Professional Documents

Culture Documents

Lecture 2 Ch9

Uploaded by

Linda VoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 2 Ch9

Uploaded by

Linda VoCopyright:

Available Formats

Chapter Outline

9.1 The Capital Budgeting Process

9.2 Forecasting Incremental Earnings

9.3 Determining Incremental Free Cash Flow

9.4 Other Effects on Incremental Free Cash Flows

9.5 Analyzing the Project

9.6 Real Options in Capital Budgeting

Copyright © 2023 Pearson Canada Inc. 9-1

9.1 The Capital Budgeting Process

• Capital Budget: A list of the projects that a company

plans to undertake during the next period.

• Capital Budgeting: The process of analyzing

investment opportunities and deciding which ones to

accept.

• Incremental Earnings: The amount by which a firm’s

earnings are expected to change as a result of an

investment decision.

Copyright © 2023 Pearson Canada Inc. 9-2

9.2 Forecasting Incremental Earnings

(1 of 9)

• Incremental Revenue and Cost Estimates

– Factors to consider when estimating a project’s

revenues and costs:

1. A new product typically has lower sales initially

2. The average selling price of a product and its cost of

production will generally change over time

3. For most industries, competition tends to reduce profit

margins over time

Copyright © 2023 Pearson Canada Inc. 9-3

9.2 Forecasting Incremental Earnings

(2 of 9)

• Operating Expenses Versus Capital Expenditures

– Operating Expenses

– Capital Expenditures

Copyright © 2023 Pearson Canada Inc. 9-4

9.2 Forecasting Incremental Earnings

(3 of 9)

• Capital Expenses and Capital Cost Allowance

– The cost of plant, property, and equipment is divided

to be deducted when estimating earnings.

▪ For tax purposes, the Canada Revenue Agency requires

the use of Capital Cost Allowance (CCA).

▪ For financial purposes, CCA is not usually used.

Copyright © 2023 Pearson Canada Inc. 9-5

9.2 Forecasting Incremental Earnings

(4 of 9)

• Capital Budgeting with First-Year Half-Year Rule: CRA

assumes assets qualify for half a year’s worth of CCA

in the first tax year. Thus, when an asset is

purchased, one-half of its cost, denoted as CapEx, is

added to the undepreciated capital cost (UCC) for the

asset pool in the same class.

• We denote this addition to the UCC as UCC1. Thus

UCC1 = 0.5 × CapEx.

Copyright © 2023 Pearson Canada Inc. 9-6

9.2 Forecasting Incremental Earnings

(5 of 9)

• Capital Budgeting with Straight Line Depreciation:

the depreciation amount is equal for each accounting

period of an asset’s useful life; used under certain

circumstances.

• For more information see the link on the CRA website

about Accelerated Investment Incentive as follows:

https://www.canada.ca/en/revenue-agency/services/ta

x/businesses/topics/sole-proprietorships-partnerships/

report-business-income-expenses/claiming-capital-co

st-allowance/accelerated-investment-incentive.html

Copyright © 2023 Pearson Canada Inc. 9-7

9.2 Forecasting Incremental Earnings

(6 of 9)

• The incremental CCA deduction claimed at the end of

the tax year is undepreciated capital cost multiplied

by the CCA rate:

• The incremental UCC is calculated as:

Copyright © 2023 Pearson Canada Inc. 9-8

9.2 Forecasting Incremental Earnings

(7 of 9)

• Incremental Revenue and Cost Estimates

Copyright © 2023 Pearson Canada Inc. 9-9

Key Terms and Definitions (1 of 2)

• Capital cost allowance (CCA): The Canada

Revenue Agency method of depreciation for income

tax purposes.

• CCA rate: The proportion of undepreciated capital

cost that can be claimed as CCA in a given tax year.

Copyright © 2023 Pearson Canada Inc. 9 - 10

Key Terms and Definitions (2 of 2)

• Half-year rule: A rule stating that, as assets may be

purchased at any time throughout a year, it can be

assumed that on average an asset is owned for half a

year during the first tax year of its ownership.

• Undepreciated Capital Cost (UCC): The balance, at

a point in time, calculated by deducting an asset’s

current and prior CCA amounts from the original cost

of the asset.

Copyright © 2023 Pearson Canada Inc. 9 - 11

9.2 Forecasting Incremental Earnings

(8 of 9)

• Taxes

– Marginal Corporate Tax Rate

▪ The tax rate a firm will pay on an incremental dollar of

pre-tax income

Copyright © 2023 Pearson Canada Inc. 9 - 12

Example 9.1: Taxing Losses for

Projects in Profitable Companies (1 of 2)

• Loblaw Companies Ltd. plans to launch a new line of

high-fibre, zero-trans-fat breakfast pastries. The heavy

advertising expenses associated with the new product

launch will generate operating losses of $15 million

next year for the product.

Copyright © 2023 Pearson Canada Inc. 9 - 13

Example 9.1: Taxing Losses for

Projects in Profitable Companies (2 of 2)

• Loblaw expects to earn pre-tax income of

$460 million from operations other than the new

pastries next year. If Loblaw pays a 40% tax rate on

its pre-tax income, what will it owe in taxes next year

without the new pastry product? What will it owe with

the new product?

Copyright © 2023 Pearson Canada Inc. 9 - 14

Example 9.1: Taxing Losses for

Projects in Profitable Companies: Plan

• We need Loblaw’s pre-tax income with and without

the new product losses and its tax rate of 40%. We

can then compute the tax without the losses and

compare it to the tax with the losses.

Copyright © 2023 Pearson Canada Inc. 9 - 15

Example 9.1: Taxing Losses for Projects in

Profitable Companies: Execute

• Without the new product, Loblaw will owe

$460 million × 40% = $184 million in corporate taxes

next year. With the new product, Loblaw’s pre-tax

income next year will be only

$460 million − $15 million = $445 million, and it will

owe $445 million × 40% = $178 million in tax.

Copyright © 2023 Pearson Canada Inc. 9 - 16

Example 9.1: Taxing Losses for Projects in

Profitable Companies: Evaluate

• Thus, launching the new product reduces Loblaw’s

taxes next year by $184 million − $178 million = $6

million. Because the losses on the new product

reduce Loblaw’s taxable income dollar for dollar, it is

the same as if the new product had a tax bill of

negative $6 million.

Copyright © 2023 Pearson Canada Inc. 9 - 17

9.2 Forecasting Incremental Earnings

(9 of 9)

• Incremental Earnings Forecast

– Pro Forma Statement: A statement that is not based

on actual data but rather depicts a firm’s financials

under a given set of hypothetical assumptions.

– Taxes and Negative EBIT

– Interest Expense

▪ Unlevered Net Income: Net income that does not

include

Copyright © 2023 Pearson Canada Inc. 9 - 18

9.3 Determining Incremental Free Cash

Flow (1 of 5)

• Calculating Free Cash Flow from Earnings

– Free Cash Flow

▪ The incremental effect of a project on a firm’s available

cash

– Capital Expenditures and Capital Cost Allowance

Copyright © 2023 Pearson Canada Inc. 9 - 19

Example 9.2: Incremental Free Cash

Flows

• Let’s consider the SPI Phone 86 example. In

Table 9.2, we computed the incremental

earnings for the SPI Phone 86, but we need

the incremental free cash flows to decide whether SPI

should proceed with the project.

Copyright © 2023 Pearson Canada Inc. 9 - 20

Example 9.2: Incremental Free Cash

Flows: Plan

• The difference between the incremental earnings and

incremental free cash flows in the SPI Phone 86

example will be driven by the equipment purchased for

the lab. We need to recognize the $7.5 million cash

outflow associated with the purchase in year 0 and

add back the CCA deductions from years 1 to 5, as

they are not actually cash outflows.

Copyright © 2023 Pearson Canada Inc. 9 - 21

Example 9.2: Incremental Free Cash

Flows: Execute

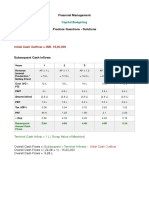

Year Blank 0 1 2 3 4 5

Incremental Blank Blank Blank Blank Blank Blank Blank

Earnings Forecasts

1 Sales - 26,000 26,000 26,000 26,000 -

2 Cost of Goods Sold - (11,000) (11,000) (11,000) (11,000) -

3 Gross Profit - 15,000 15,000 15,000 15,000 -

4 S&G expenses - (2,800) (2,800) (2,800) (2,800) -

5 R&D (15,000) - - - - -

6 Capital Cost Allowance - (1,688) (2,616) (1,439) (791) (435)

7 EBIT (15,000) 10,513 9,584 10,761 11,409 (435)

8 Income Tax @ 40% 6,000 (4,205) (3,834) (4,305) (4,564) 174

9 Unlevered NI (9,000) 6,308 5,751 6,457 6,845 (261)

10 Plus: CCA - 1,688 2,616 1,439 791 435

11 Less: Capital Expenditure (7,500) Blank Blank Blank Blank Blank

13 Free Cash Flows (16,500) 7,995 8,366 7,895 7,636 174

Copyright © 2023 Pearson Canada Inc. 9 - 22

Example 9.2: Incremental Free Cash

Flows: Evaluate

• By recognizing the outflow from purchasing the

equipment in year 0, we account for the fact that $7.5

million left the firm at that time. By adding back the

CCA deductions in years 1 to 5, we adjust the

incremental earnings to reflect the fact that CCA

deductions are not cash outflows.

Copyright © 2023 Pearson Canada Inc. 9 - 23

9.3 Determining Incremental Free Cash

Flow (2 of 5)

• Calculating Free Cash Flow from Earnings

– Net Working Capital

▪ Trade Credit

– The difference between receivables and payables is the

net amount of the firm’s capital that is consumed as a

result of these credit transactions

Copyright © 2023 Pearson Canada Inc. 9 - 24

Example 9.3: Incorporating Changes in

Net Working Capital (1 of 2)

• Suppose that the SPI Phone 86 will have no

incremental cash or inventory requirements (products

will be shipped directly from the contract manufacturer

to customers). However, receivables related to the SPI

Phone 86 are expected to account for 15% of annual

sales, and payables are expected to be 15% of the

annual cost of goods sold (COGS). Fifteen percent of

$26 million in sales is $3.9 million, and 15% of $11

million in COGS is $1.65 million. SPI Phone 86’s NWC

requirements are shown in the following table:

Copyright © 2023 Pearson Canada Inc. 9 - 25

Example 9.3: Incorporating Changes in

Net Working Capital (2 of 2)

1 Year 0 1 2 3 4 5

2 Net Working Capital Forecast (000s) Blank Blank Blank Blank Blank 0

3 Cash Requirement 0 0 Blank Blank Blank 0

4 Inventory 0 0 Blank Blank Blank 0

5 Receivables (15% of sales) 0 3,900 3,900 3,900 3,900 0

6 Payables (15% of COGS) 0 −1650 −1650 −1650 −1650 0

7 Net Working Capital 0 2,250 2,250 2,250 2,250 0

Copyright © 2023 Pearson Canada Inc. 9 - 26

Example 9.3: Incorporating Changes in

Net Working Capital: Plan (1 of 3)

• Any increases in NWC represent an investment that

reduces the cash available to the firm and so reduces

free cash flow. We can use our forecast of the SPI

Phone 86’s NWC requirements to complete our

estimate of SPI Phone 86’s free cash flow.

Copyright © 2023 Pearson Canada Inc. 9 - 27

Example 9.3: Incorporating Changes in

Net Working Capital: Plan (2 of 3)

• This increase represents a cost to the firm. This

reduction of free cash flow corresponds to the fact that

$3.900 million of the firm’s sales in year 1, and $1.625

million of its costs, have not yet been paid.

Copyright © 2023 Pearson Canada Inc. 9 - 28

Example 9.3: Incorporating Changes in

Net Working Capital: Plan (3 of 3)

• In years 2 to 4, NWC does not change, so no further

contributions are needed. In year 5, when the project

is shut down, NWC falls by $2.250 million as the

payments of the last customers are received and the

final bills are paid. We add this $2.250 million to free

cash flow in year 5.

Copyright © 2023 Pearson Canada Inc. 9 - 29

Example 9.3: Incorporating Changes in

Net Working Capital: Execute (1 of 2)

• Cash flow requirements are:

1 Year 0 1 2 3 4 5

2 Net Working Capital 0 2,250 2,250 2,250 2,250 0

3 Change in NWC Blank +2,250 0 0 0 −2,500

4 Cash Flow Effect Blank −2,250 0 0 0 +2,500

Copyright © 2023 Pearson Canada Inc. 9 - 30

Example 9.3: Incorporating Changes in

Net Working Capital: Execute (2 of 2)

• The incremental free cash flows would then be:

Year Blank 0 1 2 3 4 5

Incremental Earnings Blank Blank Blank Blank Blank Blank Blank

Forecasts

1 Sales ̶ 26,000 26,000 26,000 26,000 ̶

2 Cost of Goods Sold ̶ (11,000) (11,000) (11,000) (11,000) ̶

3 Gross Profit ̶ 15,000 15,000 15,000 15,000 ̶

4 S&G expenses ̶ (2,800) (2,800) (2,800) (2,800) ̶

5 R&D (15,000) ̶ ̶ ̶ ̶ ̶

6 Capital Cost Allowance ̶ (1,688) (2,616) (1,439) (791) (435)

7 EBIT (15,000) 10,513 9,584 10,761 11,409 (435)

8 Income Tax @ 40% 6,000 (4,205) (3,834) (4,305) (4,564) 174

9 Unlevered NI (9,000) 6,308 5,751 6,457 6,845 (261)

10 Plus: CCA ̶ 1,688 2,616 1,439 791 435

11 Less: Capital Expenditure (7,500) Blank Blank Blank Blank Blank

Blank Less: Increase in NWC ̶ −2,250 ̶ ̶ ̶ 2,250

13 Free Cash Flows (16,500) 5,995 8,366 7,895 7,636 2,424

Copyright © 2023 Pearson Canada Inc. 9 - 31

Example 9.3: Incorporating Changes in

Net Working Capital: Evaluate (1 of 2)

• The free cash flows differ from unlevered net income

by reflecting the cash flow effects of capital

expenditures on equipment, CCA, and changes in

NWC. Note that in the first two years, free cash flow is

lower than unlevered net income, reflecting the

upfront investment in equipment and NWC required

by the project.

Copyright © 2023 Pearson Canada Inc. 9 - 32

Example 9.3: Incorporating Changes in

Net Working Capital: Evaluate (2 of 2)

• In later years, free cash flow exceeds unlevered net

income because depreciation is not a cash expense.

In the last year, the firm ultimately recovers the

investment in NWC, further boosting the free cash

flow.

Copyright © 2023 Pearson Canada Inc. 9 - 33

9.3 Determining Incremental Free Cash

Flow (3 of 5)

• Calculating Free Cash Flow Directly

(9.8)

(9.9)

Copyright © 2023 Pearson Canada Inc. 9 - 34

9.3 Determining Incremental Free Cash

Flow (4 of 5)

• Calculating Free Cash Flow Directly

– CCA tax shield: The tax savings that results from the

ability to deduct depreciation.

Copyright © 2023 Pearson Canada Inc. 9 - 35

9.3 Determining Incremental Free Cash

Flow (5 of 5)

• Calculating the NPV

– To compute a project’s NPV, one must discount its

free cash flow at the appropriate cost of capital

Copyright © 2023 Pearson Canada Inc. 9 - 36

Example 9.4: Calculating the Project’s

NPV

• Assume that SPI’s managers believe that the SPI

Phone 86 project has risks similar to those of SPI’s

existing projects, for which it has a cost of capital of

12%. Compute the NPV of the SPI Phone 86 project.

Copyright © 2023 Pearson Canada Inc. 9 - 37

Example 9.4: Calculating the Project’s

NPV: Plan

• From Example 9.3, the incremental free cash flows for

the SPI Phone 86 project are (in $000s):

1 Year 0 1 2 3 4 5

2 Incremental Free Cash Flow (16,500) 5,745 8,366 7,895 7,636 2,424

• To compute the NPV, we sum the present values of all

of the cash flows, noting that the year 0 cash outflow

is already a present value.

Copyright © 2023 Pearson Canada Inc. 9 - 38

Example 9.4: Calculating the Project’s

NPV: Execute

• Using Eq. 9.10:

Copyright © 2023 Pearson Canada Inc. 9 - 39

Example 9.4: Calculating the Project’s

NPV: Evaluate

• Based on our estimates, the SPI Phone 86’s NPV is

$7.147 million. While the SPI Phone 86’s upfront cost

is $16.5 million, the present value of the additional

free cash flow that SPI will receive from the project is

$23.647 million. Thus, taking the SPI Phone 86

project is equivalent to SPI having an extra $7.147

million in the bank today.

Copyright © 2023 Pearson Canada Inc. 9 - 40

9.4 Other Effects on Incremental Free

Cash Flows (1 of 7)

• Opportunity Costs: the value a resource could have

provided in its best alternative use.

• Project Externalities: Indirect effects of a project that

may increase or decrease the profits of other business

activities of a firm.

– Cannibalization: The displacement of the sales of one

of a firm’s existing products by the sales of the firm’s

new product.

Copyright © 2023 Pearson Canada Inc. 9 - 41

9.4 Other Effects on Incremental Free

Cash Flows (2 of 7)

• Sunk Costs: Any unrecoverable cost for which a firm

is already liable.

– Fixed Overhead Expenses

– Past Research for Feasibility

▪ E.g., SPI paid $2000 for a research study analyzing

the effects: Sunk cost

▪ Sunk cost is not considered in evaluating a project, so

just ignore it!

Copyright © 2023 Pearson Canada Inc. 9 - 42

9.4 Other Effects on Incremental Free

Cash Flows (3 of 7)

• Adjusting Free Cash Flow

– Timing of Cash Flows

– Perpetual CCA Tax Shields

Copyright © 2023 Pearson Canada Inc. 9 - 43

9.4 Other Effects on Incremental Free

Cash Flows (4 of 7)

• Adjusting Free Cash Flow

– Liquidation or salvage value

▪ Capital gain tax: A tax collected on the profit (the amount by

which the sale price exceeds the original purchase price)

from assets in the year in which the assets are sold.

Copyright © 2023 Pearson Canada Inc. 9 - 44

9.4 Other Effects on Incremental Free

Cash Flows (5 of 7)

• Adjusting Free Cash Flow

– Continuing Pool, Negative Net Additions:

▪ The present value of the reduction in CCA tax shields

can be calculated as follows:

Copyright © 2023 Pearson Canada Inc. 9 - 45

Example 9.5: Adding Salvage Value and

CCA Effects to the Analysis (1 of 2)

• SPI is expected to sell the specialized computer

equipment at date 4 (or the beginning of tax

year 5), as the lab will be shut down at that point. The

expected Sale Price is high, $8 million, because of the

expected appreciation of precious minerals used

within the computer equipment.

Copyright © 2023 Pearson Canada Inc. 9 - 46

Example 9.5: Adding Salvage Value and

CCA Effects to the Analysis (2 of 2)

• It is expected that SPI will still own other computer

equipment at that time but will not be making such

purchases in excess of $8 million in tax year 5. Redo

the NPV calculation for the SPI Phone 86 project,

given this new information.

Copyright © 2023 Pearson Canada Inc. 9 - 47

Example 9.5: Adding Salvage Value and

CCA Effects to the Analysis: Plan

• In order to compute the after-tax cash flow, you will

need to incorporate the effects on cash flows of the

salvage value, the capital gains tax (using Equation

9.13), and the lost CCA tax shields (using Equation

9.16).

Copyright © 2023 Pearson Canada Inc. 9 - 48

Example 9.5: Adding Salvage Value and

CCA Effects to the Analysis: Execute (1 of 2)

Year Blank 0 1 2 3 4 5

Incremental Blank Blank Blank Blank Blank Blank Blank

Earnings Forecasts

1 Sales - 26,000 26,000 26,000 26,000 -

2 Cost of Goods Sold - (11,000) (11,000) (11,000) (11,000) -

3 Gross Profit - 15,000 15,000 15,000 15,000 -

4 S&G expenses - (2,800) (2,800) (2,800) (2,800) -

5 R&D (15,000) - - - - -

6 Capital Cost not included, as analyzed separately

Allowance

7 EBIT (15,000) 12,200 12,200 12,200 12,200 -

8 Income Tax @ 40% 6,000 (4,800) (4,800) (4,800) (4,800) -

9 Unlevered NI (9,000) 7,320 7,320 7,320 7,320 -

Free Cash Flows

Copyright © 2023 Pearson Canada Inc. 9 - 49

Example 9.5: Adding Salvage Value and

CCA Effects to the Analysis: Execute (2 of 2)

Year Blank 0 1 2 3 4 5

10 Plus: CCA not included, as analyzed separately

11 Less: Net Capital (7,500) Blank Blank Blank Blank Blank

Expenditure

Blank Less: Increase in - −2,250 - - - 2,250

NWC

13 Less Capital Gain Blank Blank Blank Blank Blank (100)

tax

14 FCF (excl. Tax (16,500) 5,070 7,320 7,320 15,320 2,150

shield)

15 Project cost of 12% Blank Blank Blank Blank Blank

capital

16 Discount Factor 1.00 .8929 .7972 .7118 .6355 .5674

17 PV of FCF (excl. (16,500) 4,527 5,835 5,210 9,736 1,220

Tax shield)

18 PV of CCA tax 736 Blank Blank Blank Blank Blank

shields

19 NPV 10,765 Blank Blank Blank Blank Blank

Copyright © 2023 Pearson Canada Inc. 9 - 50

NPV Calculation

•

Copyright © 2023 Pearson Canada Inc. 9 - 51

Example 9.5: Adding Salvage Value and

CCA Effects to the Analysis: Evaluate

• You should notice that the NPV is much higher than

what was calculated in the Table 9.6 spreadsheet. The

reason it is higher is because of the large asset sale

price. Also note that the PV of CCA tax shields is

lower and there is a capital gain; these are the other

effects of the asset sale.

Copyright © 2023 Pearson Canada Inc. 9 - 52

9.4 Other Effects on Incremental Free

Cash Flows (6 of 7)

• Adjusting Free Cash Flow

– Tax Loss Carryforwards/Tax Loss Carrybacks: A

tax collected on the profit (the amount by which the

sale price exceeds the original purchase price)

from assets in the year in which the assets are sold.

Copyright © 2023 Pearson Canada Inc. 9 - 53

9.4 Other Effects on Incremental Free

Cash Flows (7 of 7)

• Replacement Decisions

– Often the financial manager must decide whether to

replace an existing piece of equipment

▪ The new equipment may allow increased production,

resulting in incremental revenue, or it may simply be

more efficient, lowering costs.

Copyright © 2023 Pearson Canada Inc. 9 - 54

Example 9.6: Replacing an Existing

Machine (1 of 2)

• You are trying to decide whether to replace a machine

on your production line. The new machine will cost

$1.25 million but will be more efficient than the old

machine, reducing costs by $500,000 per year. Your

old machine could be sold for $50,000. You expect to

sell the new machine for $100,000 after five years.

Copyright © 2023 Pearson Canada Inc. 9 - 55

Example 9.6: Replacing an Existing

Machine (2 of 2)

• While the company does not intend to add any more

assets into the pool in five years, it does have many

assets in the pool, so the pool will continue

indefinitely. The new machine will not change your

working capital needs. The CCA rate is 45%. The tax

rate is 40% and the firm expects a 12% return on this

project.

Copyright © 2023 Pearson Canada Inc. 9 - 56

Example 9.6: Replacing an Existing

Machine: Plan

• Incremental revenues: 0

• Incremental costs: −$500,000 (a reduction in costs will

appear as a positive number in the costs line of our

analysis)

• Incremental capital expenditure:

$1.25 million − $50,000 = $1.2 million.

This is the net change to the asset pool

upon replacement.

• Cash flow from salvage value: +$100,000

Copyright © 2023 Pearson Canada Inc. 9 - 57

Example 9.6: Replacing an Existing

Machine: Execute (1 of 2)

Year Blank 0 1 2 3 4 5

Incremental Earnings Blank Blank Blank Blank Blank Blank Blank

Forecasts (000s)

1 Sales - - - - - -

2 Cost of Goods - 500,000 500,000 500,000 500,000 500,000

Sold

3 Gross Profit - 500,000 500,000 500,000 500,000 500,000

4 Capital Cost not included as analyzed separately

Allowance

7 EBIT - 500,000 500,000 500,000 500,000 500,000

8 Income Tax @ - (200,000) (200,000) (200,000) (200,000) (200,000)

40%

9 Unlevered NI - 300,000 300,000 300,000 300,000 300,000

10 Free Cash Flow

(including CCA Tax

Shield)

Copyright © 2023 Pearson Canada Inc. 9 - 58

Example 9.6: Replacing an Existing

Machine: Execute (2 of 2)

Year Blank 0 1 2 3 4 5

10 Plus: CCA not included as analyzed separately

11 Less: Net Capital (1,200,000) Blank Blank Blank Blank 100,000

Expenditure

14 FCF (excl. Tax (1,200,000) 300,000 300,000 300,000 300,000 400,000

shield)

15 Project cost of 12% Blank Blank Blank Blank Blank

capital

16 Discount Factor 1.00 0.8929 0.7972 0.7118 0.6355 0.5674

17 PV of FCF (excl. (1,200,000) 267,857 239,158 213,534 190,655 226,971

Tax shield)

18 PV of CCA tax 338,578 Blank Blank Blank Blank Blank

shields

19 NPV 276,753 Blank Blank Blank Blank Blank

Copyright © 2023 Pearson Canada Inc. 9 - 59

Example 9.6: Replacing an Existing

Machine: Evaluate (1 of 2)

• Even though the decision has no impact on revenues,

it still matters for cash flows because it reduces costs.

Just as important are the tax implications of both

selling the old machine and buying the new machine.

Copyright © 2023 Pearson Canada Inc. 9 - 60

Example 9.6: Replacing an Existing

Machine: Evaluate (2 of 2)

• Notice that the PV of the CCA tax shields is greater

than the NPV. Had we not considered these tax

implications, the replacement opportunity would not

have looked like a good one.

Copyright © 2023 Pearson Canada Inc. 9 - 61

9.5 Analyzing the Project (1 of 4)

• Sensitivity Analysis

– A capital budgeting tool that shows how the NPV

varies as a single underlying assumption is changed.

Copyright © 2023 Pearson Canada Inc. 9 - 62

9.5 Analyzing the Project (2 of 4)

• Break-Even Analysis

– Break-Even

▪ The level of a parameter for which an investment has an

NPV of zero.

Copyright © 2023 Pearson Canada Inc. 9 - 63

9.5 Analyzing the Project (3 of 4)

• Break-Even Analysis

– Accounting Break-Even

▪ EBIT Break-Even

– The level of a particular parameter for which a project’s

EBIT is zero

Units Sold × (Sale Price − Cost per Unit) − SG&A − CCA = 0

Copyright © 2023 Pearson Canada Inc. 9 - 64

9.5 Analyzing the Project (4 of 4)

• Scenario Analysis

– A capital budgeting tool that shows how the NPV

varies as a number of the underlying assumptions

are changed simultaneously

Copyright © 2023 Pearson Canada Inc. 9 - 65

9.6 Real Options in Capital Budgeting

• Real Option: The right, but not the obligation, to take

a particular business action

• Option to Delay: option to time a particular

investment, which is almost always present.

• Option to Expand: option to start with limited

production and expand only if the project is

successful.

• Option to Abandon: option for an investor to cease

making investments in a project.

Copyright © 2023 Pearson Canada Inc. 9 - 66

You might also like

- Build A Model Chapter 12Document9 pagesBuild A Model Chapter 12PaolaNo ratings yet

- Cash Flow Estimation and Risk AnalysisDocument60 pagesCash Flow Estimation and Risk AnalysisAJ100% (2)

- Chapter 09, Modern Advanced Accounting-Review Q & ExrDocument28 pagesChapter 09, Modern Advanced Accounting-Review Q & Exrrlg481467% (3)

- AssignmentDocument20 pagesAssignmentbabarakhssNo ratings yet

- Franklin Lumber Capital Budgeting Procedures - Group 3Document28 pagesFranklin Lumber Capital Budgeting Procedures - Group 3Febriyani TampubolonNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- FM11 CH 11 Mini CaseDocument13 pagesFM11 CH 11 Mini CasesushmanthqrewrerNo ratings yet

- Chapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsDocument11 pagesChapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsRavinesh Amit PrasadNo ratings yet

- Acctg 029 - Mod 3 Conso Fs Subs DateDocument8 pagesAcctg 029 - Mod 3 Conso Fs Subs DateAlliah Nicole RamosNo ratings yet

- Mis Unit III-2Document20 pagesMis Unit III-2Meenakshi Pawar100% (2)

- Mussie Beyene Asst. Professor: Capital Budgeting and Corporate StrategyDocument24 pagesMussie Beyene Asst. Professor: Capital Budgeting and Corporate StrategyeferemNo ratings yet

- Tute 7 PDFDocument5 pagesTute 7 PDFRony RahmanNo ratings yet

- M09 Berk0821 04 Ism C091Document15 pagesM09 Berk0821 04 Ism C091Linda VoNo ratings yet

- CH09 PPT MLDocument127 pagesCH09 PPT MLXianFa WongNo ratings yet

- Lecture 5 Ch16 2Document53 pagesLecture 5 Ch16 2Linda VoNo ratings yet

- Tutorial 4 - SolutionDocument16 pagesTutorial 4 - SolutionNg Chun SenfNo ratings yet

- Capital Budgeting 1Document71 pagesCapital Budgeting 1Tahir AshrafNo ratings yet

- Fundamentals of Capital BudgetingDocument122 pagesFundamentals of Capital BudgetingHuy PanhaNo ratings yet

- Making Investment Decisions With The Net Present Value RuleDocument60 pagesMaking Investment Decisions With The Net Present Value Rulecynthiaaa sNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Document36 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (23)

- Chapter 12 Notes - Capital Budgeting DecisionDocument6 pagesChapter 12 Notes - Capital Budgeting DecisionrbarronsolutionsNo ratings yet

- Acf302: Corporate Finance: Capital Budgeting and Valuation With Leverage - Part IDocument43 pagesAcf302: Corporate Finance: Capital Budgeting and Valuation With Leverage - Part IXue Meng LuNo ratings yet

- Chapter 10 0Document39 pagesChapter 10 0Jennifer M. Ramos EnríquezNo ratings yet

- Week 5 - Slides Capital BudgetingDocument44 pagesWeek 5 - Slides Capital BudgetingAmelia MatherNo ratings yet

- Valuation: Aswath DamodaranDocument100 pagesValuation: Aswath DamodaranhsurampudiNo ratings yet

- CH 12Document31 pagesCH 12Imran AliNo ratings yet

- Ques On Capital BudgetingDocument5 pagesQues On Capital BudgetingMonika KauraNo ratings yet

- QuesDocument5 pagesQuesMonika KauraNo ratings yet

- Chapter 8Document31 pagesChapter 8laurenbondy44No ratings yet

- Fa4e SM Ch08Document20 pagesFa4e SM Ch08michaelkwok1100% (1)

- Capital InvestmentDocument38 pagesCapital InvestmentSameerbaskarNo ratings yet

- B1 Free Solving Nov 2019) - Set 4Document11 pagesB1 Free Solving Nov 2019) - Set 4paul sagudaNo ratings yet

- 2-4 2005 Dec ADocument14 pages2-4 2005 Dec AnsarahnNo ratings yet

- FIN 370 Week 4 Team Assignment Caledonia Products Integrative ProblemDocument7 pagesFIN 370 Week 4 Team Assignment Caledonia Products Integrative ProblemRambo GantNo ratings yet

- Capital Budteting JainDocument56 pagesCapital Budteting JainShivam VermaNo ratings yet

- 4.2 Capital InvestmentDocument22 pages4.2 Capital InvestmentIshaNo ratings yet

- Cash Flow Estimation Class ExcerciseDocument5 pagesCash Flow Estimation Class ExcercisethinkestanNo ratings yet

- AE24 Lesson 6: Analysis of Capital Investment DecisionsDocument17 pagesAE24 Lesson 6: Analysis of Capital Investment DecisionsMajoy BantocNo ratings yet

- Qtouto 1492176702 1Document4 pagesQtouto 1492176702 1Christy AngkouwNo ratings yet

- Cash Flow EstimationDocument51 pagesCash Flow EstimationSabina MergaliyevaNo ratings yet

- Module 4 CFMADocument36 pagesModule 4 CFMAk 3117No ratings yet

- PSB Tutorial Solutions Week 2Document14 pagesPSB Tutorial Solutions Week 2Iqtidar KhanNo ratings yet

- Caledonia Products FIN370Document8 pagesCaledonia Products FIN370huskergirlNo ratings yet

- 20PT31 Cf-IiDocument4 pages20PT31 Cf-IiSakthivelayudham BhyramNo ratings yet

- Block 3 Connect HWDocument17 pagesBlock 3 Connect HWGeorgeNo ratings yet

- Ch06 ProbsDocument7 pagesCh06 ProbsJingxian XueNo ratings yet

- Fina6000 Module 4 - Capital Budgeting BDocument20 pagesFina6000 Module 4 - Capital Budgeting BMar SGNo ratings yet

- Capital Investment DecisionsDocument12 pagesCapital Investment Decisionsmoza salimNo ratings yet

- WetqDocument9 pagesWetqRalph Lawrence Francisco BatangasNo ratings yet

- Key Elements of Investment AnalysisDocument75 pagesKey Elements of Investment AnalysisAlexandra ErmakovaNo ratings yet

- TMA-02 Fall 2021-2022 Semester IDocument9 pagesTMA-02 Fall 2021-2022 Semester IMahdy TabbaraNo ratings yet

- Cash Flow & TaxesDocument11 pagesCash Flow & TaxesPartha ChakaravartiNo ratings yet

- FINA 5120 - Fall (1) 2022 - Session 4 (With Answers) - Capital Budgeting - 26aug22Document69 pagesFINA 5120 - Fall (1) 2022 - Session 4 (With Answers) - Capital Budgeting - 26aug22Yilin YANGNo ratings yet

- Valuation: Aswath DamodaranDocument100 pagesValuation: Aswath DamodaranAsif IqbalNo ratings yet

- Finance Analysis of Capital BankDocument10 pagesFinance Analysis of Capital BankAnita GaoNo ratings yet

- Capital Budgeting ProcessDocument17 pagesCapital Budgeting ProcessjanineNo ratings yet

- Tutorial 06 Solution For Additional ProblemsDocument6 pagesTutorial 06 Solution For Additional ProblemsTrung ĐàmNo ratings yet

- CH 08Document12 pagesCH 08AlJabir KpNo ratings yet

- Lec 3 4 Capital Investment PDFDocument50 pagesLec 3 4 Capital Investment PDFMuhammad Saleh AliNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Small Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsFrom EverandSmall Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- 18april - AssumptionsDocument2 pages18april - AssumptionsLinda VoNo ratings yet

- M07 Berk0821 04 Ism C07Document26 pagesM07 Berk0821 04 Ism C07Linda VoNo ratings yet

- M03 Berk0821 04 Ism C03Document16 pagesM03 Berk0821 04 Ism C03Linda VoNo ratings yet

- Lecture 3-ch12Document65 pagesLecture 3-ch12Linda VoNo ratings yet

- Quiz 1-Business FinanceDocument3 pagesQuiz 1-Business FinanceLinda VoNo ratings yet

- Question 3-Final ExamDocument1 pageQuestion 3-Final ExamLinda VoNo ratings yet

- Vo Thi Minh Ngoc-Au12hcm-Algebra-Final ExamDocument9 pagesVo Thi Minh Ngoc-Au12hcm-Algebra-Final ExamLinda VoNo ratings yet

- AU14 HCM - Algebra - Final TestDocument2 pagesAU14 HCM - Algebra - Final TestLinda VoNo ratings yet

- ANSWER: FalseDocument4 pagesANSWER: FalseLinda VoNo ratings yet

- Full Name: Vo Thi Minh Ngoc Course: K12HCMDocument2 pagesFull Name: Vo Thi Minh Ngoc Course: K12HCMLinda VoNo ratings yet

- A. True B. FalseDocument3 pagesA. True B. FalseLinda VoNo ratings yet

- Full Name: Vo Thi Minh Ngoc Course: K12HCM: AnswerDocument5 pagesFull Name: Vo Thi Minh Ngoc Course: K12HCM: AnswerLinda VoNo ratings yet

- Mandakini Hydropower Limited PDFDocument42 pagesMandakini Hydropower Limited PDFAnil KhanalNo ratings yet

- Eversleigh PROJ1July2019Document44 pagesEversleigh PROJ1July2019DeLa RicheNo ratings yet

- CH 12Document35 pagesCH 12Lê Thu TràNo ratings yet

- Chapter 5 Applied Interest Rate Analysis: ConstraintsDocument12 pagesChapter 5 Applied Interest Rate Analysis: ConstraintsVictor ManuelNo ratings yet

- MKM704 - Finance For Marketers - Lab 4 Solution: MKM704 - DR Page 1 of 9 08/07/2021 at 14:29:50Document9 pagesMKM704 - Finance For Marketers - Lab 4 Solution: MKM704 - DR Page 1 of 9 08/07/2021 at 14:29:50Marziiya RamakdawalaNo ratings yet

- Capital Budgeting - SolutionDocument5 pagesCapital Budgeting - SolutionAnchit JassalNo ratings yet

- Chapter 18. Multinational Capital Budgeting and Cross Border Acquisitions - 277478179-LN18-Eiteman-85652-14-LN18Document34 pagesChapter 18. Multinational Capital Budgeting and Cross Border Acquisitions - 277478179-LN18-Eiteman-85652-14-LN18yosua chrisma100% (1)

- 10 Risk Refinements in Capital BudgetingDocument24 pages10 Risk Refinements in Capital BudgetingMo Mindalano MandanganNo ratings yet

- BBA SyllabusDocument33 pagesBBA SyllabusPradeep Kumar BhattacharjeeNo ratings yet

- Question Bank SFM (Old and New)Document232 pagesQuestion Bank SFM (Old and New)MBaralNo ratings yet

- CorperateFinance NumericalIteration03Feb2020Document226 pagesCorperateFinance NumericalIteration03Feb2020JoanneNo ratings yet

- Konsep Capital Budgeting - TurkiDocument20 pagesKonsep Capital Budgeting - TurkiyayaNo ratings yet

- Final Exam 6Document4 pagesFinal Exam 6HealthyYOUNo ratings yet

- F. Y. B. Com - Sem Ii - Mcqs of Business Economics Ii: Module 1 - Market Structures: Perfect Competition & MonopolyDocument15 pagesF. Y. B. Com - Sem Ii - Mcqs of Business Economics Ii: Module 1 - Market Structures: Perfect Competition & MonopolyOmkar KhutwadNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- The Basics of Capital Budgeting: Evaluating Cash FlowsDocument56 pagesThe Basics of Capital Budgeting: Evaluating Cash FlowsVinit KadamNo ratings yet

- PGDM (Finance) FULL NOTES-Project - Appraisal - FinanceDocument57 pagesPGDM (Finance) FULL NOTES-Project - Appraisal - Financeanimesh_sarkar_3No ratings yet

- This Study Resource Was: Lecture Handout For Chapter 12Document6 pagesThis Study Resource Was: Lecture Handout For Chapter 12rifa hanaNo ratings yet

- 6 Capital Budgeting - Non DiscountedDocument8 pages6 Capital Budgeting - Non DiscountedXyril MañagoNo ratings yet

- Lec 10 Capital Budgeting TechniquesDocument22 pagesLec 10 Capital Budgeting TechniquesAnikk HassanNo ratings yet

- Mba Syllabus Thapar UniversityDocument96 pagesMba Syllabus Thapar UniversityRahul RaiNo ratings yet

- Calculating Irr For A Project With Mixed StreamDocument6 pagesCalculating Irr For A Project With Mixed StreamPratibha Jaggan-MartinNo ratings yet

- CH 12Document63 pagesCH 12Grace VersoniNo ratings yet

- RAMA - 54201 - 05011181520043 - 0001056204 - 0017067005 - 01 - Front - RefDocument23 pagesRAMA - 54201 - 05011181520043 - 0001056204 - 0017067005 - 01 - Front - RefAriansyahNo ratings yet

- BBA Banking and Finance PDFDocument65 pagesBBA Banking and Finance PDFMèhàŕ MàŕiàNo ratings yet