Professional Documents

Culture Documents

Financial Accounting - Semester-3: Suggested Solutions/ Answers Fall 2015 Examinations

Uploaded by

AsimsaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting - Semester-3: Suggested Solutions/ Answers Fall 2015 Examinations

Uploaded by

AsimsaCopyright:

Available Formats

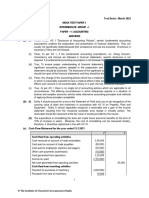

SUGGESTED SOLUTIONS/ ANSWERS – FALL 2015 EXAMINATIONS 2 of 6

FINANCIAL ACCOUNTING – SEMESTER-3

Question No.3

(a) Lease Amortization Schedule

Advance +

Date Liability Interest Principal Liability

Rental

1/1/2015 1,500,000 522,635 977,365 0.5

7/1/2015 977,365 222,635 43,981 178,654 798,710 01

1/1/2016 798,710 222,635 35,942 186,693 612,017 01

7/1/2016 612,017 222,635 27,541 195,095 416,922 01

1/1/2017 416,922 222,635 18,762 203,874 213,048 01

7/1/2017 213,048 222,635 9,587 213,048 -0- 0.5

(b)

(i) Landed cost of goods: Amount

Invoice amount 200,000 0.5

Import duty and other taxes 65,000 0.5

Transportation charges 12,000 0.5

Labour charges 5,000 0.5

Total landed cost 282,000 01

(ii) Total cost of goods 282,000 0.5

Net realizable value of goods 275,000 0.5

IAS-2 requires the inventory should be stated at lower of cost or net realizable value.

So NRV is lower of cost hence inventory should be stated at NRV i.e. Rs.275,000. 01

(c) (i)

The company should recognize the impairment losses as follows:

(i) Any assets that are apparently damaged or destroyed. Therefore, the loss of

1

Rs.1 million against inventory destroyed by fire will be allocated first.

(ii) Then goodwill of Rs.2 million should be written down to zero. 1

(iii) The remaining impairment loss shall be allocated to the tangible non-current assets. 1

After allocation of the impairment loss, the assets of the cash generating unit will show

the following position:

Rupees in million

Carrying Carrying

Impairment

value before value after

loss

impairment impairment

Property, plant and

0.75

equipment 26 (2) 24

Goodwill 2 (2) - 0.75

Patent rights 1 (1) - 0.75

Inventory 12 (1) 11 0.75

Total 41 (6) 35

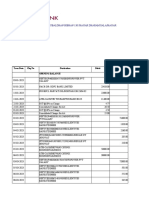

(ii) The impairment loss should be accounted for as follows:

Friends Company Ltd.

General Journal

Date Description Ref Debit Credit

December 31, 2015 Revaluation surplus account 1 - 0.5

Profit or loss account 5 0.5

Property, plant and equipment 2 0.5

Goodwill 2 0.5

Patent rights 1 0.5

Inventory 1 0.5

(To record impairment losses)

SUGGESTED SOLUTIONS/ ANSWERS – FALL 2015 EXAMINATIONS 6 of 6

FINANCIAL ACCOUNTING – SEMESTER-3

Marks

Question No.5

(a) (i) Historical cost

Assets are recorded at the amount of cash or cash equivalents paid or the fair value of

the consideration given to acquire them at the time of their acquisition. Liabilities are

recorded at the amount of proceeds received in exchange for the obligation, or in some

circumstances (for example, income taxes), at the amounts of cash or cash equivalents

expected to be paid to satisfy the liability in the normal course of business. 02

(ii) Current cost

Assets are carried at the amount of cash or cash equivalents that would have to be paid if

the same or an equivalent asset was acquired currently. Liabilities are carried at the

undiscounted amount of cash or cash equivalents that would be required to settle the

obligation currently. 02

(b) (i) Rs.

Franchise license fee:

License fee 5,000,000 0.5

Lawyer's fee 150,000 0.5

Documentation charges 50,000 0.5

5,200,000 0.5

Annual amortization cost (5,200,000 / 10) 520,000 0.5

Market value of the franchise license 3,000,000 0.5

Less: franchise license carrying cost as

of December 31, 2015

Franchise license cost 5,200,000

Amortization during 2011 to 2015 (520,000 x 5) (2,600,000) 2,600,000 0.5

Revaluation surplus 400,000 0.5

(ii) Abrar Company Ltd.

General Journal

Date Description Ref Debit Credit

1-Jan-11 Intangible asset - Franchise license cost 5,200,000 01

Bank 5,200,000 01

(To record franchise license cost)

31-Dec-15 Accumulated amortization - franchise cost 2,600,000 01

Intangible asset - Franchise license cost 2,600,000 01

(To record amortization cost for the year 2015)

31-Dec-15 Intangible asset - Franchise license cost 400,000 01

Revaluation surplus 400,000 01

(To record revaluation of franchise license cost)

(c)

Property, plant and equipment 100,000,000

Cash 100,000,000 01

Cash 3,000,000

Profit and loss 3,000,000 1.5

Cash 10,000,000

Deferred income/ Property, plant and equipment 10,000,000 1.5

THE END

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Innocent Words That Make Her HornyDocument14 pagesInnocent Words That Make Her HornyH69% (13)

- C103 - General Checklist - ISO-IEC 17025:2017 Accreditation of Field Testing and Field Calibration LaboratoriesDocument19 pagesC103 - General Checklist - ISO-IEC 17025:2017 Accreditation of Field Testing and Field Calibration LaboratorieshuidhyiuodghNo ratings yet

- Charles Zastrow, Karen K. Kirst-Ashman-Understanding Human Behavior and The Social Environment-Thomson Brooks - Cole (2007)Document441 pagesCharles Zastrow, Karen K. Kirst-Ashman-Understanding Human Behavior and The Social Environment-Thomson Brooks - Cole (2007)joan82% (17)

- Cash Flow Statement - QuestionDocument27 pagesCash Flow Statement - Questionhamza khanNo ratings yet

- Chemical & Biological Depopulation (By Water Floridation and Food Additives or Preservatives) PDFDocument178 pagesChemical & Biological Depopulation (By Water Floridation and Food Additives or Preservatives) PDFsogunmola100% (2)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- NBFC Business PlanDocument6 pagesNBFC Business PlanVishnu Upadhyay67% (3)

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- IAS 2 SummaryDocument2 pagesIAS 2 SummarySania AhmedNo ratings yet

- Final CMADocument6 pagesFinal CMAManjari AgrawalNo ratings yet

- Unilever PakistanDocument26 pagesUnilever PakistanElie Mints100% (3)

- Installation of Submarine PE PipesDocument84 pagesInstallation of Submarine PE Pipeswaseemiqbal133100% (2)

- STW 44 3 2 Model Course Leadership and Teamwork SecretariatDocument49 pagesSTW 44 3 2 Model Course Leadership and Teamwork Secretariatwaranchai83% (6)

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- ASS 1 2021 Part A SolutionDocument4 pagesASS 1 2021 Part A SolutionOdzulaho DemanaNo ratings yet

- Cma SCPL BG LoanDocument15 pagesCma SCPL BG LoanSteven BryantNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Amount (RS) Amount (RS) : As Per Our Report On Even Date For & On Behalf of The BoardDocument8 pagesAmount (RS) Amount (RS) : As Per Our Report On Even Date For & On Behalf of The BoardmuditNo ratings yet

- Test 1 SolutionDocument2 pagesTest 1 Solutionfarsi786100% (1)

- Form Ii - Operating Statement Rs. LacsDocument21 pagesForm Ii - Operating Statement Rs. LacsShushant ShekharNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriesRoger FedererNo ratings yet

- Suggested Solutions/ Answers Spring 2017 Examinations 1 of 7Document7 pagesSuggested Solutions/ Answers Spring 2017 Examinations 1 of 7Ayaz MobileNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument25 pages© The Institute of Chartered Accountants of IndiacdNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Iluted Arnings Er SDocument2 pagesIluted Arnings Er Ssuhasshinde88No ratings yet

- Investor Relations Annual Report 2022 LRholdingDocument15 pagesInvestor Relations Annual Report 2022 LRholdingkristina backaNo ratings yet

- Infosys: Balance SheetDocument6 pagesInfosys: Balance SheetchiragNo ratings yet

- Acc 2 Nov 2020 SolDocument3 pagesAcc 2 Nov 2020 SolKimberly GondoraNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument25 pages© The Institute of Chartered Accountants of IndiaShobhit JalanNo ratings yet

- Test 9 SolutionDocument3 pagesTest 9 Solutionlalshahbaz57No ratings yet

- Shawl EmbroiideryDocument11 pagesShawl EmbroiiderysyedNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document15 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- BHAGYALAKSMI CMA LOAN BHBHJDocument15 pagesBHAGYALAKSMI CMA LOAN BHBHJbal balreddyNo ratings yet

- Cash Flow Explanatory SheetDocument4 pagesCash Flow Explanatory SheetTony DarwishNo ratings yet

- Semester-6 Chapter-5Document10 pagesSemester-6 Chapter-5bharatipaul42No ratings yet

- Lecture 11-11Document2 pagesLecture 11-11Nouman ShamasNo ratings yet

- Frsa Module III Problems SolutionsDocument34 pagesFrsa Module III Problems Solutionsaijaz ahmed nagthan01No ratings yet

- CMA FormatDocument21 pagesCMA Formatapi-377123878% (9)

- Statement of Income and ExpenditureDocument2 pagesStatement of Income and Expenditureyogendra kumarNo ratings yet

- 05 DEC QuestionDocument10 pages05 DEC Questionkhengmai100% (1)

- Paper - 1: Financial Reporting: AssetsDocument43 pagesPaper - 1: Financial Reporting: AssetsTisha AggarwalNo ratings yet

- Rafeeqa Begum (DPR)Document13 pagesRafeeqa Begum (DPR)syedNo ratings yet

- Ass For BMDocument6 pagesAss For BMMeron TemisNo ratings yet

- Financial Statements of Great Eastern Shipping: YearsDocument15 pagesFinancial Statements of Great Eastern Shipping: YearsPriyankaNo ratings yet

- Sip 3Document5 pagesSip 3mohit sharmaNo ratings yet

- C-360 ReportDocument18 pagesC-360 ReportComms KNNo ratings yet

- Managerial Accounting PPDocument42 pagesManagerial Accounting PPSaurav KumarNo ratings yet

- Analysing Financial Performance: Centre For Financial Management, BangaloreDocument24 pagesAnalysing Financial Performance: Centre For Financial Management, Bangalorepankaj9mayNo ratings yet

- Financial Analysis - HomeworkDocument7 pagesFinancial Analysis - HomeworkTuan Anh LeeNo ratings yet

- SOLUTION TO SCHEDULE 3gDocument4 pagesSOLUTION TO SCHEDULE 3gKrushna Omprakash MundadaNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- Accountin Principals Task 2Document15 pagesAccountin Principals Task 2Thivya KrishnanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- ACCN 101-Jan 2022Document6 pagesACCN 101-Jan 2022Chapo madzivaNo ratings yet

- Following Expensess: Accountant CompanyDocument8 pagesFollowing Expensess: Accountant CompanyAravind ShekharNo ratings yet

- Particulars: © The Institute of Chartered Accountants of IndiaDocument17 pagesParticulars: © The Institute of Chartered Accountants of IndiaPraveen Reddy DevanapalleNo ratings yet

- FR - QuestionsDocument8 pagesFR - Questionsrocks007123No ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaRohit SadhukhanNo ratings yet

- MC Professional Plaza, LLC 2020 Form 1065Document61 pagesMC Professional Plaza, LLC 2020 Form 1065Sue StevenNo ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Exhibit 1: BALANCE SHEET of VIP Industries As at March 31Document2 pagesExhibit 1: BALANCE SHEET of VIP Industries As at March 31Neelu AggrawalNo ratings yet

- CFS Test - 1 Set-A 13-2-2022Document2 pagesCFS Test - 1 Set-A 13-2-2022Hitesh SemwalNo ratings yet

- F6PKN 2014 Jun ADocument14 pagesF6PKN 2014 Jun ARihamNo ratings yet

- S4 SmaDocument3 pagesS4 SmaAsimsaNo ratings yet

- 2012Document2 pages2012AsimsaNo ratings yet

- Cost Planning, Analysis and TechniquesDocument3 pagesCost Planning, Analysis and TechniquesAsimsaNo ratings yet

- C2 - Strategic Management Accounting: Chartered LevelDocument5 pagesC2 - Strategic Management Accounting: Chartered LevelAsimsaNo ratings yet

- Cost Planning, Analysis and TechniquesDocument3 pagesCost Planning, Analysis and TechniquesAsimsaNo ratings yet

- AGRIAUTOS INDUSTRY LTD Report 2017 PDFDocument27 pagesAGRIAUTOS INDUSTRY LTD Report 2017 PDFMIRXA SIKANDARNo ratings yet

- Marks Question No. 2 (A) (I) Journal Entries: Rupees Debit CreditDocument2 pagesMarks Question No. 2 (A) (I) Journal Entries: Rupees Debit CreditAsimsaNo ratings yet

- What Is A Pareto Analysis?: Business ManagersDocument1 pageWhat Is A Pareto Analysis?: Business ManagersAsimsaNo ratings yet

- Single Member Companies Rules, 2003Document5 pagesSingle Member Companies Rules, 2003AsimsaNo ratings yet

- Marks Question No. 5 (A) Rupees in '000' Building Vehicles Total DepreciationDocument2 pagesMarks Question No. 5 (A) Rupees in '000' Building Vehicles Total DepreciationAsimsaNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument3 pagesCost-Volume-Profit (CVP) AnalysisAsimsaNo ratings yet

- PEDocument4 pagesPEAsimsaNo ratings yet

- Units in Inventory Units Required Additional InformationDocument1 pageUnits in Inventory Units Required Additional InformationAsimsaNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument2 pagesCost-Volume-Profit (CVP) AnalysisAsimsaNo ratings yet

- QJ's Answer To Platinum - Internal ControlDocument2 pagesQJ's Answer To Platinum - Internal ControlAsimsaNo ratings yet

- Class 1 KeyDocument3 pagesClass 1 Keyshivamsingh.fscNo ratings yet

- JupaCreations BWCGDocument203 pagesJupaCreations BWCGsoudrack0% (1)

- The Limits of The Sectarian Narrative in YemenDocument19 pagesThe Limits of The Sectarian Narrative in Yemenهادي قبيسيNo ratings yet

- Volcanoes Sub-topic:Volcanic EruptionDocument16 pagesVolcanoes Sub-topic:Volcanic EruptionVhenz MapiliNo ratings yet

- Bassoon (FAGOT) : See AlsoDocument36 pagesBassoon (FAGOT) : See Alsocarlos tarancón0% (1)

- MCFKTP G3 S2 SC Number Pattern PuzzlesDocument5 pagesMCFKTP G3 S2 SC Number Pattern PuzzlesEric GoNo ratings yet

- Operation and Maintenance Manual Compressor Models: P105WJD, P130DWJD, P160DWJD, P175DWJDDocument70 pagesOperation and Maintenance Manual Compressor Models: P105WJD, P130DWJD, P160DWJD, P175DWJDManuel ParreñoNo ratings yet

- Jy992d66901 CDocument6 pagesJy992d66901 CMaitry ShahNo ratings yet

- Icc Esr-2302 Kb3 ConcreteDocument11 pagesIcc Esr-2302 Kb3 ConcretexpertsteelNo ratings yet

- Pipe Freezing StudyDocument8 pagesPipe Freezing StudymirekwaznyNo ratings yet

- 3.0 Series and Parallel DC CircuitsDocument29 pages3.0 Series and Parallel DC CircuitsJinky Loyce RaymundoNo ratings yet

- Adolescents' Gender and Their Social Adjustment The Role of The Counsellor in NigeriaDocument20 pagesAdolescents' Gender and Their Social Adjustment The Role of The Counsellor in NigeriaEfosaNo ratings yet

- Furniture AnnexDocument6 pagesFurniture AnnexAlaa HusseinNo ratings yet

- Catalogue - Central Battery SystemDocument12 pagesCatalogue - Central Battery SystemarifzakirNo ratings yet

- Earth Science NAME - DATEDocument3 pagesEarth Science NAME - DATEArlene CalataNo ratings yet

- 3E Hand Over NotesDocument3 pages3E Hand Over NotesAshutosh MaiidNo ratings yet

- Essay On Stem CellsDocument4 pagesEssay On Stem CellsAdrien G. S. WaldNo ratings yet

- EDAG0007Document5 pagesEDAG0007krunalNo ratings yet

- Random Questions From Various IIM InterviewsDocument4 pagesRandom Questions From Various IIM InterviewsPrachi GuptaNo ratings yet

- Mossbauer SpectrosDocument7 pagesMossbauer SpectroscyrimathewNo ratings yet

- XXXX96 01 01 2023to28 08 2023Document18 pagesXXXX96 01 01 2023to28 08 2023dabu choudharyNo ratings yet

- Carbohydrates StainsDocument43 pagesCarbohydrates StainssupahvyNo ratings yet

- An Introduction To Routine and Special StainingDocument13 pagesAn Introduction To Routine and Special StainingBadiu ElenaNo ratings yet