Professional Documents

Culture Documents

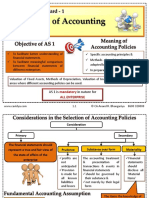

Accounting Concepts & Principles

Uploaded by

Christine RamirezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Concepts & Principles

Uploaded by

Christine RamirezCopyright:

Available Formats

MATERIALITY GOING-CONCERN

The information which will have a material effect Business may continue forever and will carry

should form a part of the financial reports and out its goals & plans in foreseeable future with

recording transactions. no intention of liquidation.

MONETARY UNIT BUSINESS ENTITY

Transactions that carry a monetary value &

Owner & business as two different entities

stated in terms of a currency (for example $ in

having different liabilities

the U.S.) should only be recorded.

HISTORICAL COST FULL DISCLOSURE

Disclosure of all important information for the

Recordation of the assets should be on their

users, lenders or investors within the financial

purchased values, purchased ow or years ago.

statement reports or as a footnote.

MATCHING CONSERVATISM

Cost should be matched with the revenue If a situation arises where there are 2

generated. acceptable options for reporting an item,

The debit side should match with the credit side. accountant goes for less favorable option.

TIME PERIOD OBJECTIVITY

There should be a standardize time period of Financial statements of an organization must be

reporting the financial statements and recording

presented with supporting solid evidence.

transactions usually monthly, quarterly or annually.

ACCRUAL ACCOUNTING

Recognition of revenues should be on occurrence of transaction regardless of the actual

receipt of the amount.

Also, recognition of revenue should be on the accrual basis of accounting.

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Accounting ConceptsDocument2 pagesAccounting Conceptseliesha rejiNo ratings yet

- Basic Accounting ReviewDocument75 pagesBasic Accounting ReviewSofie SergioNo ratings yet

- Accounting Concepts and ConventionsDocument38 pagesAccounting Concepts and Conventions727822TPMB005 ARAVINTHAN.SNo ratings yet

- Bms 1a Parangat Kapur 18100Document24 pagesBms 1a Parangat Kapur 18100Parangat KapurNo ratings yet

- GRP I - AS 1Document5 pagesGRP I - AS 1DARSHAN PNo ratings yet

- Acctg Part 3Document6 pagesAcctg Part 3Irish Claire BaquiranNo ratings yet

- Accounting ReviewerDocument4 pagesAccounting ReviewerKeon OrbisoNo ratings yet

- Acc117-Chapter 2Document26 pagesAcc117-Chapter 2Fadilah JefriNo ratings yet

- As Notes 2020-2021 Updated 17-4-2021 (On)Document135 pagesAs Notes 2020-2021 Updated 17-4-2021 (On)Desi TVNo ratings yet

- Ias 1 - Presentation of Financial StatementsDocument3 pagesIas 1 - Presentation of Financial Statementsangelinamaye99No ratings yet

- Ccfas Chapter 8 15Document5 pagesCcfas Chapter 8 15Ceann RapadasNo ratings yet

- 20150908170923introductory AccountingDocument11 pages20150908170923introductory AccountingShine CshNo ratings yet

- Conceptual Framework: Theoretical FoundationDocument13 pagesConceptual Framework: Theoretical FoundationAnne Jeaneth SevillaNo ratings yet

- Financial StatmentDocument27 pagesFinancial StatmentAlNo ratings yet

- ACTG 21B (CH4) - Lecture NotesDocument4 pagesACTG 21B (CH4) - Lecture Notesraimefaye seduconNo ratings yet

- Financial Reporting 1 BACT 303Document33 pagesFinancial Reporting 1 BACT 303emeraldNo ratings yet

- Financial Accounting 1 - 2020 - Framework of Financial Reportingv1 (24682)Document26 pagesFinancial Accounting 1 - 2020 - Framework of Financial Reportingv1 (24682)okuhlesmileyNo ratings yet

- Chapter 1: Framework of AccountingDocument3 pagesChapter 1: Framework of AccountingMhae DuranNo ratings yet

- Bea Angelee Arellano REM 1. What Is Accounting? Accounting Is How Finances Are Tracked by An Individual orDocument4 pagesBea Angelee Arellano REM 1. What Is Accounting? Accounting Is How Finances Are Tracked by An Individual orBea ArellanoNo ratings yet

- 9 Framework For Preparation - Presentation of Financial StatementsDocument13 pages9 Framework For Preparation - Presentation of Financial StatementssmartshivenduNo ratings yet

- GAAP - Assumptions and PrinciplesDocument18 pagesGAAP - Assumptions and PrinciplesCharmie Flor CuetoNo ratings yet

- Ilovepdf - Merged (1) - CompressedDocument40 pagesIlovepdf - Merged (1) - CompressedSonia Yurani MartinNo ratings yet

- Financial Accounting 2017 Ist Semester FinalDocument100 pagesFinancial Accounting 2017 Ist Semester FinalLOVERAGE MUNEMONo ratings yet

- Chap 1-4Document20 pagesChap 1-4Rose Ann Robante TubioNo ratings yet

- Accounting Rules: SMA Kristen Harapan BangsaDocument12 pagesAccounting Rules: SMA Kristen Harapan BangsaRobert Taylor AffidonNo ratings yet

- 11 Accountancy Accountancy-IIDocument188 pages11 Accountancy Accountancy-IIhugopuNo ratings yet

- Bookkeeping NCIII Lecture 2Document32 pagesBookkeeping NCIII Lecture 2jvtg994No ratings yet

- Conceptual Framework and Accounting Standards - Chapter 4 - NotesDocument4 pagesConceptual Framework and Accounting Standards - Chapter 4 - NotesKhey KheyNo ratings yet

- Part Two: Financial Accounting: An IntroductionDocument139 pagesPart Two: Financial Accounting: An IntroductionRobel Habtamu100% (1)

- Acccob 2 ReviewerDocument14 pagesAcccob 2 Revieweranika bordaNo ratings yet

- Concepts and ConventionsDocument19 pagesConcepts and ConventionsHadi HarizNo ratings yet

- Presentation of Financial StatementsDocument66 pagesPresentation of Financial StatementsCherryvic Alaska - KotlerNo ratings yet

- The Financial Statements: Chapter OutlineDocument15 pagesThe Financial Statements: Chapter OutlineBhagaban DasNo ratings yet

- Topic 2 Regulatory and Conceptual FrameworkDocument15 pagesTopic 2 Regulatory and Conceptual FrameworkfeyNo ratings yet

- Simplified Notes Unit 1 and 2Document4 pagesSimplified Notes Unit 1 and 2John Paul Gaylan100% (1)

- Generally Accepted Accounting PrinciplesDocument29 pagesGenerally Accepted Accounting Principlesarpit vora100% (2)

- 01 IntroductionDocument3 pages01 IntroductionEdizon De Andres JaoNo ratings yet

- Discussion No. 3 Conceptual Framework and The Accounting ProcessDocument3 pagesDiscussion No. 3 Conceptual Framework and The Accounting ProcessJullianneBalaseNo ratings yet

- Financial StatementsDocument3 pagesFinancial StatementsNana LeeNo ratings yet

- Class 11 Accountancy NCERT Textbook Part-II Chapter 9 Financial Statement-IDocument46 pagesClass 11 Accountancy NCERT Textbook Part-II Chapter 9 Financial Statement-IPathan KausarNo ratings yet

- Lecture 1 - Concepts and EthicsDocument10 pagesLecture 1 - Concepts and EthicsNikki MathysNo ratings yet

- Fabm 2 PDFDocument3 pagesFabm 2 PDFgk concepcionNo ratings yet

- Fabm 2Document5 pagesFabm 2Robillos FaithNo ratings yet

- Introduction To Financial Accounting 1a NotesDocument52 pagesIntroduction To Financial Accounting 1a NotesNever DoviNo ratings yet

- Accounting Concepts and PrinciplesDocument43 pagesAccounting Concepts and PrinciplesOliver RomeroNo ratings yet

- Framework Theory - StudentDocument27 pagesFramework Theory - StudentKrushna MateNo ratings yet

- Fundamentals of Basic Accounting AlilingDocument9 pagesFundamentals of Basic Accounting AlilingEmil EnriquezNo ratings yet

- Intermediate Accounting 3 ModuleDocument13 pagesIntermediate Accounting 3 ModuleShaina GarciaNo ratings yet

- Day2 10daysaccountingchallengeDocument17 pagesDay2 10daysaccountingchallengePaw VerdilloNo ratings yet

- Financial Accounting - 1Document38 pagesFinancial Accounting - 1dany2884bcNo ratings yet

- Final DT 100 Important Questions Final Audit Practice Questions Financial Reporting Conceptual NotesDocument14 pagesFinal DT 100 Important Questions Final Audit Practice Questions Financial Reporting Conceptual NotesDheeraj TurpunatiNo ratings yet

- Arupa 2nd Mid PreparationDocument2 pagesArupa 2nd Mid PreparationMd. Borhan UddinNo ratings yet

- Understanding Financial Statements For Non-AccountantsDocument5 pagesUnderstanding Financial Statements For Non-AccountantsAngella RiveraNo ratings yet

- Igse Accounting: by Ms Tara EsaDocument89 pagesIgse Accounting: by Ms Tara EsaDIllaNo ratings yet

- Acc102 ReviewerDocument13 pagesAcc102 ReviewerCurial GNo ratings yet

- Basics of Accounting Theory: AppendixDocument6 pagesBasics of Accounting Theory: AppendixRushelle Vergara MosepNo ratings yet

- Lesson 1 PPT AccountingDocument12 pagesLesson 1 PPT AccountingArchieliz Espinosa AsesorNo ratings yet

- Activity Sheet # 7 - Organization Theories For Effective BusinessDocument3 pagesActivity Sheet # 7 - Organization Theories For Effective BusinessChristine Ramirez100% (2)

- Activity Sheet # 7 - Organization Theories For Effective BusinessDocument2 pagesActivity Sheet # 7 - Organization Theories For Effective BusinessChristine Ramirez75% (4)

- Activity Sheet # 7 - Organization Theories For Effective BusinessDocument2 pagesActivity Sheet # 7 - Organization Theories For Effective BusinessChristine RamirezNo ratings yet

- Products/Foods Church: Written WorksDocument2 pagesProducts/Foods Church: Written WorksChristine Ramirez67% (3)

- Activity Sheet # 8 - Concept and Nature of StaffingDocument2 pagesActivity Sheet # 8 - Concept and Nature of StaffingChristine RamirezNo ratings yet

- Ramirez, C. Week8 Gokongwei CULSOCPDocument3 pagesRamirez, C. Week8 Gokongwei CULSOCPChristine Ramirez82% (11)

- Research SampleDocument41 pagesResearch SampleChristine RamirezNo ratings yet

- Components of Health-Related Fitness Description How To Integrate in Your Real-Life Benefit(s)Document4 pagesComponents of Health-Related Fitness Description How To Integrate in Your Real-Life Benefit(s)Christine RamirezNo ratings yet

- Tanauan City Integrated High School S. Y. 2019 - 2020Document15 pagesTanauan City Integrated High School S. Y. 2019 - 2020Christine Ramirez100% (2)

- Teenage Social Relationships Towards Alcohol Affecting Health and Education of StudentsDocument47 pagesTeenage Social Relationships Towards Alcohol Affecting Health and Education of StudentsChristine Ramirez80% (5)