Professional Documents

Culture Documents

Topic 3 - Pricing Policy

Topic 3 - Pricing Policy

Uploaded by

maureenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 3 - Pricing Policy

Topic 3 - Pricing Policy

Uploaded by

maureenCopyright:

Available Formats

Pricing Policy

AC 407 Management Accounting & Control

1

1

Objectives

AC 407 Management Accounting & Control

2

1

Factors Influencing the Price of a Product

1. Price sensitivity- Sensitivity to price levels will vary

amongst purchasers

2. Price perception- the way customers react to prices.

3. Quality

4. Intermediaries- distributing the product through

others.

5. Competitors

6. Suppliers

7. Inflation

8. Exchange rate (new reality in Zimbabwe)

9. Incomes

AC 407 Management Accounting & Control

3

1

Markets

The price that an organization can charge is determined

by the market in which it operates in:

1. Perfect competition – many buyers and sellers with

no one with no one having power on prices. Buyers

and sellers all deal with same product (Not realistic)

2. Monopoly- one seller who dominates many buyers.

Monopolist uses his power to maximize profit.

3. Monopolistic competition a large number of

suppliers offer similar, but not identical, products.

4. Oligopoly - where relatively few competitive

companies dominate the market.

AC 407 Management Accounting & Control

4

1

Price and Demand Relationship

Factors that influence demand

1. Price

2. Income

3. Price of substitute goods (alternative)

4. Price of complementary

5. Taste

6. Market size

7. Advertising

AC 407 Management Accounting & Control

5

1

Price Elasticity of Demand

Concept of price elasticity of demand

Price elasticity of demand

(a) The price elasticity of demand (PED) is a measure of the extent of change

in demand for a good in response to a change in its price. It is measured as:

The % change in quantity demanded

The % change in price

(b) Demand is referred to as inelastic if the absolute value is less than 1 and

elastic if the absolute value is greater than 1.

AC 407 Management Accounting & Control

6

1

Price Elasticity of Demand

Example 1

The price of a good is $1.20 per unit and annual

demand is 800,000 units. Market research

indicates that an increase in price of 10 cents

per unit will result in a fall in annual demand of

75,000 units. What is the price elasticity of

demand?

AC 407 Management Accounting & Control

7

1

Price Elasticity of Demand

Solution

% change in demand = (75,000 / 800,000) x 100% =

9.375%

% change in price = (0.1 / 1.20) x 100% = 8.333%

Price elasticity of demand = (–9.375/8.333) = –1.125

Ignoring the minus sign, price elasticity is 1.125

The demand for this good, at a price of $1.20 per unit,

would be referred to as elastic because the price elasticity

of demand is greater than 1.

AC 407 Management Accounting & Control

8

1

Price Elasticity of Demand

Special values of price elasticity

There two special values of price elasticity of

demand

a) Perfectly inelastic (PED = 0).

b) Perfectly elastic (PED = ∞).

AC 407 Management Accounting & Control

9

1

Price Elasticity of Demand

a) Perfectly inelastic

There is no change in quantity demanded,

regardless of the change in price. The demand

curve is a vertical straight line.

AC 407 Management Accounting & Control

10

1

Price Elasticity of Demand

b) Perfectly elastic

Consumers will want to buy an infinite amount, but

only up to a particular price level.

Any price increase above this will reduce demand to

zero. The demand curve is a horizontal straight line.

AC 407 Management Accounting & Control

11

1

PED and revenue relationship

• When demand is elastic, total revenue rises

as price falls and vice versa. This is because

the quantity demanded in very responsive to

price changes.

• When demand is inelastic, total revenue falls

as price falls because a fall in price causes a

less than proportionate rise in quantity

demanded.

AC 407 Management Accounting & Control

12

1

Pricing Strategies

1. Cost-plus pricing- sales price is determined by

calculating the full cost of the product and adding a

percentage mark-up for profit.

2. Marginal cost-plus pricing- Marginal cost-plus

pricing/mark-up pricing involves adding a profit

margin to the marginal cost of production/sales.

3. Market skimming pricing- involves charging high

prices when a product is first launched in order to

maximize short-term profitability.

4. Market penetration pricing- pricing is a policy of low

prices when a product is first launched in order to

obtain sufficient penetration into the market.

AC 407 Management Accounting & Control

13

1

Pricing Strategies

Points to note

Please read at the advantages and

disadvantages of pricing strategies discussed

above.

Revise full costing and marginal costing from

your earlier studies as that is key in cost plus

pricing and marginal cost plus.

Market skimming pricing and penetration

pricing have no calculations involved.

AC 407 Management Accounting & Control

14

1

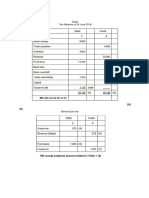

Example

Brick by Brick (BBB) is a building business that provides a range of building services to the

public. Recently they have been asked to quote for garage conversions (GC) and extensions to

properties (EX) and have found that they are winning fewer GC contracts than expected.

BBB has a policy to price all jobs at budgeted total cost plus 50%. Overheads are curr ently

absorbed on a labour hour basis. BBB thinks that a switch to activity based costing (ABC) to

absorb overheads w ould reduce the cost associated to GC and hence make them more

competitive.

You are provided with the following data:

Overhead Annual Activity driver Total number of

category overheads ($) activities per year

Supervisors 90,000 Site visits 500

Planners 70,000 Planning documents 250

Property related 240,000 Labour hours 40,000

400,000

A typical GC costs $3,500 in materials and takes 300 labour hours to complete. A GC requires

only one site visit by a supervisor and needs only one planning document to be raised. The

typical EX costs $8,000 in materials and takes 500 hours to complete. An EX requires six site

visits and fi ve planning documents. In all cases labour is paid $15 per hour.

Required:

(a) Calculate the cost and quoted price of a GC and of an EX using labour hours to absorb

the overheads. (5 marks)

(b) Calculate the cost and the quoted price of a GC and of an EX using ABC to absorb the

overheads.

AC 407 Management Accounting & Control

15

1

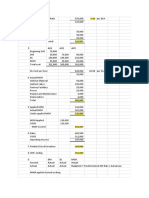

Example- Answer

(a)

Costs and quoted prices for the GC and EX using labour hours to absorb overheads:

GC ($) EX ($)

Materials 3,500 8,000

Labour 300 hrs x $15/hr 4,500

500 hrs x $15/hr 7,500

Overheads 300 hrs x $10/hr (W1) 3,000

500 hrs x $10/hr 5,000

Total cost 11,000 20,500

Quoted price 16,500 30,750

(W1) Overhead absorption rate is calculated as $400,000/40,000 hrs = $10/hr

AC 407 Management Accounting & Control

16

1

Example- Answer

(b)

Costs and quoted prices for the GC and the EX using ABC to absorb overheads:

GC ($) EX ($)

Materials 3,500 8,000

Labour 300 hrs x $15/hr 4,500

500 hrs x $15/hr 7,500

Overhead

- Supervisor (W2)/(W3) 180 1,080

- Planners (W2)/(W3) 280 1,400

- Property (W2)/(W3) 1,800 3,000

Total cost 10,260 20,980

Quoted price 15,390 31,470

(W2)

Costs No. of drivers Cost per driver

Supervisor 90,000 500 180

Planners 70,000 250 280

Property 240,000 40,000 6

(W3)

Supervisor Planner Property

Cost per driver (W2) $180 $280 $6

GC 180 x 1 = 180 280 x 1 = 280 6 x 300 = 1,800

EX 180 x 6 = 1,080 280 x 5 = 1,400 6 x 500 = 3,000

AC 407 Management Accounting & Control

17

1

END

AC 407 Management Accounting & Control

18

1

You might also like

- Multiple Choice: Principles of Accounting, Volume 2: Managerial AccountingDocument46 pagesMultiple Choice: Principles of Accounting, Volume 2: Managerial Accountingquanghuymc100% (2)

- Activity Based Costing (ABC) . Feb 2020: Cost Driver AnalysisDocument11 pagesActivity Based Costing (ABC) . Feb 2020: Cost Driver AnalysisMuhammad Noman AnserNo ratings yet

- Topic 4 - Investment AppraisalDocument46 pagesTopic 4 - Investment AppraisalmaureenNo ratings yet

- Complete Notes EconomicsDocument222 pagesComplete Notes Economicsakanksha chaudharyNo ratings yet

- Unit 10 Variance Analysis: ObjectivesDocument26 pagesUnit 10 Variance Analysis: ObjectivesKyaw Min HanNo ratings yet

- Standard CostingDocument57 pagesStandard CostingAmrit SainiNo ratings yet

- Standard Costing Standard Costing Standard Costing Standard CostingDocument22 pagesStandard Costing Standard Costing Standard Costing Standard CostingKUNAL GOSAVINo ratings yet

- Lecture 11 - Price-Setting in B2B MarketsDocument36 pagesLecture 11 - Price-Setting in B2B MarketsMihaela Popazova100% (1)

- Chapter 7 Pricing SVDocument27 pagesChapter 7 Pricing SVGayan AkilaNo ratings yet

- 4: Pricing Decisions: Topic ListDocument8 pages4: Pricing Decisions: Topic Listanon-555172No ratings yet

- Economics For Managers: Wwu MünsterDocument100 pagesEconomics For Managers: Wwu MünsterAditya SrivastavaNo ratings yet

- Assignment 2 Demand & Supply PDFDocument6 pagesAssignment 2 Demand & Supply PDFhemantNo ratings yet

- Pricing Decisions F5 NotesDocument4 pagesPricing Decisions F5 NotesSiddiqua KashifNo ratings yet

- Pricing Products and Services: Appendix ADocument18 pagesPricing Products and Services: Appendix ARochelle CabellezaNo ratings yet

- Gls University'S Faculty of Commerce Semester - Iv Cost Accounting - 2 Objective Questions 2017-2018Document12 pagesGls University'S Faculty of Commerce Semester - Iv Cost Accounting - 2 Objective Questions 2017-2018Archana0% (1)

- Chapter 7 - Pricing Decisions - Student VersionDocument35 pagesChapter 7 - Pricing Decisions - Student VersionPiece of WritingsNo ratings yet

- Quizzer-Cost-Behavior - Docx Regression Analysis Least SquaresDocument1 pageQuizzer-Cost-Behavior - Docx Regression Analysis Least SquareslastjohnNo ratings yet

- Pplication M: Icroeconomics Heory Asis Nderstanding EY Conomic Ariables Ffecting UsinessDocument22 pagesPplication M: Icroeconomics Heory Asis Nderstanding EY Conomic Ariables Ffecting UsinesschristylNo ratings yet

- Session 8 - Capacity PlanningDocument28 pagesSession 8 - Capacity Planningchandel08No ratings yet

- Pricing PPT MergedDocument95 pagesPricing PPT MergedVarun ChandnaNo ratings yet

- Unit 06 (Standard Cost & Variance AnalysisDocument156 pagesUnit 06 (Standard Cost & Variance Analysisadam100% (1)

- Managerial Economics 1Document6 pagesManagerial Economics 1Sameer ReddyNo ratings yet

- Managerial Economics - Session 1 - MMUI 2023Document53 pagesManagerial Economics - Session 1 - MMUI 2023Ayu PoernomoNo ratings yet

- Introduction To PricingDocument11 pagesIntroduction To PricingMuhammad Hamza ZahidNo ratings yet

- Managerial Economics - Session 1 - MMUI 2023Document54 pagesManagerial Economics - Session 1 - MMUI 2023pusdiklatkm2No ratings yet

- Session 8Document14 pagesSession 8Debdoot GhoshNo ratings yet

- TOPIC 4 - AF09101 - Short-Term Decisions (BEP) and CostingDocument44 pagesTOPIC 4 - AF09101 - Short-Term Decisions (BEP) and Costingarusha afroNo ratings yet

- Three: Competencies and ProfitabilityDocument68 pagesThree: Competencies and ProfitabilitySamiul21No ratings yet

- Lecture 4 Slides - ReadyDocument67 pagesLecture 4 Slides - ReadyJoey ChinNo ratings yet

- 2 - Cost Terms, Concepts and BehaviorDocument12 pages2 - Cost Terms, Concepts and BehaviorARISNo ratings yet

- Total Cost of Ownership:: Application in Supply Chain ManagementDocument22 pagesTotal Cost of Ownership:: Application in Supply Chain ManagementusmanNo ratings yet

- Supply ScheduleDocument5 pagesSupply ScheduleJosua PagcaliwaganNo ratings yet

- CAF 2 Autumn 2019Document9 pagesCAF 2 Autumn 2019IbrahimNo ratings yet

- Assignement - 2 Solution - EditedDocument16 pagesAssignement - 2 Solution - Editedboom boomNo ratings yet

- Part DDocument67 pagesPart D2958863601No ratings yet

- Jawaban Kuis UTS - LengkapDocument4 pagesJawaban Kuis UTS - Lengkapdago atasNo ratings yet

- MA2 Mock 1-Qs - 2023-24Document11 pagesMA2 Mock 1-Qs - 2023-24daniel.maina2005No ratings yet

- Ch5 LimitingFactorsDocument19 pagesCh5 LimitingFactorsali202101No ratings yet

- SOV E05169BCOM PBD Answer SchemeDocument7 pagesSOV E05169BCOM PBD Answer SchemeNeeraj KrishnaNo ratings yet

- Inventory Management PDFDocument49 pagesInventory Management PDFVyVyNo ratings yet

- Sensitivity AnalysisDocument4 pagesSensitivity AnalysisMei Yi YeoNo ratings yet

- MAS 04 Absorption and Variable CostingDocument6 pagesMAS 04 Absorption and Variable CostingJericho G. Bariring0% (1)

- PIPFA Solutions W15Document71 pagesPIPFA Solutions W15Mudassar PatelNo ratings yet

- Sample MAS (Absorption & Variable Costing With Pricing Decision)Document6 pagesSample MAS (Absorption & Variable Costing With Pricing Decision)Gwyneth CartallaNo ratings yet

- Strategic Cost ManagementDocument21 pagesStrategic Cost ManagementDeepak ShettyNo ratings yet

- Topic 5 - Product Pricing Profit AnalysisDocument44 pagesTopic 5 - Product Pricing Profit AnalysisJoan LibrandoNo ratings yet

- Chapter 2 Overhead - Activity Based CostingDocument16 pagesChapter 2 Overhead - Activity Based Costing2023627486No ratings yet

- Pricing Decisions: By: DR Shahinaz AbdellatifDocument30 pagesPricing Decisions: By: DR Shahinaz AbdellatifEman EmyNo ratings yet

- BUSI 1023 Unit 3 ElasticityDocument46 pagesBUSI 1023 Unit 3 Elasticitytharusan4512No ratings yet

- Part A: Managerial Accounting Assessment - ACC720 - March 2020Document4 pagesPart A: Managerial Accounting Assessment - ACC720 - March 2020Helmy YusoffNo ratings yet

- Managerial Accounting Code: 0502603Document21 pagesManagerial Accounting Code: 0502603nanaNo ratings yet

- Ped and Mrketing MixDocument4 pagesPed and Mrketing MixTanny MaxNo ratings yet

- Week 12 Lecture Notes (1 Slide)Document48 pagesWeek 12 Lecture Notes (1 Slide)Kevin ShajiNo ratings yet

- Engg. Economics Lecture 3Document8 pagesEngg. Economics Lecture 3vsvsasasNo ratings yet

- MAS Cost Concepts and AnalysisDocument6 pagesMAS Cost Concepts and AnalysisMary Dale Joie BocalaNo ratings yet

- Presentation 9 - Cost Concepts and Design EconomicsDocument18 pagesPresentation 9 - Cost Concepts and Design EconomicsafzalNo ratings yet

- Reading 8 Topics in Demand and Supply AnalysisDocument26 pagesReading 8 Topics in Demand and Supply AnalysisNeerajNo ratings yet

- Valuation Cast Study For Ibbi AspirantsDocument43 pagesValuation Cast Study For Ibbi AspirantsMuruga DasNo ratings yet

- WKSHTDocument8 pagesWKSHTjohnNo ratings yet

- End Term Paper - Microeconomics-Final Exam-2020 BatchDocument4 pagesEnd Term Paper - Microeconomics-Final Exam-2020 BatchVishnuvardhan RavichandranNo ratings yet

- A) Discuss The Managing Director's Pricing Strategy in The Circumstances Described Above. (5 Marks)Document17 pagesA) Discuss The Managing Director's Pricing Strategy in The Circumstances Described Above. (5 Marks)Hannah KayyNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Data Communications & Networking: 4.2 Types of NetworksDocument36 pagesData Communications & Networking: 4.2 Types of NetworksmaureenNo ratings yet

- University of Zimbabwe Business Studies Department Business Mathematics - Bs107 1 Semester Examination - February/March 2009 Time: 3 HoursDocument3 pagesUniversity of Zimbabwe Business Studies Department Business Mathematics - Bs107 1 Semester Examination - February/March 2009 Time: 3 HoursmaureenNo ratings yet

- Sinclair Online Academy: Vectors 2 Question BankDocument15 pagesSinclair Online Academy: Vectors 2 Question BankmaureenNo ratings yet

- Paper 1 Mock ExamDocument7 pagesPaper 1 Mock ExammaureenNo ratings yet

- Topic 6 - Network AnalysisDocument64 pagesTopic 6 - Network AnalysismaureenNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLoan LoanNo ratings yet

- Marginal CostingDocument15 pagesMarginal CostingShri VidhyaNo ratings yet

- Interim ReportingDocument14 pagesInterim ReportingAbby Navarro100% (3)

- National Income Important Topics by Sunil PandaDocument5 pagesNational Income Important Topics by Sunil PandaSaturo GojoNo ratings yet

- Answer Key Accounting Paper 2 Term 3 Form 4Document8 pagesAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedNo ratings yet

- AECOM Handbook 2023 31 40Document10 pagesAECOM Handbook 2023 31 40vividsurveyorNo ratings yet

- PM - G - 2 - Indentification of Plant & MachineryDocument4 pagesPM - G - 2 - Indentification of Plant & MachinerySanjay PatelNo ratings yet

- Balance of TradeDocument5 pagesBalance of TradePakeeza JavedNo ratings yet

- Management Theory and Practice: Dr. Subrahmanyam ADocument40 pagesManagement Theory and Practice: Dr. Subrahmanyam ASri HarshithaNo ratings yet

- Marketing Principles Asia Pacific 2nd Edition Pride Test BankDocument32 pagesMarketing Principles Asia Pacific 2nd Edition Pride Test Bankfintanthamh4jtd100% (32)

- PNG Eiti 2016 ReportDocument190 pagesPNG Eiti 2016 ReportPhilNo ratings yet

- NBL Annual Report 20161 PDFDocument322 pagesNBL Annual Report 20161 PDFRumana ShornaNo ratings yet

- MKT 730fundamentals of MarketingDocument252 pagesMKT 730fundamentals of Marketingjoseph emmanuelNo ratings yet

- EU Tax Observatory - Annual Report - 202122Document14 pagesEU Tax Observatory - Annual Report - 202122Alexander BocaNo ratings yet

- OSCE-UNECE - Handbook of Best Practices at Border Crossings - A Trade and Transport Facilitation PerspectiveDocument268 pagesOSCE-UNECE - Handbook of Best Practices at Border Crossings - A Trade and Transport Facilitation PerspectiveZágon CsabaNo ratings yet

- Final Assessment: Petroleum Economics Problem SolvingDocument4 pagesFinal Assessment: Petroleum Economics Problem SolvingSayaf SalmanNo ratings yet

- Project Appraisal Ratio Analysis - 2023 - Students - SlidesDocument36 pagesProject Appraisal Ratio Analysis - 2023 - Students - SlidesThaboNo ratings yet

- Farm Fresh - Redacted Version - 15.12.2021Document548 pagesFarm Fresh - Redacted Version - 15.12.2021I am JonesNo ratings yet

- Original PDF Horngrens Financial Managerial Accounting 6th Edition PDFDocument41 pagesOriginal PDF Horngrens Financial Managerial Accounting 6th Edition PDFjames.auiles492100% (38)

- 30 132 1 PBDocument10 pages30 132 1 PBannida nursyifaNo ratings yet

- Ejercicio 7.23Document1 pageEjercicio 7.23Enrique M.No ratings yet

- Euro To Idr - Google SearchDocument1 pageEuro To Idr - Google SearchPutri WaNo ratings yet

- Job Order Costing Activity 2Document7 pagesJob Order Costing Activity 2RJ MonsaludNo ratings yet

- Business Combination AssignmentDocument4 pagesBusiness Combination AssignmentRica Joy RuzgalNo ratings yet

- Zimbabwe: 2021 Annual Research: Key HighlightsDocument2 pagesZimbabwe: 2021 Annual Research: Key HighlightsXXKEY2XXNo ratings yet

- Mungkahing Proyekto For Microenterprise DevelopmentDocument4 pagesMungkahing Proyekto For Microenterprise DevelopmentNina Rica BautistaNo ratings yet

- Invoice 267977536-769933Document1 pageInvoice 267977536-769933Julz MariottNo ratings yet

- Bus RouteDocument1 pageBus RouteMark Joseph Foliente PlandesNo ratings yet

- Beta - Calculations PDFDocument3 pagesBeta - Calculations PDFRebecca Ann SajiNo ratings yet