 pagesJune CalendarAmrozia MazharNo ratings yet

- NCQ Branch AccountDocument7 pagesNCQ Branch AccountAdiNo ratings yet

- Balance Transfer Email 2Document3 pagesBalance Transfer Email 2api-217525844No ratings yet

- Method of Valuation of ShareDocument11 pagesMethod of Valuation of Shareamarjitkumar008100% (1)

- PWC - Payment Trends in APACDocument18 pagesPWC - Payment Trends in APACVinay SudershanNo ratings yet

- E-Resources Module-VIII Paper No.: DSE-xiii Paper Title: Money and Financial Markets Course: B.A. (Hons.) Economics, Sem.-VI Students of S.R.C.CDocument3 pagesE-Resources Module-VIII Paper No.: DSE-xiii Paper Title: Money and Financial Markets Course: B.A. (Hons.) Economics, Sem.-VI Students of S.R.C.CLado BahadurNo ratings yet