Professional Documents

Culture Documents

CIMA SCS - May 2021 - Mock 1 Debrief 3

CIMA SCS - May 2021 - Mock 1 Debrief 3

Uploaded by

Kim P. Tran0 ratings0% found this document useful (0 votes)

45 views1 pageOriginal Title

3. CIMA SCS - May 2021 - Mock 1 debrief 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views1 pageCIMA SCS - May 2021 - Mock 1 Debrief 3

CIMA SCS - May 2021 - Mock 1 Debrief 3

Uploaded by

Kim P. TranCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

4/22/2021

Gateway - SCS Mock 1 Debrief

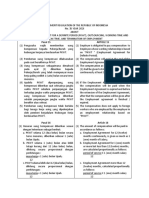

Strategic benefits of Merger Strategic Benefits of Merger

• • Acquisition & integration of Skylaine

There may also be revenue enhancing

synergies (cross -selling opportunities will also reduce competition with

generating new revenue streams)- e.g. increases in future revenue streams

Offering Skylaine customers landing possible. The ability of Airlines to

slots in Arrfield airports in which there create price/service competition

is spare capacity at attractive prices as between Arrfield & Skylaine will be

well as offering Arrfield customers eliminated

slots in Skylaine airports, without

• Skylaine has a strategically located

incurring significant additional costs

airport within 50 miles of the Capital

City. This could have the potential to

add extra capacity to the capital

(provided enhanced infrastructure can

be put in place).

© Peter Plant - First Financial Training

Gateway - SCS Mock 1 Debrief

Strategic benefits of Merger Strategic benefits of Merger

• Optimises the use of the recent • Enhanced knowledge capital - the

upgrade in IS/IT /IM by Skylaine can combined experience of the two

be exploited by rolling it out across boards & senior management teams

the Arrfield airports. should improve the overall business

• There is already evidence of potential

Shareholder wealth enhancement • Enhanced relationship capital -

(Increase in PAT N$400m - total Skylainey will has developed

group PAT= $1,465m + $551m + relationships with other Norland

$400m = N$2,416m), which is likely to Regional Development Authority etc. &

be reflected in the post-merger share other corporate clients to add to the

price Arrfield's relationship portfolio etc.

© Peter Plant - First Financial Training

You might also like

- Sealed Air Case StudyDocument8 pagesSealed Air Case StudyDo Ngoc Chau100% (4)

- Rolls Royces in Singapore Harnessing The Power of The Ecosystem To Drive GrowthDocument15 pagesRolls Royces in Singapore Harnessing The Power of The Ecosystem To Drive GrowthAli HasyimiNo ratings yet

- CFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 26Document1 pageCFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 26Kim P. TranNo ratings yet

- 5 Year IKTVA Planning Format GuideDocument9 pages5 Year IKTVA Planning Format GuideThiru NachiNo ratings yet

- HR Training & Development MBADocument49 pagesHR Training & Development MBAJinuachan Vadakkemulanjanal GenuachanNo ratings yet

- Airnz 2019 Annual Results PresentationDocument48 pagesAirnz 2019 Annual Results PresentationBeefNo ratings yet

- EPC Business Plan & Budget v03Document15 pagesEPC Business Plan & Budget v03Syahrul Aidil Mohamad TajuddinNo ratings yet

- G. Ford Motor Company - 2021 Q4 and FY Earnings Review 20220203Document44 pagesG. Ford Motor Company - 2021 Q4 and FY Earnings Review 20220203nguyenhoangNo ratings yet

- Offshore Workshop 21 2 2023Document69 pagesOffshore Workshop 21 2 2023MOOTAZ KHALEDNo ratings yet

- AirIndia Embarks On A Turn Around PlanIDocument6 pagesAirIndia Embarks On A Turn Around PlanIvinit_jaiswalNo ratings yet

- MXWL - High Voltage Product Line Divestiture - 12.19.18Document10 pagesMXWL - High Voltage Product Line Divestiture - 12.19.18Aziz SabaNo ratings yet

- C.O.Capital - Capital Budgeting (OK Na!)Document8 pagesC.O.Capital - Capital Budgeting (OK Na!)Eunice BernalNo ratings yet

- Project CharterDocument2 pagesProject CharterShivangi DhingraNo ratings yet

- Corpo Presentation AKR Jan 2024Document28 pagesCorpo Presentation AKR Jan 2024muhadiNo ratings yet

- WPIL PYT MultibaggerDocument2 pagesWPIL PYT MultibaggerRajeev GargNo ratings yet

- Sona Koyo Steering Systems Limited (SKSSL) Vendor ManagementDocument21 pagesSona Koyo Steering Systems Limited (SKSSL) Vendor ManagementSiddharth UpadhyayNo ratings yet

- System Development Consolidation PDFDocument6 pagesSystem Development Consolidation PDFDonRafee RNo ratings yet

- Sankalp Kant - GM BDDocument2 pagesSankalp Kant - GM BDhimanshu royNo ratings yet

- Advanced Performance Management (APM) : Strategic Professional - OptionsDocument11 pagesAdvanced Performance Management (APM) : Strategic Professional - OptionsNghĩa VõNo ratings yet

- Finance Options: From Clarke Energy and Berkshire FinanceDocument2 pagesFinance Options: From Clarke Energy and Berkshire FinancedakNo ratings yet

- PWC Shale Well Development Planning Operating Expenses and InvestmentDocument14 pagesPWC Shale Well Development Planning Operating Expenses and InvestmentpanthaloorNo ratings yet

- Hertz Global Holdings, Inc.: Morgan Stanley Laguna ConferenceDocument12 pagesHertz Global Holdings, Inc.: Morgan Stanley Laguna ConferenceAfiq KhidhirNo ratings yet

- Lecture 2 Ch9Document66 pagesLecture 2 Ch9Linda VoNo ratings yet

- CFO International Manufacturing Engineering in Boston MA Resume William SchmidtDocument3 pagesCFO International Manufacturing Engineering in Boston MA Resume William SchmidtWilliamSchmidt2No ratings yet

- IP - Q4 FY 2020pdf AffleDocument23 pagesIP - Q4 FY 2020pdf AffleS.Sharique HassanNo ratings yet

- Proposal For The Development of A Distribution Master Plan: Integrated Supply ChainDocument26 pagesProposal For The Development of A Distribution Master Plan: Integrated Supply ChainJuan Carlos Rodriguez MuñozNo ratings yet

- Adani Group May - 2019Document15 pagesAdani Group May - 2019Poonam AggarwalNo ratings yet

- CH09 PPT MLDocument127 pagesCH09 PPT MLXianFa WongNo ratings yet

- Supply Chains and Working Capital: ManagementDocument60 pagesSupply Chains and Working Capital: ManagementMarko NikolicNo ratings yet

- Scatec Second Quarter and First Half Report 2023Document40 pagesScatec Second Quarter and First Half Report 2023José Afonso OliveiraNo ratings yet

- Siemens: Upgrade To BuyDocument18 pagesSiemens: Upgrade To BuyChander LaljaniNo ratings yet

- Pareto Securities ConferenceDocument27 pagesPareto Securities Conferencescribd.5.krys1964No ratings yet

- Hai The Arab World - PsDocument17 pagesHai The Arab World - Psaristos_arestosNo ratings yet

- Ar 14-15 PDFDocument292 pagesAr 14-15 PDFchandrasekharNo ratings yet

- Quarz Capital Management Open Letter To CSE Global FINAL 26th Feb 2018Document6 pagesQuarz Capital Management Open Letter To CSE Global FINAL 26th Feb 2018qpmoerzhNo ratings yet

- Ibt Chapters 8 1 2 Terms OnlyDocument5 pagesIbt Chapters 8 1 2 Terms OnlyMariah Dion GalizaNo ratings yet

- Petrofac - Subsurface Technology Centre IndiaDocument5 pagesPetrofac - Subsurface Technology Centre IndiaashwanikhareNo ratings yet

- en - Za h1 Sales - Final - Slides v3Document19 pagesen - Za h1 Sales - Final - Slides v3Das AnkitaNo ratings yet

- Chapter 9 Corporate Level StrategyDocument21 pagesChapter 9 Corporate Level Strategyabrar171No ratings yet

- FAC Assignment - Section A - Group 9Document9 pagesFAC Assignment - Section A - Group 9Sahil ShethNo ratings yet

- FY2017AnnualRep L&T Annual Report 2016-17Document488 pagesFY2017AnnualRep L&T Annual Report 2016-17sathishNo ratings yet

- GCP Applied Technologies: Receives Binding Offer From Henkel AG & Co. To Acquire Darex Packaging TechnologiesDocument8 pagesGCP Applied Technologies: Receives Binding Offer From Henkel AG & Co. To Acquire Darex Packaging TechnologiesAnonymous 6tuR1hzNo ratings yet

- Deloitte Auto Component PLIDocument22 pagesDeloitte Auto Component PLIAshlesh MangrulkarNo ratings yet

- FactsheetDocument2 pagesFactsheetakhilkuwarNo ratings yet

- Financial Accounting Information For Decisions 9th Edition Wild Solutions ManualDocument45 pagesFinancial Accounting Information For Decisions 9th Edition Wild Solutions Manualpatrickbyrdgxeiwokcnt100% (26)

- AnandRathi On Power MechDocument18 pagesAnandRathi On Power MechDhittbanda GamingNo ratings yet

- Horizontal Integration, Merger&AcquisitionDocument4 pagesHorizontal Integration, Merger&AcquisitionKi-Baek KimNo ratings yet

- Arliga Ecoworld Infrastructure Private Limited (Erstwhile Known As RMZ Ecoworld Infrastructure Private Limited)Document7 pagesArliga Ecoworld Infrastructure Private Limited (Erstwhile Known As RMZ Ecoworld Infrastructure Private Limited)Srinivasan RajNo ratings yet

- 8 - Saf+ 2023-07-11 Icao Stocktaking KL - Final PDFDocument8 pages8 - Saf+ 2023-07-11 Icao Stocktaking KL - Final PDFSandra Díaz TrujilloNo ratings yet

- Revision Pack and AnsjjwersDocument34 pagesRevision Pack and AnsjjwersShree Punetha PeremaloNo ratings yet

- RRC CaseDocument5 pagesRRC Casezihan zhaiNo ratings yet

- Indian Institute of Management Kozhikode: Course Name: - Section:-Roll No: - PGP/23/115 Answer Script InstructionsDocument11 pagesIndian Institute of Management Kozhikode: Course Name: - Section:-Roll No: - PGP/23/115 Answer Script InstructionsSourabh Agrawal 23No ratings yet

- RHB Equity 360° - 4 October 2010 (Construction, Property, BAT Technical: Zelan, Genting Msia)Document3 pagesRHB Equity 360° - 4 October 2010 (Construction, Property, BAT Technical: Zelan, Genting Msia)Rhb InvestNo ratings yet

- Airthread Case Summary MBDocument3 pagesAirthread Case Summary MBPer KlintNo ratings yet

- 7merging Prms and CogehDocument32 pages7merging Prms and CogehJideSalNo ratings yet

- ISO Funding FinalDocument2 pagesISO Funding FinalHARISH BHARADWAJNo ratings yet

- Initiating Coverage - Expleo Solutions - 050822Document19 pagesInitiating Coverage - Expleo Solutions - 050822rathore400No ratings yet

- TOGAF® 10 Level 2 Enterprise Arch Part 2 Exam Wonder Guide Volume 2: TOGAF 10 Level 2 Scenario Strategies, #2From EverandTOGAF® 10 Level 2 Enterprise Arch Part 2 Exam Wonder Guide Volume 2: TOGAF 10 Level 2 Scenario Strategies, #2Rating: 5 out of 5 stars5/5 (1)

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- CFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 24Document1 pageCFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 24Kim P. TranNo ratings yet

- CFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 23Document1 pageCFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 23Kim P. TranNo ratings yet

- CFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 25Document1 pageCFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 25Kim P. TranNo ratings yet

- CIMA SCS - May 2021 - Mock 1 Debrief 9Document1 pageCIMA SCS - May 2021 - Mock 1 Debrief 9Kim P. TranNo ratings yet

- Barron's AP Psychology, 5th Edition 48Document1 pageBarron's AP Psychology, 5th Edition 48Kim P. TranNo ratings yet

- CFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 27Document1 pageCFA Program Curriculum 2017 - Level I - Volumes 1-6 (2016) 27Kim P. TranNo ratings yet

- Mock Exam Walkthrough - LearnSignal CIMADocument4 pagesMock Exam Walkthrough - LearnSignal CIMAKim P. TranNo ratings yet

- Ifc Annual Report 2020Document134 pagesIfc Annual Report 2020Kim P. TranNo ratings yet

- Line at Point S Is Followed by The Breaking of The Basic Up Trendline at PointDocument7 pagesLine at Point S Is Followed by The Breaking of The Basic Up Trendline at PointKim P. TranNo ratings yet

- MJM0S200687Document2 pagesMJM0S200687Surya SudhanNo ratings yet

- CAF-BCK-Additional Questions PDFDocument24 pagesCAF-BCK-Additional Questions PDFadnan sheikNo ratings yet

- Vivekananda Suaro IIM KozhikodeDocument13 pagesVivekananda Suaro IIM KozhikodevivekNo ratings yet

- DerivativesDocument3 pagesDerivativessarf_88No ratings yet

- Financial Accounting and Cost AccountingDocument34 pagesFinancial Accounting and Cost AccountinggeraldNo ratings yet

- Total Effectiveness Equipment Performance (TEEP)Document16 pagesTotal Effectiveness Equipment Performance (TEEP)Dinesh JayabalNo ratings yet

- Pavithra Mannepalli: 19jgbs-Pavithra.m@jgu - Edu.inDocument2 pagesPavithra Mannepalli: 19jgbs-Pavithra.m@jgu - Edu.inBalu EnagantiNo ratings yet

- VAT Upload FormDocument6 pagesVAT Upload Formmintesnot kibruNo ratings yet

- 4P's of Marketing in Services and Additional 3 P'sDocument16 pages4P's of Marketing in Services and Additional 3 P's4 99No ratings yet

- EY IBC ReportDocument40 pagesEY IBC ReportShushrut KhannaNo ratings yet

- Terms, Conditions & DisclosuresDocument8 pagesTerms, Conditions & Disclosuresapi-285070305No ratings yet

- Resume - CA Rohit JainDocument1 pageResume - CA Rohit JainArisha NarangNo ratings yet

- DCF Analysis PDFDocument11 pagesDCF Analysis PDFanandbajaj0No ratings yet

- Introducing IBBIDocument10 pagesIntroducing IBBIGaurav Tripathi0% (1)

- Journal of Corporate Finance: Contracts Between Managers and Investors: A Study of Master Limited Partnership AgreementsDocument14 pagesJournal of Corporate Finance: Contracts Between Managers and Investors: A Study of Master Limited Partnership AgreementsNicolette LeeNo ratings yet

- Company Profile Synergy Multi Services (P) LTDDocument8 pagesCompany Profile Synergy Multi Services (P) LTDAmar RajputNo ratings yet

- PO CrownwellDocument4 pagesPO Crownwellpkvaish.jacNo ratings yet

- Inventories Valuation ConceptDocument13 pagesInventories Valuation ConceptSumit SahuNo ratings yet

- Revised Framework For Resolution of Stressed AssetsDocument4 pagesRevised Framework For Resolution of Stressed AssetsAyush RampuriaNo ratings yet

- Fall 2017 Security InterestDocument89 pagesFall 2017 Security InterestSarah EunJu LeeNo ratings yet

- Adamco Agricultural Farm Machinery Trading Management SystemDocument2 pagesAdamco Agricultural Farm Machinery Trading Management SystemSerious GamerNo ratings yet

- BS VodafoneDocument25 pagesBS VodafoneSandhyaSharmaNo ratings yet

- Joint VentureDocument133 pagesJoint VentureArindom MukherjeeNo ratings yet

- Cadbury Committee Report and Oecd Report On Corporate GovernanceDocument5 pagesCadbury Committee Report and Oecd Report On Corporate GovernanceVrushti Parmar100% (1)

- Inv Consulting Services AgreementDocument8 pagesInv Consulting Services AgreementParvesh KuchwahaNo ratings yet

- Translation Article 15 - 16 - 17 - PPNo 35 Year 2021Document2 pagesTranslation Article 15 - 16 - 17 - PPNo 35 Year 2021oggy SatyaNo ratings yet

- Probable Solution For Questions Asked - Current Batch - March 2015Document30 pagesProbable Solution For Questions Asked - Current Batch - March 2015aditiNo ratings yet

- Assignment - Working Capital ManagementDocument1 pageAssignment - Working Capital ManagementAlmasNo ratings yet

- Button & Hensher - Handbook of Transport Strategy, Policy and Institutions - 2005Document861 pagesButton & Hensher - Handbook of Transport Strategy, Policy and Institutions - 2005dds100% (1)